Curve

Curve Finance founder Michael Egorov took out a $100m loan on CRV across multiple lending platforms, most notably Aave (~$65m). Some of the proceeds of this were apparently used to purchase two mansions in a flamboyant showcase of leveraging DeFi in the real world. However, things turned sour when Curve was hacked this week for around $70m in various tokens. There has been uncertainty in the market if CRV will remain above the liquidation threshold for the loans. CRV is currently $0.58.

His current positions are:

- $60m from Aave (liquidation: $0.37)

- $9.1m from Frax (FRAX)

- $14m from Abracadabra (MIM)

- $7.7m from Inverse (DOLA)

At the time of writing, Michael has around $9m to repay Frax (yesterday, this was at around $17m). This is arguably the most perilous position; interest rates are now at 85% and could significantly increase in the pool is fully utilized. The priority appears to be repaying this first.

The circulating supply of CRV is 889m, and Michael has just under 40% of this in the lending platforms. A liquidation would probably see the CRV price completely collapse as there is insufficient on-chain liquidity. This would have extremely adverse effects on the DeFi ecosystem, as Curve is a key pillar infrastructure for stablecoins and pegged assets. A collapse in CRV will also leave protocols with bad debt. Aave would need to sell AAVE to cover the deficit. Aave will likely be able to cover this, but it would likely be highly detrimental to its price. Abracadabra, Inverse, and Frax could be put in similar positions.

Smart Money

Interestingly, we haven’t seen large Smart Money selling for CRV.

- 0xkyle wrote an interesting piece on the bull and bear cases for the token.

- This Smart Money wallet has bought the dip (~$19k).

- Another notable inflow was a wallet withdrawing CRV liquidity - likely a precautionary measure to easily sell should the situation further sour.

