What to Expect?

This report aims to look at ETH ICO Recipients’ Externally Owned Accounts (EOAs) to help answer the following questions:

- Are these wallets currently bullish as indicated in their ETH balances over time?

- Who are the top ETH holders of ETH ICO Recipients currently?

- Who are the active ones currently and sending transactions of significant sizes ($250K, over the past quarter)?

- What are the top protocols that ETH ICO Recipient wallets are interacting with currently?

- What are the bridges with the most unique interactions with ETH ICO Recipients?

How much ETH do ETH ICO Recipients have staked on ETH 2.0 beacon contract?

Key Takeaways

- ETH ICO Recipients have seen their ETH balances decreasing over time due to ETH transferring to other EOAs or exchanges.

- Based on recent transactions >250k USD value, there are only 5 wallets of interest in the ETH ICO Recipient label. This may imply that many of these wallets are either dormant, obfuscated through multiple wallets, or just generally less active.

- Liquid staking (deposits into beacon chain) by ETH ICO Recipients’ wallets increased this year, but makes up only a small portion of ETH ICO Recipients cumulative ETH balances.

- Bridges with the most interaction count with ETH ICO Recipients wallets include: Polygon, ZKsync, Optimism, Arbitrum, Wormhole, Multichain, Hop protocol, xDAI omnibridge, and dYdX L2 perp bridge.

- The top token balances of ETH ICO Recipient wallets is predominantly ETH, with other tokens including MKR, USDC, OMG, ENJ, VERI, RPL, WBTC, DAI, xDATA, RARI, WETH, MANA, LINK, and NMR.

- Top protocols interacted with by the top 100 ETH ICO Recipients’ wallets include ETH2 beacon chain staking contract, Balancer, Aave, Convex, Bancor.

- High level of wallet obfuscation with most ETH ICO Recipients transferring the bulk of their ETH to exchanges and other unlabelled wallets.

What is an ETH ICO Recipient and why are we investigating them

- ETH ICO Recipient labels are OG addresses that have received ETH from genesis.

- In this report, we’ve scoped ETH ICO Recipient addresses that are EOAs (non-entities) to have a quick view on the Ethereum OGs on whether the segment is bullish, active, and generally what active wallets are up to recently.

- The aim of this report is to get a better view of the current crypto landscape through the lens of the OGs who have been here since genesis. This will likely add some color to some of the trends observed within this report in relation to tokens, protocols and general activity.

