”It feels like an ouroboros: the value of crypto tokens is that you can use them to earn yield which is paid for by... people trading crypto tokens.[...] I would love to see a story for where the yield is coming from, or could come from, that's rooted in something external. I have heard plausible candidates! eg. that there's fundamental structural reasons why crypto is durably more efficient at doing international currency trade. I would love to hear more though.”

Introduction

Cryptocurrency markets are evolving beyond their initial focus on ERC20 tokens and DeFi. While these sectors dominate current user activities (top contracts across chains are usually stable-coin ERC20s and DEXs) and portfolio allocation (currently, 7 of the top 10 top token holdings of Nansen “Smart Money” are either DeFi project tokens or tokens primarily used in DeFi) and have matured to the point of offering various reliable and working products, their growth will likely plateau as yield and profit opportunities diminish given their money-market nature, vs the growing interest in non-money, capital markets.

This has three probable implications - first, the next significant use cases in crypto probably lie in verticals and assets that extend beyond ERC20 tokens. Second, to be sustainable, these new assets or products have to create sufficient yield from beyond DeFi by bringing or creating new value on-chain. Third, these new use cases should be well-suited for crypto and remain interoperable with a new kind of DeFi that services non-ERC20 tokens to tap into this vast liquidity (over $82b DeFi TVL) and make use of the functioning and proven products that already exist, while circumventing vulnerabilities like oracle pricing. We call this other side of DeFi object-oriented finance. As Vitalik wrote, this new era of DeFi needs an underlying object based on fundamental value, possibly off-chain, that can be assessed via cash flows, not only comp. This report explores several such verticals, identifying the most promising candidates that can move beyond simple tokenization and DeFi primitives to offer compelling use cases that resonate with a broader audience.

