Last week was a tiring and noisy week, so this note will try and stick to the key developments and their implications for markets going forward.

The “Trump” or “Bessent” put

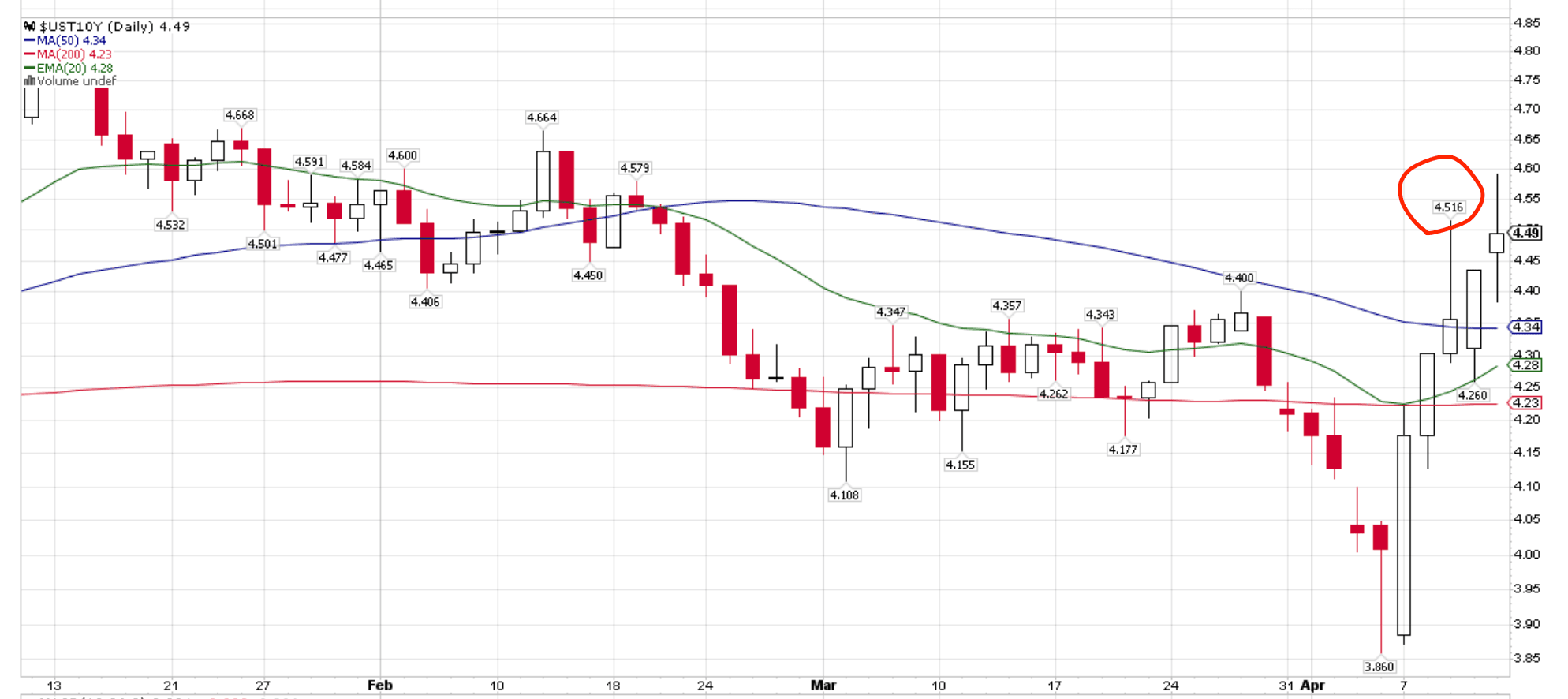

The relatively bullish interpretation of the recent developments in US tariff negotiations, and the one we tend to favor, is that the US administration seems to have been forced to lower the heat on reciprocal tariff negotiations, pushed by the fast sell-off of US Treasury markets. Through-to-peak, the US Treasury 10-year yield surged by 66bps to > 4.5%, from Monday 7 to Wednesday 9 April. Credit spreads, IG and HY, also widened from historically sub-10th 10-year percentiles to their median, again in a matter of days.

