Introduction

Hyperliquid is an L1 perp DEX (with an Arbitrum bridge) that is capable of 20k orders per second with a fully on-chain order book. It seeks to directly compete with CEXs in terms of user experience and cost and has become a notable player in the DEX space. It offers a very wide range of assets for leverage trading (101 as of 5 Jan 2024), combined with a CEX-like UX that makes it very attractive to degens.

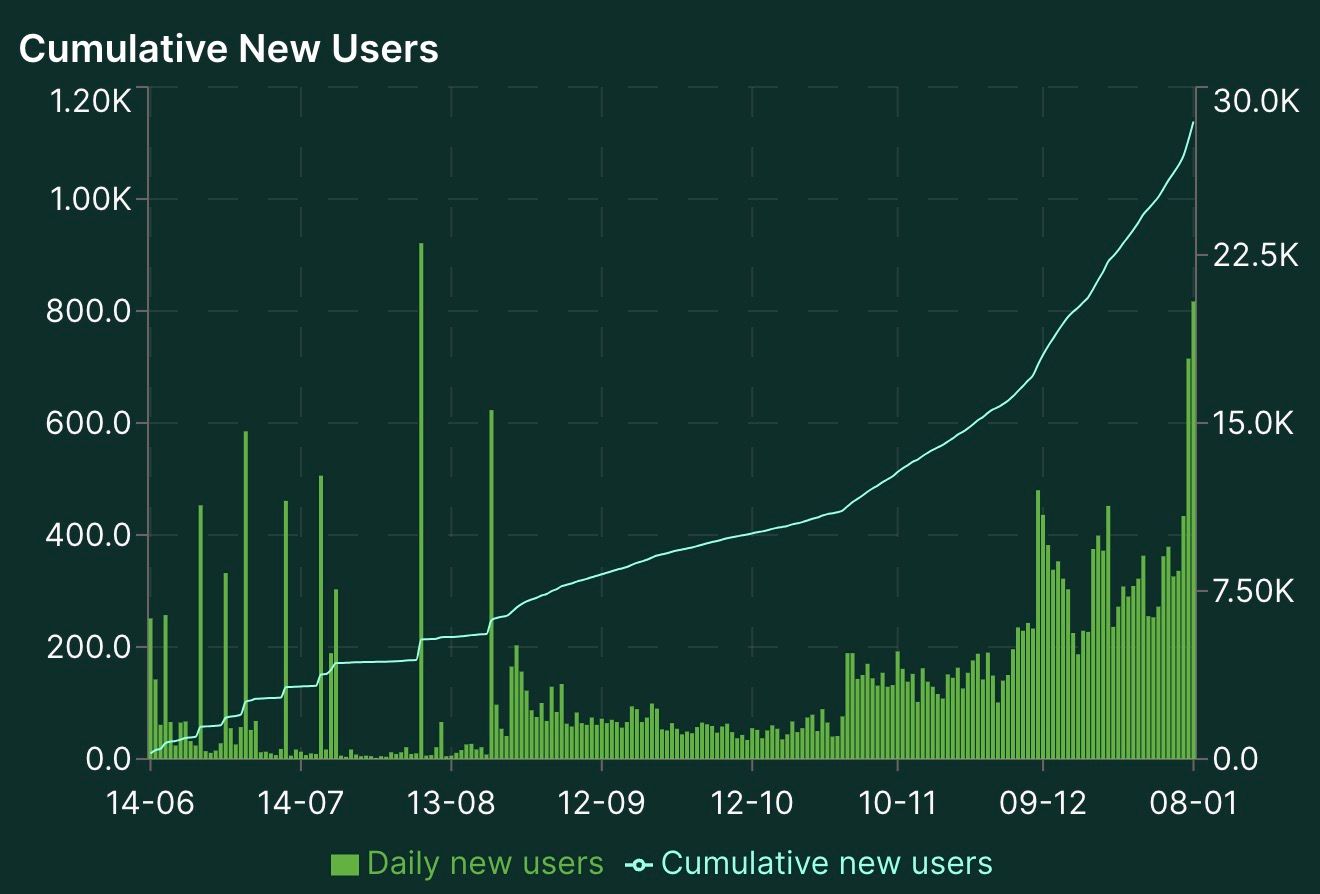

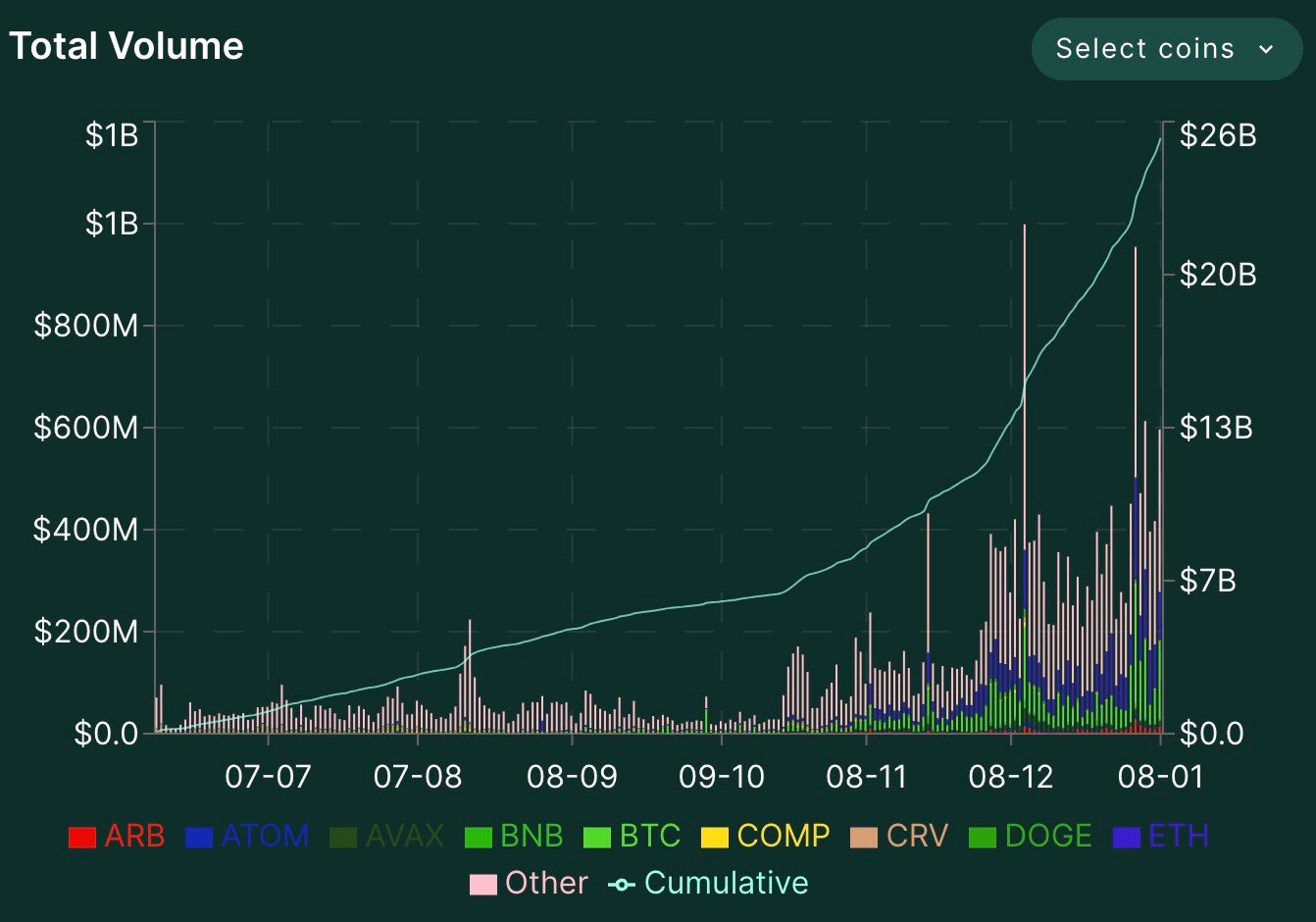

It opened up a points program in November 2023 stated to last for 6 months (until April 2024). This has notably increased usage across all metrics on the exchange, and volumes have ranged from $190m - to almost $1b each day since 4 December 2023. Many expect an airdrop to be tied to this points program.

