Key Terms

| Term | Description |

|---|---|

| Parachain | A blockchain that connects to the Polkadot relay chain and inherits Polkadot’s shared security and interoperability with other parachains. Parachains are essentially shards. Polkadot will initially support 100 parachains. |

| Relay Chain | The main network that parachains plug into and where transactions are finalized. |

| Substrate | An SDK that developers can use to build highly customizable blockchains. It is the primary SDK that developers use to build Polkadot parachains. |

| XCM/XCMP | Polkadot’s cross-chain message-passing protocol. It allows communication between Kusama, Polkadot, and their parachains. |

| Pallets | Pallets are basically blockchain building blocks on Substrate. There are currently 40+ pallets, which include a governance pallet, a recovery pallet, and an oracle pallet that can be incorporated into chains built using Substrate. |

| Inter Blockchain Communication (IBC) | A generalized messaging protocol that allows for any Cosmos Zone to be interoperable with each other. Made up of many parts: 1) Base layer - Tendermint BFT consensus chains, 2) Transport layer - permissionless relayers from source to destination chain, 3) Authentication layer - light-client verification, 4) Interface layer - IBC data packets |

| CosmWasm | Cosmos’ Virtual Machine implementation for deploying smart contracts, written in Rust. |

| Light clients | Light clients are programs that connect to full nodes to interact with a blockchain without having to download or store the full block data. |

| Mosaic | Composable Finance’s liquidity and transfer availability layer, connecting the Composable ecosystem to EVM chains and rollup solutions. |

| Centauri | Similar to Mosaic, Centauri functions as the transport layer, permitting communication with Cosmos Zones. |

| Merkle Mountain Range Trees (MMRs) | MMRs are a special kind of Merkle tree data structure, composed of perfectly-sized binary subtrees. MMRs are used to resolve high computational volume problems by enabling highly efficient ancestry proofs. |

| Bridge Efficiency Enabling Finality Yielder (BEEFY) | BEEFY is Parity’s consensus gadget that enables parachains on the DotSama ecosystem to be bridged over to other chains while providing finality proofs. Finality proofs ensure that transactions on the blockchain are absolute. |

| BEEFY light client | The BEEFY light client implementation for the Cosmos-IBC ecosystem enables Cosmos chains to follow the finality of the Kusama relay chain as well as Picasso’s. |

TLDR

- Composable Finance is building core infrastructure for an interoperable DeFi future, where developers can deploy cross-chain native dApps and users can seamlessly deploy capital across ecosystems.

- To maximize cross-ecosystem communication, Composable Finance is building on the Polkadot/Kusama (DotSama) ecosystem. Substrate allows communication between parachains via Polkadot's XCM technology.

