Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Arbitrum (the "Customer") at the time of publication. While Arbitrum has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Arbitrum is a comprehensive suite of scaling solutions, tailored to address Ethereum’s scalability challenges. Among its key components is Arbitrum One utilizing Arbitrum Rollup technology to enhance transaction throughput while maintaining security; Arbitrum Nova, focusing on improving the trust model through Arbitrum Anytrust technology; and more recently, Arbitrum Orbit providing a permissionless framework for deploying Orbit Chains (L3s) on top of Arbitrum One or Arbitrum Nova. These solutions collectively aim to offer faster, more cost-effective and secure transactions, fostering innovation and supporting Ethereum’s growth as a sustainable and scalable blockchain.

Optimistic Rollups

Arbitrum One is an Optimistic Rollup and one of the leading scaling solutions for the Ethereum blockchain. Optimistic rollups assume that the validators are not malicious and that transactions are posted correctly. To ensure that transactions are valid, anyone can submit a fraud proof if they identify any invalid transactions within a week. The dispute is then narrowed down to a single line of instruction and executed on the L1 chain to verify correctness. The fraudulent node would have its stake slashed, with its portion going to the winner of the challenge. The process of presenting evidence of an incorrect state transition is called fraud proof and the nature by which challengers can prove over multiple rounds of assertions was developed by Offchain Labs. This is the basis of how an Optimistic Rollup like Arbitrum One works, reducing the workload on the main L1 chain, as not all the transactions need to be re-executed and incentivizes nodes to be well-behaved.

Check out Nansen’s previous report on Arbitrum and other scaling solutions for Ethereum here.

Key Developments: Q2 2023

AIP-1.1

This proposal detailed the actions regarding 750M ARB tokens (7.5% supply of ARB airdrop) that were allocated to the Foundation’s Administrative Budget Wallet. In one of the transparency reports, 0.5% was used to complete the setting up of the DAO with 0.4% being disclosed as a loan and the remaining 0.1% sold to meet the obligations of initial governance and short-term operating expenses.

The remaining 7% of these tokens would be subjected to a 4-year lockup and vested linearly with time. The proposal also broke down the budget into several categories which would be used to track against actual expenses. Additional funds from the vesting would also be made available for Ecosystem Growth opportunities.

Arbitrum Orbit Launch Tool

On June 21, Offchain Labs released a guide for developers to launch their own devnet Orbit chain. This tool allows developers to customize their Orbit chain with various parameters including fee tokens, permissions, governance, and security.

Native USDC

Previously on Arbitrum, the network only had USDC.e, which was a bridged version of USDC from Ethereum which was not issued by Circle. On Jun 8, Circle announced the launch of native USDC on Arbitrum, establishing Arbitrum as the 9th blockchain to support native USDC. Furthermore, users would be able to on and off ramp directly to the Arbitrum chain. The Arbitrum Foundation would be working with ecosystem apps to provide a smooth transition of liquidity over time.

