Key Terms

| Term | Definition | |

|---|---|---|

| L2 and L3 (Rollups) | L2 refers to blockchain scaling solutions that handle transactions off Ethereum L1, with settlement and data availability on L1. Rollups batch hundreds of transactions into a single transaction on L1. By posting validity proof to L1, rollups inherit the security of Ethereum. L3 is to L2 what L2 is to L1. | |

| ZK-Rollups | L2 smart contracts that verify transactions using cryptographic proofs that are computed off-chain and verified on L1, enabling very low transaction fees and high scalability. Note that although StarkEx and StarkNet are generally referred to as ZK-Rollups, they are not actually zero knowledge. The correct term is Validity-Rollup. | " |

| Validium | Validium is the data availability mode whereby the data is stored off-chain, making transactions significantly cheaper. However, the tradeoff is that there are less data available, and it is also at more risk of getting lost. | |

| Validity Proofs | Verifiable cryptographic validity proofs that attest to the validity of off-chain transactions. | |

| STARKs | STARK stands for Scalable Transparent Argument of Knowledge. STARKs are validity proofs that are used by StarkEx and StarkNet to validate off-chain transactions. They enable very fast proving times, but consume ~10x more gas than SNARKs. They do not need an initial trusted setup. | |

| API | An Application Programming Interface (API) is a software interface that enables connection and communication with another program or software (client and server). APIs are generally used to request and access live data from a database. | |

| SDK | A Software Development Kit (SDK) is a collection of software tools combined into one downloadable package. An SDK contains all the necessary frameworks needed for application development on existing backend infrastructure. |

TLDR

- Immutable X is the first NFT and gaming-specific scaling solution built on StarkWare's ZK-Rollup technology, allowing the protocol to execute up to 9,000 TPS for NFT trades, mints, and transfers as well as zero gas costs (but incurring a 2% protocol fee on transactions) for users while maintaining Ethereum's security.

- Immutable X's core mission is to ease and support the onboarding requirements for game developers by reducing the complexities of blockchain parameter configuration through features such as APIs, SDKs, a shared order book system, NFT-enabled wallets, and a developer grant program.

- Immutable X chose to build on StarkWare's StarkEx scaling engine as it enables nominal transaction costs and fast confirmation on transactions. StarkEx employs a Validium-based rollup, so it only requires validity proof rather than submitting the entire transaction data, which makes it more scalable and cost-efficient.

- The APIs, in conjunction with the SDKs, allow game developers to seamlessly integrate with the Immutable X protocol and reduce the difficulties of implementing the blockchain element on the backend. Immutable X also fosters an NFT-specific wallet experience by supporting Ethereum wallets without switching networks. The shared order book system enhances liquidity for the entire ecosystem.

- IMX is the utility token of the Immutable X network that is given as a reward to network participants to encourage pro-network activities such as trading, providing liquidity, and game development. Its use cases include transaction fees, staking for a portion of the accrued revenue, and governance.

- The foundation recently allocated 500m IMX tokens to the Immutable X developer grant program and venture arm in partnership with various VCs and entities to bootstrap and assist aspiring builders with their development, as well as attract top-tier teams to build on their ecosystem.

Introduction

Immutable X Protocol Overview

Immutable X is the first NFT and gaming-specific layer-2 scaling solution on Ethereum. The protocol aims to solve the liquidity, scalability, and complexities of blockchain gaming and NFT trading and bootstrap a sustainable ecosystem by incorporating key protocol features and design considerations such as:

- 9,000 TPS via StarkEx scaling engine

- Carbon neutrality for end-users and zero-gas fees

- In-house APIs and SDKs for developers

- NFT-specific wallet integration

- Shared liquidity and order book throughout all Immutable X-supported platforms

- $500m developer fund and venture arm

- Usage reward mechanism in the form of IMX tokens

Immutable X was developed in partnership with StarkWare, leveraging their StarkEx Validity-Rollup technology, which is how the protocol achieves 9,000 TPS for all ERC-721 asset transactions while incurring no gas costs for users and retaining security from the Ethereum L1. Note that the protocol has never reached the 9,000 TPS limit in practice since there has not yet been sufficient demand to meet this limit.

Furthermore, as the infrastructure provider for the ecosystem, Immutable X wants to minimize the barriers to entry for game developers to attract builders from all backgrounds (particularly non-crypto-native gaming studios). Immutable X's APIs and language-specific SDKs significantly alleviate the sophistication and time required to configure the blockchain aspect of game development. The grant program and partnership offerings also align with their vision of serving as the backend infrastructure provider for the gaming ecosystem on L2.

Since the start of the year, Immutable X has settled over 33.3m NFT mints, 7.55m NFT trades, and saved over 2.71m kWh in energy costs at the time of writing. The energy saved is in relation to the amount of energy usage that would have been spent if the transactions occurred on Ethereum L1.

