Overview

Arbitrum recently announced Arbitrum Odyssey - a 2-month long initiative to drive growth of the ecosystem. Although there has yet to be an official statement regarding a potential ARBI token, the team did not confirm nor deny the speculations.

We’ve seen similar initiatives with other L2s like Optimism, where they recently announced the Optimism Collective. When the Optimism token was announced, Steven Goldfeder (@sgoldfed) from Arbitrum tweeted, “The appetizer is always served before the main course”. Whether or not this is related to the potential Arbitrum token in the foreseeable future, there are opportunities to explore the wider Arbitrum ecosystem.

Enter Arbitrum

Our team published a report on Arbitrum in February which covered the technicalities of optimistic rollups, Arbitrum dApps, a comparison table of L2s, Arbitrum user experience, and more.

In optimistic rollups, transactions get submitted without any proof, however, anyone can check if transactions are valid - if they are proven to be incorrect, the fraudulent transactions will be reverted, the dishonest validator will have their stake slashed, and the watcher rewarded. Link to the full report here.

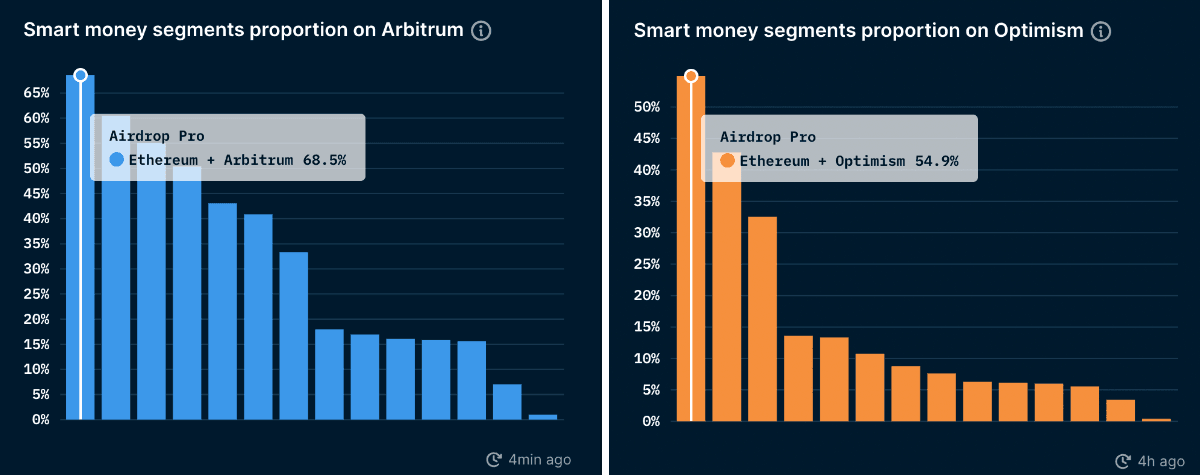

Interestingly, the smart money segment proportion on both Arbitrum and Optimism is largely dominated by “Airdrop Pro” wallet addresses. The smart money segment proportion is a telling indicator of smart money addresses on Ethereum with substantial activity on Arbitrum and Optimism.

Arbitrum Nitro Upgrade

Arbitrum Nitro is essentially an upgrade from the current Arbitrum One (mainnet) to Nitro. In short, it adopts notable languages/tooling like WASM, Geth, and Golang. Why does this matter? This will spearhead a much faster transaction time creating a network effect to incentivize more users to enter the Arbitrum ecosystem. According to Offchain Labs, transaction fees following the Arbitrum Nitro upgrade will be cut by at least 50%, which are typically around $0.50 to $1 at the time of writing.

The Nitro stack is built on several innovations. At its core is a new prover, which will perform Arbitrum’s current interactive fraud proofs over WebAssembly (WASM) code. This means that the L2 Arbitrum engine can be written and compiled using standard languages and tools. In normal execution at this point in time, validators and nodes run the Nitro engine compiled to native code and only switch to WASM if fraud proof is detected. With the introduction of Arbitrum Nitro, the core component is replaced by Geth, the EVM engine that defines the Ethereum standard right to Arbitrum.

Arbitrum Odyssey

Arbitrum Odyssey is a 2-month long initiative to give users the ability to experience different Arbitrum ecosystem projects and in return, will be rewarded with exclusive NFTs designed by Ratwell and Sugoi. If you’re not familiar with these names in crypto, Ratwell and Sugoi are the head designers for the Tubby Cat NFT collection, and have paved the way for many other illustrations for notable crypto personalities.

