In this note, we explore scenario analysis for policy, macro, and market developments and their potential impact on crypto prices.

Tariff policy key developments

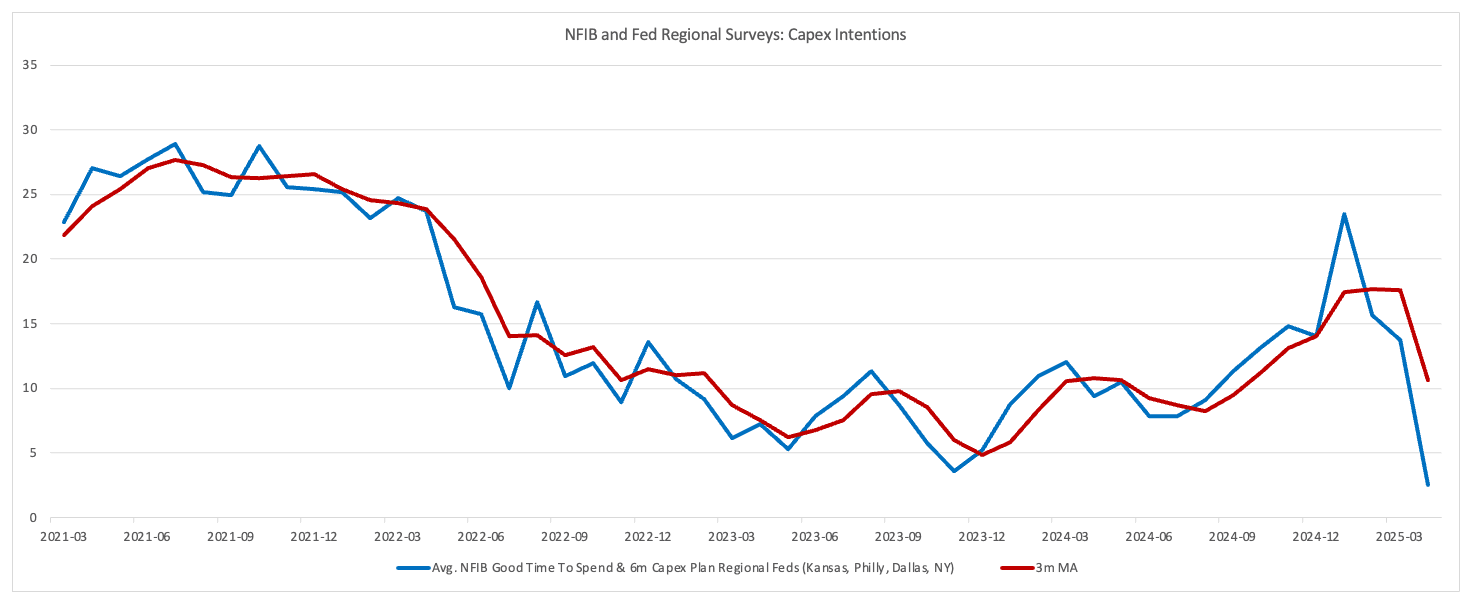

The contrast between resilient hard data and collapsing business and consumer surveys shows that economic agents in the US and other regions have adopted a “wait-and-see” strategy regarding spending, hiring, and price adjustments as they seek more clarity around tariffs.

