Introduction

Mantle Network is an Ethereum L2 blockchain network focused on executing the concept of modular blockchains. While comparisons are often made between Mantle Network and established L2s like Optimism and Arbitrum, Mantle Network sets itself apart by incorporating EigenLayer's EigenDA, resulting in a distinctive three-layer modular blockchain structure. Ethereum handles the settlement and consensus layer in this structure, EigenDA ensures data availability, and Mantle Network serves as the execution layer.

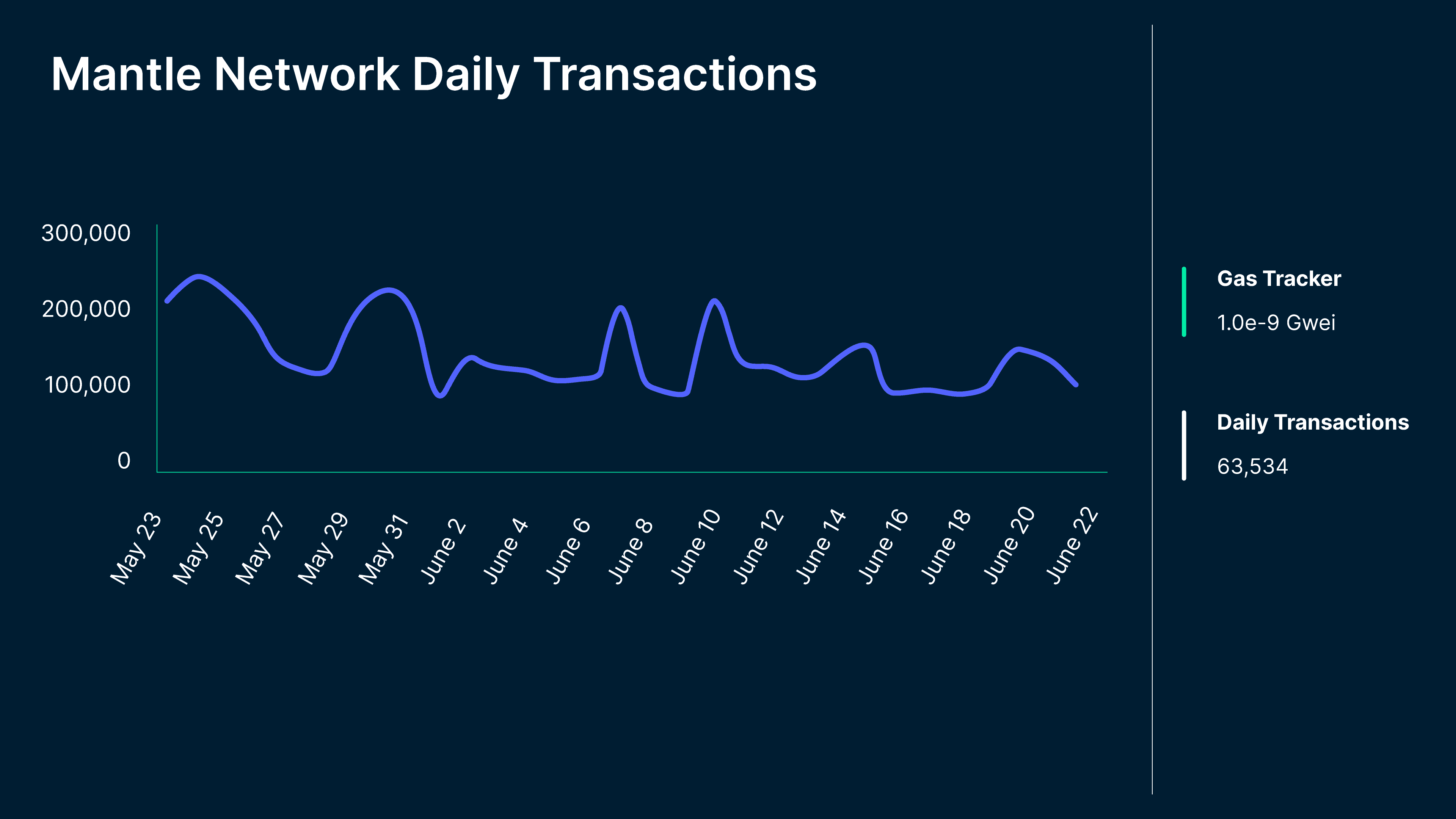

Currently, Mantle Network is in its Testnet phase; however, it has experienced significant adoption in recent months. The network processes approximately 63.5k transactions daily, accumulating a total transaction count of 12 million. Additionally, there are 897k unique wallet addresses associated with the network.

