Introduction

Loopscale is a newly launched lending protocol built on Solana, offering a modular, order book–based approach to fixed-rate lending and structured yield products. Unlike traditional DeFi money markets that pool liquidity and dynamically set interest rates, Loopscale matches borrowers and lenders through fixed-term, fixed-rate contracts. The protocol is designed to support diverse collateral types (LP tokens, LSTs, memecoins, etc.), provide isolated risk per loan, and offer programmable strategies on top of the lending layer. Overall, this aims to enable composable leverage, better capital efficiency, and safer DeFi money markets. As for the user, there are currently attractive yield opportunities and an active points program across many of the markets offered - in other words, stablecoin enjoyers can earn a decent yield while farming points during these volatile times.

The protocol just launched on April 10, 2025, and in its first few days, has already seen meaningful traction from early adopters with over $40m in TVL. Its launch coincides with an ongoing points program and a live set of vaults and looping strategies that allow users to deploy capital immediately across different risk-return profiles. Loopscale is backed by leading investors including CoinFund, Solana Ventures, Coinbase Ventures and others.

In this report, we’ll break down:

- What Loopscale offers today across its vaults, loops, borrow, and advanced lend products?

- Where the risks lie, especially in leveraged PTs?

- How to think about current yield opportunities and the ongoing points campaign?

Let’s dive in.

Products

Loopscale’s architecture is modular, and its product stack reflects that. Each product is a composable layer built on top of the core lending engine, designed to serve different user intents, from passive yield to leveraged yield farming. This is important because it isolates risk to each unique product (rather than a pool model that is subject to the riskiest asset in the basket of assets) and allows for much more customization from the end users’ needs. The system breaks apart the lending stack into reusable building blocks, allowing developers or financial strategists to design customized products like leveraged looping vaults, risk-isolated lending markets, and points-incentivized strategies.

Loopscale Vaults

Loopscale Vaults are curated strategies managed either by Loopscale Labs or external strategists. Users deposit a base asset (i.e. USDC, JLP, SOL), and the vault executes a predefined yield strategy using the core Loopscale primitives. These vaults typically have varying strategies as defined by the Vault Curator - they can interact with the fixed-rate borrow market and others; for example, they can lend out USDC at fixed terms or utilize Loops to generate yield with leverage.

Vaults offer a “set-it-and-forget-it” approach but it is still rather sophisticated yield farming under the hood. They abstract away the complexities of collateral management, leverage, and order matching. Strategies vary by risk, leverage, and duration so please do read further into how each vault is managed and allocated.

Loops

Loops are the leveraged product. It consists of structured positions that allow users to “loop” their collateral, borrowing more of the deposited asset (or a correlated one) to redeposit and amplify yield. For example, a user can deposit stSOL, borrow more stSOL at a fixed rate, and redeposit; compounding their yield across multiple turns of leverage.

Loops can be:

- Market-neutral, such as looping stablecoins or LSTs with minimal volatility risk

- Directional, where the loop exposes users to asset price movements, such as looping SOL or JLP

The borrowing occurs against a fixed-rate contract, meaning users know their borrowing costs upfront, making loops a bit more predictable.

Borrow

The core fixed-rate borrowing market on Loopscale allows users to access liquidity for a defined duration (i.e. 3, 7, or 30 days) at a fixed interest rate. Collateral is isolated per loan, which helps mitigate contagion and undercollateralization risks across the system.

Borrowers can access liquidity against a wide range of collaterals. From blue-chip assets like SOL and stSOL, to higher-risk LP tokens, memecoins, and even tokenized restaking assets. This diversity expands access beyond the typical “safe collateral” constraints of most money markets and can stand to be the home to the long tail of riskier assets.

Advanced Lend

Advanced Lend is a tool for users who want precise control over their lending parameters. Rather than simply depositing into a pool, users can customize:

- The asset they want to lend

- The rate and duration of the loan

- The type of collateral they are willing to accept

This order book–driven model empowers lenders to price risk dynamically, match with borrowers who meet their terms, and execute more sophisticated fixed-income strategies.

Risks

Loopscale inherits standard lending risks (smart contract exploits, oracle failure, liquidation), but its leveraged Loops introduce additional complexities:

- Volatility and Liquidation: Leveraged loops can be force-liquidated during adverse price moves, especially for volatile assets.

- Yield vs Borrow Mismatch: If asset yields fall below fixed borrow rates, loops can become unprofitable.

- Liquidity Constraints: Exiting looped positions may face slippage or delays if market depth dries up.

Finally, Loopscale is less than a week old at the time of writing, so users should exercise the usual caution when interacting with newly launched protocols. Users are encouraged to review Loopscale’s full risk and security docs and checking out their audits here.

Yield Opportunities

Loopscale offers various yield opportunities across its products. Below is a summary of current offerings.

