A Brief Introduction: Solidly ve(3,3)

What is Solidly’s ve(3,3)?

Solidly is an Automated Market Maker (AMM) based on Uniswap v2, allowing users to swap between two tokens in a liquidity pool. Its uniqueness lies in its ve(3,3) model.

Solidly’s ve(3,3) model is derived from the two preceding concepts: The Vote Escrow (ve) Model pioneered by Curve Finance, and the (3,3) model pioneered by OlympusDAO. The Solidly model’s approach to fee distribution and sustainable liquidity mining addresses some challenges faced by new projects in bootstrapping liquidity and growth, unsustainable farming rewards, and sell pressure on reward tokens. Read more here.

Why is Solidly’s ve(3,3) important to look at?

Solidly ve(3,3) model: All forks Market Share

Solidly is currently the third most forked protocol, with a total value locked (TVL) of over $593 million, trailing only Uniswap V2 ($4.40 billion) and Compound ($1.64 billion) forks in TVL. The platform saw a recent resurgence of interest in January 2023. Recent incidents, such as the collapse of FTX and SVB, have triggered a shift in capital away from centralized exchanges (CEXs), with decentralized exchanges (DEXs) gaining a greater importance and relevance.

Solidly ve(3,3) as a Dominant DEX model

According to Defillama, Solidly fork DEXs have been moving up the rankings in terms of DEX fees and revenues. Looking at the top 10 DEXs, we can see that Solidly forks, namely Ramses Exchange, Equalizer Exchange, Velodrome, Thena and SolidLizard make up 6 out of the top 10 DEX.

