Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Arbitrum (the "Customer") at the time of publication. While Arbitrum has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

In the third quarter of 2023, Arbitrum maintained a consistent daily transaction volume, hovering around 600k, while also boasting a Total Value Locked (TVL) of ~$2b. On the developer front, Arbitrum experienced a remarkable surge, with the number of developers nearly doubling compared to the early part of the year.

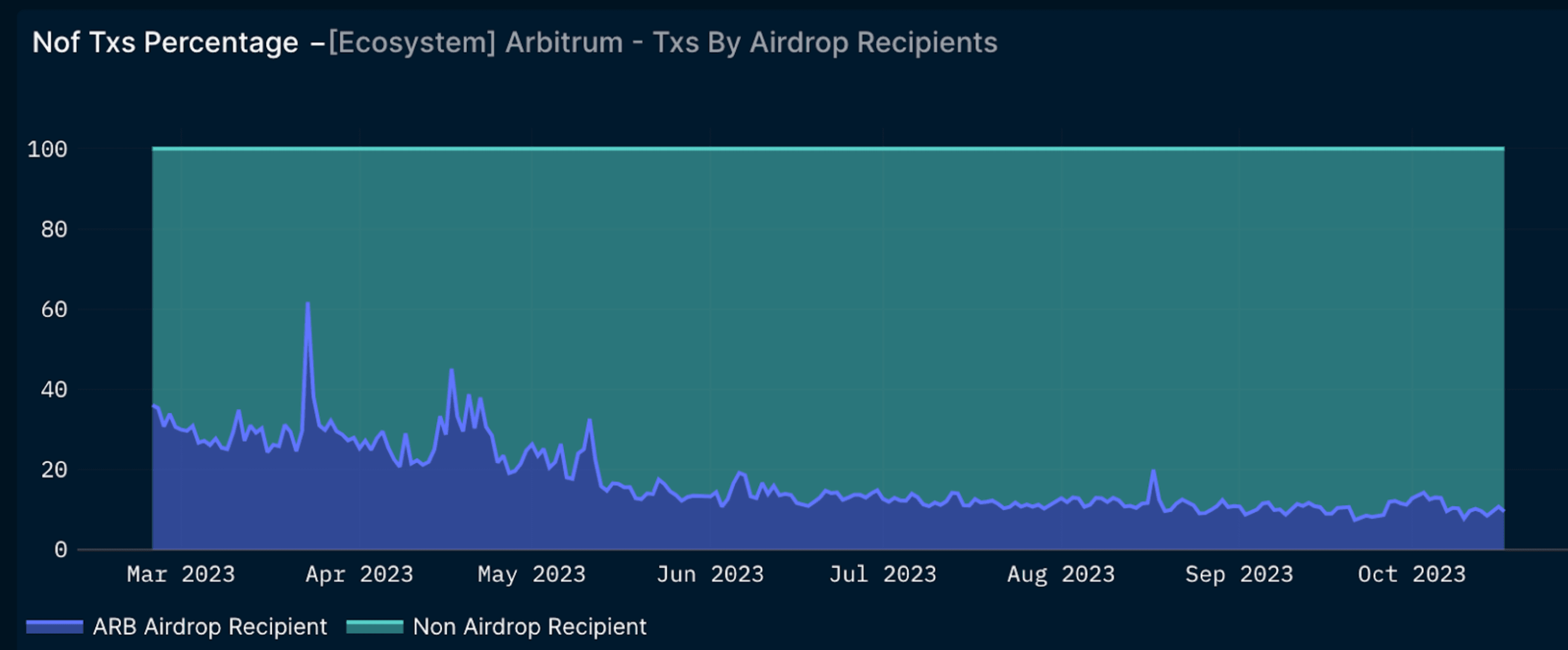

According to our Arbitrum Quarterly Report Metrics dashboard, users who did not receive the airdrop contributed significantly more to total daily transactions compared to airdrop recipients, increasing from 69% to 85%. Simultaneously, approximately 20k new wallets initiated their first transactions each day, signaling a promising response to initiatives like the resumption of the Arbitrum Odyssey.

Key Developments: Q3 2023

AIP-6

- Arbitrum Improvement Proposal 6 (AIP-6) outlined a comprehensive framework for amending the Arbitrum Constitution, focusing on the Security Council.

- This proposal introduced a detailed timeline for Security Council elections, including nomination, compliance checks, and member elections, ensuring a methodical and transparent approach to council member selection.

- It also specified the criteria for removing members and how their vacant seats should be handled, emphasizing the importance of maintaining diversity within the Council and avoiding conflicts of interest among elected members.

- The first round of elections for the initial cohort was held on Sep 15, marking a significant milestone in the evolution of Arbitrum's governance.

