What is Stride Protocol?

Stride Protocol is the leading liquid staking provider (LSD) in the Cosmos ecosystem. Stride’s dominance and integrations with the broader DeFi ecosystem are quite dominant, with over 80% market share. For Ethereum users, it can be seen as the Lido of Cosmos, and its tokenomics provide a way for traders to gain exposure to an index of some of the most popular Cosmos chains.

Given the nature of LSDs in the market, Stride is in a good position given the clear product-market fit and has a path to capture significant revenues.

Why STRD?

Product Market Fit

- Cosmos SDK tokens are used to secure layer-1 chains and force users to make a very strong tradeoff - either stake the token to secure the chain and earn a yield or participate in DeFi activities with unstaked tokens.

- The above tradeoff created a problem for token holders; on the one hand, DeFi apps could not compete with the yield of native staking, which limited the growth of TVL in DeFi apps. On the other hand, this meant the only thing to do with a token was to stake it, which creates a potential downward spiral in terms of sell pressure. LSDs provide a convenient solution to this tradeoff - stake your assets and use them productively in DeFi.

- Since the launch of Stride, we have seen significant growth in TVL despite a general decrease in asset prices.

The Addressable Market of LSDs

- Looking at the Ethereum LSD landscape since 2020, we can see the significant growth of LSDs. 2023 in particular saw a huge growth in LSDs, which can be attributed to the Shanghai upgrade which was a major catalyst for LSDs.

- One key takeaway is it's a winner-takes-most market as of today, with Lido winning out most of the LSD market share, creating a flywheel effect for its continued growth.

- With over $36m in TVL and over 80% market share, Stride has a flywheel of integrations with key DEXs and money markets. It is in a strong position for further growth.

- Similar to Ethereum, DEXs and money markets provide a natural home to LSDs given users can create leverage to loop their LSDs to earn more yield or manage risks through AMMs or yield-bearing vaults.

2023 Outperformance

STRD is up 330% YTD, outperforming both ETH and LDO.

Given it significantly outperformed ETH and the top LSD provider in crypto in 2023, what’s next for Stride?

Catalysts for Stride

Given that it is a liquid staking provider, a catalyst can be defined as anything that will help Stride issue more LSDs, thus, increasing its TVL and revenues for stakers.

Short-term Drivers

- Liquid staking module

- This launched on September 13th and allows ATOM stakers to instantly liquid-stake their ATOM without any bonding periods. Since launching, the number of ATOM tokens liquid staked through Stride has increased by 25.9% in just over 2 weeks.

- Given there are many institutions and larger players who stake/validate on the Cosmos Hub, they can't just immediately liquid stake their assets as there are some operational hurdles to get through. Because of this, the trend may continue well into the future until the 25% of ATOM tokens safety cap is reached. In USD terms, this module unlocks over $500m in staked capital with ATOM at $7.13.

- Money Markets Expanding

- Mars Protocol recently raised deposit caps on stATOM from 200k to 350k, which is already the most popular asset on Mars.

- Umee’s largest market is stATOM, outpacing USDC and native versions of ATOM and OSMO. The stATOM supplied has only increased rapidly throughout September.

- DEXs

- Proposal discussion on Osmosis deploying 20m OSMO ($6.2m with OSMO at $0.31) from the community pool into a paired pool with stOSMO. This would allow for deeper liquidity for stOSMO which would open up the collateral integrations with Mars Protocol, Membrane Finance and Levana Protocol.

- Stress tested peg on DEXs: stATOM volumes hitting ATH on Osmosis this past week, around 430k stATOM were sold and quickly arbitraged back to the soft-peg to Stride’s redemption rate.

- Stable swap and concentrated liquidity curve pools are available for Stride-staked assets on Osmosis, allowing for much more depth than the traditional constant product pools (xy=k).