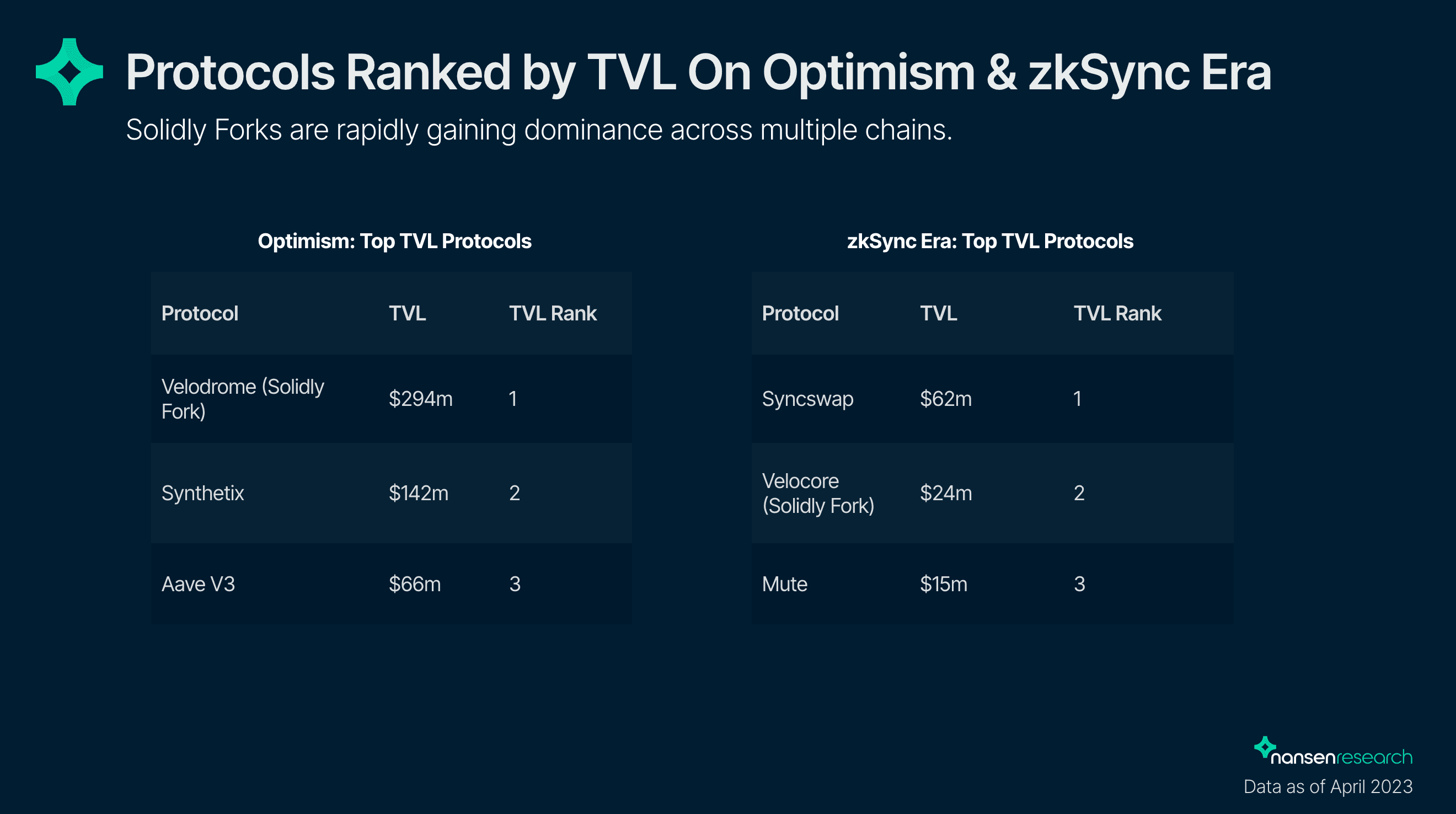

Solidly forks are rapidly gaining dominance across various chains, emerging as top DEX platforms in their respective ecosystems. This reflects an important trend of growing user preference for newer incentivization models on newer chains, instead of relying on established platforms like Curve and Uniswap. Although these new DEX platforms currently have lower TVL than Curve and Uniswap, they offer potential for further innovation and development.

How does Solidly ve(3,3) work?

Model MechanicsIn the ve(3,3) model of Solidly, the DEX offers rewards in the form of emissions, fees, bribes, and rebases. Traders pay fees for swaps while liquidity providers receive token emissions for staking tokens. Protocols incentivize liquidity providers through gauges and veTOKEN voters govern token emissions by voting on gauges weekly. This creates revenue in the form of fees and bribes that contribute to token emissions going to LPs. As revenue increases, so does the attractiveness of veToken as an investment, which in turn helps to sustain emission rewards to LPs and consequently generate more trading volume and fees. This cycle draws in liquidity and generates fees, creating a flywheel effect that fuels Solidly’s growth.

The Current Landscape

This report looks at the top Solidly forks (TVL) on five popular chains.

The table shows Solidly forks across different chains as a % of the total TVL for Solidly forks. The dominant Solidly forks are Velodrome on Optimism (46%), Thena Exchange on BSC (17%), Ramses Exchange on Atbitrum (7%), Equalizer on Fantom (6%) and Velocore on zkSync Era (4%).

Solidly forks & Potential Catalysts

VelodromeVelodrome is a leading ve(3,3) DEX by TVL on the Optimism network, created by veDAO to become a liquidity hub. It offers four types of rewards, namely, emissions, fees, bribes, and rebases, which are distributed proportionally to LP stakers based on votes every epoch.

Velodrome has gifted veNFTs to leading protocols, granting them voting power over future emissions of the VELO token and fee collection. It aims to fairly compensate LPs for impermanent loss incurred and uses a vote-locking mechanism to control governance and avoid dilution via emissions and rebases.

Velodrome has three modifications to the original Solidly design, including tying rewards with emissions, ensuring productive gauges, and programming prolonged emissions decay. The DEX charges a stableswap fee of 0.02%, which is half of Curve’s swap fee. In addition, Velodrome has received continuous OP grants that incentivize both the team and users, likely contributing to its success. Velodrome has seen TVL rising to over $281m since launch making it the top project by TVL on Optimism.

Potential Catalyst: Velodrome being closely tied to the Optimism ecosystem makes it a potential beneficiary of the upcoming bedrock upgrade, which could have a positive impact on VELO's value. However, the end of OP incentives is expected to negatively affect Velodrome.

