Recent Upgrades and Features

Ether.fi’s evolution into a crypto neobank has introduced investor-friendly services that bridge DeFi with real-world use cases. In late April, the team launched Ether.fi Cash, a non-custodial crypto credit card and smart wallet. This product allows users to borrow stablecoins against their onchain assets (i.e eETH) and spend via a Visa card, all while their yield bearing assets continue earning yield. In other words, it allows crypto holders to spend borrowed money without being forced to sell some of their assets, which often avoids forced selling. There are many sources of yield spread across DeFi today and Ether.fi’s plugin allows users to spend against yield bearing denominations of ETH, BTC, and even stables using underlying Aave borrow rates. Outside of the native onchain yield, the card earns up to 5% rewards, and offers many competitive travel perks.

Ether.fi Cash has facilitated over $12.5M in spending, paying out over $381K in ETHFI cashback rewards as of July 7th. Usage ramped up sharply into the summer: as of late June, Ether.fi’s card was processing over $300k in daily volumes. With 105,000+ transactions and 3,100+ cards issued, it is a strong signal of product-market fit in Ether.Fi’s new offering.

Building on the card’s momentum, Ether.fi also rolled out a travel perk for its users. Ether.fi Hotels, launched in early June and it lets members book luxury accommodations (1M+ hotels worldwide) through the Ether.fi app at discounts up to 60%, with 5% cashback when paying in crypto via the Ether.fi card. The service is offered in partnership with Entravel, a crypto-native travel platform for hotel booking and more. By tying DeFi yields to tangible benefits like discounted travel, Ether.fi is enhancing the real-world utility of holding and using crypto productively throughout DeFi.

The Club Initiative

Focus on growth and governance: To drive adoption, Ether.fi introduced a referral program in June (as part of its “The Club” membership initiative). Users who refer others to the platform’s card and services earn recurring cashback rewards, aligning community growth with incentives. Meanwhile, the Ether.fi protocol also shows promising revenue growth, forecasting over $447M of annualized revenues according to DeFillama. In line with its tokenomics, they also have a portion of revenues to ETHFI token buybacks to reward holders.

Ether.fi’s Automated Yield Strategies

Yield is one of the main drivers for TVL and getting new users. The Liquid product allows for people to do this programmatically through their automated vaults. Users can deposit assets like ETH and earn up to 26% APR, BTC into their liquid BTC vault for 2.1% APR and even stablecoins like USDC, which are yielding 10% APR as of July 7th. The Liquid product acts as a savings account that earns users yield in a non-custodial way. The offering is quite compelling for crypto users who are looking to bridge the gap between their onchain assets and real world spending

Broader DeFi Integrations

DeFi integrations bolster utility: Ether.fi spent the last quarter expanding its suite of services to new user bases through integrations such as the following:

- Institutional lending: On June 30, Maple Finance added Ether.fi’s restaked ETH token weETH as collateral on its onchain credit platform. This unlocks a new institutional borrowing venue for weETH holders.

- Wider DeFi support: Aave DAO moved to strengthen price oracles for weETH on Ethereum’s Aave V3, reflecting weETH’s growing role as a supported asset. Folks Finance similarly listed weETH for cross-chain lending and borrowing on Ethereum and Base in early June and on June 12, Ether.fi enabled weETH bridging to Avalanche via LayerZero – extending the token’s reach to new ecosystems.

Restaking

Restaking leader defies the trend: Ether.fi has emerged as the dominant protocol in Ethereum restaking. It further continues to lead in the LST space with over 48% Eigenlayer dominance, 30.95% Symbiotic dominance and even 6.33% Karak dominance as of July 7th. Even as hype around “point farming” waned in early 2025, Ether.fi’s TVL continued to grow through Q2 and it became more productive in various money markets and restaking protocols.

Onchain Activity

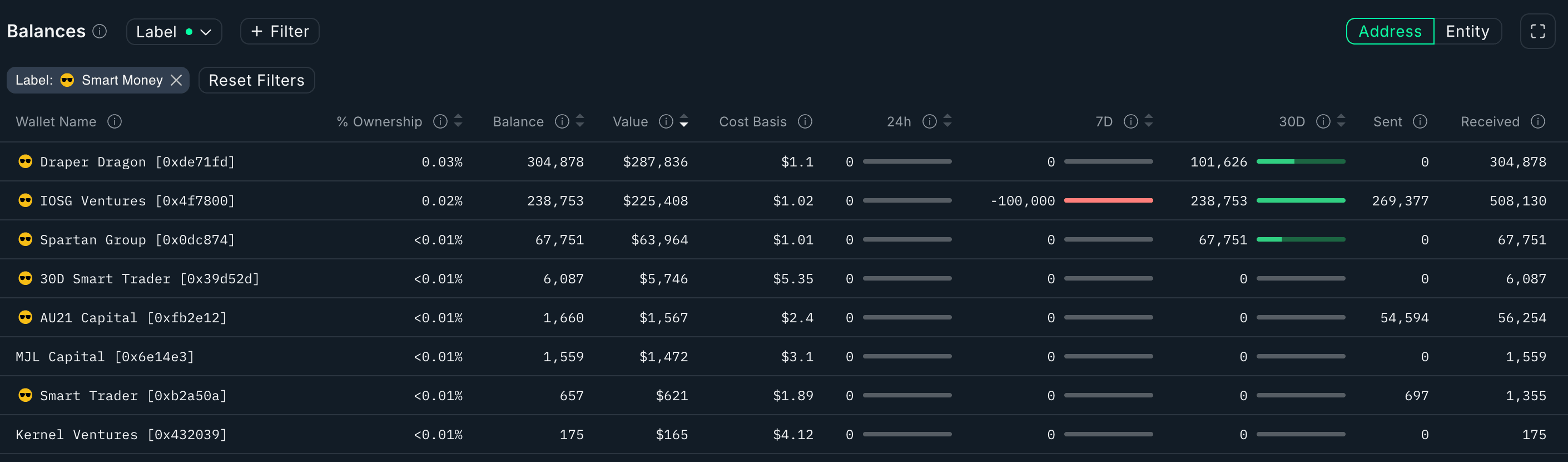

Onchain Smart Money Holdings: The token ETHFI has relatively few smart money holders with sizable positions (greater than $50K) as of July 7th.

Onchain flows show some recent activity from three smart money addresses across well known VCs. The new source of flows come from addresses funded by core investor and contributor addresses, which likely indicates some type of investor unlock. Otherwise, there is no notable DEX trading or inflows to note, despite the recent spike in adoption. Most of the 30 day netflows are to CEXs such as Binance or to fresh addresses holding only ETHFI and look to be funded by investor recipient addresses. To track the latest netflows across top holders, you can use Token God Mode to get a deeper picture of the onchain flows. Despite the significant smart money balances, ETHFI is trading around a $941M FDV and has seen significant volatility, down nearly 70% off of its highs as of July 7th, trading around $0.94/ETHFI.

Conclusion

Ether.fi offers a growing suite of services spanning yield generation and real world spending. Strategic integrations into DeFi lending to Visa-backed spending further expand its user base and diverse offerings. By blending onchain yields with familiar financial utilities, Ether.fi’s pivot to a crypto neobank is positioning it as a comprehensive platform for crypto investors and everyday users to tap into onchain yields.