Introduction

Noble is a custom app-chain, built for general asset issuance spanning RWAs and stablecoins. With nearly ~$500m assets issued across 6 issuers such as Circle’s USDC, Ondo’s yield stablecoin, EURe and most recently, the launch of their own yield-bearing stablecoin, USDN, Noble is positioned in two of the fastest growing markets and narratives today: stablecoins and RWAs. We will mainly cover USDN in this report and its simple yet novel approach to a yield/points program it is offering over the next ~4 months. Noble is a Proof-of-Authority chain and there is no native token for Noble at the moment - hence, this presents an opportunity for those speculating on points to get in early for multipliers (as discussed below) and for the humble yield farmers to stay for a generous yield.

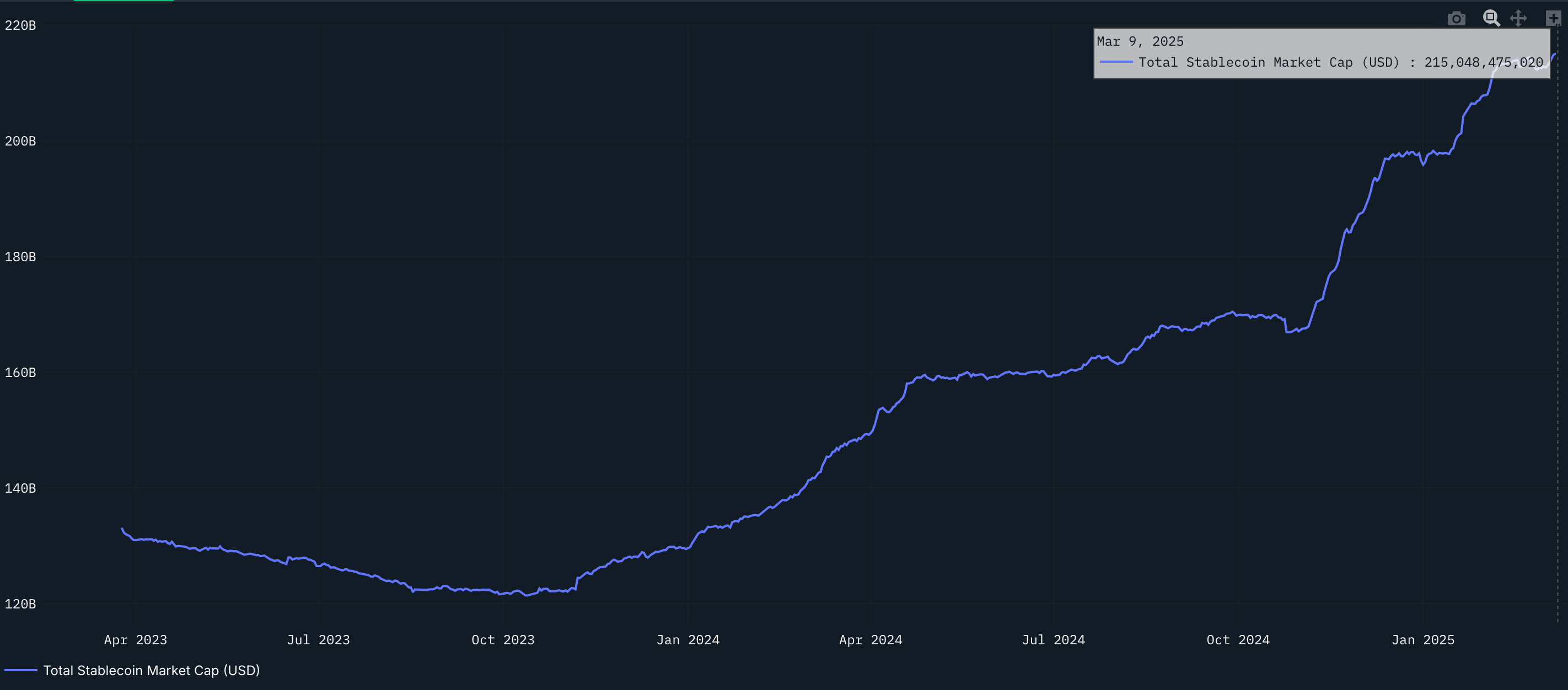

Stablecoin Market Growth

Given the backdrop of stablecoins, we can look no further than the exponential rise in the aggregate stablecoin marketcap. Despite constant market drawdowns and volatility, the chart below is the most promising charts for crypto’s current and growing meta.