Architecture

Mantle Network ORU requires sequencers to execute and authorize transactions via Multi-Party Computation (MPC) before publishing to L1. The MPC aims to reduce the trust risk of L2 execution results. Using Threshold Signature Scheme (TSS) technology, specialized nodes contribute to multi-party signatures that improve the correctness of off-chain transaction execution results. This is expected to significantly shorten the withdrawal challenge period, which typically takes ~7 days for traditional ORUs.

EigenDA

Mantle Network utilizes EigenLayer's EigenDA as its data availability layer. To provide a brief summary, EigenDA is a product developed from EigenLayer, serving as the data availability layer by utilizing restaked ETH. This approach enables substantially reduced costs and increased bandwidth for data availability compared to Ethereum's L1 blockchain.

EigenDA provides several benefits for Mantle:

- Enhanced security: Uses ETH’s validator network and re-staking mechanism.

- Boosted staking utility: As EigenDA allows nodes to participate in staking via Mantle Network, this adds more utility to Mantle’s native token.

EIP-3074 and EIP-4337

Mantle Network intends to incorporate EIP-3074, which grants the ability for externally owned accounts (EOAs) to delegate control to smart contracts. This will enable developers/ protocols to incentivize usage by subsidizing gas fees on their dApps to easily onboard users.

Mantle Network has been conducting experiments with EIP-3074 to enable existing wallets to access meta-transactions and have their gas fees covered, eliminating the need for account migration. Additionally, Mantle Network aims to explore EIP-4337, which focuses on implementing long-term account abstraction for its ecosystem. While this transition may require a longer timeframe, it promises a substantial enhancement in user experience when it comes to fruition.

Similarities and Differences between Mantle & Other ORU Solutions

- Traditional ORUs rely on Ethereum for data availability, final settlement, and as an execution layer for fraud proofs.

Mantle Network uses Eigenlayer’s DA solution, EigenDA and Mantle Network serves as the execution layer.

- Traditional ORUs currently rely on a single Sequencer that is operated by centralized entities. Sequencers allow users to receive confirmation that their transaction is batched and will be recorded on L1. This is risky as it is subjected to a single point of failure if anything happens to the Sequencer.

The goal is to construct a design that allows for multiple Sequencer nodes and in return rewards these nodes with MNT rewards. This will remove the centralized source of failure for ORUs. Read more on implementation here.

- The current fraud-proof model relies on an on-chain verifier (a contract that settles disputes) that can only execute instructions in a lower-level virtual machine (e.g., MIPS or WASM).

Mantle Network introduces an improved version of fraud proofs that allows them to compile and verify fraud proofs with EVM-level instructions.

Tokenomics

MNT serves as a reboot of BIT, which was launched on July 15, 2021, as the governance token of BitDAO, following the BitDAO-Mantle Merger which we will walk through below. The token began vesting on Oct 15, 2021.

MNT

BIP-21 has pushed forth the brand and token merger, with approval to convert BIT to MNT. With MIP-22’s proposal on Mantle’s token conversion design, the BIT token will be converted 1:1 to the new MNT token that will be used for gas payments on the Mantle L2 network. BIT was initially created as primarily a governance token, hence the MNT token is necessary to enhance utility and functionality of the Mantle ecosystem.

The MNT token should have upgradability and minting functions. A one-way token conversion ratio should be 1 BIT:1 MNT token. A MNT-ETH pool will be created, using proceeds from BIT-ETH pool and there will be a temporary conversion treasury to facilitate the token conversion process.