- Tokenomics Changes

- Since the migration to a consumer chain, STRD staking rewards decreased by 50%. Paying for their security to ATOM stakers/validators will be through 15% of inflationary staking rewards and 15% of real yield mechanisms such as:

- Transaction fees

- MEV revenues

- STRD has a maximum supply of 100m tokens, with over 87% of tokens circulating as of September 28th, 2023.

- Since the migration to a consumer chain, STRD staking rewards decreased by 50%. Paying for their security to ATOM stakers/validators will be through 15% of inflationary staking rewards and 15% of real yield mechanisms such as:

Long-term Drivers

- New Cosmos Chains

- There are many chains that are planning to launch in the next year. Some of the larger names include dYdX, Celestia, Berachain, Namada, Monad, Penumbra, dYmension and many others. In total, the estimated valuations on these chains through their most recent investment rounds push well into the multi-billion dollar valuation range. Naturally, these chains tokens will likely onboard the largest LSD provider when they go live.

- Axelar’s General Message Passing

- Stride’s Cosmos-based LSDs can now flow to other ecosystems over Axelar. Additionally, other chains such as Ethereum, NEAR, Avalanche and many others can now be onboarded - this increases the addressable market from Cosmos chains to all PoS chains.

- New Features and UX

- Some new features allow for a simpler UX for stakers and abstracts away the cross chain experience.

- Skip API integration will allow 1-click reward selling into your desired token of choice (i.e receive tokens in 4 different assets but sell them into stATOM)

- Enabling 1-click staking of tokens on separate chains. For example, you can liquid stake ATOM that is on Osmosis and you get stATOM on Stride within a few seconds.

- Metamask snaps also recently launched, which brings about the same wallet experience most Ethereum users are used to. This opens the door to a better/more familiar UX without having to create a new private key to play around with Cosmos chains.

Minimalist Design

- Stride is secured by the Cosmos Hub, with over $2b backing it, which increased Stride’s previous security by over 100x.

- No additional smart contracts, Stride is built as an open-sourced project using modules on the Cosmos SDK and IBC. There are no other apps besides the core liquid staking protocol.

- The codebase has been audited 3 times, has continuous audits from Informal Systems, and has IBC rate limiting in place.

What do I get as a STRD Holder?

- STRD tokens give holders governance rights over updates in the protocol.

- Staking STRD allows stakers to receive 10% of all generated staking rewards generated on the platform. This fee sharing ties STRD staking revenues with the TVL on the platform - more TVL on Stride = more revenues for STRD stakers.

- The rewards are accrued in a variety of LSD tokens of top chains Stride supports.

- Currently, their annualized fees are bringing in over $6.2m, with just over $36.9m in TVL.

- Stride is working with Skip, and they will begin making money on transaction fees and MEV. This can be shared with STRD stakers, and 15% will go to ATOM validators/stakers.

Can the team deliver?

- The team and community have aligned themselves on the ethos of decentralization and their ability to execute their vision.

- Since launching, they quickly became the largest LSD provider in the Cosmos and successfully became a consumer chain that is fully secured by the Cosmos Hub.