ThenaThena is a DEX launched on the Binance Smart Chain (BSC) in January 2023, incubated by Binance. It has attracted $64.1M TVL to date and charges a 0.20% fee on vAMM pools and a 0.04% fee on sAMM pools.

Thena incentivizes gauge voters with pool fees, similar to Solidly. The DEX offers veTHE tokens, which are locked for veNFTs that allow voters to vote for gauges weekly and receive 80% of trading fees and 100% of bribes for associated pools. Thena also has theNFT, a founders’ token that grants theNFT stakers a separate share of trading fees. Thena is the second largest Solidly fork DEX by TVL.

Potential Catalyst: The potential listing of THE token on Binance could lead to positive price action.

Ramses ExchangeRamses is a Solidly fork DEX built on Arbitrum. It offers dilution protection rebases, gauge boosts, and veNFTs to direct emissions to LP token pairs. Ramses charges a 0.2% swap fee for volatile pairs and a 0.01% swap fee for correlated pairs. The protocol native pairs will be set at a 0.5% swap fee initially.

Users can earn yields from Ramses pools by staking veRAM. Ramses incentivizes users to provide LP tokens through staking gauges that allocate more RAM to pairs with more votes. Ramses has seen TVL rising to over $43.8m since launch, making it the third largest Solidly fork DEX by TVL. Ramses Exchange plans to launch a launchpad in the near future to diversify its revenue streams and is also set to release concentrated liquidity to further enhance its DEX offering.

Potential Catalyst: The potential introduction of incentives by Arbitrum will likely boost Ramses Exchange in a similar fashion to Velodrome on Optimism.

Equalizer ExchangeEqualizer is a Solidly fork DEX built on Fantom. The platform utilizes two tokens, EQUAL and veEQUAL, which allow users to participate in emissions and obtain a percentage of the fees collected. Unlike other protocols that use the rebase model, Equalizer has decided to remove it, to ensure a fair chance for new entrants. Additionally, Equalizer has set the fees at a rate of 0.2% per trade for volatile pairs and 0.02% for stable pairs. Bribes are allocated to gauges to incentivize veEQUAL holders to vote for LPs similar to the other ve(3,3) models. A differentiating factor for Equalizer Exchange is in its 0% rebasing, which is the lowest among Solidly forks.

Potential Catalyst: Equalizer's 0% rebase provides a favourable environment for new entrants to join and may become an even more appealing proposition as chain incentives on competing chains diminish.

Velocore ExchangeVelocore is based on Velodrome and built on top of the Solidly codebase. Similarly to Velodrome, Velocore has made several key improvements to the Solidly codebase, including tying rewards with emissions to ensure a healthy equilibrium between voters and external bribers, and prolonging emission decay to make the protocol an attractive opportunity for future protocols. The protocol offers two liquidity pool types: Stable Pools and Variable Pools. The fees for Stable liquidity pools are 0.02%, while for Variable liquidity pools, they are 0.25%. Velocore utilizes two tokens for managing its utility and governance: VC, an ERC-20 utility token, and veVC, an ERC-721 governance token. The ve(3,3) mechanism rewards behaviors correlated with Velodrome's success, such as liquidity provision and long-term token holding. Emissions are distributed weekly, and veVC holders receive a rebase proportional to LP emissions and the ratio of veVC to VC supply. veVC holders also decide which liquidity pools receive emissions through gauge voting.

Potential Catalyst: As the zkSync airdrops have yet to be distributed, interacting with Velocore could increase the chances of receiving airdrops. On top of that, if zkSync incentives are planned in the future, they are likely to boost Velocore in a similar fashion to Velodrome on Optimism.

An examination of Velodrome’s Life Cycle

Velodrome is taken as reference due to its prominent position as a blue chip among Solidly forks.

In mid-2022, Velodrome received its first OP grant but faced a setback in August with a loss of $350k in operational funds. Although the funds were recovered, user confidence was impacted, leading to a long period of decline and stagnating TVL. However, with the implementation of OP's new incentives in early 2023, the positive flywheel effects of the model began to take hold, resulting in a surge of user interest and accumulation of VELO for farming. In the period between March and April, the protocol underwent a v2 migration, where TVL saw a dip and bounced back quickly.

