Over the past four years, Bitcoin (BTC) has transitioned from a fringe reserve experiment to a core balance sheet asset for numerous public companies. Long constrained by regulatory uncertainty and accounting limitations, this shift accelerated notably in 2024 and 2025. New fair-value crypto accounting standards from the Financial Accounting Standards Board (FASB), the launch of US spot Bitcoin ETFs, and increasingly aggressive monetary strategies from global corporations have created a fundamentally altered financial landscape. Bitcoin is no longer merely a hedge; for some firms, it has become their primary asset.

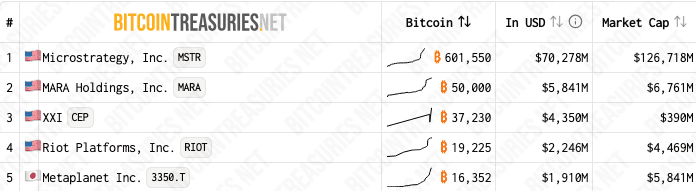

Currently, the five largest corporate Bitcoin holders, MicroStrategy, Marathon Digital, Twenty One Capital, Riot Platforms, and Metaplanet, collectively control over 700K BTC. The financial implications are profound. These companies are redefining public enterprise in the post-fiat era, with their stock prices less dependent on traditional revenues and more closely aligned with the volatility of Bitcoin itself.

But what does the market think about this strategic shift?

To explore this, we focus on two core indicators: how these firms trade relative to the net asset value (NAV) of their BTC holdings (premium or discount to NAV), and how tightly their stock prices correlate with Bitcoin's price movements.

A Market of Extremes: Premiums, Discounts, and Their Significance

MicroStrategy remains the largest corporate Bitcoin holder, with 597,325 BTC worth approximately $70B as of mid-2025, representing 57% of its total market cap. Remarkably, it trades at a 68% premium to its Bitcoin net asset value (NAV). This indicates the market values MicroStrategy not merely for its Bitcoin holdings but for its method of holding Bitcoin—characterized by strategic debt issuance, consistent accumulation, and clear market messaging. Investors treat MicroStrategy akin to a leveraged Bitcoin ETF, amplifying exposure to Bitcoin price movements. Consequently, its stock typically exhibits 2–3× Bitcoin's volatility, maintaining correlation often exceeding 0.9.

In contrast, Marathon Digital, with 50K BTC accounting for over 85% of its market cap, trades nearly at parity with its Bitcoin NAV. Investors largely view Marathon as a custodial miner rather than a strategic allocator, reflected by its modest premium. Marathon's stock demonstrates strong Bitcoin-linked behavior, closely mirroring Bitcoin’s directional moves, often matching or slightly exceeding its volatility.

Riot Platforms, holding 19,225 BTC constituting approximately 50% of its market cap, occupies an intermediate valuation position, trading at double its Bitcoin value. This premium likely stems from investor confidence in Riot’s diversified mining infrastructure and crypto initiatives. Riot's diversified infrastructure also tempers volatility somewhat, although its performance remains closely aligned with Bitcoin’s movements.

Metaplanet, Japan’s pioneering Bitcoin treasury enterprise, trades at 3.5× its BTC NAV with holdings of 15,555 BTC. Investors seem to value Metaplanet’s regional dominance, early-mover status, and Web3 growth narrative in Asia. Despite regulatory variations in Japan, Metaplanet’s stock correlation with Bitcoin strengthened significantly in 2025, tripling alongside Bitcoin’s 90% rise, marking it as Asia's high-beta Bitcoin equity.

Most notably, Twenty One Capital, a SPAC-backed Bitcoin holding company supported by SoftBank, Tether, and Bitfinex, trades at a staggering 91% discount to its Bitcoin NAV. With holdings of 37,230 BTC worth over $4.4B, its market cap remains just $399M. Despite arguably offering the purest Bitcoin exposure, Twenty One Capital exhibits the weakest proxy behavior among peers. This stark disparity indicates market skepticism, likely due to post-SPAC uncertainties, structural challenges, and liquidity concerns, necessitating significant catalysts to realign valuation.

Collectively, these firms illustrate that holding Bitcoin alone does not define market valuation or beta behavior. Investor confidence, strategic positioning, infrastructure strength, narrative, and market perception significantly influence premiums, discounts, and the intensity of Bitcoin correlation.

Beyond the Balance Sheet

The differences in valuation and market correlation reveal that Bitcoin holdings, while becoming more important, are insufficient alone for investor confidence. Investors critically evaluate how Bitcoin is held, the rationale behind holdings, and the credibility of management.

MicroStrategy has effectively embedded Bitcoin into its corporate identity. Marathon and Riot manage Bitcoin exposure through their mining operations and financial strategies. Metaplanet leverages regional narratives to bolster its Bitcoin growth story, while Twenty One Capital tests market reception of pure Bitcoin holdings without operational or historical context.

This differentiation also extends to capital structures. Premiums emerge when Bitcoin serves as an accretive asset, complemented by clear strategy or leverage. Discounts arise from passive Bitcoin storage, uncertain governance, or narrative deficiencies. With fair-value accounting normalizing BTC income statements and ETFs capturing speculative capital, corporations now compete beyond mere Bitcoin quantity.

Offchain is New Onchain

In the past two years, both retail and institutional investors have increasingly chosen to gain Bitcoin exposure through public equities and ETFs rather than holding BTC directly. Retail ownership of spot Bitcoin ETFs has surged, with over 75 percent of ETF shares held via brokerage platforms, reflecting a preference for regulated, off-chain exposure. At the same time, stocks like MicroStrategy and Marathon have become popular Bitcoin proxies. In late 2024, MicroStrategy saw record-breaking retail inflows, including over 42 million dollars in a single day, as traders treated the stock as a high-beta Bitcoin instrument.

Large investors have followed suit. Hedge funds, banks, and asset managers have poured billions into Bitcoin ETFs and equity-linked instruments, citing clearer regulation, easier custody, and tax advantages. On-chain data shows relatively stagnant or declining direct wallet growth, especially among smaller holders, reinforcing the shift. This off-chain behavior means much of today’s Bitcoin demand does not appear on the blockchain, but instead flows through traditional financial markets. The result is a new investment paradigm where both whales and retail participants increasingly rely on stocks and funds for Bitcoin exposure, changing how capital enters the ecosystem.

Price and Perception

As Bitcoin solidifies its status as a reserve asset, the experiences of these five firms offer insight into future market valuations of crypto exposure. The critical factor is not simply holding Bitcoin, but the strategic coherence underlying these holdings.

If the early 2020s tested whether corporations could hold Bitcoin, the mid-2020s illustrate how markets reward or penalize their approaches. No straightforward valuation formula exists, only a narrative-driven market rewarding conviction and penalizing opacity.