The US’s back-pedaling means that the conflict between the ideology of “reindustrializing and bringing manufacturing jobs back to the US” and a more pragmatic pro-growth approach has a pain point beyond which the latter prevails. The US administration appears unwilling to risk a market shock that would lead to the dreaded US recession.

The maneuvering outside of market chaos, along with trade negotiations with Japan and South Korea (India, Switzerland, Italy are next on the meeting list), as well as the majority of press communication were led by one man, US Treasury Secretary Bessent. Bessent’s prominence coincides with the lesser influence of aide Navarro and Commerce Secretary Lutnick. Keep an eye on these political dynamics for a gauge on whether ideology or pragmatism is dominating.

Also, last week showed Big Tech companies’ influence on President Trump: reciprocal tariff exemptions were announced for semiconductors, chip manufacturing machines, computers, smartphones (etc.) late last Friday, representing 100bn or 22% of the US’s Chinese imports, and a bit less than 300bn for the imports from the rest of the world, according to Bloomberg.

Taking these developments altogether, our main scenario is that we are past the peak uncertainty in terms of tariff policy, which should be reflected by markets.

That said, it will likely be a bumpy climb up the "wall of worry", which will likely favor quality assets over the rest.

Elements of uncertainty

These are the likely bumps for markets:

Commerce Secretary Lutnick, even if less present than Bessent, is still talking to the press and hinted that exemptions on electronic products would be only to allow those to fall under sectoral tariffs. Our constructive interpretation on sectoral tariffs is that these could be used as one-on-one negotiations with the largest companies in each sector, e.g. ASML for semis in Europe, and Novartis and other pharmaceutical companies in Switzerland. There are some areas of compromise that could replace tariff imposition, notably commitments to invest and build plants in the US, and also repatriate fiscal revenues from offshore locations (e.g. Ireland) to the US.

Another area of uncertainty involves the countries outside of the US’s “best friends” list. 90 days is a very short time to negotiate a tariff rate below the original ceiling of the Rose Garden, and some countries might end up with a tariff rate closer to that original high number than to 10%.

The elephant in the room is the negotiation with China; mutually imposed 125%+ tariffs, if really implemented, will hurt the Chinese economy too, probably forcing the authorities to actively support employment and find alternative export destinations to the US. That said, China is the only economy to be able to stand up to the US for some time, and neither the US nor the Chinese leader wants to “lose face”, so, to us there is a question mark on how fast the de-escalation can take. The longer it takes, the more US businesses will refrain from capex plans and hiring, and consumers from spending (the details of the latest CPI report already suggest slower consumption of apparel, travel, and dining out). The lower the US growth, the lower US assets need to derate before stabilizing. This week we will pay particular attention to US March retail sales to gauge consumer spending (reported on Wednesday 16).