Emerging new verticals

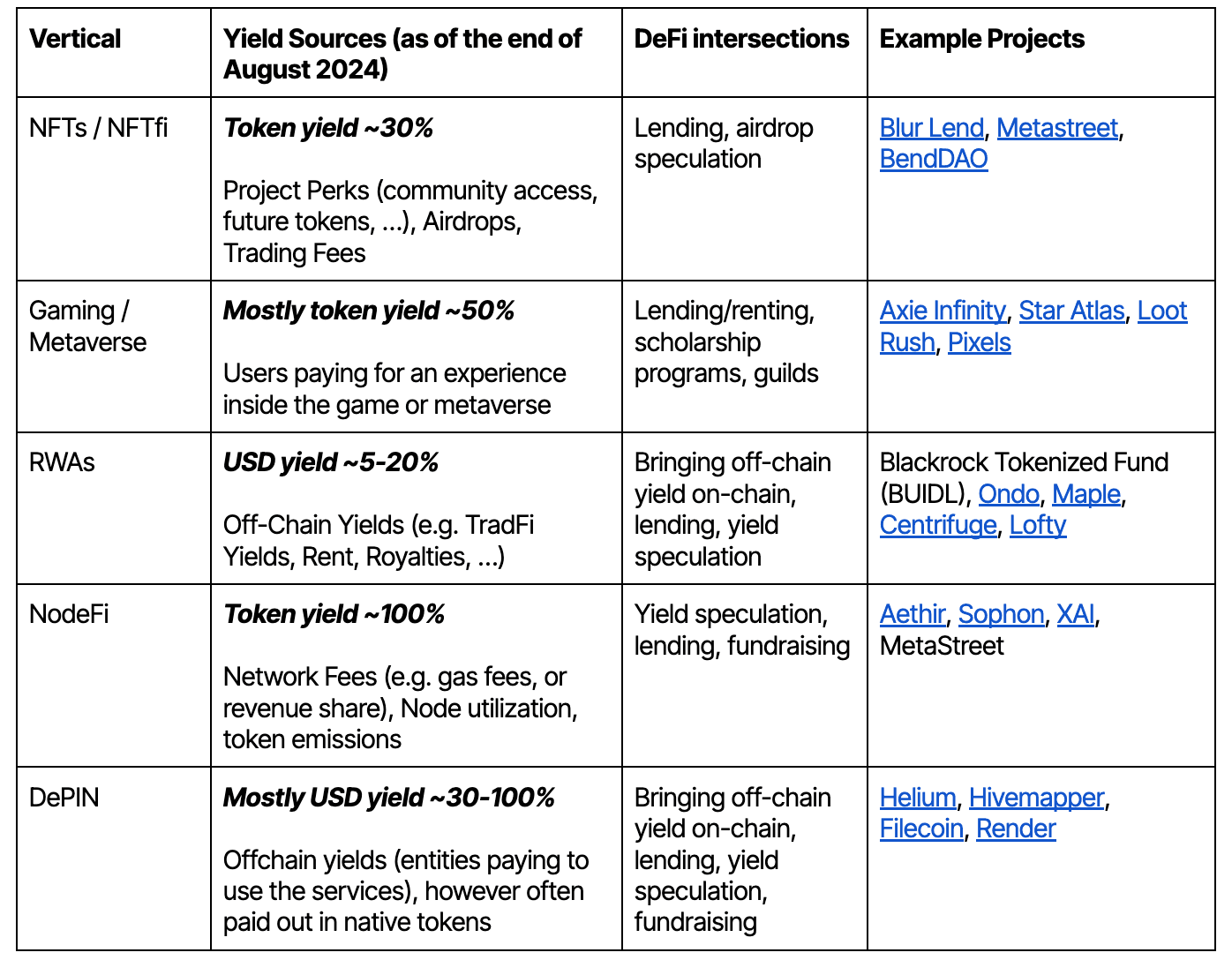

The following section dissects five of the most promising emerging crypto verticals. Each vertical is introduced briefly, followed by its key market metrics and a critical evaluation of future growth prospects. The table below offers a concise overview of the verticals, highlighting their yield potential, possible DeFi intersections, and notable project examples, which will serve as a guide for the subsequent deep dives.

NFTs

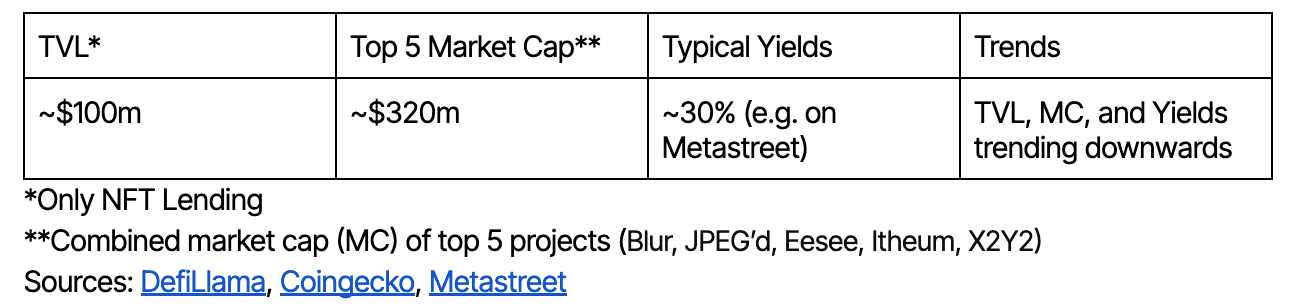

NFTfi, particularly in the lending space, helped pioneer the integration of non-ERC20 tokens (especially non-fungible tokens) into the DeFi ecosystem. During the height of the NFT market, various NFTfi products emerged, most of which were geared toward lending. However, since many NFT collections lack an intrinsic way to generate yield, they often struggle to justify their value outside of social “hype”. These assets are prone to significant value drops when project sentiment or narratives shift, making them ill-suited as collateral. This issue is further magnified by the extreme illiquidity of many NFTs, which has led most NFTfi and lending protocols to fail in gaining (and retaining) widespread adoption.

Although the NFT market as a whole—and by extension, NFTfi—did not return to its former glory in 2024, NFTfi still managed to attract some attention due to the resurgence of the airdrop meta this year.

NFTs with Frequent Airdrops

As airdrop sybils became more sophisticated, protocols began seeking out 'real' market participants, often directing a portion of their airdropped token supply to holders of select blue-chip NFT collections. For a few select collections (e.g., Pudgy Penguins or Miladys), this addressed the issue of “intrinsic” yield (i.e. a non-zero probability of future cash flow associated with holding the asset), making them more attractive assets to borrow against and adding some resilience to their floor prices.

