This is a noisy market, to state a euphemism. In the last few days, equity implied volatility surged above 20 (VIX), crypto prices ascended a few % points one day, and retraced this ascent the following day.

The root cause is of course the interpretation of the US administration’s policy directions, and main intentions: Are these pro-business, purely protectionist, or even on the verge of irrationality?

We take a stab at demystifying the latter. We also review price, volume, and flow patterns to gauge traders’ and investors’ psychological state before issuing some thoughts on how to navigate these markets.

Tariff noise and future market moves

To summarize, only the extra 10%+10%=20% of blanket tariffs on Chinese exports have been implemented so far, bringing the average overall tariff rate on Chinese imports from 20% to 40%.

The rest are just threats so far. True, we are past the March 4 deadline for a blanket 25% tariff on Canadian (except oil, 10%) and Mexican exports to the US, but there remains ambiguity between Commerce Secretary Lutnick’s suggestion of a compromise between the US and Canada/ Mexico, and President Trump addressing the Congress yesterday without mentioning this possible negotiation outcome.

On March 12, all past exemptions on 25%-steel-and-aluminium tariffs are scheduled to expire.

And, what to look “forward” to on April 2: announcements on “sector-specific tariffs” and “reciprocal tariffs”, covering autos, lumber, semiconductors, and pharma. The “reciprocality” will especially target Europe and Canada and their own import tariffs + local VAT/GST taxes on auto/agricultural products, as well as South Korea, India, and China on auto tariffs.

We analyze and attempt to clarify tariffs and other related policies in the three following buckets, with the first bucket being the most positive for US growth and productivity and the last bucket the most “stagflationary”.

Tariffs that make economic sense for the US

Threats that push international companies to invest in the US, especially when it comes to high-added value knowledge and products, are especially valuable for US productivity and long-term economic growth. Bloomberg estimates that such investment pledges have reached USD 1tn so far, and promised hundreds of thousands of jobs. The most high-profile are TSMC with 165bn, Apple with 500bn, and Stargate (the ChatGPT-Oracle-Softbank JV) with 500bn.

We also do see how “reciprocal tariffs” could make sense: if the partner country imposes higher tariffs than the US on the same product, then the US could pressure the country to adjust its tariffs lower, e.g. Indian levies on car imports. This would actually end up with a somewhat “liberal” solution (less trade barriers).

Tariffs that satisfy the “protectionist” electorate

Then there are the ideological “tariffs” that tackle the lower-value-added industries such as metals and aluminum and the agricultural sector. It probably makes more economic sense to import than produce those products locally (especially when it comes to copper, a critical input for semis), but there is an ideology and a target electorate demography behind the tariffs.

We note that the proposed additional tax cuts by the administration also have a “populist” stance: favoring tips, social security payments, and overtime.

Overall, this category of tariff appears inflationary, with no clear impact on growth.

Ambiguous to stagflationary tariffs

Blanket tariffs disrupting integrated and established supply chains like auto and broader manufacturing between the US-Canada-Mexico are stagflationary for the US. The recently published February ISM Manufacturing survey illustrates this impact, with new orders down -6.5 points below 50 and prices up 7.5 points, above 60.

So what is in it for the US? We see a few possible explanations: when it comes to Mexico, China has been using the country as an export base to the US for EVs and other manufacturing products. The US could be using the tariff pressure point to make China’s presence in Mexico more difficult and renegotiate the United States-Mexico-Canada Agreement (USMCA). This is what has been hinted at by Lutnick but unconfirmed by Trump, so far. Lutnick also said that the auto industry could potentially be sheltered from Mexican and Canadian tariffs. Overall, the US’s agenda is less clear for Canada (the fentanyl sticky point seems a bit light to us).

Overall, some tariffs make economic sense, especially as negotiation “weapons”. The problem is that many do not, which could expose the US to retaliations on multiple fronts and be confusing for Corporate America and the US consumers. Treasury Secretary Bessent has signaled a strategy of “short-term pain for long-term gain”. This is valid as long as rising inflation expectations do not materialize into actual inflation and if prolonged uncertainty does not weigh on spending and investment.

One general investment strategy (for TradFi and crypto) is to wait for the noise to pass and for the “good announcements”, probably into the spring, when the tax cut package discussion with Congress starts. This is if one does not wish to trade the ups and downs in volatility and tariff announcements (next big stop, April 2nd).

Crypto America: “Grift Age or New Golden Age?”

“Both!”

