Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Polygon Labs (the "Customer") at the time of publication. While Polygon has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Polygon PoS, an EVM-enabled sidechain scaling solution developed by Polygon Labs, gained popularity due to its low fees and developer-friendly environment since its emergence in 2021.

Alongside Polygon PoS, Polygon Labs has developed various scaling architectures, such as Polygon zkEVM, and Supernets; application-specific blockchain networks built on the Polygon Edge framework—an EVM-compatible blockchain framework. Polygon Labs is also actively working on Polygon Miden, a ZK-rollup aiming to deliver a faster, more secure network with minimal transaction costs. The team also introduced Polygon 2.0, an upgrade proposal that enhances the Polygon ecosystem and enables seamless value creation and exchange using ZK technology.

This quarterly report analyzes the performance of the Polygon ecosystem in Q2 2023, highlighting the implemented developments that have improved network performance and user experience within it.

Key Development: Q2 2023

- Polygon Labs released v0.9 of Polygon Supernets, a significant milestone toward the production release of v1.0. This test version introduces expanded allowlists, staking support, token separation, NFT bridge functionality, and improved deployment workflows. The release empowers users with enhanced control over their blockchain operations and sets the stage for creating "Super networks" with scalability and sovereignty.

- Polygon Bridge for zkEVM provides a secure and user-friendly experience, offering fast finality and support for popular assets without the need for token mapping. Launched as Mainnet Beta, it has garnered adoption from leading dApps and infrastructure providers in the blockchain space.

- Polygon Labs proposed Polygon 2.0, an upgrade to create a protocol for value exchange, programming, and accessibility to the global economy. It aims to achieve scalability and unified liquidity through ZK technology, seamlessly connecting ZK-powered Layer 2 chains. The upgrade includes transitioning to zkEVM validium for enhanced security and performance without altering the user experience. The implementation is planned for Q1 2024.

Ecosystem

During Q2 2023, the Polygon network was bustling with activity, drawing in significant projects from both the web3 industry and other sectors. The following are notable developments that occurred within the Polygon ecosystem during this period:

- y00ts, a major NFT project on Solana, migrated a majority of its NFTs to the Polygon network, allowing users to stake their NFTs for rewards and reach out to a larger collector community. The project has already seen significant secondary sales volume and increased activity in profile picture NFTs, with Magic Eden experiencing over 3x growth in NFT sales compared to the previous month.

- Eleos Labs is integrating its FailSafe cybersecurity system with Polygon to enhance blockchain security. In collaboration with GrabDefence, it aims to protect against theft and fraud. FailSafe detects threats and intercepts malicious transactions, improving asset safety. Eleos Labs seeks to address the lack of practical security solutions in Web3 for the mass adoption of blockchain technology.

- Regen Network, a public chain built with Cosmos SDK, has launched a bridge to the Polygon network in collaboration with Toucan protocol, aiming to improve scalability and lower transaction costs. The partnership aligns their shared commitment to sustainability and opens up new opportunities for collaboration within the vibrant Polygon ecosystem.

- Franklin Templeton's Franklin OnChain U.S. Government Money Fund (FOBXX) is now on Polygon blockchain, making it the first U.S.-registered mutual fund to use blockchain for transactions and share ownership. This integration offers operational efficiencies and increased security while providing investors access to a regulated fund with competitive yields.

- Solid World, a blockchain-based virtual world platform, has announced its launch on the Polygon proof-of-stake (PoS) network. Leveraging Polygon's scalability, low transaction fees, and vibrant ecosystem, Solid World provides users with a seamless and immersive virtual experience while ensuring efficiency and cost-effectiveness.

- Flipkart, Hang, and Polygon Labs have collaborated to launch a brand-first loyalty program - FireDrops 2.0. The partnership aims to leverage web3 technology, powered by Polygon's blockchain infrastructure, to enhance customer engagement, foster brand loyalty, and provide unique experiences to Flipkart users.

