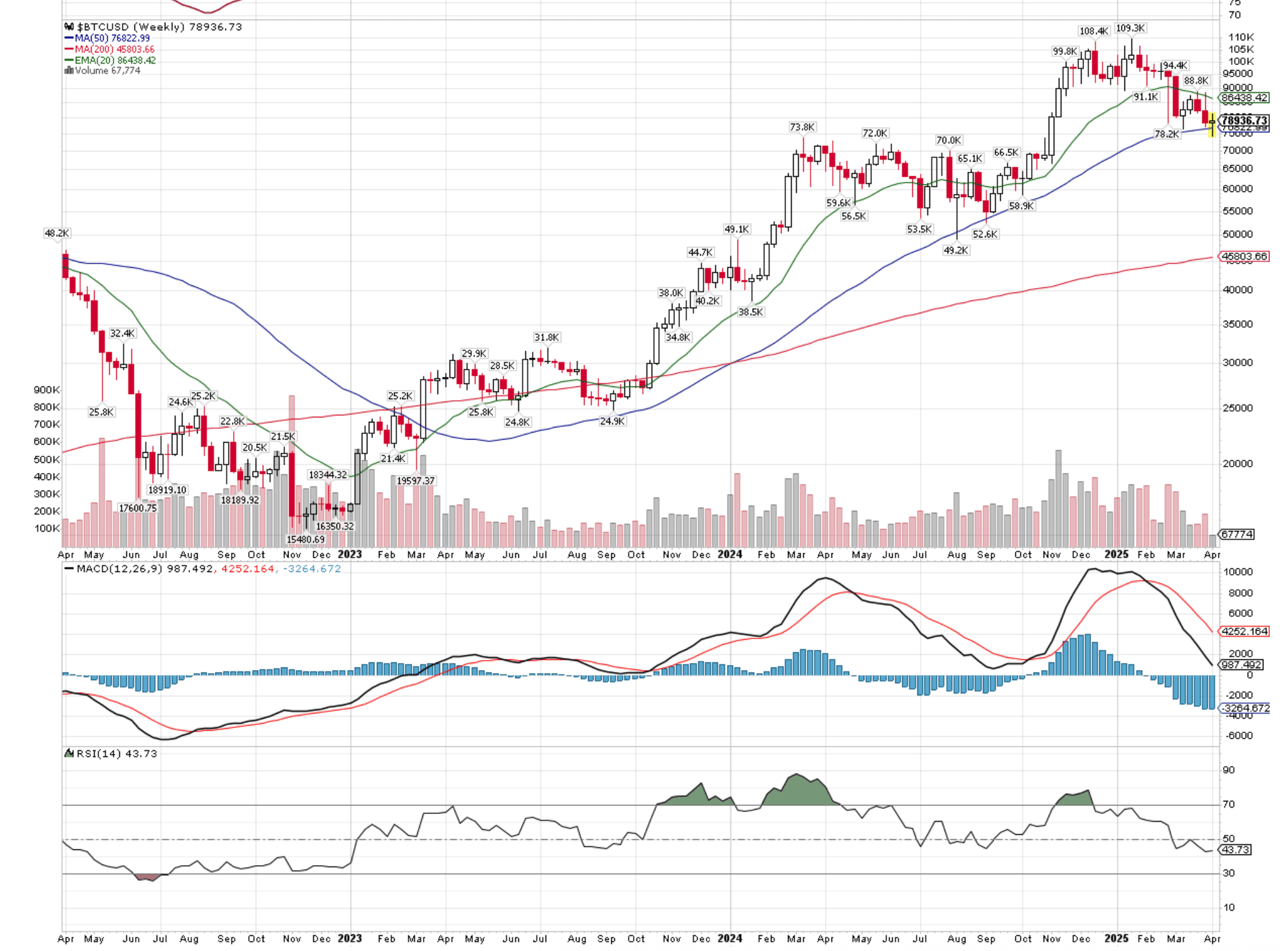

Across financial markets, the post-rose-garden tariff announcement has led to full-on panic. Notably, the sell-off, which had been so far limited to US equities, widened to other countries’ equity markets from Italy (-15.8% week-on-week), Hong Kong (-14.9%), Singapore (-14.2%), Taiwan (-13.9%), Europe (-13.1%) and of course, the US (Small Caps/ Tech -13%, S&P 500 -12.5%). Among commodities, copper (-15.7%) and crude oil (-14.6%) underperformed, and even gold lost -5.2% week-on-week (“winners” being sold to realize some profit). The US dollar underperformed vs G10 currencies, but global growth currency proxies such as the AUD/USD sold off -4.2%. Crypto and BTC did not resist, with BTC/USD in the high 70ks as we write.

