Introduction

Pendle Finance is a tokenized yield-trading protocol primarily on Ethereum mainnet and Arbitrum. Pendle allows users to long or hedge the yield exposure on their yield-bearing assets by splitting the underlying asset into its principal (PT) and yield token (YT). On-chain yield-bearing assets include LP tokens, LSDs, LRTs, LRT liquidity pools on Uniswap, GLP, RWAs (real world assets), etc. Users can purchase the asset at a discount and earn a fixed yield to maturity, long the yield of an underlying asset, or employ a mix of these strategies.

This report looks at how Pendle is well-positioned to capitalize on ETH restaking and its potential to become a fundamental DeFi primitive.

Background

The Interest Rate Market Opportunity and LSTs

In TradFi, the interest rate derivatives markets are enormous - exceeding well over $400tn in notional value. The derivatives market can often be larger than the underlying market itself in terms of notional value. It makes sense that interest rate derivatives in DeFi will also rise in prominence as the market matures and there is increased demand for risk management products.

Pendle experienced very rapid growth throughout 2023 as its value proposition for yield trading and hedging became recognized with the rise of LSTs. LRTs are the next evolution of LSTs and have enormous growth potential. The sheer size of the tradfi interest rate markets and the increasing sophistication of DeFi bodes well for the growth of projects such as Pendle, which is by far the leading yield trading protocol in the Ethereum ecosystem.

In our view, there are sizeable growth opportunities and increasing demand for yield trading products like Pendle.

Pendle’s Opportunity

Pendle’s addressable market is technically all yield-bearing assets on chain. Here are potential reasons to be bullish:

- Less than 25% of all ETH is staked. This is far lower than typical PoS networks (averaging approx. 50%) and Pendle has already shown it can be a direct beneficiary of liquid staked ETH.

- Pendle can be a key destination for LRT (liquid restaking token) liquidity and yield trading/hedging.

- Pendle can benefit directly from more RWAs on-chain. A key example is yield-bearing stablecoins which are another asset class likely poised for significant growth.

- As the crypto market heats up, yields will increase across the board e.g. money markets, DEXs, etc., corresponding with further demand for sophisticated yield trading products.

The strongest tailwind at present for Pendle is restaking - which is the focus of this report.

Restaking

Restaking refers to the ability of ETH stakers to earn extra yield by 'restaking' their ETH/LST as collateral to secure other networks. This theoretically allows these networks to benefit from Ethereum's economic security. For example, an app-chain needs to bootstrap its own validator set which is extremely expensive and challenging to do in a sufficiently decentralized and secure manner. With restaking, this app-chain can be secured by (re)staked ETH, essentially allowing applications to leverage Ethereum’s economic security. This adds additional risk though, - the nuances of which are beyond the scope of this report (check out Vitalik’s blog post on the topic). In terms of risk, Tarun Chitra used the rough analogy of staked ETH as government bonds and restaked ETH as corporate bonds (in terms of risk).

Restaking is widely expected to be one of the strongest narratives of 2024 and potentially beyond. If successful, it can be used to enable a range of crypto applications that were not previously possible due to challenges bootstrapping security, as well as provide an additional and powerful use-case for ETH the asset. It is already one of the fastest growing sectors in DeFi, with over $1.5b in ETH restaked in EigenLayer (Ethereum’s primary restaking protocol) before the protocol has even gone live. What’s more, EigenLayer’s TVL has been capped, and more would likely be staked without caps. It is clear that, for better or worse, restaking will become one of Ethereum and crypto’s most important primitives this year.

Projects that stand to be key beneficiaries from restaking are yield protocols such as Pendle Finance. As a yield market, Pendle offers a complementary product to LRTs and gives users the ability to hedge or speculate on yields.