Nansen On-chain Data

Daily Transactions

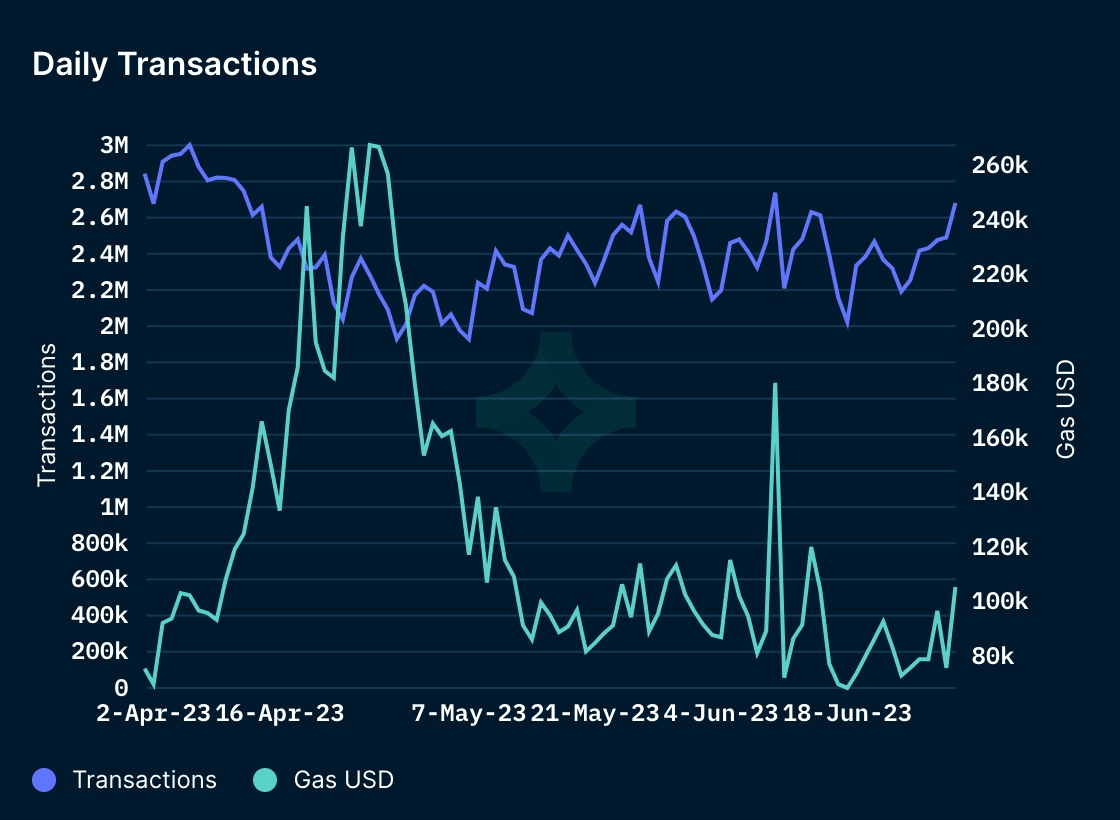

In Q2 2023, the daily gas fees on Polygon PoS displayed notable volatility, ranging from approximately ~$68k to $236k. This indicates fluctuations in the cost of executing transactions and smart contracts on the network during that period. Concurrently, daily transaction counts experienced a peak of around 3.0m transactions and a low of approximately 1.9m transactions. These fluctuations in transaction volumes reflect varying levels of network activity and usage throughout the quarter.

