Introduction

Perpetuals currently hold the title for the most popular derivative within the crypto markets, accounting for more than 90% of trading volume on derivative DEXs, largely attributed to their simplicity. A trader needs to specify only his view (long/short) and size expressed in leverage. Conversely, options, which are prevalent in traditional markets, are not as popular in the crypto sphere. The complexity of options requires consideration of multiple factors such as the strike price, strike date, and the impact of the 'Greeks' on the contract price, making it less attractive for the average trader.

Valorem aims to change the game by building a permissionless options protocol on Arbitrum that allows to write options on any ERC20 token. The platform is designed in a way that is user-friendly for retail investors while also catering to the needs of traditional finance (TradFi) funds by providing their favored derivative products. The protocol currently runs on Arbitrum Goerli, is scheduled to go live soon on Arbitrum mainnet, and is eventually planned to migrate to Ethereum.

Options

Options are a type of financial derivative that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (known as the strike price) on or before a specific date (the expiration date). There are two types of options: 'calls' and 'puts'. A call option gives the holder the right to buy the underlying asset at the strike price before the expiration date, and it is typically purchased with the expectation that the asset's price will rise (bullish view). On the other hand, a put option grants the holder the right to sell the asset at the strike price before the expiration date, generally purchased with the expectation that the asset's price will fall (bearish view).

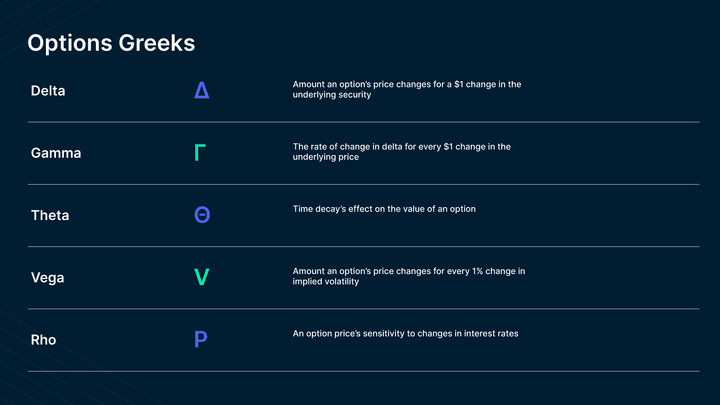

The price of an option is also influenced by the 'Greeks': Delta, Gamma, Theta, Vega, and Rho. These are quantitative metrics used to assess various aspects of risk in an options contract, such as the rate of change of the option price relative to changes in the underlying asset's price, time decay, and changes in the underlying asset's volatility.

We will delve further into various types of options contracts: European call and put options, American options, and the more complex and diverse class of derivatives known as exotic options.

