Introduction

IO.net is a decentralized GPU network that provides computing power for machine learning and AI applications. It works by aggregating underutilized GPU resources from data centers, cryptocurrency miners, and other sources to create an alternative to centralized cloud providers. The main advantage of IO.net is cost reduction. By using idle computing power, it offers services up to 90% cheaper than traditional providers as well as cheaper than several competitors in the crypto space. This makes AI technology more accessible to startups and small businesses with limited budgets. The network is also scalable, adjusting to changing demands for various applications, including crypto payment services.

As of March 4th 2025, IO.net has a market capitalization of $149 million. The platform has developed technology for creating decentralized compute clusters and has built a global GPU network, establishing itself in the decentralized infrastructure space.The cloud computing market is growing significantly. Market research indicates it will expand from $753.11 billion in 2023 to $5,150.92 billion by 2034. This growth is driven by increased computational needs, adoption across industries like finance and healthcare, and blockchain technology advancements not to mention the one taking up most mindshare in recent time, AI. Platforms like IO.net are set to take advantage of this growth in demand, so let us see if their goal to be a one-stop shop for anyone wanting to build decentralized AI apps holds up.

Tokenomics

Supply and Emissions

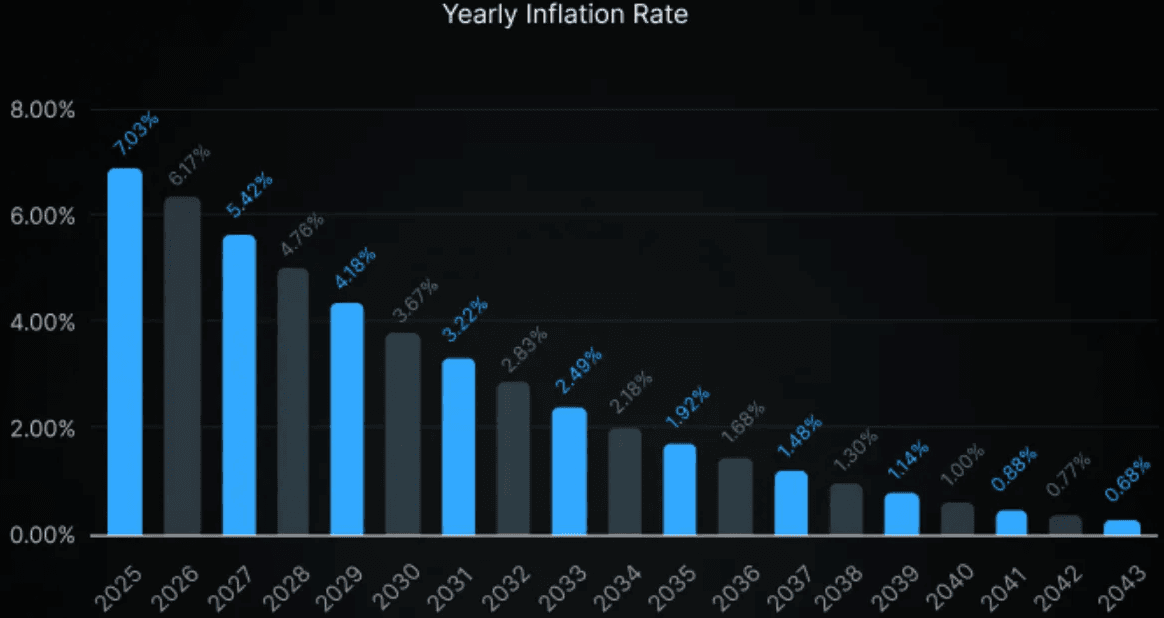

IO.net’s tokenomics are built around a fixed cap of 800 million $IO. At the Token Generation Event (TGE) in June 2024, 500 million $IO were released, while the remaining 300 million $IO are set to be emitted as hourly rewards to GPU suppliers and stakers over the next 20 years. Emissions follow a disinflationary model, starting at 8% annual inflation in year one and gradually decreasing by ~1% per month until the full supply is reached.

To counteract inflation from emissions, IO.net incorporates a burn mechanism, using a portion of platform revenues to buy back and burn $IO, adding deflationary pressure over time.

Allocation Breakdown

The 500M genesis supply is split across five categories: Seed Investors, Series A Investors, Core Contributors (team), Research & Development, and Community/Ecosystem. Over time, 50% of the total supply is allocated to community incentives, including emissions and airdrops. Early adopters benefited through initiatives like the Ignition program and Galxe campaign, which distributed 32.5M $IO in the genesis airdrop.