Competitor Analysis

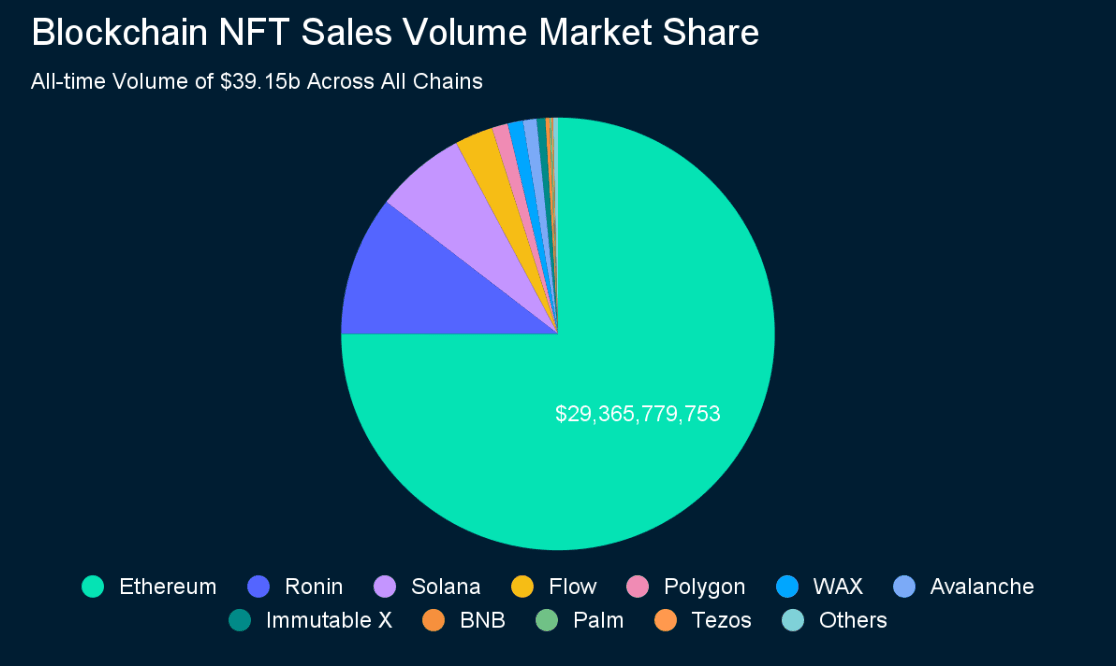

Today, Immutable X ranks 10th in the all-time NFT sales volume chart and controls 0.6% of the sector's market share, with $249m in total value transacted on the platform from games such as Guild of Guardians, Illuvium, Gods Unchained, and more.

As seen in the pie chart below, Ethereum accounts for most of the overall NFT sales volume by far at $29.37b and currently has a 75.0% market share. Axie Infinity's Ronin network sidechain is the second largest chain by value transacted but only accounts for an estimate of 10.4% of the market share.

| Blockchain | All-time Sales Volume |

|---|---|

| Ethereum | $29,365,779,753 |

| Ronin | $4,088,773,017 |

| Solana | $2,648,041,903 |

| Flow | $1,112,104,343 |

| Polygon | $471,671,179 |

| WAX | $443,783,447 |

| Avalanche | $402,017,136 |

| Immutable X | $249,225,543 |

| BNB | $119,441,276 |

| Palm | $58,082,048 |

| Tezos | $47,562,376 |

| Others | $144,199,658 |

Data as of September 22, 2022

Investors & Raises

- Immutable first raised $2.4m from its Seed round led by Nirvana Capital and Continue Capital in July 2018. Other investors include Coinbase Ventures and Sora Ventures.

- In September 2019, they raised again, acquiring an additional $15m from Naspers Ventures, Galaxy Digital EOS VC Fund, Apex Capital, and more in a series A funding round.

- The series B funding round took Immutable's valuation to $410m after they raised $60m from BITKRAFT, King Rival Capital, and others in September of last year.

- Most recently, the project is now valued at $2.5b following a series C round led by Temasek earlier in July, which saw an aggregate of $200m in funding.

Why Ethereum?

Immutable X’s core thesis for building on Ethereum is due to the strong network effects and security benefits that the Ethereum blockchain offers. Ethereum has the highest; liquidity, number of active users and developers, nodes securing the network (decentralization), network activity (revenue accrual), and the various verticals that have developed over the years, including NFTs and gaming.

Ethereum is particularly dominant in the gaming and NFT sectors, with over 8.1m ETH ($10.5b as of September 19th, 2022) in trading volume YTD from 2.41m different wallet addresses trading NFTs on the Ethereum L1. With such a large and fast-growing ecosystem, Ethereum is undoubtedly the most attractive blockchain to deploy, especially with the scalability benefits that L2s have to offer.

Although Ethereum’s NFT sector developments have exploded, there are still obstacles to overcome to scale and onboard the next 100 million+ users. Ethereum's L1 still has some limitations. Primarily low scalability, relatively poor UX, slow developer experience, and illiquidity.

Protocol Architecture and Features

Rollup Design

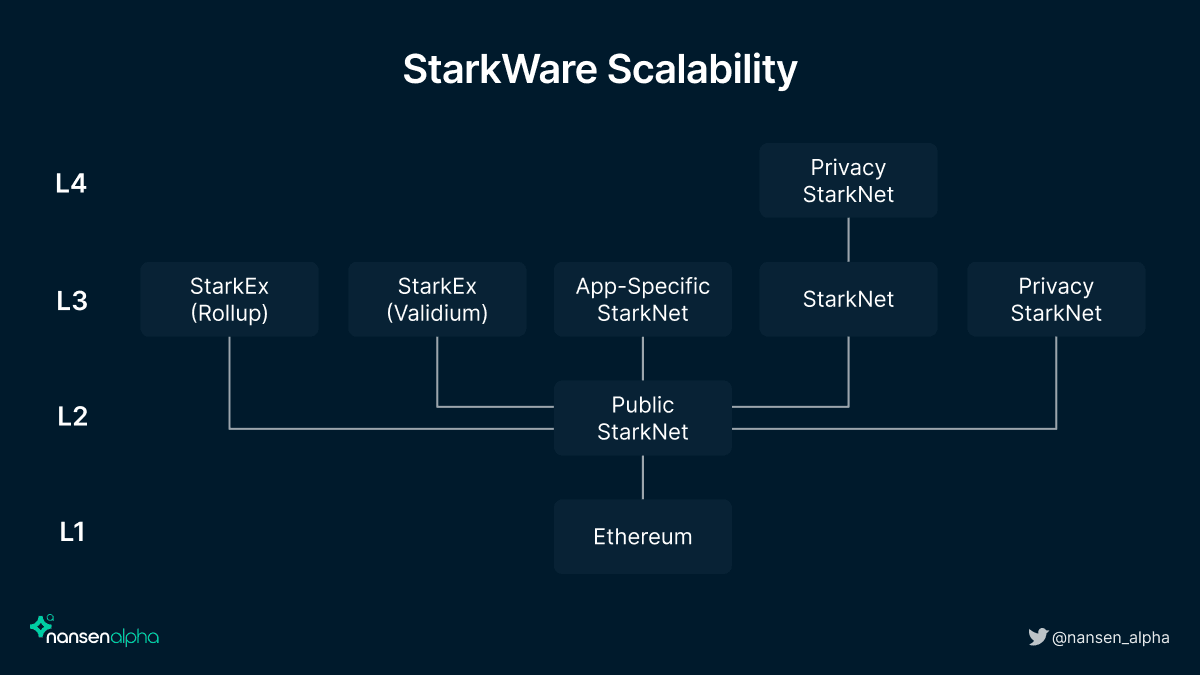

Immutable X has partnered with StarkWare for their array of available ZK-Rollup technologies, which is perfect for supporting multiple projects that prioritize different aspects of the blockchain depending on their goal. ZK-Rollups enable low transaction costs while maintaining high scalability by computing cryptographic proofs on L2 and verifying the transactions on L1. In brief, ZK-Rollups execute L2 transactions off-chain, batch the transactions together, and post the validity proof on L1, leveraging it as the settlement and data availability layer. StarkWare uses Cairo, a language invented specifically for validity proofs.

