Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Polygon Labs (the "Customer") at the time of publication. While Polygon Labs has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Polygon is a scalable blockchain platform that leverages Ethereum's security, offering faster transactions and lower fees through solutions such as Polygon PoS, zkEVM, and the Polygon Chain Development Kit (CDK).

In Q1 2024, Polygon enhanced zkEVM with the Etrog and Elderberry upgrades, improving transaction processing and nearing full Type 2 ZK-EVM[https://vitalik.eth.limo/general/2022/08/04/zkevm.html] compatibility. The effectiveGasPrice mechanism made DeFi transactions more cost-efficient. In NFTs and gaming, Hypr Network used Polygon CDK to build scalable infrastructure, Mirror enabled writers to mint NFTs, and Courtyard.io revolutionized digital collecting.

On the enterprise front, SettleMint integrated its platform with Polygon zkEVM, simplifying dApp development, while Libre and Arianee launched dedicated chains for tokenization and digital product passports. Community initiatives included Fox Corporation's Verify for content provenance and the Amoy testnet for developers, underscoring Polygon's commitment to innovation and ecosystem growth.

Key Developments

Etrog upgrade went live on Polygon zkEVM Mainnet Beta as of 13th February 2024, introducing support for additional precompiles and a new method for processing transactions. This upgrade brings Polygon zkEVM close to full Type 2 ZK-EVM compatibility, allowing developers to redeploy Ethereum smart contracts without modifications.

- Elderberry upgrade went live on Polygon zkEVM Mainnet Beta on 14th March 2024. This upgrade included optimizations to the ROM to reduce out-of-counter errors and additional fixes to the recent Etrog upgrade.

- Polygon zkEVM Mainnet Beta introduced effectiveGasPrice, a new mechanism for calculating transaction fees based on execution and data availability. This update ensures more accurate fees, making DeFi transactions cheaper while increasing costs for transactions with high calldata but low executions. Future optimizations, including EIP-4844 (blobs) and data compression, are expected to further reduce costs throughout the year.

- Polygon Labs introduced the dApp Launchpad, a CLI tool designed to streamline the development of EVM-compatible dApps. dApp Launchpad simplifies the entire process from environment setup to deployment, integrating frontend and smart contracts for seamless development. This tool allows developers to quickly build, launch, and scale dApps across any EVM chain, including Polygon PoS and Polygon zkEVM.

Ecosystem

DeFi

- Keom reimagined DeFi with a zero-knowledge approach by building an onchain order book on Polygon Miden. Using Miden’s unique execution model, Keom created high-throughput, privacy-preserving dApps, combining account-based and UTXO systems with ZK proofs for enhanced security. This allowed decentralized order book exchanges to operate without holding liquidity, relying instead on user-stored liquidity. Keom also helped users build complex spending conditions for their notes, ensuring security through individual note behaviors, showcasing Polygon Miden's potential for innovative, privacy-focused DeFi.

- Libre, a tokenization-specific ZK L2 built with Polygon CDK, is now live, allowing eligible investors to access tokenized funds by Brevan Howard and BlackRock. Institutions can leverage Libre to tokenize assets compliantly, enhancing capital efficiency and transparency. Built as a joint venture of WebN and Laser Digital, Libre offers a dedicated blockchain space for tokenized financial assets, streamlining access for accredited investors. Libre is also developing Libre Gateway to integrate multiple protocols and connect to the AggLayer, aiming to aggregate liquidity across Polygon protocols and provide seamless institutional finance.

- FraXion, developed by Randolph & Main Capital Group, aims to democratize institutional-grade real estate investments and improve capital access for women and minority-led businesses. By tokenizing and fractionalizing high-quality real estate, FraXion makes investments accessible to a broader pool of investors.

- Polygon initiated phase one of native USDC migration on Polygon PoS. Native USDC allows for direct minting and redeeming on Polygon PoS, enhancing capital efficiency and user experience. This ecosystem-wide initiative aims to phase out bridged USDC.e, promoting seamless transactions and broader adoption of Polygon PoS. Key advantages include direct minting and redeeming, full reserve backing, and integration with Circle Account, providing a robust and efficient solution for users and developers.

NFTs & Gaming

- Hypr Network is integrating with Polygon Chain Development Kit (CDK) to build a scalable, zero-knowledge-powered gaming infrastructure using Celestia’s data availability layer. Initially built with the OP Stack, Hypr will provide zero-knowledge-based gaming SDKs and contribute to the Polygon CDK open-source stack by developing multi-backend DA services and expanding the precompiled contract library.

- Mirror is now live on Polygon PoS, with Polygon Labs also launching an official Mirror account. This move allowed creators to mint their stories as Writing NFTs on Polygon PoS, enhancing engagement and interaction within the Web3 publishing platform. Polygon Labs also launched a governance channel on Mirror for discussions on decentralized decision-making and protocol governance.

