Introduction

Uniswap v4 is the most significant upgrade to the protocol yet, turning the dominant DeFi exchange into a flexible platform for building new financial applications. The core innovation are hooks—customizable smart contracts that let developers plug in their own logic at key points in a pool’s lifecycle. This makes it easy to build bespoke trading features, dynamic liquidity strategies, or entirely new primitives directly within Uniswap itself. Alongside hooks, v4 introduces major technical improvements: dynamic fees, a more gas-efficient "singleton" architecture, and native ETH support.

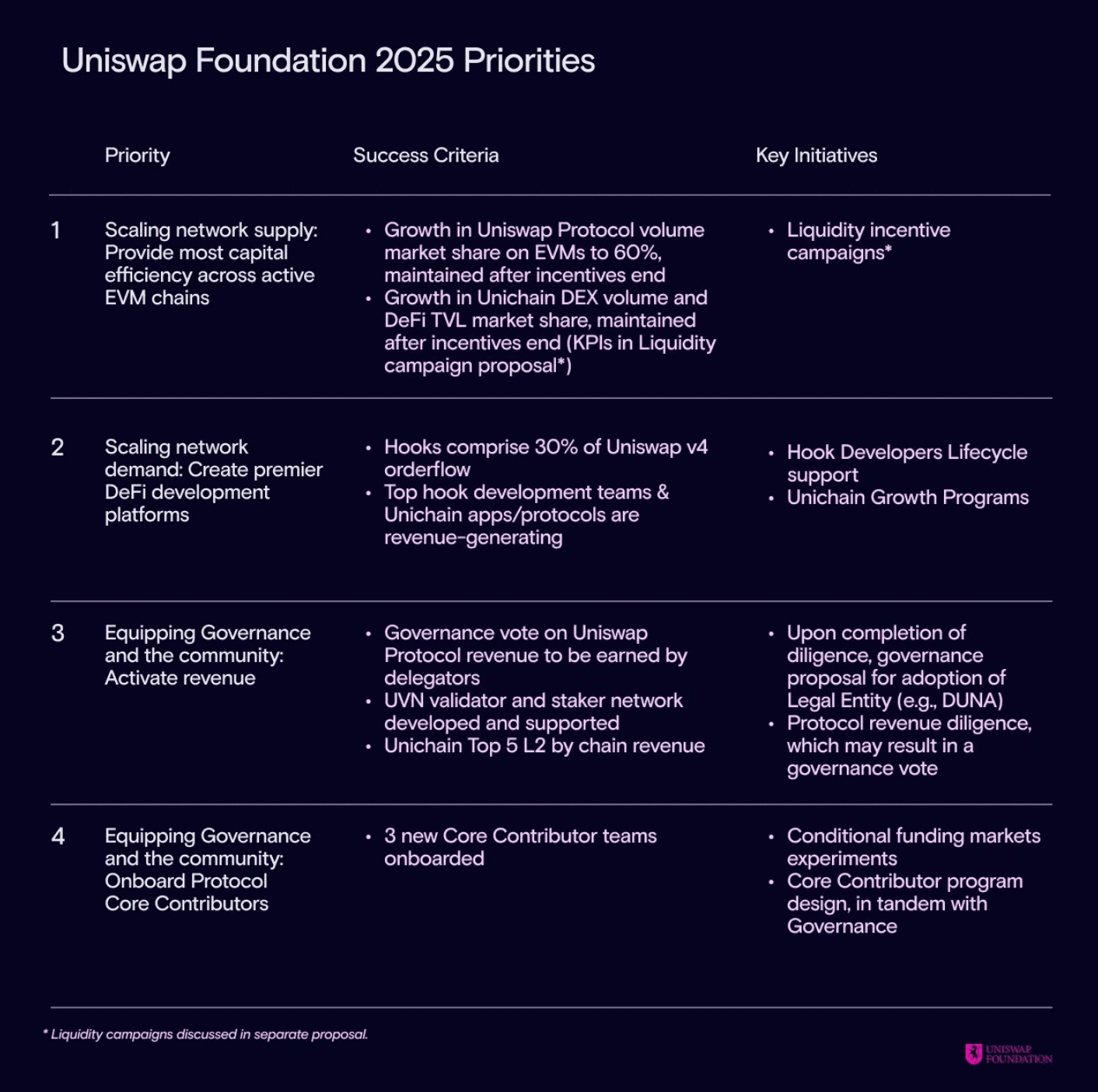

The Uniswap Foundation is betting big on this future, with over $144M in approved incentives and a goal for hooks to drive 30% of v4 volume by year-end. With momentum building and the design space wide open, v4 can become the foundation layer for the next wave of DeFi innovation.

