Introduction

WalletConnect is an open-source communications protocol that serves as the connectivity layer between wallets and DeFi applications. It enables secure, end-to-end encrypted interactions across multiple blockchains, allowing users to connect their wallets to any application without exposing private keys or depending on browser extensions. By standardizing how wallets and apps communicate, WalletConnect simplifies onchain access for both users and developers, abstracting technical complexity while supporting a wide range of wallet types, from self-custodial to institutional solutions. Built for scalability and interoperability, the protocol underpins an increasingly large portion of the onchain economy.

As of August 2025, WalletConnect has facilitated over 352.8 million connections across more than 51.7 million unique wallets and powers 57,980 integrated applications. This growth is supported by its evolving monetization model, which introduces a sustainable fee framework for applications, designed to ensure long-term ecosystem alignment without taxing end users.The network is on track to surpass $400 billion in annual Total Network Volume (TNV), highlighting its emergence as core infrastructure for onchain financial markets. With 15.5 million monthly connections and expanding adoption across both retail and institutional segments, WalletConnect has firmly established itself as the standard connectivity layer for the decentralized economy.

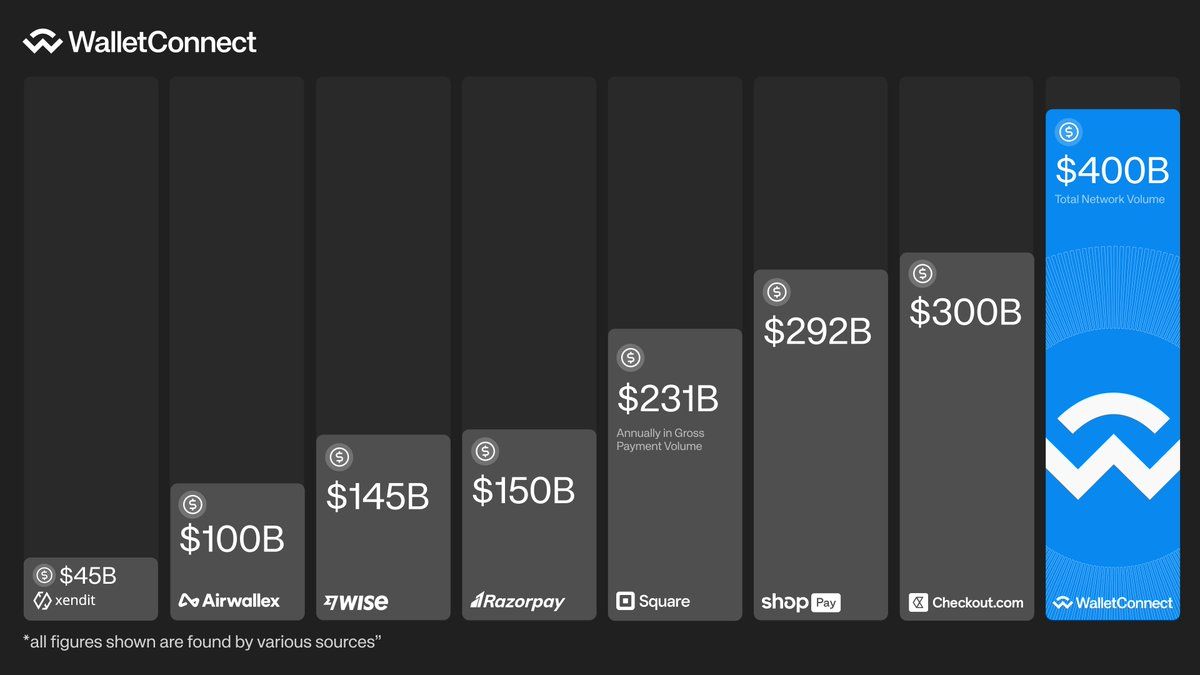

Total Network Volume (TNV)

TNV measures the aggregate onchain transaction value facilitated by the WalletConnect Network. Reaching the $400 billion annual TNV milestone underscores WalletConnect’s scale and critical role in the onchain ecosystem. For context, $400 billion in yearly volume exceeds the throughput of many major fintech platforms (for example, it surpasses Square’s ~$231 billion GPV and rivals Shopify’s ~$292 billion GMV), signaling that WalletConnect’s network is handling volumes on par with traditional financial infrastructure.

In short, TNV is a broad indicator of ecosystem health and adoption, reflecting billions in DeFi activity, payments, and onchain transactions flowing through WalletConnect’s connections each year.

