Introduction

Starknet is a permissionless general-purpose ZK-Rollup on Ethereum that uses the Cairo programming language and Cairo Virtual Machine. The Cairo VM is optimized for STARK proofs, with the StarkWare team betting that it will enable them to deliver the most performant ZK-Rollup. The project has raised significant funds, with its latest funding round in May 2022 raising $100m at an $8bn valuation.

Many are anticipating a Starknet airdrop, and we are observing relatively high activity on the network given its infancy, lack of EVM compatibility, and the caps imposed on deposits.

It will be interesting to see if its unique approach prevails over its EVM counterparts (check out Nansen’s zkEVM report here). For those interested in learning more about StarkWare and Starknet, check out Nansen’s report here.

With that, let’s have a look at the data for Starknet today:

Deposits on Starknet greatly accelerated from mid-March when the deposit caps were raised again. ETH is the dominant bridged asset (accounting for nearly 75%). This is largely due to it having by far the highest maximum cap imposed by StarkWare. At the time of writing, there is about $65m bridged to Starknet.

The current caps on the bridge are:

Note that these are yet to be reached; however, Starknet’s upgrade to 0.12.0 and 0.12.1 expected in July could spur inflows that reach these caps due to its expected massively improved performance. Some have anticipated that TPS could reach 100 with this update, which would put it among the most performant L2s (however, it remains to be seen if this will be achieved). The maximum daily TPS the network has reached so far is 3.

Total Wallets Bridging

At the time of writing, there have been close to 520k wallets that have bridged to Starknet. This is significant, especially considering the relatively low TVL.

However, the majority of wallets have bridged very low amounts. This is indicative of airdrop farming, sybil wallets, and also the fact that depositing on a new network is risky and users may not want to risk significant funds there.

As of now, our data below shows:

- 60% of depositors have bridged between $1 - 100.

- 94% of depositors have bridged less than $1,000.

Wallet Age

*At the time of writing, this is the breakdown of wallet age:

- 1-year+ (24.5%)

- 3 - 12 months (41%)

- 1 - 3 months (26.6%)

- 1 week - 1 month (6.78%)

- < 1 week (1.1%)

Here we observe most wallets (~75%) being less than one year old. These are likely wallets that have been created with the purpose of airdrop farming / exploring new networks.

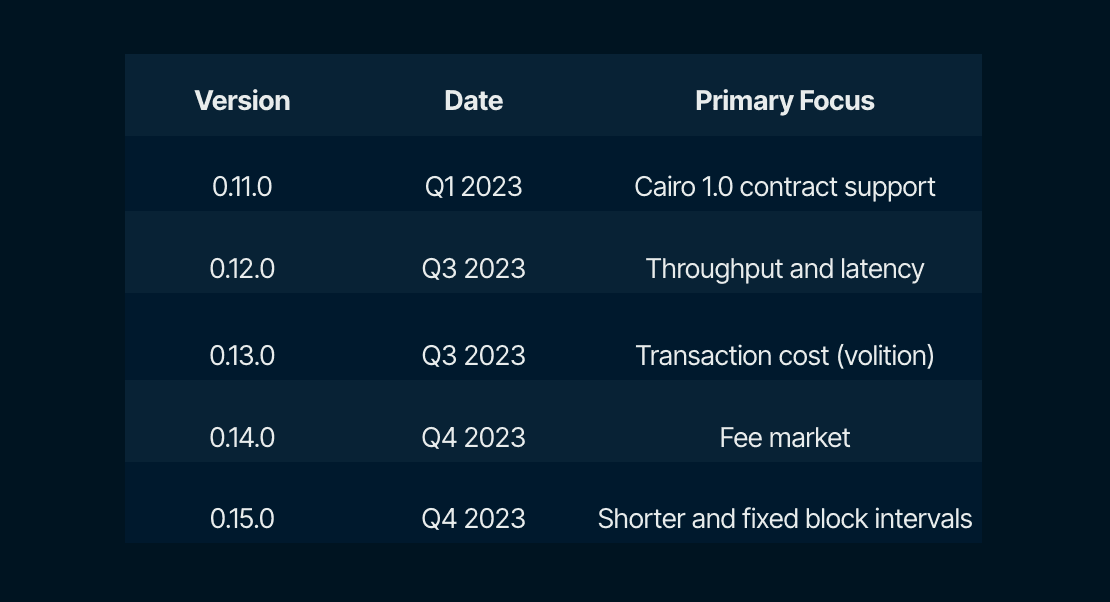

Roadmap

Here are the expected updates from the StarkWare team. Note that they are slightly behind on this with 0.12.0 launching in early Q3 rather than Q2.

Top bridgers

This dashboard shows the largest depositors on Starknet:

Top Protocols on Starknet

Below are the 5 largest protocols on the network (by TVL at the time of writing). Note the relatively low TVL which can be largely attributed to the restrictions imposed on the network at present. Of these, 4 out of the top-5 are AMMs, with the lending protocol zkLend coming in at 4th. Note that none of these projects have tokens and participation in any of them may qualify for an airdrop.

| Rank | Protocol | Total Value Locked (TVL) |

|---|---|---|

| 1 | JediSwap | $8,018,901 |

| 2 | 10KSwap | $2,681,829 |

| 3 | mySwap | $2,513,129 |

| 4 | zkLend | $1,029,394 |

| 5 | SithSwap | $292,460 |

SM Bridgors

Again, we observe a general uptick in distinct Smart Money deposits from March onwards as the network’s capacity increased again. There have been 173 Smart Money depositors on the Network, with 75 of these coming after March 17th, 2023.

Starknet is still in its infancy, with limited performance and a nascent ecosystem. Despite this, it has attracted relatively significant activity. This can be attributed to the community’s excitement for the project and its potential. It stands out as a non-EVM general-purpose ZK-Rollup, and it will be interesting to see if its different approach can provide it with a competitive advantage going forward. It will be worth tracking the project as it undergoes further upgrades this year.

The vast majority of wallets interacting with the StarkGate bridges have deposited very low amounts - which can be attributed to both the caps set on network deposits and also the risks of depoisting into a new protocol and Starknet’s limited performance so far. As performance improves with a host of expected upgrades this year, it will be interesting to see how network activity changes.