ETH ICO Recipients Wallet (EOA) Balance Overview

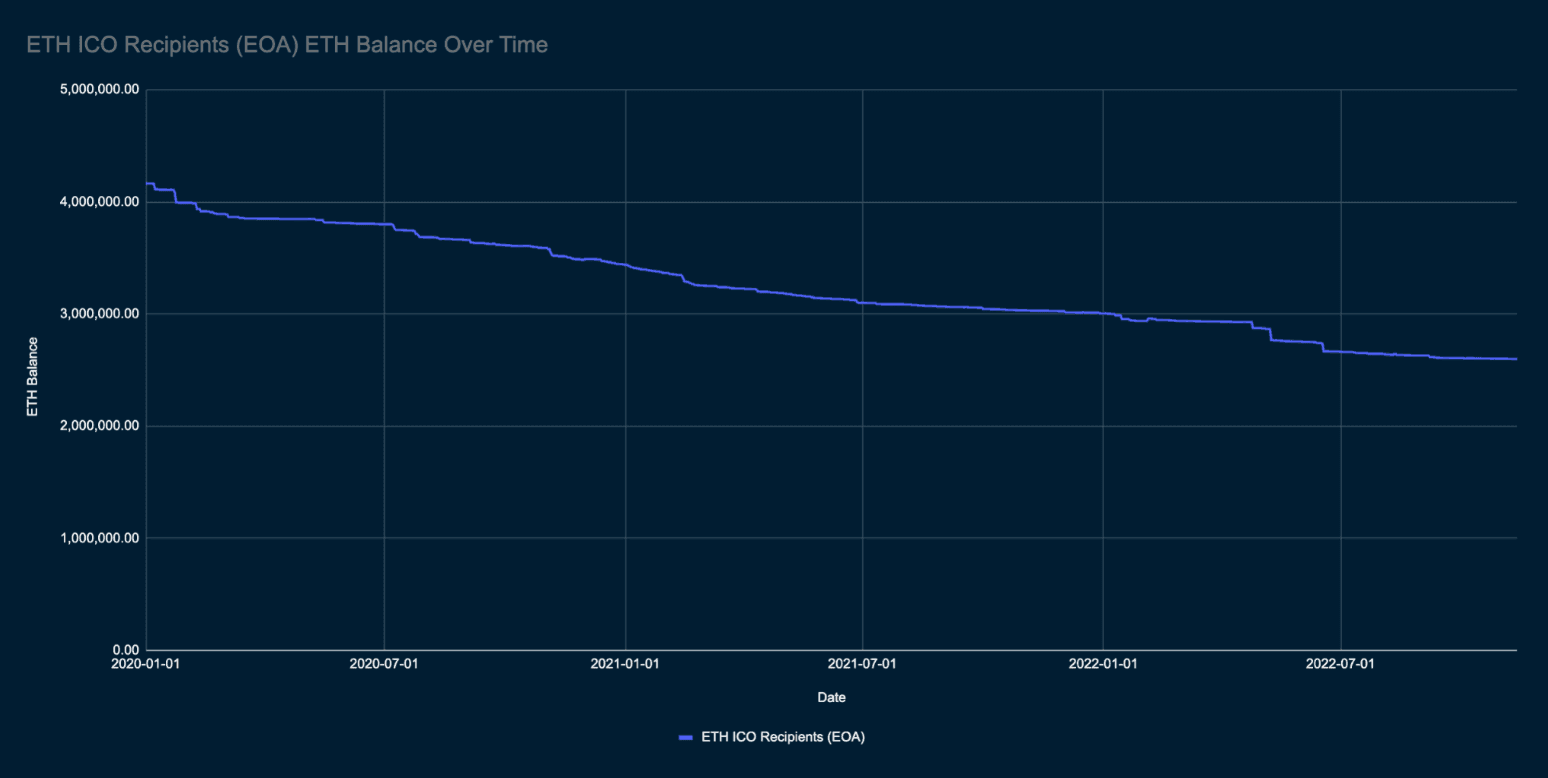

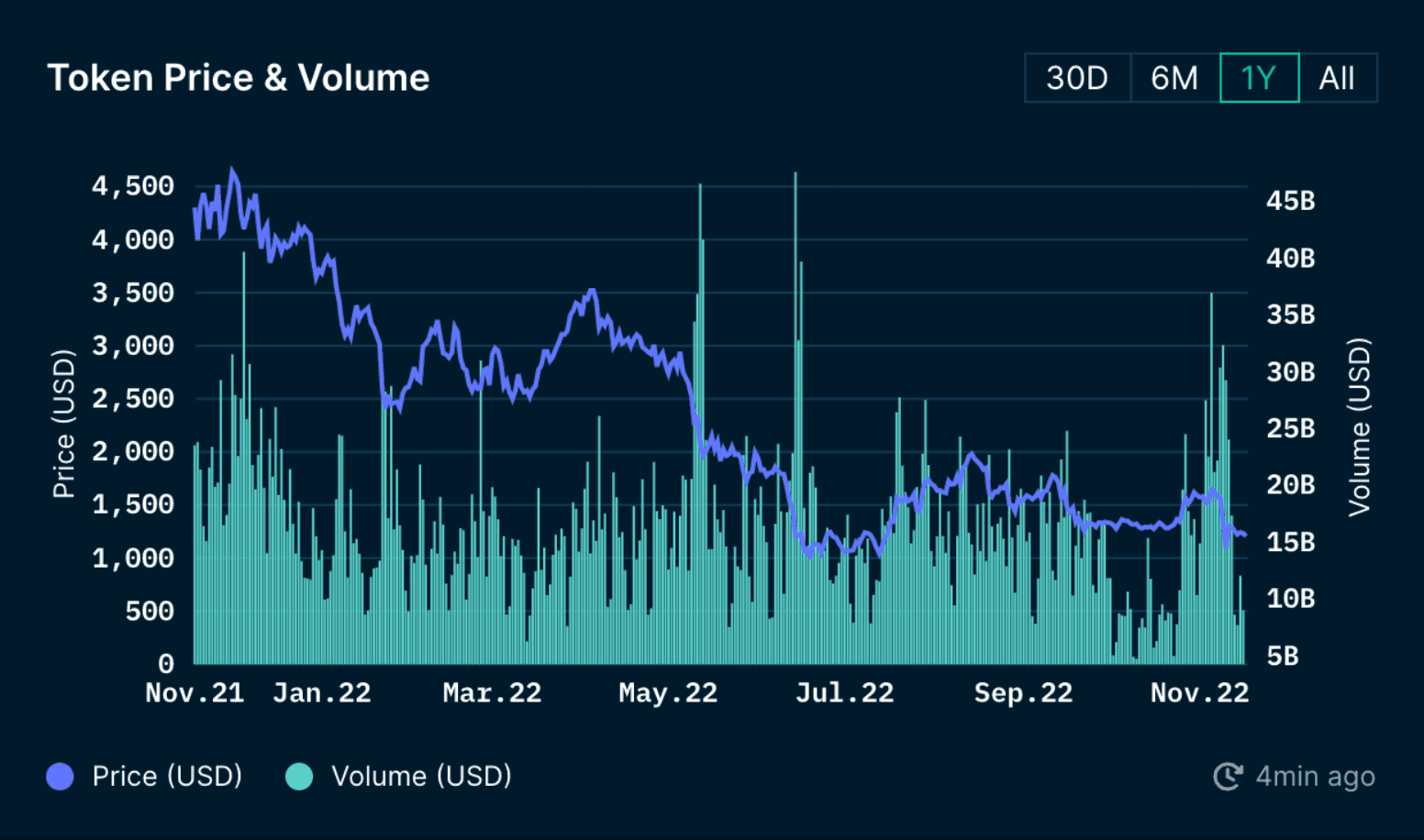

Are ETH ICO Recipient Wallets Bullish Over Time? As a cohort, ETH ICO Recipients have seen a steady decline in balances since 2020, with ETH balances dropping 64% from 4.11m ETH to 2.59m ETH from January 2020 to November 2022. Although there is a downward trend of ETH balances, there are other factors that may have contributed to this decline - multiple hops of ETH transfers of other EOAs, deposits to exchanges and deploying ETH as collateral to specific DeFi applications. Given most large whales and early investors are up many multiples on their investments, it has led to a large sell off of ETH. Since early 2022, over 41% of ETH’s premine supply, amounting to over 10m ETH, has been sent to exchanges from network genesis.

ETH ICO Recipient Top ETH Balance Wallets

Below are the top 10 ETH ICO Recipient wallets with the highest ETH balances:

| ETH ICO Recipient Wallet Label | ETH Balance |

|---|---|

| ETH Millionaire | 250,000 ETH |

| ETH Millionaire | 61,216 ETH |

| ETH Millionaire | 55,498 ETH |

| ETH Millionaire | 50,000 ETH |

| ETH Millionaire | 48,879 ETH |

| ETH Millionaire | 40,891 ETH |

| ETH Millionaire | 40,110 ETH |

| ETH Millionaire | 40,000 ETH |

| ETH Millionaire | 33,998 ETH |

| ETH Millionaire | 32,200 ETH |

For the purpose of this analysis, the ETH ICO Recipient wallets are further filtered with Traces Activity in 2022. Sub-transactions that happen “internally” are called a Trace, and include the functions of:

Call: Used to call a smart contract function specified by parameters in the data field and/or to transfer ether from one account to another. Create: Used to create a smart contract, after which ether is sent to the new smart contract.

Suicide: used by the smart contract's owner to terminate the smart contract. initiates the transfer of ether for a refund when a contract is terminated. Furthermore, terminating a smart contract can free blockchain memory, which may have an impact on the value transferred.

Traces activity is used as a proxy for a wallet’s activity, and taking 2022 Traces activity filters down the dataset to potential ETH ICO Recipients that are active in 2022.

The list below shows the top 10 ETH ICO Recipient EOA wallets that had recent Traces Activity in 2022:

| ETH ICO Recipient Wallet Label | ETH Balance |

|---|---|

| ETH Millionaire | 55,498 ETH |

| ETH Millionaire | 16,575 ETH |

| ETH Millionaire | 15,000 ETH |

| ETH Millionaire | 13,371 ETH |

| ETH Millionaire | 4,001 ETH |

| ETH Millionaire | 3,002 ETH |

| ETH Millionaire | 2,959 ETH |

| ETH Millionaire | 2,707 ETH |

| ETH Millionaire | 2,627 ETH |

| ETH Millionaire | 1,952 ETH |

ETH ICO Recipient Wallets (EOA) Top Recent Protocols

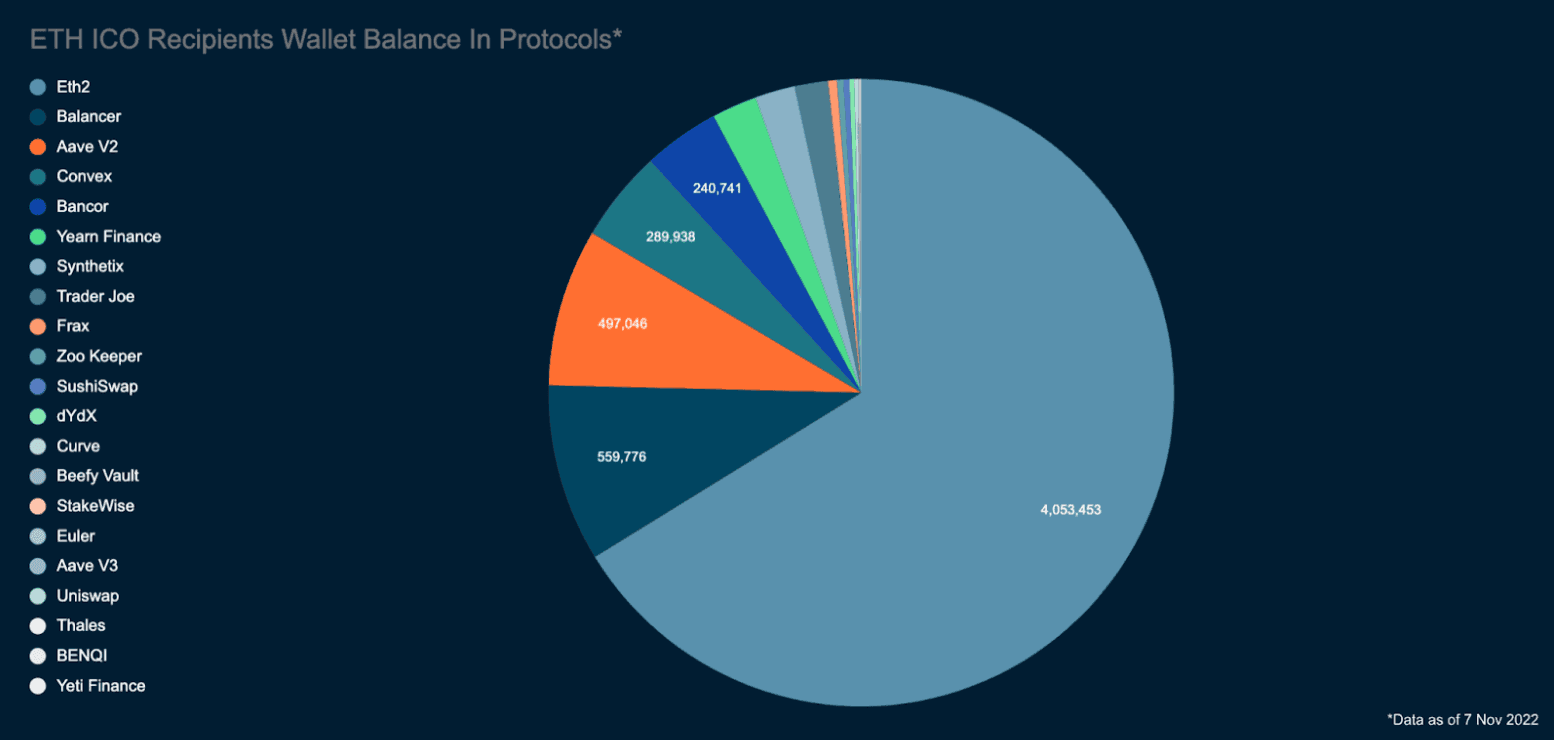

Aggregated Overview The below chart shows an aggregated view of protocol balances held by the top 100 ETH ICO Recipient EOA wallets with the highest ETH balances with recent activity in 2022.

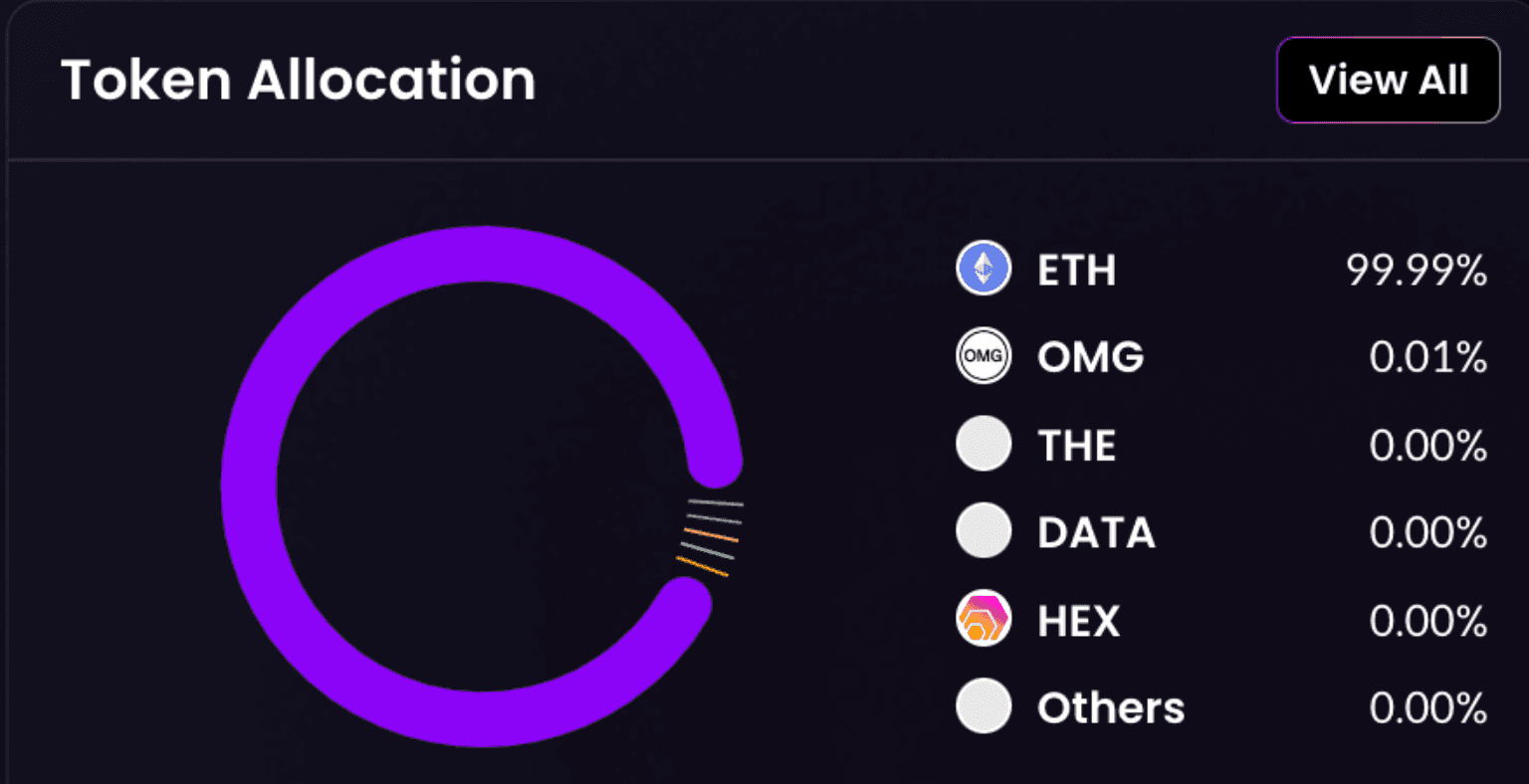

ETH2 makes up the largest component of balances currently held by ETH ICO Recipient wallets with activity in 2022. There’s a total of $4.05m worth of ETH currently staked in ETH2. A total of $257m is held across this segment across a number of different token balances, made up of mostly ETH, followed by the other tokens in the chart above.

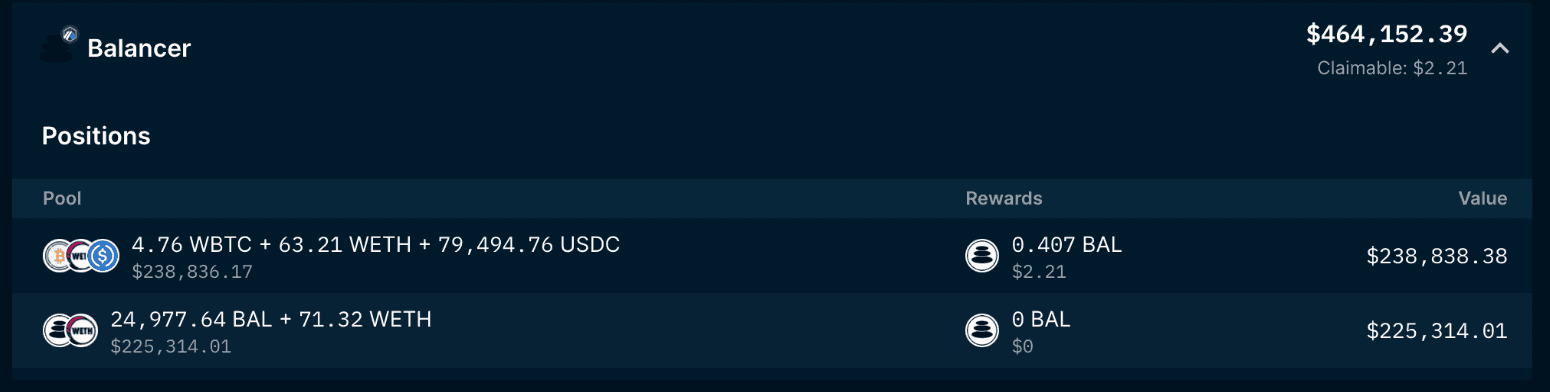

Top 5 Protocols currently used by Top 100 ETH ICO Recipient EOA wallets The top 5 Protocols currently used by Top 100 ETH ICO Recipient EOA wallets are namely ETH2, Balancer, Aave V2 and Convex. This section will drill down into the ETH ICO Recipient’s wallet interaction with each respective protocol.