- Eintracht Frankfurt launched an innovative project allowing fans to own a piece of the club's history both physically and digitally by providing blockchain wallets hidden in branded cards, enabling access to digital collectibles on Polygon PoS. By tapping the Eintracht Frankfurt x youba wallet card against a smartphone using NFC, fans were onboarded to Web3 without needing prior blockchain knowledge. This initiative resulted in nearly 4,000 wallets being created, each with a digital seat collectible. At the end of the 2023/24 season, digital seat owners are planned to receive airdrops based on their stadium visits, successfully abstracting blockchain complexities for a wider audience.

- Courtyard.io revolutionized digital collecting by minting real-world collectibles as NFTs on Polygon PoS, allowing seamless buying and selling online without shipping items. Users sent appraised items like Pokémon cards to a Brink’s vault, which then minted them as NFTs, ensuring security and trust. The project saw rapid growth, with 500 cards tokenized weekly, while maintaining low redemption rates. Courtyard.io aimed to abstract crypto complexities, offering a user-friendly experience akin to traditional financial transactions. This initiative highlighted how blockchain technology can transform the collectibles market, providing liquidity and value while preserving the integrity of physical items.

- Polygon Labs and Warner Music Group launched a music accelerator program to support developers building the future of the music industry on Polygon protocols. This initiative includes a Developer Support Cohort, providing infrastructure, products, and services with discounts and premium benefits to select accelerator projects. Notable contributors include 4Everland, Blocto, CertiK, Coinflow, Crossmint, Decent, Revelator, Opolis, Privy, Tatum, Thirdweb, Wonderverse, and Zeeve, each offering specialized support to enhance the development and adoption of Web3 music projects.

- Outsyde is pioneering the tokenization of real estate to transform land ownership into a liquid and tradable asset. By leveraging Polygon PoS technology, Outsyde enables partners and third-party service providers to monetize land opportunities, such as carbon offsets, conservation, and renewable energy. This approach democratizes access to real estate investments, offering fractional ownership and enhancing transparency and efficiency in land management.

Enterprise

- SettleMint integrated its Blockchain Transformation Platform (BTP) with Polygon zkEVM, enabling enterprises to build and grow dApps on this zero-knowledge Layer 2 rollup for Ethereum. This integration allows developers to use a single platform for full-stack application development on Polygon zkEVM, offering significant cost and time savings.

- Polygon ID Release 6 introduced Dynamic Credentials, enabling users to refresh expired credentials automatically, simplifying short-lived credentials like credit scores and KYC/AML. The release also featured QueryBuilder for testing zkQueries and enhancements like Private Proof of Uniqueness, onchain revocation service, and customizable Credential Display Method.

- Arianee launched a dedicated chain using Polygon Chain Development Kit (CDK) to maximize the potential of digital product passports (DPPs) and engagement tokens. This Layer-2 application-specific chain, powered by zero-knowledge technology, enables brands like Audemars Piguet and Moncler to create their own DPPs and loyalty tokens.

- Polygon launched the Amoy testnet for Polygon PoS, providing a new environment for developers to build, test, and experiment. Amoy uses Ethereum’s Sepolia testnet as its root chain, ensuring the availability of essential validators, infrastructure, faucets, and tooling in a sustainable setup.

Fox Corporation launched a beta version of Verify, an open-source protocol built on Polygon PoS, to tackle the challenge of AI-generated media and establish content provenance. Verify allows publishers to register and cryptographically sign content onchain, ensuring consumers can identify content from trusted sources.

Nansen On-chain Data

Daily Transactions

In Q1 2024, the Polygon PoS network experienced notable fluctuations in daily transaction counts, ranging from 2.9m to 5.1m transactions. Correspondingly, daily gas usage also varied considerably, peaking at approximately $280k USD. Unlike Q4 2023, Q1 2024 did not experience the extreme spikes in transaction volume and gas fees caused by the "inscription" craze associated with BRC-20 tokens. The absence of such extraordinary events in Q1 suggests a more stabilized usage pattern on the Polygon network, with fewer instances of intense, short-term activity driving up costs and transaction counts. Polygon's performance in Q1 2024 indicates a resilient network capable of maintaining high transaction volumes and adapting to changes in demand, with a stable user base that continues to leverage the platform for various applications

Daily Active Addresses

During Q1 2024, Polygon's PoS network experienced a steep increase in user activity, with daily active addresses peaking at 1.2m (compared to a peak of 691k in Q4 2023). The number of active addresses then stabilized between 1.2m and 900k through March and April, reflecting ongoing adoption and sticky activity.

Average Daily Gas Paid (vs Ethereum)

In Q1 2024, the average daily gas fee on Polygon varied between $0.01 and $0.06. In comparison, Ethereum's gas fees were significantly higher, ranging from $3 to a peak of $30. Unlike Ethereum, which experienced notable spikes and an overall upward trend in gas fees throughout the quarter, Polygon's gas fees remained stable within a narrow range. During this period, Polygon also saw an increase in daily transactions while maintaining consistently low transaction fees. This contrast highlights the cost-efficiency and stability of Polygon's network in managing transaction fees compared to Ethereum.