How Does Noble Work?

USDN holders effectively get paid for holding it via the floating treasury bill rate, which at the time of writing is 4.3%. Regardless of vaults, this is the base yield all USDN holders receive on their holdings (besides points farmers who forfeit this yield). The infrastructure that ties USDN with T-Bills is a counterparty called M^0 , which connects the T-bills on behalf of USDN holders. USDN is currently 108% overcollateralized by short dated T-Bills which can be monitored here.

Moving on to the vault programs being offered, it may be easier to make a loose comparison to Pendle. For those familiar with Pendle, Noble’s own version of the PT/YT markets are simply the Points Vault (YT) and the Boosted Yield Vault (PT); however, the boosted vault provides variable yield APR - it simply moves in tandem with the points vault.

The mechanism is very simple at its core - USDN is fully backed by treasury bills (T-Bills) and Noble pays out this native 4.3% APR to USDN holders (regardless of the vaults). For those farming the points vault, they forgo this native yield (floating T-bill rate) which is then redirected to the boosted yield vault. So, the age old question is - where does the yield come from? It is simply from treasury bills backed by the US government, the most reliable counterparty in history. So T-Bills effectively put the “boost” in boosted yield and we will go into more detail below.

We are excited about these vaults for a few reasons:

- Overcollateralized stablecoin without overly complex financial engineering or reflexive with crypto funding rates

- Great alternative for USDC holders who do not care about decentralization tradeoffs

- T-Bill holders get the same yield but onchain, with better UX and no need to be an American or go around many hoops to get access to it.

- Near-instant access to the underlying yield paid out every 30 seconds instead of waiting up to 30 days to realize the principal + yield of newly issued T-Bills through a brokerage account.

- It is still quite early for the points program for a project which garnered much VC mindshare having just completed a series A round, raising $15m from the likes of Paradigm and Polychain.

Let’s dive into each vault and lay out how to get funds over to Noble to begin farming.

Boosted Yield Vault

The boosted yield vault is simply a vault providing variable yield to depositors that comprises two sources of yield: native T-Bill yield of their underlying deposit and T-Bill yield forgone by points farmers. At the time of writing, the vault is earning 16% APR.

- Boosted Yield = r_tbill * (1 + (Points Vault Balance / Yield Vault Balance))

Boosted Yield Vault Example Scenarios

Assuming T-Bill Yield = 4.1%

| Scenario | Points Vault Balance | Boosted Vault Balance | Boosted Yield (APY) |

|---|---|---|---|

| Equal Vault Sizes | $1,000,000 | $1,000,000 | 8.20% |

| Points Vault 2x Boosted | $2,000,000 | $1,000,000 | 12.30% |

| Points Vault Half Boosted | $500,000 | $1,000,000 | 6.15% |

Key Insights:

- Equal vault sizes: Boosted yield is double the T-Bill rate.

- Points Vault twice as large as Boosted Vault: Yield triples.

- Points Vault half Boosted Vault size: Yield increases by 50%.

Yield moves proportionally based on the ratio between Points Vault and Boosted Yield Vault balances, anchored to the T-Bill base rate.