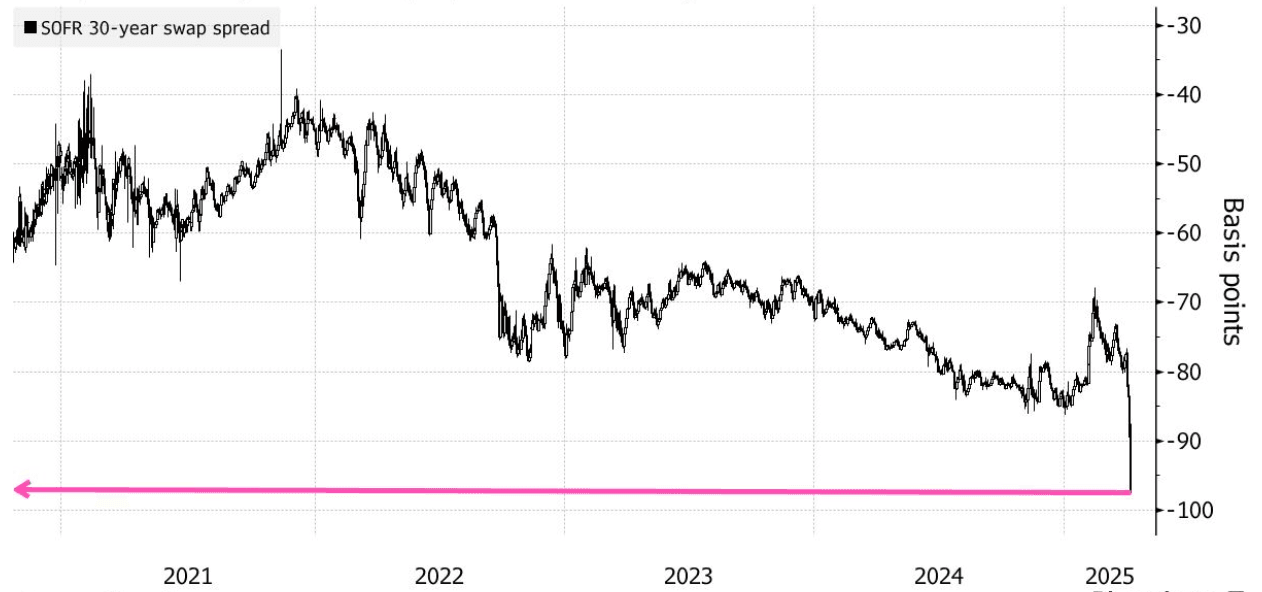

There is a longer term narrative that has to do with cross-asset positioning and flows. At the end of last week, the correlation between US dollar (lower) and US Treasuries (lower) turned positive, all while equities were falling, meaning that UST lost their “safe haven” property for a few days. This has happened in past episodes of de-risking or inflationary shock, with equities and USTs down, but usually the US dollar higher (see 2022). What exactly happened last week and how likely is this correlation to persist?

As most of Rate flows are not transparently reported and/ or lagged, we can only speculate on a few narratives ranging from banks unwinding their swap positions, accentuated by leveraged unwinding (see this article for more details) to foreign real money investors offloading USTs.