These are the wallets staking ETH2 at an aggregated total value of $4.05m: ETH ICO Participant ETH ICO Participant ETH Millionaire ETH ICO Participant

These are the wallets on Balancer and the pools they are using at an aggregated total value of $559k: ETH ICO Participant is holding a position with 238K in Balancer’s WBTC + WETH + USDC pools and 225K in BAL + WETH pools.

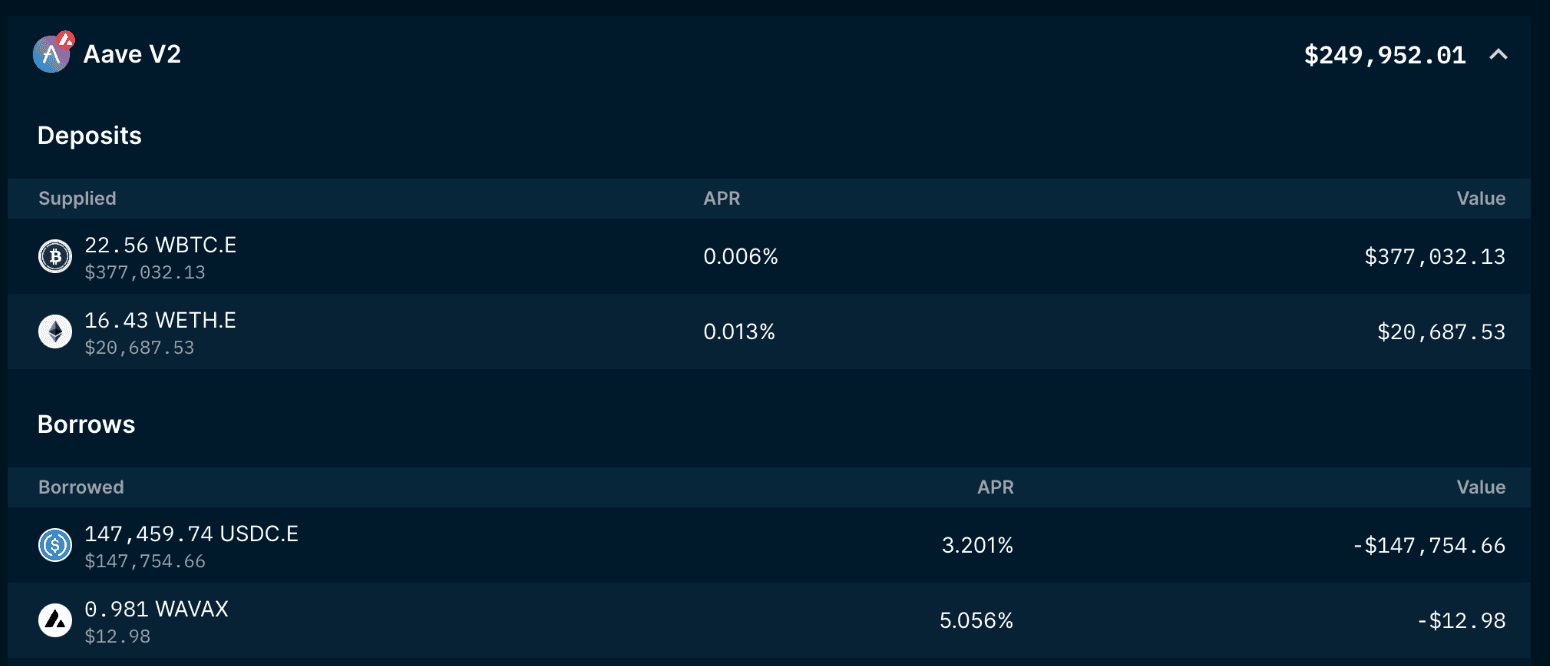

- These are the wallets on Aave and the pools they are using at an aggregated total value of 497K USD:

ETH ICO Participant ETH ICO Participant ETH ICO Participant is borrowing USDC on Aave with WBTC and WETH.