STARK Proofs

StarkWare uses the STARK validity proof technology for StarkNet and StarkEx as opposed to SNARKs since it is considered more efficient. On a high level:

- STARKs do not require a trusted setup ceremony. Instead, it uses publicly available randomness to create trustlessly verifiable computation systems.

- SNARKs are not post-quantum secure, whereas STARKs are considered quantum-resistant.

- SNARKs rely on complex cryptography and can be prone to implementation errors, which makes it less scalable and slow in relation to STARKs.

On the other hand, there are also benefits to implementing SNARKs:

- STARKs have larger proof sizes in comparison to SNARKs. Therefore, STARKs consume approximately 10x more gas.

- STARKs are newer and less tested than SNARKs. SNARKs have a more established developer library, published code, and developer activity.

STARK proofs are highly scalable as most of the computation is done off-chain via an off-chain prover. The generated proof is then sent to an on-chain verifier to confirm its validity. While STARK proofs are larger and more costly to publish on-chain, Immutable X considers this trade-off acceptable for greater user security.

StarkEx

Specifically, Immutable X was built via the StarkEx Validum-based scaling engine as it is highly optimized for NFT minting and transfers due to its focus on scalability and interoperability. StarkEx enables nominal transaction costs and fast confirmation on transactions since it only requires validity proof rather than submitting the entire transaction data. Additionally, StarkEx can be thought of as a "scaling-as-a-service" tool for dApp deployment, perfect for onboarding multiple games. Immutable X's rollup solution allows for over 9,000 TPS, which is vastly more suitable for gaming NFT assets than Ethereum L1 and is most likely able to support the scale required by mainstream adoption of NFT projects.

Data Availability

In the case where the Immutable X protocol halts and becomes unresponsive, users will need access to data to withdraw their assets. The protocol supports two data availability modes:

- Rollup mode

- State changes between each transaction batch are published to L1, which adds a small cost to each transaction but retains the base layer security.

- Validium mode

- A Data Availability Committee (DAC) signs each batch to signal that they have an available copy of the data. Thus, it requires only one member of the committee to act honestly for the users to be able to withdraw.

- The DAC currently consists of Immutable, StarkWare, Deversifi, Consensys, Nethermind, Iqlusion, Infura, and Cephalopod.

- A Data Availability Committee (DAC) signs each batch to signal that they have an available copy of the data. Thus, it requires only one member of the committee to act honestly for the users to be able to withdraw.

The Validium mode for their StarkEx rollup implementation stores data off-chain. Hence, making transactions significantly cheaper. In this case, users of Immutable X do not pay any gas fees for their NFT transactions. This is beneficial for gaming and NFT trading, where many transactions are needed.

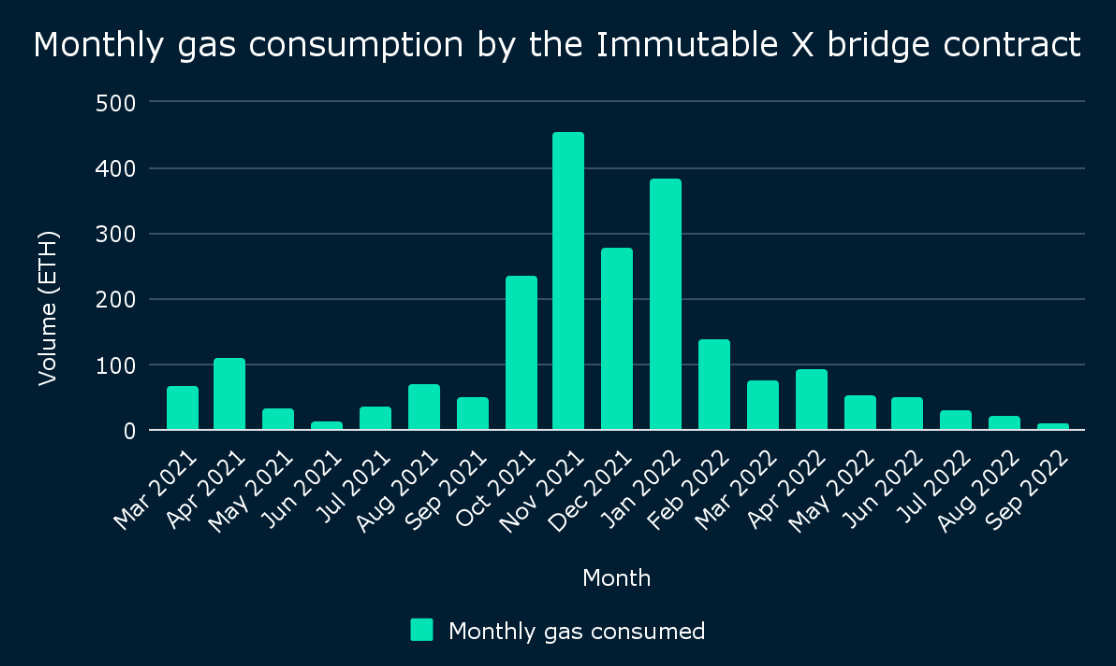

While users are omitted from paying gas fees for NFT mints, trades, and transactions, bridging assets from L1 to Immutable X still requires gas fees. The gas consumption by the bridge contract gives a gauge into the activity flowing through the Immutable X ecosystem. Unsurprisingly, the bridge contract consumed the most amount of gas during the gamefi bull run in Q4 2021, with a peak of around 450 ETH in November. Considering Immutable X has settled over 40 million NFT trades and mints this year alone, the average of 115 ETH in gas fees bridged over monthly is much more efficient than what it would have been if those transactions were conducted on an L1 platform like OpenSea.

At the time of writing, the bridge contract holds $73m in TVL according to the Nansen Portfolio wallet tracker, with IMX, OMI, and ETH being the most deposited assets by cumulative value at 32.89%, 32.26%, and 19.5%, respectively.

Layer-3

Immutable X will also be supporting many StarkEx instances on L3, where each instance is interoperable with one another. StarkWare plans to port StarkEx to L3 (StarkEx becomes the application-specific layer). In short, transactions are processed on L3, and the proofs are sent to and verified on the StarkNet L2. StarkNet, in turn, rolls up multiple proofs into one and submits them to L1. This design allows for much more scalability, customizability, and interoperability.