All these moves are telling us that the fear of a US growth slowdown has increased and has now spread to pricing a more global growth shock. What surprised us and markets were the magnitude of additional tariffs imposed on China in particular, and on Chinese supply chain countries such as Vietnam, Malaysia, and, of course, the retaliatory tariffs announced by China combined with other restrictive measures on rare earth exports, anti-trust lawsuits vs US companies, etc.

The worst case scenario for global growth, risk assets and crypto markets is a severe US - China tit-for-tat escalation, potentially followed by a US - Eurozone escalation. The best case is a quick negotiation between the US and its main trade partners, before April 9th or before the implementation date for reciprocal tariffs. The main scenario is likely to be something in between, we think. Here are a few scenarios and some subjective probabilities attached to those:

- 15% Best case scenario: A de-escalation within the week, or the retaliatory tariffs as they were initially announced (higher-range numbers) do not get implemented. Instead, lower tariff rates or other bilateral compromises are negotiated. Some major trade partners have signalled their willingness to compromise, most notably, Japan. The Eurozone is “blowing hot and cold”, with Van der Leyen raising the possibility of zero tariffs on industrial goods, but, within the next hour, the Bloc apparently considering retaliatory tariffs on select US goods. We assign our lowest probability to this scenario just as a factor of the short timeline (two days) before tariff implementation, which is unlikely to allow for constructive negotiations, especially given the number of bilateral talks to hold and the ambiguity of the US administration’s asks (is it about the headline trade deficit number, the non-tariff barriers, currency manipulation, US tech taxation, intellectual property, etc? Different administration members have voiced different requests). In this scenario, BTC bottoms now.

- 30% Worst case scenario: Escalation US - China. China is the only country with enough economic power to retaliate against the US without blinking too soon. Unfortunately, it looks like President Trump has chosen to re-escalate in response to China’s own retaliatory actions, threatening an additional 50%-tariff hike against China. This is what the beginning of the worst case looks like. It would be growth-negative for every country, and mark the beginning of a global growth shock. We would not touch crypto before deep bear market levels if this scenario unfolds.

- 55% Base case scenario: There will be some negotiated outcome, but it will take time to materialize, possibly till June (original timeline floated by Bessent). It will take time because the US administration has indicated it was determined enough to shrug off some downside in equities. At the same time we do believe there is a pain point beyond which political credibility and support becomes eroded, and the administration will have to compromise/ negotiate. This means choppy markets until then especially as: businesses delay investment, consumers restrain spending (uncertainty + negative wealth effect of lower equities). Corporates will especially struggle on dealing with tariff implementation after April 9. We will probably witness a mix of price hikes for the end-consumer, cost increases/ margin reductions (lower EPS), and the interruption of some line of activities (supply destruction). This Friday, the S&P 500 Q1 earnings reporting season kicks off. Pay attention to the mix of guidance suspension, capex and labor force cuts announcements, price hikes projections, etc. In this base case scenario, we see further downside to BTC and US equities. We will be confident adding risks once there are tangible signs of a successful de-escalation between the US and China

