Projects and Sectors of Interest

In this market, we see consistent outperformance and underperformance across projects and sectors. We will lay out some of our thoughts below and what is on our radar for current trades or potential new setups.

Memes

Memes trade based on attention and the community. There was much speculation and outperformance here over the last year, but what's next? If attention is the main factor for speculation, we must ask ourselves, what can be more significant than the President of the United States launching a memecoin? Given this, we think the top is in for most memes, regardless of their market cap. In the long run, we still expect memes to exist, but a local top was surely put in. For instance, if WIF is able to list their logo on the Las Vegas sphere, what is the logical outcome of this? We think many of the previously defined catalysts, such as the sphere, are actually rendered non-events now, and a flight togreener pastures is taking place (i.e., BTC, SOL, HYPE, and stable farms) that either have strong organic adoption, regulatory momentum, or pay you a regular yield

AI and DePin

We do not like betting on any one project/framework here given the recent price action but we see some of the most asymmetric opportunities with the backdrop of a global race to AGI, further fueling the AI narratives at large. Given this, we see the largest tailwinds backing this sector but do not yet know where to allocate. With open-source models gaining in popularity, such as Deepseek and Llama, we are seeing confirmation of the decentralized and open-source AI theme and people will want to bet on this. This is a sector that will be close on our radar in the sea of noise (sideways/down price action). We are also excited about the DePin space, protocols such as Grass have huge upgrades that are flying relatively under the radar.

Hyperliquid

Hyperliquid continues to be one of the alts with the strongest price action, including the recent drawdown. It also continues to record impressive trading volumes and boasts many upcoming catalysts. The HyperEVM is soon to launch, with a more friendly token standard for CEXs to potentially list HYPE (currently hard to list with the HIP-1 token standard). More importantly, this opens the door to many new use cases that drive economic value to the Hyperliquid ecosystem and, more specifically, bolster the tokenomics of HYPE. There are execution risks with the EVM and this trade appears to be almost “consensus” amongst CT persona now, but we remain excited about HYPE due to its flywheel effect as an ecosystem.

HYPE vs BTC/ETH Since Report

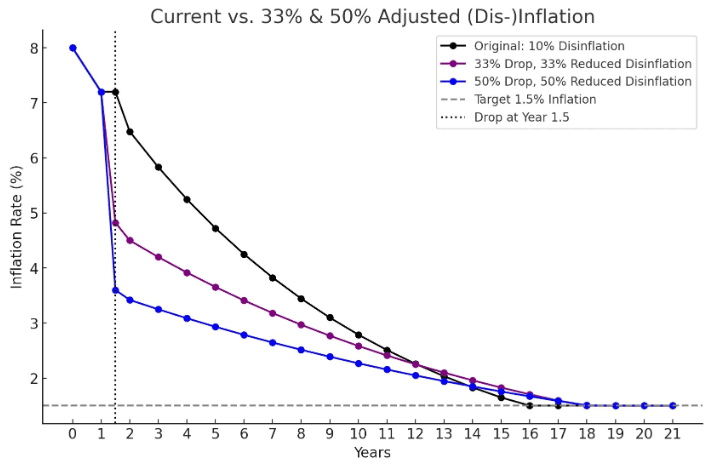

Celestia

We think Celestia is one of the most asymmetrical opportunities in the space at the moment on a long time horizon. Down over 83% from its ATH, we think TIA is undervalued at its current $1.7b MC given the upcoming catalysts, growing ecosystem, and its recent growth. We wrote out our thesis here and since then, they are aiming to further strengthen the tokenomics with a proposal to reduce the inflation rate by 33%. If you believe there will be many L2s and the demand for blockspace will increase over time, TIA remains a solid directional bet on a modular future.

Berachain

Mainnet is expected on February 6th, just 1 day from now. Despite launching just a few days after the largest liquidation event in history ($ wise), Berachain was still able to attract over $3.1b in the TVL so far. We will be keeping an eye out, particularly farming opportunities that arise, and we are excited about this momentum of TVL prior to mainnet - with a speculative airdrop and many apps available immediately, there can be some notable plays here.

Stables and Yield Farming

If not trading, then what? Stables and airdrop farming.

For stables, I am spread across a few farms, mainly: Hyperliquid HLP vault, Pendle USR PT on Base, Sky Savings on Base, usde PT on Pendle, and directly getting offchain t-bill exposure (laddered across short term maturation). This is of course quite conservative given you can comfortably get 20+% across many reliable farms but I personally like to reduce counterparty risk to a few apps and cognizant of other risks as we move further into the cycle (where its likely more things tend to “break”).

Farming-wise, we remain excited about Eclipse and continue to farm it. Gas fees are rather cheap on mainnet so bridging over via their mainnet bridge is relatively affordable (likewise for minting tETH). For those on Solana, can also use Hyperlane to bridge to Eclipse while potentially farming another airdrop. Additionally, you can join the discord and get an invite code for the Turbo Tap program. There are things like All Domains where you can link your Twitter profile and such, so it is nice in that it is slightly resistant to sybils. For those with ETH, you can put it to good use while collecting staking and restaking yield via tETH.

BTC is still trading within a range and is still around ~$100k, but all other alts are down double-digit plus percent. It becomes increasingly imperative to position in clear market leaders or winners. New money entering the space no longer means a “rising tide raises all boats” as is clear with ETH/BTC ratio trading at levels not seen since pre-Covid crash. Our directional bias is neutral given we think that we are not out of the clear yet, and expect further range trading for BTC and continued dispersion for altcoins at large. Still, we are not using leverage and maintaining a key theme of simplifying the portfolio and waiting for confirmation. Either way, I am still positioned heavily for upside while having dry powder to dip my toes with stink bids placed for HYPE/SOL/BTC.

All of the above is not investment advice, just my personal view of and actions in these very uncertain markets.