XRP is the utility token of XRP Ledger (XRPL), the digital payment network and protocol launched as early as 2012 before Ethereum and DeFi “Season 1” rose. For a utility token, XRP experienced quite an ascent post-US-elections, up +433% trough-to-peak (local peak on December 3rd) vs. +40% for BTCUSD. As an aside, our Token Momentum strategy picked up XRP among its top 5 tokens from 15 November on.

How justified is this ascent? Is it the mere reflection of another hopeful crypto “narrative,” or is it grounded in some fundamental value? How well will XRP fare in 2025?

To assess these “fundamentals,” we will review the value proposition of Ripple’s businesses, including those living on XRPL, in light of the market and political regime that will commence in the US in 2025.

Segments and products

Ripple, the entity behind XRPL and XRP, has initially positioned itself on cross-border payments facilitated by a messaging system and by XRP as a bridging currency. It requires participating entities like banks and remittance companies to run servers that validate these payment transactions.

This core business is likely to receive an acute attention from US regulators and the presidential administration: payments sit at the intersection of off-chain and on-chain, traditional finance and DeFi. It is still unclear how crypto protocols will interact with traditional institutions and corporates, whether stablecoins will dominate, CBDCs, or a mix of those. Ripple does offer an option to onboard CBDCs, and it is currently preparing the launch of its USD stablecoin, RLUSD, freshly approved by the New York Department of Financial Services (contract addresses here).

More recently, aside from some DeFi developments, Ripple has worked on new functions on XRPL and, in collaboration with a UK digital asset exchange, custodian, and broker, has ventured into the tokenization of financial assets. This is yet another area that is likely to gain some regulatory clarity and develop significantly in the next four years, with already a few traditional competitors such as GS Digital, Franklin Templeton, and BlackRock having entered the market.

Overall, Ripple’s product roadmap is aligned with the crypto activities likely to be prioritized by the new US administration. These are also very competitive market segments. Let’s assess how Ripple and the XRPL, more specifically, can use their competitive advantages to differentiate.

Technology

XRPL works thanks to specific servers that match transaction records and reach a majority using the Ripple Protocol Consensus Algorithm. The technology has received criticism in the past from decentralization “purists”. That said, in the hopeful world post-2025 where permissioned ledgers meet open blockchains, and enterprises solutions are intertwined with crypto protocols, and to quote our favorite fictional business man, who cares?

Indeed, the technology brings two other desirable properties, from a user and intermediary perspectives: speed and efficiency.