Genesis Vaults

| Product | Asset | APY | TVL | Point Boost | Notes |

|---|---|---|---|---|---|

| Loopscale Genesis Vaults | USDC | 2.89% | $17.55m | 6x | 25.92k points per $1k deposited daily |

| Loopscale Genesis Vaults | USDG | 2.42% | $4.36m | 6x | 25.92k points per $1k deposited daily |

| Loopscale Genesis Vaults | SOL | 9.24% | $9.12m | 6x | 25.92k points per $1k deposited daily |

Loopscale has an active points program to incentivize early adopters of these genesis vaults. Although the yield for stables is lower than the floating tbill rate, the points multiplier is quite substantial for early genesis depositors at a 6x multiplier and a daily fixed ~26k points/$1k deposited.

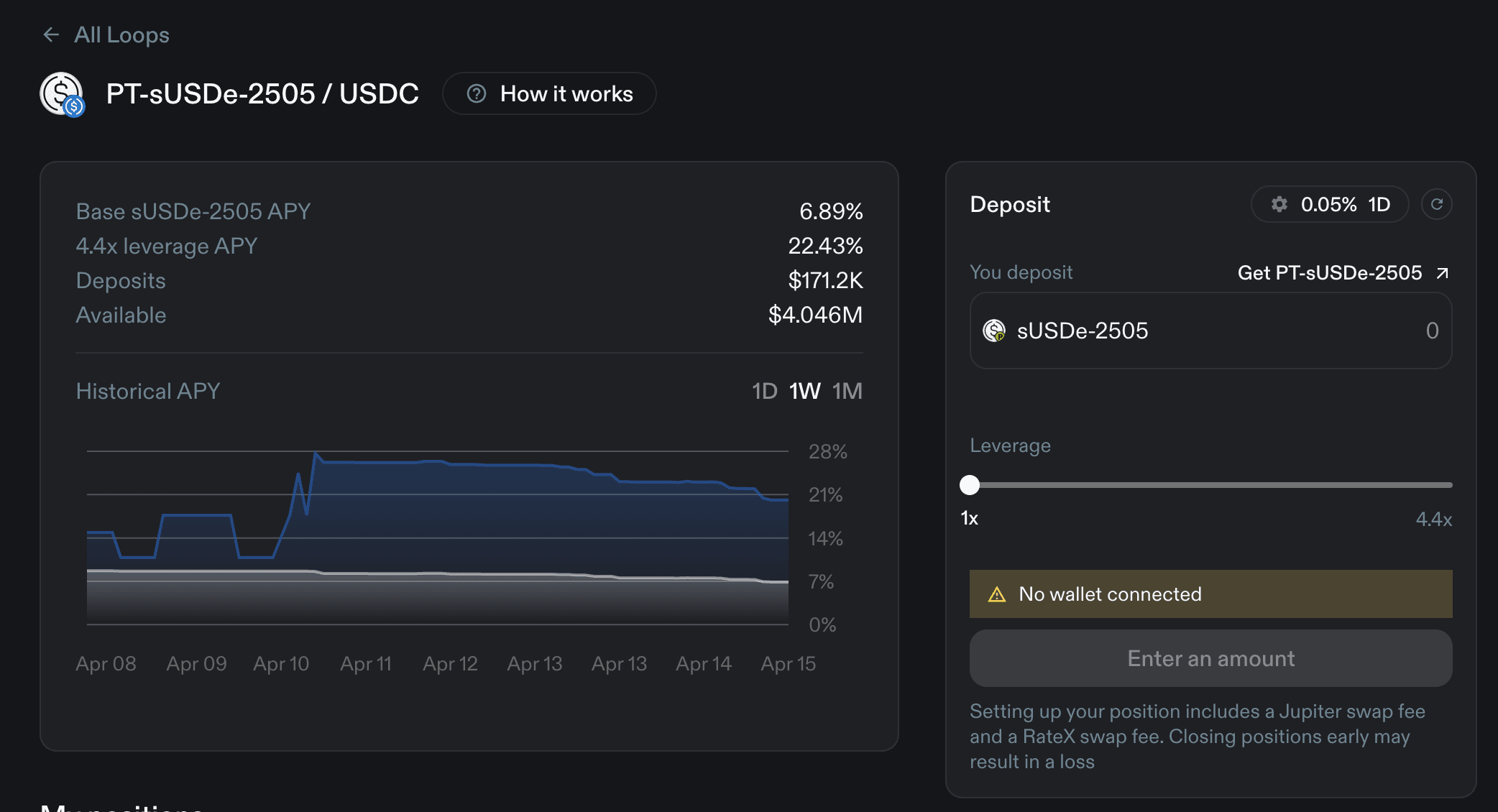

Additionally, we see many Loop leverage-based vaults with some traction and available capacity for new deposits. They have leveraged PTs through RateX offering 22% APR at 4.4x leverage with ~$4m in liquidity to borrow.

