Disclaimer

Nansen has produced the following report as part of its existing contract for services provided to Linea (the "Customer") at the time of publication. While Linea has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Linea, developed by Consensys, is a zero-knowledge (zk) rollup designed to address the scalability constraints on Ethereum. ZK-Rollups batch a large number of off-chain transactions and generate a mathematical proof regarding their validity. Linea is an EVM-compatible ZK-Rollup, enabling EVM developers to deploy their applications in a familiar environment.

The reduction of on-chain data and execution steps also results in reduced gas fees, as Linea minimizes the number of instructions executed within the L1 EVM. Furthermore, Linea's ZK-rollup design enhances security by relying on mathematical ZKPs (Zero-Knowledge Proofs) to validate state updates. This avoids the vulnerabilities associated with challenge periods in Optimistic Rollups. Many consider ZK technology as the endgame for blockchain scaling.

Linea completed its mainnet launch on 16th August 2023.

Roadmap

Linea's roadmap outlines its path towards decentralization. Each phase addresses specific challenges and aims to further enhance the robustness and reliability of the Linea ecosystem.

Phase 0 - Completed

- Launch of Mainnet Alpha (11 July 2023)

- Allows developers to move their dApps to Linea with minimal changes. Linea is a type-3 zkEVM - in which it is fully Ethereum compatible but not Ethereum equivalent.

- Formation of Security Council for network monitoring and risk mitigation

- Publicly available client software for local node verification

Phase 1

- Introduction of the Open Source Stack under AGPL-3.0 license for transparency and code modification

- Implementation of 100% EVM Coverage in zkEVM arithmetization

- Publishing, auditing, and bug bounties for arithmetization specifications

Phase 2

- Diversification of the Security Council for balanced representation

- Enabling Censorship Resistant Withdrawals to ensure user sovereignty

- Stricter multi-sig threshold for timely upgrades

Phase 3

- Decentralizing Operators (Provers and Sequencers) to enhance trust

- Decentralizing Governance for equitable, transparent decision-making

Phase 4

- Introduction of Multi-Prover rollup for diverse implementations of zkEVM prover

- Limiting Governance Powers by making rollup logic upgrades immutable

- Security Council intervention only in case of discrepancies or system issues

Key Developments: H2 2023

Linea Voyage

- The Linea Voyage, spanning from November 7th to December 21st, 2023, was an educational initiative in collaboration with Intract and MetaMask Learn.

- The program brought investors on several missions across the ecosystem, ranging from bridging and liquidity provision to complex trading and interactions with the various dApps. It concluded with a focus on account abstraction on Linea. Linea leveraged Timeless, Pimlico, and Web3 Analytic to power the AA wave of Linea’s DeFi Voyage.