Hyperliquid’s core contributors are Chameleon - a team of crypto market makers. Their experience in market making on both CEXs and DeFi, and the disparity in performance between DEXs and CEXs inspired them to build Hyperliquid. The project is currently fully self-funded, arguably making its growth more impressive as there are no major VC shills at present. Furthermore, there are no token incentives (although a points program is in place).

Check out its stats page to see its impressive growth.

New users, for example, are on an accelerating uptrend:

As is total volume:

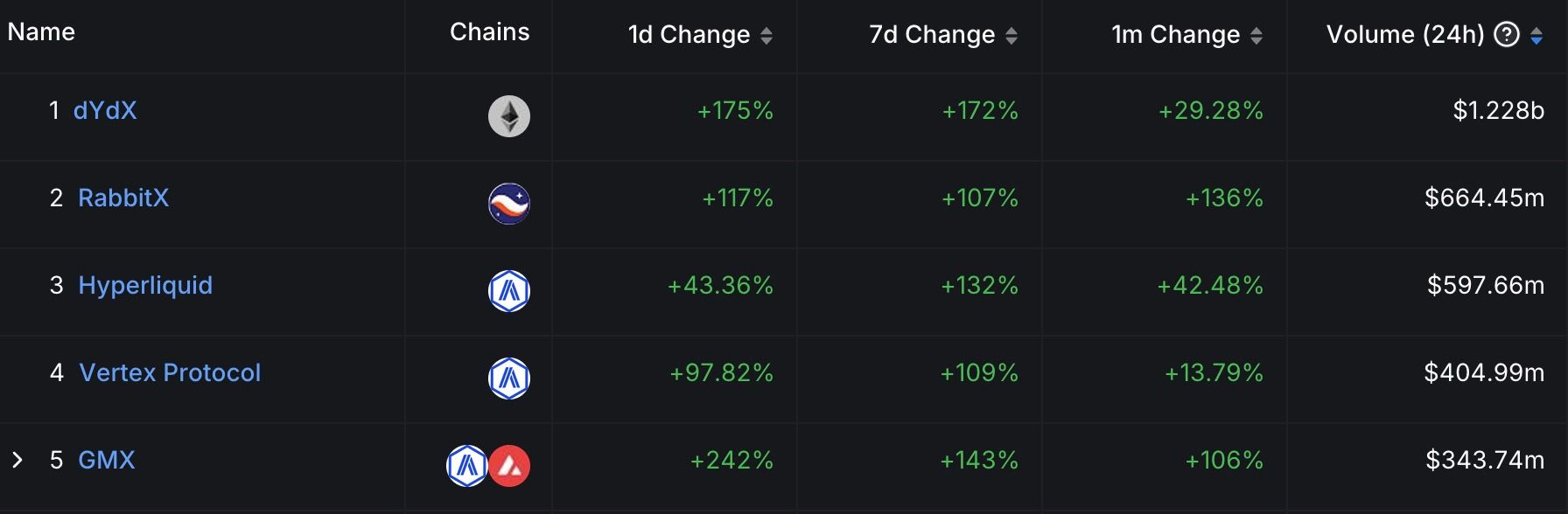

It regularly features in the top 3 of the decentralized perps leaderboard and the following screenshot is as of 9 January 2024.

So why all the hype? Let’s take a closer look.

About

Hyperliquid L1

Hyperliquid is written from the ground up and fully optimized for perps trading - capable of 20k operations per second with sub-second block latency. It currently achieves a median latency of 0.3 seconds and a 99th percentile (slowest) latency of 0.9 seconds. Despite using a modified version of Tendermint consensus, it does not rely on any external frameworks such as the Cosmos SDK. The logic for state transitions is developed in Rust and includes an ABCI server compatible with Tendermint.

Interestingly, all activity currently occurs on-chain. Other highly performant perp DEXs such as dYdX have overcome performance issues by adopting a hybrid on-chain / off-chain approach. However, Hyperliquid has managed to attain very high performance while remaining fully on-chain.