Pendle Smart Money Holdings

Pendle and RSTs - EtherFi Example

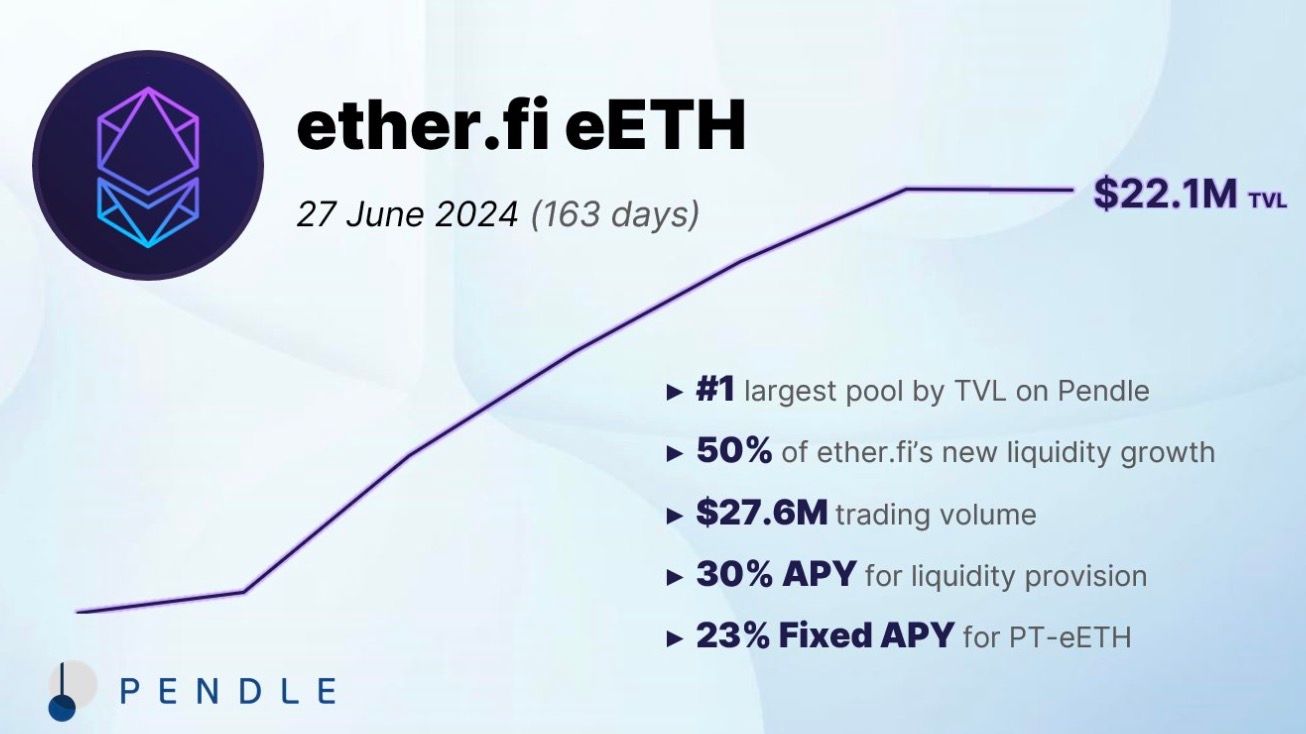

On 10 January 2024, Pendle entered the restaking game with an incentivized eETH pool (EtherFi). Within 5 days of launching, eETH became the largest pool on Pendle.

This is an indication of market appetite for LRT yield and how significant LRTs can be for Pendle and also Pendle’s value as a key liquidity destination for LRTs.

- There is potential for Pendle to aim to become a key source of liquidity for yield-bearing tokens. As a case study - during the LSD hype, Pendle was supporting several Balancer (Aura) pools of LSD tokens. The increase of TVL in these pools on Pendle also meant an increase in TVL of the underlying pool (the Balancer pools) - deepening their liquidity. In some instances, the majority of the LP tokens of the underlying assets were actually held on Pendle contracts, making Pendle the main liquidity growth driver of the underlying.

Strategies

EtherFi

With EtherFi and Pendle, ETH holders can now do the following:

- Deposit ETH into EtherFi and receive eETH. This is automatically staked and then restaked in EigenLayer.

- This earns:

- ETH staking rewards

- EigenLayer points

- EtherFi loyalty points

- Restaking yield (when EigenLayer goes fully live)

- By LPing on Pendle Finance, they can further earn from

- Pendle incentives

- Swap fees

Breaking it down:

eETH = 1 ETH (PT) + Yield & rewards (YT)

The YT here represents:

- Staking yield

- EigenLayer points

- EtherFi loyalty points

- Future restaking yield

Therefore, users can now speculate on the future yield of these YTs and gain leveraged exposure to EigenLayer and EtherFi loyalty points and the eETH staking yield. Or holders can lock in a fixed yield for their eETH and hedge the value of their YTs also in a yield marketplace. This is because the YT earns the yield and points associated with the deposited ETH.

EtherFi is just the beginning. There is a large number of restaking projects seeking to capitalize on the narrative - and Pendle’s prominence and complementary product offering could lead to significant growth.

Locking in Yield

The PT-eETH token acts like a zero-coupon bond, where users forfeit their EigenLayer and EtherFi points for guaranteed yield. At present, this stands at almost 25% with 162-day maturity. This is very significant and also shows how bullish the market is on EigenLayer and EtherFi points.