This allowed NFTfi to continue generating competitive yields for some collections, even though the broader NFT market was off its peak. However, since these collections are so few, the growth potential for this market remains extremely limited. Additionally, airdrops are unpredictable in terms of frequency, value, and sustainability, placing the entire vertical in a high-risk niche.

NFTs without Frequent Airdrops

Since the end of the last NFT cycle, most collections have been gradually losing value. With little to back their worth, they are largely unproductive assets, highly sensitive to shifts in narratives and “FUD,” making them unsuitable as collateral. Notably, art NFTs seem more resilient, as collectors primarily value them for their aesthetics, but they remain similarly unproductive assets in a financial sense.

While a new NFT hype cycle could drive demand for lending markets tied to these collections, this demand would likely be short-lived as demand will ultimately subside again without the possibility of an embedded cash flow.

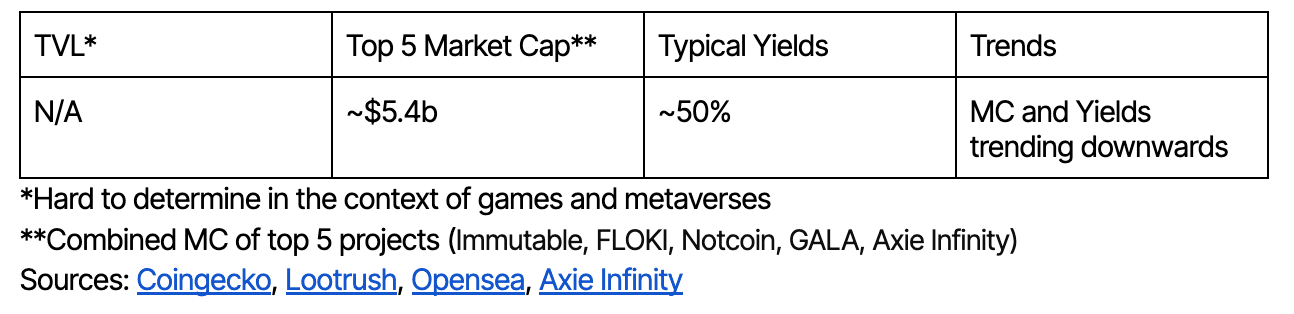

Gaming/ Metaverse

Similar to the NFT market, the gaming and metaverse markets have seen better days. This is not to say that there aren’t exciting developments, but valuations and asset prices have generally been trending downward.

Unlike NFTs, however, these assets often have a built-in mechanism to generate revenue. Users participating in games or metaverse experiences are often willing to pay for that engagement. For projects in the early stages, the script can also flip, with projects paying users for their participation by rewarding them with project tokens. Either way, gaming, and metaverse assets are typically productive, leading to competitive lending yields and use cases such as Axie’s scholarships, where Axie owners 'rent' their Axies to players and share the generated spoils (tokens).

Nevertheless, this type of collateral shares many of the downsides of NFTs, including volatility and market dependency, with most of the yield coming in the form of (again, volatile) tokens.