Minimizing Toxic Flow

The L1 is designed to optimize for trade matching, not volume. Competition between HFT makers and HFT takers is often associated with significant volume but can result in toxic flow where spreads and liquidity degrade. Hyperliquid orders transactions so that cancel orders and post-only orders are executed first which greatly reduces volumes between HFT makers and takers with the aim of providing better rates for end users. Check out this post for a more detailed explanation of the rationale behind transaction ordering on Hyperliquid.

So, given that it’s fully on-chain, what about state growth?

State Growth

As a fully on-chain L1, Hyperliquid is subject to state growth. Typically for general-purpose L1s/L2s key bottlenecks are efficient state access and managing state growth. State growth ultimately slows down a network and makes it more expensive. Hyperliquid’s L1 is designed purely as a perps platform whose state can be efficiently represented with the most frequent operations of the network stored directly in the memory of the nodes. This means that at present the primary bottlenecks are consensus and execution speed rather than state growth.

Relative Performance

At present, Hyperliquid operates at ~20k TPS - enabling it to operate a fully on-chain order book at its current scale (operating efficiently with a $1b daily volume and 30k+ users). At present, this is an order of magnitude more performant than dYdX v4 who claim an initial 2,000 TPS. However, dYdX v4 has already decentralized its validator set so it will be interesting to see how this impacts Hyperliquid going forward.

Despite its on-chain outperformance, it still notably lags behind CEXs which have centralized matching engines. In addition, a 20k TPS is already pushing Tendermint consensus to its limits. To close this gap, a new consensus algorithm is being worked on to significantly increase its TPS and reduce latency, with the goal of achieving performance on par with CEXs.

The new consensus mechanism being developed aims to push the current performance bottleneck to network bandwidth. This is much easier to overcome than being restricted by the algorithm itself. This is in the pipeline and it remains to be seen how difficult it will be for the team to execute on this plan but the current aim is to roll this out in 2024.

Arbitrum Bridge

Hyperliquid made the interesting decision of building an L1 attached to Arbitrum with a bridge secured by the L1 validator set. The rationale for doing so was that it is very difficult to bootstrap assets to a new chain, and Arbitrum has a combination of deep liquidity, easy onramps, cheap transactions, and production readiness.

As stated, the Arbitrum bridge is secured by the same validator set as the L1. Deposits and withdrawals are completed when a minimum of ⅔ validators agree to an action. When withdrawals are requested, there is a dispute period so that the bridge can be locked if a malicious withdrawal is detected. Unlocking the bridge requires another ⅔ validator quorum.

The bridge contracts have been audited by Zellic.

Analyzing bridging activity, we were able to gain some interesting insights:

By analyzing the values of withdrawals - deposits, we identified highly profitable traders on the platform. This does not give an exact picture of Hyperliquid's top traders (which you can find on Hyperliquid) but it shows objective profits from traders that you can track on Nansen. Check out the official leaderboard here.

Enough about the tech, what about the product?

Product

Hyperliquid offers a perpetual swap trading interface and general experience similar to that of a CEX. This, combined with over 100 tokens, has made it very popular with degens even without token incentives. The platform has the following order types:

Order Types on Hyperliquid

- Market

- Limit

- Stop Market

- Stop Limit

- Post Only: An order that is added to the order book but doesn’t execute immediately. It is only executed as a resting order. It exists as a maker order on the order book but does not match with orders already on the book. They add liquidity to the market.

- Scale orders: let advanced users place many limit orders at different prices with one click.

Order options

- Reduce Only: reduces a current position rather than opening a new position

- Take Profit

- Stop Loss

Vaults

Vaults are a primitive on Hyperliquid that can employ various trading, liquidations, and market-making strategies. Anyone can deposit to a vault of their choice and earn their share of the profits. Note that depositing into a vault includes smart contract risk as well as vault execution risk.

HLP - Hyperliquidity Provider

This is the protocol vault that performs liquidations and market making strategies. It was designed by the team (who themselves have extensive experience as market makers). All profit (or potential losses) from the vault goes to vault depositors. The vault has a minimum 4-day lockup; this means that one can withdraw funds any time after 4 days.

The HLP currently has an APR of ~265%.

Here is a blog post about the HLP vault and an update on it.