WalletConnect’s volume is supported by more than 350 million wallet-to-app connections, each representing a secure bridge enabling users to sign, transact, and interact across DeFi applications. The network serves over 50 million users, spanning 70,000+ apps and 700+ wallets, underscoring its ubiquity as the connective tissue of the onchain ecosystem. Notably, ~72% of all payments on WalletConnect are settled in stablecoins, highlighting their foundational role in onchain commerce and settlement. EVM-based ecosystems overwhelmingly dominate activity, driving roughly 98% of TNV, with Ethereum Mainnet alone contributing 77.4%, followed by BNB Chain (6.8%), Arbitrum (3.7%), Avalanche (2.9%), Base (2.9%), and Solana (2.0%), while smaller but growing shares come from Sei (1.3%), UniChain (0.9%), and Linea (0.7%).

By category, DeFi leads with approximately 65% of TNV (~$260 billion), followed by Infrastructure & Data (10%), Cross-chain & Interoperability (3%), AI & Agents (0.75%), Memes (1.9%), Wallets & Custody (1.54%), and Payments & Onboarding (0.27%), with Other or Unclassified activity comprising around 17.5%. Within the $1.08 billion in annual payment volume flowing through the WalletConnect Network, stablecoins dominate value, while ETH leads transaction count, reflecting a complementary dynamic between stability and utility. USDC represents about 54% of total payment value (20% of transactions), USDT contributes 11% of value (13% of transactions), and ETH accounts for 31% of value but over half of all payment transactions. This distribution helps illustrate how stablecoins continue to gain in usage for onchain payments, while ETH’s high transactional frequency signals its growing role as a native payment medium.

Onchain Behavioral Insights

A Healthy Onchain Picture, Despite Market Volatility

Despite short-term market volatility, the longer-term onchain picture remains one of organic growth, with WalletConnect's network activity demonstrating resilience and continued expansion.