Each game developer wants different trade-offs, whether data availability, entirely subsidizing gas transactions for users, privacy, or other considerations. Therefore, supporting multiple rollup instances that allow each developer to control their parameters within a local environment makes the most sense for growth trajectory and developer onboarding. Some developers want to customize their own rollup rather than sharing the bandwidth with other games on the same instance.

Check out our in-depth report on StarkWare and the differences between StarkNet and StarkEx here.

API Abstraction Layer & Platform SDKs

Immutable X uses APIs to wrap its exchange engine's logic, converting complex, asynchronous blockchain interactions (which can take up to hours) into synchronous API calls. The APIs consist of both read and write functionalities that abstract away the complexities of building a backend. Every asset mint, trade, and transfer on Immutable X is executed via API calls, meaning that the developers do not need to directly interact with smart contracts.

Immutable X also provides SDKs to ease the intricacies of building on the protocol. Immutable X currently offers a Typescript SDK implementation, designed to easily integrate the protocol into websites. There are three types of SDKs provided; Core SDKs, Wallet SDKs, and Link SDK. More details about the functionality description of each type can be found in their SDK documentation.

The APIs, in conjunction with the SDKs, are tools that assist partners who wish to develop their projects on the protocol. The technology and infrastructure provided by Immutable X enable partners to build their projects in hours rather than weeks and focus on designing high-quality games with fantastic user experiences instead of spending time dealing with blockchain and smart contract fundamental concepts. This is particularly useful for traditional gaming companies wanting to enter the space but does not have sufficient prior knowledge about smart contracts.

NFT- Enabled Wallets

Immutable X has integrated support for desktop Ethereum wallets like MetaMask and Gamestop wallet without switching networks. Users can also connect via Email.

The protocol achieves this by providing an intermediate layer called the Link, which connects any Ethereum wallet to Immutable X, facilitating NFT-specific wallet experiences. The Link essentially connects the user's private key on the main chain to the Immutable X key and functions as the wallet manager, authorizing and authenticating transactions on the Immutable protocol, encoding the signatures, and relaying them to the main chain for verification when needed. The Link uses the key to sign transactions.

To trade on Immutable X, users must sign transactions via an Immutable X key to confirm their identity as an additional security layer. In short, the key allows the Immutable X Link to function as an extension of the wallet. Once activated, the key permanently links to the associated Ethereum wallet account. New users can easily create the key to their preferred wallet by signing two transactions; one to authorize the connection and confirm identity (seed generation) and one to set up the Immutable X key. Once signed, it delegates wallet security and recovery to the user's Ethereum wallet. Even if the key is lost, the user can re-generate it by signing a new Ethereum signature. Details on how to create a new key can be found here.

Once the key is generated and paired, users can easily deposit their ETH or other supported currencies onto Immutable X. More information on how to deposit and withdraw assets from Immutable X can be found here. Users can also track transactions and other Immutable X network on-chain data with Immutascan, the native block explorer.

Shared Liquidity & Order Book

One of the existing problems hindering the potential of NFTs is liquidity. There must be a direct counterparty to execute a trade. Moreover, the NFT ecosystem on Ethereum still has relatively segregated order book liquidity. OpenSea, for example, has an extremely adherent network effect and retention rate. Even with token incentives, competitors like LooksRare and X2Y2 are finding it difficult to gain market share. While aggregators such as Gem.xyz and Genie.xyz aim to reduce fragmentation, the products are more geared toward power users. However, as the blockchain gaming sector continues to mature, there will be native marketplaces for individual games and their assets, amplifying this problem.

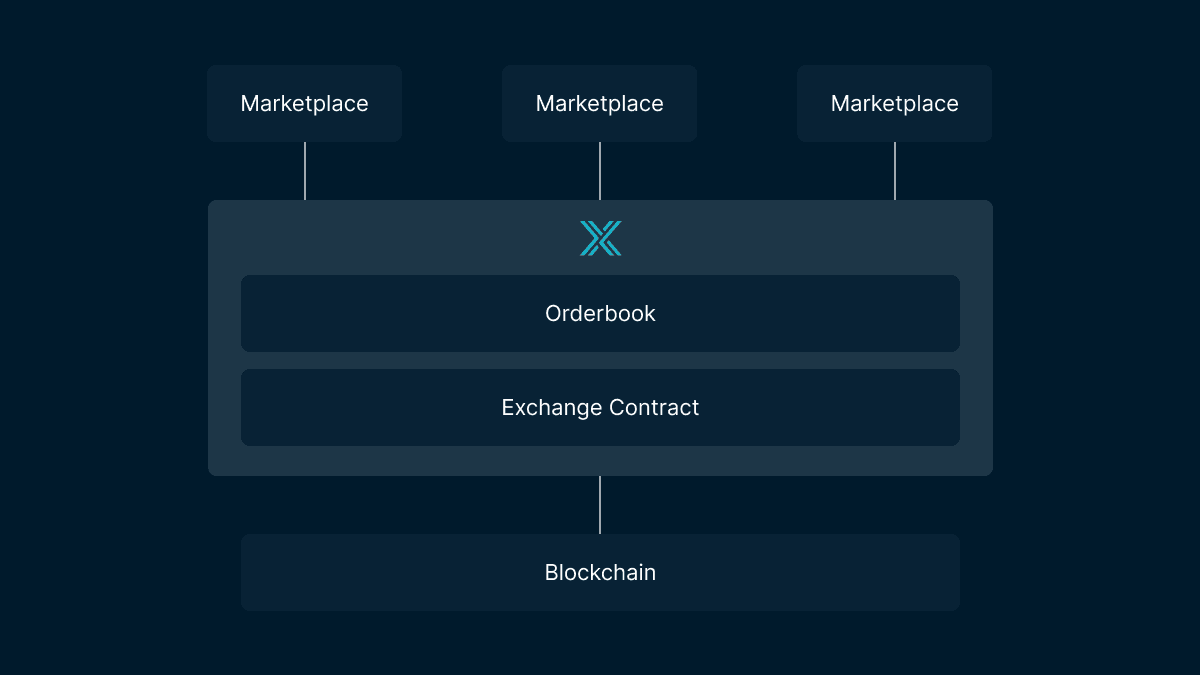

Immutable X aims to reduce order fragmentation, increase scalability, and create better experiences for trading and accessing in-game assets in the ecosystem by implementing a global order book system for all its marketplaces at the protocol level. The global order book system allows users to list and buy assets on any Immutable X-integrated marketplace. As a result, asset liquidity on Immutable X becomes platform-agnostic. This enables games to build their own native marketplace without a backend, improving and customizing better user experience while providing liquidity to other NFTs on the rollup. IMX Marketplace, OKX, Mintable, Tokentrove, and Kinguin are some of the Immutable X-integrated marketplaces that currently exist.