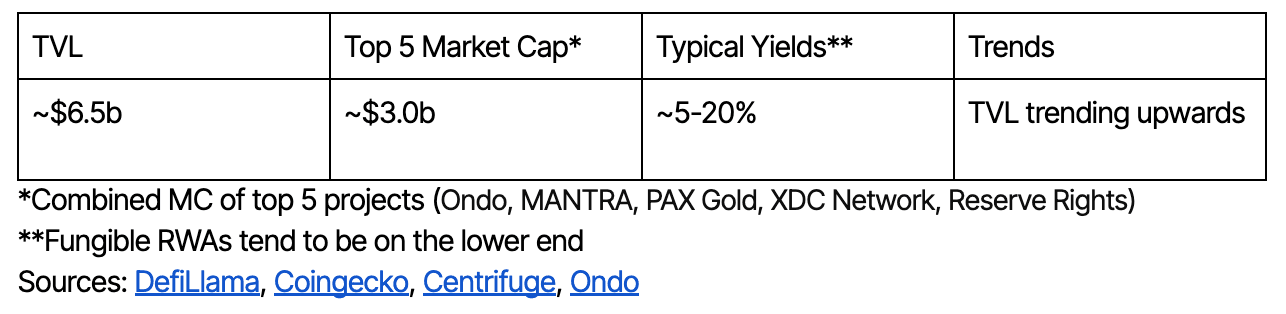

RWAs

RWAs are typically productive assets, and unlike the previously discussed asset types, both the assets themselves and their primary yields come from outside the crypto space and are fiat-denominated. This mitigates many of the sustainability issues that NFT, gaming, and metaverse yields face, making these assets less volatile and more suitable as collateral. However, by bringing off-chain assets on-chain, the trustless nature of the blockchain is compromised. One must trust that the entity bringing the real-world asset on-chain does so accurately, with correct valuation, and enforces the user’s rights if anything goes wrong (often across multiple jurisdictions).

While this is generally true for all RWAs, distinguishing between fungible/ crypto-adjacent RWAs (e.g., treasuries, funding rates) and non-fungible/ less crypto-adjacent RWAs (e.g., real estate, intellectual property) helps assess the opportunities and challenges within this vast and diverse asset universe.

Fungible RWAs

Fungible and crypto-adjacent RWAs, such as tokenized treasuries (e.g., Ondo, BUIDL, Maple) or other traditional finance products (e.g., Ethena tokenizing funding rates), are already conceptually close to what’s happening in DeFi, making them relatively straightforward to implement, though regulatory hurdles may still exist.

These products typically take the form of pools into which users can deposit yield-accruing tokens that can be treated the same way as other tokens within DeFi. They are easily integrated into most DeFi applications.

The underlying assets are often tied to USD or stablecoins, making them ideal collateral. However, despite their sustainability and reliability, the on-chain growth potential is debatable since off-chain alternatives are already readily available and easily accessible, making it difficult to attract retail users. Additionally, because yields are usually in the single-digit range, these pools are often not the first choice for crypto-native participants seeking higher returns—unless combined with yields from other DeFi applications or leveraged.

Non-Fungible RWAs

Non-fungible RWAs, on the other hand, are conceptually more complex to implement on-chain and typically face even greater regulatory challenges. The underlying assets are often illiquid (e.g., real estate), and their value is difficult to verify or estimate (e.g., intellectual property).

On the flip side, non-fungible RWAs tend to offer higher yields, depending on the specific asset, as their yield often originates from outside the crypto market. This helps diversify income streams, and tapping into these sources can be lucrative for on-chain investors, especially if successfully combined with other DeFi applications.

For retail investors, many of these yields are typically inaccessible due to gated access (e.g., to intellectual property) or high initial investments (e.g., real estate), which is a compelling reason for these assets to move on-chain in the first place.

So far, however, the potential of non-fungible RWAs has yet to reach mass adoption or attract significant liquidity, as most existing markets for these assets feel immature and clunky, and they continue to struggle with regulatory issues.