European Options

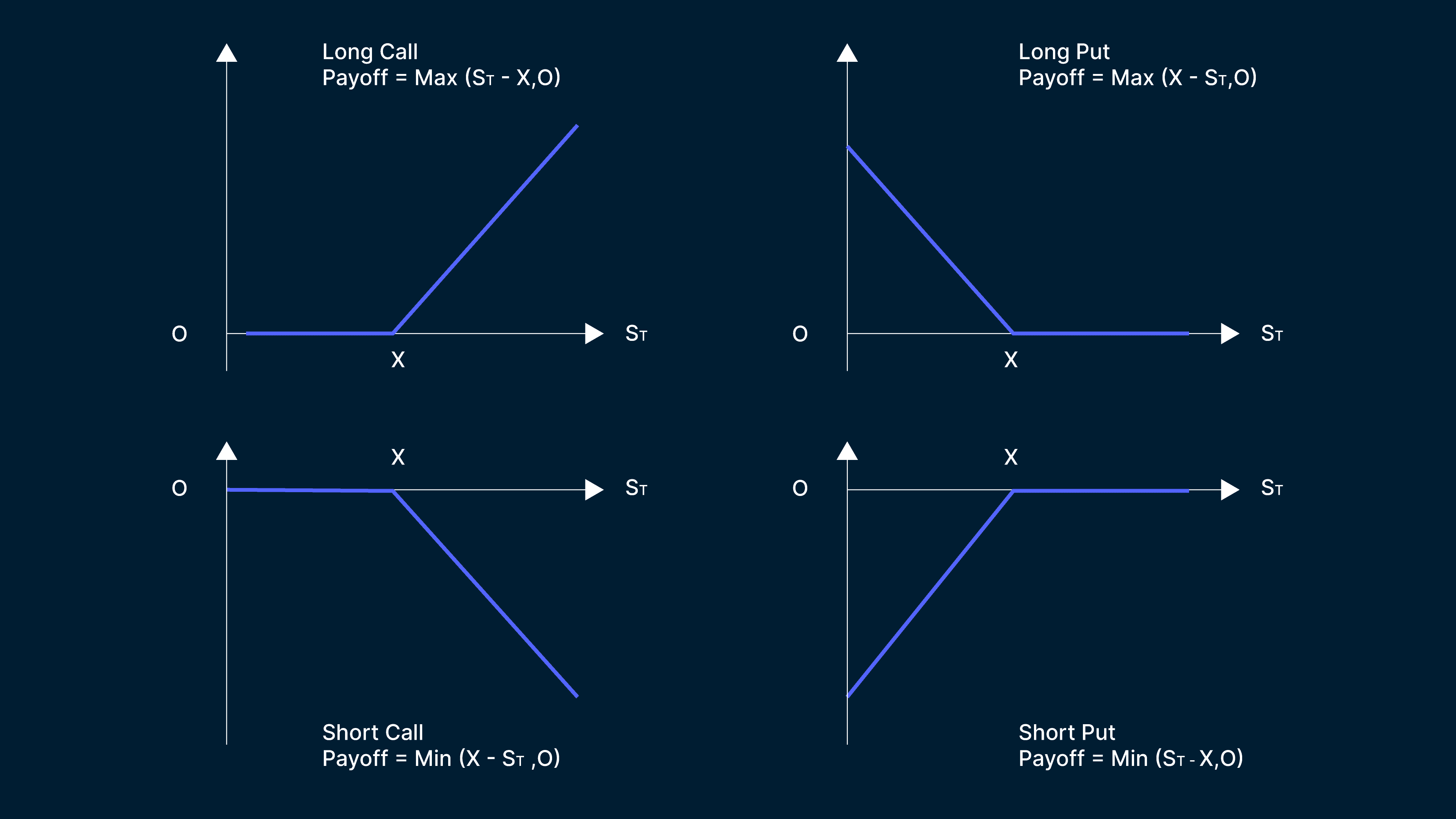

The key characteristic of European options is that they can only be exercised on the expiration date. This means that the holder must wait until the expiration date to exercise the option if it is favorable. For a European call option, the payout is zero if the underlying asset's price is below the strike price at expiry. However, if the asset's price is above the strike price, the payout increases linearly with the asset price. Whereas, a European put option showcases an inverse payout profile; the payout increases linearly as the underlying asset's price drops below the strike price.

American Options

American options, on the other hand, are similar to European options in that they give the holder the right to buy or sell an underlying asset at a predetermined price within a specified time frame. However, the crucial distinction is that American options can be exercised at any point during the option's lifespan, up until the expiration date. It's important to note that while American options provide more flexibility, they are also typically more expensive than European options due to the added value of early exercise.

Consider a European call option and an American call option, each with a strike price of $100 on the same stock; while the European option only allows you to buy the stock for $100 at the end of a year, the American option would allow you to exercise it early, potentially profiting if the stock price jumps to $150 within six months.

Exotic Options

Exotic options encompass a wide range of derivative contracts that have non-standard features compared to traditional European or American options. These options often have complex payoffs and specific conditions that differ from standard options. Exotic options are designed to meet specific risk management or investment objectives and are tailored to address particular market conditions or investor requirements. Examples of exotic options include barrier options, Asian options, basket options, and binary options.

Valorem supports writing covered calls and cash-secured puts, as well as offering American, European, and Exotic options through the delivery of the underlying asset (physical settlement) or through cash payment (cash settlement).

DeFi Option Protocols Adoption

Options play a role in traditional markets because of their ability to provide significant leverage, manage risk, and speculate on price movements without needing to own the underlying asset directly, with their volume largely exceeding that of spot volume. However, within crypto, the volume of spot trading outweighs that of options trading by miles to date.

To illustrate the volume difference between the two: decentralized perpetuals saw $1 billion in the last 24 hours, while decentralized options had a volume of $2 million, making the former roughly 500 times larger.

Nevertheless, there has been a noteworthy increase in options trading volumes for assets like BTC and ETH in the recent year, both on centralized exchanges like Deribit and on-chain protocols. This discrepancy between spot and options trading volume suggests a largely untapped market potential.