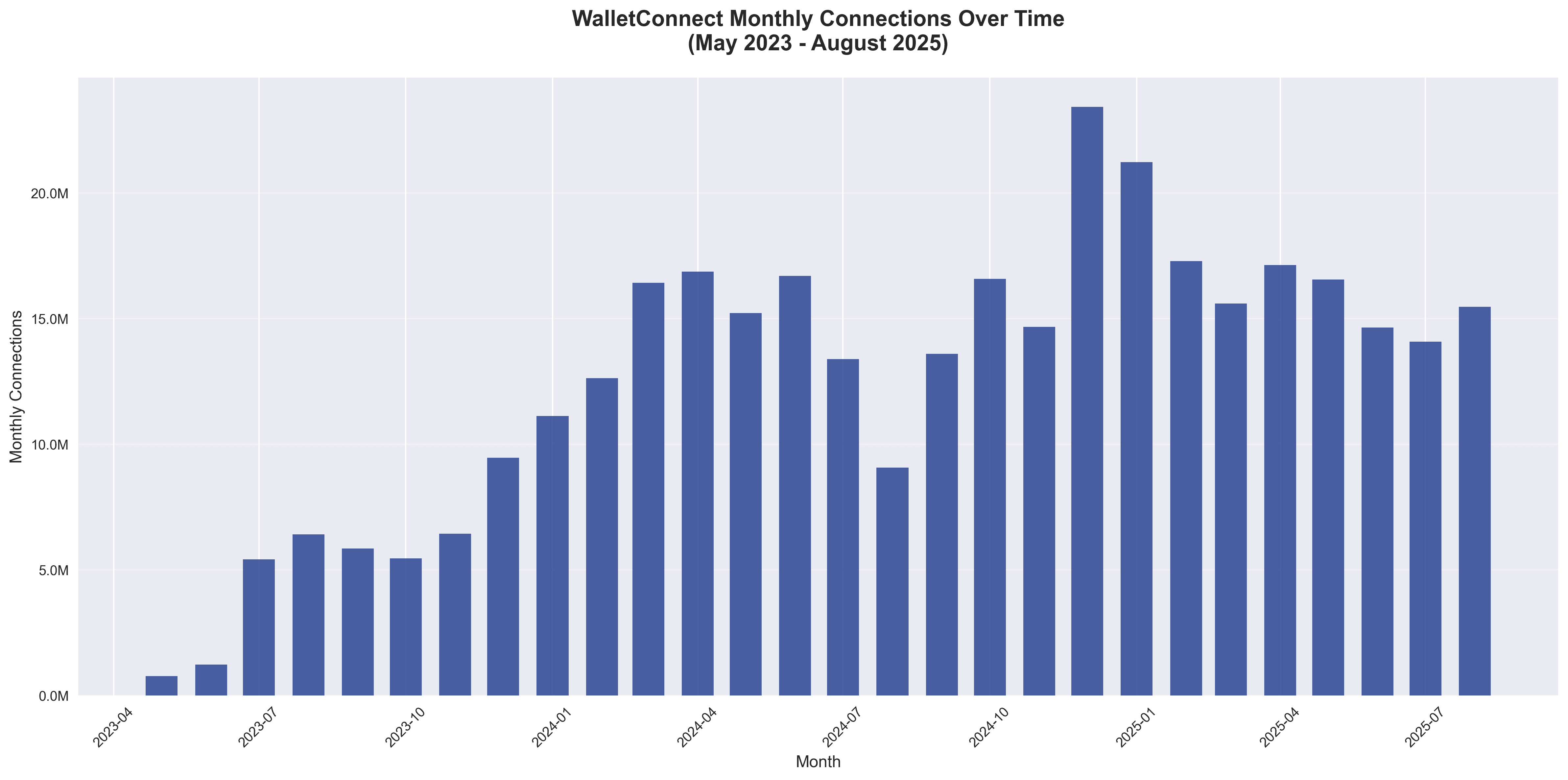

The protocol has maintained strong monthly connection volumes, averaging over 15 million connections per month in recent periods, with peak activity reaching 23.4 million connections in December 2024. This sustained growth has continued steadily into August 2025, netting 70% YoY monthly connections growth. The network's ability to maintain high connection volumes despite market volatility showcases sticky user adoption through various market conditions.

WalletConnect's success reflects the broader trend toward multi-chain adoption. The protocol supports connections across Ethereum, Solana, Bitcoin, and numerous other blockchains, connecting users to over 7,000 applications, positioning it as the universal connectivity layer as an all in one platform whereby users can find their favorite apps. The chain agnostic approach and bringing the apps closer to users has been crucial to its growth, as the network has facilitated over 352.8 million total connections.

Figure 1: WalletConnect Monthly Connections Over Time (May 2023 - August 2025)

The data reveals a clear growth trajectory, with particularly strong performance in 2024 and continued momentum into 2025.