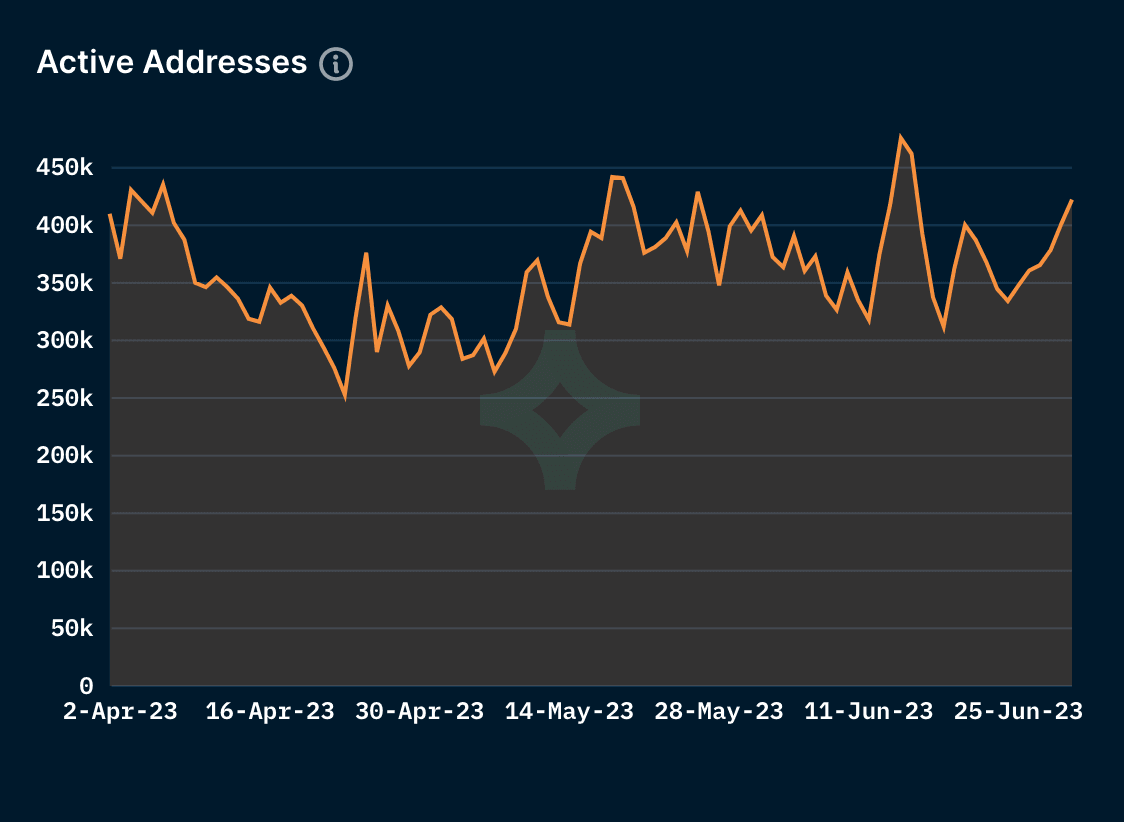

Daily Active Addresses

In the second quarter of 2023, the number of daily active addresses on Polygon PoS remained relatively stable, fluctuating within a range of 253k to 475k. The consistent range is indicative that Polygon has been able to maintain a solid user base and sustain a steady level of daily user interactions.