There are four main benefits to a shared order book for end users:

- Submit an order to the order book

- Retrieve orders from the order book

- Cancel an order in the shared order book

- Create a trade using one or more orders from the order book

The team has also mentioned introducing a cross-rollup liquidity solution while maintaining 9,000 TPS through this global order book, making the L2 NFT/gaming ecosystem even more composable. Once games gain adoption and a large user base, they may need to move to their own dedicated L3 rollup for further design parameter improvements, which varies depending on the game's priorities and vision.

IMX Tokenomics

Token Utility

IMX is the utility token of the Immutable X network that aligns the incentives of all network participants (traders, game developers, and marketplaces). IMX is given as a reward to network participants to encourage pro-network activities such as trading, providing liquidity, and game development.

IMX has three main properties as the utility token of the protocol:

Fees

Network fees are the primary source of revenue for the protocol. Immutable X currently charges a fixed 2% fee on all asset sales and NFT trades. While users are not required to pay transaction fees in IMX, 20% of all fees that occur on the network must be denominated in IMX. If the user chooses not to pay protocol fees in IMX, Immutable will automatically convert the corresponding currency to IMX on the open market. 20% of the generated revenue is then deposited into the staking reward pool, while the foundation receives the remaining 80% as its main income stream.

Immutable also permits network participants to apply additional fees, further promoting development and opening doors to new revenue streams. In particular:

- As Immutable X utilizes a shared order book system for all marketplaces on the network, individual marketplaces can set their own fees on top of the 2% transaction fee cut. Hence, if one order created on one platform is filled on another, both marketplaces can receive revenue from the trade.

- Asset originators can also incorporate royalty fees to each NFT they minted and generate income from all secondary sales of the asset. The royalty percentage is fixed and cannot be adjusted after the NFT is minted.

Staking

As stated above, the 20% of IMX tokens accumulated from the generated as part of the fee capture mechanism is sent to the staking reward pool. The IMX within this pool is distributed proportionally to active stakers on the protocol relative to their stake. Eligibility requirements to be regarded as an active staker is as follows:

- Have staked IMX tokens on L2,

- Completed a trade on Immutable X marketplaces that uses the Immutable order book in the past 14 days of the current cycle.

Note that the staker must have their L2 wallet linked to the L1 wallet to receive the staking rewards since rewards are distributed on L2. Users can stake their IMX tokens here, calculate their expected rewards with the staking rewards calculator, and check for wallet eligibility here.

Governance

It is evident that Immutable X is seeking to incentivize the alignment of all parties to drive, retain, and grow activity on the network. Therefore, IMX holders are entitled to vote on governance proposals directed toward token-related matters such as reserve allocation, developer grants, activating daily rewards, and token supply adjustments.

Attractive token economic design and decentralization (voting power equivalent to the number of tokens held)will likely be important for sustainability in the long run. As submissions get approved, the foundation will implement the corresponding proposal accordingly. Note that governance proposals are exhibited on L1, but holders on both L1 and L2 are eligible. However, members must hold a certain amount of tokens (TBD) to qualify for governance participation. The Immutable X governance is not yet live as of today.

