Introduction

The last year has seen crypto markets rally, with the major L1s and L2s performing strongly from a price perspective. One notable exception is MATIC, which is down 34% over the past 12 months. But despite its recent price underperformance, there have been significant developments behind the scenes.

This report looks at the potential for a Polygon revival, driven by its sharpened focus on ZK, chain aggregation, and new tokenomics.

Price Performance

Comparing MATIC to other major L1 and L2s since May 2023, it is clear that it has significantly underperformed as attention has been elsewhere. In fact, it is the only major L1/L2 that is down over the period.

As of 6 Feb 2024, it trails Polkadot, Tron, Avalanche, and Cardano by circulating market cap. It also trails Optimism (+71%) and Arbitrum (+125%) by FDV.

ZK Narrative

Polygon has placed big bets on ZK. For those bullish on ZK technology, it's hard to ignore the fact that many, including Vitalik, have praised Polygon’s technology and capabilities here. They onboarded three key teams: Miden, Hermez, and Mir who are working separately / together to bring massive scale to Polygon.

Given its in-house ZK capabilities, could Polygon be considered an index ZK play?

Aggregation Layer

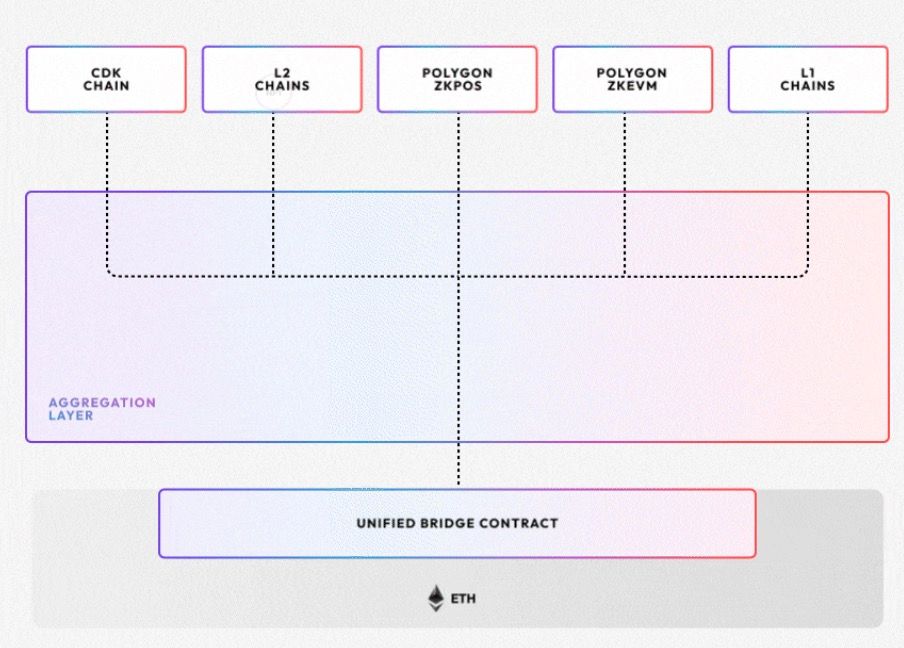

On 24 January 2024, they announced the ZK-aggregation layer. This ‘chain aggregation’ approach takes components of both monolithic and modular architectures. It envisions separate execution environments (allowing for unbounded scale like in the modular vision) but with shared state and liquidity (like in the monolithic vision).

This would allow ZK-provable L1 or L2 blockchains to connect, settling their proofs to Polygon’s aggregation layer. For example, Near is building a ZK-wasm prover on behalf of Polygon so that wasm-based chains such as Osmosis can connect to the aggregation layer and avail of its benefits. The aggregation layer enables horizontal scaling with chains operating in their own independent execution environments while settling to a ZK aggregation layer, which enables them to share liquidity.

At a very high level:

- Each connected chain operates in its own independent execution environment.

- The chains submit their ZK proof to the aggregation layer.

- At the aggregation layer, another aggregate proof (a proof of all the proofs of the connected chains) is computed and posted to Ethereum L1 in a single transaction.

As more chains join the Polygon ecosystem, transaction costs should come down. This is because the cost of posting a proof to Ethereum is the same for 2 rollups vs 2,000 rollups.

By unifying liquidity, the aggregation layer solves the bridging problem by enabling real atomic cross-chain execution. For example, in the future you can make a trade e.g. 100 ETH to USDC and the trade will be executed across multiple Polygon chains to find the best possible execution price (without you knowing).

This addresses the problems with the modular blockchain thesis at present. With no unified liquidity, L2s are competing against each other, bootstrapping the same pools, etc, resulting in worse depth and user experience across the board. If executed properly, unified liquidity and interoperability among an unbounded number of sovereign blockchains is a leap forward in blockchain design that is objectively superior to current models.

Immediate Impact?

The ZK-aggregation layer and chain abstraction promise unlimited scalability and unified liquidity across an arbitrary number of chains and different execution environments. The reality, initially, will likely be different as the technology is tested in production and scaled. However, the rationale makes sense, and if Polygon can pull it off, they can position themselves very well for a multichain future.

Chain Development Kit - CDK

Polygon remains a very EVM-reliant ecosystem, with Polygon PoS and zkEVM accounting for practically all activity. The EVM has its limitations, and for true adoption and scale, the ecosystem will need to see new execution environments and experimentation. Developers and chains will be able to connect to Polygon’s CDK and build their chain as they see fit while being interoperable with every other chain plugged into the aggregation layer. As stated above, Near is developing a zkWASM prover for the Polygon ecosystem. In the future, a zkMOVE and zkSVM prover could bring great value to the ecosystem, although currently, the likes of SVM are too fast to connect with zk-proofs. However, ZK-technology continues to exceed expectations in its pace of development.