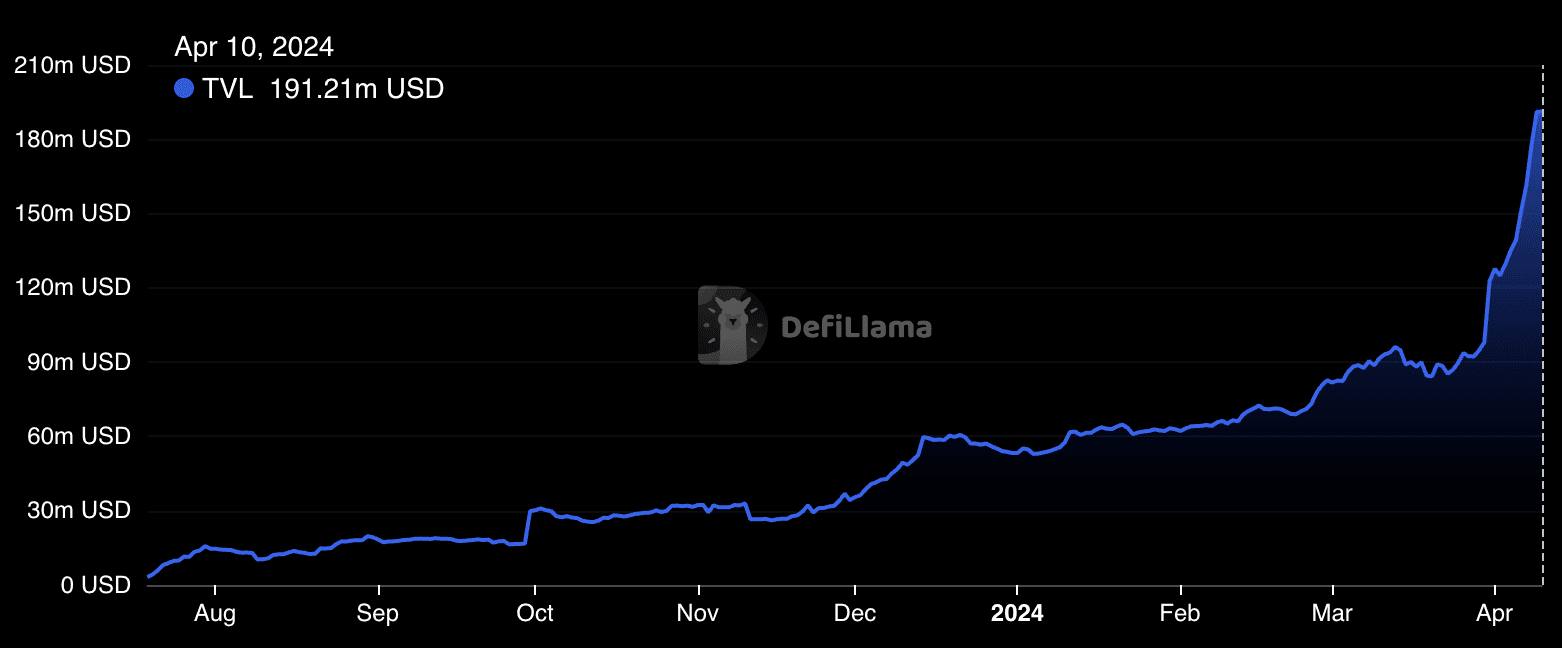

- As can be seen below, Linea experienced a large increase in TVL in late November, which can be partially attributable to the Voyage campaign.

Ecosystem

Mendi Finance

Mendi Finance is a Linea-native lending protocol. It has so far established itself as the leading lending protocol on Linea, with a TVL of $16m as of February 2024.

Gnosis Safe

Gnosis Safe deployed on the network. This is important as it is the core infrastructure required for a burgeoning DeFi ecosystem. Infrastructure like Gnosis Safe will be key for Linea to further develop its ecosystem.

SyncSwap

SyncSwap is a user-friendly DEX operating on Ethereum ZK Rollups, providing users with a cost-effective and easy-to-use platform while ensuring full Ethereum security. On July 20, SyncSwap integrated with the Linea mainnet and emerged as a prominent dApp on the network.

Lynex

Lynex chose Linea to launch its DEX infrastructure. The objectives of the platform are to facilitate liquidity on Linea and foster capital efficiency. The decentralized exchange uses the ve(3,3) framework, which is a combination of Vote-Escrow, incentivizing buy-and-hold, and Staking, Rebasing & Bonding. Incentives are distributed via LYNX and veLYNX tokens.

Alpha V2 Release

Linea released Alpha v2 on February 13th. It is an upgrade that reduces by 90% the cost of publishing data and verifying ZK proofs on Ethereum. It achieves this by introducing proof aggregation and data compression to Linea.

Alpha v2 was successfully deployed to Linea Mainnet on February 13th and introduces two new features to Linea: Proof aggregation and data compression.

With proof aggregation, a number of proofs can be batched into a single recursive proof that is posted to mainnet, reducing costs significantly. Proof aggregation is where ZK-rollups can achieve massive scale.

Furthermore, Linea have implemented data compression in order to minimize data posting costs on L1. As part of this, Linea can store more data per submission to mainnet. This can rise nearly 2x from 70kb now to near Ethereum’s maximum of 123kb. Linea has gone from 150 transactions per batch to approximately 1,500 - a 10x increase.

This has resulted in a 66% reduction in gas fees on Linea with further cost reductions stated for EIP-4844.