The thinking behind the Arbitrum Odyssey initiative is simple: to reward users for onboarding into the Arbitrum Ecosystem.

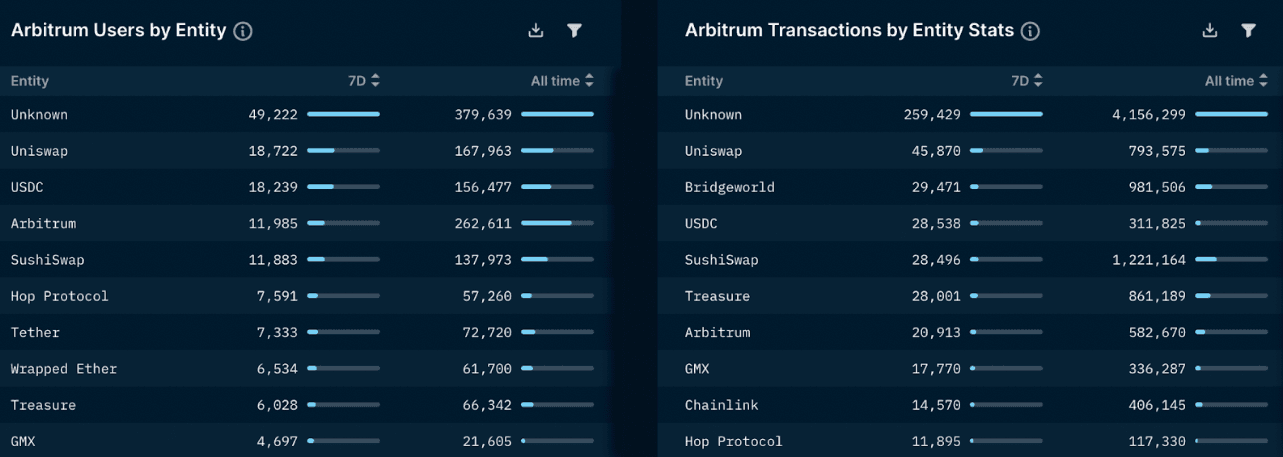

As covered in our earlier report on Arbitrum back in February, Arbitrum has a thriving ecosystem of dApps and a TVL of ~$1.7b (at the time of writing).

With the growing ecosystem, the initiative makes perfect sense - rewarding users via NFTs for exploring the many dApps. Users will have a chance to experience the different projects built on Arbitrum and be rewarded for doing so. At the end, any user who has collected at least 12 of the 15 NFTs will receive the most exclusive and final arbi-verse NFT designed by Ratwell and Sugoi. Although the purpose of these NFTs has yet to be revealed, this might potentially be useful later down the line. Instead of pure speculation, users can directly participate and get involved with the dApps.

Earlier, it was announced that the following 56 projects will be included in the first round of this initiative (view chart below).

Out of the 56 projects included in the first round of the initiative, different communities came together and voted for the Top 14 protocols. Here are the Top 14 protocols chosen for the first round of Arbitrum Odyssey:

| Protocol | Description |

|---|---|

| Yield Protocol | Collateralized fixed-rate borrowing and lending on Ethereum/Arbitrum |

| HashflowNetwork | Bridgeless cross-chain swaps |

| Aboard Exchange | The order-book decentralized derivatives exchange |

| Tofu NFT | Multichain NFT marketplace |

| Uniswap | AMM protocol |

| Official ApeX Dex | A decentralized derivatives protocol |

| 1Inch | A collection of composable decentralized financial instruments |

| Izumi Finance | A multi-chain DeFi protocol providing one-stop liquidity as a service (LaaS) |

| Breeder Dodo | A decentralized trading protocol for Web3, powered by the proactive market making (PMM) algorithm |

| Swapr ETH | Swapr is a multichain, governance-enabled AMM based on a fork of Uniswap, governed by @DXdao_ |

| TreasureDAO | A series of metaverses governed by their in-game currency $MAGIC |

| BatteFly Game | DeFi strategy game powered by TreasureDAO, $MAGIC |

| Idea Market | The credibility layer of the internet |

| SushiSwap | A community-built platform for DeFi apps including trading, lending and leverage |

Voting Updates (Updated on 10 May)

Week 1: Bridge Week Week 2: Yield Protocol and Hashflow (changed to GMX) Week 3: Aboard Exchange and TofuNFT Week 4: Uniswap and Apex Week 5: 1inch and Izumi/Yin Finance Week 6: Dodo and Swapr Week 7: TreasureDAO and Battlefly Week 8: Idea Market and Sushi

The Arbitrum team is still working with the participating protocols, Ratwell & Sugoi, and Project Galaxy to figure out what actions will need to be completed to participate in the Arbitrum Odyssey. For now, it might be worth it to explore these dApps on Arbitrum and test it out accordingly.