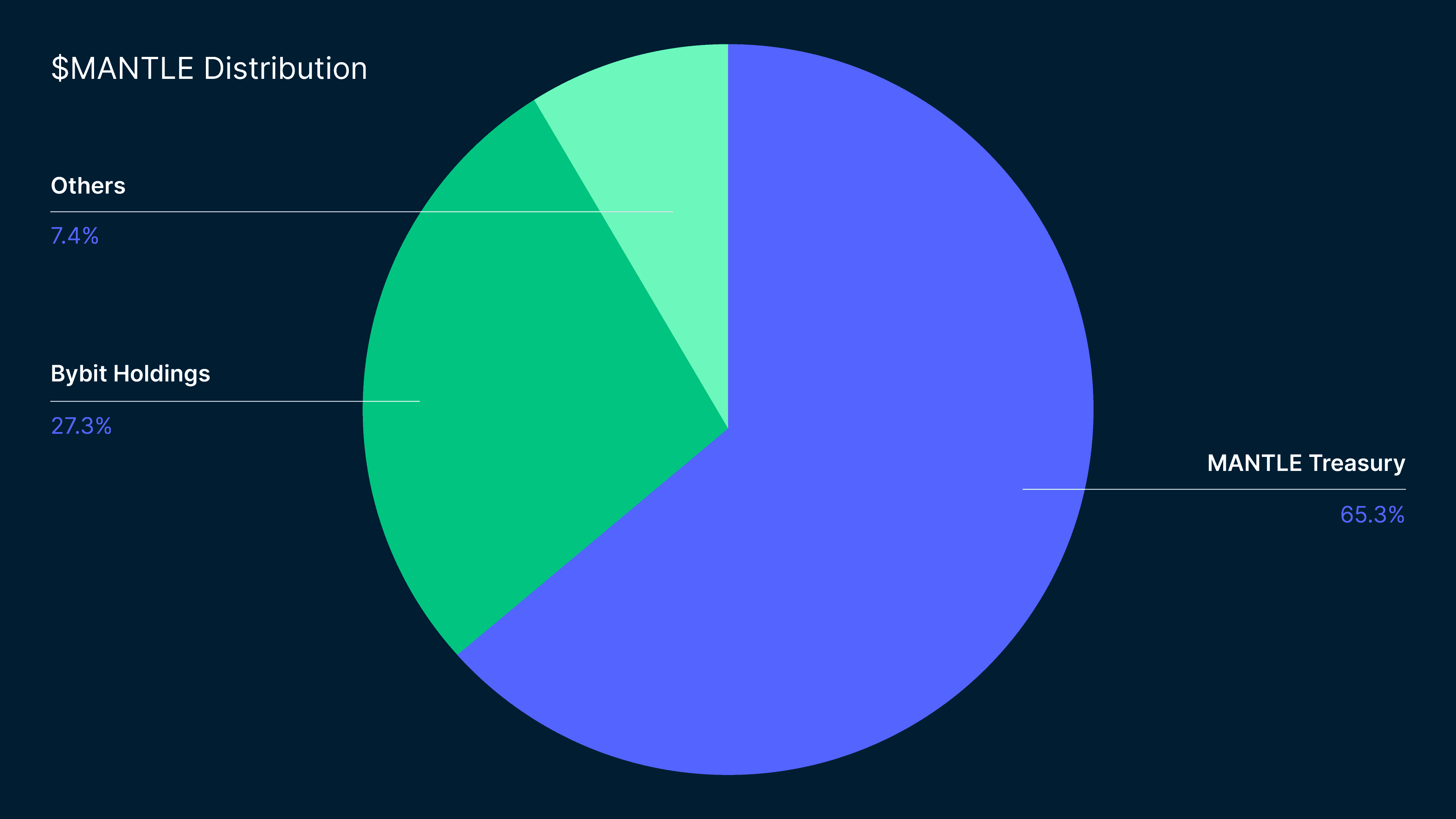

Taking into consideration that 780m BIT tokens have been burned, the distribution of MNT can be estimated as follows:

- Mantle Treasury (non-circ.): 6,019,959,337 (65.3%)

- Bybit Holdings (circulating): 2,519,316,795 (27.3%)

- Other Circulating: 680,040,636 (7.4%).

- Source: Blockcrunch

This would mean that the BitDAO treasury would be referred to as the MANTLE treasury.