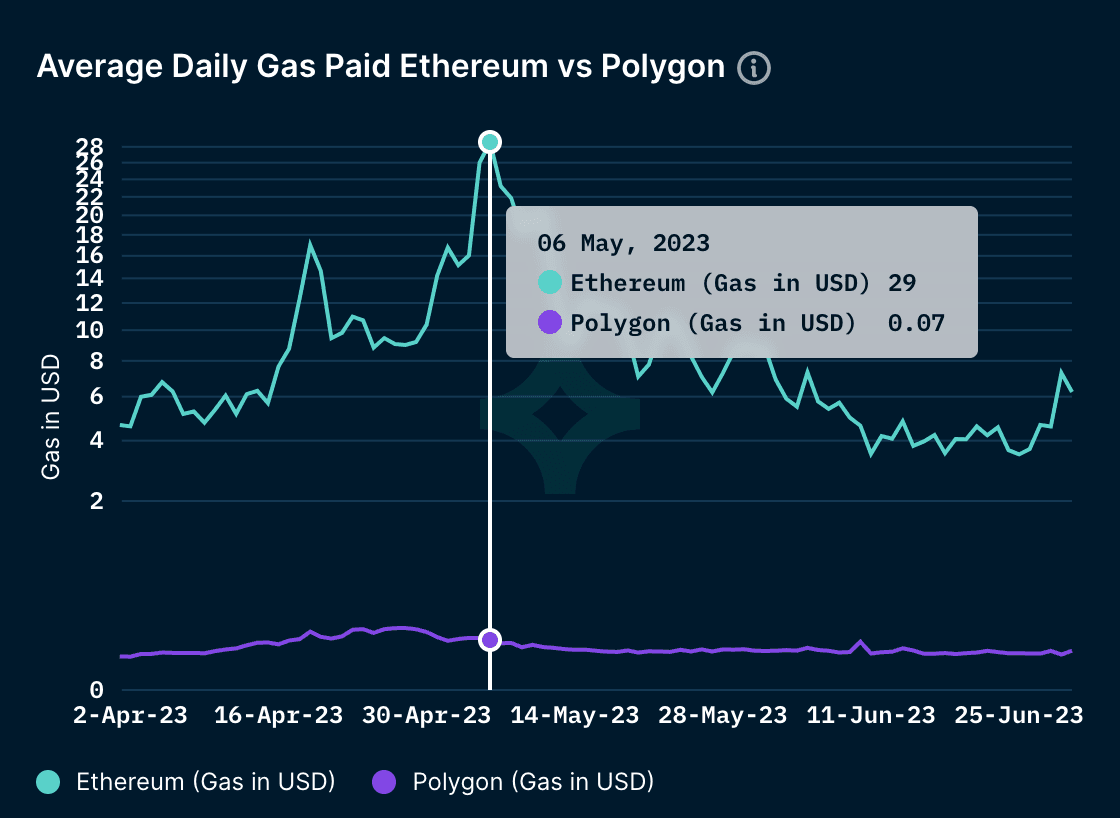

Average Daily Gas Paid (vs Ethereum)

During Q2 2023, the average daily gas fees for transactions on Polygon peaked at $0.12. Throughout the quarter, the gas fees on Polygon PoS fluctuated within the range of $0.03 to $0.12. In contrast, Ethereum's gas fees ranged from $3.47 to $29. This comparison highlights the comparatively lower gas fees on Polygon, making it an attractive option for cost-effective transactions when compared to Ethereum.