Vesting and Unlock Schedule

As of now, no major investor or team tokens have entered the market. Both investors and team allocations have a one-year cliff, followed by gradual monthly unlocks:

- Seed & Series A investors: Unlocks begin in July 2025 (13 months after TGE), vesting over two years.

- Core team & employees: Unlocks start in July 2025, vesting over three years.

Marketcap and Fully Diluted Valuation

IO.net currently is sitting at a $155 million marketcap with 144 million current circulating supply and an FDV of $859 million based on Coingecko. This means there likely will continue to be a constant level of sell pressure in the future given the linear unlocks starting in July 2025. However with the current increase in revenues we may be able to see the burn mechanic mitigate a lot of this or at the very least some.

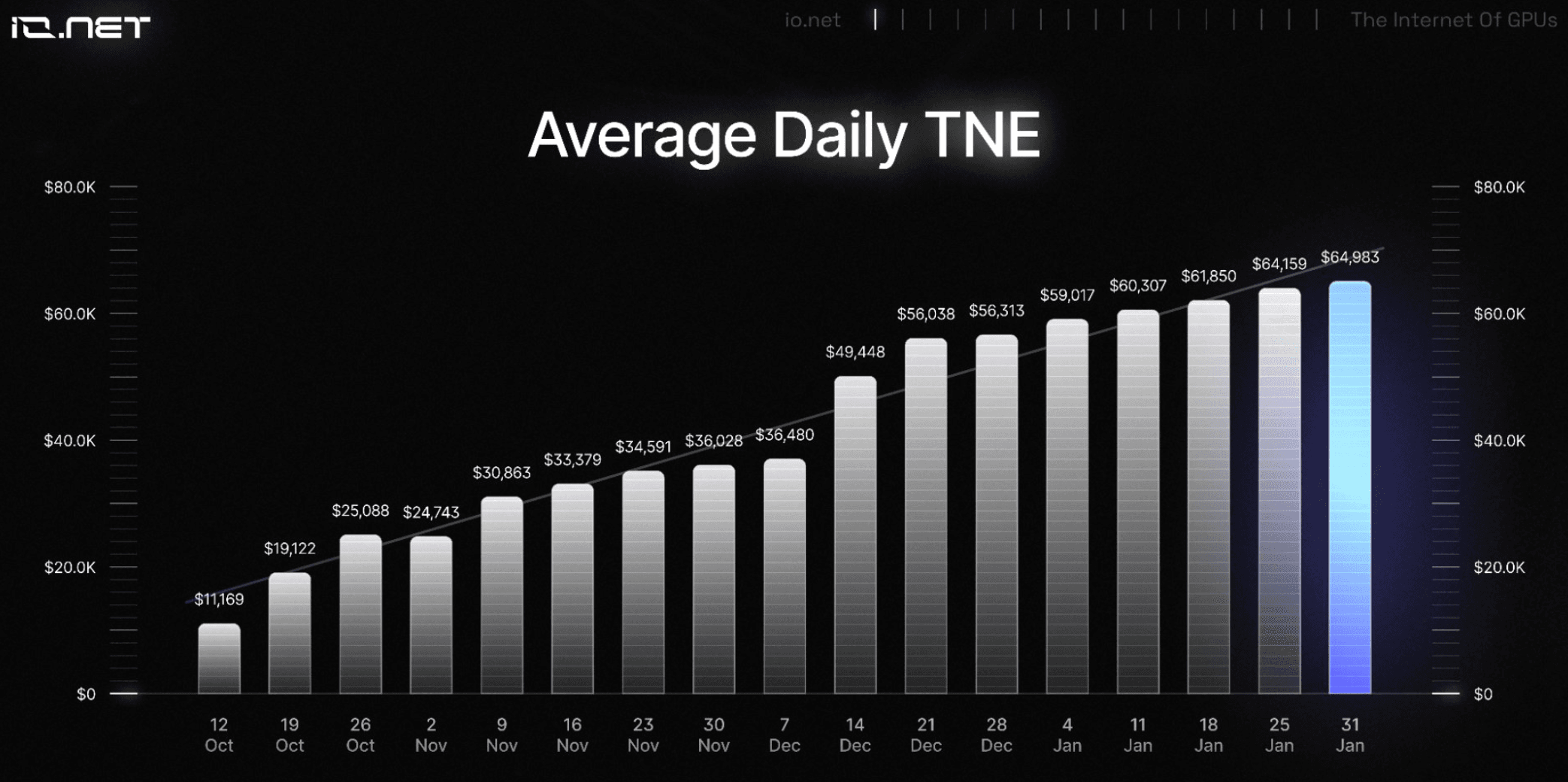

Revenue

Public Revenue Figures: IO.net saw significant revenue expansion in 2024. The project reported an annualized Total Network Earnings (TNE) of $18.4 million in November 2024. By January 2025, monthly revenue had exceeded $1 million, with daily average TNE topping $64,000 – highlighting a rapid uptick this year. This growth is attributed to high demand for IO.net’s decentralized GPU computing services, which by end of 2024 spanned 139,000+ GPUs across 139 countries in over 6,000 clusters and in January 2025 seeing continued increases in total compute hours by month from 1,391,057 hours in September 2024 to 7,111,360 in January 2025.

The strong Q4 2024 revenue surge provides momentum into 2025. IO.net’s model of monetizing idle GPUs and offering low-cost AI compute has solidified its standing in the AI infrastructure market. Looking ahead, the team aims to expand partnerships beyond 100 organizations in 2025 and have already launched new services (e.g. an “IO Intelligence” platform combining vector database as a service with up to five agents and 25 open-source AI models). While exact 2025 revenue projections aren’t publicly stated, the company’s 2024 achievements and ongoing expansion into sectors like biotech, gaming, and Web3 suggest potential continued growth in revenue. If IO.net sustains its network growth (further showcased by growing verified GPUs from 60k march 2024 to 327k march 2025 with 5,35k being cluster-ready) and usage, mid-2025 could see monthly revenues well above the $1M mark, further strengthening the project’s financial base.

News and Developments

Co-Staking Marketplace Launch (Feb 2025)

In mid-February, IO.net rolled out its Co-Staking Marketplace, allowing $IO holders to stake alongside GPU device operators and share in block rewards. This setup lowers the barrier for both hardware owners and token holders, making it easier for community members to participate in network security without needing to own physical GPUs. By expanding staking access, the launch enhances $IO’s utility while also increasing IO.net’s total computational power.