Gaming Narrative

Immutable is still considered a key index play for blockchain gaming, and it is very much intertwined with Polygon with Immutable zkEVM. Immutable zkEVM chains will be tied into the Polygon zk aggregation layer, which can enable them to share liquidity among other Polygon chains. The combination of successful gaming and high-quality DeFi infrastructure could be a potent combination for them.

Immutable zkEVM early access went live on 29 January 2024. With this, gamers can get:

- Gas free transactions

- Enhanced mechanics

- Interoperability

At present, only select game studios can deploy before it further develops and opens up to permissionless participation.

Polygon zkEVM - A DeFi Chain?

Polygon zkEVM has had a slow start to life. However, the team has repeatedly communicated that they will be ramping it up in 2024. Efforts have gone into creating a sustainable ecosystem with key players. zkEVM is in an incubation period, and has recently entered its ‘stage 2’ focused on onboarding dApps. For example, Spark.fi and Aave will deploy over there, along with a host of new applications. Core infrastructure such as Gnosis Safe, LayerZero, Alchemy etc has been put in place. LRTs have arrived with Kelp DAO deploying at the start of February. They are trying to cultivate a DeFi native and degen environment. Furthermore, Sandeep is now an advisor on Ether.fi so it is likely that we will see a deployment here.

The zkEVM will be fully activated in March 2024 when they expect to ship Plonky3 - a major upgrade to their existing tech which should greatly improve the scalability of the zkEVM. Polygon will almost certainly try and create as much noise around this as possible.

Recent DeFi Developments

- crvUSD deployed on Polygon

- KelpDAO on zkEVM

- Olas is launching a bonding program on Polygon protocols with Balancer, bringing deep liquidity to power Polygon’s AI Agent economy.

- Ajna (covered in this Nansen report)

- Polymarket exceeded $50m in monthly volume for the first time in January 2024.

- USDM - a yield-bearing USD stablecoin covered in this Nansen report.

POL

MATIC is moving to POL - and it's not just the name that is changing. POL can be thought of as similar to a native restaking token. POL stakers will be able to secure other chains in the Polygon ecosystem - opening up additional revenue streams.

These are:

- POL rewards

- Transaction fees from the underlying chain

- Chain rewards

This provides value to POL holders and also the underlying chains that can tap into Polygon’s underlying security. This means Polygon can lend its economic security to chains that opt-in, allowing builders to focus on building rather than trying to bootstrap satisfactory economic security.

Being a validator on these different chains can encompass:

- Block validation

- ZK proof generation

- Participation in DAC

- Etc.

Polygon validators can validate an arbitrary amount of chains in the ecosystem - depending on their capabilities.

Plonky3

Polygon is about to release PLONKY-3 which should be a huge improvement on the capabilities, speed, and cost of proving for the zkEVM. Polygon released Plonky2 which was 100x faster than alternatives at the time and has become widely adopted in the zkEVM space.

This will prove each of the chains on the CDK and aggregation layer. It is a system that can help create a more optimized way to generate proofs for zkEVM. The aggregation layer will be powered by Plonky3, enabled by its fast recursive proofs. It shows that Polygon continues to have the internal capabilities to operate at the cutting edge of ZK.

On 6 Feb 2024, Polygon zkEVM upgraded from a type-3 to a type-2 zkEVM. This makes it closer to Ethereum equivalence. It is outlined further in this Nansen report.

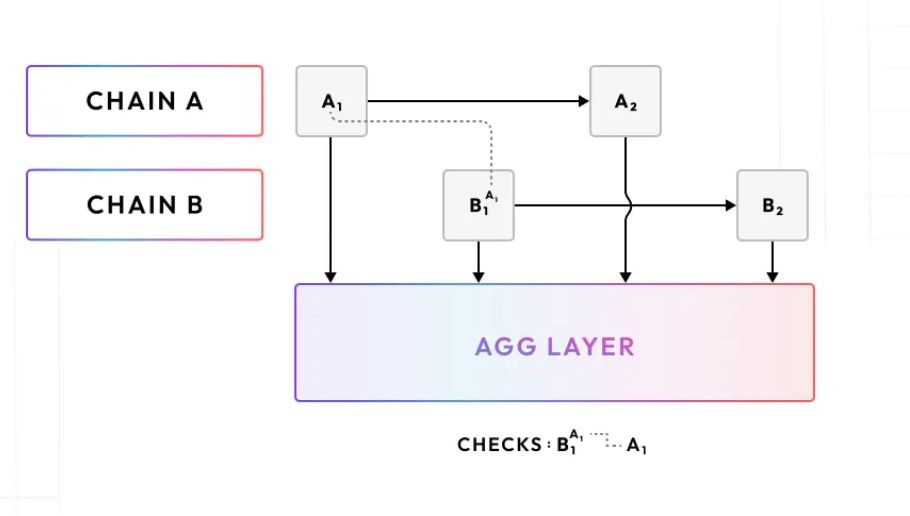

Asynchronous Interoperability

The following provides a very high level overview of how chains are interoperable via the aggregation layer. Read Brendan Farmer's (founder of Mir) excellent blogpost here to dive into how it works.

- You want to make a cross-chain transfer from Chain A to Chain B. This transfer occurs in block A(1). If Chain B does not wait until block n is finalized on Ethereum then it could result in an invalid state.

- This is solved by the aggregation layer which allows Chain B to temporarily assume that the block A(1) is valid without waiting for the proof on Ethereum. Chain B will then commit to the claimed Chain A state root as a dependency in the header for its next block before submitting it to the aggregation layer.

- This means that chains connected to the aggregation layer can be asynchronously interoperable with each other, bringing latency down from ~20 minutes to "at most a few seconds."

Source: Brendan Farmer Blog