The new US administration is made up of politicians, as well as (ex-) businessmen. Politics and business have become more visibly intertwined and aligned in their economic incentives.

Crypto is no exception. Without touching upon meme coins or WLFI, in the presidential circle, there are major crypto names such as Ripple, Coinbase, and Circle. The US asset management and banking sectors are also looking to benefit from new product development and new sources of fees (e.g., BlackRock, Robinhood, Frankin Templeton, Goldman Sachs). That said, the regulatory changes that benefit Corporate Crypto are likely favorable for the sector as a whole.

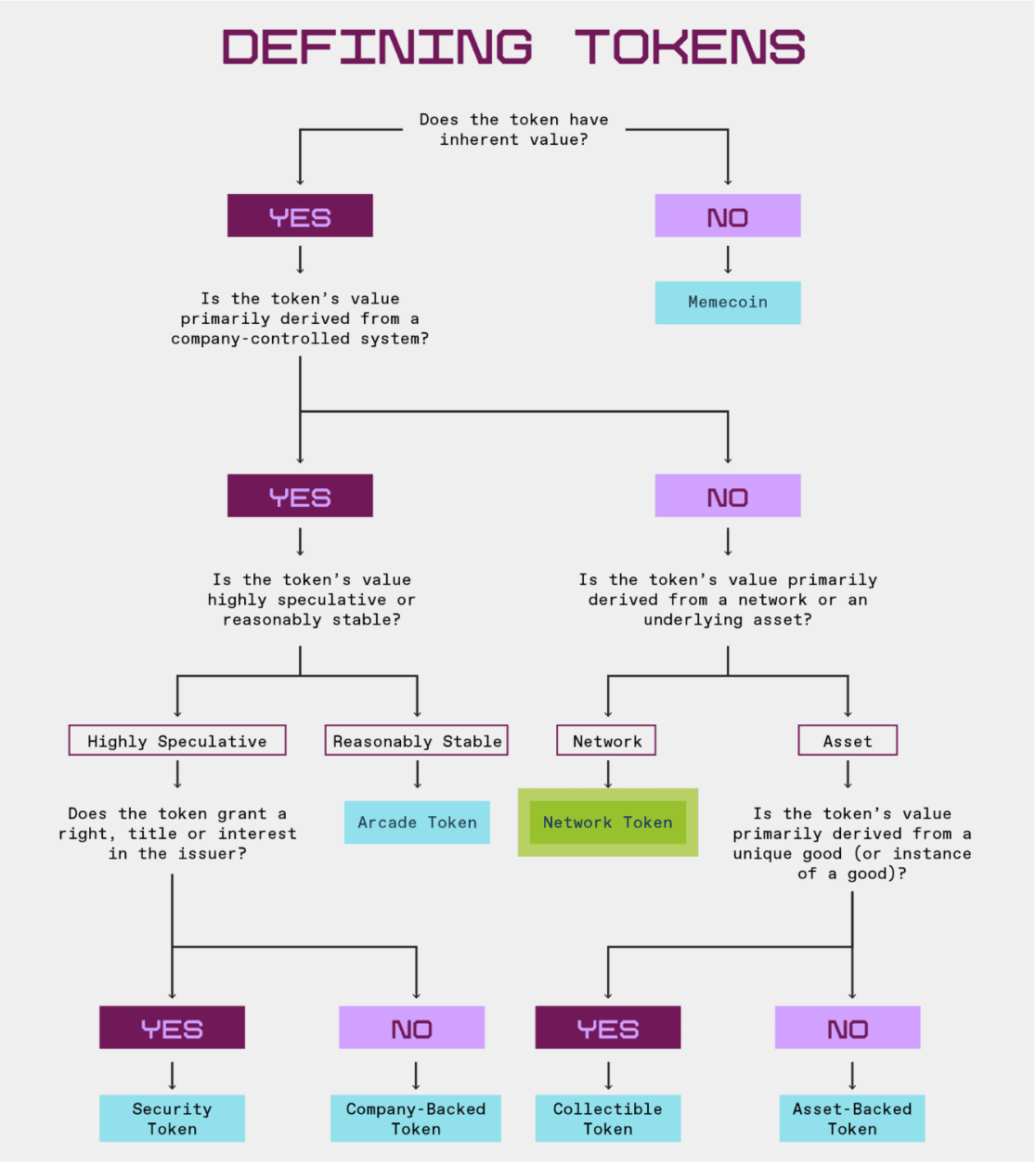

Aside from the ongoing slew of SEC lawsuits against crypto corporations being abandoned, the SEC has proposed to exclude meme coins from the security status, referring to them as “collectibles” instead. We think that more regulatory clarity will come, notably led by the CFTC, together with the SEC, that will leave more tokens outside of the “security” category. This will make it easier to associate tokens with private initiatives in the US.