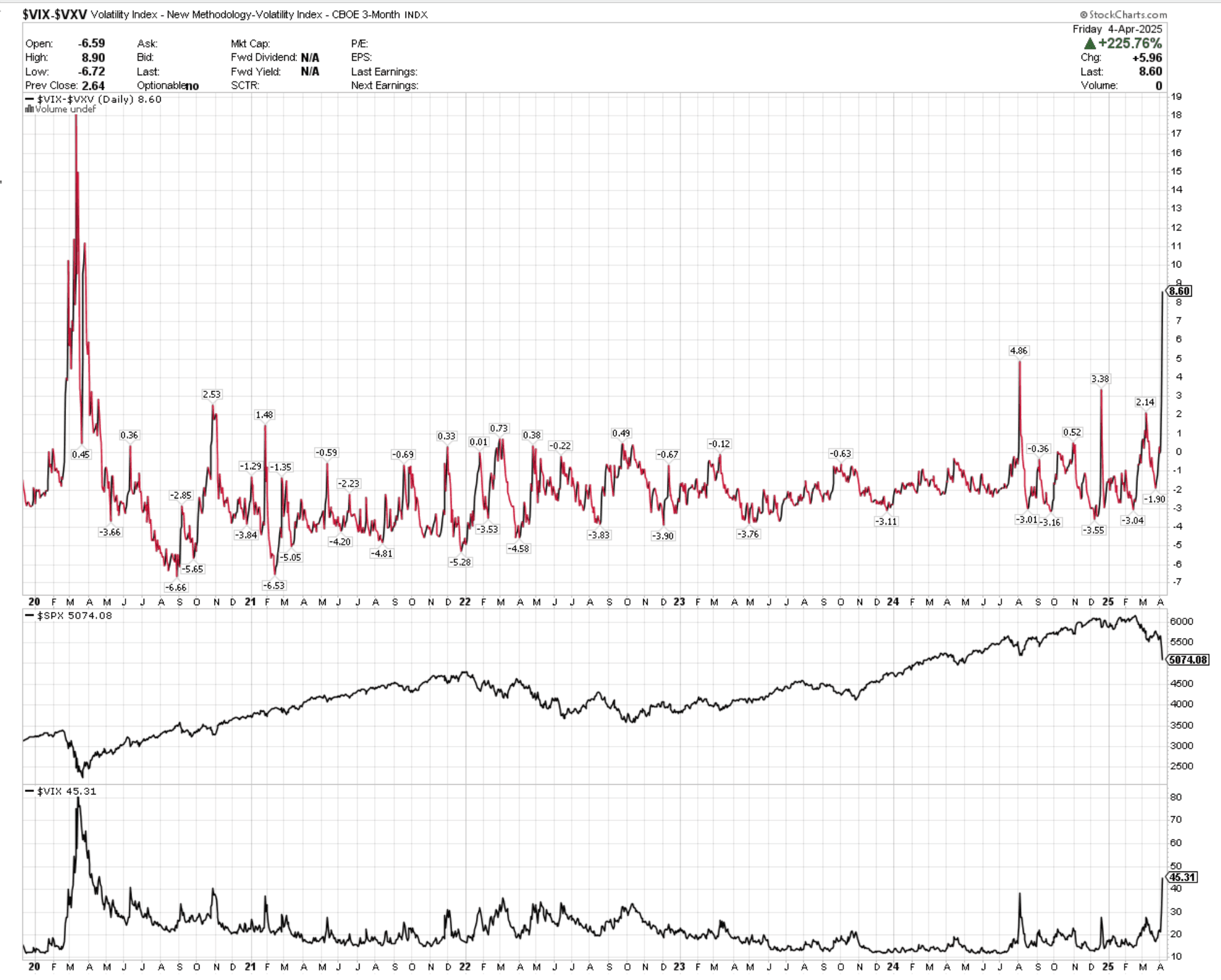

Looking at two historical charts, the first one on the VIX inversion level (top panel) and the VIX level (bottom panel), it appears that the latest sell-off is more consequent than the Tech meltdown of August 2024, but not quite at the level of panic recorded during the latest economic recession, in March - April 2020.