Nansen On-chain Data

Daily Transactions

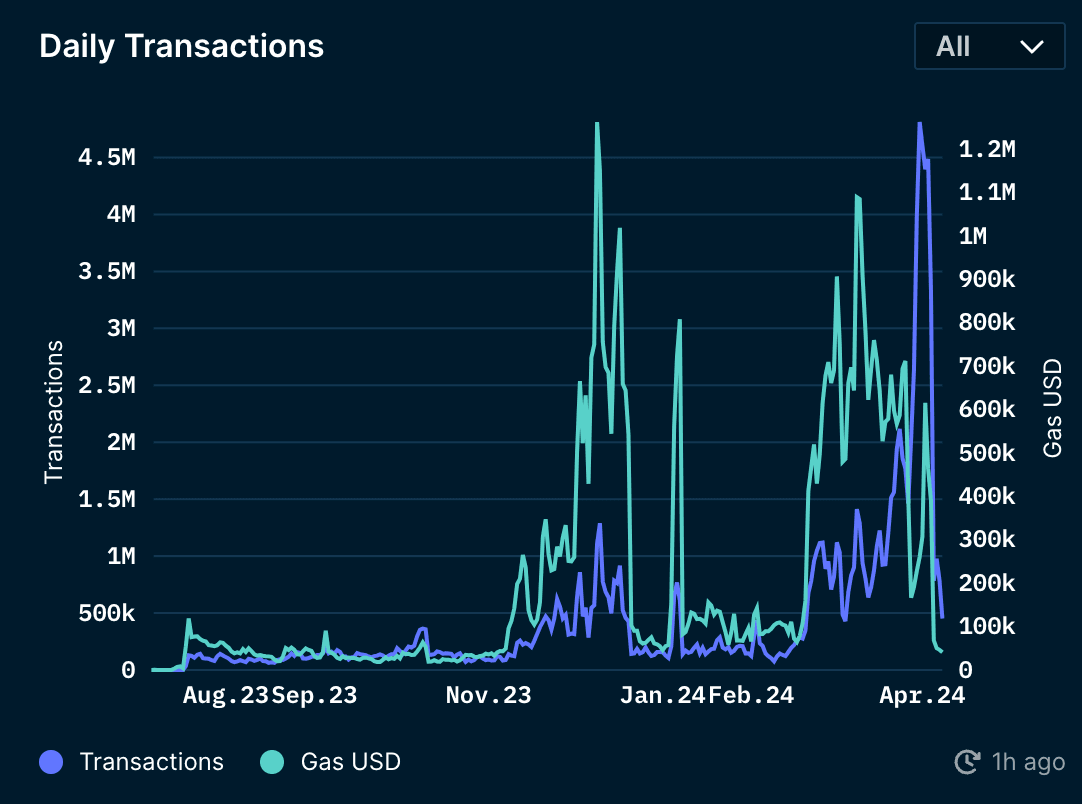

The volume of transactions on the Linea mainnet has exhibited consistent growth since its deployment, starting from approximately 80k and reaching a peak of 1.2 million on Dec 10. This surge in transaction volume can be attributed to the inscription craze at the time.

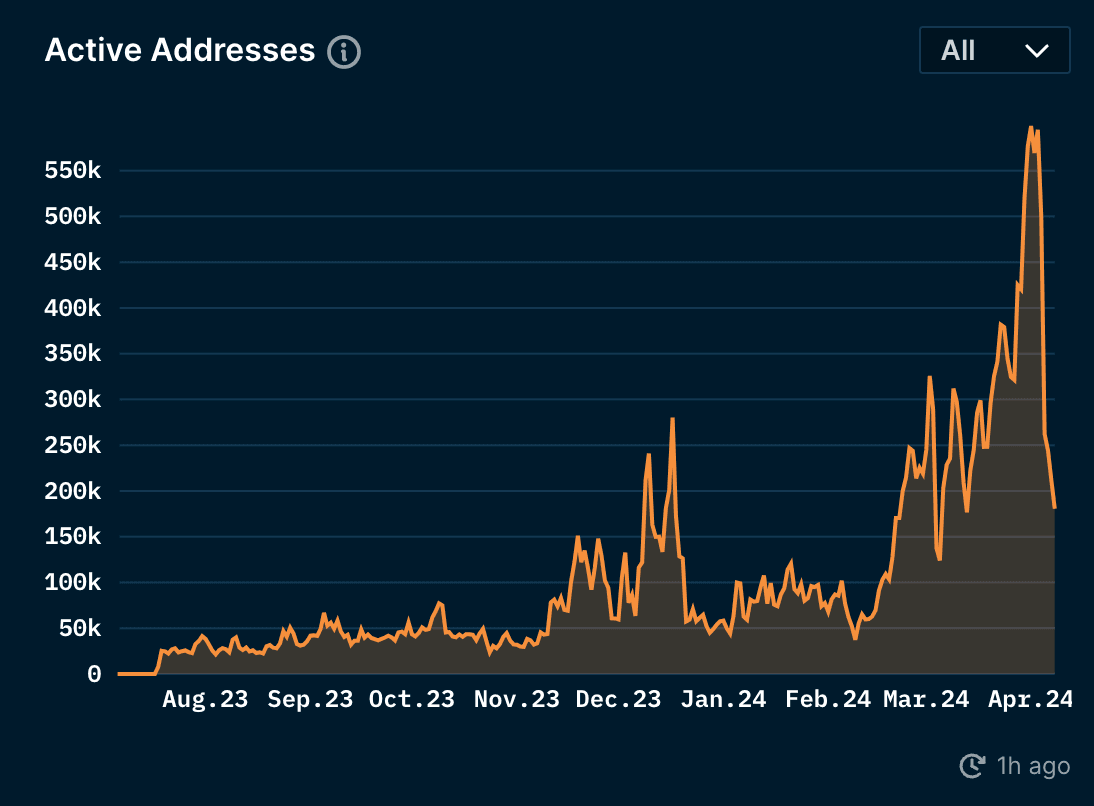

Active Addresses

The trajectory of active addresses closely mirrors that of transactions, showcasing robust growth since November, notably aligning with the commencement of the Linea Voyage. This suggests that initiatives like Linea Voyage are successfully attracting and onboarding new users to the chain.