There are some actual, practical use cases being worked upon, such as making stablecoins efficient, settlement-fast legal payment means, notably for cross-border transactions.

The next milestone for “big crypto announcements” is of course the White House Crypto Summit on March 7th, where Lutnick teased more details on the Crypto Strategic Reserve.

The Crypto Strategic Reserve

What strategic reserve?

A strategic crypto reserve would be equivalent to a fiscal “saving” account. At the state level, Arizona, Utah, Texas, Kentucky, and Maryland are moving to authorize the holding of cryptocurrency as part of state reserves or investment funds.

At the federal level, the reserve, if passed, is likely to have a similar status to that of the Treasury’s gold reserves.

Where will the crypto come from?

If we look at the local states’ crypto reserve processes, which are more advanced, we can see that funds are unlikely to come from diverting existing fiscal revenues or assets to crypto, even at the federal level. For the Federal Reserve, the most obvious source of crypto would be the tokens confiscated by the government in past criminal seizing. The US government currently holds 200,000 BTC or USD 17bn equivalent. That said, some of these holdings are due for restitution to the victims of various hacks and crimes that led to the seizing. Thus, the source of the crypto reserves remains unclear.

Approval process

Local state reserve approvals stand at various levels of Senate/ House clearing processes.

If the US Treasury decides to propose a federal allocation to crypto, the main scenario is that Congress will need to be involved in amending the legislation around Federal assets, and allow digital assets. This is what happened historically for gold allocation.

There could also be a scenario, with a lower probability in our view, where Congress is bypassed. This was the case for Treasury’s FX reserve allocation to EUR and JPY, which was historically decided by the U.S. Treasury and the Federal Reserve. The second scenario would have a quicker implementation timeline than the first, of course.

Monetary vs. symbolic value

When it comes to states’ reserves, there has been a clear cap on how much can be allocated to crypto (max 5% for some States). At the federal level, we have trouble imagining crypto allocation outpacing gold asset allocation in size (USD 11bn as of end-2024). This means that even if crypto assets match gold & silver asset size, they will barely represent a third of Strategy’s current BTC holdings.

Despite a likely low monetary value, the symbolic value of a crypto reserve, if enacted, will likely be significant. Combined with more capital-efficient rules on crypto custody for banks, the crypto reserve announcement would have a strong positive signaling effect for BTC as one of the key assets to hold in a default buy-side strategic asset allocation.

We will not go into the debate about which token should be in the reserve. Bitcoin is the obvious candidate and is also favored by local States.

Other market-moving macro developments

There is a 500bn EUR industrial and infrastructure investment fund (10% Germany's GDP) being touted by the current SPD and CDU parties for Germany. For approval, the two parties will need the support of smaller parties like the Greens, so there is still a probability that the proposal will not pass. That said, this, together with some removal of the geopolitical risk premium linked to the Ukraine war (and the potential rehabilitation of some Nordstream pipelines) is propping up the EUR/USD higher. We are cautious about the move when entering April and the tariff negotiations between the US and Europe.

In China’s annual government work report, a 5% GDP growth target was announced combined with a targeted fiscal deficit of close to 10% of GDP and a primary focus on private consumption, notably through social benefits disbursement. China remains in a slow positive economic momentum, not a boom, and we would be cautious with “pauses” in Chinese equity markets’ recent ascent So far, Chinese developments do not weigh as much as US policy changes for crypto markets, in our view, despite positive signaling around AI investment by the central government.

Price and Flow Patterns

These are the charts that caught our attention because revealing changes in investors’ narratives and sentiments.