Arbitrum Stylus

- Offchain Labs released its code and public testnet for Arbitrum Stylus on Aug 31, enabling developers to utilize both traditional EVM tools and WASM-compatible languages to create applications on Arbitrum Nitro chains.

- Stylus would significantly reduce gas costs and enhance computational, storage, and memory efficiency, making resource-intensive blockchain applications more feasible.

- With the SDK open-sourced, the upcoming Stylus Hackathon at ETHGlobal NY presents an opportunity for developers and enthusiasts alike to compete for bounties totaling $20,000.

Arbitrum Odyssey Reignited

- On Sep 26, the Arbitrum Odyssey made its return, kicking off with "The Blueberry Nebula". This marked the start of a seven-week exploration within the broader Arbitrum Odyssey campaign, spotlighting GMX as the first dApp to explore.

- Throughout this period, participants would complete missions ranging from DeFi activities to gaming and earn unique NFT badges.

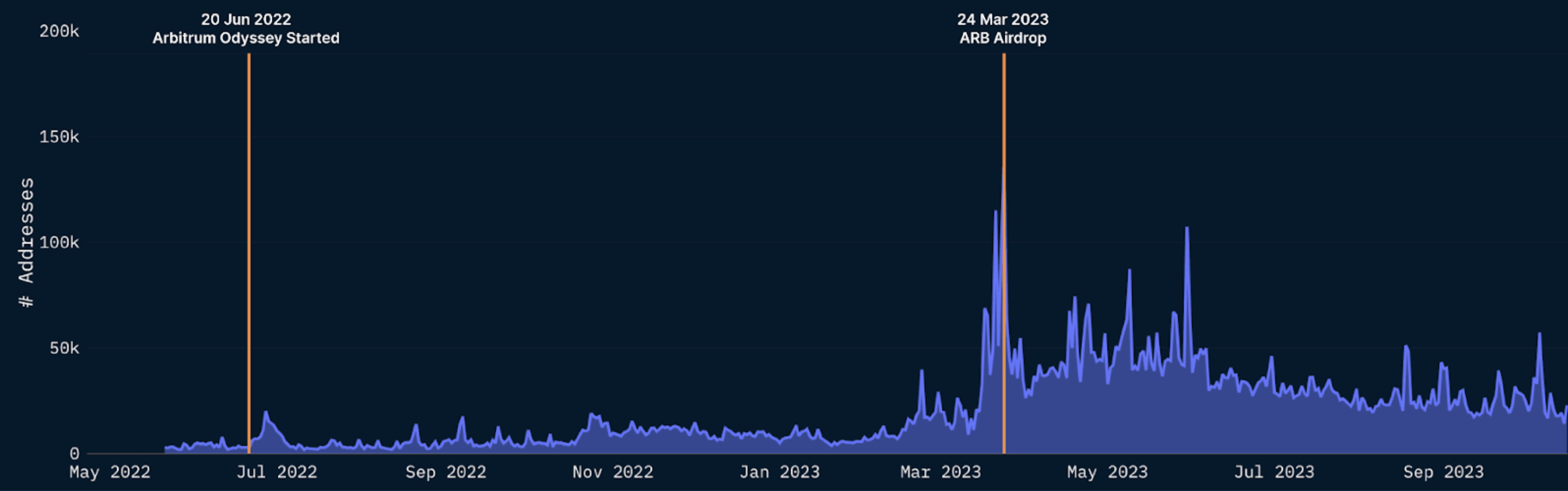

- Interestingly, back when the Arbitrum Odyssey was paused in Jun 2022, Arbitrum One experienced growth in first-time users, increasing from ~3k to 20k, an impressive improvement of 600%.

- With its resumption, Arbitrum could see a similar pattern, potentially seeing a rise in volume and user count in the upcoming months despite dwindling numbers from Q3.

Ecosystem

Arbitrum One hosts a dynamic ecosystem of dApps, which can be viewed on the Arbitrum One Portal directory. In conjunction with the Arbitrum Odyssey resumption, the Arbitrum One Portal also received a significant revamp, enabling users to explore the Arbitrum ecosystem further. Besides the dApps featured on the Arbitrum Odyssey, there have been many new additions to the Arbitrum ecosystem including a new on-chain game, Kaiju Cards and the integration of Arbitrum Nova on Hop Protocol.

Kaiju Cards

- On Sep 30, Treasure introduced Kaiju Cards, a tactical roguelite deckbuilder, to its ecosystem.

- Developed by Permadeath Studios, a Los Angeles-based gaming and entertainment company that boasts a team of industry veterans with experience at companies like Adult Swim and Nickelodeon.