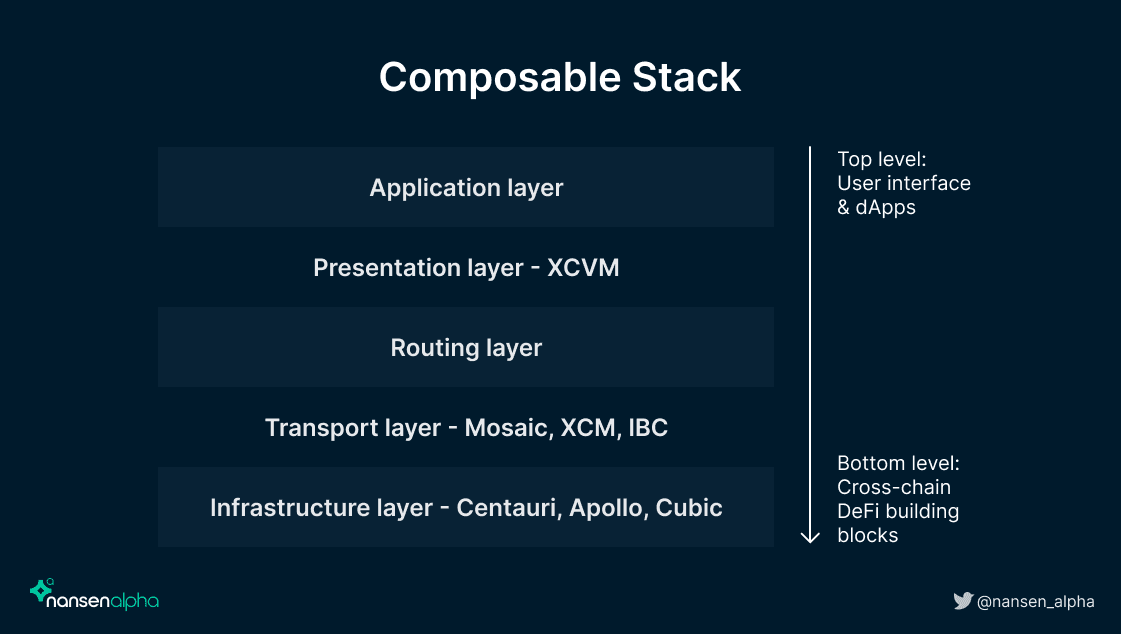

- Composable Finance's technology stack consists of five main layers; the application layer, the Cross-Chain Virtual Machine (XCVM), the routing layer, the transport layer, and the infrastructure layer.

- The XCVM is Composable Finance's virtual machine development, which integrates the CosmWasm smart contract framework. XCVM allows developers to launch cross-chain native smart contracts within a single interface. This implementation also bridges DotSama to the Cosmos-IBC ecosystem.

- The routing layer supports the XCVM by managing possible and efficient routes. The routing layer is responsible for relaying messages passed from the XCVM to the destination chain and layer.

- Mosaic, a primary Substrate pallet, functions as the liquidity and transfer availability layer between the Composable ecosystem and EVM-enabled blockchains. Mosaic maintains liquidity within its vaults through a series of fee management algorithms, facilitating capital movements across chains.

- Other primary pallets developed by Composable Finance, such as Centauri, Apollo, and Cubic, are the building blocks that serve as the infrastructure layer for the Composable stack.

Composable Finance Overview

The current DeFi landscape is still heavily fragmented and isolated within each existing ecosystem, whether it be Ethereum, Avalanche, Polkadot, Cosmos, or Solana. Deploying capital for cross-chain strategies is inefficient as it takes time to bridge over to another chain. Moreover, some of these chains and layers do not have any connection points to one another, making some strategies impossible to execute securely. Thus, users are unable to leverage the full potential of DeFi. Furthermore, bridging solutions are usually secured by a multi-sig, which poses a risk for users. As we have seen in recent months, bridges are one of the biggest bottlenecks in the industry and are susceptible to hacks, as large amounts of funds are locked up within protocol-controlled wallets. Some of the largest hacks in crypto history came from bridge hacks, including well-known names like Wormhole, Ronin, and most recently, Nomad.

Composable Finance aims to develop technologies that allow for seamless cross-chain DeFi activity, breaking down the siloed walls that limit opportunities within this fast-growing space. Their vision is to be the center of an interoperable DeFi future, where users can seamlessly deploy capital and employ cross-chain strategies without bothering about technicalities and security risks of moving assets between chains. In short, they believe the future of DeFi should be blockchain-agnostic.

Composable Finance's solution is a modular technology infrastructure stack, where each component works synchronously to solve this fragmentation and inefficiency issue. Through the Composable ecosystem as an entry point, developers will be able to deploy dApps with native cross-chain functionality, with the complications of the underlying cross-chain and cross-layer communication abstracted away. Composable's infrastructure stack consists of:

- Parachains on Kusama and Polkadot

- Composable Finance is deploying two parachains; Picasso on the Kusama network and Composable on the Polkadot network. These parachains will serve as the central point for Composable’s cross-chain DeFi activity.

- Composable Cross-Chain Virtual Machine (XCVM)

- Through XCVM, developers will be able to deploy cross-chain native smart contracts on the Picasso and Composable parachains.

- Core bridge infrastructure

- Mosaic will be the bridging infrastructure to EVM chains and roll-up solutions.

- Centauri will be the bridging infrastructure providing communication to the Cosmos-IBC ecosystem.

- DeFi building blocks (pallets)

- Composable's primary pallets, such as Apollo (Composable-native oracle) and Cubic (Composable vault), will serve as the building blocks for developers to leverage while constructing their dApps.

With this array of infrastructure stacks, Composable Finance can usher the full potential of cross-chain DeFi functionality, unifying liquidity across various blockchains, and enhancing composability.

- Composable interacts with EVM-compatible chains and layers, such as Polygon and Arbitrum, through the Mosaic pallet, a liquidity & transfer availability layer for EVM chains.

- By integrating CosmWasm and the IBC protocol, Composable Finance connects the DotSama ecosystem to chains within the Cosmos Zone.