In short, there is a reason why the Base lead is so bullish on v4 and why some teams like Whetstone Research are going all in on v4 given how large the design space for DEXs is becoming.

Why Uniswap v4 Matters

- DEX Innovation: Uniswap v4’s flexibility effectively turns it into a base layer for new DeFi apps. Instead of building a brand-new DEX from scratch, projects can build on Uniswap v4 by writing hooks that modify pool behavior. For example, a team can create a stablecoin swap pool with Curve-like low slippage, a bonding curve token sale, or MEV-resistant trading mechanism just by adding custom hooks on top of Uniswap’s core. This dramatically lowers the barrier to launching new financial primitives.

- Broad Userbase: For DeFi users, v4 means a wave of more sophisticated products: imagine dynamic liquidity pools that auto-rebalance to reduce impermanent loss, or pools that double as prediction markets or lending markets. For institutional players, v4 enables compliant liquidity pools (e.g. KYC-gated pools) without forking or altering the core protocol. In short, Uniswap v4’s modular design lets builders tailor liquidity pools to specific use cases.

Uniswap v4 is not just an incremental upgrade for Uniswap; it’s a shift from a one-size-fits-all AMM to a configurable liquidity engine. This matters because it broadens the scope of Uniswap as a protocol, combining the liquidity depth of Uniswap with custom logic – enabling novel services like onchain advanced order types, automated yield strategies, risk management tools and coupling other DeFi components tightly together with the underlying DEX (i.e lending, etc.). In simpler terms, this would imply that many popular DEX/token issuance designs today could simply be built as a hook, rather than its own implementation (i.e Pumpdotfun as a hook, MEV-focused DEXs like CowSwap as a Hook, etc.). We are already seeing this happen today and will explore these projects below.

Notable Projects Leveraging Uniswap v4

The potential of Uniswap v4 is best illustrated by the early projects building on it. Uniswap Foundation already set it 2025 priorities, with hooks at the forefront and a successful proposal to support lots of fresh funding for new developments.

Coinbase Verified Pools - Onchain Adoption

Coinbase Verified Pools integrate Coinbase’s institutional-grade KYC/AML standards verification directly into Uniswap v4 pools, offering institutions compliant, secure access to decentralized liquidity. This marks a significant step toward broader institutional adoption of DeFi and v4 hooks in general.

Bunni – Automated Liquidity Optimization for LPs

Bunni is a DEX built on Uniswap v4 that automates liquidity management to maximize LP profits, making up over 90% of Uniswap v4 volumes today. LPs deposit funds, and Bunni uses v4 to manage positions dynamically, adjusting liquidity across price ranges in response to market shifts ("shapeshifting" liquidity) and autonomously rebalancing token ratios. It uses rehypothecation hooks to deploy idle LP funds into external yield-generating opportunities until they're needed. Additionally, Bunni optimizes fee revenue through volatility-based dynamic fees and an auction-based fee-setting mechanism. By integrating AMM functionality with active market-making and lending strategies, Bunni turns liquidity provision into a passive, optimized investment, reducing impermanent loss and significantly boosting capital efficiency.

It went live at the end of January 2025, and is currently the largest hook on top of Uniswap v4 and has seen strong adoption so far, live on Ethereum, Base and Arbitrum. You can checkout its growth in volumes here, along with potential farming opportunities such as the Flaghip USDC-USDT vault which is yielding up to ~13% at the time of writing.

Flaunch – Token Launchpad

Flaunch is a token launchpad built on Uniswap v4 that facilitates token launches, primarily on Base network. It leverages Uniswap v4's custom hook framework to enforce rules like redirecting 100% of trading fees directly to developers, providing project teams immediate revenue in ETH without needing to sell tokens. Additionally, it integrates automated buybacks using accumulated fees, creating sustained buying pressure through a hook called “Progressive Bid Wall”. Most distinctively, Flaunch implements a short "price-lock" or no-sell period (~30 minutes) at launch to prevent immediate dumping. Flaunch is currently live on Base, has successfully launched several memecoins, and demonstrates a compelling narrative for the next run in onchain speculation.