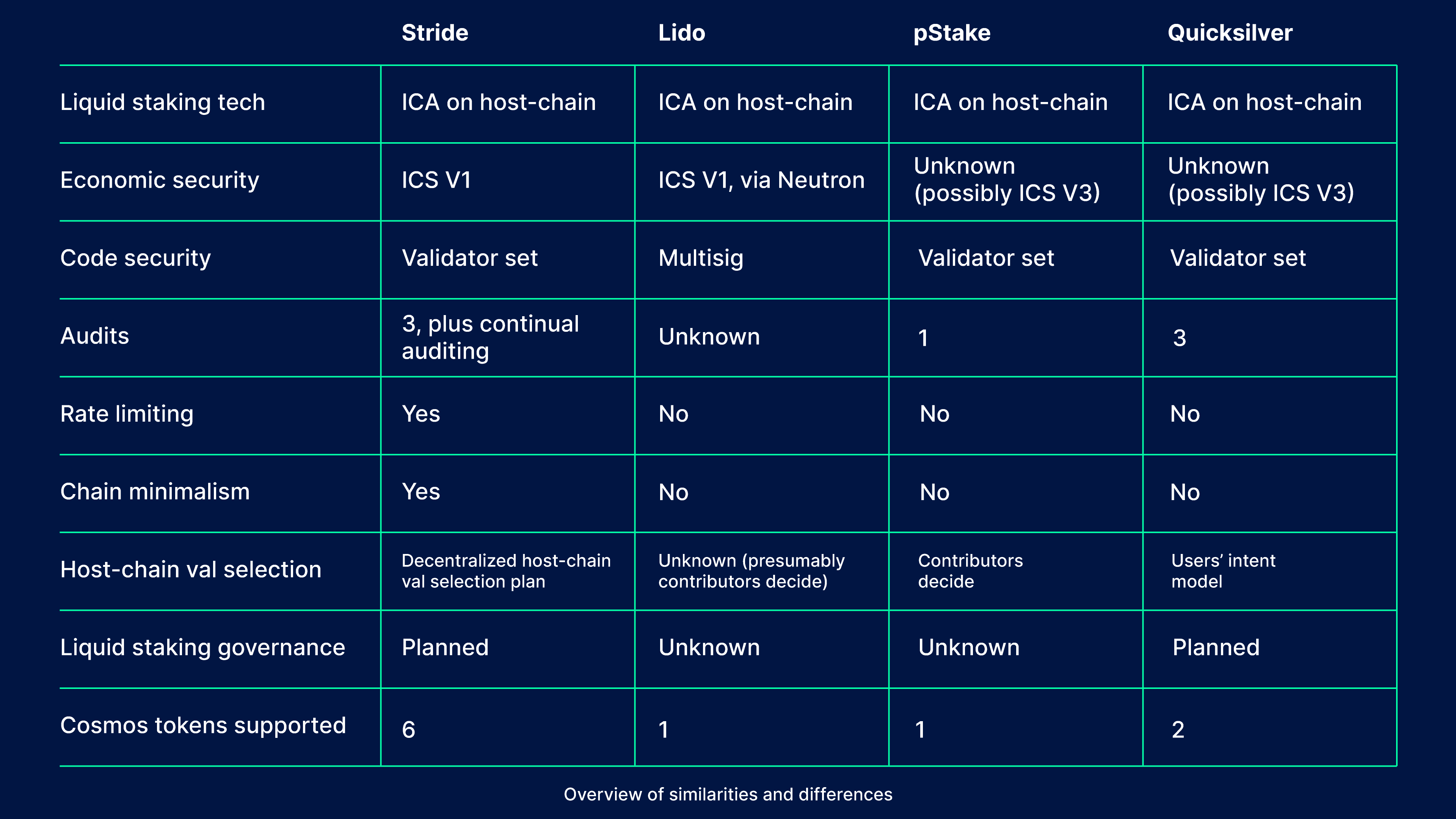

Competition

There is a lot of competition in Cosmos’s LSD market, but many of them vary in their approach. As for tradeoffs, we include the table below from Stride to give better context on the top providers out there today.

With over 80% of the market share and one of the most secure and aligned approaches, Stride is in a good position to capitalize on the continued growth of the Cosmos LSD market.

Valuation

- STRD currently has a market cap of $72.29m and FDV of $82.58m. Its FDV/TVL ratio is just 2.17.

- STRD may be undervalued given its real yield revenues towards STRD stakers, its new value capture mechanisms through transaction fees and MEV, along with other near-term catalysts that increase the addressable market of Stride to billions of untapped markets.

- Stride is positioned well for a multichain future and is effectively an index bet for the most successful Cosmos chains. The team has a strong track record in execution, and their minimalist design strategy aligns well with both decentralization principles and the specific needs of the communities they serve.