- Composable Finance is working closely with the NEAR protocol team to implement IBC on NEAR, facilitating communication between NEAR, Cosmos-IBC, and Substrate chains.

Picasso

Composable Finance’s vision is to create a protocol that allows for cross-ecosystem communication, where the overarching blockchain ecosystems are repositioned as a network of agnostic liquidity and available yield sources. To accomplish this, the team has launched Picasso, a custom-built L1 parachain on the Kusama network along with the native token PICA. The parachain is the core of the Composable stack. As a parachain, Picasso can securely interact with other parachains through XCM channels at a minimal cost. In other words, it is natively interoperable within the DotSama ecosystem.

Additionally, Picasso manages the Centauri IBC-Substrate bridge as well as Mosaic, the transfer availability layer for EVM-compatible chains. As a result, Picasso becomes a cross-chain hub, merging liquidity between various chains and rollup solutions.

Picasso also offers a suite of DeFi products, such as the Pablo DEX. Their focus on cross-chain liquidity and communication allows users to deploy capital and maximize their yield seamlessly across chains, including Polkadot, Cosmos, and EVM-compatible chains and rollups (with NEAR coming shortly) without worrying about technicalities, potentially opening up vast new strategies and opportunities. However, by positioning itself as the central hub for cross-chain DeFi activity, Picasso will also attract liquidity from other chains, allowing it to obtain deep liquidity. Picasso will deploy Apollo (Oracle), Cubic (Parachain vault), Mosaic, and Centauri pallets as a starting point for expanding their DeFi ecosystem.

Composable

Similar to Picasso, Composable is the custom L1 parachain on Polkadot, enabling it to benefit from the shared security of the Polkadot Relay Chain. Furthermore, this allows the team to focus their energy on building pallets and the technology stack without recruiting node validators and maintaining the network's security. Like Picasso, the Composable parachain utilizes the XCVM smart contract framework, integrates its own routing layer, and will deploy Mosaic and Centauri pallets as the first native pallets of the ecosystem.

Picasso is the canary network of Composable, used for stability and performance testing. Protocols and pallets that pass the voting process to "graduate" from the Picasso parachain are then onboarded to the Composable parachain. This framework ensures that the quality of protocols deployed on the Composable parachain is maintained.

Identical pallets on Picasso and Composable can communicate either via IBC or XCM, depending on the availability and performance efficiency of each during that time. This eliminates the redundant use of pallets and allows for real-time communication for these pallets across networks. Hence, Composable becomes the contracts chain, whereas Picasso functions as the pallets chain.

Technical Stack Overview

Composable Finance's mission is to reduce complexity, costs, and delays in the DeFi user experience by enhancing cross-chain infrastructure. As they aim for a seamless flow of capital across chains at the end-user interface level, the technical stack must be modular; with building blocks that can be easily integrated and added together. This infrastructure design focuses on simplicity and readily available products (pallets), promoting developers to create better user experiences. To achieve modular composability, Composable's technical stack consists of five main layers: application layer, presentation layer (XCVM), routing layer, transport layer, and infrastructure layer.

Application Layer

The application layer represents the top of Composable's technology stack, which are the cross-chain dApps deployed to the Picasso and Composable parachains using the XCVM. The main purpose of this layer is to abstract away the complexities that the layers below perform, resulting in simple, user-friendly interfaces. Users should not have to know how each stack works when deploying capital across chains via Composable.

Cross-Chain Virtual Machine (XCVM)

XCVM is Composable’s native virtual machine that enables cross-chain smart contract communication without the need to deal with the underlying technicalities. The current approach to interoperability forces developers to choose one native chain and rely on bridges for liquidity transfers. For example, DeFi protocols such as Uniswap, Curve, or Aave want to live on many chains. As the first movers within the DeFi space, they are native to Ethereum. However, if the users want to interact with these protocols on another chain, they bear the burden and risk of bridging their assets through bridging solutions, which are still nascent.

In addition, deploying on a secondary chain is inefficient since it requires manual recreation of another instance, fragments liquidity, forces users to use insecure bridges, and leads to a worse UX given the varying underlying chain assumptions and native tokens needed to transact. Thus, XCVM reduces these pain points by allowing the triggering of smart contract calls that can exist across different ecosystems without having an instance on each destination chain. In other words, XCVM enables developers to write smart contracts that span many blockchains within a single, developer-friendly interface.