Catalysts

$200M Ecosystem Fund

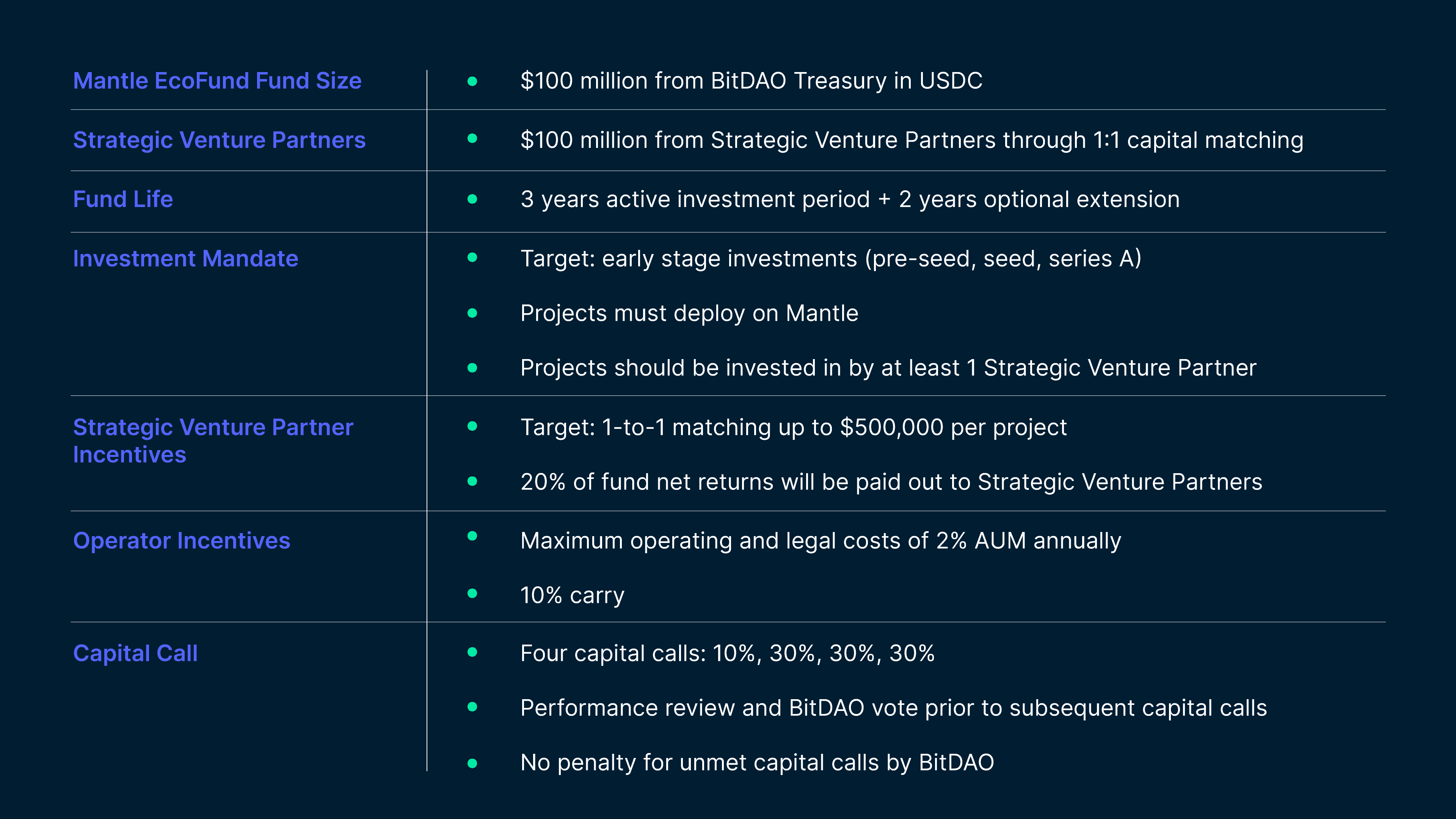

The Mantle Network ecosystem fund proposal was put forth on February 26. The Mantle core team has put forward a proposal to establish a $200m ecosystem fund, with $100m coming directly from BitDAO’s treasury and the other half supplied by strategic VCs including Pantera Capital, Spartan, Folius Ventures, QCP Capital, Cadenza Ventures, Dragonfly Capital, and Play Ventures Future Fund. The goal of this $200M ecosystem fund is to support projects and builders.