An important question arises regarding the future of investing in the token after the incentives have dried up. In such a case, the token can be viewed as a bet on the growth of the DEX's revenue exceeding emission rates in the long run, and investors may hold the token based on their belief in the sustainability of the ve(3,3) model, which will be explored further in the upcoming section.

Comparison Table & Model Discussion

Solidly Landscape Chart Top TVL Solidly fork on Each Chain

Model Design: Protocol Exploits

The original Solidly DEX's faced decline due to vulnerabilities in its code, which have since been resolved. However, any new vulnerabilities and exploits will still have a significant impact. The ve(3,3) model exacerbates sell offs with a negative flywheel effect, where lower prices result in lower LP APYs, lower TVLs, and lower token demand that drives price even lower. Restoring positive momentum after a vulnerability or exploit can be especially difficult for Solidly forks.

Model Design: Rebasing, Boon or Bane?

The concept of rebasing or anti-dilution may sound appealing in protecting veToken holders from being diluted on their percentage share of holdings, but it can ultimately break the flywheel and be unhealthy for the economy. While rebasing may protect existing voters, it removes the positive effects of inflation that incentivize all actors to grow the economy. For instance, projects could exploit it to direct emissions to uneconomical pools. Thus, newer generation Solidly forks with less focus on rebasing and more focus on better incentives alignment and innovation, are expected to be more sustainable in the long term. However, it should be noted that rebasing can also impact buyer psychology, with higher rebase exchanges tending to benefit from positive price action by rewarding early participants. Overall, balancing incentives alignment remains a critical factor for a Solidly fork to succeed.

Model Sustainability: Inflation & Growth

Decentralized exchanges (DEXs) have a lot of untapped potential, as they only account for a small percentage (2.1%) of total perp swap volumes according to Laevitas. In the DEX segment, Solidly forks have been performing well despite the bear market, as seen from their fees & revenue generated (Defillama). Furthermore, the high TVL in Solidly DEXs presents an opportunity for innovation and additional feature development to ensure long-term sustainability. One example of such potential development is Curve's crvUSD, which is expected to increase revenue and value capture beyond the Curve DEX itself. Overall, while the ve(3,3) model can boost initial growth with high emissions, growth will eventually need to match the necessary emissions inflation rate.

Top veToken Holders For Each Chain’s Top fork

This section dives into some of the largest holders of veTokens for Externally Owned Accounts (EOA). EOA accounts are interesting for us to see potentially what other strategies they are looking at. To do this, we look at the top activities of the individual EOA wallets, and round it off with the top entities the wallets are interacting with as a cluster.

Velodrome Top veToken HoldersVelodrome is a Solidly fork on Optimism.

Wallet 1

Top notable activities:

- Staking and farming on Velodrome, with total value over $2.8m in Velodrome.

- Other activities include farming on Thena and Camelot.

Wallet 2

Top notable activities:

- Staking and farming on Velodrome, with total value over $4.2m in Velodrome.

- Very active account that is also farming on Pendle (~$2m), Liquity ($627k), Lyra ($409k), Ribbon($378k), Synthetic ($345k).

Wallet 3

Top notable activities:

- Staking and farming on Velodrome, with total value over $1.2m in Velodrome.

- Mostly holding stables aside from farming on Velodrome

Wallet 4

Top notable activities:

- Staking and farming on Velodrome, with total value over $1.0m in Velodrome.

- Other activities include farming on Kwenta and Liquity.

Wallet 5

Top notable activities:

- Staking and farming on Velodrome, with total value over $1.0m in Velodrome.

- Other activities include farming on Kwenta and Liquity.

Nansen Portfolio Cluster for top veVELO holders here.

Thena Top veToken HoldersThena is a Solidly fork on BSC.

Wallet 6

Top notable activities:

- Staking and farming on Thena, with total value over $477k in Thena.