NodeFi

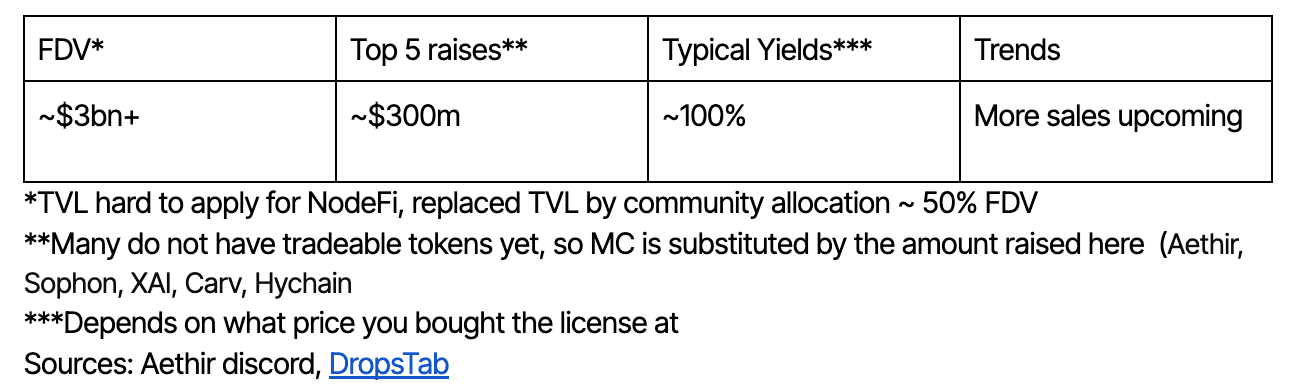

NodeFi is a new and emerging narrative and method for raising funds for projects. Licenses to operate blockchain nodes are tokenized (usually as NFTs) and sold, with the (token) rewards for node operators typically being quite substantial. At least for the projects, it seems to be working; the three largest node sales alone (XAI in November 2023, Aethir in March 2024, and Sophon in May 2024) have collectively raised almost $250 million.

These licenses are productive assets and can earn yield when combined with a running node or when delegated.

Currently, depending on the price of the node license (as people usually buy in at different costs due to a tiered system in most sales—buy late, pay more), the yield can be very competitive. The crypto market tends to quickly latch onto successful models, and with the past successes of node sales, more are likely to occur, further extending this nascent sector.

However, node sales are not without downsides. First, the yield is heavily tied to the crypto market, usually denominated in the project token and dependent on valuations as well as network usage. This, in turn, affects the value of the licenses, making them highly volatile. Second, completely permissionless use and integration of node licenses into DeFi may pose a centralization risk for the networks themselves. For this reason, many networks initially make node licenses non-transferrable and limit the number of nodes a single user can buy. Nevertheless, a flourishing ecosystem built around node licenses that mitigates at least the second issue is imaginable. Unlocking such stuck capital can be exemplified with new NodeFi products, such as with XAI and MetaStreet.

Overall, despite being highly dependent on crypto market conditions, the NodeFi vertical is growing and likely here to stay. It is still too early to identify clear winners for an ecosystem built on top of this, but one will most likely emerge as these productive assets continue to gain popularity.

DePIN

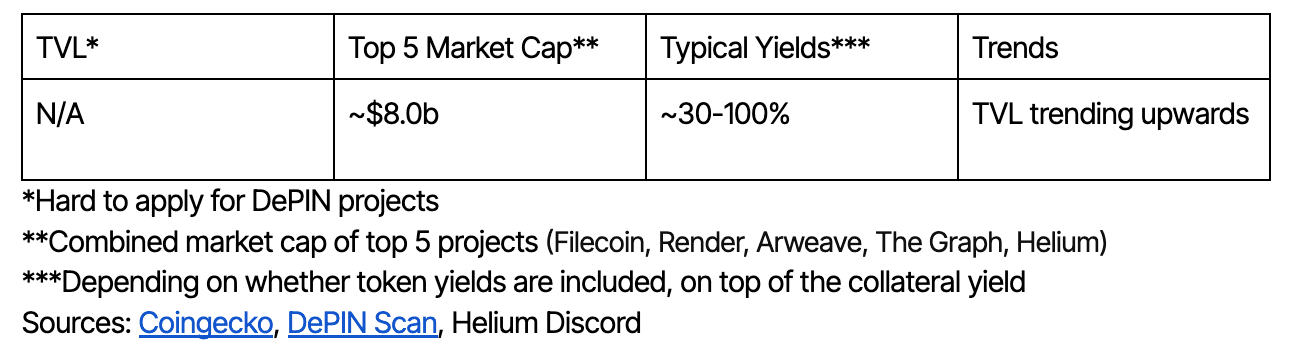

Decentralized Physical Infrastructure Networks (DePIN) is a category that has been gaining significant attention lately. The main subsectors currently include Compute/ AI-focused networks (e.g., Render), wireless networks (e.g., Helium), sensor networks (e.g., Hivemapper), and energy networks (e.g., Arkreen). While the general concept of DePIN has been around for a while (Helium’s blockchain went live in 2019), the rise of AI—especially since the release of ChatGPT-3 in November 2022—has driven significant hype, particularly for compute projects adjacent to this sector. Following this trend, a distinction between Compute/ AI-focused DePIN and other types of DePIN allows for a more precise discussion.