The Onchain "Supply-Side": Apps and Ecosystem

Application Ecosystem Development

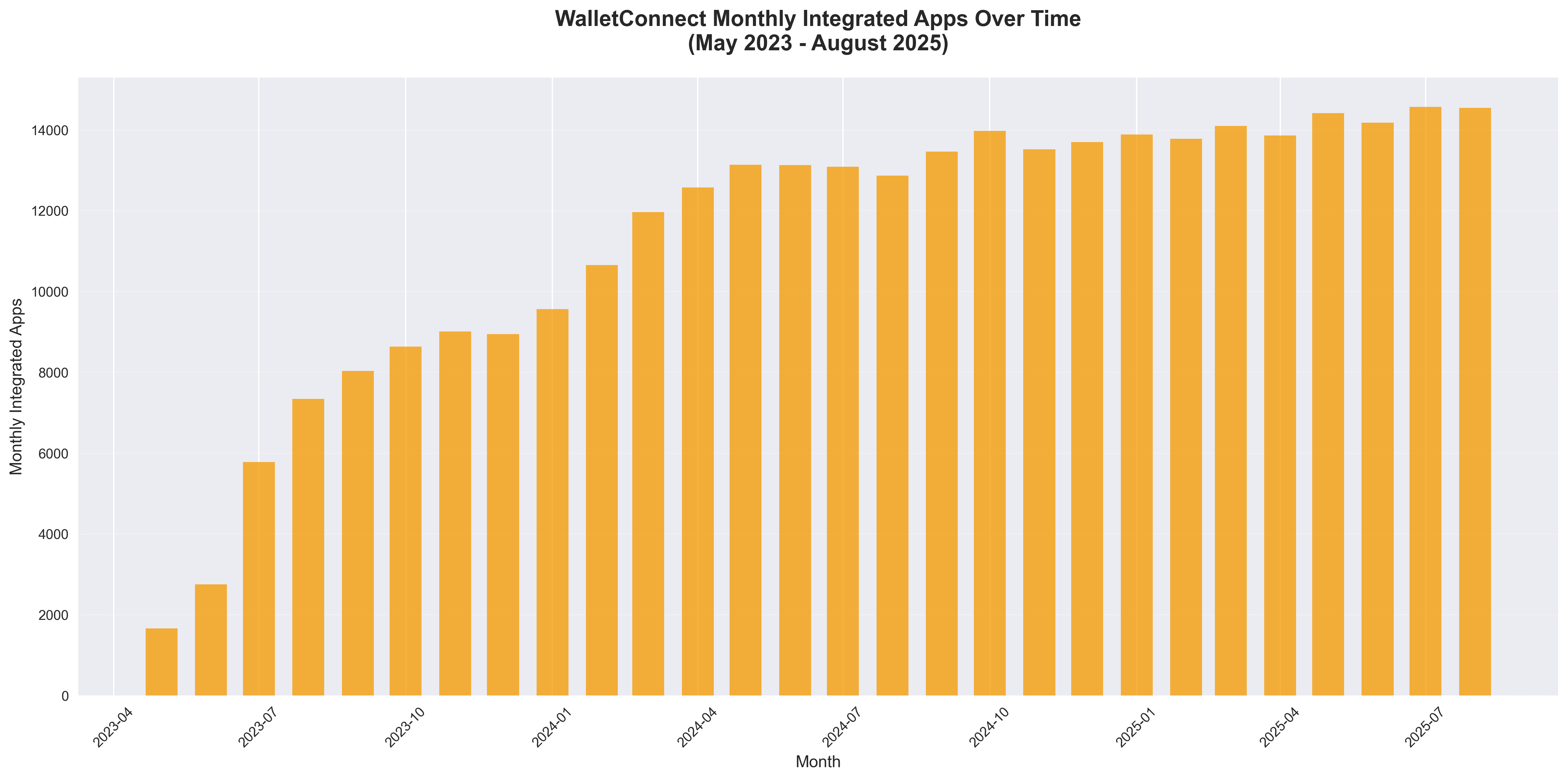

WalletConnect's ecosystem has grown to encompass over 57,980 integrated applications as of August 2025. The network demonstrates consistent growth in application integrations spanning use cases from DeFi and payments to gaming and enterprise applications.

Figure 2: WalletConnect Monthly Integrated Apps Over Time (May 2023 - August 2025)

Payments and Institutional Adoption

This growth reflects strong developer adoption and the protocol's comprehensive SDK offerings, which have made WalletConnect the standard for wallet-to-app connectivity across its diverse ecosystem. This expansion in developer and application activity is mirrored by rapid user growth, as WalletConnect continues onboarding millions of wallets monthly.

In addition to developer-driven growth, WalletConnect is seeing significant momentum from payments, stablecoin adoption, and institutional use cases. WalletConnect powers wallet connectivity for payment and stablecoin experiences across Coinbase, Shopify, Stripe, and MoonPay, among others. With the accelerating rise of stablecoins and payment-focused L1/L2s, WalletConnect’s interoperability positions it as the connectivity layer enabling these ecosystems to work seamlessly together.

Further, institutional adoption has become a major growth driver. WalletConnect eliminates the need for bespoke protocol integrations through a unified connectivity layer and features an institutional-grade architecture supporting EOAs, MPC, and multi-signature wallets. Its open-source and multichain design is built for compliance, scalability, and long-term reliability, making it the preferred standard among leading custodians, wallet infrastructure providers, and institutional platforms. Notable adopters include Fireblocks, Ledger Enterprise, HexTrust, BitGo, and Anchorage Digital, among others.