Token Supply & Distribution

Supply Breakdown

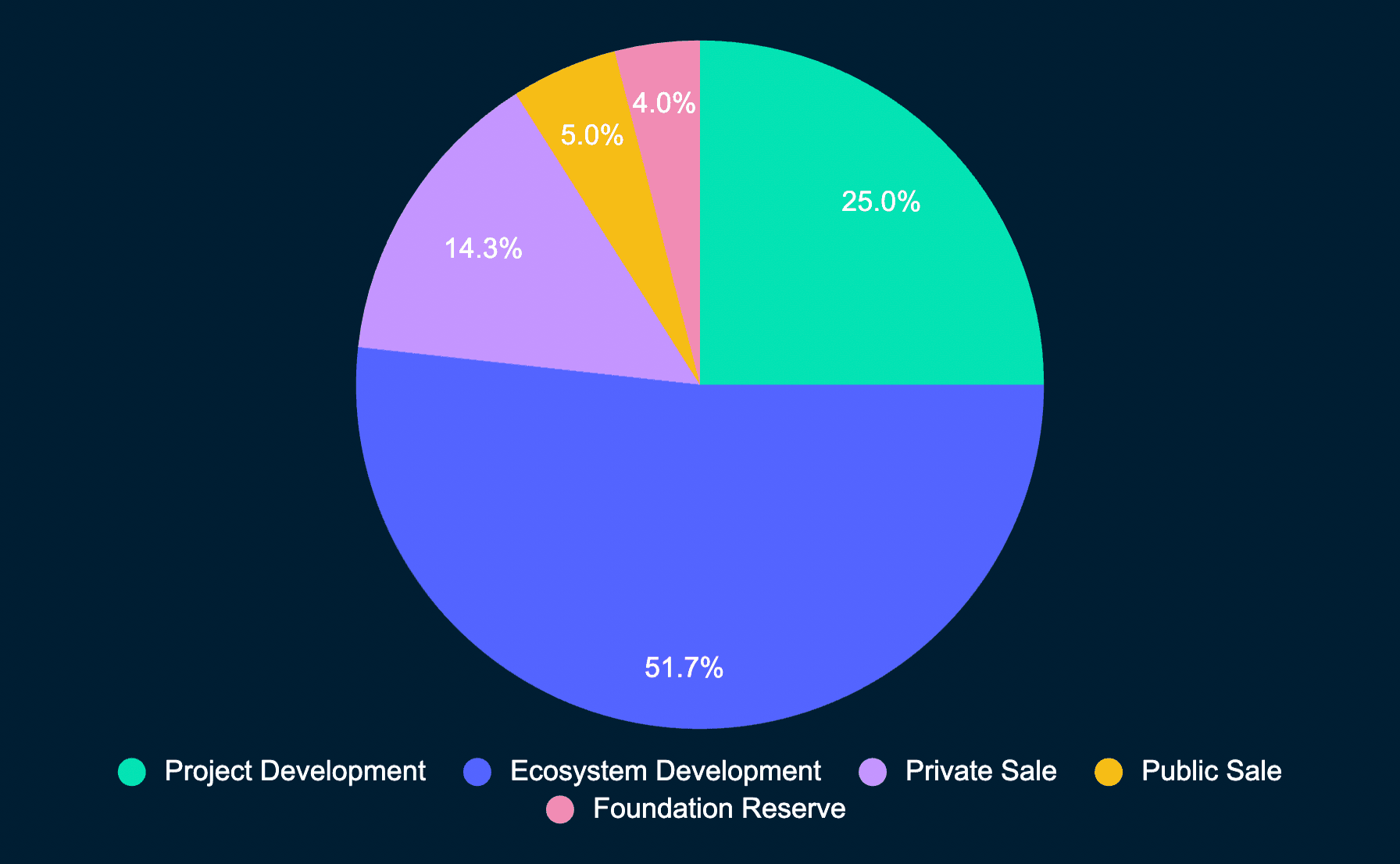

The IMX total supply is capped at 2 billion tokens and allocated accordingly:

| Segment | Allocation | Details |

|---|---|---|

| Ecosystem Development | 51.74% | Allocated for user rewards, developer grants, liquidity provision, and marketing campaigns. |

| Project Development | 25.00% | Allocated to the development of the protocol. |

| Private Sale | 14.26% | Allocated to private sale investors. |

| Public Sale | 5.00% | Allocated to public sale participants. |

| Foundation Reserve | 4.00% | Allocated mainly to the liquidity provision on exchanges. |

Project Development

While there is not much information regarding the usage of the 25% allocation to the project development, it could be attributed to some selling pressure for additional funds for the team later on. This could be the primary driver that aligns the team's interests with motivation for protocol growth and development.

Note that there is no direct IMX allocation for directors or employees of Immutable as compensation for their services or involvement in the project.

Public Sale Information

Immutable X conducted its public sale in September of last year on CoinList. Investors could purchase up to $500 worth of IMX tokens but with a minimum sum of $100 at $0.1 per token for option 1 (6 months linear release) buyers and $0.15 for option 2 (3 months linear release) buyers. An aggregate of 100m tokens (5% of total supply) was allocated to the public sale, which sold out, netting $13m for the project. The project also conducted an IEO on Huobi, selling 6m tokens at $0.16 per token.

| Public Rounds | Token Price | Allocation | % of Total Supply | ROI |

|---|---|---|---|---|

| ICO (Option 1) | $0.1 | 40m | 2% | 7.6x |

| ICO (Option 2) | $0.15 | 60m | 3% | 5.07x |

| Huobi IEO | $0.16 | 6m | 0.3% | 4.75x |

The breakdown of the private sale allocation can be seen below. Note that there is no known information about the token price of one of the private round allocations.

| Private Rounds | Token Price | Allocation | % of Total Supply | ROI |

|---|---|---|---|---|

| Private sale | N/A | 29.2m | 1.46% | N/A |

| Private sale - Initial users | $0.025 | 240m | 12% | 30.4x |

| Private sale - Early users | $0.05 | 8m | 0.4% | 15.2x |

| Private sale - Huobi Ventures | $0.1 | 8m | 0.4% | 7.6x |

Data as of September 30, 2022 Source: CryptoRank, Vestlab

Ecosystem Development Allocation

Approximately half of the IMX token supply is allocated to ecosystem development and distributed to network participants and developers as a reward for conducting pro-network activities. The goal is to bootstrap adoption and usage of the games, marketplaces, and other applications building on Immutable X. There are two main initiatives outlined:

- Daily Rewards

To jumpstart activity and drive adoption, the protocol allocates a limit of 100,000 IMX tokens from the ecosystem development reserves to the daily reward pool. Daily rewards are given to users who trade or mint assets, with a minimum value of $10 and capped at $10,000, from eligible collections (non-zero royalty fee) and held for more than 24 hours. These measures prevent wash-trading from users trying to game the system. Users are able to earn points, which translates to their claimable share.

The daily trading volume determines the amount of IMX tokens from the 100,000 daily supply available for distribution. If the user sells their assets within 24 hours, their trading volume will not be counted. The trading rewards tiers are as follows:

Total transaction volume <$1.2m = 40,000 IMX

Total transaction volume $1.2m - $2m = 60,000 IMX

Total transaction volume $2m - $3m = 80,000 IMX

Total transaction volume >$3m = 100,000 IMX

66.6% of the daily reward tokens are subject to a linear 6-months vesting schedule to prevent immediate unloading from short-term-minded users and instead align with the vision of long-term believers of the project. Users can verify the daily trading volume and eligible collections here.

- Developer Grants

Token holders can also vote on governance proposals that grant aspiring developers funds from the ecosystem development reserve to build and contribute value to the protocol. The foundation will also directly finance some funds from the project development reserve to developers. The Immutable X Fund section below covers more details of the grant program.