XCVM orchestrates smart contract functions across supported L1 and L2 chains. Instead of reimagining the design space of existing bridging protocols, XCVM functions as the orchestration framework for cross-chain communication and function calling across ecosystems. By acting as an orchestration layer, XCVM allows bridging protocols to build on top of its communication scheme for efficient cross-ecosystem capital transfer. XCVM manages the following procedures:

- Send instructions to the routing layer

- Initiate call-backs into smart contracts

- Handles circuit failures (network outages)

- Provides finality

- Allows for the deployment of natively cross-chain protocols and smart contracts

Specifically, XCVM handles the communication between chains and layers by passing the information to the routing layer, which is responsible for relaying the data from XCVM to the correct destination chain and layer (similar to Port Control Protocol, or PCP, in Web2). Therefore, all instances of a protocol on different chains are always up-to-date.

XCVM utilizes the CosmWasm smart contract framework native to Cosmos, making it the first project to bring CosmWasm to the DotSama ecosystem. CosmWasm enables cross-chain communication between IBC-integrated chains, giving the Composable ecosystem and XCVM-compatible chains access to all Cosmos-native chains, thus bolstering the multi-chain vision and blockchain-agnostic liquidity. Through the CosmWasm integration, developers can write smart contracts from the DotSama ecosystem that also exists as multi-chain contracts within the IBC-Cosmos ecosystem. XCVM coalesces CosmWasm's inter-chain feature with Polkadot's shared security model, making its smart contract platform highly interoperable and secure.

Composable Finance's use-case can be depicted as follows: a user wants to borrow USDC on Angular, a secondary cross-chain native pallet developed by Composable Finance, and enter a USDC/OSMO LP position in Osmosis. Composable's XCVM transmits the data packet to the routing layer, which relays the most optimal path to Centauri, the transport layer connecting the Cosmos Zones to the DotSama ecosystem. USDC is supplied to the Osmosis liquidity pool, with settlement being recognized on Composable's parachain.

Routing Layer

As mentioned, the routing layer's responsibility is to find the most optimal path from the source chain and layer to the destination chain and layer for any given action, such as providing liquidity into a pool.

In the current state of cross-chain infrastructure, users who want to perform activities across different ecosystems have to manually source the best possible path to the destination, which is time-consuming. The pathway execution layer solves this inefficiency by functioning as an aggregator for cross-chain fee management. The routing layer will find the most optimal outcome for the user according to their prioritized set of parameters, such as the cheapest, fastest, or KYC/AML compliance.

The routing layer serves two purposes; constructing and maintaining the graph structure of all available chains (edges) and bridges (vertices) and finding the best route during any given time. As the number of chains grows, the number of vertices expands quadratically. Hence, it is paramount that the graph structure is maintained. Directed graph structure is one of, if not the most, efficient data structure algorithms, which helps save the user time and cost. Moreover, the protocol does not need to store all the data on-chain.

To maintain the graph data structure, Composable Finance is developing a network of decentralized nodes to provide oracle and relaying services, allowing for protocol-to-protocol interactions. There are two roles that anyone can maintain:

Indexer node

- The indexer nodes act as an oracle to regularly update the graph, signaling availability, and other metrics such as fees. The notifications sent by indexer nodes will be weighted and accounted for to update the data structure. The risk of false information is significantly reduced by having multiple data inputs. The nodes are rewarded for performing their actions, and the rewards are slashed if the client acts dishonestly.

Routing node

- Individual routing node operators permissionlessly run custom algorithms off-chain to find the best route for any given transaction submitted by the XCVM and propose the route back to the XCVM. Nodes with the best solutions are rewarded.

Transport Layer

Mosaic

Mosaic is Composable Finance's primary pallet on Picasso, serving as the liquidity and transfer availability layer that facilitates asset transfers between EVM chains and rollups. Users can also bridge assets from Mosaic to other parachains via Kusama’s XCM. At its core, it consists of a network of bridges operated by relayers interacting with smart contracts on the source and destination chains. Specifically, Mosaic combines a dynamic fee model, liquidity forecasting, passive liquidity rebalancing, and active liquidity management to enable cross-ecosystem transfers and liquidity movements to existing bridging infrastructures. Mosaic aims to provide bridging-as-a-service for protocols to deepen liquidity and manage their liquidity more effectively, as well as enable users access to fast asset transfers with low fees, maximizing their yield.