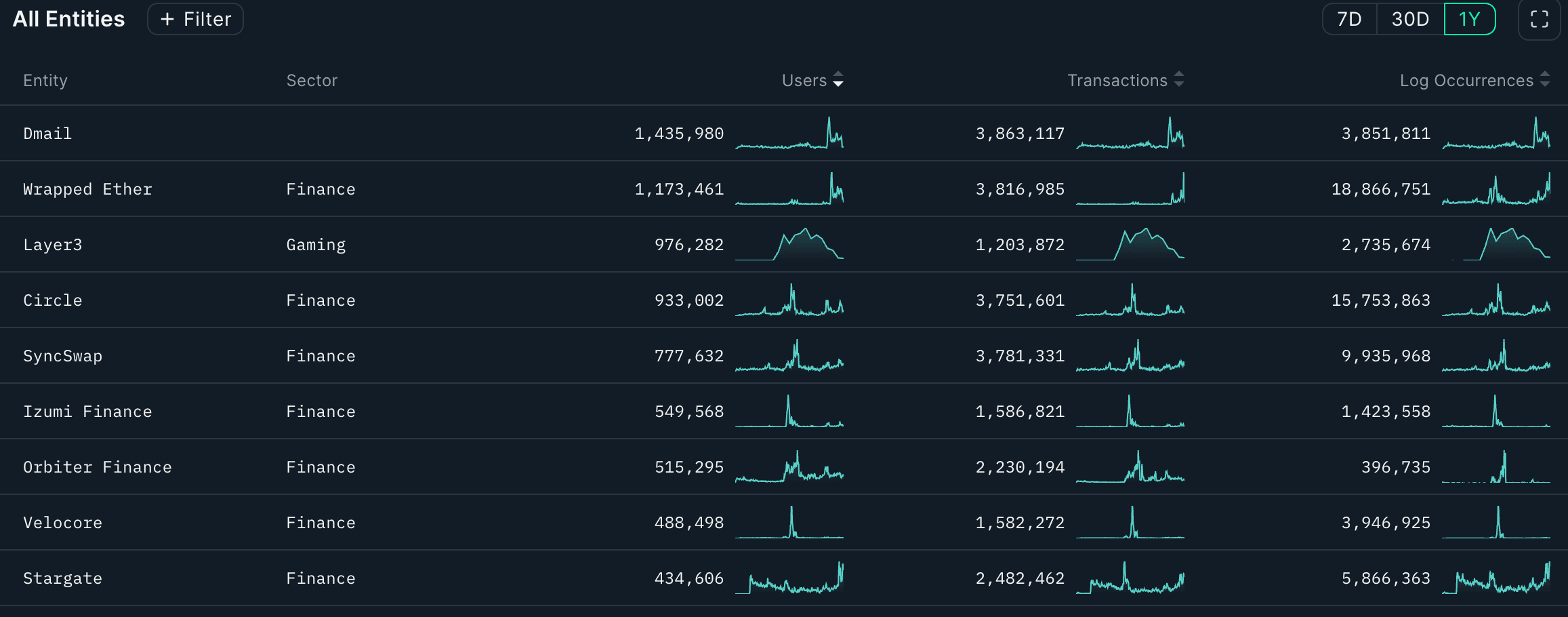

Top Entities by Users and Transactions

Utilizing Nansen labels for identifying prominent entities based on transaction volume and user activity reveals a noteworthy presence of DEXs. These DEXs overlap those on zkSync and could be a signal that users are strategically rotating their funds and potentially migrating assets from other blockchain networks to actively participate and engage with Linea.

Closing Thoughts

In summary, Linea successfully launched and made significant improvements with its Alpha v2, resulting in a 66% reduction in gas fees. The protocol has been noted for ease of deploying EVM applications. The Linea Voyage initiative saw an uptick in activity and interest in the ecosystem. Transactions and activity on the network have trended upward since launch, and Linea will look to build on this progress in H1 2024.