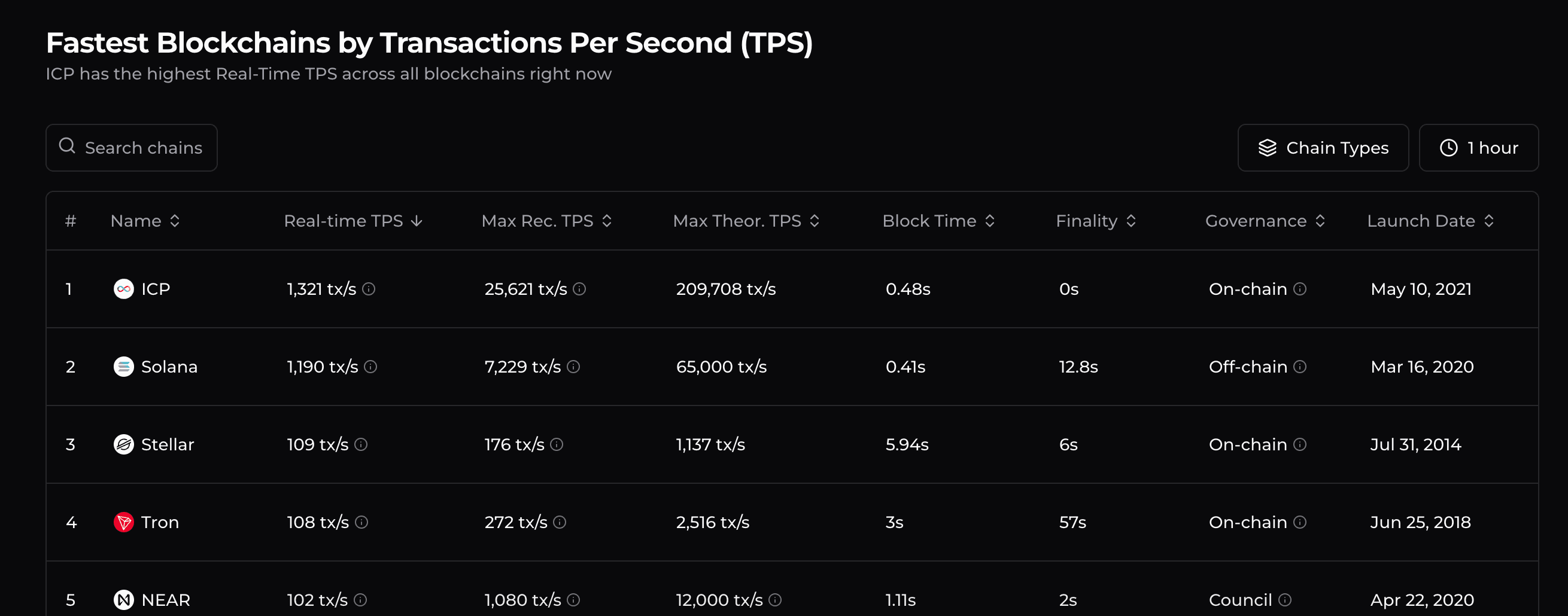

At 1,500 Transactions Per Second (TPS), when compared to Layer 1 and Layer 2 competitors, XRPL ranks as #1, followed by ICP (1,321 TPS) and Solana (1,190 TPS).

It is tricky to introduce permissioned blockchains in this benchmark, because these do not report technical performance statistics. From JP Morgan’s website, we learn that Kinexys Digital Payments “enables cross-border transactions in minutes”.