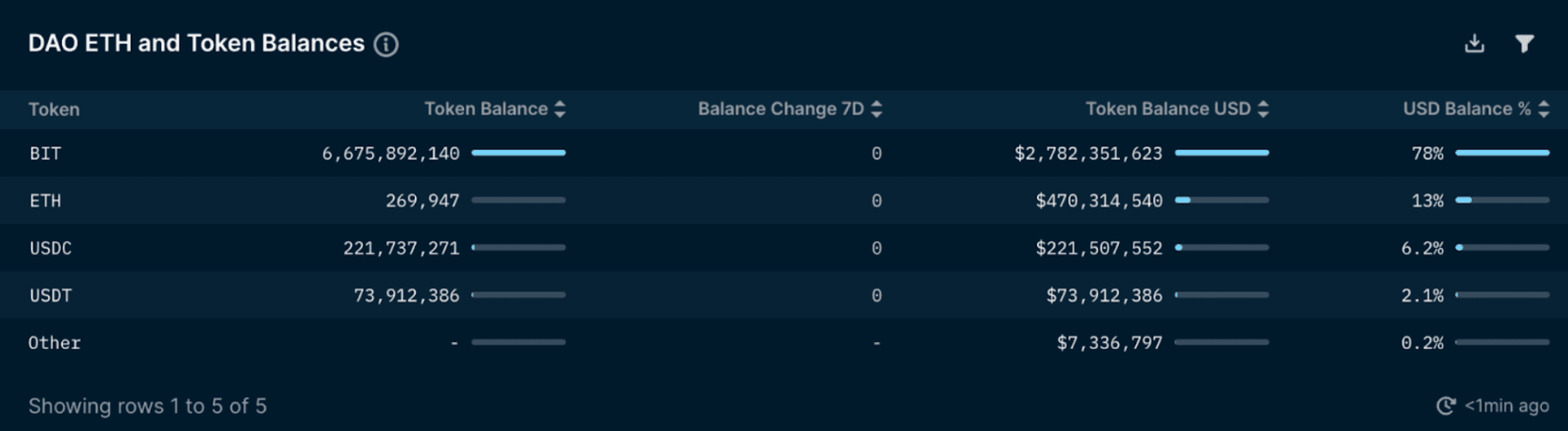

BitDAO currently has a large treasury of $3.25b liquid assets, with 78% of their balance in BIT, followed by 13% in ETH, 6.2% in USDC, and others. Having 78% in their native token would mean that deciding to liquidate its treasury would completely tank the native token price.

Comparatively, Uniswap has a total treasury value of $2.23b, and Lido Finance at $284m.

This $200m ecosystem fund is poised to bring in emerging protocols and ecosystems, in particular, to facilitate dApp adoption to the Mantle ecosystem.

Mantle LSD

There’s an ongoing discussion on Mantle LSD and mntETH. The idea is to create a Mantle LSD, a liquid staking protocol deployed on Ethereum Mainnet. Users, including the Mantle Treasury, can deposit ETH and receive mntETH receipt tokens. According to their soft proposal, the development is estimated to take 12-16 weeks, which will happen well after Mantle Network goes live on Mainnet.