- The Pioneer Event, set to run for a month, offers an early alpha release of the game with a free-to-play option and the opportunity to mint Pioneer Kaiju, granting players access to the Battlepass and various enticing bonuses.

Hop Protocol Integration

- Hop Protocol announced support for Arbitrum Nova, offering low transaction costs and robust security.

- The integration greatly benefits Treasure, known for its dynamic ecosystem of gamers, creators, and developers on Arbitrum One.

- Together with Treasure’s initiative of the MAGIC bonder, AMMs and proposed HOP incentives, the integration of Nova on Hop Protocol could potentially drive more growth into on-chain gaming and NFTs.

Nansen On-chain Data

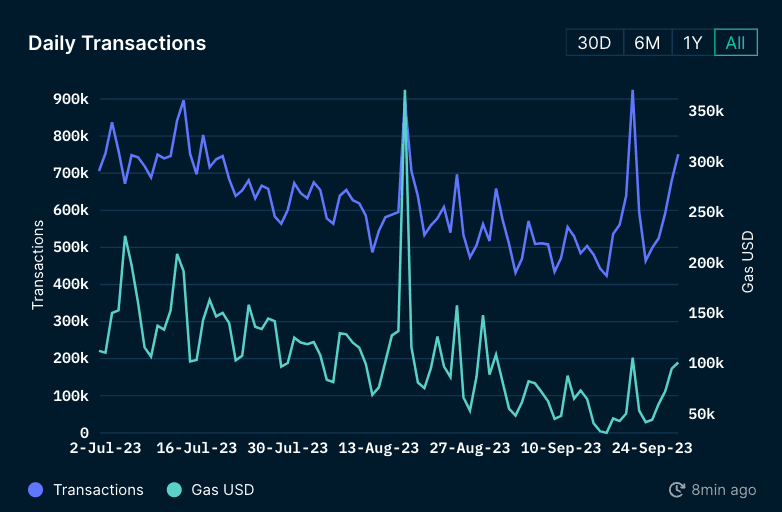

Daily Transactions

During the third quarter of 2023, the daily transaction count on Arbitrum One witnessed a decline from 700k to a low of 500k. Gas prices also exhibited a similar trend, with a significant surge occurring on August 18th. Notably, multiple reports indicated that SpaceX had sold $373M worth of its Bitcoin holdings. This action potentially triggered a substantial liquidation event involving approximately $1b worth of crypto assets, contributing to the heightened volatility observed during that week.

Active Addresses

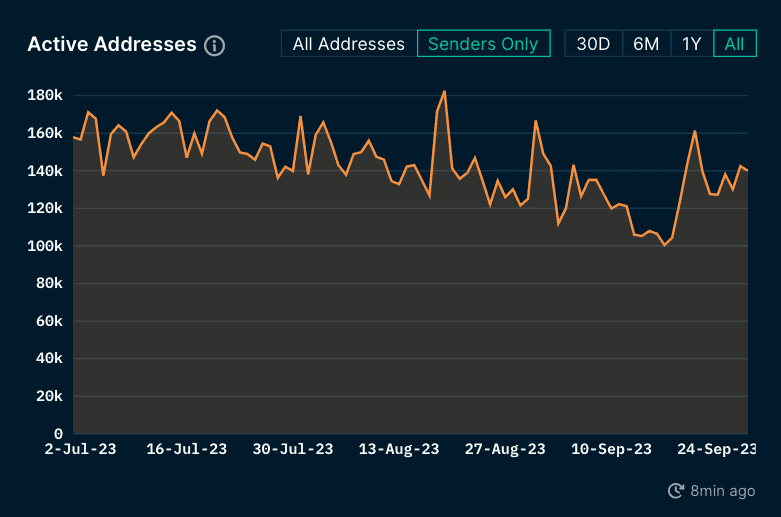

Throughout the quarter, Arbitrum One maintained a steady level of daily active addresses, consistently hovering at approximately 140k. This represents a notable contrast from the preceding quarter, which boasted a higher count of 250k daily active addresses.

