Introduction

Pendle Finance has become the main venue for yield trading, allowing users to lock in or speculate on future yield by splitting yield-bearing assets into Principal (PT) and Yield (YT) tokens. After an explosive 2024 that saw Pendle ride the emergence of liquid staking and “points farming” narratives, the protocol is entering a new phase marked by stablecoin yield dominance, major upgrades, and cross-chain expansion. With its 4 year mark being hit and the rollout of “Boros”, Pendle is positioning itself at the forefront of onchain DeFi going into 2025 with TVL climbing back over $4.8B.

The “Boros” upgrade introduces margin yield trading and funding rate markets, expanding Pendle into a massive derivatives TAM while potentially increasing fee generation for PENDLE holders. Cross-chain deployments on Solana, Hyperliquid, and TON are also underway - expanding Pendle beyond its dominance on mainnet and popular L2s. Additionally, Pendle and broader DeFi applications benefit from the positive SEC regulations laid out for how DeFi is to be treated and can build around this for potential institutional players who would want to tap into the native onchain yield protocol. With this backdrop in mind, let’s dive into Pendle’s recent developments and why it continues to stand out in the DeFi landscape.

Pendle’s Momentum and Onchain Signals

Even in a choppy crypto market, Pendle has demonstrated relative strength and growing traction. Since the local market bottom in early March, PENDLE token prices rebounded over 105% since the March 11th lows to June 30th.

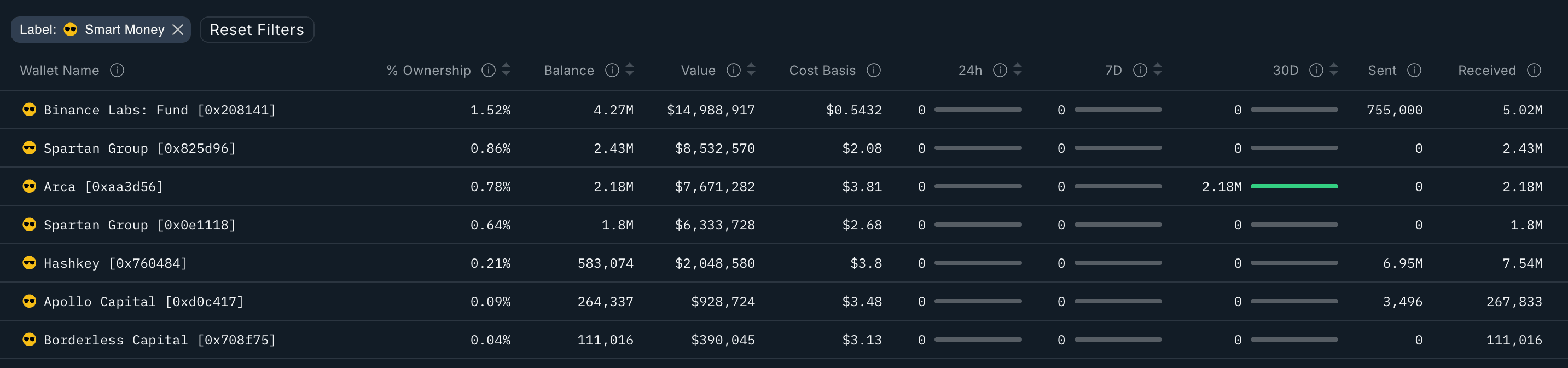

While broader altcoins remained sluggish relative to BTC, including PENDLE, it’s combination of real yield and upcoming catalysts makes it interesting here as overall altcoin sentiment is quite poor, despite fundamentals quietly improving. Notably, onchain data reveals some large positioning from notable VCs. As of June 30th, the top Smart Money balance snapshot is the following:

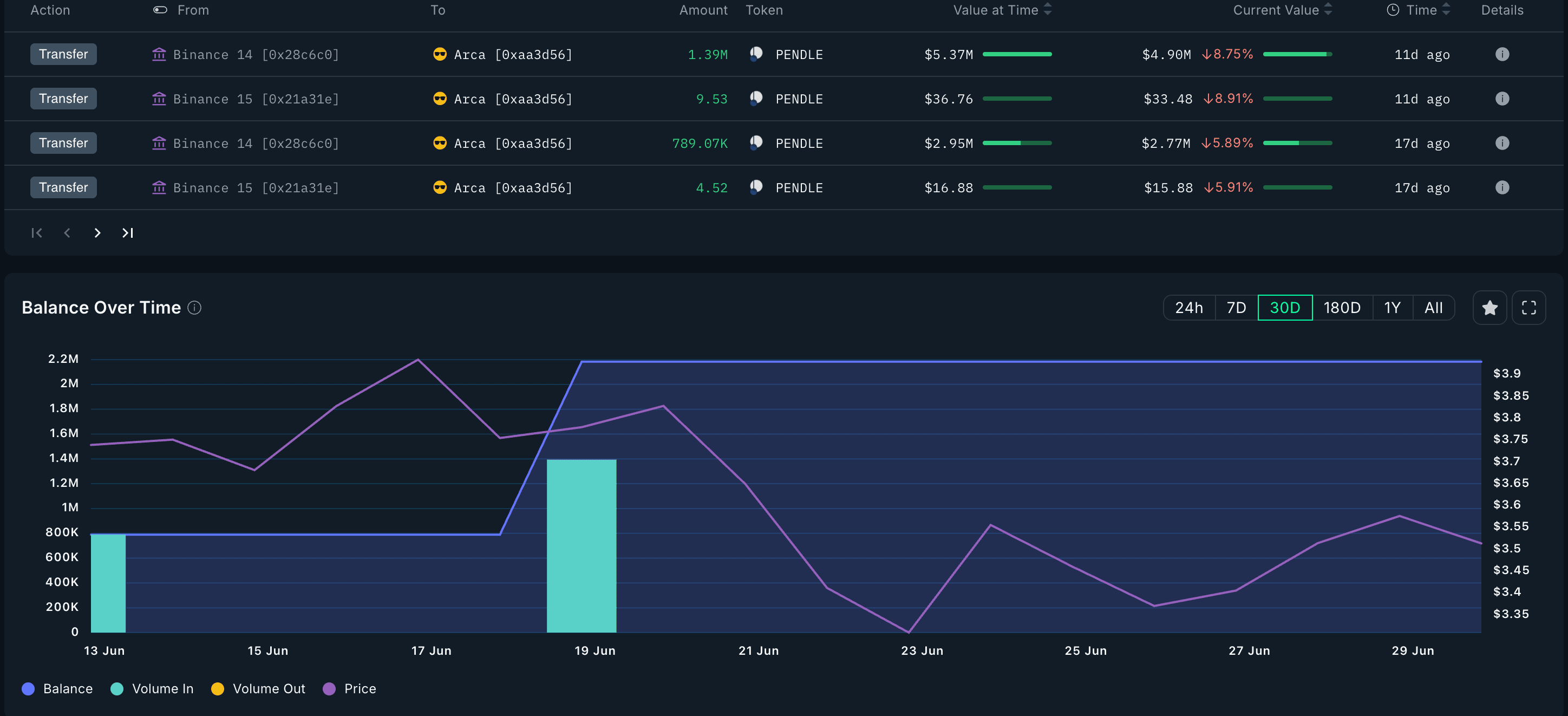

The data shows some strategic holdings across the likes of Binance Labs, Spartan Group, Arca, Hashkey, and Apollo Capital. Most notable is that Arca has accumulated quite a large position over the last 30 days, now worth over $7.67M at the time of writing. A zoomed in view of their position shows millions of inflows from Binance. These PENDLE tokens are currently sitting idle in their wallet at the time of writing as shown below.

As for general PENDLE holders, there are over 42,400 unique wallets that hold at least $1 of PENDLE. Moreover, the protocol’s usage has had positive downstream incentives for token holders. May 2025 saw the highest fee payouts yet to vePENDLE holders at $3.86M, thanks to its growing trading and LP activity. This real yield (which vePENDLE stakers receive as revenue share) reinforces the value accrual for token holders a key fundamental that sets Pendle apart from many purely inflation-driven DeFi tokens. As of June 30th, annualized token holder revenues is projected to be around $23.65M.

Recent Developments and Integrations

Over the past few months, Pendle has made significant strides in expanding its ecosystem through continuous upgrades and strategic partnerships. The protocol has onboarded a diverse set of yield-bearing assets from across DeFi, adding dozens of new pools including stablecoins and liquid restaking tokens from projects such as Ethena, Mellow, and Karak. Notably, there’s been a marked increase in stablecoin variety, reinforcing Pendle’s role as the go-to rate infrastructure for onchain finance and a launchpad for emerging narratives.

In terms of integrations, Pendle LPs are now usable as collateral within Silo Finance money markets, enhancing capital efficiency across the platform. Additionally, Morpho has introduced a more streamlined approach to PT looping, further improving user experience and composability. These strategic moves signal Pendle’s ongoing commitment to cementing its infrastructure layer in DeFi.

What’s Next? Catalysts on the Horizon

As we move into the second half of 2025, Pendle sits at the nexus of several powerful narratives in crypto. Some of the key catalysts and opportunities that could drive Pendle’s next phase of growth include:

- Onchain Rate Infrastructure: Pendle is building DeFi’s onchain equivalent of yield curves, complete with a fully functional yield curve and soon, the world’s first funding‑rate curve. As laid out in Pendle’s blog, they’re aiming to bring yield trading natively onchain. This can become a key economic indicator moving forward. Similar to how price action, funding rates and sentiment (fear and greed) serve as indicators to assess the current sentiment around a token, a funding rate curve can give the market much more information and nuance around a particular token over forward looking timeframes. These curves create a collective market expectation of funding rates across a series of maturities, providing a new primitive for traders assessing tokens well into the future.

- Stablecoin Yield Boom: Stablecoins are undergoing a renaissance, and Pendle can be seen as a proxy “stablecoin yield beta” play in DeFi. Pendle directly benefits from the adoption of yield-bearing stablecoins as it drives more fees to stakers. The stablecoin narrative continues to have strong tailwinds YTD with better U.S. regulatory clarity and the passing of the GENIUS Act to the stablecoin supply being up over 23.59% as of June 30th.

- Continued Market Expansion and Integrations: Pendle will likely be the home to many new pools being launched, particularly along the stablecoin sector and as integrations make Pendle markets more useful throughout DeFi (i.e through money markets, etc.)

All told, Pendle’s roadmap is full of large directional bets: broader stablecoin adoption, new yield products (funding rates, RWAs, BTC yields), cross-chain user growth, and institutional integration. Each of these “big picture” themes individually could drive significant upside for Pendle’s platform activity, on top of its current product market fit and clear execution of protocol integrations and new market listings. Together, the roadmap and its recent metrics make a compelling case that Pendle’s growth is the beginning of a longer journey to become DeFi’s definitive fixed income hub.

Conclusion

In short, Pendle has emerged as a standout in DeFi by consistently delivering on both growth and innovation. In a market often obsessed with memes or short-lived fads, Pendle’s focus on real yield utility has attracted sticky liquidity and a loyal following of sophisticated users. The protocol’s recent performance, from relative price strength to record-breaking revenue, showcases the strength of its product-market fit.