Introduction

Pendle is a blue chip DeFi protocol that allows users to trade the future yield of a token. For those not familiar with Pendle, check out their docs here. 2024 really solidified Pendle as go-to launchpad for asset issuers looking to grow their ecosystems as seen with Ethena, BTCfi, restaking and many other sectors. Given their major moat of liquidity and distribution, combined with the future catalysts planned for v3, we believe Pendle is positioned strongly for 2025.

- The new upgrade is likely to bring more activity to Pendle, which generally accrues value to vePENDLE holders.

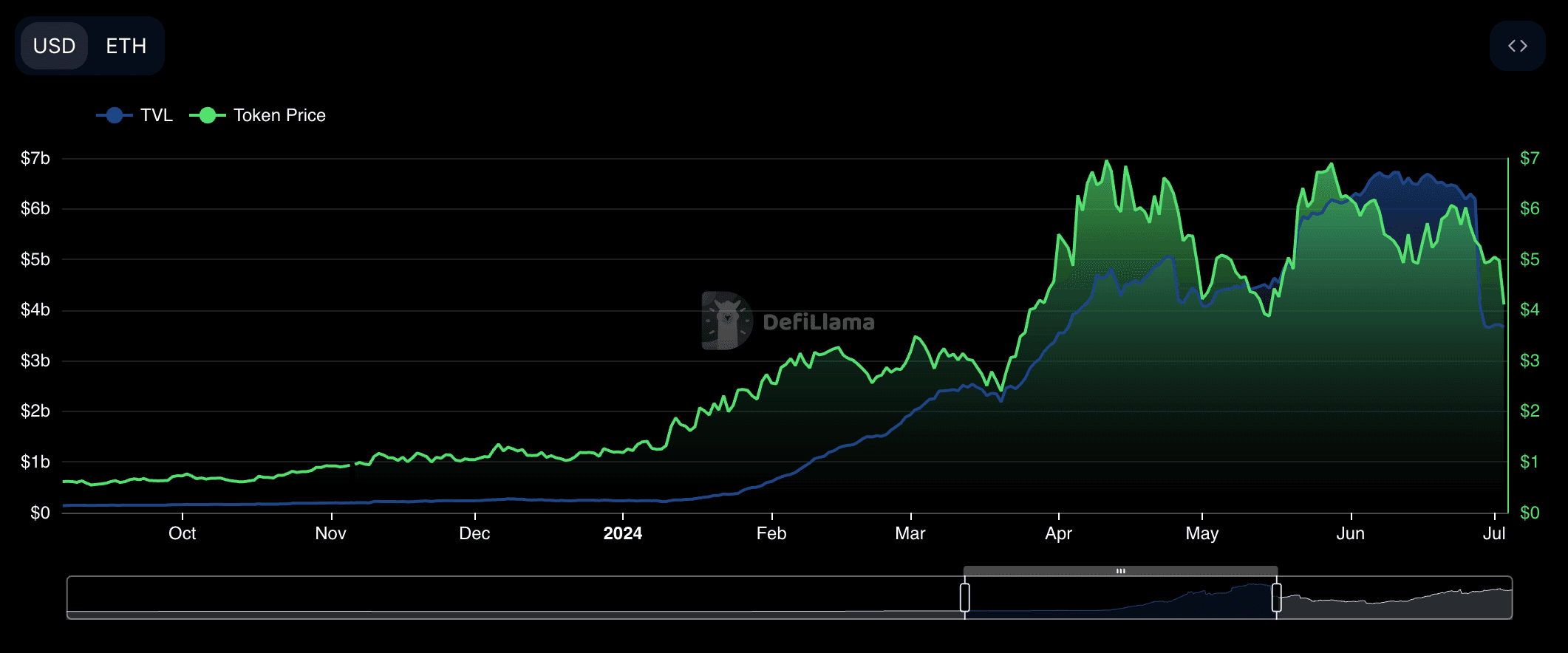

- There has historically been a correlation between the PENDLE price and TVL growth, assuming the v3/Boros upgrade drives more TVL from its new products and chain expansion, we expect strong potential tailwinds for PENDLE in 2025.

- Some potential risks for Pendle include the decrease in overall speculation of airdrops/points and thus, potential yields go down and new inflows. Additionally, Ethena's USDe makes up 58% of all TVL, which can be impacted if yields go down and the market shifts towards other yield opportunities.