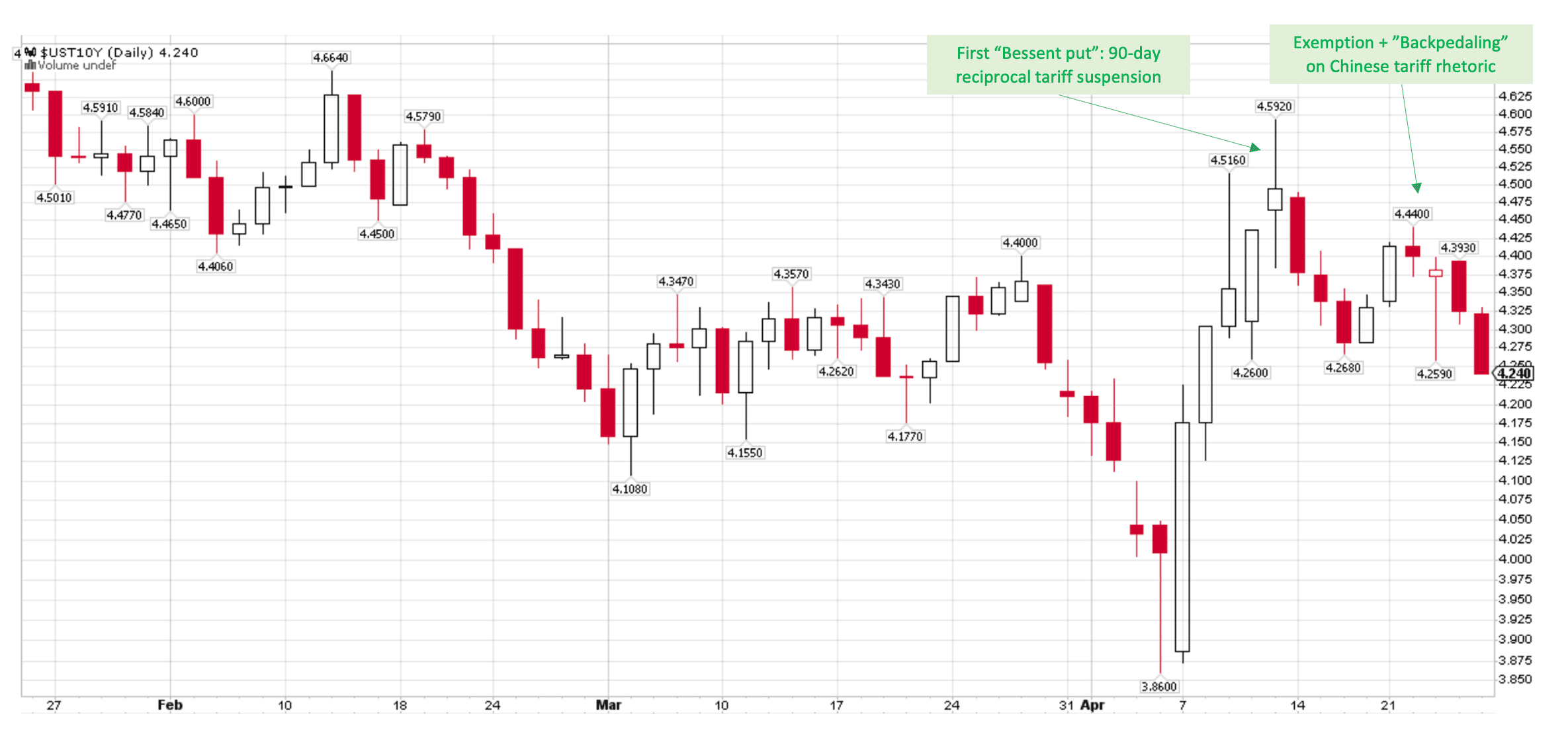

After escalating post-” Liberation Day” on April 2, policy uncertainty seems to have receded after April 9, when the US administration announced a 90-day suspension on reciprocal tariffs to allow for negotiations. Later in the month, the US hinted that 100 %+ tariffs on China were unsustainable and would very likely be lowered, after also granting an exemption on some semis and tech imports. Meanwhile, after initiating tit-for-tat tariffs on US imports, the Chinese also allowed exemptions on some products.

Neither China nor the US has an economic interest in interrupting bilateral trade. The US administration also “backpedaled” after pronounced market weakness, notably in US Rate duration and the US dollar. President Trump also toned down his stance against the US Fed Chair.

Scenarios going forward

Main Scenario 55%: Given this, the main tariff scenario is for the US reaching deals or at least “agreements in principle” with its main trade partners, probably settling around the 10% reciprocal tariff “floor”. With China, one objective of the administration seems to settle at 60% (tariff rate before the last bout of escalation). There remains uncertainty regarding sectoral tariffs for technological and pharmaceutical goods. Still, the best case could be for separate one-on-one agreements with the leading international companies in these sectors, to bring factories (and fiscal revenues) to the US (see TSMC, Roche, Merck, Novartis recently committing more investment to the US). This is the base case scenario: it would allow the global economy and risk assets to muddle through.

Second Most Likely Scenario 30%: Accidents and delays are possible, especially as China plays the card of time in its negotiations with the US. May is seen as pivotal as Chinese shipments reach the US’s shores and exemptions on some tariff categories, such as auto parts and sub-USD-800 shipments from China/ HK, expire. The scenario with the second highest probability is that these negotiation “bumps” significantly dent US consumption and investment and push prices up.