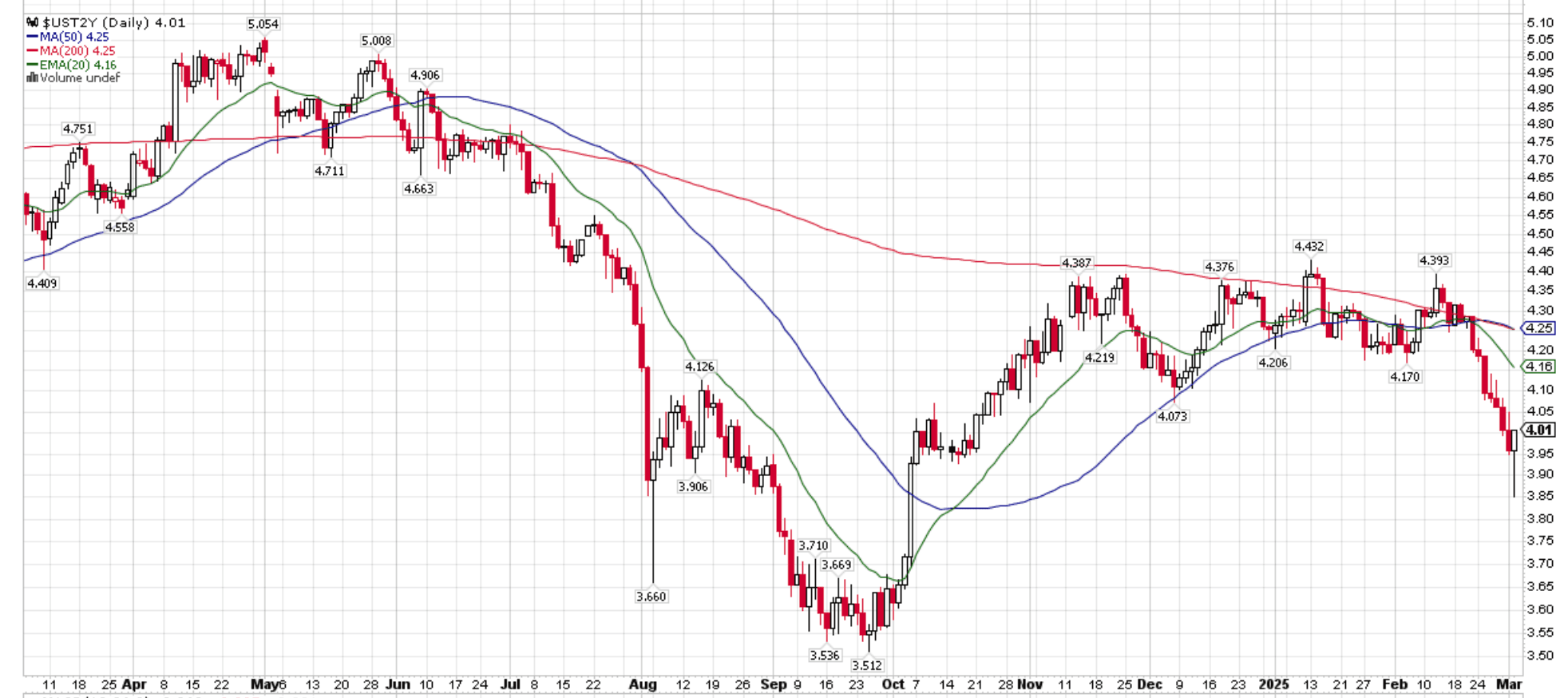

After flattening year-to-date, the US yield curve has been re-steepening, meaning the US 2yr yield is decreasing more than the 10yr, as traders are starting to price more Fed rate cuts, probably as a result of growth concerns linked to February dismal data (this Friday will give a peak into February payrolls, ADP employment growth released today was weak). Fed Chair Powell is speaking on Friday and will maintain his “on hold” guidance we think, which could mark a pause in this move.