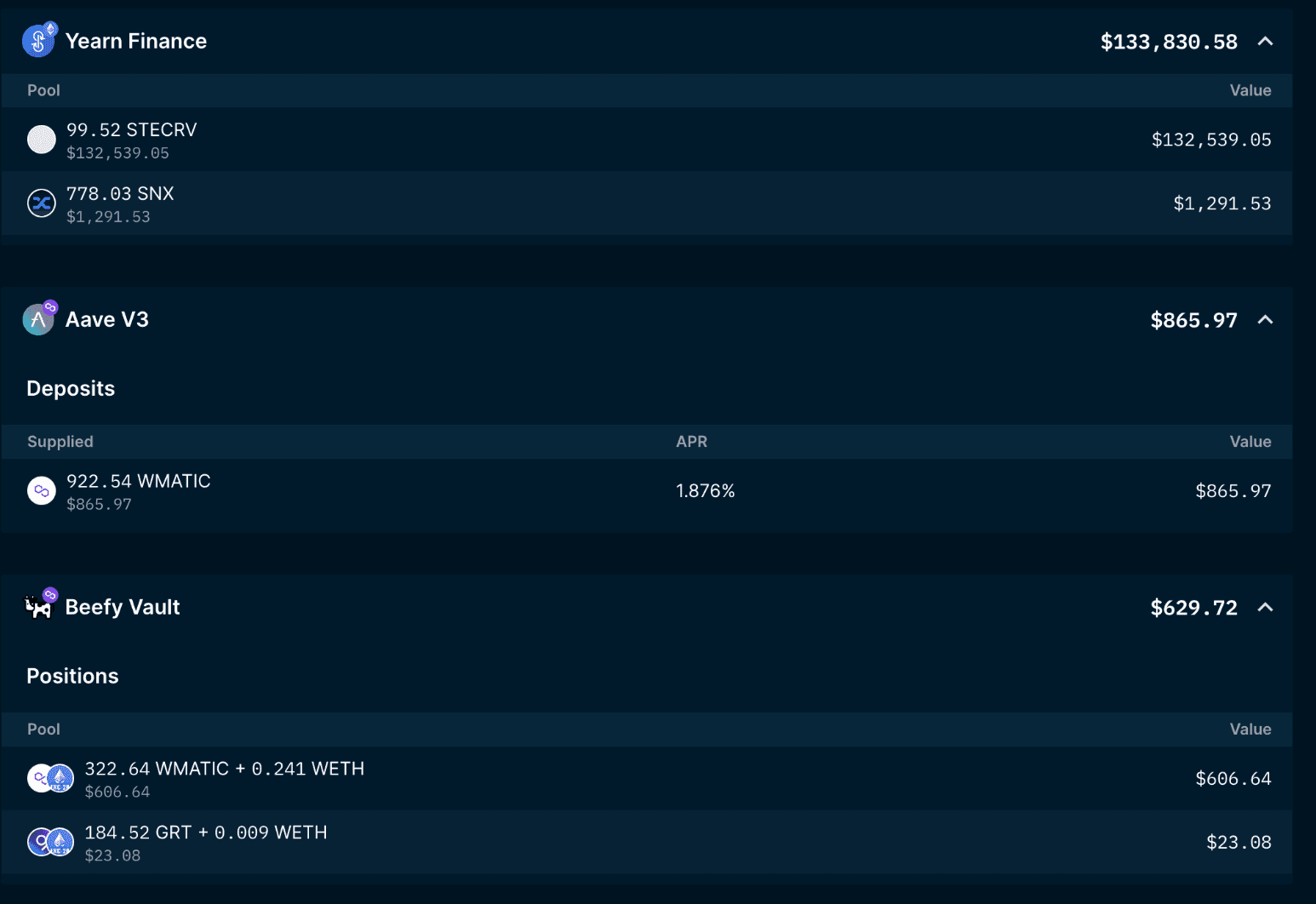

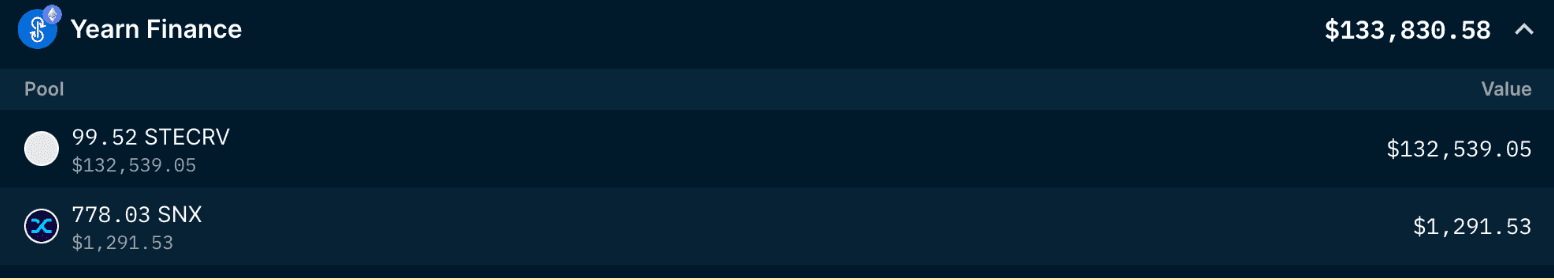

ETH ICO Participant has a small remaining borrowing position on Aave with WETH, and is mainly on Yearn Finance with STE CRV.

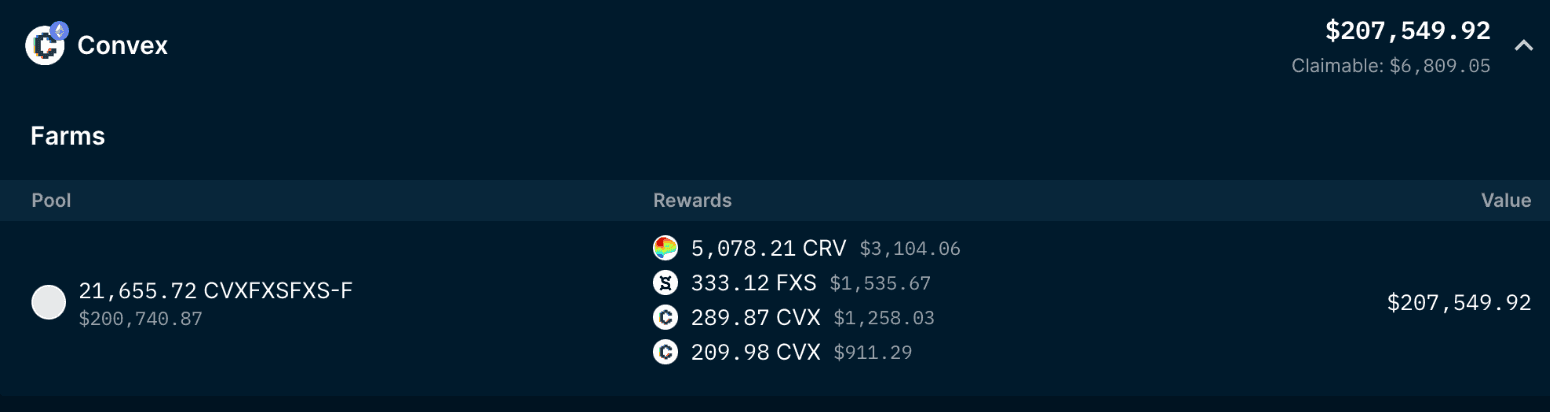

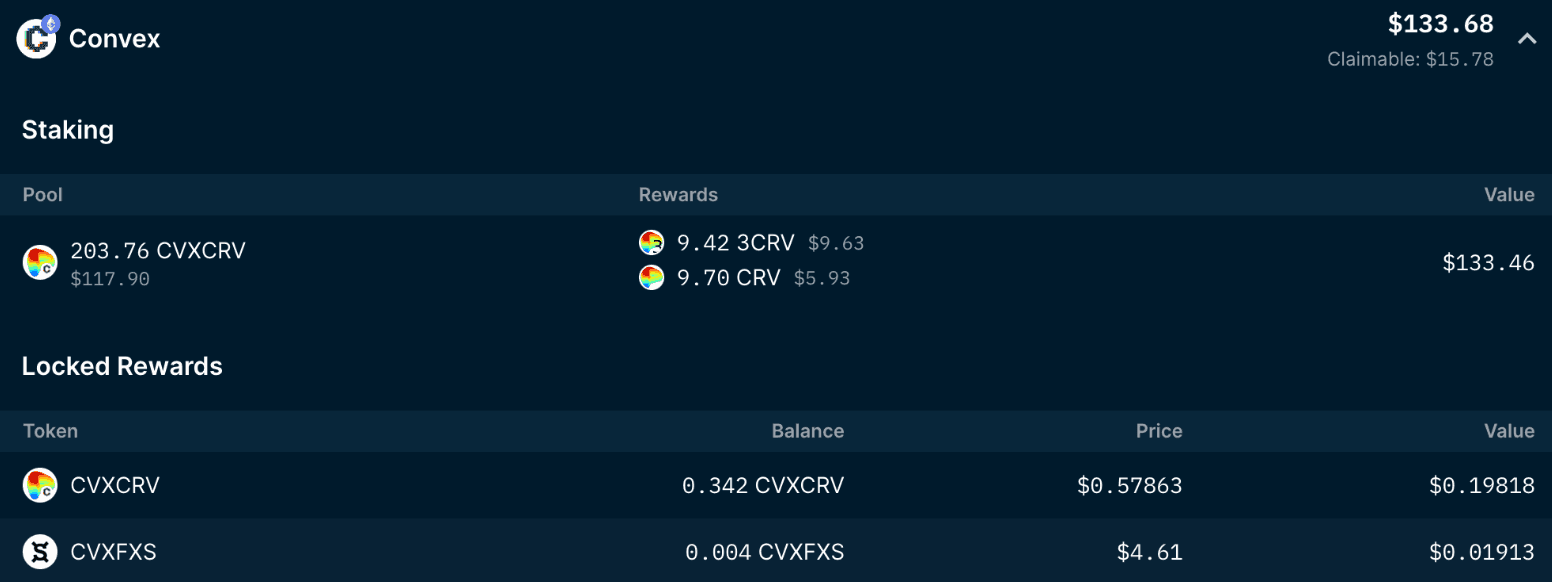

- These are the wallets on Convex and the pools they are using at an aggregated total value of 289K USD:

ETH ICO Participant ETH ICO Participant ETH ICO Participant is farming on Convex’s CVXFXSFXS - F pools with $207K.

ETH ICO Participant has only small holdings in CVXCRV pools on Convex, but still has $132K in Yearn Finance’s STECRV.

Smart Alerts can be leveraged on to follow the wallets of interest.

What about the dormant ETH ICO Whales?

Source: Nansen Portfolio (Cumulative token holdings of top 5 addresses)

The ~100% wallet holdings in ETH for the above top 5 wallet balance addresses, along with the wallet’s dormancy, could suggest that the original owners might have possibly lost access to these wallets.