Compute/ AI-focused DePin

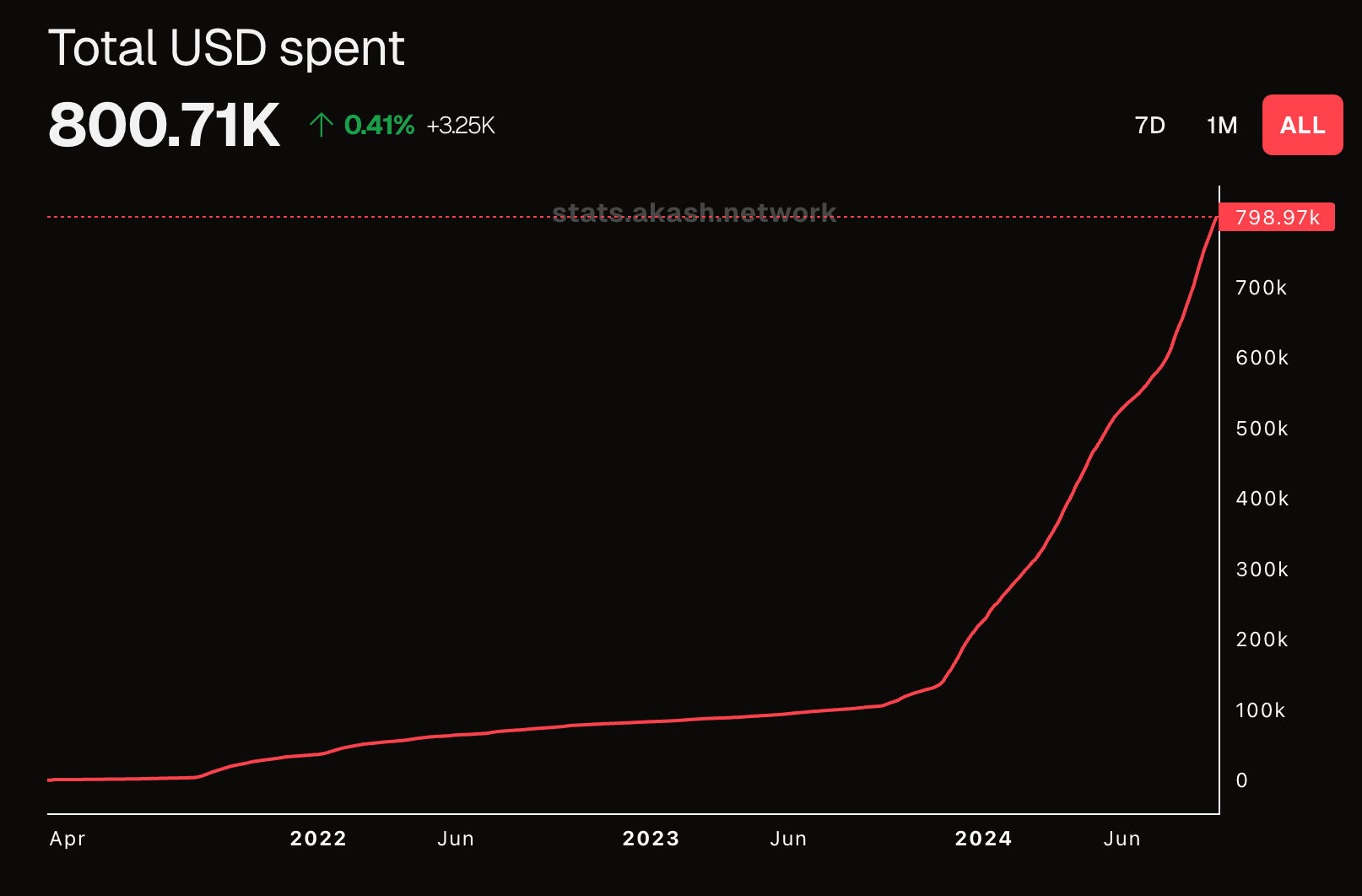

Although these projects have not yet captured a significant share of the total market for GPU renting (with the GPU-as-a-service market size in 2023 around $3.2 billion, while e.g. Aethir reports $36m ARR and Akash Network rented out units since 2021 for a total of below $800,000), the sector is rapidly gaining popularity with both investors and users.