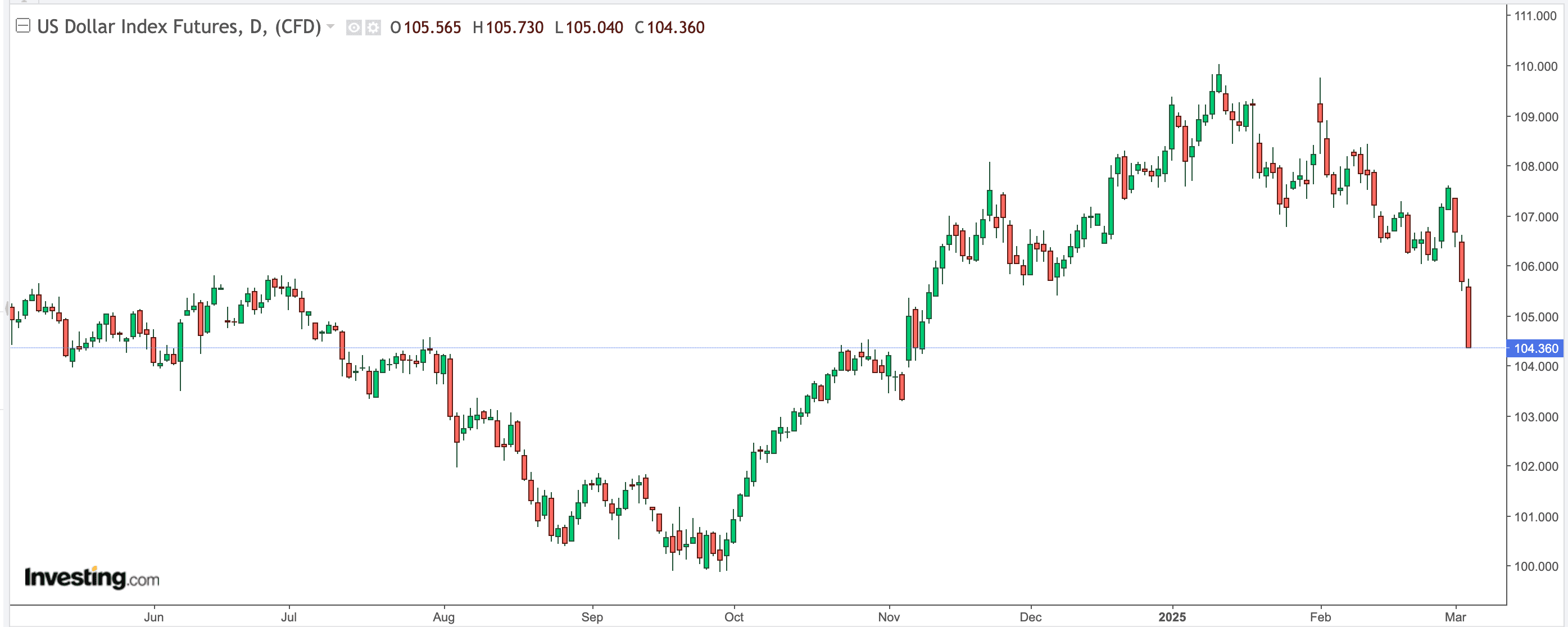

The US DXY index has retraced most of its post-US election move. This is a repricing of Eurozone growth from a dismal outlook to less so (see above) and a shaving of US growth estimates following February's bad data and tariff noise.