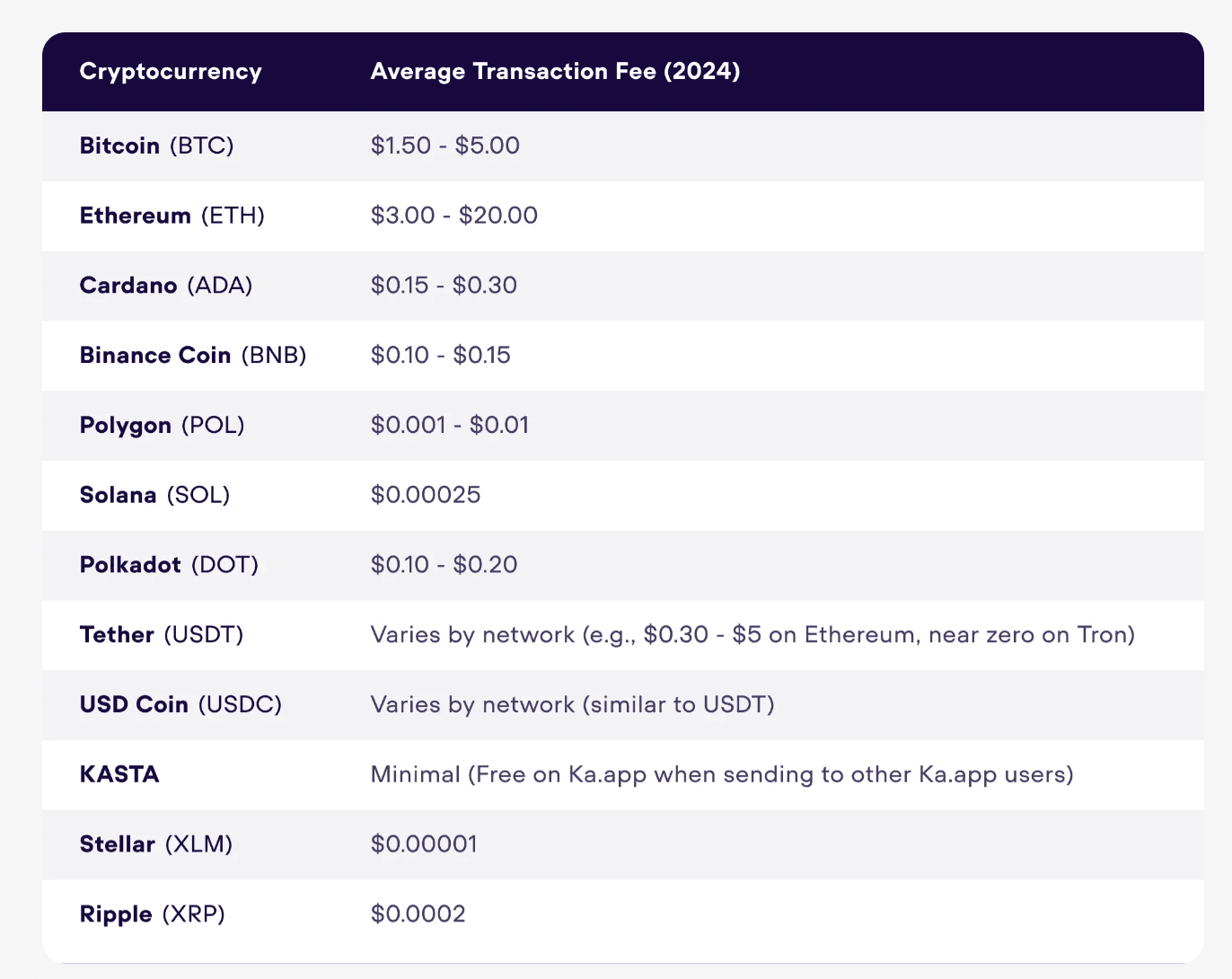

XRPL is also competitive when it comes to average transaction costs. According to Ripple’s latest market report, the cost per transaction averaged 0.001512 USD in Q3 2024. Only Stellar appears more competitive if we consider this metric.

Partnerships and politics

RippleNet is the enterprise blockchain network of Ripple: it provides real-time messaging, clearing,and settlement of financial transactions to a global network banks, payment providers, digital asset exchanges and corporates.

If we look into this network, we find major global names among banks (Credit Agricole), payment providers (dLocal), and corporates (aws).

Of course, understanding the intensity and frequency with which each of these partners use RippleNet would be insightful. This information is not publicly disclosed, however.

Ripple has so far focused on partnerships outside out of the US, but in 2024, has indicated its intention to expand its US network. There will be strong competition for payments and cross-border payments (e.g. Coinbase partnering with ApplePay, JPM developing its Kinexys Digital Payments system). To differentiate, Ripple will need sufficient political clout.

Of course, the growing prospect of the end of the SEC’s legal pursuits against Ripple are already a favorable sign, and responsible, in our view, for most of the November - December rally (already “in the price” of XRP).

