Introduction

Crypto markets are constantly evolving, but some of the biggest players shaping the landscape today aren’t just individual traders or funds—they include governments, major financial entities, and high-profile figures.

The U.S. government now holds over 195,000 BTC, with a proposed bill aiming to add another 1 million BTC to a strategic reserve—a move that could redefine national crypto adoption. Meanwhile, Donald Trump’s World Liberty Financial continues to make notable investments and strategic partnerships, fueling speculation about its long-term crypto strategy.

Then there are the Trump-linked tokens, where massive gains for a select few contrast with steep losses for many others. The success of notable snipers like Naseem and the exit of smart money raise questions about insider advantages and market dynamics.

With billions in play and shifting narratives, the question isn’t just who’s winning but how these moves are reshaping the broader crypto landscape.

U.S. Government

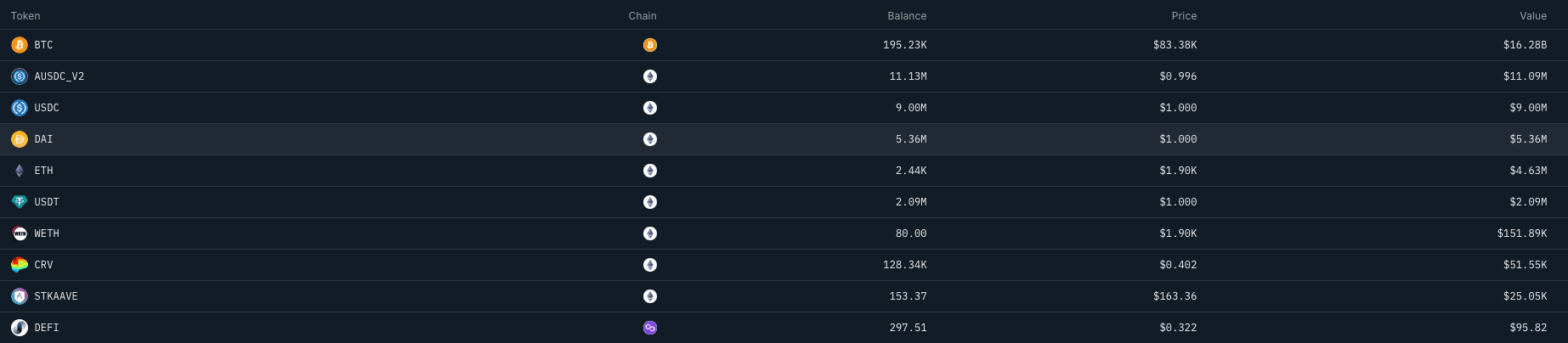

The U.S. government has, throughout the years, seized a large number of Bitcoin to the point where they now hold 195,234 BTC worth $16.12 billion as of March 12, 2025, at 10:00 PM CET. In total, they hold tokens worth $16.15 billion, including USDC and other yield-bearing stablecoins such as DAI and AUSDC_V2 (Aave interest-bearing USDC), along with about $4.6 million worth of ETH.

We’re now in 2025, and the U.S. has a pro-crypto administration that has announced plans for a Bitcoin strategic reserve. In addition, Rep. Nick Begich has introduced the House Strategic Bitcoin Bill, proposing the purchase of 1 million BTC—around 5% of the total supply—over the next five years to position the U.S. at the forefront of crypto adoption. Assuming this passes, at current price levels, this would be worth about $109.2 billion.

The key question remains whether the bill will pass as is or if a revised version will be needed to gain approval. Regardless, such a large-scale Bitcoin acquisition would likely impact BTC’s price, though it also raises concerns about the government holding as much, if not more, BTC than the estimated 1.1 million attributed to Satoshi Nakamoto.