Top Entities by Users and Transactions

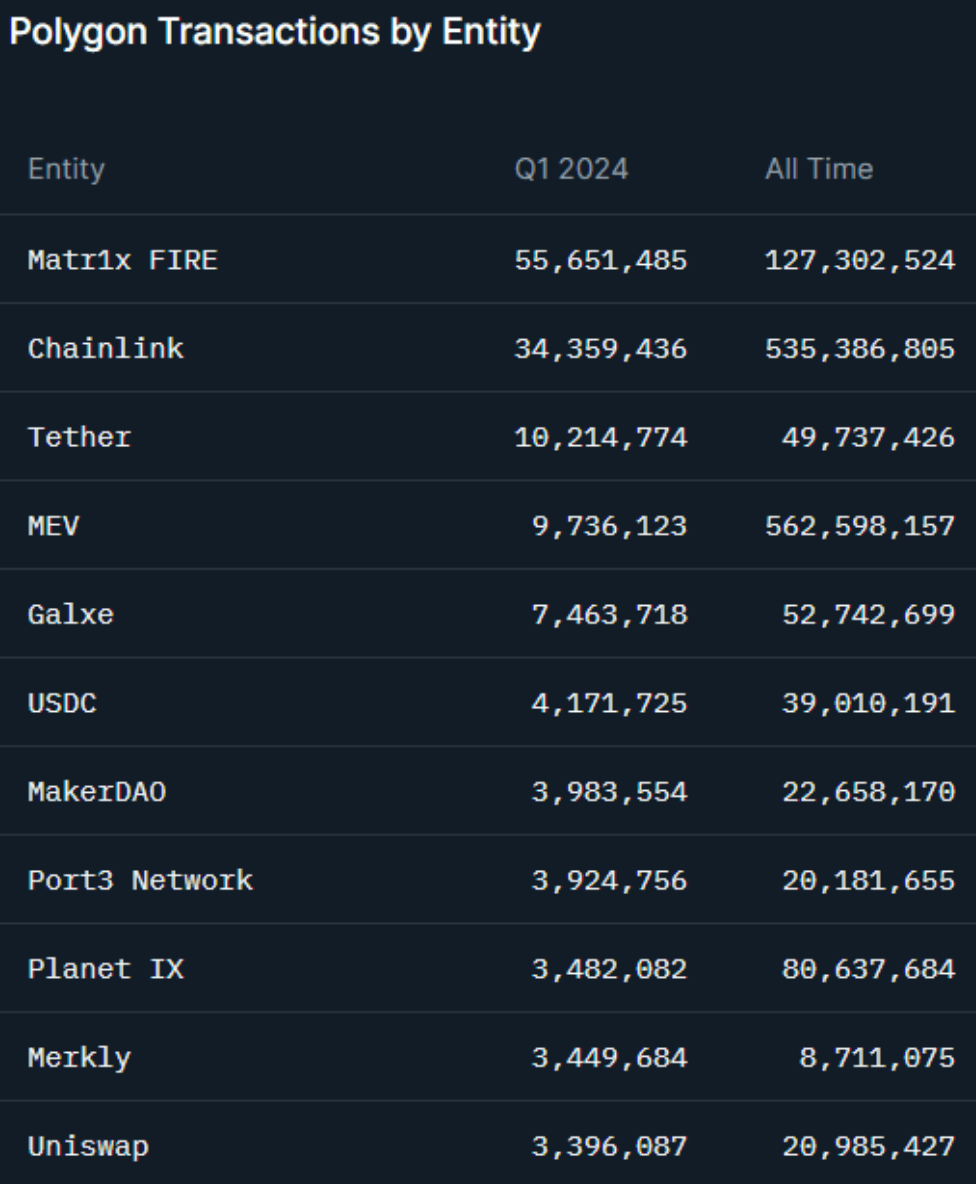

Source: Nansen (data excludes unlabeled transactions)

Nansen's list of labels provides a comprehensive way to analyze the top entity interactions on Polygon PoS based on the number of users and transactions. Matri1x FIRE claims the top position in number of transactions at 55.65m. Chainlink drops to second at 34.36m, followed by Tether at 10.21m. Matr1x FIRE also holds the top spot for number of users at 17.94m. This indicates that a primary use case for Polygon PoS is gaming, followed by financial dApps.

Closing Thoughts

Reflecting on Q1 2024, Polygon has demonstrated impressive growth and stability, reinforcing its status as a leading blockchain platform. The network saw consistent increases in daily transactions, highlighting ongoing user engagement and adoption. Key developments, such as the Etrog and Elderberry upgrades to zkEVM and the introduction of effectiveGasPrice, have enhanced the network's functionality and appeal. Moreover, the ecosystem's expansion into sectors like DeFi, NFTs and Gaming, in particular, showcases Polygon's versatility. As the network continues to evolve, Polygon is well-positioned to support further growth and adoption, ensuring a robust and vibrant environment for its users and developers.