Nansen On-chain Data

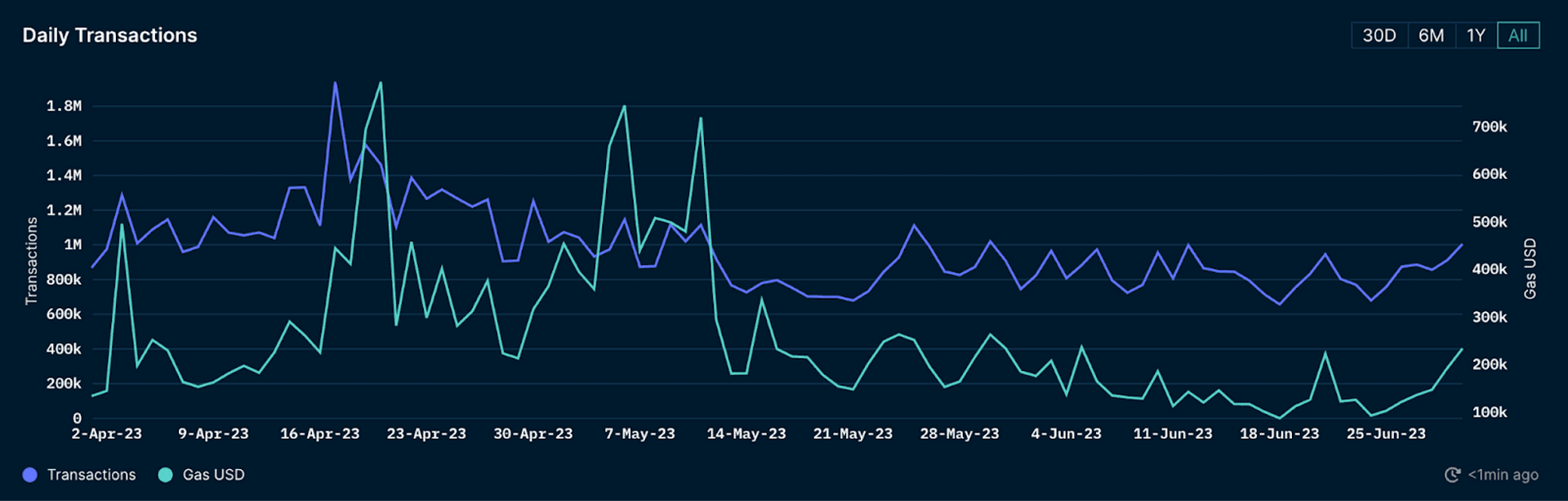

Daily Transactions

In the second quarter of 2023, the daily transactions on Arbitrum One stayed relatively flat, hovering at an average of 800k transactions and gas prices followed a similar pattern. In contrast to the previous quarter, the transaction count stayed consistently higher this quarter, indicating more activity since the airdrop happened.

Check out our latest report on the state of the Arbitrum ecosystem following the ARB airdrop last quarter here, where we use on-chain metrics to analyze the fundamentals and performance of Arbitrum One.