User Adoption Patterns

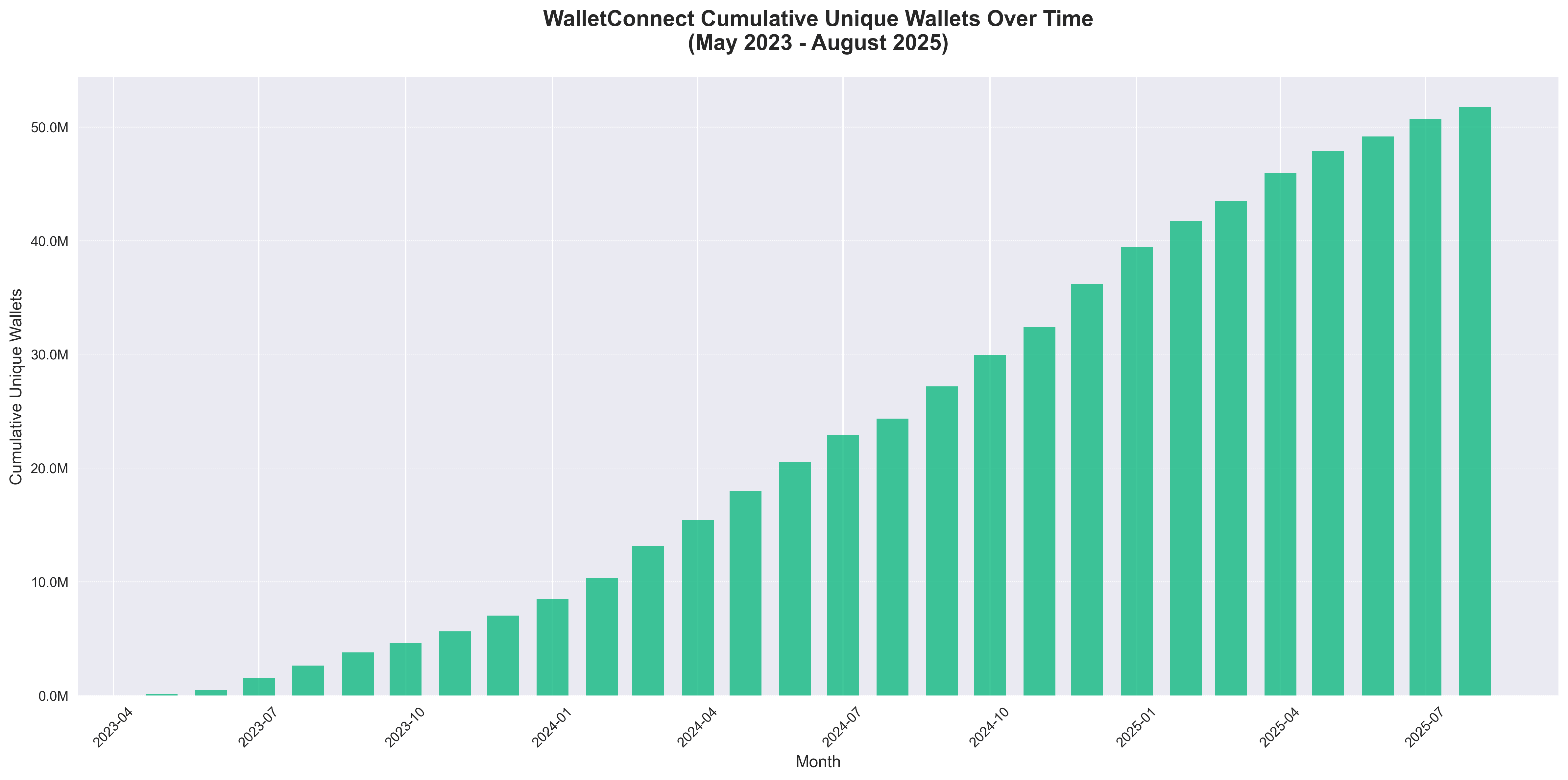

The network has successfully onboarded millions of unique wallets since inception in 2018. The data reveals peak monthly unique wallet activity of 5.98 million in December 2024, with cumulative unique wallets reaching 51.7 million by August 2025.

Figure 3: WalletConnect Monthly Unique Wallets Over Time (May 2023 - August 2025)

The current growth rate of 112.7% represents more than a doubling of the user base annually, which is promising for a network that has already onboarded ~52 million unique wallets. Further, application integrations also mirror a similar growth as their user base.

Application Integration Trends

In 2025 alone, WalletConnect has onboarded an average of 14,137 apps monthly. DeFi applications lead the integration categories, followed by growing adoption in enterprise applications and cross-chain use cases. This trend is supported by comprehensive SDKs and documentation that have made WalletConnect the preferred choice for developers building onchain applications.

Monetization Strategy: A Sustainable Path Forward

Fee Structure Overview

WalletConnect's proposed monetization model represents a new approach to sustainable network economics. The model is built on the principle that end users continue to connect for free, while applications pay fees based on the network value they derive. This approach aims to ensure that the network remains accessible to users while creating a sustainable revenue model that scales with network usage.

The fee structure is designed to be volume-based, meaning higher volume applications pay more in absolute terms but enjoy lower effective rates, benefiting from economies of scale. All fees are paid in WCT tokens, creating recurring demand for the native token and aligning the protocol's success with token utility.