OTC Curve

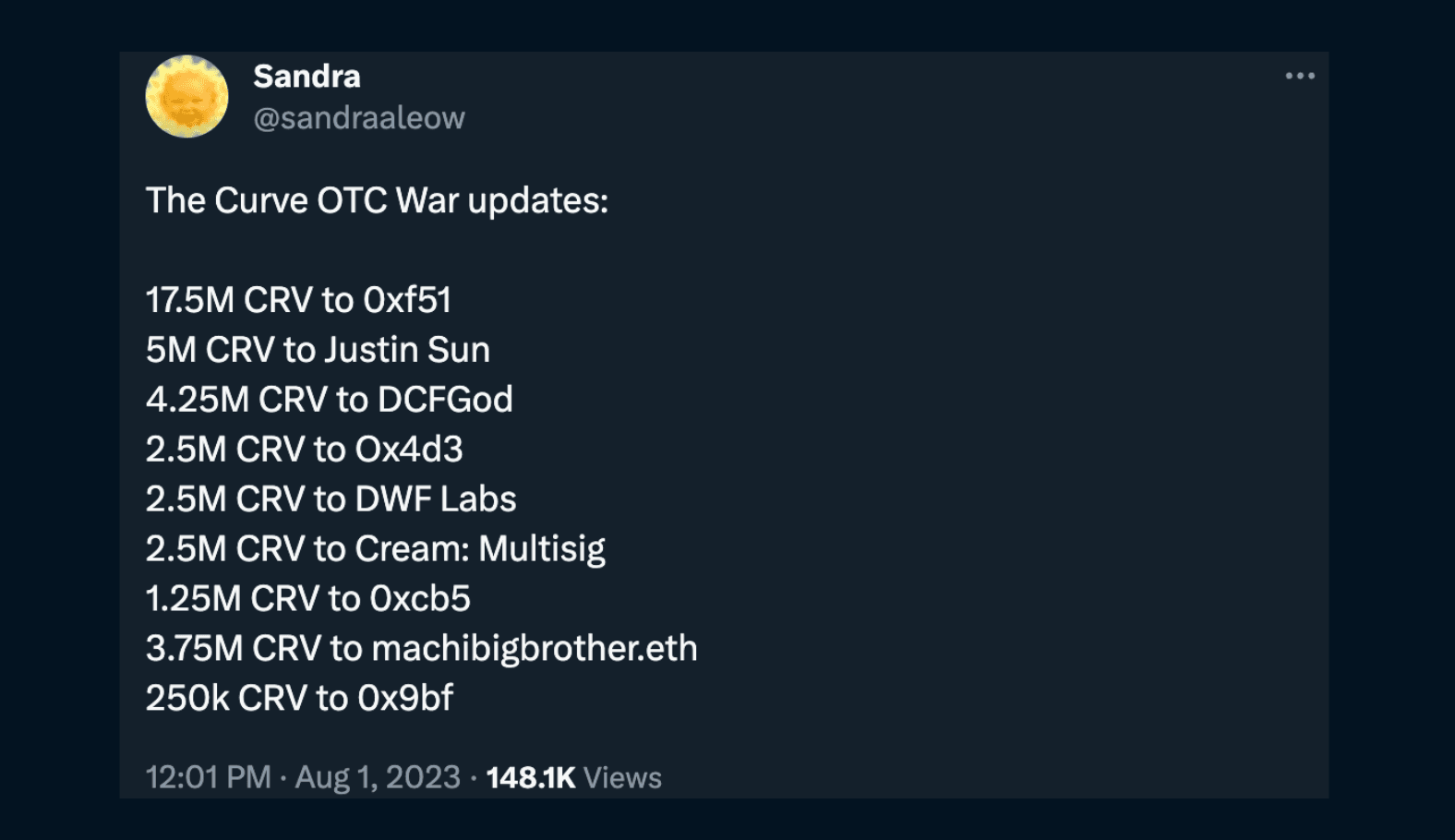

Michael Egorov has started selling Curve OTC. It is reported but cannot be confirmed that the OTC Curve sales were at $0.4 with a six-month lock-up. These are likely ‘gentleman’s agreements’. He has sold ~52.5m CRV so far for debt repayments.

These include:

- 0xf51

- The largest recipient with 17.5m CRV.

- Machi Big Brother (3.75m CRV).

- DWF Labs have had ~$7.5m inflows of CRV starting around 10:30 UTC.

- Convex Founder (2.5m)

- DCFGod

- Justin Sun

- If interested in tracking the situation, set up Smart Alerts to get live updates on Telegram for Michael’s wallet.

The redistribution of CRV through these OTC sales could also be perceived as bullish. Michael has a very disproportionate amount of the token and large purchases of it from other major DeFi players can be seen as a positive.

This Twitter thread covers updates on which entities Michael is selling CRV to.

The hacker itself has 7.2m CRV as well which is also worth watching. This amount should not have a drastic amount on markets but could contribute to a negative flywheel of fear selling. Any further protocol issues/hacks would likely cause Curve price to reach liquidation levels.

Ideally, Michael pays back most onerous loans e.g. Frax as soon as possible and FUD around Curve decreases. It remains the pillar infrastructure in DeFi and has generally wide support from the community.

That said, it is very important to keep tabs on how the situation evolves.

MKR Run and ‘Smart Burn Engine’

🤓 ethhasbottomed.eth purchased $148k in MKR. Maker has experienced a strong price run this year, outperforming ETH. It is up 55% over the past 30 days. Maker recently reintroduced a buyback program with the ‘Smart Burn Engine’ where Dai revenue is used to periodically market buy MKR, and add MKR/DAI liquidity to a Uniswap v2 pool. It's a protocol-owned liquidity approach to value accrual, and its implementation is likely a key reason for the price run. Most significantly, MKR has some of the strongest fundamentals in the DeFi space and is one of the few profitable protocols. It has significantly reduced its reliance on USDC in recent months in favor of real-world assets which has significantly increased its revenue.

The buyback program should, over time, create very deep liquidity for MKR, strengthening the protocol at a fundamental level. LP tokens are sent to this wallet. It deposited ~$6.7m in July. However, this deeper liquidity will obviously decrease volatility and, thus, the effect of the buybacks. However, it adds back value accrual to the MKR token and is a positive development for the protocol.

One thing to note is that Maker has low memetic value and can now be better valued using traditional finance metrics e.g. cashflow. This potentially reduces its ‘pumpamentals’ compared to the rest of the market. Another point of caution is that major US investors such as a16z have exited recently. This may be due to upcoming headwinds from US regulators.

Maker will also be moving towards a sub-dao model. Read more about this here. The purpose of this is to further decentralize the protocol, however, it has also been widely criticized as being overly complicated