Tail Risk 15%: The tail scenario is for a trade war between the US and China that takes much longer to resolve (no de-escalation in May) and causes the global economy to fall into recession.

Scenarios and BTC price

Below are subjective probabilities and forward paths for BTC vs altcoins according to our three speculated scenarios:

| Scenario | BTC Price Action | Alts Price Action | |

|---|---|---|---|

| Main Scenario 55% | Wall-of-worry climbing | BTC revisits and reaches above the all-time highs | Select altcoins outperform (meme season unlikely to repeat itself) |

| Second Scenario 30% | China-US negotiations drag on further, impacting the macro | BTC range-bound with some bouts of volatility | Altcoins underperform |

| Tail Risk 15% | Full trade war, global recession | BTC double-digit drawdown | Altcoins register deeper drawdowns |

In the sections below, we go through the regional developments in the US, the Eurozone, China, which informed our scenario analysis above, for those curious to look a bit deeper into the macro drivers.

Macro: Regional Summaries

The US: A recession can be avoided, some weakness in the low-end consumer segment

According to the Beige Book, flash PMIs, and corporate earnings communication, consumers are front-loading certain purchases like cars but spending less on non-financial services such as travelling and dining out. Companies have slowed hiring, have not started to lay off workers, but are in “wait-and-see” mode. Most firms said they would pass on higher costs to the end-consumer, although for B-to-C sectors, the final demand is already tepid, which might push companies to absorb higher input costs and eat into their margins.

PMI nowcasting estimates of US growth are consistent with US real growth tracking at 1% SAAR and inflation at 3%.

Some business sectors are faring better than others for now. Because of the already cautious attitude to spending, consumer-facing companies are guiding for flat-to-low-single-digit growth in earnings in 2025 (and negative growth for airline companies). In contrast, tech companies have delivered solid results so far, with no downward revisions in their guidance. Tech and Pharma companies do not have full visibility on sectorial tariffs yet and are announcing higher investment in the US to preempt the tariff negotiations. The best scenario would be non-tariff agreements between the US and the individual companies (for more investment, fiscal repatriation, etc.).

The Fed has indicated that it was ready to wait for more tangible signs of growth weakness before resuming rate cuts (because of the perception of upside risks on inflation). This probably means that US jobless claims will have to rise by a significant amount for the Fed to act.

Eurozone: The Q1 growth tailwinds are fading

In the Eurozone, the Q1 initial spurt of growth is losing momentum. Some narratives have been priced in (the German fiscal package) while others are taking time to materialize (European common defense spending, resumption of economic and energy links with Russia).

Manufacturing activity has been resilient, maybe, here again, because of export front-loading, but the Service sector has softened substantially in April bringing growth nowcasters for the Eurozone close to 0%. France is the weak link, followed by Germany, but the rest of the Eurozone is also slowing.

Swap market pricing of an ECB policy rate of 1.50% at the end of 2025 seems reasonable, especially as disinflation continues.

With flow data being reported, we are learning more about what drove the outperformance of the EUR (and other G10 currencies) vs the USD in the past weeks. It appears that flow repatriation was not a main driver, but local investors e.g. in the Eurozone, that had investments in the US (equities, credit, bonds) increased their USD downside hedges significantly. There are now signs (in vol markets notably) that those hedges are being taken off as investors have become more sanguine about the tariff risks on the US economy and assets.

China: Policymakers are attempting to cushion the tariffs’ impact

China has delivered a very strong Q1, with the first signs of relief for the consumer as house price deflation eased and retail sales growth accelerated. This was most likely the result of the Chinese authorities stepping in to boost local bond issuance, thereby helping the deleveraging process, and also subsidizing some sectors of consumption.

With the new US tariffs (even in the 60%-tariff scenario) and restrictions, China has indicated that it would reinforce fiscal aid for the consumer, and for social safety nets, especially for employees in the export-oriented economy.

There are also signs that China is pursuing alliances with other countries, either to re-route its exports or to find new end-consumers, notably in the Eurozone.

Ultimately, the domestic authorities will very likely continue a proactive easing policy, but this will probably be insufficient to reach 5% GDP growth in 2025.