Revenue Distribution Model

The collected fees are strategically distributed to strengthen the entire ecosystem. Wallets and custodians receive 30% of fees, rewarding the user onboarding infrastructure that drives network growth. Node operators receive 25% for maintaining network performance and reliability, while WCT stakers receive 20% for their long-term commitment to network security. The remaining 25% is allocated to community grants (15%) and research and development (10%), ensuring continued innovation and ecosystem development. Staking has seen promising adoption so far, with over 113,910,353 WCT staked across 55,698 unique stakers as of October 22nd, 2025.

Economic Flywheel

The monetization model may create a self-reinforcing cycle that can benefit all network participants. Institutional adoption brings more users and capital to the network, which increases network volume and fee revenue. This revenue is then distributed to improve infrastructure and provide incentives, which attracts more applications and users, creating a sustainable growth model that scales with network adoption.

Market Position and Competitive Advantages

WalletConnect has established itself as the de facto standard for wallet-to-app connectivity, with over 350 million connections. The protocol's enterprise adoption is evidenced by its trust from major institutions including Fireblocks, Ledger, Robinhood, Blockchain.com, OKX Wallet, Binance Wallet, and Gemini Wallet. This institutional confidence, combined with 57,980+ integrated applications and comprehensive cross-chain support spanning Ethereum, Solana, Bitcoin, and more, positions WalletConnect as the universal connectivity layer for bringing users closer to their favorite DeFi applications.

Network Performance

WalletConnect's infrastructure demonstrates enterprise-grade reliability through its end-to-end encryption, which ensures secure connections without key exposure. The protocol's decentralized architecture eliminates certain single points of failure, while comprehensive cross-platform support for mobile, desktop, and web applications ensures universal accessibility. Real-time communication protocols provide low-latency connections that meet the demands of both retail and institutional users.

Under the hood, WalletConnect service nodes form the backbone of the network, persisting and routing encrypted messages using a “mailbox” system for offline clients. The network employs techniques like rendezvous (consistent) hashing to evenly distribute load across nodes, which enhances reliability and fault tolerance while preserving user privacy (nodes cannot decrypt the data they transmit). Furthermore, because WalletConnect’s node network is run by different operators around the world, the system is more resilient against downtime or censorship. Anyone with the requisite expertise and staked WCT can operate a node, reflecting the open and permissionless ethos that allows WalletConnect to reliably serve millions of users across various chains.

Security Model

The protocol maintains security without compromising user experience through its non-custodial design, which ensures no private key exposure. All communications are encrypted in transit, while the protocol's permissionless access model ensures it remains open to all developers. Regular security audits and continuous improvements demonstrate WalletConnect's commitment to maintaining the highest security standards as the network scales.

Token Economics and WCT Utility

Token Utility Expansion

The monetization model significantly enhances WCT token utility by making it the primary payment method for network fees, creating recurring demand tied to network activity. Long-term token holders receive revenue share through staking rewards, while governance rights allow token holders to influence network development. The requirement for WCT tokens to run network infrastructure further increases token utility and demand.

The introduction of network fees marks a significant expansion of WCT token utility. Under the new model, WCT becomes the primary payment medium for network services, which creates a recurring demand tied directly to WalletConnect’s growth (every application transaction effectively drives WCT usage for fee settlement). Long-term token holders benefit via fee redistribution, by staking WCT, they receive a share of the network’s fee revenue as rewards, aligning incentives for supporters. WCT also grants governance rights, allowing token holders to influence key network parameters and development directions through decentralized voting. Additionally, running critical infrastructure (such as service nodes) requires staking WCT, which further increases the token’s utility and embeds it at the heart of network security and reliability. In essence, WCT is designed to secure and sustain the network: it aims to incentivize builders, users, and node operators to contribute to WalletConnect’s success. By requiring fees to be paid in WCT and redistributing those fees to stakeholders, the network’s value loops back into the token’s value, aligning long-term incentives and helping ensure the network remains self-sustaining as it decentralizes. In summary, WCT’s role spans staking, governance, and fee mechanisms, making it integral to WalletConnect’s economic design and future growth.

Conclusion

WalletConnect represents a compelling infrastructure play in the crypto space as it abstracts away the complexity of the current onchain UX. The protocol's impressive growth metrics, combined with its newly proposed monetization strategy, position it as a strong contender to become the default connectivity standard for the onchain economy.

The protocol's transition to a more sustainable, fee-based model represents a natural evolution that aligns incentives across all network participants while maintaining the open, permissionless nature that has driven its success.