Let's dive in.

Recent Strength vs the Overall Market

Since the local bottom BTC put in on February 3rd, PENDLE has shown remarkable strength, up over 34% from the lows.

Despite the recent strength off the local bottom, PENDLE is still down nearly 30% YTD in 2025, so it is not immune to broader risk off conditions.

Price Action vs TVL

Historically, PENDLE price action has directionally followed TVL as the fundamentals get better and drive fees to vePENDLE holders.

What's next for the protocol and PENDLE Holders? Enter v3/Boros.

Pendle v3 and Boros

The v3 upgrade comes with many exciting catalysts for the Pendle ecosystem, increasing the addressable market through its new products and the potential to drive more fees to vePENDLE holders.

Funding Rates Trading: The Core Upgrade

- Market Innovation: The flagship upgrade in v3 is enabling funding rates trading and the opportunity to expand to off chain markets include traditional finance rates (i.e interest rate swaps, LIBOR, etc.). For funding rates, users can now trade the differential between fixed and floating funding rates, effectively allowing them to capture yield arbitrage opportunities and hedge against volatility.

- Enhanced Trading Dynamics: By integrating funding rates as a core asset class, Pendle transforms traditional yield strategies into a dynamic market. Traders can now take long or short positions on funding rate differentials.

- Capital Efficiency: Leveraging margin-enabled trading from the Boros upgrade, this feature improves capital efficiency. It offers more granular control over yield exposure, thereby potentially driving deeper liquidity.

- Tokenomics: Optimizing their fees to align incentives between LPs, users and the protocol itself. They will be implementing a dynamic fee rebalancing so that pools remain optimal despite fluctuations in rates.

Supporting Catalysts

- Multi-Chain and Ecosystem Integration: Expanding across multiple blockchains positions Pendle to capture diverse liquidity pools beyond the EVM ecosystem, most notably Solana.

- Product and UX Innovations: The upgrade introduces refined trading interfaces and innovative yield instruments that further diversify the product offering.

These specific enhancements, particularly funding rates trading, mark a significant leap in Pendle’s evolution—positioning it as a compelling opportunity for sophisticated yield strategy players.

PENDLE Stand to Gain?

PENDLE holders, more specifically, vePENDLE holders have direct exposure to the upside growth of the platform. Historically, vePENDLE holders generated ~40% APY on average. They also received over $6m worth of airdrops such as Puffer, Ethena, EtherFi, Eigenlayer and many others. The v3/Boros upgrade, along with broader expansion to new chains such as Solana, we see a lot of tailwinds for new markets driving more fees and potential airdrops to token holders.

Risks

Although there are many catalysts laid out in v3, there come risks for the year ahead. Outside of macro factors, we see two main risks, which are downstream of broader risk appetite in crypto markets. Many of the same tailwinds driving Pendle, like Ethena, are reflexive in both directions strengthening fundamentals in a bullish market and weakening them in a downturn.

- The speculation of airdrops/points continue to decline and thus, potential yields go down and new inflows decline. Many of the key markets and high yields are downstream of this meta so we can expect yields to naturally fall in line with risk appetite.

- USDe accounts for ~58% of Pendle’s TVL, creating a centralized risk on Ethena. Ethena yields do quite well when funding rates are high in a bull market given the yields are high but when the market cools off, so do the yields for USDe holders. Thus, if market participants chase greener pastures (more yield), then we can see TVL (nearly 58% of current TVL) being impacted.

Given the recent outperformance by PENDLE since the local bottom, PENDLE has shown relative strength. However, BTC is still range bound and bidding alts here is quite risky but if you are stable heavy and are looking to bid things, we like to follow tokens with both strength and clearly defined catalysts. With this being said, catching falling knives is never a good strategy in a market defined by dispersion so DYOR.

We believe Pendle has many broader macro tailwinds going for it, mainly the ever increasing stable coin markets and clearly defined regulatory frameworks coming out to drive more and more innovation in stable coin designs and launching tokens more generally; thus, creating more speculation for airdrops/points. As we have seen with the exponential growth in Ethena, we can expect a continued exponential growth in tokenized future with many new tokens launching. Although this doesn’t directly translate to increased TVL, we believe that the shared growth that Pendle has created for some of the major projects today makes it the key launchpad for asset issuers at large to grow their marketshare. With expansion beyond the EVM, new trading products, and much more, we are excited for the next Pendle upgrade.