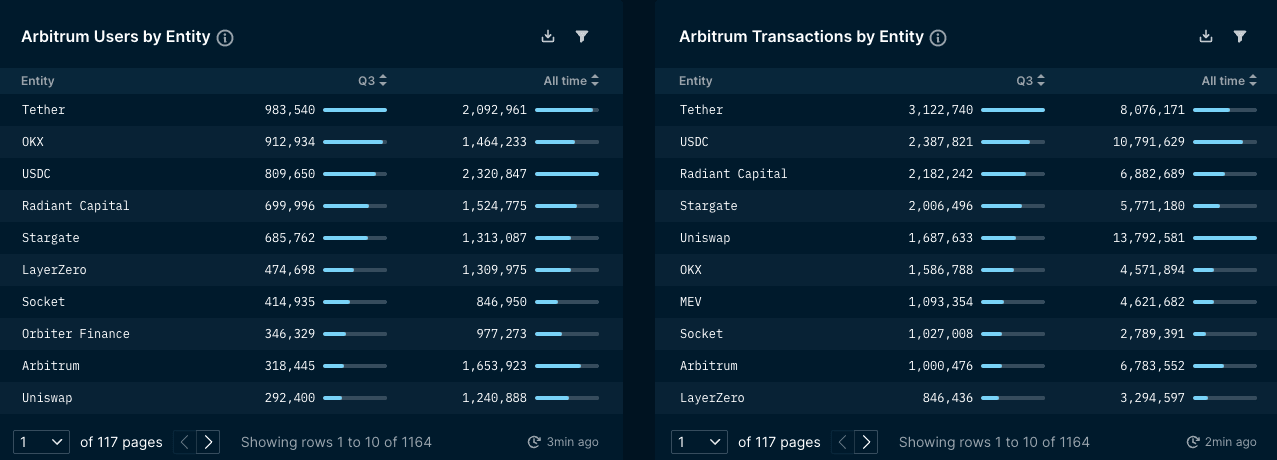

Top Entities by Users and Transactions

When utilizing Nansen labels to identify the leading entities based on transaction volume and user activity, it's noteworthy that stablecoins such as USDC and Tether prominently feature among them. Additionally, other standout entities would include Radiant Capital and Stargate. Radiant Capital facilitates lending, while Stargate, built on top of LayerZero, optimizes cross-chain asset transfers, enhancing user accessibility across multiple blockchains.

Smart Money Segments on Arbitrum

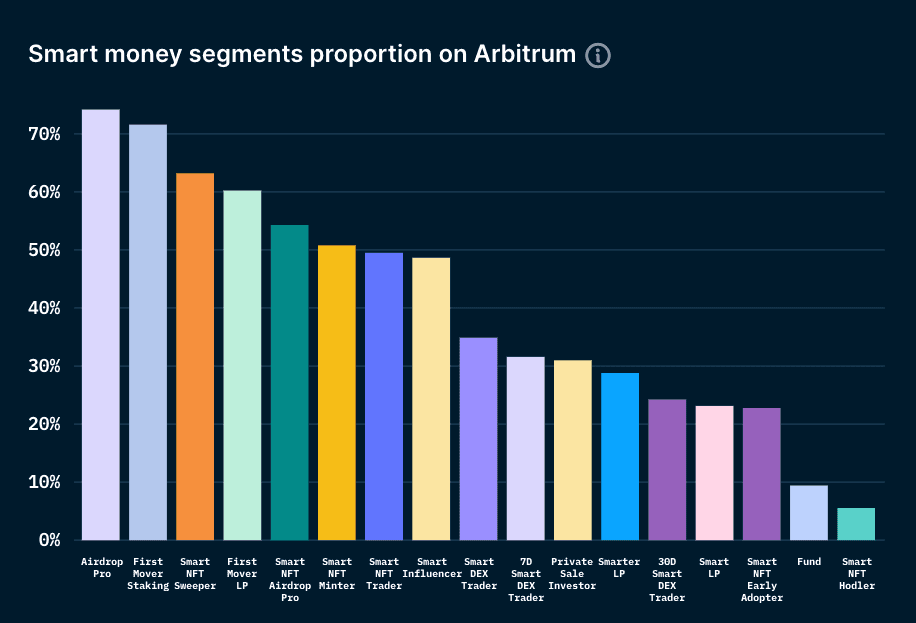

A core offering from Nansen lies in its "Smart Money" labels, highlighting wallets recognized for their significant on-chain activity and profitability. Notably, the most significant overlap of "Smart Money" between Ethereum and Arbitrum One could be found within the Airdrop Pro and First Mover Staking categories. These categories have consistently demonstrated the highest overlaps, even before the Arbitrum airdrop event, suggesting the continuity of key players within the ecosystem.

Check out this page for how these categories are defined and how you can use these labels on Nansen!

Closing Thoughts

In summary, the third quarter of 2023 saw significant developments in the Arbitrum ecosystem. These included governance improvements through AIP-6 and the relaunch of the Arbitrum Odyssey campaign, marking a resurgence of educational initiatives and ecosystem growth. Despite market volatility, the overall improvement in on-chain metrics from the previous quarter underscores the resilience of the Arbitrum ecosystem, highlighting sustained engagement and dedication from users to Arbitrum’s ongoing expansion.