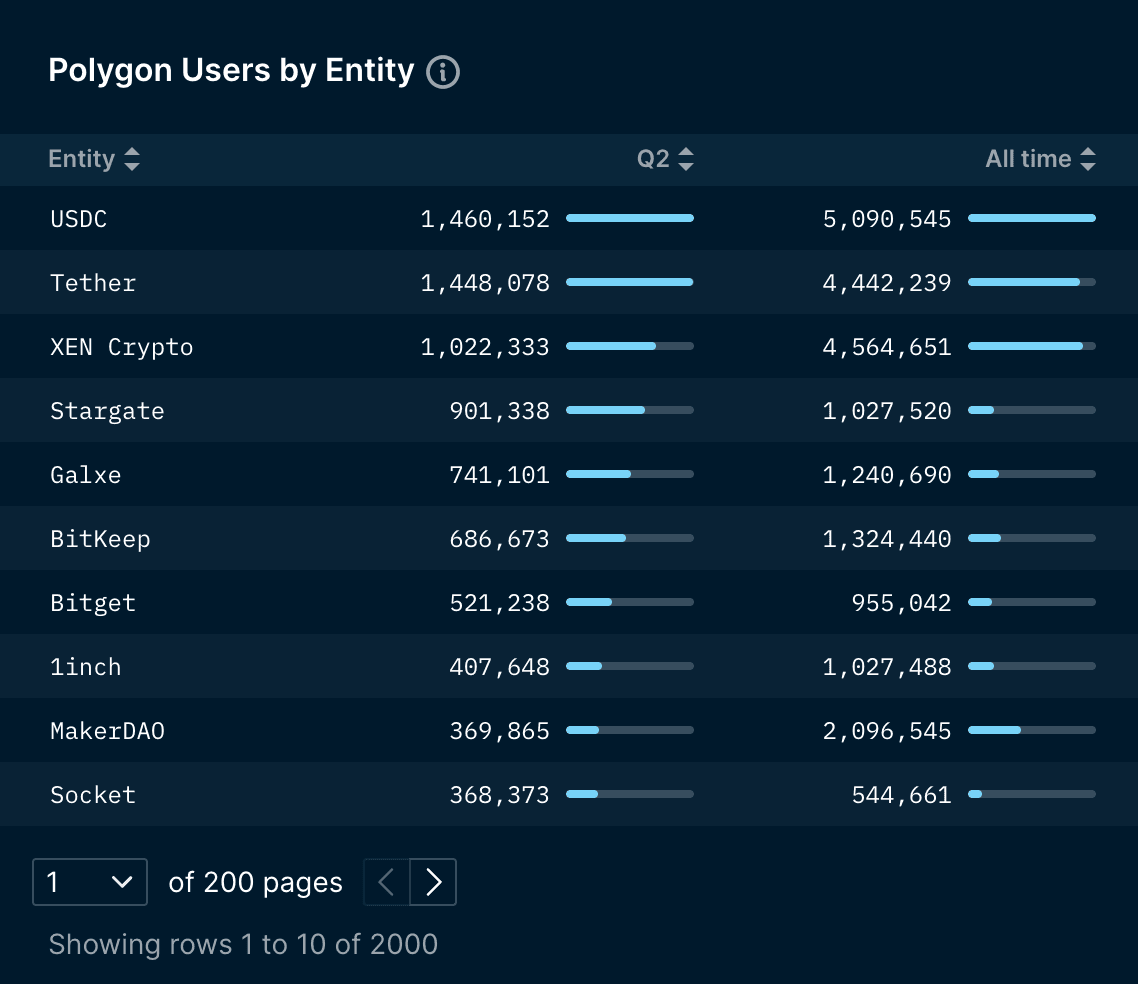

Top Entities by Users and Transactions

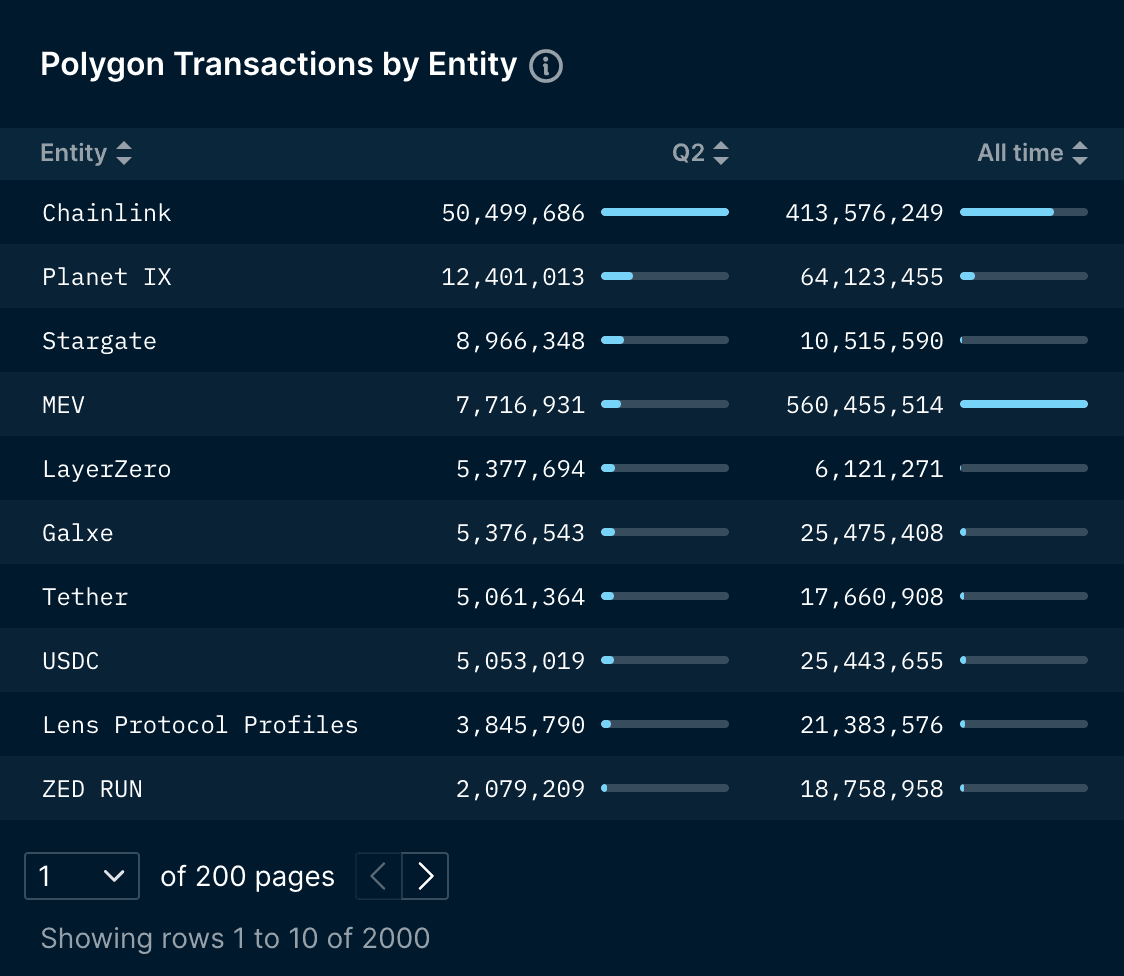

To perform an analysis of the leading entities on Polygon PoS during Q2 2023, we can leverage Nansen's comprehensive list of labels to assess user numbers and transaction volumes. In Q2 2023, Chainlink dominated transaction volumes on Polygon with 50.5m transactions, followed by Planet IX with 12.4m transactions. Stargate and MEV bots also made significant transaction volume, recording 8.9m and 7.7m transactions, respectively. These entities showcased the network's robustness and diverse use cases, particularly in cross-chain data oracles, GameFi, and arbitrage opportunities.

USDC and Tether emerged as the leading entities for user activity on Polygon, with 1.46 million and 1.44 million users, respectively. XEN Crypto also demonstrated substantial user engagement, with 1 million users.