As AI becomes increasingly central to technological innovation and training proprietary models becomes a key differentiator for many companies, GPU renting as a DePIN subsector is likely to experience significant growth. Real-world demand for GPUs and the willingness to pay for them continue to rise (this topic will be covered in detail in a later report), and these yields are highly competitive, even compared to other on-chain opportunities. Additionally, yields are usually USD-denominated, as they originate from outside the crypto ecosystem, opening up interesting opportunities such as Pendle-like yield speculation as a meta-bet on the GPU market.

Moreover, the price of GPUs as underlying assets is relatively easy to assess and predict compared to other verticals (e.g., NFTs, real estate, and project-related licenses), making this a more attractive choice for lending use cases.

However, it should be noted that this sector comes with some of the trust and regulatory issues already discussed in the RWA section, albeit to a lesser extent. Additionally, DePIN is generally prone to being out-competed by off-chain competitors, as many of these markets and use cases benefit significantly from economies of scale and efficiency due to centralization. Nevertheless, the unique opportunities presented by integration into the crypto market—such as token incentivization and additional yield through DeFi integration—mean that the AI-adjacent compute vertical has a solid chance of capturing meaningful market share in the future.

Non-Compute DePIN

Non-compute DePIN networks include wireless networks like Helium, sensor networks like Hivemapper, and energy networks like Arkreen. Yields for these networks usually depend heavily on the utilization of the network’s “nodes,” and can vary greatly (e.g., Helium hotspots that are frequently used generate higher earnings, while mapping “important” streets for Hivemapper also earns more).

This subsector shares many of the challenges faced by AI-adjacent compute DePIN, though some of the benefits are less pronounced. The demand side for many of these products is often well-served by off-chain solutions, with sectors like wireless and sensor networks not experiencing the same rising demand and shortage that the AI compute sector does. Additionally, setup, quality, and maintenance of services are harder to ensure, standardize, and maintain compared to running GPUs in data centers. GPUs also tend to be more versatile in application, whereas many non-compute DePIN sectors rely on project-specific devices with limited reusability.

That being said, the potential for DePIN is vast, and an innovative non-compute application with a strong product-market fit could still take the world by storm at any time.