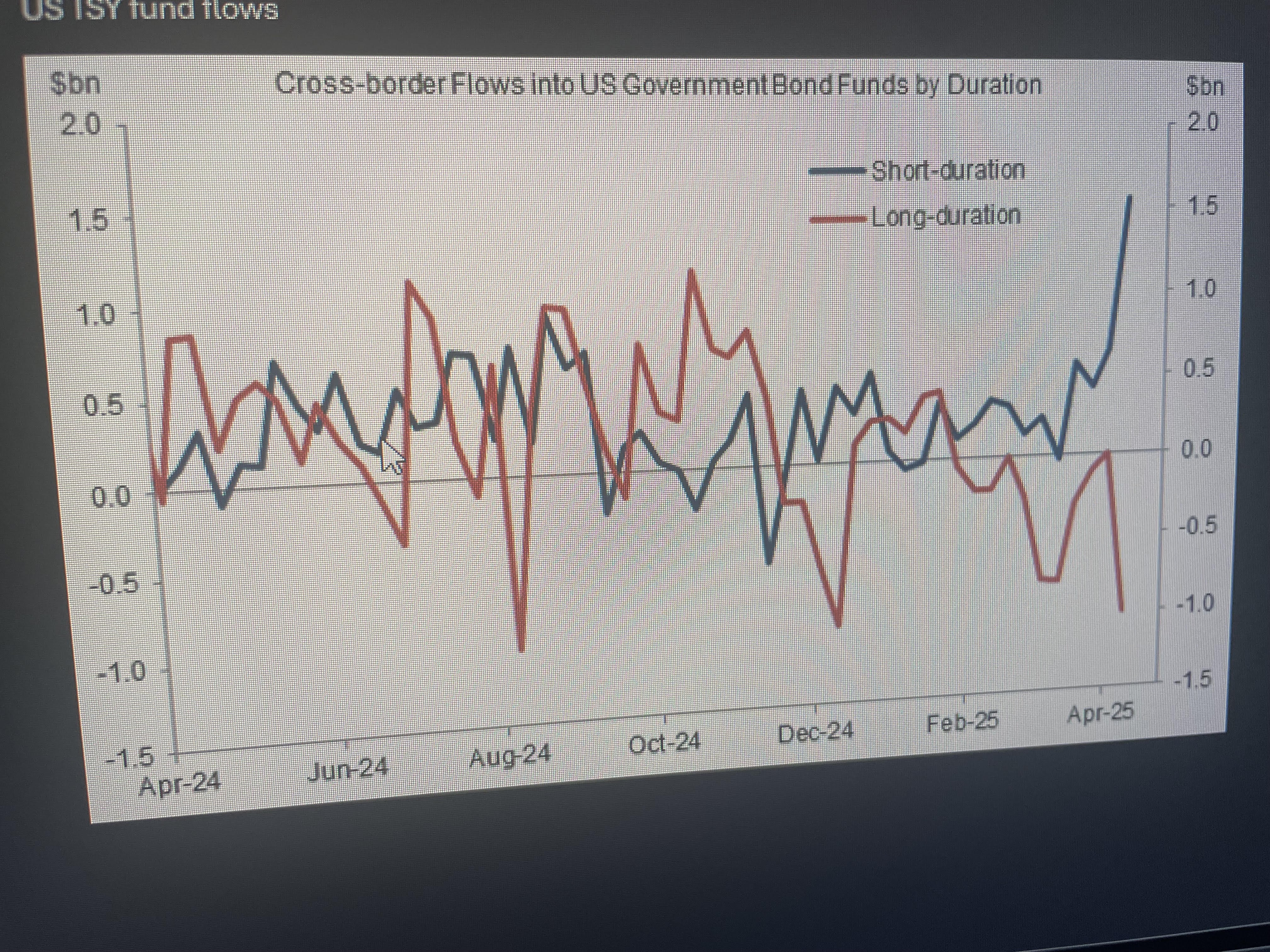

We will not speculate further, but observe that long UST duration was the most vulnerable asset segment (see portfolio flows below) vs short-duration and that non-US real money, after hedge funds earlier this year, has very likely started to increase hedge ratios that favor their local currencies and protect them against a weaker US dollar (see charts below). Non-US bonds were also bid as their yields fell or increased less than US yields.

How sustainable are foreign capital outflows from USD exposure? This is a very tough question. On the one hand, there is a lot of foreign capital exposed to US dollar downside, so the move could feed itself (lower USD, higher hedging, etc.) as long as tariff uncertainty lingers. On the other hand, we cannot 100% buy the narrative of global capital migrating away from the US: the US stock market in particular retains twice as high margins as German equities for example, with now cheaper valuations relative to history. There appears to be a lack of alternatives notably for equities, as long as the Eurozone’s or China’s growth lag the US’s.

Case in point, European and Chinese equity markets underperformed the US during the worst part of the tariff chaos:

Market implications

To summarize, we have likely passed the peak tariff uncertainty, with risk assets now climbing a bumpy wall of worry.

For us, this means sizing risk exposure conservatively and adding exposure to “quality assets”. In crypto, the obvious one is BTC. In the US equity market, some Tech names are now 50% cheaper than their historical median, e.g. Nvidia. In Europe, there are attractive high-margin names in Pharma that have the potential to do well once there is clarity on the sectoral negotiations. Finally, we scooped up some gold, the expensive but ultimate hedge for the complicated geopolitical setup of the next few years.

As an aside, our Risk Barometer turned risk-on at the end of last week:

Good luck.