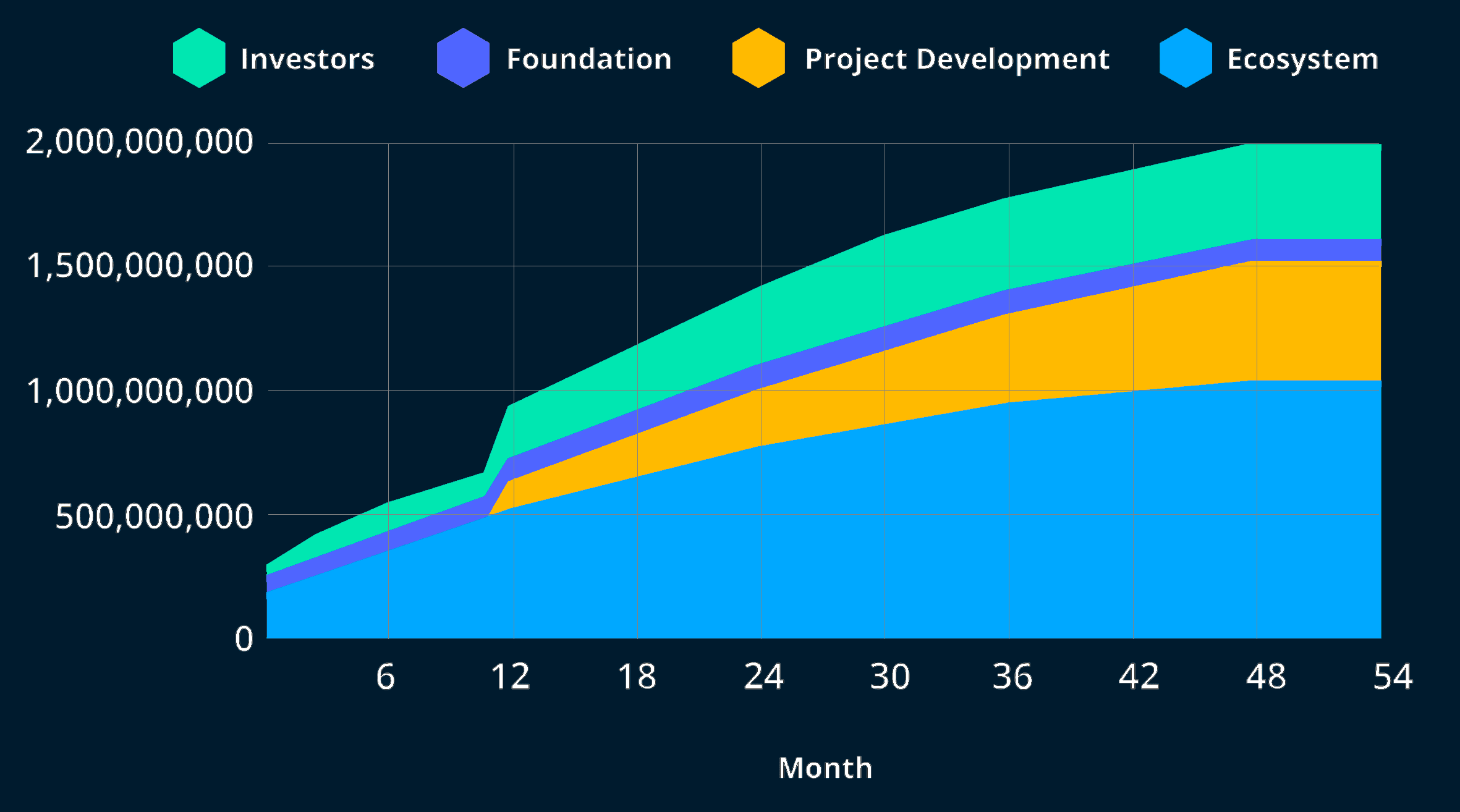

Token Unlocks & Supply Schedule

Immutable X classifies three states for the tokens according to the respective lock-up periods, as shown below:

| Type | Available to trade | Available to pay for trades | Available to withdraw | Available to stake | Available to vote |

|---|---|---|---|---|---|

| Locked | No | No | No | No | No |

| Awaiting Cliff | No | No | No | Yes | Yes |

| Unlocked | Yes | Yes | Yes | Yes | Yes |

Source: Immutable X Whitepaper

The vesting period and lock-up rules for each segment can be seen here:

| Segment | % subject to lock | Lock start date | Unlock cliff | Unlock length | Unlock frequency |

|---|---|---|---|---|---|

| Private Sale | 100% | Token launch | 1 year | 2.5 years | 28 days |

| Public Sale (Discounted Tranche) | 100% | Token launch | None | 6 months | 28 days |

| Public Sale | 100% | Unlocked at launch | None | 3 months | 28 days |

| Project Development | 100% | Token launch | 1 year | 4 months | 28 days |

| Daily Rewards | 66.66% | Daily UTC 12 am | None | 6 months | 28 days |

| Developer Grants | 100% | Per contract | None | 2 years | 28 days |

| Foundation Reserve | 0% | Token launch | None | None | None |

Source: Immutable X Whitepaper

The definitions for the terms mentioned are as follows:

- Percentage subject to lock: The percentage of tokens distributed that are locked

- Lock start date: Starting date for when the cliff and unlock periods are calculated

- Unlock cliff: The period during which no tokens are unlocked

- Unlock frequency: The frequency that the unlocked amount is updated

For example, the private sale participants have a 100% locked rate which starts at token launch, with a 1-year unlock cliff over 2.5 years (30 months) and an unlock frequency of 28 days. While no tokens are unlocked and distributed after the first month, 1/30 of the tokens are now categorized as “awaiting cliff”. Similarly, 1/15 of the distribution is classified as “awaiting cliff” after two months.

The token supply schedule can be seen here:

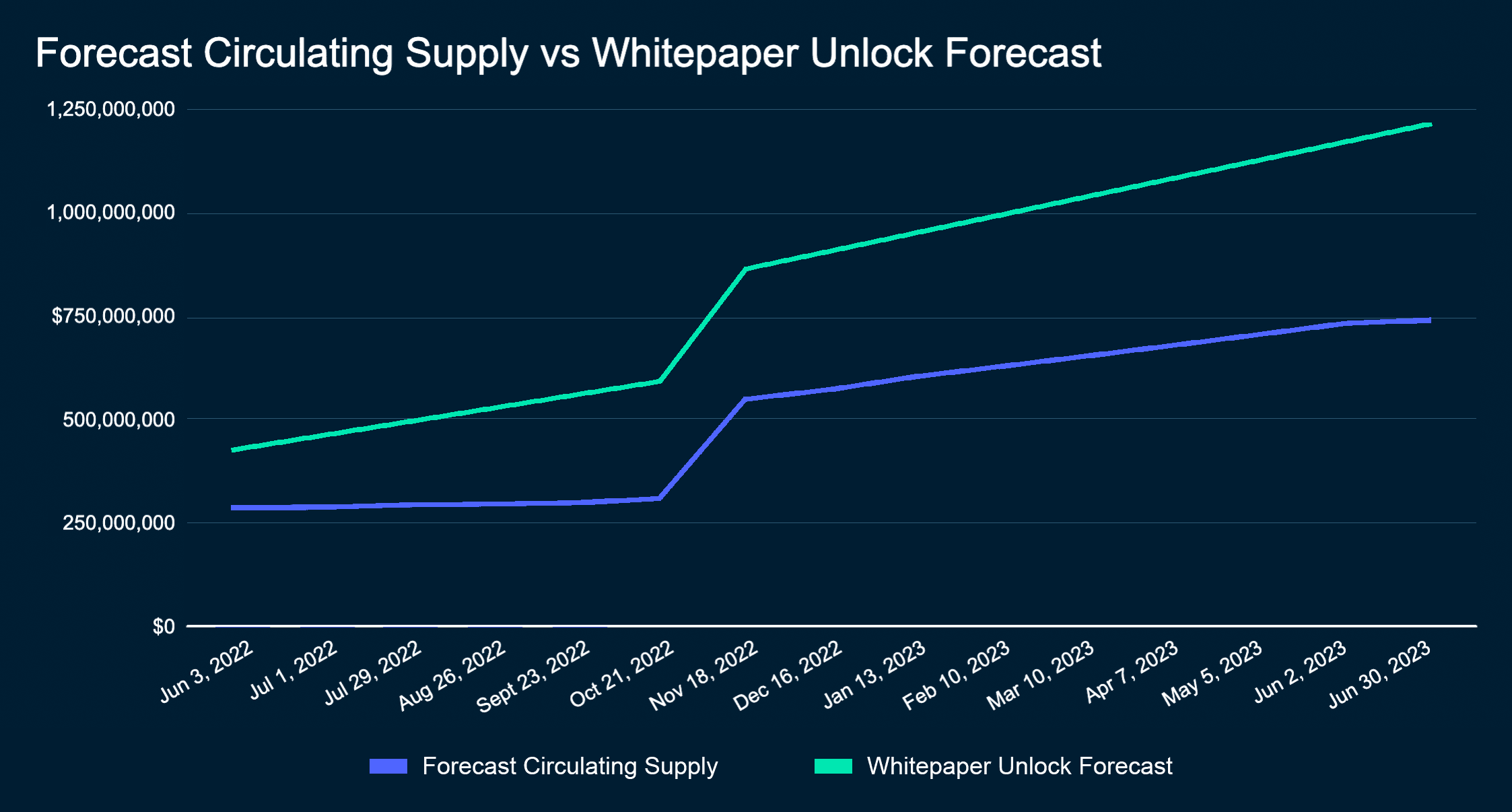

According to the supply forecast provided by the team, the actual distribution of IMX across ecosystem-driven initiatives has been lower than expected, which led to a lower forecast for circulating supply. Some reasons the actual forecast is lower than expected could be: the foundation not giving out as many grants as expected, fewer ecosystem-driven initiatives and fund deployment, fewer projects that have met their milestone targets, or not enough projects applying for the program itself.

However, the real circulating supply will fluctuate relative to the forecast based on the number of grants awarded and milestones achieved by grant recipients to unlock the allocation. Note that the biggest unlocking event of IMX tokens will commence during Q4 of this year due to releases from the private sale and project development segments.

The are currently approximately 235m IMX tokens in circulation, but roughly 118.75m and 132.4m tokens from the private sale investors and project development segments are about to end their 1-year cliff, respectively. In other words, the upcoming unlock schedule contributes to 251m tokens, equivalent to 12.55% of the total supply and more than half of the circulating supply, potentially coming into circulation.

More information on the supply forecast and historical activity of the wallet maintaining custody of the IMX tokens (3 of 5 multi-sig) can be found on this Notion page.

Immutable X Fund

Immutable X has allocated approximately 500m IMX tokens to the fund, which consists of two parts; ventures and grants. The venture side was established in partnership with venture firms, including BITKRAFT, Animoca, AirTree, King River Capital, and Gamestop, to give developers access to additional investment opportunities. Meanwhile, Digital Worlds NFTs, the non-profit organization and issuer of IMX, will also offer grants and resources to aspiring projects. The fund is expected to invest regularly over the next 4 years.

The purpose of distributing these performance-based grants is to retain top-tier developers to grow in parallel with the ecosystem. As Immutable X is the infrastructure layer, developers are essential for value creation on the protocol to drive activity and users. Without use cases and good UX, there is no value. In August alone, there were 11 agreed partnerships, 4 launched partnerships, and 1 partnership that has achieved all milestones.

Some notable game partnerships

| Game | Type | Partnered Since |

|---|---|---|

| Illuvium | RPG adventure game | 6/16/22 |

| Ember Sword | MMORPG | 6/28/22 |

| Gods Unchained | Trading card game | 6/16/22 |

| Guild of Guardians | Mobile RPG | 6/16/22 |

| Planet Quest | Tactical multiplayer shooter | 6/29/22 |

| Deviants’ Factions | Trading card game | 8/16/22 |

| WAGMI | Tower defense game | 6/28/22 |

Roadmap

Immutable's efforts to create a gaming and NFT ecosystem on their blockchain have been successful so far. The team has been executing new features, as well as announcing partnerships and developer support initiatives regularly. They have already announced partnerships with the likes of Gamestop, Rarible, Reddit, and more.

Features such as mobile wallet support, royalty contract, L2 ETH off-ramp to fiat, and protocol fee mechanism have all been completed. Self-custodial staking, wallet SDK, Golang SDK, NFT purchases with fiat, and more are in progress, with other features like offers, auctions, payments via arbitrary ERC-20 tokens, and other language-specific SDKs in the backlog. A detailed list of the protocol feature integrations and roadmap can be found on this Notion page.

All these developments indicate signs of a well-beyond adept and qualified team necessary to ship a robust infrastructure, which brings confidence to aspiring developers looking to launch their games on the protocol. The future looks bright for Immutable X as they continue to build and onboard both creators and users to L2, fulfilling their potential to become a powerhouse in the gaming and NFT space.

Risks

Even though Immutable X appears to be moving in the right direction, some associated risks need to be kept in mind.

- Firstly, as Immutable X is built on Ethereum, it naturally relies on Ethereum for network security. While Ethereum is one of the most secured networks in the space, the chance that the network becomes compromised is still non-zero (for example, validator staking centralization).

- A greater risk is the security assumption on L2, such as trust assumptions around the data availability committee's honesty in conducting diligence on transaction data and potential loss or exploitation of data from off-chain storage.

- Secondly, Immutable X must carefully manage and control the IMX token emissions. As we have seen many times in the past year, unfavorable token emissions led to the downfall of many gaming-related projects due to the constant selling pressure that outweighed the demand for the token's use case. This can also make the ecosystem unattractive to build or spend time on.

- Lastly, the long-term success of Immutable X depends on developer retention and their ability to build addictive games that incorporate blockchain technology in the background. However, the ability to keep builders within the Immutable X ecosystem depends on L2 adoption for NFTs and gaming as opposed to alternative L1s like Avalanche or Solana and lucrative incentives and infrastructure to build on Immutable X.