Updates to the Arbitrum Ecosystem

GMX

- Paraswap integration with GMX

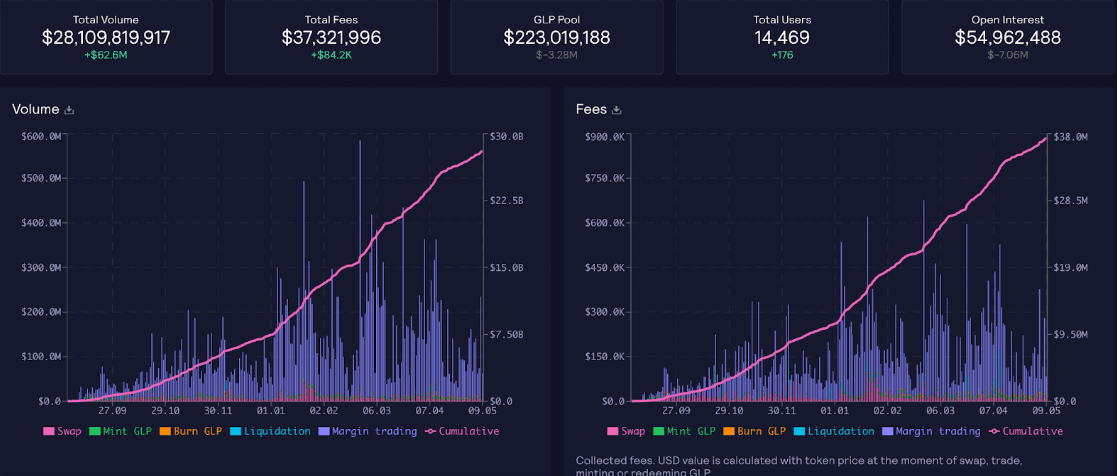

For context, GMX is a decentralized derivative platform and spot platform. Users can leverage trade and swap assets directly on the platform. Paraswap’s integration with GMX can be attributed to GMX’s swap function.

Exchanges need deep liquidity whether through a central order book model (CLOB) or typical decentralized automated market maker (AMM) model. GLP stakers receive 70% of the platform fees in ETH and esGMX, which incentivizes users to deposit assets as liquidity on the GMX exchange and as a result, they mint GLP (which represents shares in the GLP pool).

In the case of Arbitrum, holders of GLP token earn escrowed GMX rewards and 70% of the platform fees distributed in ETH. For Avalanche, holders of the GLP token earn escrowed GMX and 70% of the platform fees distributed in AVAX. Simply put, as GLP holders provide liquidity for leverage trading, they make profits when traders make a loss, and the same goes for the counterparty. Token weights are adjusted to help hedge GLP holders based on the open positions of traders.

| Scenario | Get lower fees if... |

|---|---|

| Current weight > target weight | Swap tokens for native token |

| Current weight < target weight | Swap native token for other tokens |

The AUM and GLP supply has also seen exponential growth ($230m+ in Arbitrum, more than a 2x growth) since December 2021.

- X4: Protocol Controlled Exchange Launch

Some of the main features of the X4 launch include:

- GMX Swap

X4 converts the AMM from a place to trade into a platform for different projects to build on. “The platform would provide a service to projects by having a ready-to-use swap interface, liquidity, volume and fee tracking as well as integrations with charting and utility providers, freeing developers to focus on other aspects of their protocol.”

- PVP AMM

PVP AMM is an AMM for leverage trading that matches traders against each other. Traders can provide collateral to go long/ short. Moreover, funding rates are paid based on the ratio between the longs & shorts.

- esGMX Emissions

A recent proposal was made to reduce the amount of esGMX emissions for GLP on Arbitrum. The proposal stated to reduce the amount from 100,000 esGMX to 50,000 esGMX for April and 25,000 esGMX starting May.

Another idea that was suggested is to have the emissions be dynamic. How this would work is by having a target APR for GLP. For example, the team would have a target APR of 35% for April 2022 and 25% starting from May 2022.