Community Vaults

Creating a vault is permissionless. Vault owners are required to deposit and maintain at least 5% of the vault’s capital so that they have some skin in the game. At present ‘sifu’ is a popular vault, yielding approximately 300% to date. Note that participating in vaults is highly risky, and it is likely that most user vaults are riskier than the HLP vault. The lock-up period for user vaults is only 1 day. Vault owners receive 10% of the vault’s profits.

Check out the various vaults here.

Hyperps

Hyperps are a product unique to Hyperliquid and can be simply described as perps for unlisted tokens e.g. ZRO (LayerZero). They do not rely on any external data and trade like normal perps but don’t require an underlying spot or index oracle price. Funding rates are determined relative to the moving average mark price rather than the spot price. The purpose of this is to make the price less susceptible to manipulation compared to other pre-launch futures. Note that funding rates are a key consideration when trading hyperps, and if there is heavy price momentum in one direction funding will heavily incentivize positions in the opposite direction for the next 8 hours.

Hyperps are a new financial product and it is important to fully understand them before considering using them. Check out this blog post and the docs for more information.

Points Program

Hyperliquid has run a points program since November which is expected to end in April. Each week, 1,000,000 points are distributed. Many anticipate that there will be a token airdrop directly linked to the points. The Hyperliquid team has not disclosed any ‘formula’ for gaming points; however, we speculate on the following activities as potentially allowing users to accumulate points:

- Deposit into vaults (with the HLP likely being the lowest risk).

- Use Hyperliquid to conduct their leveraged trading.

- Users can create delta-neutral strategies to protect themselves from large losses while accumulating points.

Fees

At a high level

- Taker fees: 2.5bps (Referrers receive 10% of referees’ taker fees)

- Maker fees: 0.2bps rebate

- Insurance fund and HLP (Hyperliquidity Provider vault for market-making strategies on Hyperliquid) fees: ~2.05bps

- 40% of fees go here. The purpose of this is to have funds to repay affected users if the DEX operates incorrectly.

Hyperliquid claims that fees will be distributed to the community - potentially similar to how dYdX operates. In addition, they will implement L1 gas fees to prevent spam transactions / DDOS and reduce unnecessary state growth. It will be interesting to see how these gas costs impact the overall cost of interacting on Hyperliquid. Perp DEXs are rapidly increasing in quality as they try to take market share from their CEX counterparts, and a race to the bottom in terms of fees will ensue as they compete for the highest volume and activity.

Risks

Centralization

Hyperliquid aims to become fully decentralized in the future and is currently operating a beta product. However, at present it is centralized meaning that users have risk with the core contributors. Regulation is another significant risk that is greatly exacerbated by centralization. It will be worth observing whether the project can satisfactorily decentralize as potentially hostile regulations loom. dYdX has sought to optimize for decentralization with its v4 and is undoubtedly further ahead on this journey.

Code / Design Risk

Hyperliquid has created its own L1 from scratch, and as with all new crypto applications, there is significant risk in the code. The protocol remains in development and interacting with any such technology is a risk.

Liquidity Risk

Although it is gaining significant traction and liquidity, Hyperliquid is still a DEX in its infancy and lacks the liquidity of larger derivatives players like major CEXs. For example, during the market pull on 3 January 2024, SOL fell to approximately $95 on liquid exchanges, but on Hyperliquid it fell to ~$70. In addition, it offers perps on low cap meme coins which may have some significant price slippage at times.

Oracle Manipulation Risk

Hyperliquid relies on various price oracles that the validators maintain. If oracles are compromised then this could have adverse consequences for traders. Oracles are a key point of failure in most DeFi protocols.

The opportunity for perp DEXs is enormous. DEXs still make up less than 5% of volumes in crypto, and the primary reason is due to easier onboarding, cheaper fees, and better UX. Projects like Hyperliquid are greatly closing this UX gap and even allow for email logins. It will be interesting to see the project’s performance when it decentralizes its validator set and also the level of decentralization that it attains. Furthermore, the team is working on significantly overhauling consensus to reach a level of performance on-par with CEXs. This would be a significant breakthrough for the crypto space as a whole. It will be worth following the progress of this ambitious and exciting project.