Introduction

Polygon zkEVM has received far less attention than other emerging L2s, for example zkSync, partly due to the lack of expectation of an airdrop. While there is no confirmation of an airdrop for either protocols, Sandeep (founder) hinted that there will be one for Polygon zkEVM.

Airdrops aside, zkEVM is a novel L2 with a strong team, and hence warrants a deeper look into who is interacting with it and why. This report examines the profile of wallets interacting with Polygon zkEVM and the flow of funds there.

zkEVM

Polygon is building a type-2 zkEVM - where it supports Ethereum’s opcodes. This makes it more closely Ethereum equivalent than zkSync for example, resulting in an easier environment for Ethereum developers to deploy applications. Check out this Nansen article outlining the different classifications of zkEVM. At present, Polygon is at Type 3 and building towards Type 2, whereas zkSync is at Type 4 classification (where smart contract source code e.g. Solidity is compiled into a language more optimized for ZK-proofs).

It has been widely noted that it's easier to deploy Ethereum applications on Polygon zkEVM over zkSync due to its closer equivalence.

Note that there are tradeoffs between the EVM classifications. Generally, as you move up the tiers (towards Type 4) in zkEVMs, you will have more performant systems, but the tooling and complexity for developers will increase. This could cause some serious issues; however, satisfactory tooling can be built around this. The same is true the other way around; the closer to Type 1 you get, the greater the difficulty in proving. In return, these low-level types inherit more tooling, simplicity, and alignment with Ethereum mainnet.

Polygon zkEVM has opted for a closer path to Ethereum equivalence. Taiko and Scroll have also taken this path. Time will tell if this can support burgeoning ecosystems and applications. Given the expected similarity between these rollups, business and ecosystem development will likely be key determinants of success.

Network Design

Polygon zkEVM, like most rollups, has opted to align with Ethereum in that ETH will be the gas token. MATIC will be used to incentivize the aggregators (who provide the proofs for the transactions). Sequencers pay aggregators in MATIC to incentivize them to generate verifiable proofs. The MATIC fee will increase during periods of high activity to incentivize faster/more proof production. It is currently unclear how much direct value accrual this mechanism will create for MATIC - although it does not appear to be substantial.

Polygon 2.0

Polygon is shifting towards a ZK ecosystem, in which every Polygon chain will be a ZK L2. The ecosystem's focus on ZK tech is a potential bullish sign for the future of Polygon zkEVM. This is not to say that it will become the premier Polygon chain, but it makes it worth paying close attention to. Read this introductory post to Polygon 2.0 here.

Nansen Data

This section looks into the bridging and wallet data for Polygon zkEVM. Note that it has substantially less TVL than other rollups. It is worth checking out our zkSync and Starknet dashboards for comparative purposes and to learn more about those ecosystems.