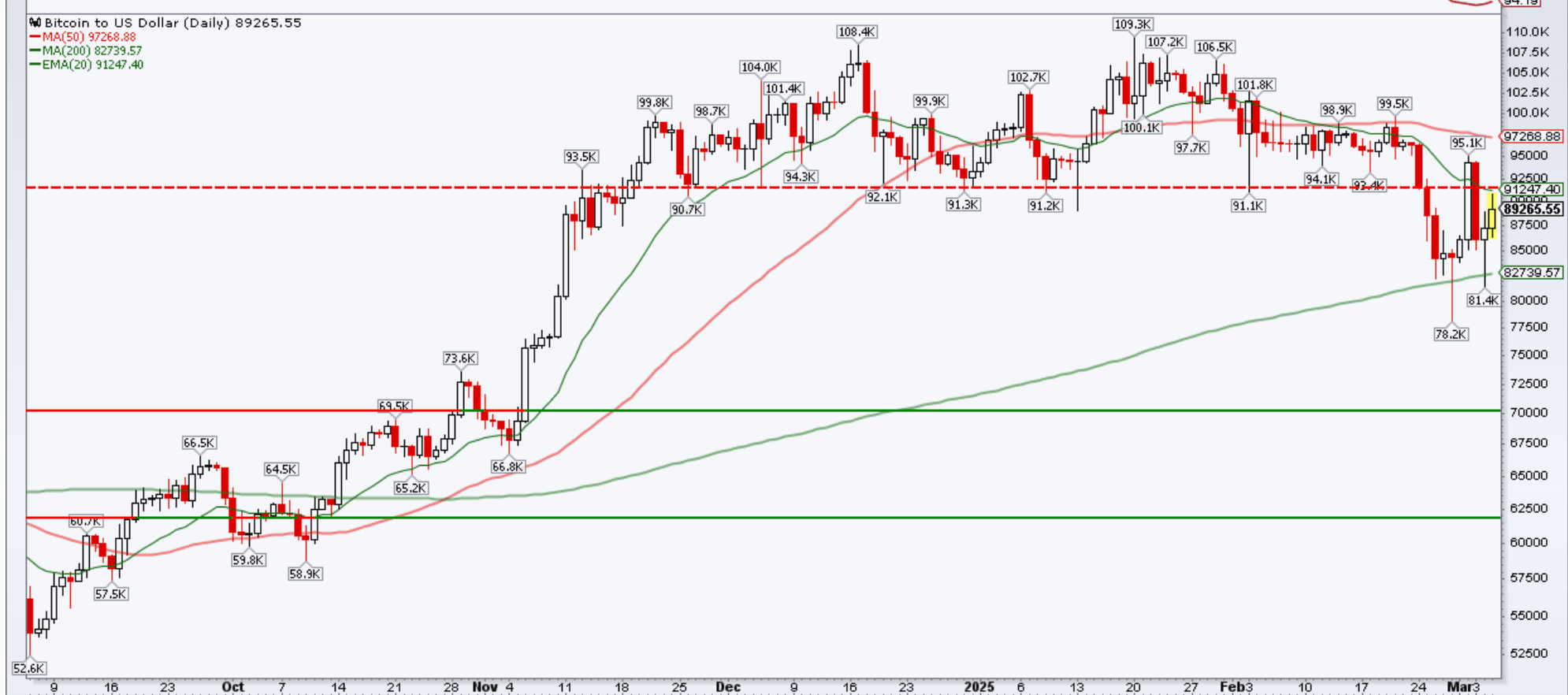

BTC has held and rebounded above its 200-day moving average but remains stuck below its 50-day moving average and 20-day exponential moving average. Enough “good news” are sustaining the largest crypto currency, but there is no strong conviction in more upside at this stage.

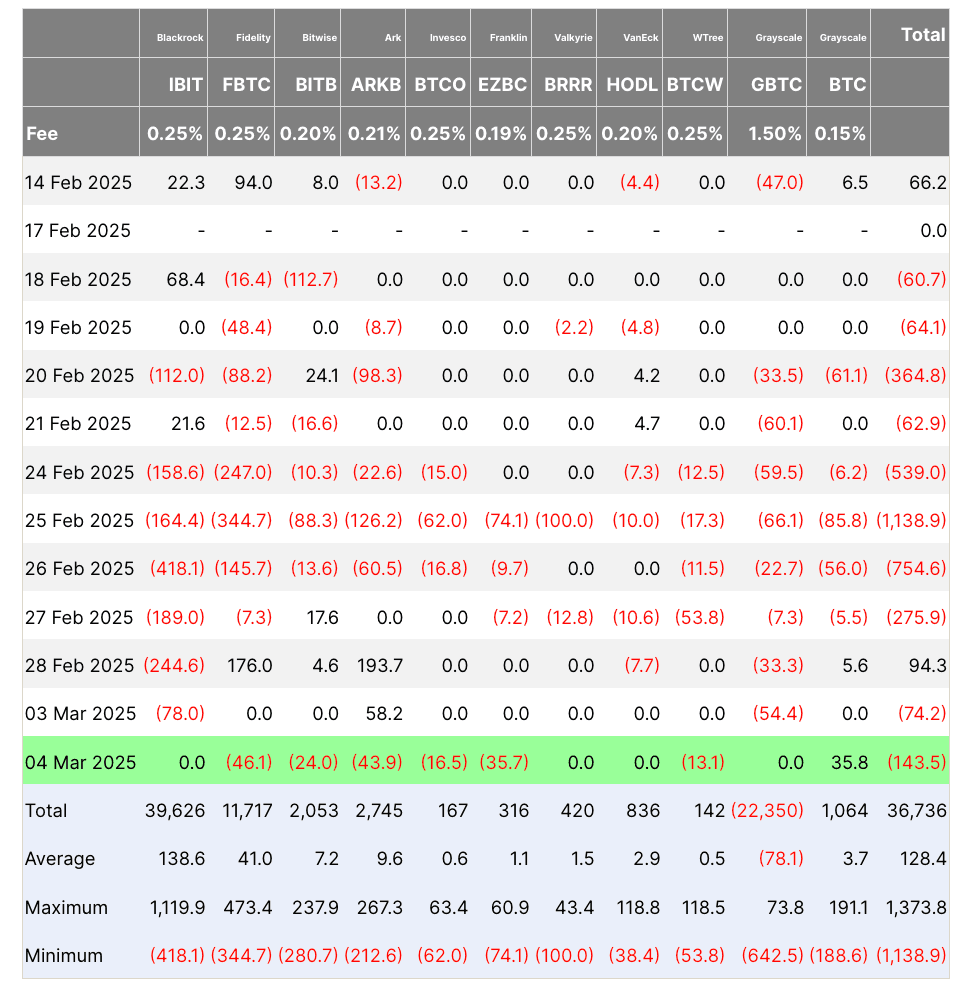

This lack of upside conviction is confirmed by the BTC spot ETF flow picture: nine almost straight days of rather significant net outflows only interrupted by one day of net inflows.