Retail interfaces

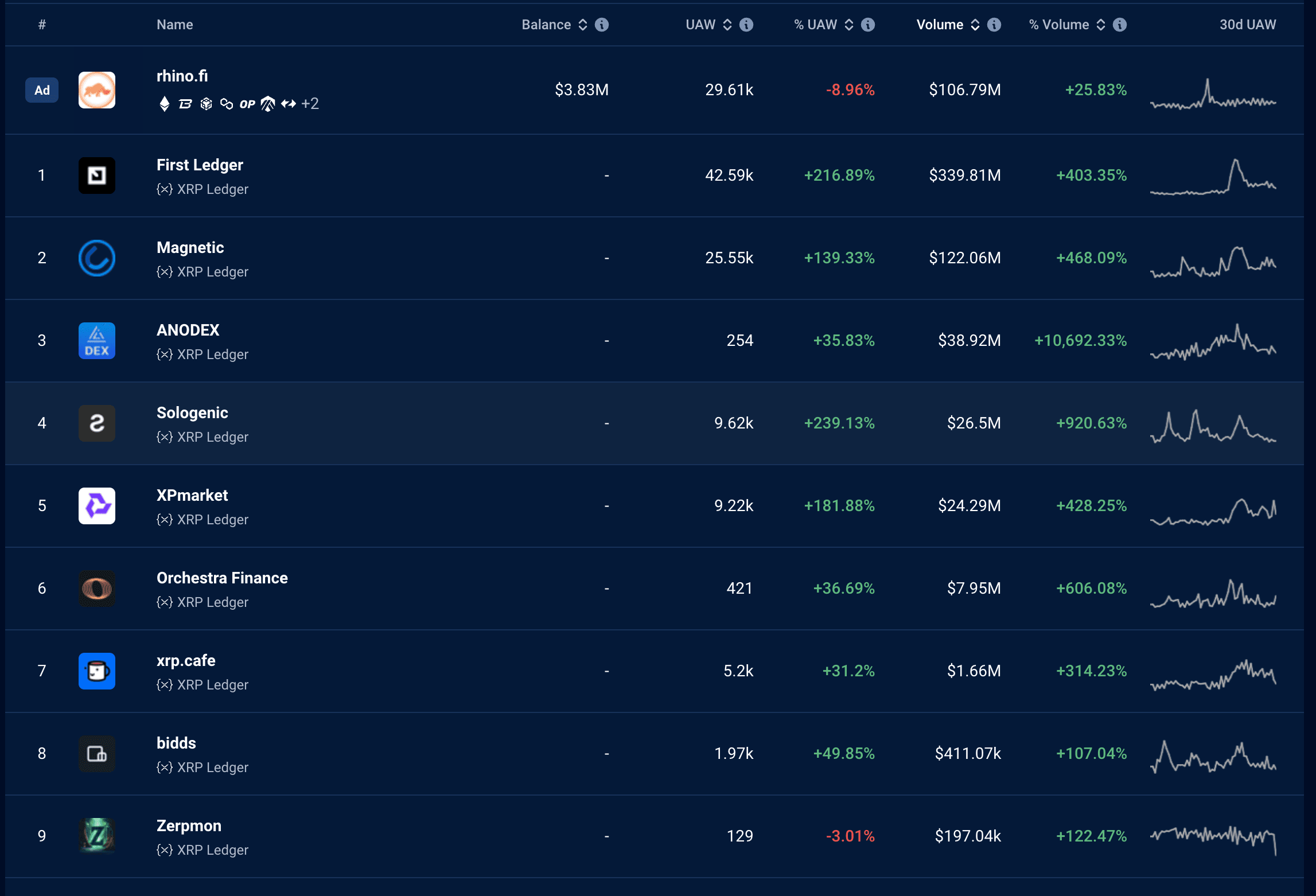

A coincident phenomenon of XRP’s price surge post-election has been retail traders’ enthusiasm for the new DeFi functions enabled by the network.

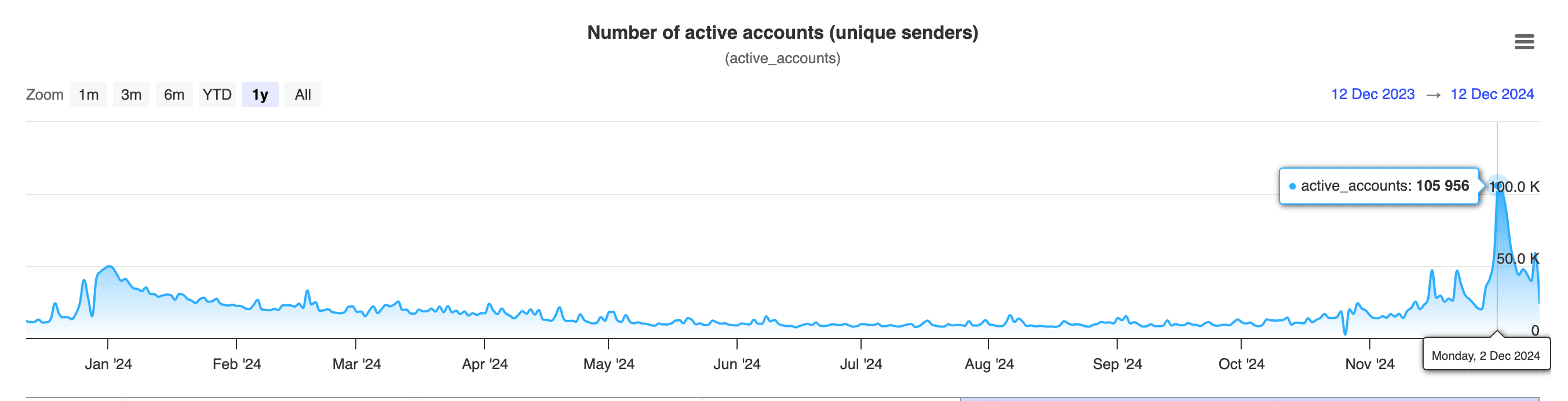

Indeed, the number of active accounts on XRPL reached an all-time high of 105,956 on December 2nd (one day before the local XRP price peak).

Applications for trading, token on-ramping and accessing XRPL wallets such as First Ledger, Magnetix, and ANODEX experienced significant growth over the past 30 days.

The ongoing development of intuitive and easy-to-interact-with interfaces and applications could bring a new audience of users to XRPL going forward, the retail speculative crowd.

XRP tokenomics

Ripple holds a significant share of XRP pre-minted tokens in escrow accounts, and releases these regularly to manage the circulating supply of XRP. At the end of Q3 2024, 38.9bn XRP tokens sat in escrows, and 200m tokens had been released monthly over Q3. This represents an estimated supply release pace of 6% annualized.

Understandably, Ripple has managed XRP as a “bridge” currency, to enable translations between different currency crosses, which requires a lower-volatility asset, hence the regular supply release. With the expected issuance of the future stablecoin, RLUSD, which could play this bridging role, it begs the question of the future role of XRP. According to the prospects of XRP, it might become relevant for traders to see it as a proxy of Ripple’s business success.

ETF prospects

After Canary Capital, Bitwise, and 21Shares, WisdomTree has filed for am XRP spot ETF, which has contributed to igniting animal spirits post-election. This newsflow might be in the price for now, at least until we get proof that the expected positive developments on crypto regulations materialize.