Rollup TVL

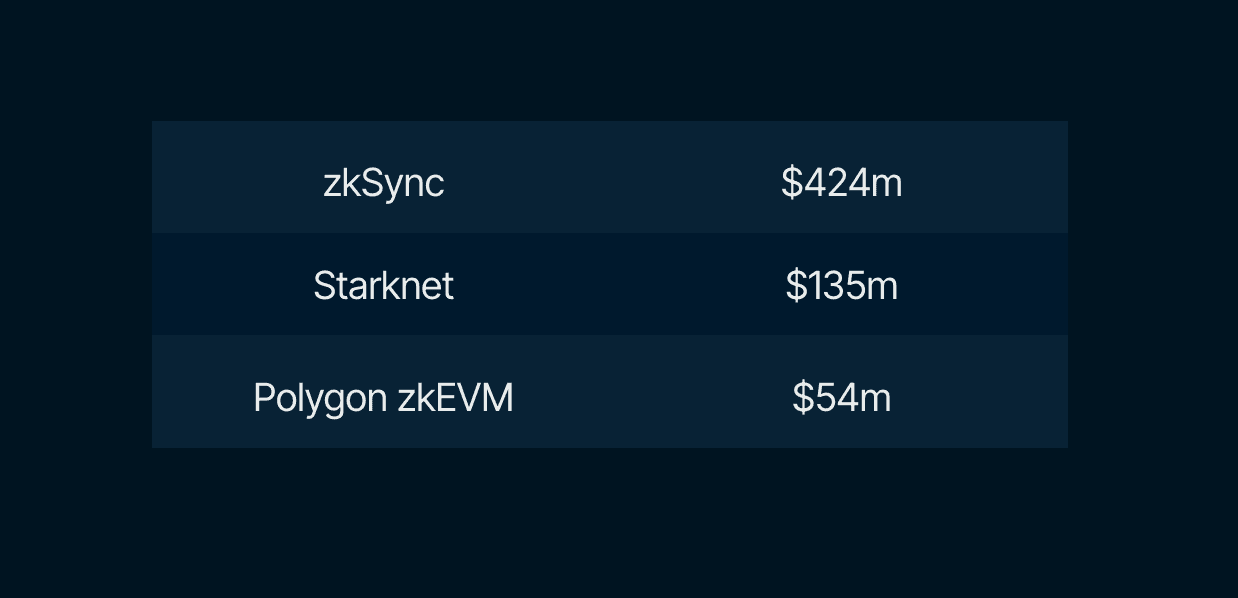

As of writing, there is a little under $55m in the Polygon zkEVM bridge contract. This is again less than other ZK-rollups like zkSync ($424m) and Starknet ($135m).

This large disparity is reflected in other metrics. This is due to the greater expectation of airdrops with the latter two - and the intrigue in not knowing how big they will be. Polygon is far more well-known, and less on top of mind for airdrop hunters.

Looking at Smart Money Depositors, Polygon has 75. This is significantly less than zkSync for example, which has had 411. That said, there is considerably less TVL and interest in Polygon, and relative to its TVL this is a notable portion of Smart Money deposits. Note the slight uptick in deposits from the end of July. This could be a result of more interest/bullishness in the ecosystem following the announcement of Polygon 2.0 which is a more ZK-focused Polygon.

For example, zkSync has ~8.5x the value bridged compared to Polygon zkEVM. This shows a massive disparity in interest, despite Polygon having more battle-tested applications deployed on it.

Applications include

- Quickswap

- Balancer

- Gamma

- Beefy

Polygon zkEVM has around 90k cumulative, unique depositors. Again this is far less than its competitors (~1.5m zkSync, ~660k Starknet).

With that, it's worth taking a deeper look into the wallets that have deposited:

This is an interesting data point, although given the rest of the data, not too surprising. The most notable aspect of this is that wallets greater than 1 year make up the largest cohort of users on the chain. This is in contrast to Starknet and zkSync who have 3-12 months and 1-3 months as the largest cohort respectively. This suggests that zkSync is the most actively farmed chain, with the other two to lesser degrees.

To an extent, Polygon’s fewer wallets is due to the lesser interest in farming there. However, there are strong signs that a large portion of the wallets are being used for farming purposes - and there is still a high number of wallets with an age of less than 3 months.

The large proportion of wallets more than 1 year old can be seen as a positive sign for Polygon zkEVM, amid their metrics falling far short of their peers. It is very early days, and Polygon zkEVM is definitely an ecosystem to keep a very close eye on.

The dollar value of deposits suggests that most wallets are committing low funds to the chain. This is presumably due to two things: first, it is a new and untested chain and therefore, carries high risk, and second there are users interacting with the chain with the hope of benefiting from an airdrop.

Polygon zkEVM has far lower numbers than its competitors. However, its higher Ethereum equivalence makes it an easier environment to deploy Ethereum applications there. There appears to be more organic use of the chain (as a proportion of users) relative to its competitors, due to the lesser expectation of an airdrop. However, an airdrop cannot be ruled out and it will be interesting to see how the ecosystem grows.

The ZK-Rollup space is very immature at present. Although competitors have far higher metrics, arguably none have any killer apps with strong use cases. Polygon zkEVM is recognised for its strong tech, and well-established DeFi protocols have demonstrated confidence in deploying there. This leaves it all to play for. It is worthwhile keeping a close eye on all ecosystems as they develop.