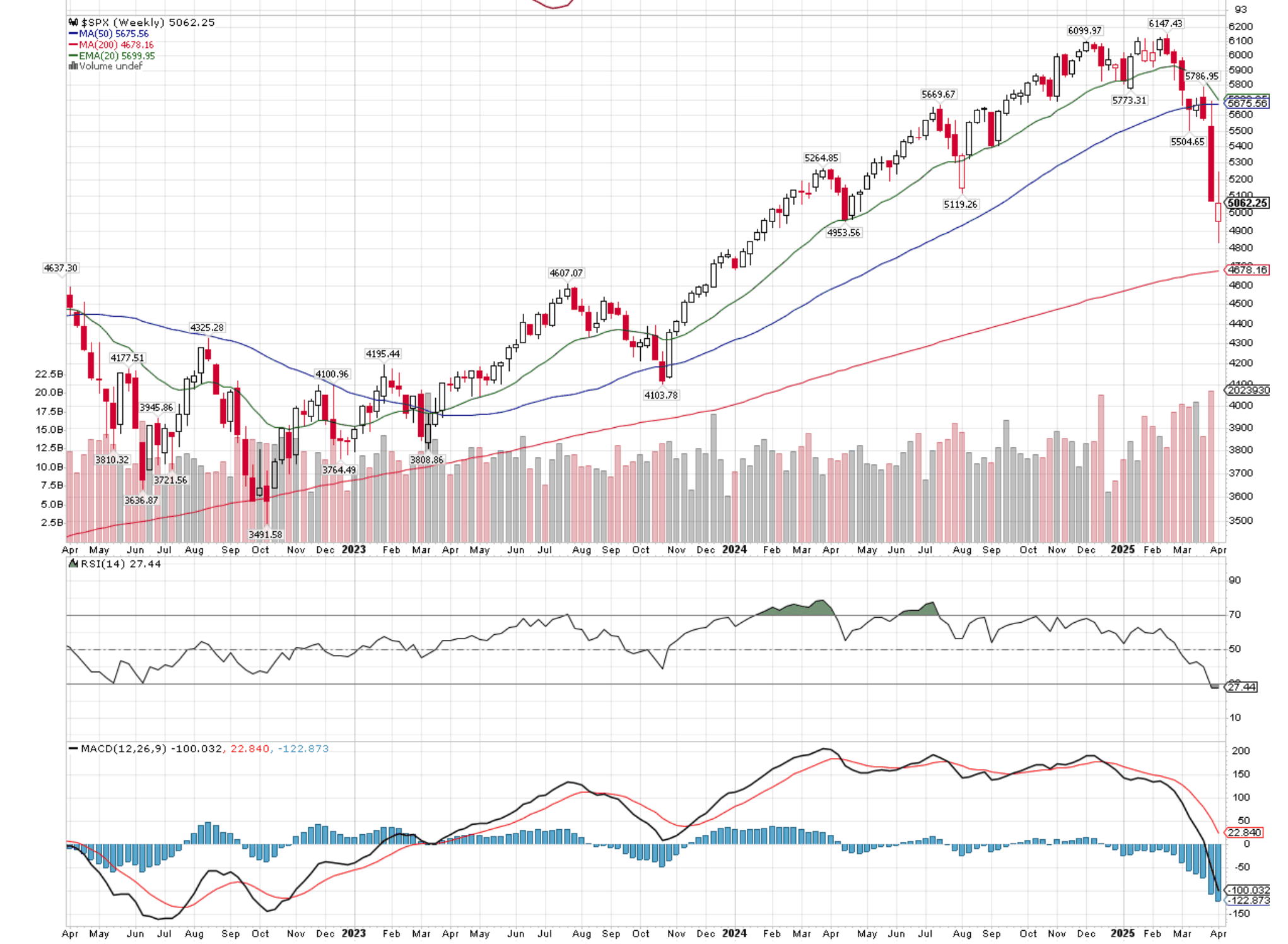

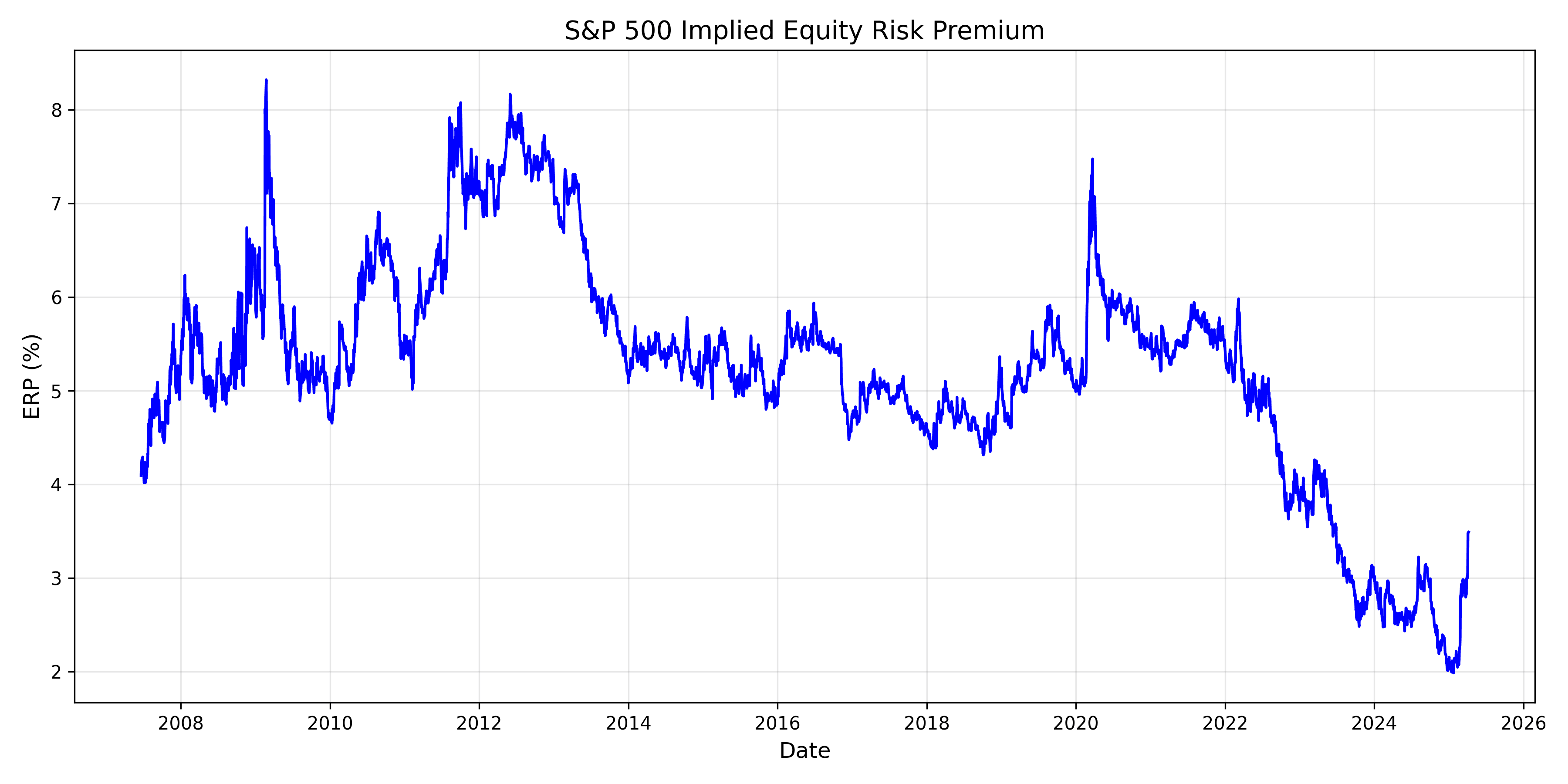

It is a similar pattern if we look at the chart of the equity risk premium for the S&P 500 below, it has moved up sharply after hitting a bottom mid-January, but if we are going to get two-to-three quarters of zero growth in the US this year because of uncertainty/ tariff negotiation lingering, the risk premium is still too low, in our view.

But, hard macro data is doing OK, isn’t it?

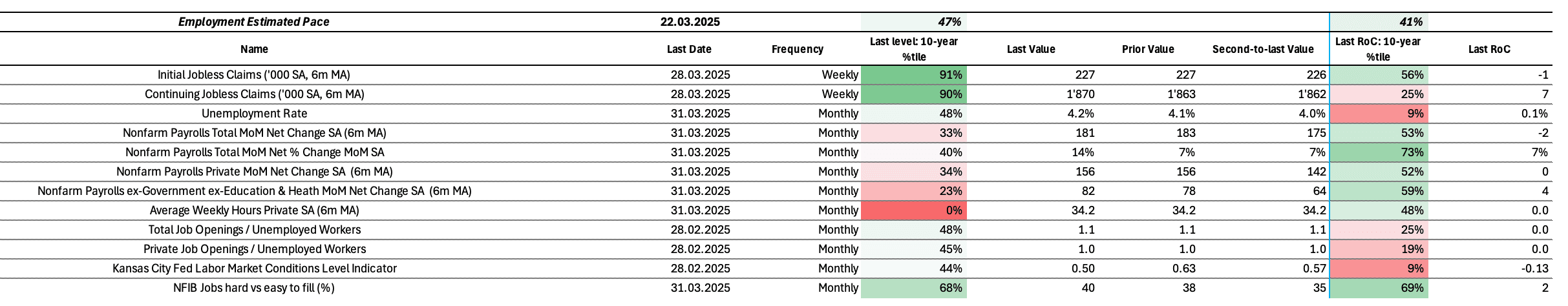

The US March PMIs are consistent with a 1%-1.5% US growth in Q1 and our labor market scorecard is telling us that we are at trend levels, with no clear deterioration, yet.