Smart Money Segments on Polygon

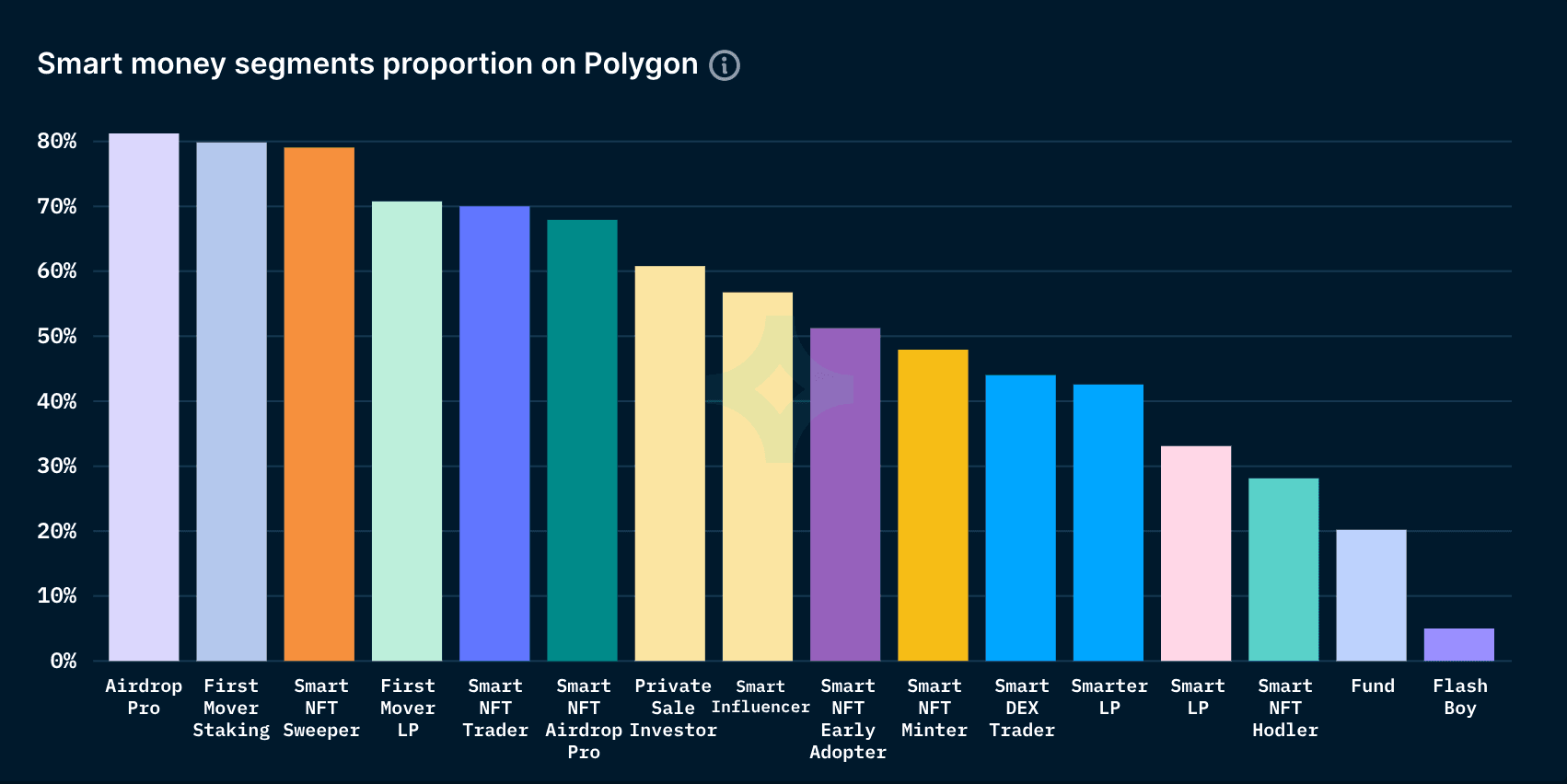

The chart above provides a comprehensive breakdown of Smart Money Ethereum addresses active on Polygon. Smart Money is one of the most beneficial features offered by Nansen, as it comprises a list of labels for wallets that exhibit high levels of activity and profitability on-chain. During Q2 2023, Airdrop Pro, First Mover Staking, and Smart NFT Sweeper represented nearly 80% of the Smart Money on Polygon. This implies there is enthusiasm for both DeFi and NFT on Polygon PoS.

Check out this page for how the Smart Money categories are defined and how to use those labels on Nansen!

Closing Thoughts

There was significant progress in Q2 2023 with the release of Polygon Supernets v0.9 and the introduction of Polygon 2.0.

The Polygon 2.0 upgrade proposal aims to enhance security, performance, and interoperability through the transition to zkEVM validium, a decentralized Layer 2 solution secured by zero-knowledge proofs. These improvements prioritize user and developer experience.

Furthermore, notable developments also included NFT migrations, cybersecurity integrations, mutual fund adoption, digital securities expansion, and the launch of a brand-first loyalty program. Overall, Polygon's scalability, low fees, and vibrant ecosystem position it as a prominent blockchain platform driving the adoption of decentralized technology.