Mosaic's development plan is split into three phases:

- Phase 1: Proof-of-concept

- The first phase of Mosaic is a proof-of-concept where Mosaic can be connected to Ethereum, Arbitrum, and Polygon to monitor fees and transfer sizes. The first phase of the roll-out has been completed.

- Phase 2: Integration of core features

- Core functionalities including dynamic fee management, passive liquidity forecasting and balancing, and active liquidity management is integrated with this phase.

- Mosaic will also expand to other chains like Optimism, StarkNet, Avalanche, Fantom, and Moonriver.

- Phase 3: Additional features

- After all of the core features of Mosaic have been implemented, additional features such as decentralized executors and on-chain dispute resolution will be integrated.

Dynamic Fee Model

Mosaic's dynamic fee model is calculated based on the liquidity availability of the source and destination chains and layers. The current fee model structure depends on the percentage of trade size compared to the amount of available liquidity in Mosaic’s vaults. The fee starts at 0.25%, with a linear increase until the trade size is 30% of the total available liquidity in the vault. At 30% utilization, the fee caps out at 4%. The average fee percentage for fast asset transfers across EVM layers is 0.32%.

Liquidity Forecasting

Composable Finance employs Machine-Learning based forecasting models to maintain low fees and ensure available liquidity for users at all times, thereby enhancing user experience. The model can predict when a particular liquidity level will be reached for a layer. By accurately predicting liquidity values in vaults, the protocol can detect liquidity shortfalls and effectively rebalance the vaults, keeping fees low and making sure there is sufficient liquidity to be bridged since depleted liquidity levels lead to failed asset transfers.

Passive Liquidity Rebalancing

Mosaic's liquidity forecasting model is constantly monitoring for vault imbalances to ensure sufficient liquidity. When a shortfall on a layer is detected, Mosaic identifies the best route to migrate enough liquidity via an external bridge to that layer to rebalance the vaults based on forecasted demand. By passively checking the health of Mosaic vaults' liquidities, the protocol can maintain liquidity levels such that transactions can go through. In turn, this also returns yield to liquidity providers and ensures that users can transfer with low fees. Mosaic has announced integrations with three bridging solutions: Hop protocol, Connext, and Multichain.

Active Liquidity Management

While passive liquidity rebalancing prevents potential liquidity shortfalls within the Mosaic vaults, there are cases where the transaction size can be a significant share or even exceed the available liquidity within a particular vault. Active liquidity management solves this issue by providing just-in-time (JIT) liquidity, where a liquidity provider actively provides capital when there is an immediate need for liquidity. Liquidity providers who wish to run an active liquidity bot on Mosaic are rewarded for lending liquidity temporarily with increased compensation when a liquidity gap is identified on a pending transfer.

Active liquidity management and passive liquidity rebalancing mechanisms work in tandem. In particular, Mosaic vaults are constantly rebalanced and maintained while active liquidity bots can front-run potential liquidity shortfalls, thereby ensuring that there is enough capital within the vaults for transactions to go through in all cases.

Additional Features

Apart from the core features highlighted above, Mosaic also has a single-sided staking feature, allowing users to benefit from the rebalancing mechanism. Mosaic has integrated a user interface on top of AMMs, which lets users directly swap tokens within the supported realm of supported assets without leaving Mosaic. Currently, supported assets include USDC, USDT, DAI, WETH, MIM, and FRAX. Mosaic Phase 2 also involves the ability to transfer LP tokens across chains and layers, creating more utility for LP tokens and deepening liquidity for dApps. Lastly, Composable Finance has also integrated cross-chain NFTs into Mosaic. Users can deposit their NFTs from a Mosaic-supported chain into Composable's Summoner Vault, where it will be locked up and minted on the destination chain.

Centauri

Centauri is Composable Finance's trustless light-client-based bridging infrastructure linking the Cosmos ecosystem to the Kusama ecosystem through communication with the IBC protocol. Referring to the example of deploying a cross-chain strategy in the XCVM section above, liquidity transfers involving any Cosmos Zone will be routed via Centauri. As IBC and CosmWasm smart contract framework is integrated into the XCVM, it is the first facilitation of asset transfer between Cosmos, Substrate-based protocols, and NEAR (after the integration is completed). Similar to Mosaic, Centauri functions as the transport layer for Composable XCVM and secondary pallets, fostering capital and information flow to and from IBC-integrated chains.