Full details here.

Vesta Finance

Vesta Finance is a lending protocol launching on Arbitrum that offers borrowers interest-free lending with low collateral requirements. Full report by Nansen Alpha here.

Updates from the Vesta Finance team:

VSTA Staking Module - Hearth

The VSTA governance token currently lacks meaningful utility and value accrual mechanism(s). The team is working to implement a governance staking module that ensures governance votes are cast by those who are long-term believers in their protocol. They are currently seeking comments before they launch the staking module, users can still participate here.

The governance staking module would allow users to either stake or lock the VSTA liquidity pool token. This will entitle users to receive rewards and protocol revenue which can be further staked or withdrawn. They are planning to roll out the staking module in Q3, 2022.

TreasureDAO

- TreasureDAO x StriderDAO partnership (Link here)

Here, Nansen has also covered a full report outlining TreasureDAO’s ecosystem for context.

TreasureDAO is teaming up with StriderDAO and a former lead designer from one of the world’s leading MMORPGs to build one of the first bottom-up AAA NFT and Web3 Game studios.

“Strider has a vision for making games that align with the organic and community-centric nature of the Treasure ecosystem, they want to not only make great games but also utilize the power of Web3 to make the experience of being a community member fresh and fun”.

The team mentioned that they currently have more than 50 projects underway, and this AAA project currently codenamed “Project Bilbo” will serve as a powerful synergy to showcase the collaborative efforts of TreasureDAO and their ecosystem.

Full medium article here highlighting their partnership with StriderDAO.

- BridgeWorld Litepaper updates here

Other Potential L2 Airdrop Strategies

NFA, this is a list of potential retroactive airdrops from various L2s - none of which are confirmed until there is an official announcement from the team.

zkSync

zkSync is a layer-2 scaling solution designed to provide users with the ability to make Ethereum transactions cheaper and near-instant. zkSync is currently the 7th largest L2 by TVL, with $82.85M.

zkSync updated their whitepaper last month with a confirmation that there will be a token. Previously during an AMA with their co-founder, he made a statement that zkSync is focused on full EVM compatibility and they want the network to be owned by the community in every regard.

Here are a few easy ways to get involved with the zkSync ecosystem:

1. Use Argent Wallet

Argent is a pioneering social recovery wallet. They let you indicate a “guardian” if you were to lose your wallet’s signing keys.

To create a zkSync wallet on Argent, you can follow these simple steps:

- Open up the wallet and users will be presented with two options: L1 Ethereum account and a zkSync account

- Once the funds are moved over to zkSync, you’re all set to explore the various opportunities on L2.

2. Trade on Zigzag exchange

Zigzag Exchange is an Ethereum Layer-2 (L2) decentralized exchange (DEX) built on blockchains utilizing Zero Knowledge (ZK) rollups.

How to trade on Zigzag exchange:

- Bridge funds from ETH to zkSync (which can be done via Argent wallet above)

- Once completed, you can start trading on Zigzag — it functions similar to an order book exchange like Binance.

- To view your order status, you can directly click on the zkScan explorer.

3. Donate on Gitcoin

Gitcoin hosts Gitcoin Grants every quarter, for communities to donate and fund open-source projects. Since 2020, Gitcoin Grants have also integrated zkSync as a method to make donations.