Angstrom – MEV-Resistant DEX Design

Angstrom is a DEX built by Sorella Labs designed to mitigate MEV issues like front-running and sandwich attacks. Built on Uniswap v4, it leverages custom hooks to implement app-specific transaction sequencing, replacing miner-driven ordering with an internal mechanism that actively prevents harmful trade sequences. Additionally, Angstrom employs a transaction auction, enabling traders or arbitrageurs who seek priority to bid, with proceeds redistributed to liquidity providers as rewards—capturing MEV value for LPs instead of bots or miners. This innovative approach embeds MEV resistance directly within the DEX, potentially improving prices for traders, aligning incentives, and making arbitrage beneficial to LPs. You can check out some of the great research they are doing on issues they are tackling such as loss-versus-rebalancing (LVR) here, aiming to protect LPs from the constant arbitrage between DEXs and CEXs.

Cork Protocol – Hedging Stablecoin Depeg Risk

Cork Protocol, built on Uniswap v4, enables onchain hedging and insurance markets for stablecoins and liquid staking tokens (LSTs/LRTs). It tokenizes the risk of depeg events, allowing traders to price and hedge against these risks across various sectors.

Lumis – Structured Liquidity Protocol

Lumis is a non-custodial liquidity protocol that integrates spot, derivatives, and lending markets using an app-specific sequencer. This design enables atomic composability and instant position updates, facilitating efficient hedging strategies. Lumis offers a delta-neutral stablecoin and synthetic ETH vaults, providing users with advanced tools for liquidity provision and risk management. You can checkout the full breakdown in their blog here.

Use Cases With Uniswap v4

Beyond some of the popular hooks mentioned above, developers continue to experiment with diverse applications on Uniswap v4. There are projects spanning advanced onchain trading, prediction and event markets, optimized AMMs for stable and yield-bearing assets, and much more. These examples highlight the breadth of what’s now possible, including the Unichain hackathon winners from 2025.

- Unipump – Implements a custom bonding curve via Uniswap v4 hooks to let new tokens launch directly on Uniswap, turning the DEX into a primary launch platform for tokens. Winner of the Uniswap Foundation’s Infinite Hackathon.

- Prediction Market Hook – A hook that allows any Uniswap v4 pool to host prediction markets, letting users bet on whether a pair’s future price will be above or below a certain level. Built by Shift0x, it was also a winner of the Infinite hackathon and it helps remove centralized components of traditional options and enables LPs to even hedge price swings with onchain leverage.

On top of the most recent hackathon winners, Uniswap v4 was also open sourced a while ago and the community has already built many hooks spanning different use cases.

- Cross-Chain Liquidity – A hook that transfers a user’s liquidity position to another chain behind the scenes, so LPs don’t have to manually bridge assets. This cross-chain liquidity prototype showcases how Uniswap v4 hooks can integrate bridge logic, simplifying multi-chain liquidity management for users.

- Arbitrage Controller – A dynamic fee hook that adjusts swap fees based on recent price movements to discourage toxic arbitrageur order flow. Built as a proof-of-concept at ETHGlobal NYC 2023, it mimics TradFi’s dynamic spreads to improve LP returns while keeping liquidity provision passive.

- Backrunning Hook – Captures arbitrage opportunities that occur right after a swap and redistributes the profit to the pool’s liquidity providers instead of MEV bots. This “MEV rebate” hook concept shows how v4’s hooks can capture MEV and return it to LPs, increasing profitability of LPs.

- Diamond (LVR Hook) – A proof-of-concept by Arrakis Finance that uses a Uniswap v4 hook to minimize loss-versus-rebalancing (LVR) for LPs by forcing the arbitrage trade to happen at the start of each block. Usually, this cost is incurred by LPs who take the brunt of the constant arbitrage between the pricing of DEXs and CEXs. This hook requires MEV arbitrageurs (block builders) to commit and pay for that block’s price move, showcasing another way of protecting LPs using advanced MEV mitigation.

This was just a short list of apps and potential use cases, but there are many more including margin trading on LIKWID and many others, including those that received grants/subsidized audits from the foundation here. As noted from the above, we can group many of the projects building hooks under a few high level sectors:

- Token launchpads

- MEV mitigation to protect LPs/traders

- Capital efficiency gains creating new yield opportunities

- New trading tools for risk management

- Margin Trading/Options

- Permissioned pools

In short, hooks continue to expand what is possible on a DEX today and we are excited about the continued adoption, funding and innovation we are seeing well into 2025.