Setting the Scene for the Options Landscape

Existing option protocols like Lyra and Dopex take the approach of an AMM design where only a handful of large-cap tokens are supported. These protocols operate fully on chain, including reliance on price oracles, dependency on existing DeFi primitives, and premium value assumptions, which are thought to compromise execution quality. As such, they tend to effectively support only a few tokens with significant market capitalization.

However, Valorem innovates with a hybrid approach combining on-chain and off-chain designs. This includes an on-chain order book, off-chain Request-For-Quotation (RFQ), and on-chain settlement. The off-chain component enables the protocol to tap into deep professional market maker liquidity by lifting the constraints of on-chain computation and latency issues. Moreover, it allows for permissionless option listing and trading across all ERC-20 pairs, therefore also capturing the long tail-end of markets.

Valorem Architecture

Valorem features three key phases: Clear, Trade, and Structure. Clear, the options settlement layer will be live at launch, whereas the Trade and Structure are planned for later down the road.

Valorem Clear

Valorem Clear operates as a clearing and settlement system for option contracts. Valorem is designed in a way that execution costs are minimized when compared to existing options protocols by removing price oracles, reliance on existing DeFi primitives, and premium value assumptions. Settlement of options is carried out physically via a fair settlement algorithm. The protocol supports options for any pair of ERC-20 tokens, as long as they do not rebase or impose a transfer fee. It allows permissionless, self-custody transfer and settlement of both long and short positions put and call options.

Core Principles

Permissionless

The protocol is designed to be permissionless, and intended for unrestricted public usage. Anyone is free to use any function supported by the protocol without any limitations, aiming to be the Uniswap for options.

Risk-adjusted

Risk is minimized through the protocol by physically settling options and ensuring they are fully collateralized. This strategy reduces counterparty risk and assures settlement. At its core, the system is not leveraged, leaving space for the development of more advanced margining systems on top.

Simplistic design

Adopting a minimalist design philosophy, Valorem's protocol uses a single smart contract for clearing and settlement operations. This approach allows for better execution costs when writing and exercising options, as well as an intuitive developer experience.

Composability

Valorem is highly composable. Its composable nature means it can be seamlessly integrated into other smart contract systems, serving as a building block for more complex derivatives. This paves the way for innovative hybrid-liquidity models, such as Automated Market Makers (AMMs) integrating with the system (through a Seaport adapter) to fulfill unquoted orders, for instance.

ERC-1155

Valorem Clear utilizes the ERC1155 multi-token standard to gas-efficiently tokenize long and short positions. The protocol facilitates the creation of options for any valid pair of ERC-20, excluding rebasing, fee-on-transfer, and ERC-777 tokens. Upon creation, these options take the form of semi-fungible Option tokens, which can be freely bought, sold, or transferred among addresses like any ERC-1155 token.

An option writer's claim to the underlying assets or exercise assets is represented by a unique, non-fungible Claim token. This Claim NFT can be redeemed to retrieve the holder's share of the underlying exercise assets.

New Option Type

Users or protocols can create a new type of option in a permissionless way by specifying a unique tuple containing the following information:

- The underlying asset: the token the option holder receives if the option is exercised.

- The underlying amount: the amount of the underlying asset to be received upon exercise of one option.

- The exercise asset: this is the token the option holder pays with to exercise.

- The exercise amount of the exercise asset required to exercise one option.

- The earliest exercise timestamp.

- The expiry timestamp.

Key Actors

The core protocol features three main actors: the Protocol Admin, the Option Writer, and the Option Holder.

The Protocol Admin collects protocol fees and has the ability to update the Protocol Admin address, update the address of the Token URIGenerator contract, and modify the fee parameter.

Option Writers can create new option types and write options for valid ERC-20 asset pairs. Post expiration, they can redeem their Claim NFT for their share of the underlying or exercise assets.

Option Holders can transfer and exercise options via an ERC-1155 transfer from the writer to the holder of the desired amount of option contracts. To exercise an option, they must have enough of the exercise asset and appropriate approval for Clear on the ERC20 exercise asset.

Valorem Trade

Valorem Trade serves as a signature relay platform for the peer-to-peer trading of Valorem Clear options and other digital assets, with settlements managed on-chain via Seaport. Users get access to professional market maker liquidity through an off-chain Request-For-Quote (RFQ) system, which facilitates trading options with minimal price impact, low fees, and tight bid/ask spreads. Valorem has announced a partnership with the crypto native market maker, Dark Forest Research, for its launch. More such partnerships are expected to follow suit.