Aztec

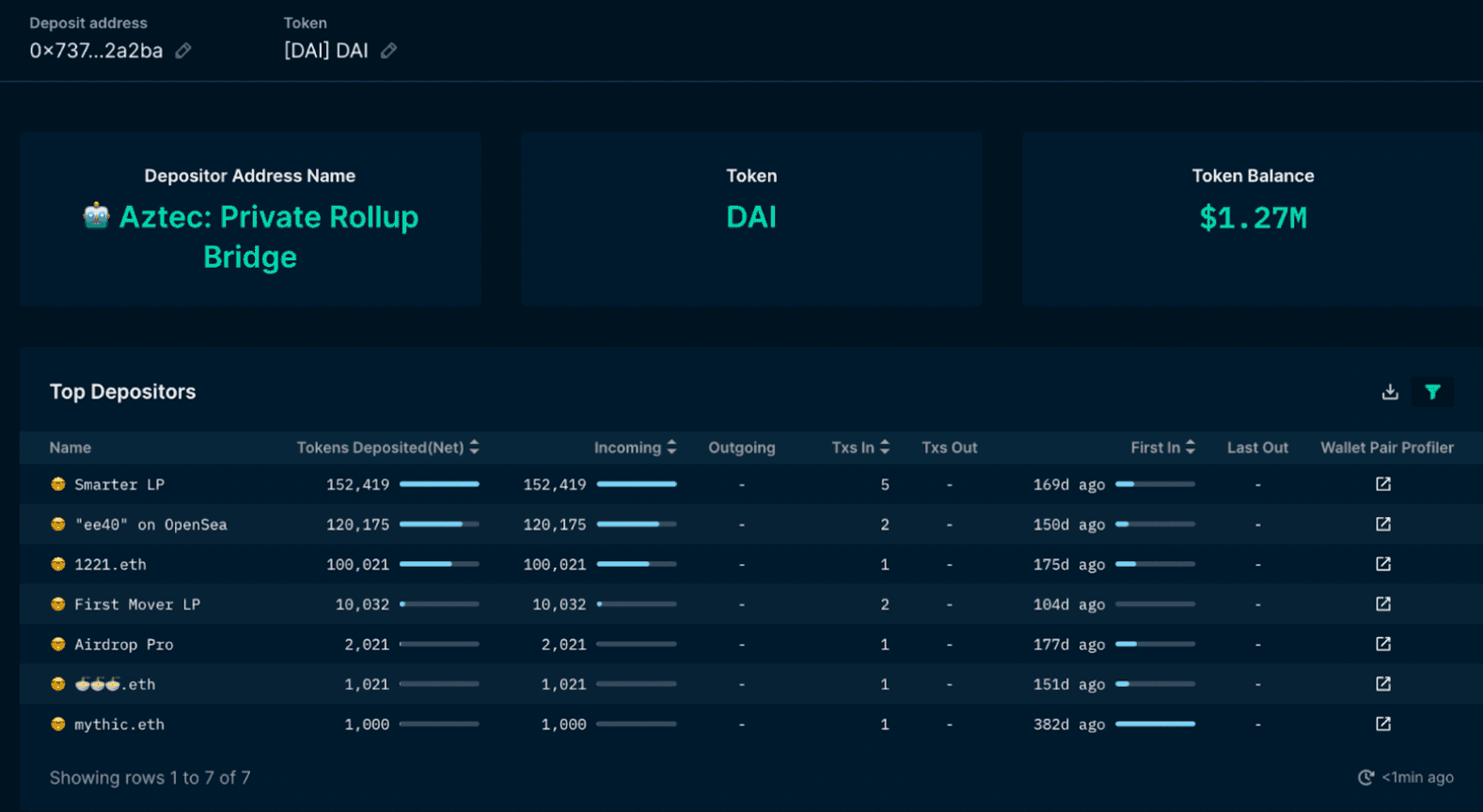

Aztec is an open source layer-2 network bringing scalability and privacy to Ethereum. Aztec uses zk-SNARK proofs to provide privacy and scaling via their zk-Rollup service.

Although the TVL for Aztec is currently only $10.1m, the Aztec bridge seems to have some volume but relatively low in comparison to the other bridges.

Below are the Top Depositors for the Aztec Bridge, filtered by smart money wallets.

Cozy Finance (expanded to Arbitrum)

Cozy Finance is a protocol for protecting DeFi deposits. Protection Markets allow you to provide and receive protection against predefined conditions like a loss of funds due to a smart contract hack.

The main components that define a protection market are:

- A money market with a liquidity pool of digital assets with an underlying token for the market.

- A trigger contract that specifies an on-chain condition to protect the assets in the pool against.

- An interest rate model

Orbiter Finance

Orbiter Finance is a decentralized cross-rollup Layer 2 bridge that currently supports zkSync, Arbitrum, and StarkNet.

Although Orbiter Finance has no airdrop or token (yet), the team released a statement for users to enjoy the product “before token issuance”. A simple way to potentially qualify for the token/ airdrop is to build assets via orbiter.finance from Ethereum mainnet to Arbitrum, zkSync, and StarkNet.

Nansen’s Take

Arbitrum has a thriving ecosystem of dApps and a TVL of ~1.4b at the time of writing. Although Arbitrum currently has no token incentives, there has been hints from the team regarding a potential airdrop/ token. In this report, we’ve highlighted a few strategies that you can undertake to potentially qualify for an airdrop/ token and to explore the 2-month Abritrum Odyssey initiative.