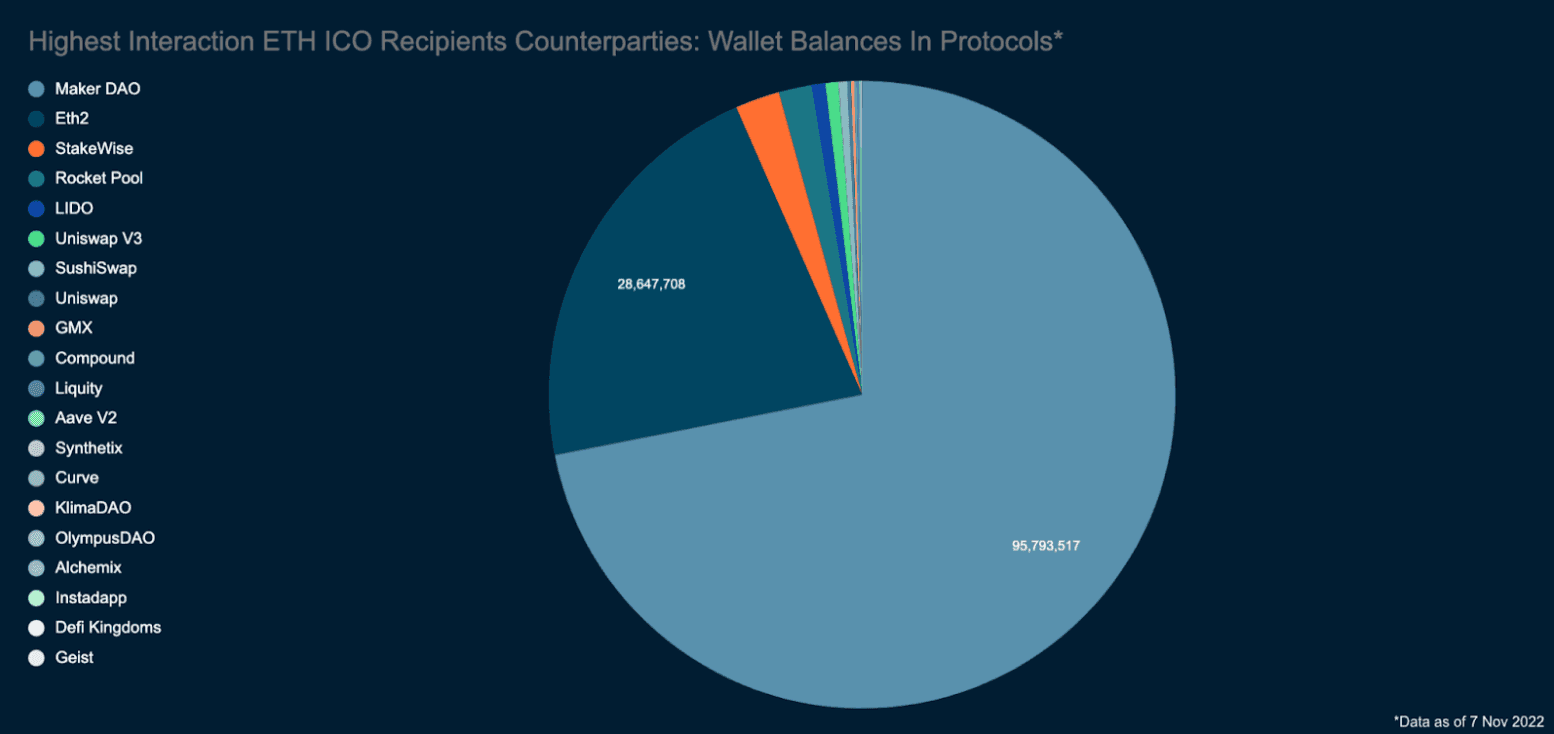

To dive deeper into high signal wallets, the analysis investigates the counterparty EOAs to the original subset of ‘ETH ICO Recipients’. This allows us to drill down on other early OGs in the space who are likely related to the ICO recipients. From the analysis, we concluded that ETH ICO counterparty wallets are mostly holding tokens in the following protocols, with $1.1b held in tokens, mostly in ETH:

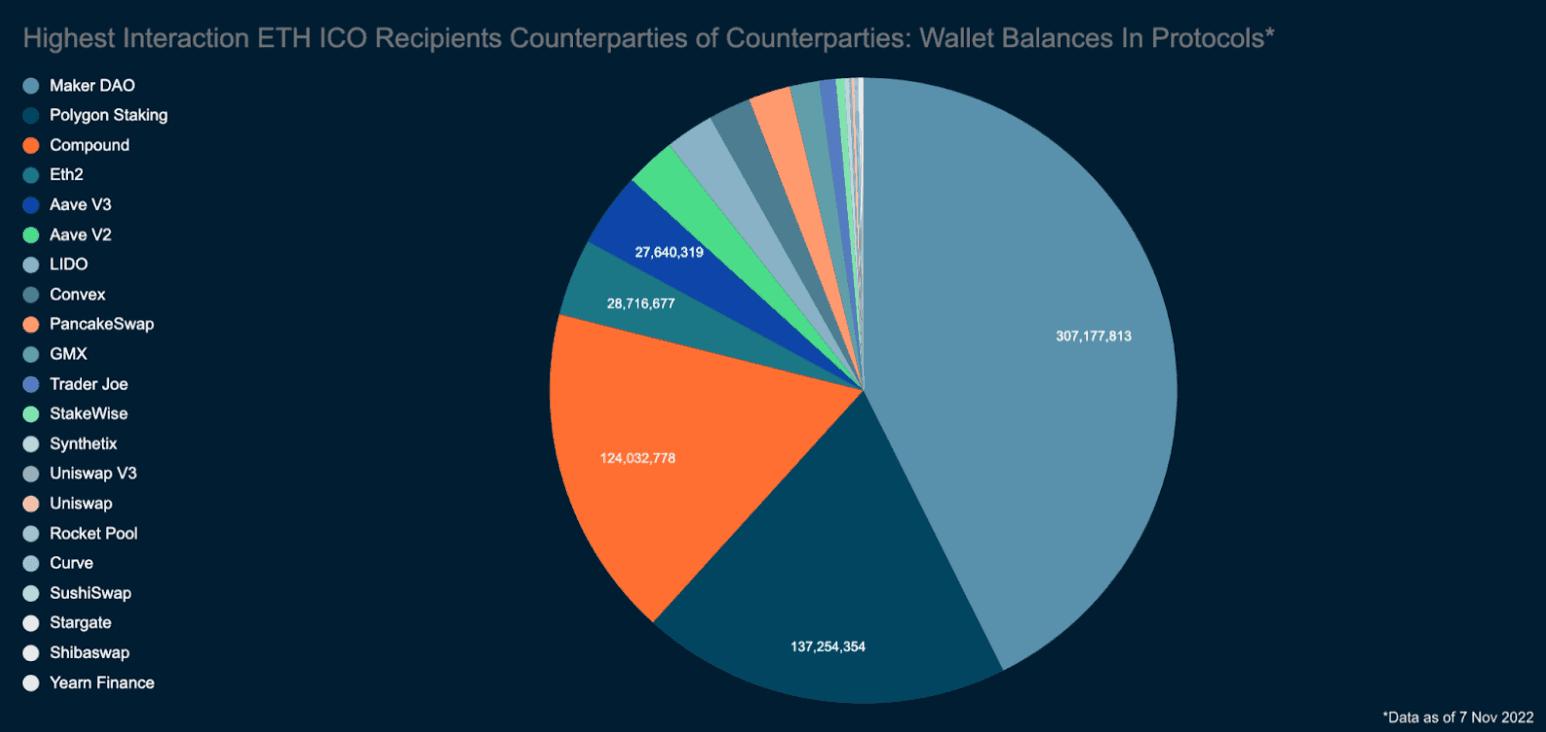

ETH ICO Counterparty of Counterparties Wallets are mostly in the following protocols, with $2.2b held in tokens, mostly in ETH:

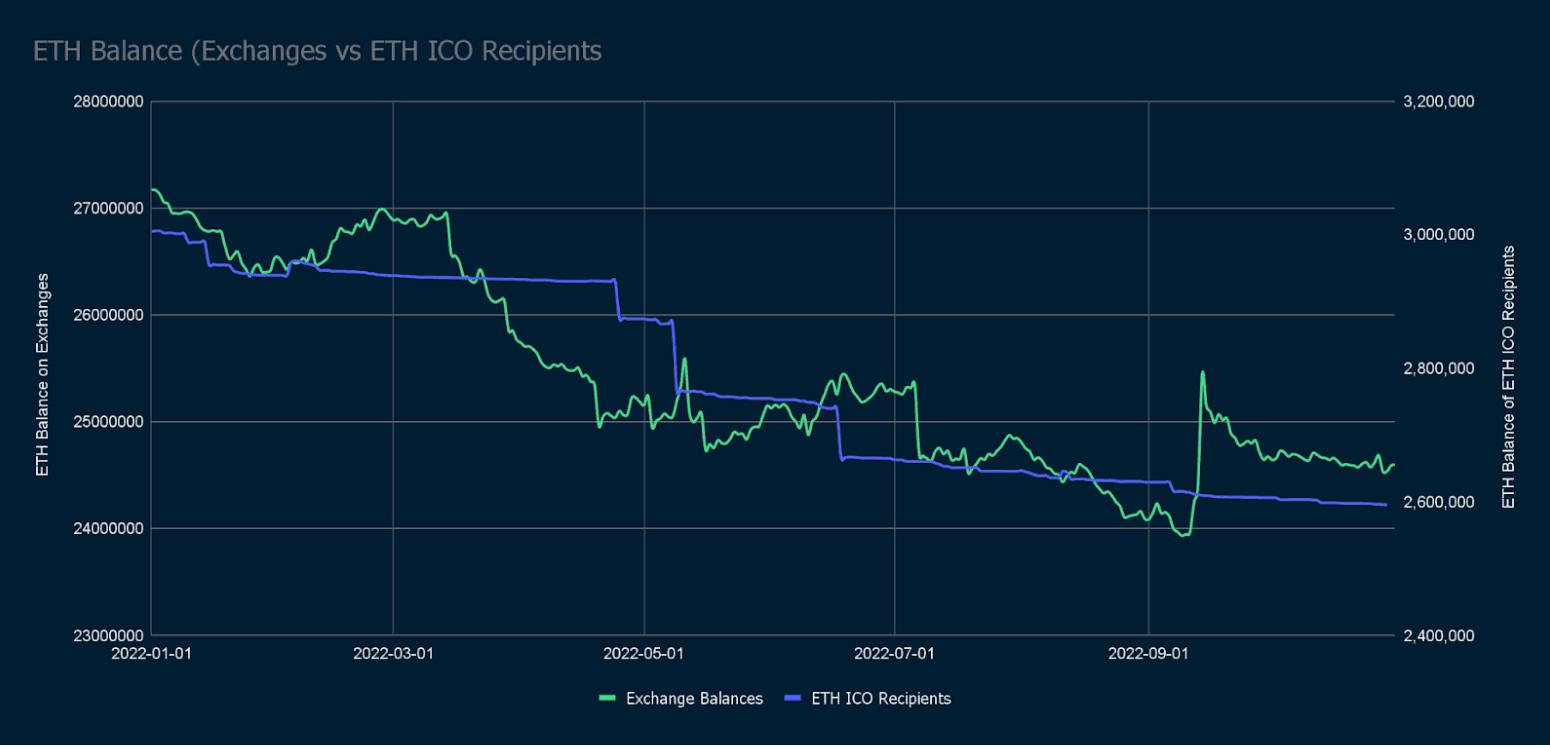

ETH Balance of Exchanges vs ETH ICO Recipients

As was previously stated, ETH ICO Recipients' ETH holdings have been progressively declining. This trend was amplified in late April of 2022, when we observed a ~9% decline in ETH holdings from late April to late June.

On the flipside, we saw greater volatility in the Exchange’s ETH balances, especially during mid-September 2022 when ETH balances spiked due to traders unwinding their long spot ETH trade after receiving their ETH PoW airdrop as part of the Ethereum merge event.

It appears that even the Ethereum merge had little influence on the ETH balances of the ETH ICO Recipients. Next, the report will dive into all ETH ICO recipients that are deemed as active addresses (>1 transaction in 2022).

Top 20 ETH ICO Addresses with at least 1 Transaction in 2022

Overview We noticed a few common activities among these wallets that are worth highlighting.

- The utilization of Argent Wallet to store their ETH by a number of addresses.

- Some addresses started reducing their ETH positions in both January and June 2022. (Although a small percentage of their entire ETH holdings)

- Borrowing of DAI on MakerDao’s Oasis with ETH as collateral.

- Staking batches of 32ETH to run multiple validators.

- It was noted that one of the addresses bridged to the Celer Network using the cBridge.

Active EOA ETH ICO Recipients with Transaction >250K over the past Quarter

Overview Most ETH ICO recipient wallets are inactive. However, the recent active ones are:

- ETH ICO Recipient 1 is particularly active, having bridged through Rainbow bridge on NEAR and Arbitrum, and actively participates in LP pools using protocols such as Aave, Sushi, and Ribbon finance.

- ETH ICO Recipient 2: 42$.ethis relatively active in stETH liquid staking and has been steadily increasing his staked ETH balance this year.

- ETH ICO Recipient 3: bpeters.ethis an NFT collector and has significant funds shifted to DAI-USDC LP and is still currently holding on to Cryptopunk NFTs.

- ETH ICO Recipient 4is an active tornado cash user.

ETH ICO Recipient 5seems to be holding onto a bullish view on Chainlink and holding onto $420K worth of LINK tokens. He has recently bridged Avax bridge as well.