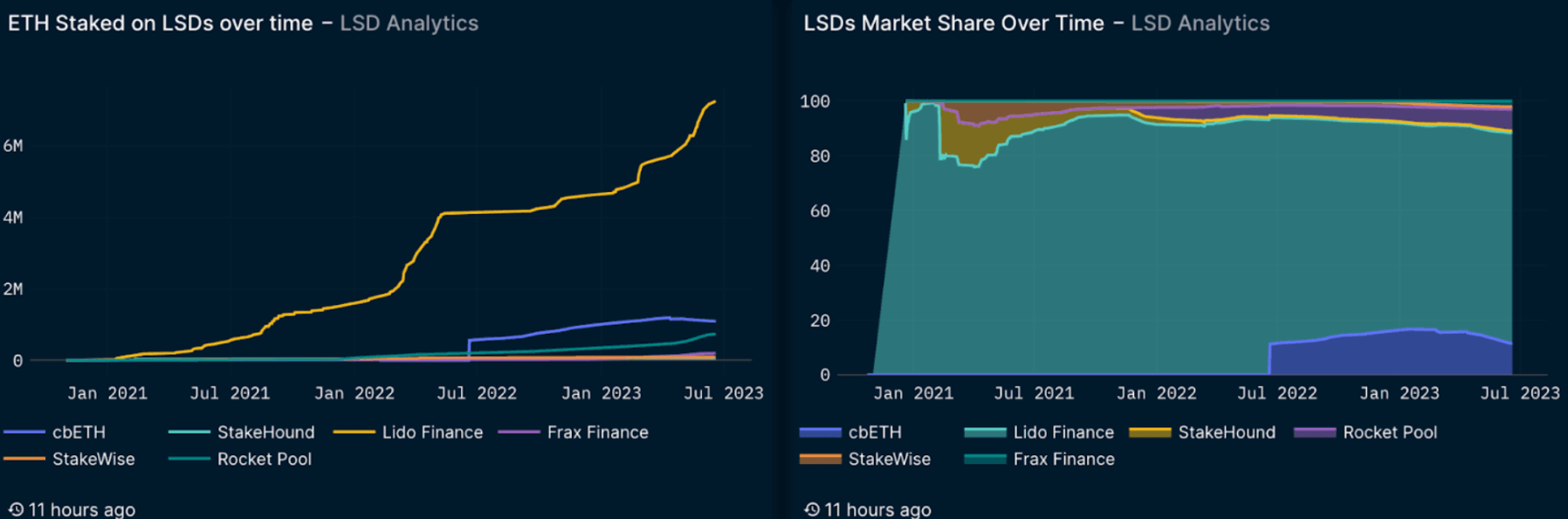

The LSD landscape has taken the DeFi space by storm and has gained immense traction since the Shapella upgrade, which combines changes to Ethereum’s execution layer, consensus layer, and the Engine API. As seen in the chart below, the ETH staked on LSDs has been continuously hitting new highs, and the LSD market is facing some healthy competition across protocols. The total ETH staked in LSDs is currently at 9.26M ETH, which represents more than 40% of the total ETH staking market, and we expect to see this percentage increase over time.