How to navigate these markets?

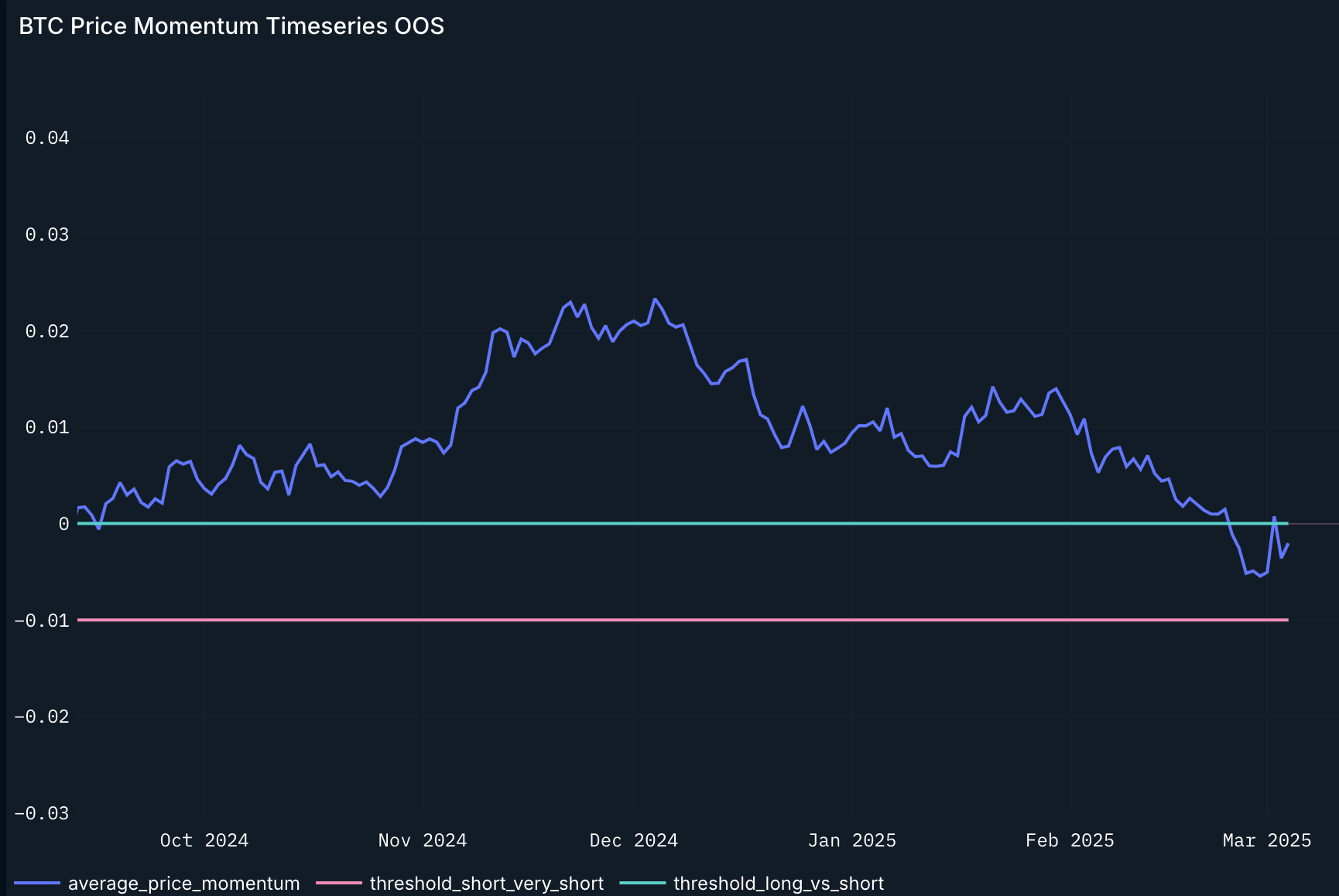

Our BTC Momentum indicator keeps flipping back and forth above and below neutral, which makes it more difficult to take a direction.

