Introduction

We use Nansen’s labeling to get a better read on onchain macro trends related to liquidity flows for a typical retail user. We track flows from CEXs to our retail segment (defined using Nansen’s labeling/coverage) and we track a few metrics:

- Aggregated USD funding by chain

- Aggregated wallet counts by chain

We currently look at Ethereum, Base, Arbitrum, and Optimism. For those interested in how we defined our retail segment, we assumed the following:

- First incoming transfer from a CEX

- Not a smart contract

- Not belonging to a known entity

- The first interaction is with a smart contract within 3 days of funding

- Assumes retail is funded by CEXs, instead of using a bridge for funding.

- Funded by a CEX with less than $100k worth of tokens (ETH and ERC-20s)

Key Insights

Current activity shows significantly lower retail funding across all chains compared to March 2024 levels. Base and Arbitrum have seen the most dramatic declines, with current funding and new retail users down nearly 90% from March levels. Ethereum has shown the most resilience, with relatively smaller declines in both metrics, particularly in new retail users which are only down about half from March levels.

Last week’s total funding amounted to $22.1m across all chains, representing a 78% decline from the third week of March at $101.2m. New retail users have also fallen 85% from 88,952 to 13,390 users, suggesting a broad-based cooling in capital flows and user acquisition across the EVM/L2 ecosystem, despite the uptick in several narratives such as AI agents and the resurgence of DeFi.

It appears we bottomed in USD funding at the end of August, with funding slowly picking up. Again, this is nowhere near levels seen in March 2024 during the first runup of memes, predominantly driven by Base. As for the number of new retail entering the market, we see a more gloomy story below:

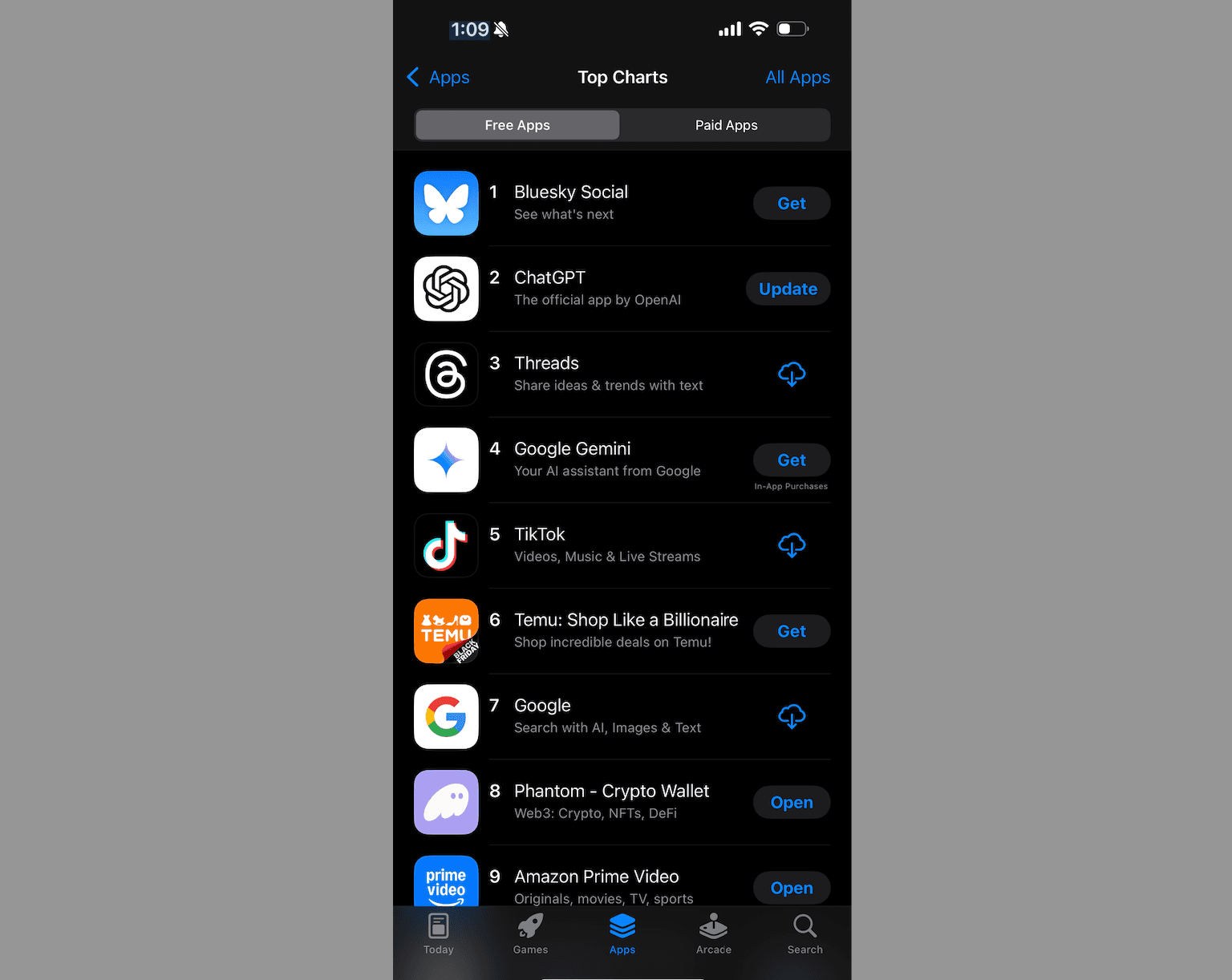

Given the above metrics, we are seeing underwhelming evidence of retail being onboarded to ETH/L2s directly from CEXs in the latter half of 2024. But where is retail being onboarded? Although we have not shown the equivalent retail metrics for Solana, we can see very clear signs that this is where the typical retail user is onboarding in today's market given Phantom's number 8 spot in the App Store for free apps. This feels like a more relevant indicator to gauge retail interest than the Coinbase app ranking in previous cycles, given the heavy focus on Solana altcoins and memes dominating attention.

Meanwhile, BTC and SOL are up over 45% and 35% respectively in the same timeframe. BTC has been the strongest horse, with ETH lagging at -4%.

Solana altcoins have been the biggest winner of new retail onboarding with the likes of many billion-dollar memes including BONK, WIF, POPCAT, PNUT, and GOAT.

In short, despite BTC near the $100k level, we have not seen the onchain follow through for retail on EVM chains that we saw back in March 2024 with BTC below the previous ATH. Again, this only looks at a specific snapshot, so this is not an indicator of broader onchain trends. There are many signs of growing adoption with respect to transaction activity and active addresses; however, given the flows into BTC via the ETF and the retail interest in memecoins on Solana, the retail onchain lens looks to be underperforming on EVM chains.