Noble Points Vault

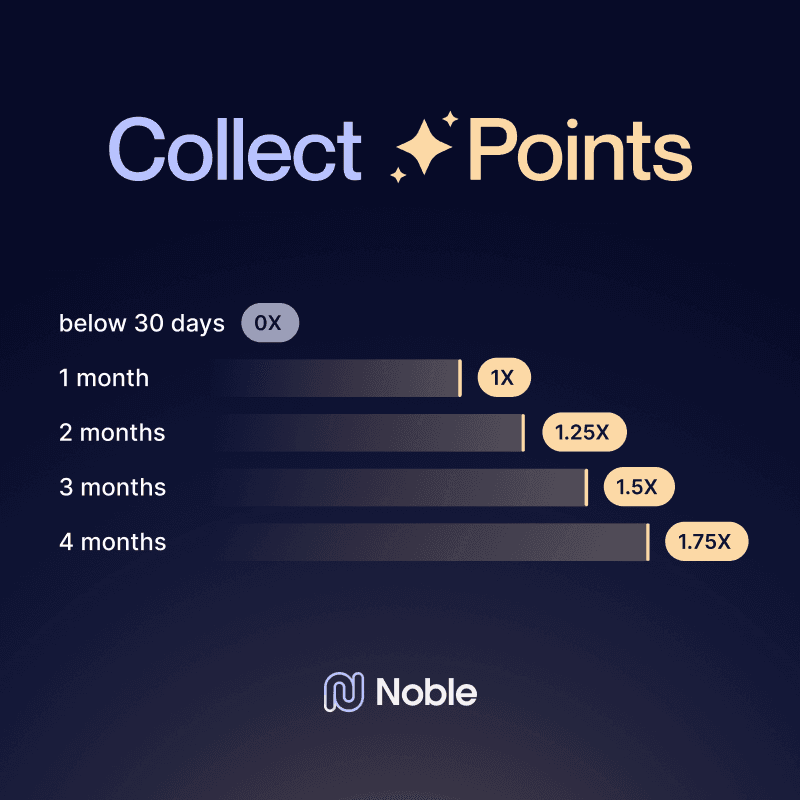

The points program is being run alongside the boosted vault over the next ~120 days. The incentives line up such that it favors long term depositors with multipliers the longer they maintain their deposits. For the points to be worth it, you need to commit these funds for at least 30 days to get 1:1 points earned and the entire duration will yield a 1.75x point multiplier.

Besides the multiplier based on time held within the vault, there is also a soft feature of TVL milestones. These milestones are laid out in large round number increments (i.e $10m, $50m, $100m, $200m, $500m etc.) and they will retroactively reward points to vault depositors during these times. The amount of points to be be given out is unknown, so this is more of a promise laid out by the team and is less gamified given the 30-day minimum already incentivizes long term depositors; however, it adds another dynamic to points farmers for potential further boosts. Most recently, the $10m milestone was reached and they added a 5% bonus on their current base points.

Beyond The Vaults

As mentioned in the beginning, Noble’s product vision is much larger than just a points farming program - Noble is planning to sit at the center of asset issuance as a whole. We can almost think of the protocol as the main exporter of goods which in this case are underlying stablecoins, including their own, RWAs and other assets for other applications and chains to build off of. One can imagine the strategic advantage of a DAO holding a productive stablecoin that pays a native yield during bear markets or even a perp DEX that allows their traders access to a native savings account for their idle capital.

Market Competitors and How to Bridge

The main competition for their USDN product are other products such as Ondo’s USDY or Coinbase’s USDC yield that users can get on Base or on Coinbase itself. Some of the main competitive advantages for Noble include the vault program for growth over the next few months, which provides outsized returns in the form of yield vs competitors. Additionally, the near instant access to the underlying yield (paid out every 30 seconds), and the general programmability of it to power alternative DeFi applications make USDN a new and exciting one to watch.

Given Noble is a Cosmos chain at the moment, most of the growth remains only within the broader IBC ecosystem. The team has teased further cross chain expansion into the EVM world but for today, users still have to bridge over to Noble chain before partaking in the points program. This makes it a bit less accessible for EVM folks but not by much. Users can bridge over funds a variety of ways:

- USDC via a CEX like Coinbase to the Noble network (settles in 15 seconds)

- Noble Express, which is their own bridge (settles in ~15 minutes with plans to implement near instant transactions via Skip Go fast and Agoric Fast USDC this month)

Once the USDC is deposited to the Noble chain, users then need to convert it to USDN. You can do that here and then deposit it into the points/yield vault. Gas fees are handled in USDC (~$0.01 fees) so no need to worry about bridging over an additional gas token.

Concluding Thoughts

Given the volatility and the general drawdown in other yield-bearing stablecoins with the likes of USDe’s coming down to 5% APR (weekly trailing average), we see USDN vaults as a very promising alternative, offering more than 3x the yield at the time of writing. However, it is important to note that the ongoing rate is tied to the floating treasury bill rate and the Fed is expected to cut, which will bring down the base yield for USDN holders. Additionally, there remains risk given it is a new protocol, mainly smart contract risk and centralization vectors including its backing. We still see this as very early days for both Noble and the vaults being offered so please do your own research before trying things out.