For short-term traders, one strategy is to buy around events with the potential for max fear (e.g., prior to a tariff announcement, the next milestone date is April 2) and to sell at local optimism peaks e.g. possibly after the White House Crypto Summit on Friday.

These short-term strategies can work, but they are not our preferred style.

As stated last week, we are looking for:

- Price consolidation (boring price action where crypto starts to slowly post-higher lows)

- Tariff noise mostly tuned out

- Stabilization in Tech stocks (Nvidia’s price moving average is turning south), and a rebound in US macro data

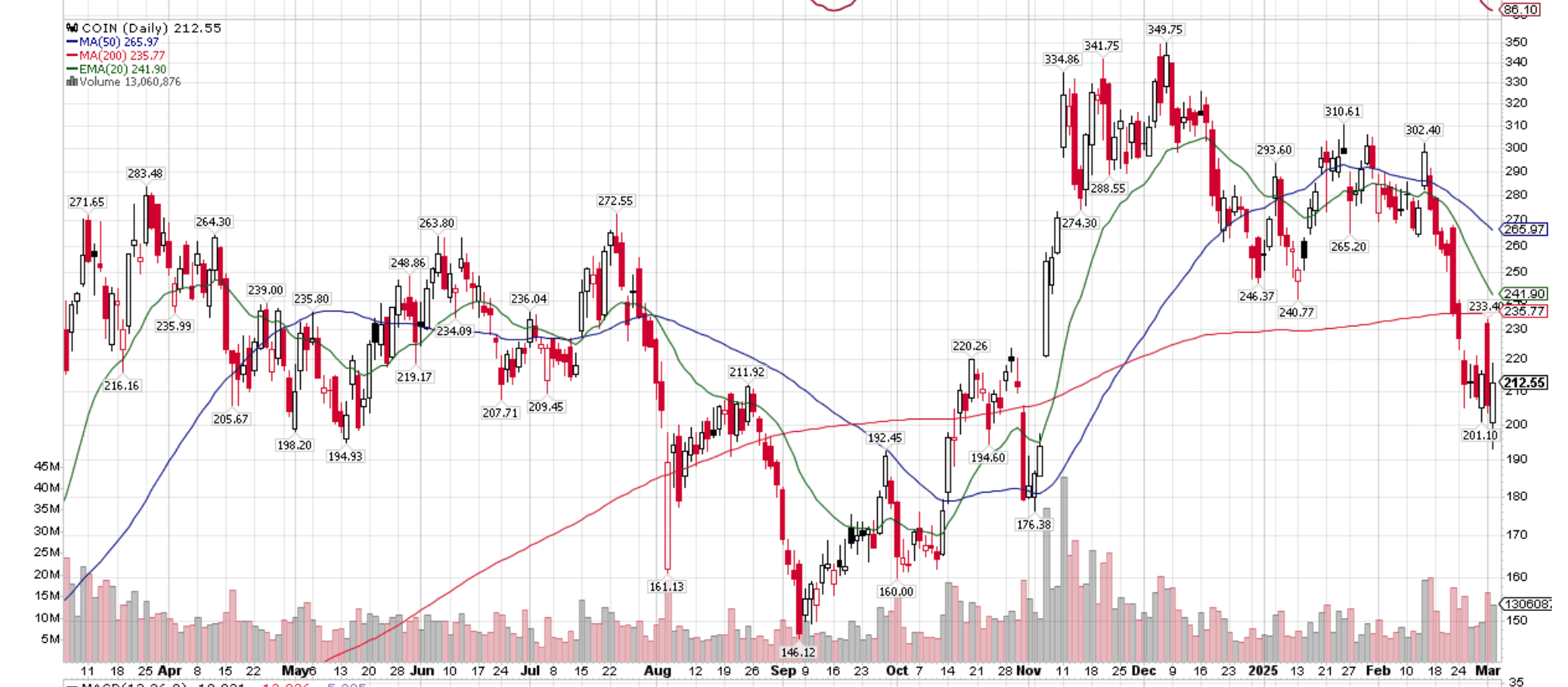

That said, there are some crypto names that we are not allocated to, and that have strong narratives in our view, such as Coinbase, positioned for stablecoin growth via its partnership with Circle, present in the inner “circles” of the US administration, and fostering innovation via its on-chain footprint on Base. While we do not pretend to time the local bottom (technicals notably moving averages do not look great), COIN has retraced most of its post-US election ascent and stands definitely in a better situation than before the election. Therefore, we personally take a small position that we are looking to build longer-term (NFA).