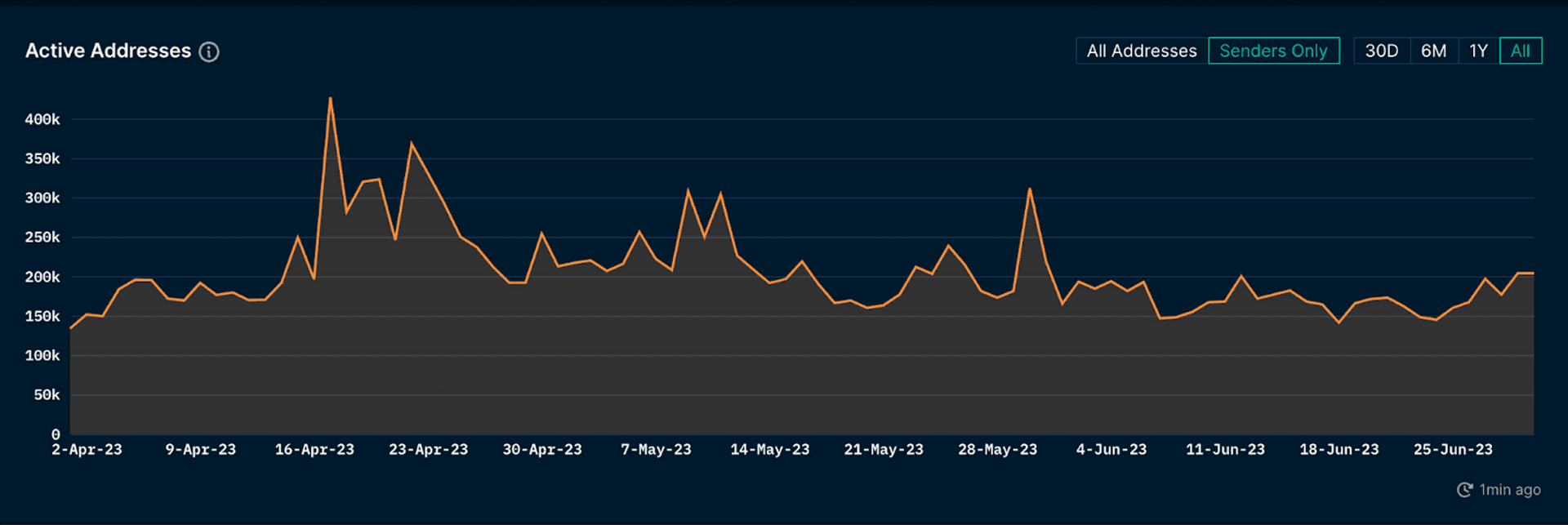

Active Addresses

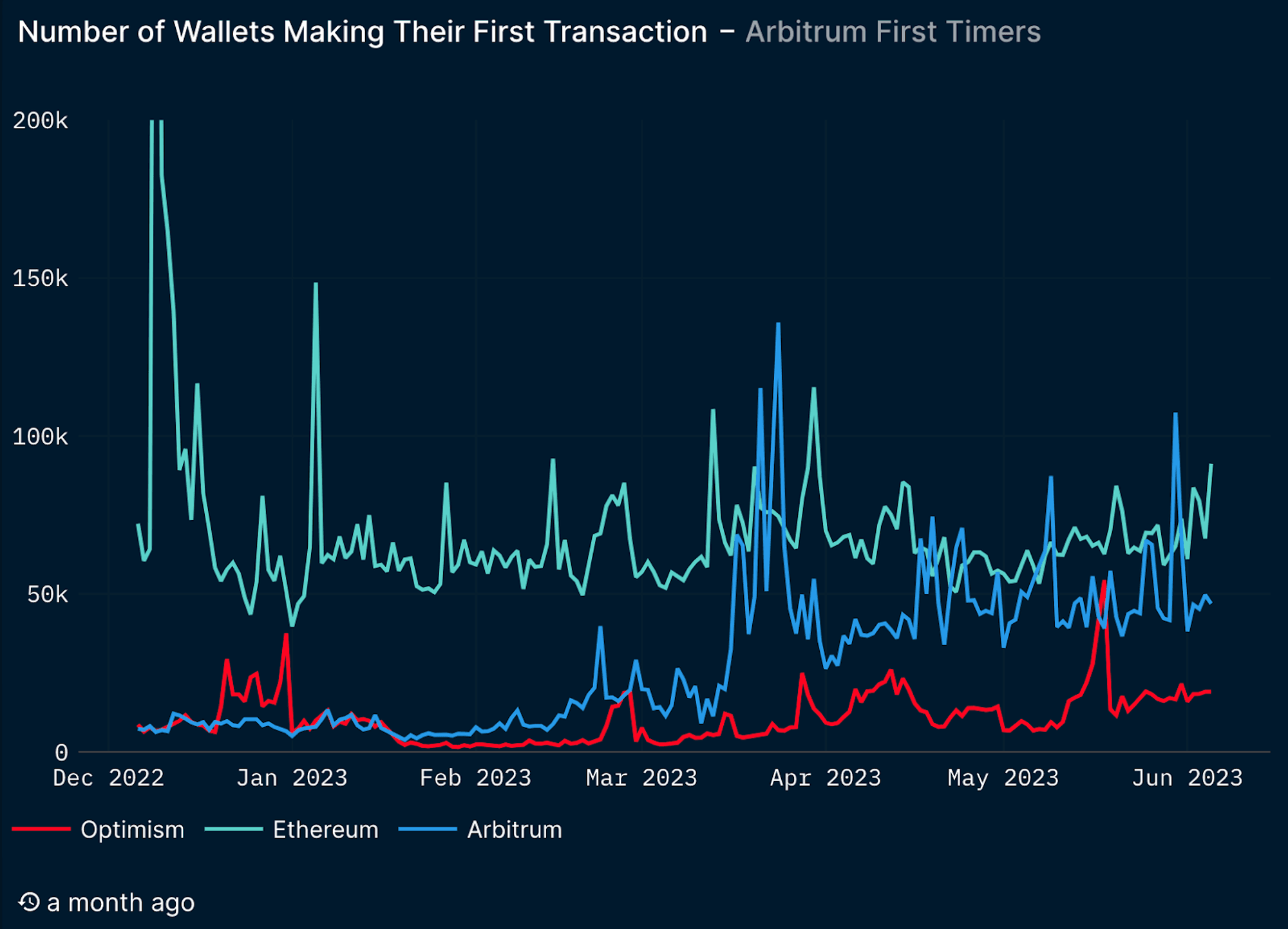

Daily active addresses on Arbitrum One over the quarter also stayed relatively flat at around 200k addresses. In contrast, the number of wallets making their first transaction on Arbitrum One has been increasing since the start of the year, surpassing Ethereum on certain days in Q2. With the ARB airdrop speculation over, the increased number of fresh wallets certainly points towards more organic activity.

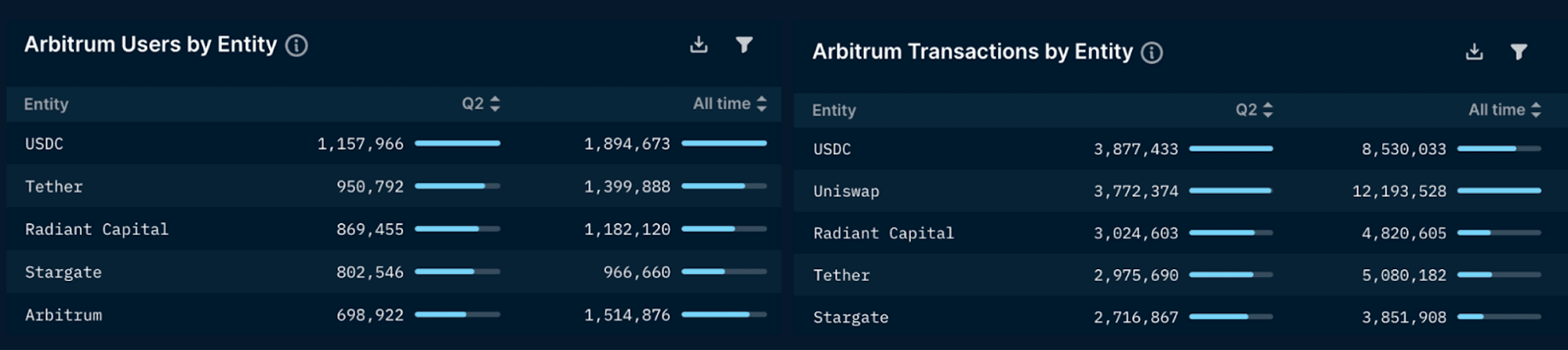

Top Entities by Users and Transactions

Using Nansen labels, the top entities by transactions and users notably feature stablecoins (USDC, Tether). This could be due to the temporary de-peg of USDT when there was a large withdrawal in Curve’s 3Pool, which makes up the majority of the pool. This probably led the market to experience heightened levels of volatility and uncertainty following the USDC de-peg last quarter.

Closing Thoughts

Closing out the second quarter of the year, Arbitrum continued to deliver infrastructure improvements and further developments to its ecosystem. Issues that cropped up such as the Sequencer disruption were met with quick resolution and allowed the chain to continue as usual. Furthermore, despite the completion of the ARB airdrop incentives, there is still an elevated amount of activity in terms of both transaction count and user count compared to before the airdrop. The continued influx of new participants also points towards the resilience and thriving ecosystem that Arbitrum has built.