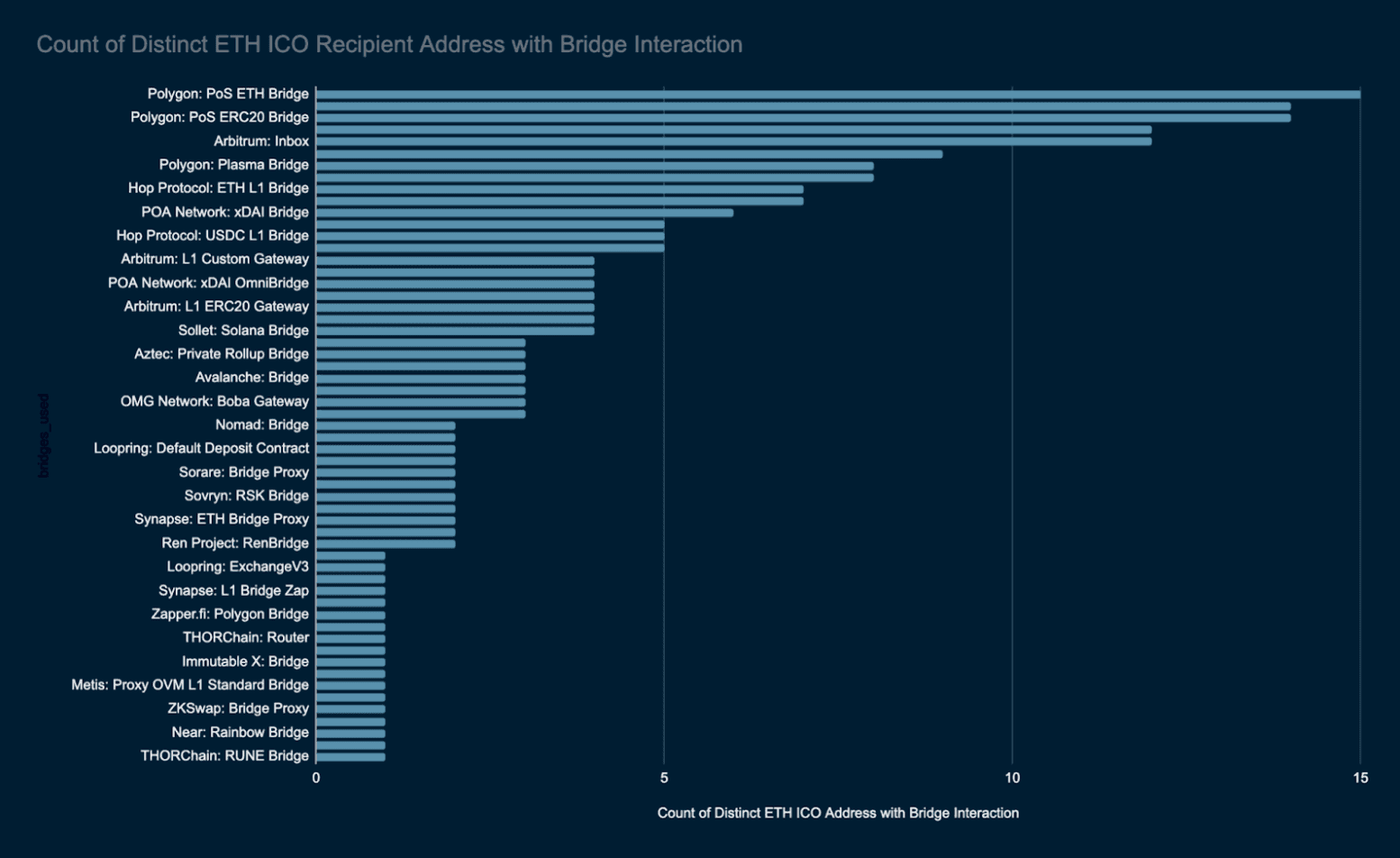

Top bridges ETH ICO Recipients used by unique interaction count

Polygon bridges have the highest interaction count with ETH ICO Recipient wallets, followed by ZKsync, Optimism, Arbitrum, Wormhole, Multichain, Hop Protocol, xDAI omnibridge, and dYdX L2 perp bridge. ETH ICO recipients are mainly bullish on the EVM based on bridging but more importantly, there is a continued trend in using trust-minimized bridges with layer 2s.

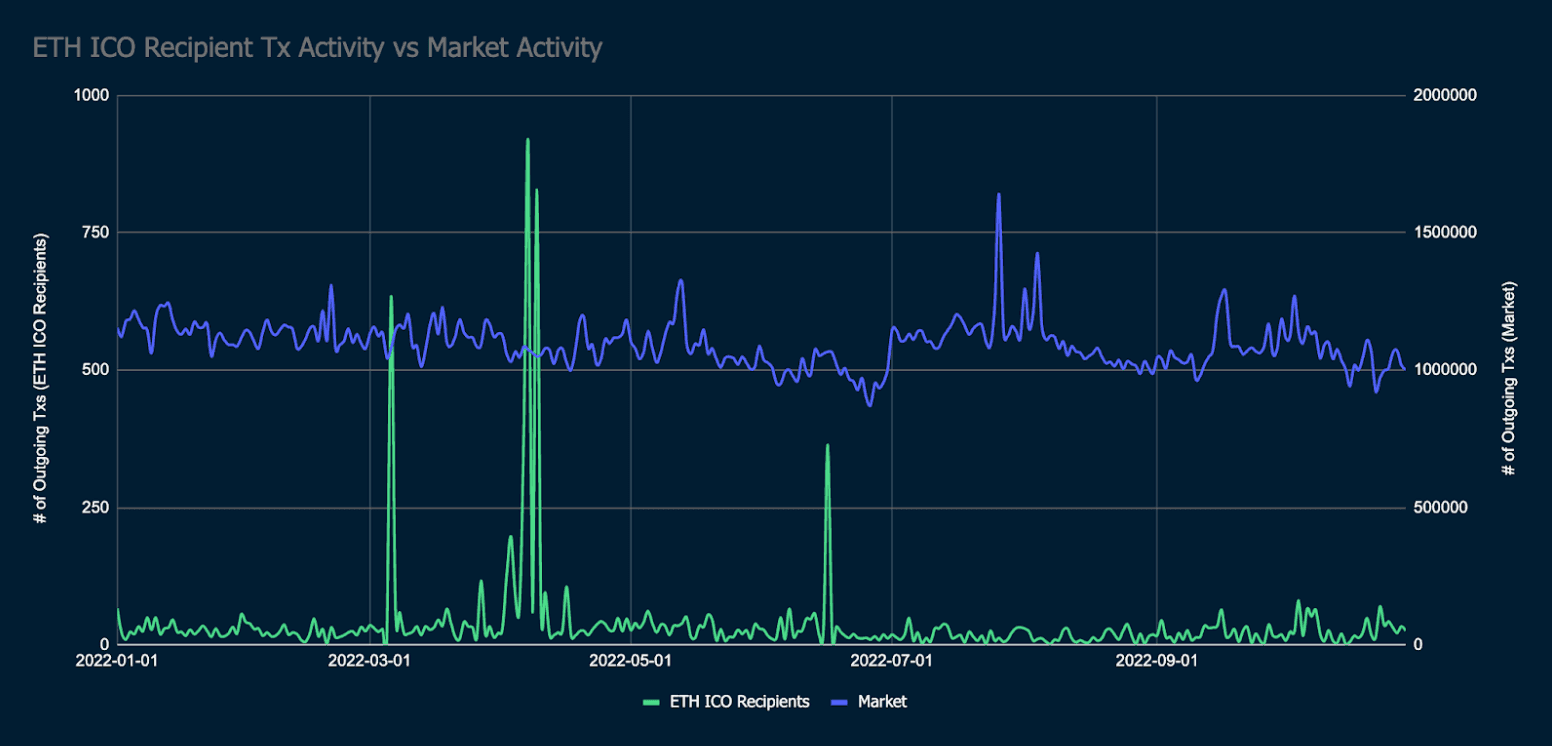

Benchmarking Transaction activity of ETH ICO Recipients vs the Broader Market

From the chart, it appears that there were unusual spikes in transaction activity by the ETH ICO Recipients that were not reflected in the broader market.

However, after further analysis, we noted that the majority of the outgoing transactions recorded during these spikes were attributed to one particular wallet that was involved in transferring / wrapping huge amounts of Etheria NFTs (Etheria is the first true NFT project in history, deployed October 2015 and demoed at DEVCON 1). Apart from this, we also observed one of the addresses dumping ETH on the 16th of June 2022, close to the market bottom.

Closing Thoughts

The data shows that a large portion of ETH ICO Recipient addresses have remained inactive for a very prolonged period. The report investigation suggests that most ETH ICO Recipients have obfuscated their wallets and activity via many counterparties, exchanges for trading/hedging, and with some losing access to their wallets as indicated by the wallet’s dormancy. Several ETH OGs are still bullish ETH and the overall L2 landscape and DeFi. This was indicated by their respective ETH balances, bridging activity, and protocol participation, although the general activity of the ETH ICO Recipient segment remains low.