However, this data is lagging, and the corporate and consumer behaviors that we have highlighted in our base case above are likely to strongly dampen growth in Q2 and maybe even in Q3.

The Fed to the rescue?

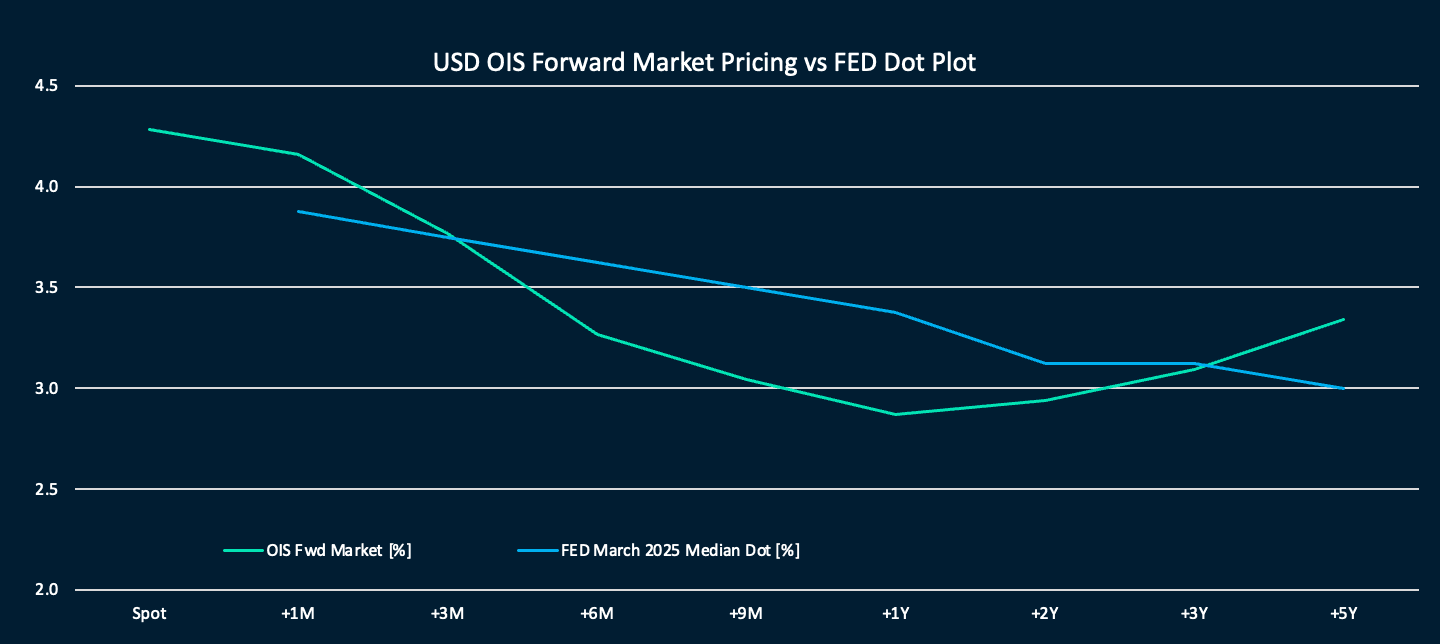

To summarize Fed Chair Powell’s last Friday message, there is still too much uncertainty on the growth/ inflation impact (maybe even a more sustainable impact than previously anticipated on inflation) of the US administration’s policies, and the Chair is comfortable waiting. What would move the Fed to cut rates? A surge in the higher-frequency labor market data, initial jobless claims (so far well-behaved, see our scorecard above). The issue is that the labor market is still lagging other variables, unfortunately (so no Fed put for some time). This being said, rate markets are betting on 4 to 5 rate cuts by year-end. This might be a bit too optimistic, but we do think that the Fed will cut if/ when the labor market does weaken, it will just take some time and some visible economic deterioration.

To wrap up, being patient remains our most favored strategy, in order to build confidence on the scenario of negotiation vs escalation, and also to reach levels of equity risk premia that are closer to 5%+, consistent with a more conservative pricing of slower US growth.

On technical levels, the BTC/USD price is testing its 50-week moving average, the next stops are the low-70ks and then the mid-50ks. The S&P 500 looks like it might be heading towards its 200-week moving average next, or 4.6k.