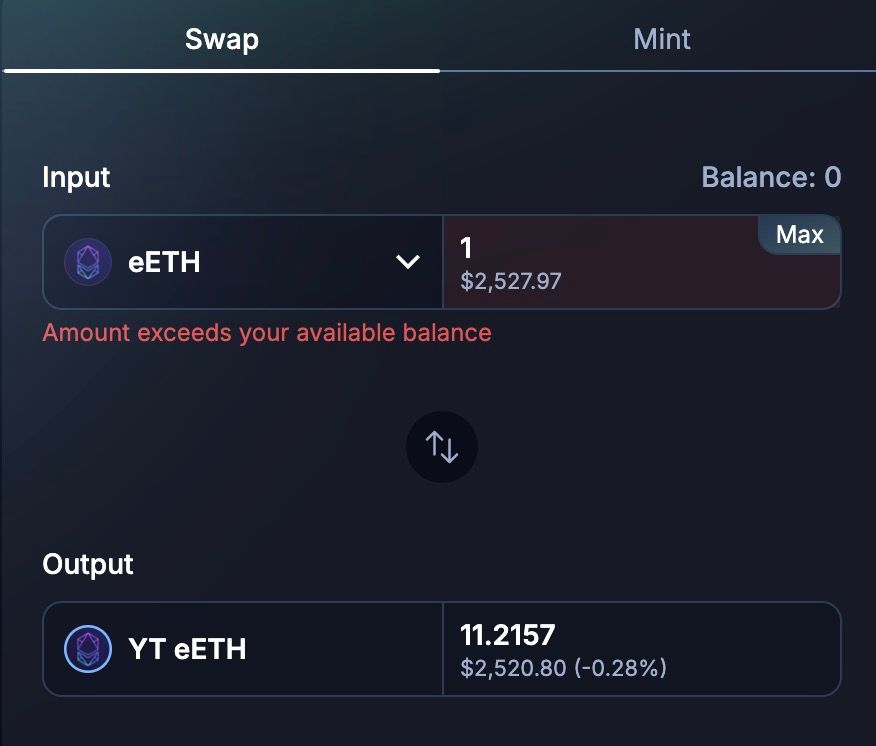

Leveraged Farming

Users who are bullish on the yield from eETH (staking rewards, EigenLayer points, EtherFi points) can gain leveraged exposure by buying multiple YTs. In the example shown above, 1 ETH could be used to purchase 11 YTs, which are equivalent to having a 11 ETH (re)staking position on EtherFi (i.e. 11x points accrual).

Couple this with 2x Boost for Pendle from EtherFi (i.e. 22x EtherFi Loyalty Points), and Pendle users could potentially find a significant edge in accelerating points accumulation vs. the average EtherFi user. Note the risk of following such a strategy; it is purely speculative on the future value of points.

All in all, this is akin to leveraged airdrop farming and could have significant demand if market excitement and attention remain on LRTs.

LPing

Users maintain all the benefits they would receive staking on EtherFi with additional PENDLE rewards and swap fee revenue. As seen below, they will receive EigenLayer points and doubled EtherFi points.

Bull Case

Yield trading is a key financial product and the Ethereum ecosystem will be experiencing an influx of yield-bearing products (with restaking). While restaking will be very bullish for Pendle, the bull market will likely bring additional tailwinds in rising yields and greater participation. Pendle has the potential to be a key destination for all notable yield-bearing tokens on Ethereum.

Institutional

Pendle has an institutional team working on attracting larger-scale capital and sophisticated actors to benefit from its products. This makes sense - as yield trading products are typically too advanced for normies, and institutional/large-scale actors can drive far more value to the protocol. The team has been shipping various product improvements and features to help attract these users; for example - limit orders.

Limit Orders

Users can place limit orders for their PT or YT at their desired implied APY. This creates a more efficient yield market, and the limit orders can be filled beyond the Pendle AMM’s liquidity. This is because limit orders are queued at their specific price level meaning that the liquidity at these levels becomes thicker. Limit orders are matched with other limit orders and/or market swaps (for the most efficient execution). This is beneficial to users with size as it enables zero price impact swaps. Of course, this is dependent on liquidity and both sides of the market. The limit order feature is commencing on Arbitrum initially for select pools, including:

- aUSDC

- wstETH (March 2024)

- rETH

- gDAI

- GLD

Users can also farm ARB rewards simply by having limit orders filled.

Pendle V3

The launch of Pendle V2 was a great success for the protocol, with TVL increasing 21x and price increasing 18x within 8 months of launching. Pendle V2 introduced a custom AMM for trading yield and principal tokens (as well as ve-tokenomics) which combined with the LSD narrative triggered widespread adoption of the protocol and a subsequent massive price increase.

While it is unlikely that V3 will have such a significant impact, their V2 and subsequent product improvements are a testament to the team’s ability to ship and the V3 could further propel the protocol to greater heights.

While not much has been revealed about V3, the protocol will enable margin trading for on-chain yields which should further mature the yield trading market and allow for more capital efficiency. The increasing sophistication of Pendle and its institutional efforts could bring larger actors to the protocol to capitalize on the opportunity.

Pendle appears well-positioned to be an EigenLayer / ETH restaking beta play. It offers a strong value proposition to LRT projects as seen with EtherFi, and as more projects incentivize liquidity there the network effects could have a snowball effect on the project as a whole. At the time of writing, users can get a guaranteed 24% yield on their eETH on Pendle (with 163 day maturity), can participate in leveraged airdrop farming (YT speculation), and avail of high LP rewards.

While well positioned for the restaking narrative, Pendle can bring value to all yield-bearing assets on-chain, from stablecoins to real-world assets. It will be interesting to see more details on the upcoming v3, and how the team can keep shipping on its institutional and business development efforts.