Centauri uses the Bridge Efficiency Enabling Finality Yielder (BEEFY) developed by Parity, which allows the protocol to implement light clients to track and trustlessly reach consensus on transaction finality between Picasso and IBC chains. Light clients allow nodes to verify the state of a blockchain without having to download the entire block data, reducing the complexity and computing power required. Any Cosmos chain can prove finality for the Kusama relay chain and any parachain in a single instance of the BEEFY light client. Centauri also utilizes Merkle Mountain Ranges (MMRs) to allow block headers to be hashed in an 'append-only' manner. The BEEFY finality gadget uses the MMR to obtain these finality proofs, ensuring that consensus is reached between the two networks.

Infrastructure Layer

The infrastructure layer of the Composable ecosystem is the base layer that supports the entire system. This layer consists of the parachains themselves as well as other core primary pallets (other than Mosaic and Centauri) architected by the Composable Finance team, including Apollo (oracle) and Cubic (vault system). These building blocks are critical to the development of applications on the application layer, as they are essential for constructing dApps within any DeFi ecosystem. By deploying these primary pallets, developers can easily integrate these base layer structures into their protocol.

Apollo

Apollo is an MEV-resistant decentralized data oracle native to the Composable ecosystem and is one of the primary pallets currently being developed. As a primary pallet, other secondary pallets and DeFi primitives within Picasso and Composable are encouraged to leverage Apollo for their data feed.

In a proof-of-stake chain, one of the most common forms of MEV is allowing validators to rearrange transactions within a block. Thus, the validator would be able to front-run a trade by placing a transaction before the price update of an asset is executed. Apollo solves this issue by guaranteeing the price update a fixed slot within a block after the block's initialization. Apollo's data feed is also the median price of multiple oracles to limit oracle manipulation.

Cubic

Cubic, the first vault standard, is another primary pallet of the Composable Finance ecosystem. Vaults are critical to Composable Finance's ecosystem as it is used to store and move liquidity across different chains and layers, essentially one of the main pillars for bringing the cross-chain vision to life. Cubic is the link between Kusama, Mosaic's network of bridges to EVM layers, and Centauri's communication system to the Cosmos-IBC ecosystem. Cubic will be the vault infrastructure leveraged by DeFi primitives on Picasso and Composable for cross-chain vault strategies. The vaults are controlled by the multi-sig account of the Picasso Network council, which can vote to pause deposits, investments, and withdrawals or destroy the vault to return funds to users in case of an exploit.

Composable's Roadmap

In the first half of 2022, the Composable Finance team has progressed their developments and bootstrapping initiatives. Namely, the project secured the parachain slot on Polkadot and raised over $32million from a Series A funding round, with participation from notable names like GSR, Ignite, Coinbase Ventures, LongHash Ventures, Jump Capital, Spartan Group, and more. The project has also partnered and collaborated with other protocols; Osmosis, Moonbeam, RMRK, IndexZoo, Crocswap, Connext, Multichain, Acala, and most notably, NEAR. Specifically, as Composable Finance aims to become the hub for cross-chain DeFi, the team must expand their outreach and width. Composable's integration with NEAR, pending approval, will enable Polkadot light clients based on IBC standards. Referencing the existing elements from the Centauri bridge will bring IBC, and trustless bridging, to NEAR.

In terms of developments within Composable's infrastructure stack, the Composable team has effectively rolled out the development of Picasso and Pablo and is now shifting gears toward QA, system testing, and code audits as of August. The team is working with blockchain security firm Halborn to ensure that their products are robust. Precisely, the main objectives for the final delivery stages of Picasso and Pablo are sufficient liquidity for Pablo, feature-complete, user-friendly UX/UI, assisting in onboarding new users to Kusama, and completing the audit process.

The second demo of XCVM will be presented at the CosmoVerse event in September, while improvements on the UI/UX side of XCVM for both institutional and retail users are ongoing. On other fronts, Centauri's front end will be finalized shortly, Mosaic's Phase 2 system monitoring has been running smoothly, and there has also been significant progress on the IBC-light client. Composable Labs was also recently introduced to drive collaboration and secondary pallet development initiatives, as well as Composable Research, which concentrates on studying existing problems within the DeFi space.