World Liberty Financial

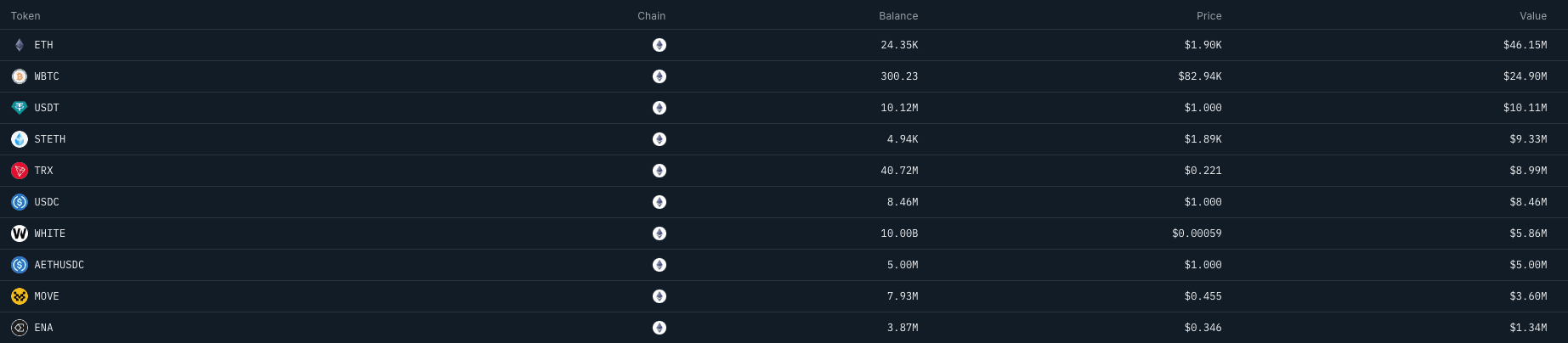

Donald Trump’s World Liberty Financial has, since its inception, been acquiring and trading various tokens. As of now, the wallets associated with the entity hold tokens worth $125.5 million, including ETH, WBTC, stETH, and more.

Recently, they have increased several positions, adding 111 WBTC, 4,468 ETH, and 3,420,039 MOVE, with a total investment of approximately $20 million. Aside from their top 10 holdings listed above (excluding WHITE, which they did not purchase themselves and has a low TokenSniffer score of 10/100, warranting caution), they have also acquired and hold LINK, AAVE, and ONDO, with a combined value of approximately $1.3 million based on current prices and holdings. On February 13, in the evening Central European Time, they doubled their SEI holdings, purchasing around $100K worth, bringing their total to 1.09 million SEI, now valued at $215K.

Based on these token holdings, it's possible that some or all may be included in their Macro Strategy reserve, which was announced on February 11, 2025. The initiative aims to support leading crypto projects, with the stated goal of “bolstering leading projects like Bitcoin, Ethereum, and other cryptocurrencies that are at the forefront of reshaping global finance.”

World Liberty Financial has also announced a strategic partnership with SUI and aims to include it in their reserve, but at this point, they still do not hold any SUI in their public wallets.

Trump Family Tokens

The Trump Family tokens, TRUMP and MELANIA, have continued to see price declines and smart money exiting. However, not all major holders have left—some smart wallets still hold over $700K worth of TRUMP. It has, however, climbed 20% from its bottom on February 11, which is surprising given that new unlocks begin in just over a month, on April 18.

A wallet associated with Donald Trump remains a major TRUMP token holder, currently holding 16,545,696 TRUMP tokens valued at $172 million. The wallet has been actively providing liquidity on Meteora DLMM (TRUMP-USDC) pools since the token launch.

Over the past 17 days, it has received TRUMP tokens from centralized exchanges (Gate.io and KuCoin) and Meteora liquidity pools while also depositing and withdrawing liquidity. Notably, eleven days ago, the wallet deposited 50K TRUMP and $2 million USDC into the Meteora DLMM pool, suggesting continued involvement in liquidity provisioning rather than just accumulation or offloading.

Aside from wallets providing liquidity, what else is interesting? Naseem, a well-known sniper in the crypto space, made at least $137 million on the TRUMP token, and wallets tied to Naseem still hold 180,592 TRUMP tokens worth $1.9 million. According to a thread by Bubblemaps on X, Naseem denies having insider knowledge and instead claims to have “spotted an official Meteora address interacting with a TRUMP-USDC pool a day before launch.” While the sniper has a reputation, it raises concerns that this trader has also successfully sniped/traded tokens related to Hayden Davis, such as LIBRA, HAWK, and ENRON.

While some wallets made significant profits from the token launch, others took substantial losses. The 15 largest losing wallets collectively lost $63.6 million, with the biggest single loss coming in at $17.1 million from one wallet. This highlights how some entities are able to truly profit far more than the rest of the players in the space—whether due to an information advantage, skill, or something else.

A similar pattern emerges with MELANIA, where the biggest loss stands at $15.1 million, while the largest single wallet win reached $82.5 million.

Final Thoughts

From the U.S. government’s growing Bitcoin holdings to World Liberty Financial’s expanding investments, the lines between traditional institutions, politics, and crypto markets continue to blur. The government’s potential acquisition of 1 million BTC could reshape the market, while Trump-linked financial entities actively trade and accumulate crypto assets, signaling a broader shift in adoption among high-profile figures.

Meanwhile, the Trump Family tokens highlight the extremes of crypto speculation, where a select few saw massive wins, while many more took steep losses, but this has not discouraged players from continuing to trade these volatile tokens.