Conclusion

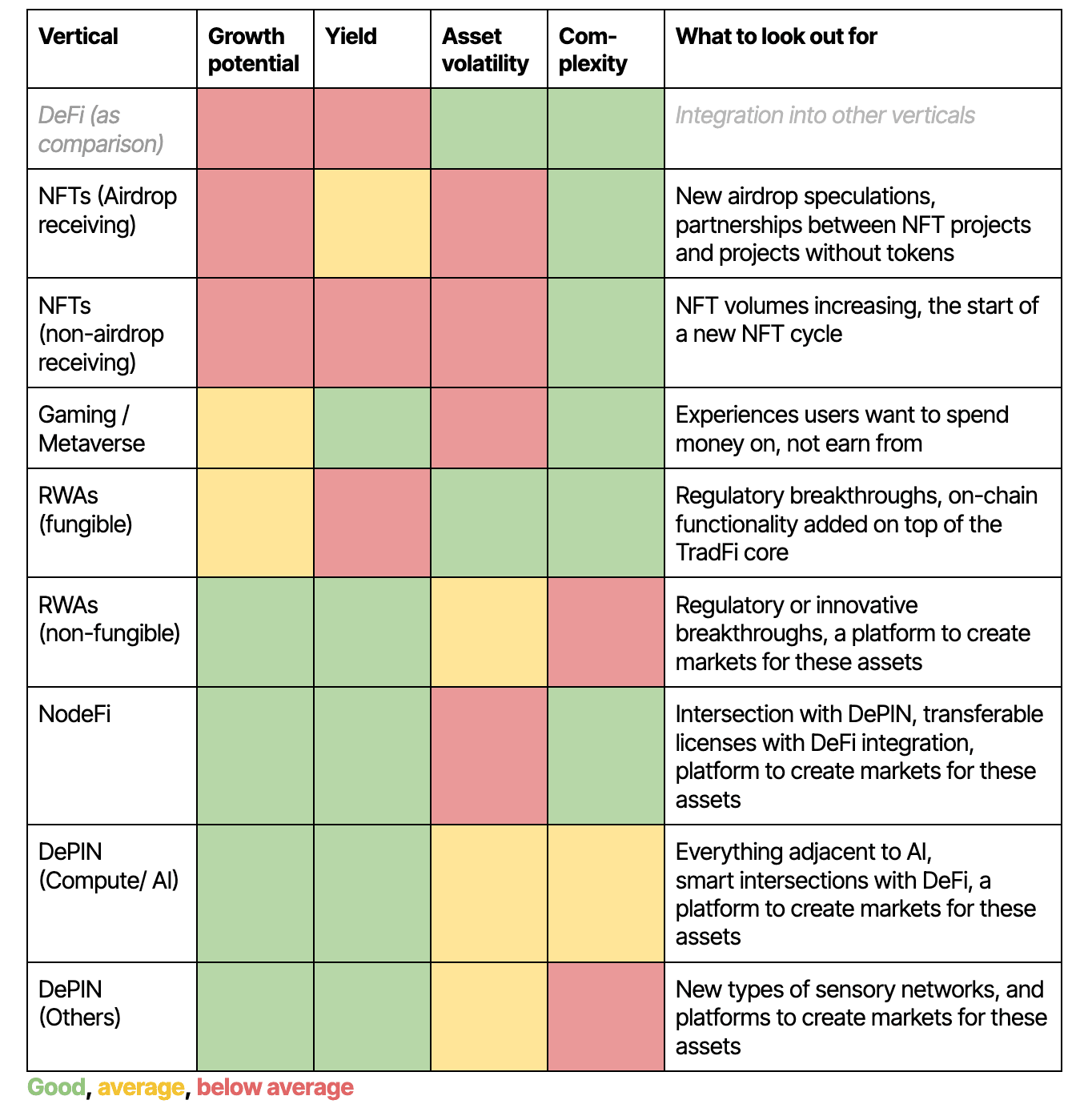

The table below qualitatively visualizes how the discussed emerging verticals perform across the following dimensions:

- Growth potential: Evaluate the growth potential and state of the underlying market, as well as the ability to capture market share if the market already exists off-chain.

- Yield potential: Assesses the yield potential of the vertical, excluding additional token incentives.

- Asset volatility: Measures the volatility of the underlying productive asset and its correlation to the success of individual projects, also implying its suitability as collateral.

- Complexity: Considers the complexity of implementation, including off-chain components and regulatory issues.

Overall, AI-related compute DePIN appears to be in a prime position to become the next major vertical, with a sizeable and fast-growing market, high yield potential, predictable asset prices, and comparatively low implementation complexity. It seems to be only a matter of time before the synergies and potential interoperability with existing crypto-native use cases—such as innovative fundraising, lending, yield speculation/fixed yield products, or self-repaying loans—lead to breakthroughs and the development of successful products.

Honorable mentions include NodeFi and non-fungible RWAs. NodeFi, with its large growth and yield potential and straightforward implementation, holds great promise but is heavily reliant on the success of the underlying projects and tokens, as well as often non-transferable licenses. It has yet to prove its long-term sustainability and create markets for these node licenses that are easily interoperable with DeFi.

Non-fungible RWAs offer attractive yields and could bring real advantages on-chain that are unavailable in their current off-chain form. However, the implementation and regulatory hurdles are complex, and no product has yet achieved deep retail penetration.

Notably, all three verticals mentioned above face similar challenges in creating markets for their assets and successfully (and sustainably) integrating them into DeFi. This could mean that a breakthrough in one vertical could spark innovation in the others as well. As Vitalik stated, major DeFi lending protocols currently don’t offer markets for low-liquidity, high-value assets—precisely the kind of assets that 'normies' have and know.

Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Metastreet (the "Customer") at the time of publication. While Metastreet has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.