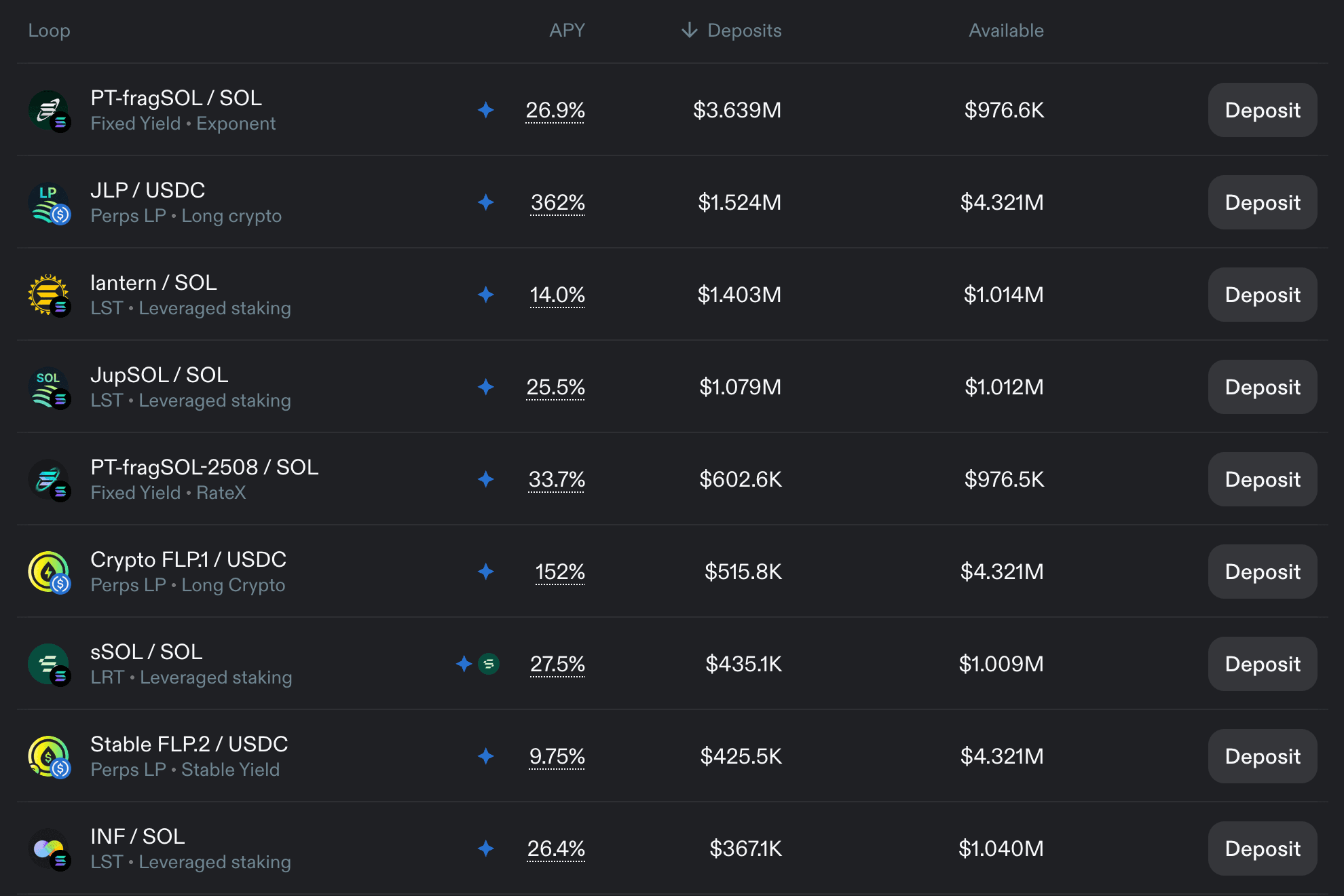

The other top vaults sorted by TVL are featured below.

These vaults are quite risky depending on the strategy used and the type of leverage the user is comfortable with. In the above, we see LSTs, LRTs, popular alts, Perps LP and PTs being used for across this leverage product. Each comes with its own set of risks but the potential APRs of these can be attractive depending on the risk appetite - of course, all of the risks above should be taken into consideration on the directional risk being taken. Plus, additional due diligence should be taken as the full underlying risk goes beyond the scope of this informational report.

On top of vault generated points, users can also verify that they follow the official X account and are in the Discord to get a one time 5k points boost. Given the boost on its vaults, particularly for its genesis vaults, it makes it compelling to be an early user here.

Conclusion

Overall, Loopscale is a new project that brings an interesting approach to DeFi lending combining fixed-rate borrowing, modular vault design, and a collateral-agnostic approach into a single platform. With mainnet live and an active points program in place, Loopscale is positioned strongly for further growth of sophisticated fixed-income and leveraged DeFi products on Solana. The main question lies in how much traction and scalability Loopscale is able to generate from here? We have seen other products such as Euler, Morpho, Silo Finance, amongst others, which have innovated beyond simple spot lending model to continue to grow and take up more market share so we feel this space is ripe for new entrants. We feel Loopscale is off to a solid start from early adoption and offers interesting opportunities for yield chasers and points farmers alike.