IO Intelligence is one of IO.net’s latest parts, combining Vector Database as a Service with AI agents and open-source models like DeepSeek and Llama. It is designed to simplify AI deployment by handling privacy-sensitive tasks locally while scaling intensive computations in the cloud.

The platform aims to reduce technical overhead for developers, offering both an API and a web-based interface for integration. It is relevant for real-time analytics and financial applications, where secure data handling and computational efficiency are key. By automating AI workflows, IO Intelligence has the potential to provide a structured approach to managing AI-driven processes at scale.

Expanding Partnerships & Ecosystem Growth

IO.net has been actively securing high-profile partnerships, reinforcing its role within AI and Web3 infrastructure.

- February 2025: Announced a deal with Gaia, a decentralized AI agent network, to provide GPU power for AI inferencing, improving performance for Gaia’s users.

- February 2025: Partnership with ChainGPT to allow for faster model training, reduced costs for inference and decreased latency with regard to real time analytics

These are just a few of the partnerships on top of the 85 already announced by January 2025, such as Injective, Nillion and Ai16zdao, further showcasing the many projects interested in cheap and available cloud compute. Compared to other projects IO.net remains competitive in terms of pricing, although according to recent data for H100 80GB SXM GPUs Akash comes in $7 cents cheaper compared to IO.net. With prices being this competitive it will likely come down to economies of scale as well as having high quality GPU providers with the best uptime. Price competitiveness also changes across the different GPUs with one provider coming out on top over the other and vice versa.

Conclusion

IO.net has rapidly expanded its footprint in the decentralized compute space, offering low-cost, scalable GPU power for AI and machine learning. Its model of monetizing idle GPUs, combined with a growing list of enterprise and Web3 partnerships, has positioned it as a competitive alternative to traditional cloud providers and competitors in the crypto space alike.

With steady revenue growth, expanding network capacity, and new initiatives like Co-Staking and IO Intelligence, IO.net is actively broadening its utility. However, with linear token unlocks starting mid-2025, sell pressure remains a factor to watch. The cloud computing market is set for massive growth, and whether IO.net can maintain its momentum will depend on continued adoption and ecosystem expansion and price competitiveness.