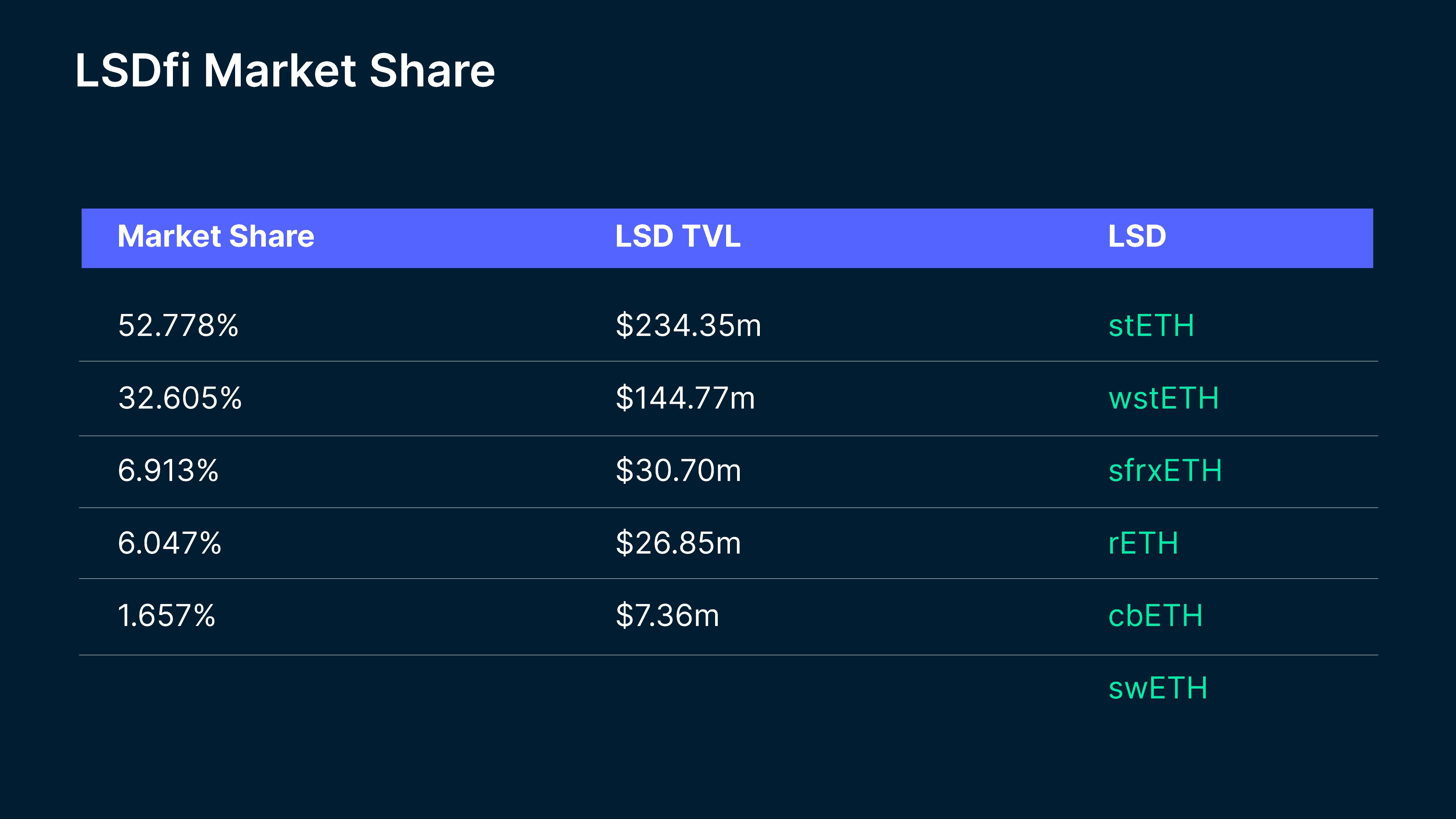

The introduction of mntETH will allow Mantle to leverage the advantages that the LSD landscape provides. mntETH can also be used in a wide array of DeFi products, as LSDs can serve many purposes for DeFi such as borrowing and lending, leveraged products, and yield-generating assets. Currently, stETH is still the preferred LSD, carrying over $237m in TVL (51.4% of LSD market share), followed by wstETH at $151m. If Mantle launches mntETH and captures a measly 1% of the LSD market share, this would place them at about $6-7m TVL for mntETH. Considering the network effect that Mantle has already adopted from BitDAO, and the significance of their DAO Treasury of $3.2b in total, including ~270 ETH, this can position mntETH as the top 3 within the decentralized LSD category, exceeding sfrxETH’s TVL of $30.7m (6% of the LSD market share).

Mantle x Lido Strategic Collaboration

There is an ongoing discussion regarding Mantle and Lido’s strategic collaboration. The proposal states:

- 40k ETH from BitDAO treasury can be allocated to stETH

- Use the stETH to bootstrap DEX liquidity and integrations across Mantle

- Establish a revenue-sharing agreement between BitDAO and Lido DAO for a period of 12 months

- Add Mantle in Lido’s bridging plan; to bridge stETH to Mantle

In short, the proposal highlights that a portion of stETH will be used to bootstrap liquidity on Mantle Network. Not to mention, both Lido DAO and BitDAO’s treasury are amongst two of the largest in DeFi, this strategic collaboration can most likely accrue plenty of value to both DAOs. Currently, Lido DAO has about $281m in its treasury, while BitDAO is holding about $3.39B.

This strategic partnership can be used as a temporary solution to bootstrap initial liquidity and accrue value back to both Lido DAO and BitDAO’s treasury from their revenue-generating system, which can pose a win-win situation for both protocols. However, Mantle’s LSD mntETH should still be prioritized as the primary LSD for Mantle.

Mantle Network Mainnet

Mantle Network Testnet launched on January 10th and is still live. Mantle highlighted that they are building certain incentives for holders and ecosystem participants. There are several grant programs and the ecosystem fund in place for their Testnet and Mainnet phases. The mainnet launch is expected to happen in Q3.

Partnerships with Prominent DeFi Protocols

So far, multiple protocols have already announced their strategic partnerships with Mantle Network.

- Multichain

- Synapse

- Pyth

- Ankr

- Izumi

BitDAO is currently partnered with a gaming DAO, Game7, which has launched HyperPlay as one of its key products. They’ve indicated that Mantle will be one of the supported chains for Game7.

Mantle Network distinguishes itself in the Ethereum Layer 2 landscape through its innovative three-layer modular blockchain structure, incorporating EigenLayer's EigenDA for data availability. The network has experienced significant adoption during its testnet phase, processing a high volume of transactions and attracting a large number of unique wallet addresses. The adoption of Multi-Party Computation (MPC) and Threshold Signature Scheme (TSS) technology in the execution and authorization of transactions could enhance security and reduce the withdrawal challenge period, contributing to a more efficient and trustworthy ecosystem.

Furthermore, the potential introduction of Mantle LSD and mntETH opens up opportunities in the liquid staking market, leveraging the advantages of the growing LSD landscape. With ongoing discussions and collaborations with prominent DeFi protocols, such as Lido, BitDAO's strategic partnerships are set to bring value and liquidity to the network.

With the mainnet launch expected in the near future, Mantle Network is well-positioned to advance its modular blockchain concept and provide a robust infrastructure for decentralized applications, attracting more participants and contributing to the growth of the overall DeFi ecosystem.