One can interact with Valorem Trade either through a web interface or a gRPC API, acting as either makers or takers. Takers can request quotes from makers, who may respond with a signed offer that the taker can execute via the Seaport smart contract, which manages the required asset transfers. The platform’s design enables off-chain price discovery with on-chain settlements for enhanced security and transparency.

MEV Resistance

In Valorem Trade, RFQs are sealed, limiting the quote request's visibility to the maker alone. Similarly, only the intended taker can view the provided quote, specifically intended for them, making the RFQ process robust against possible MEV exploits.

Valorem Structure

Research and development in areas like margining, oracles, and other ecosystem aspects will allow users to employ sophisticated options strategies and create new structured products. At this stage, information about Valorem Structure is limited. However, as user feedback rolls in over time, Valorem Structure is expected to be better understood and shaped.

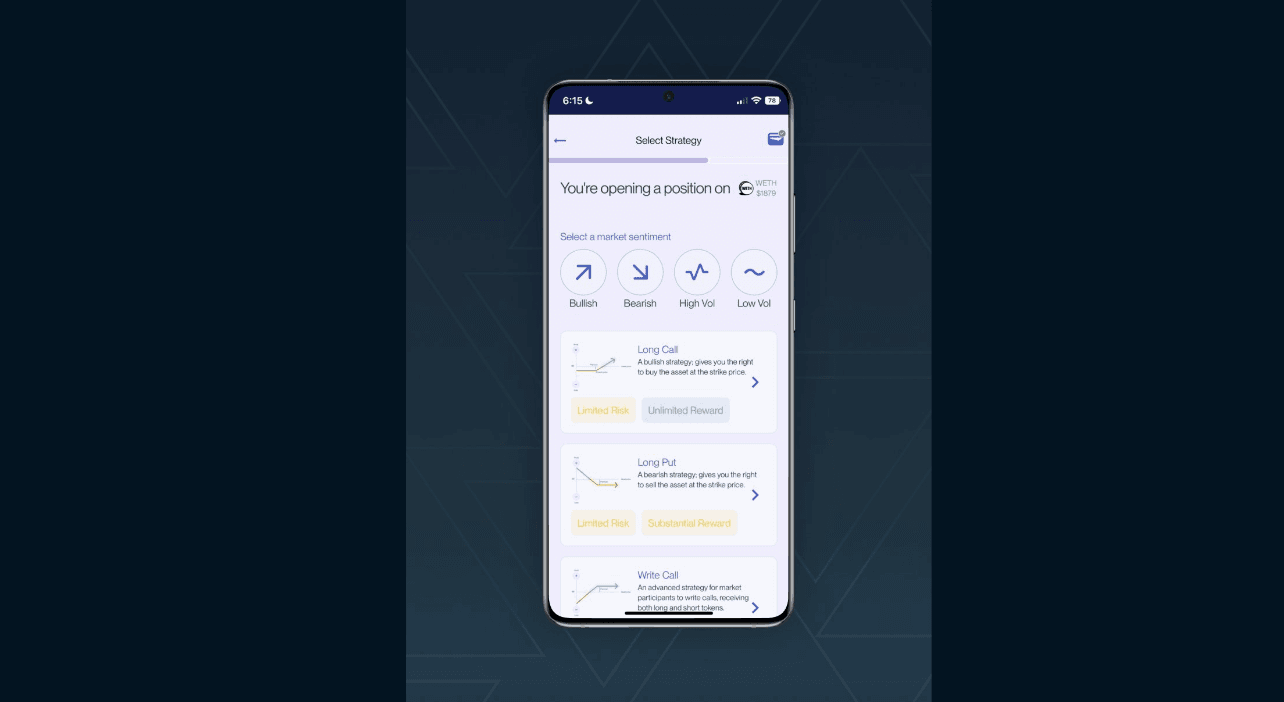

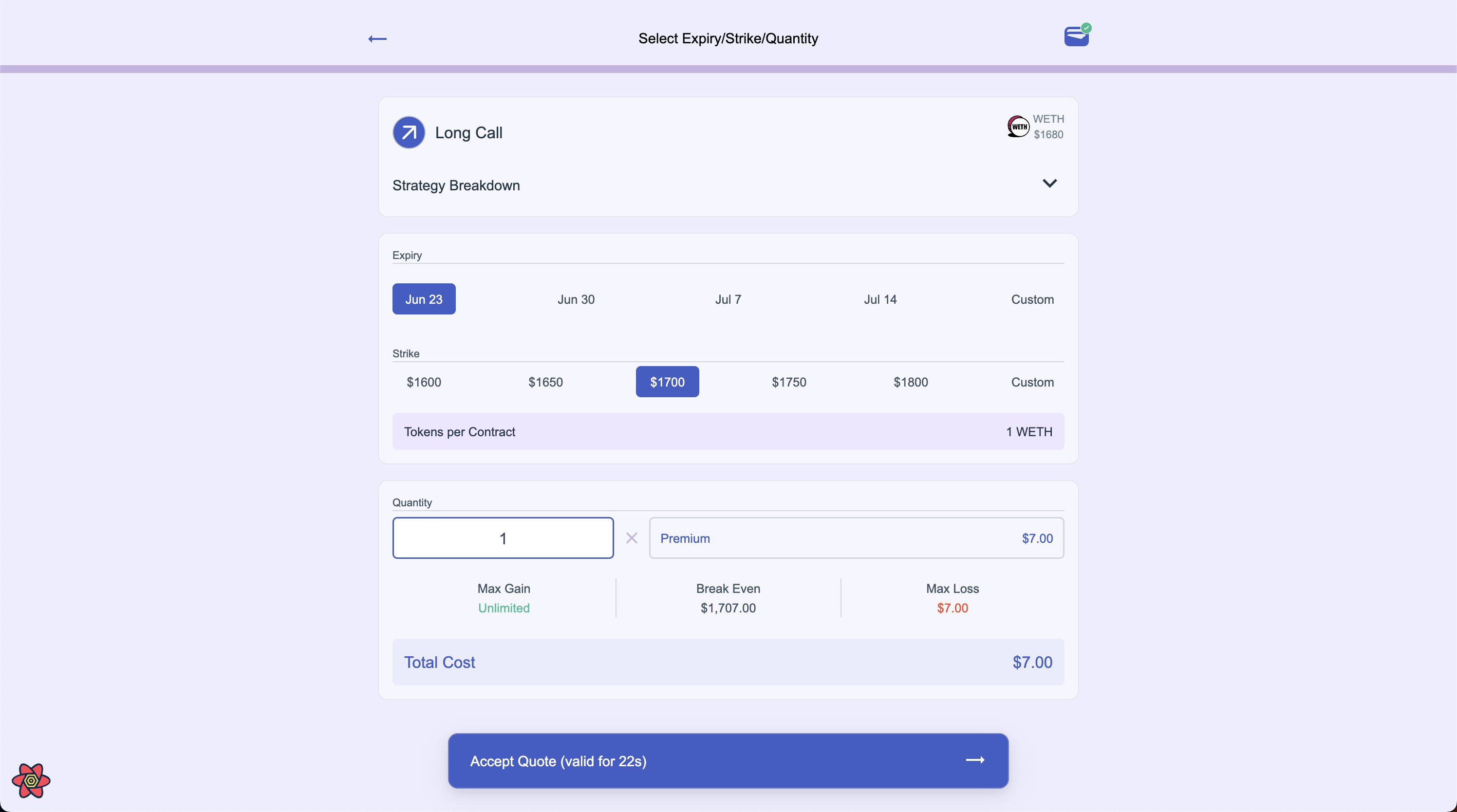

Interface

The dApp comes with an intuitive interface where the user can specify his/her sentiment. It also offers detailed descriptions of various option products along with associated risk profiles. Upon selecting a sentiment, the user is redirected to a page featuring the product that reflects their choice. Here, they are prompted to determine specific parameters such as the strike price, expiration date, and the number of contracts. Once determined, the user can proceed with the purchase.

Risks

One of the risks associated with Valorem or any other DeFi option protocol is the potential failure to gain adoption due to perpetuals' continued dominance in the derivatives market, with options struggling to secure a significant market share. Perpetuals' success as a derivative can be primarily attributed to their simplicity, making them a preferred choice and widely considered a crypto-native product.

Another potential risk is that it fails to provide meaningful liquidity. While the partnership with market-making firm Dark Research Forest has been confirmed, its reputation and ability to offer competitive quotes are yet to be tested. The exact incentive structure is also not known at this point. However, the possibility of onboarding other market makers in the near future could mitigate this risk factor.