Wallet 8

Top notable activities:

- Staking and farming on Thena, with total value over $278k in Thena.

Wallet 9

Top notable activities:

- Staking and farming on Thena, with total value over $170k in Thena.

Wallet 10

Top notable activities:

- Staking and farming on Thena, with total value over $187k in Thena.

- Staking and farming on Mummy Finance, with total value over $631k in Mummy Finance.

Nansen Portfolio Cluster for top veTHE holders here.

Ramses Top veToken HoldersRamses is a Solidly fork on Arbitrum.

Wallet 11

Top notable activities:

- Staking and farming on Rames, with total value over $282k.

- Highly active LP. Other activities include farming on Velodrome, Thena, Hermes Protocol, and more.

Wallet 12

Top notable activities:

- Staking and farming on Ramses, with total value over $147k.

- Other activities include farming on Solidly, and The Ennead.

Wallet 13

Top notable activities:

- Staking and farming on Ramses, with total value over $794k.

- Other activities include farming on Solidly, DEI Finance, and SoliSnek.

Wallet 14

Top notable activities:

- Staking and farming on Ramses, with total value over $179k.

- Other activities include farming on GMX and SoliSnek.

Nansen Portfolio Cluster for top veRAM holders here.

Equalizer Top veToken HoldersEqualizer is a Solidly fork on Fantom.

Wallet 15

Top notable activities:

- Staking and farming on Equalizer, with total value over $606k.

Wallet 16

Top notable activities:

- Staking and farming on Equalizer, with total value over $504k.

Wallet 17

Top notable activities:

- Staking and farming on Equalizer, with total value over $234k.

Wallet 18

Top notable activities:

- Staking and farming on Equalizer, with total value over $254k.

- Other activities include farming on Tarot.

Wallet 19

Top notable activities:

- Staking and farming on Equalizer, with total value over $209k.

Nansen Portfolio Cluster for top veEQUAL holders here.

Velocore

Velocore is a fork of Solidly operating on the zkSync era. At present, Velocore has a relatively modest TVL of only $22m. Nonetheless, considering the excitement surrounding zkSync era, it could be worthwhile to conduct a more thorough investigation as the zkSync chain matures. Notably, we see very few of the top veToken holders in our Solidly fork cluster that have made the transition to zkSync so far.

Solidly forks Top EOA wallets Entity Interactions

The following findings have been identified:

- Major DEXs like Uniswap, 1inch and Paraswap are unsurprisingly the top entities by interactions.

- FRAX, Aura Finance, and Balancer interactions indicate some involvement which is likely linked to the recent LSD narrative and efforts to maximize LSD yields. An instance of recent strategies where users employed protocols such as aura, balancer, and others to maximize yields can be found here.

- Hop Protocol, Synapse, and Multichain appear to be the most utilized bridges for this cluster.

- The zkSync season continues to be on the radar for this cluster; however, most users of this wallet cluster have not yet bridged over.

- The top Solidly forks token holders in most chains exhibit considerable holding sizes, whereas the top holdings in the Fantom fork are noticeably smaller.

- A few wallets stand out as highly active LPs and are worth setting smart alerts on, namely: Wallet 2 & Wallet 11. Notably, Wallet 11 looks to be betting on Solidly forks as a narrative, moving funds into the top Solidly forks across the different chains. Wallet 1 as well, but has its money on Velodrome and Thena forks only.

Risks

Business RiskThe long-term viability of the ve(3,3) model ultimately hinges on the ability to match growth with the protocol’s emission rates over time. Although the domain of DEXs offers vast untapped potential, the ve(3,3) model remains in its early stages within a DEX landscape that is constantly changing. Consequently, there exist potential challenges, including the need to maintain their dominant position in the face of emerging DEX models.

Smart Contract RiskDespite undergoing at least one audit, all the protocols mentioned earlier are vulnerable to smart contract bugs and exploits. It should be noted that the risks associated with smart contracts are inherent and recent incidents, such as the Sushiswap exploit and Yearn finance hack, serve as a poignant reminder of the potential vulnerabilities.