Introduction

Given the continued consolidation and uncertainty in markets, farming stables and core holdings is a productive way to put your assets to work. Outside of the recent farming reports, Summer Finance came on our radar recently. Mainly, they provide an attractive base yield, with speculative SUMR tokens earned on top of them for their new vault programs. The SUMR token is not tradeable or transferrable until July 1st, so the SUMR token rewards are not liquid until then and the projected yields on top of the base rewards, will certainly fluctuate. With that being said, let’s dive in.

What is Summer Finance?

Summer.fi is a DeFi app designed to simplify and enhance how users lend, borrow, and generate yield on their assets. It originated as Oasis.app, MakerDAO’s original lending portal, and has since rebranded and evolved into a multi-protocol DeFi ecosystem. Since, they raised a series A back in 2023 of $6m and have continued to build out new products and have gone multichain. Most recently, they launched their Lazy Summer Protocol, which a yield protocol that is auto-rebalanced by AI agents to earn the highest onchain yields.

So far, the Lazy Summer vaults have attracted over $80m in TVL, spread across 17 different protocols at the time of writing. On top of the base yield generated from the underlying yield strategies across different protocols like Morpho, Aave and other lending products, they are issuing 215,000 $SUMR rewards daily, to all users. Currently, users can deposit USDC, USDT, or ETH into the vaults and earn outsized yields on their stables (relative to floating T-Bill yield, Spark savings rate, and others) while farming speculative SUMR tokens. All of the contracts have been audited and the same risk team that works for MakerDAO, Block Analitica, manages the risks of the vaults we will cover later in the report. Additionally, they have active bug bounties available.

Lazy Summer Vault Strategies

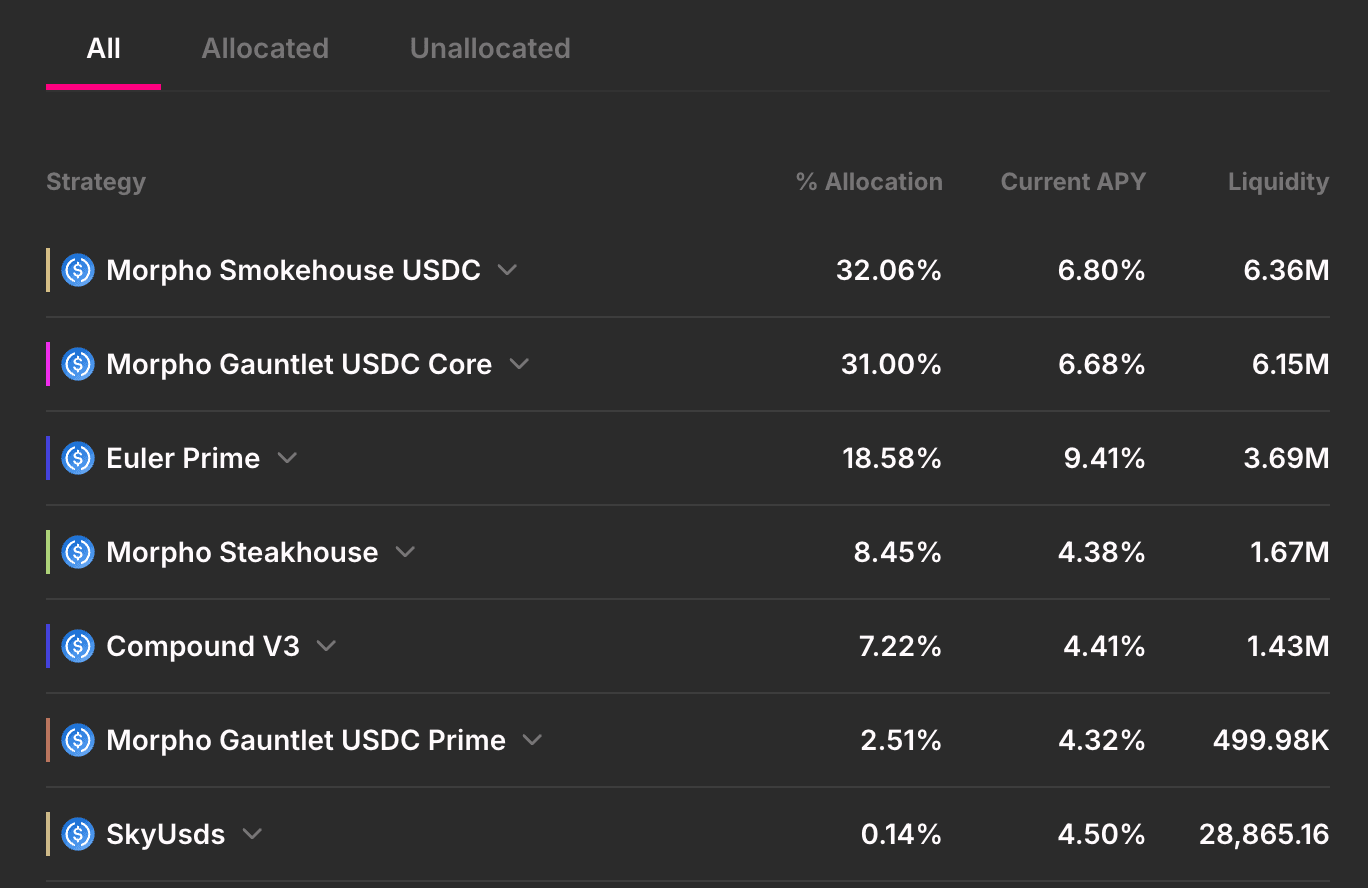

The vaults dynamically adjust their positions to maximize yield across trusted protocols. Given this, the strategies touch many different protocols to generate the yield for users. Summer Finance stands as the curator of sorts, along with the risk teams such as Block Analitica, to assess the risk of counterparties, active risk management, and general smart contracts of the Summer protocol. They make their underlying strategies very transparent by featuring it on the UI - each vault has a live view of the protocol allocations, counterparties, liquidity and yields. This is quite straightforward, and you should read through the risks before depositing any funds.

The highest base APR vault is the USDC vault on Ethereum earning 6.99% plus 24.78% in SUMR rewards, with nearly $20m in TVL. Given the SUMR rewards cannot be sold and do not have any markets for pricing, take this with a grain of salt - read more about SUMR here. Additionally, all of the vaults including this one, do not take any exposure to any peg risk. The below is the current allocation of the strategy:

In short, it is quite explanatory to see how yield is generated on a vault by vault basis but you can checkout all of their vaults here, which span USDC, USDT, EURC, and ETH across Arbitrum, Base and Ethereum mainnet.

Pro Summer Finance

Summer also has other vaults and strategies under their Pro app spread across stables, ETH, LSTs/LRTs, including those for BTC. These won’t be covered but are worth mentioning. Note, the yields can go negative over varying timeframes, but you can checkout these vaults here.

Concluding Thoughts

Summer Finance has been building for quite a while and has built a very easy to use product, with generous base yields and transparency front and center. We believe that the counterparty protocols are quite reliable and have been battle-tested so far, and that the risk management team of Block Analitica, is well established for our liking. Given they have managed risk for Maker DAO for years, we feel that the yield is quite straightforward and the SUMR token farming is the cherry on top. However, we will say the % view of SUMR rewards is misleading given we do not know what SUMR will be worth on July 1st, or if they will open up trading for it then - this leaves a bit to be desired. With that being said, we feel the base yields on these strategies already outcompete Sky savings rate, USDE and other base yields using lending as the source of yield. Thus, do your own research before trying any of these products but Summer is one to keep on the radar for idle capital during these non-trending markets.