Composable Tokenomics

Composable Finance has obtained the 8th Polkadot parachain slot, with over 9,000 participants contributing 6.075m DOT tokens to the protocol. The maximum token supply for Composable’s native token, LAYR, is 100 million. The token distribution breakdown of LAYR is as follows:

| Segment | Total Supply in % | Release Schedule |

|---|---|---|

| Seed Investors | 20.00% | 20% unlocked upon TGE with remainder linearly released over 2 years. |

| Team | 25.00% | 6-month cliff followed by linear vesting over 2.5 years. |

| Emissions | 10.00% | No lock-up period. Released by the protocol as rewards and incentives to bootstrap growth. |

| Crowdloans | 16.00% | 25% unlocked upon TGE with the remainder linearly released over 2.5 years. |

| Treasury | 24.00% | N/A |

| Polkadot Vault Strategy | 5.00% | 50% unlocked upon TGE with the remainder released over 6 months. |

A large proportion of tokens were allocated towards investors and the team (45%) with relatively short lockups. Distributing almost half of the token supply toward seed investors and the team can reduce token incentives for growing the ecosystem. The 20% TGE unlock for seed investors plus a 2-year vesting schedule is arguably too short to align them for a long-term vision. The team’s vesting schedule is not alarming, but start-ups typically would have an approximately 4-year unlock period. A major financial infrastructure like Composable that seeks to build should require significant development beyond 2.5 years. However, with a highly committed team, this may not be an issue. It will be interesting to see if gas fees will be sufficient to reward participants for contributing to the ecosystem once emissions run out - whether that be additional minting or allocating a portion of the treasury funds as an incentive.

LAYR’s utility is gas fees and governance. LAYR token holders can vote on network decisions such as pallet onboarding, ecosystem growth (directing treasury towards different initiatives), and public goods infrastructure. Block producers and oracle operators are also required to submit a stake to produce blocks and update price feeds on the Composable parachain, respectively.

Similar to LAYR, the Picasso also has its own native token, PICA, which secured the 13th parachain slot auction on Kusama. In addition to LAYR’s utilities, PICA holders are also entitled to vote on pallet graduation, which determines the pallets that are ready to be deployed on the Composable parachain. The total supply of PICA is 10 billion tokens compared to the 100 million supply cap of LAYR.

Key Takeaways

Composable Finance is directly spearheading the multi-chain vision by expanding on all fronts. The team appears to be highly competent and committed to building an interoperable and composable future where:

- liquidity is unified throughout various chains and layers,

- users are abstracted away from the complexities of smart contract communication, and

- building blocks are independent.

While being native to the DotSama ecosystem, Composable Finance is implementing a network of bridges to cover both the EVM landscape and Cosmos Zones, which gives them access to extensive amounts of liquidity and DeFi products (and unlocking new cross-chain strategies that are cost-efficient). Further, their virtual machine implementation enables dApps to deploy with native cross-chain functionalities. To complete the entire stack that maximizes communication between blockchains, Composable is also working with external parties like Parity, as well as launching developer grant programs to bootstrap their ecosystem. While their attempt to create an entire technical stack for interoperable DeFi is undoubtedly ambitious, there are also key risk factors that need to be highlighted.

Risks

Most significantly, assembling such a protocol with many building blocks moving and interacting in unison is considerably more prone to smart contract bugs and code errors than regular protocols. In particular, the vaults and bridging infrastructure are the most vulnerable areas. Even if there is no multi-sig, logical flaws within the code can be detrimental, as seen with the recent Nomad's $150m exploit. With such large amounts of capital at stake due to Composable being the hub for cross-chain DeFi activity and liquidity transitions, Mosaic's vault security is of utmost importance.

Another concern for Composable Finance is the Polkadot ecosystem adoption. Although Polkadot has some of the most vibrant developer activities in the industry, user adoption of the broader Polkadot ecosystem has been lackluster, possibly due to the relatively high barrier to entry compared to other blockchains like Solana and Ethereum. Even though the Composable team has been assisting with efforts to onboard more users, there is still uncertainty on this front. In fact, there is still a small, but non-zero, risk that the cross-chain theory does not play out due to bridging infrastructure issues.

To conclude, Composable Finance as a concept is highly ambitious and involves many parts moving in tandem. Bridges, messaging systems, and Oracles are difficult to maintain due to security issues, let alone a layer-1 with its own virtual machine instance. Although, the team has been executing according to their roadmaps and consistently providing updates through their developer logs on Medium. Composable Finance's future is yet to be determined, but they are en route to being the hub for an interoperable and modular DeFi future.