Introduction

Endorsed by Argentina President Javier Milei on February 14, 2025, $LIBRA was initially framed on X as a way to fund small businesses and Argentina ventures. With the involved parties and/or creators, Hayden Davis (Kelsier → self-described as “the facilitator”), Julian Peh (Kip Protocol → described by Hayden Davis as “the team”), Mauricio Novelli, and Manuel Godoy (Tech Forum Argentina), it quickly spiked to a $4.5B valuation.

LIBRA was minted on February 14, 2025, at 21:38 UTC. At 22:01 UTC, Milei tweeted about it, sparking market interest, with snipers joining in simultaneously. By 22:44 UTC, the token’s price surged to a peak of $4.55, marking a dramatic rise within an hour of its creation, only to immediately fall.

LIBRA’s unraveling truly began after the token was “rugged,” with Hayden Davis later dismissing it as just a meme coin in stark contrast to its initial framing as a tool for Argentina’s economy. Meanwhile, Milei quietly deleted his endorsement tweet as backlash mounted (only long after the price had already plummeted 80% from its peak), later stating that he was not familiar with the details of the project.

Adding to the controversy, Davis told Coffeezilla that Milei had no financial stake in $LIBRA, but the damage was done by then. With the token already collapsed and Milei’s backing erased, holders were left questioning if this was ever more than a speculative insider play.

We see very tangible onchain evidence showing a group of “insiders” unilaterally profiting off of the masses who got involved (e.g., traded the token).

Trading Overview

Many traders lost money on the recently launched token $LIBRA, which on February 14th had 50.7k unique holders but, at the time of writing, February 18th, featured only 35.77k holders. What are the features of the wallets that made profitable trades? Were they all “snipers” and “insiders”, or just very fast and skilled traders?

Looking across all wallets that had an absolute gain or loss of more than $1,000, we find a total of 15,431 wallets. Out of these, 86.07% of the addresses have realized losses amounting to $251 million, really showcasing the magnitude of losses suffered on the recent $LIBRA play. On the flipside, the other 2,101 profitable wallets were able to take home just about $180 million in realized gains.

57 wallets were quick to enter, with 37 making over $1,000 in profit, suggesting that some early entrants were likely simple bots rather than major players deploying millions. Of the 37, two wallets bought around 22:01 UTC and finished selling by 22:44 UTC on February 14th, realizing a gain of $5.4 million, with the wallet HyzGo2 profiting the most at $5.1 million.

| Profit Cohorts | Wallets | Total Realised (USD) |

|---|---|---|

| < -1M | 23 | -$40,934,800 |

| -1M to -100K | 392 | -$96,512,700 |

| -100K to -10K | 2827 | -$82,391,600 |

| -10K to -1K | 9903 | -$31,886,100 |

| 1K to 10K | 1478 | $4,802,460 |

| 10K to 100K | 468 | $13,257,300 |

| 100K to 1M | 121 | $37,090,200 |

| > 1M | 34 | $124,631,000 |

Note: Nansen's P&L data are estimates based on token dex trading and in/outflows's time slots from the respective wallets.

There are also wallets still having unrealized gains and losses. 1,001 wallets are still holding the token with combined unrealized losses of just around $11 million, and 71 are still up on their investment but substantially less as of February 18th, 8:00 AM UTC at $0.54 million.

| Profit Cohorts | Wallets | Total Unrealised (USD) |

|---|---|---|

| < -1M | 1 | -$2,823,380.00 |

| -1M to -100K | 12 | -$2,262,030.00 |

| -100K to -10K | 133 | -$3,680,140.00 |

| -10K to -1K | 855 | -$2,490,140.00 |

| 1K to 10K | 61 | $161,217.00 |

| 10K to 100K | 9 | $131,518.00 |

| 100K to 1M | 1 | $218,236.00 |

Who is Still Trading $LIBRA?

After the initial high-volume surge and fall of the token’s price on the 14th and 15th of February, some wallets are surprisingly still trading $LIBRA. Since February 16th, 1,990 wallets have traded and/ or held the token, but why is this data point even of interest?

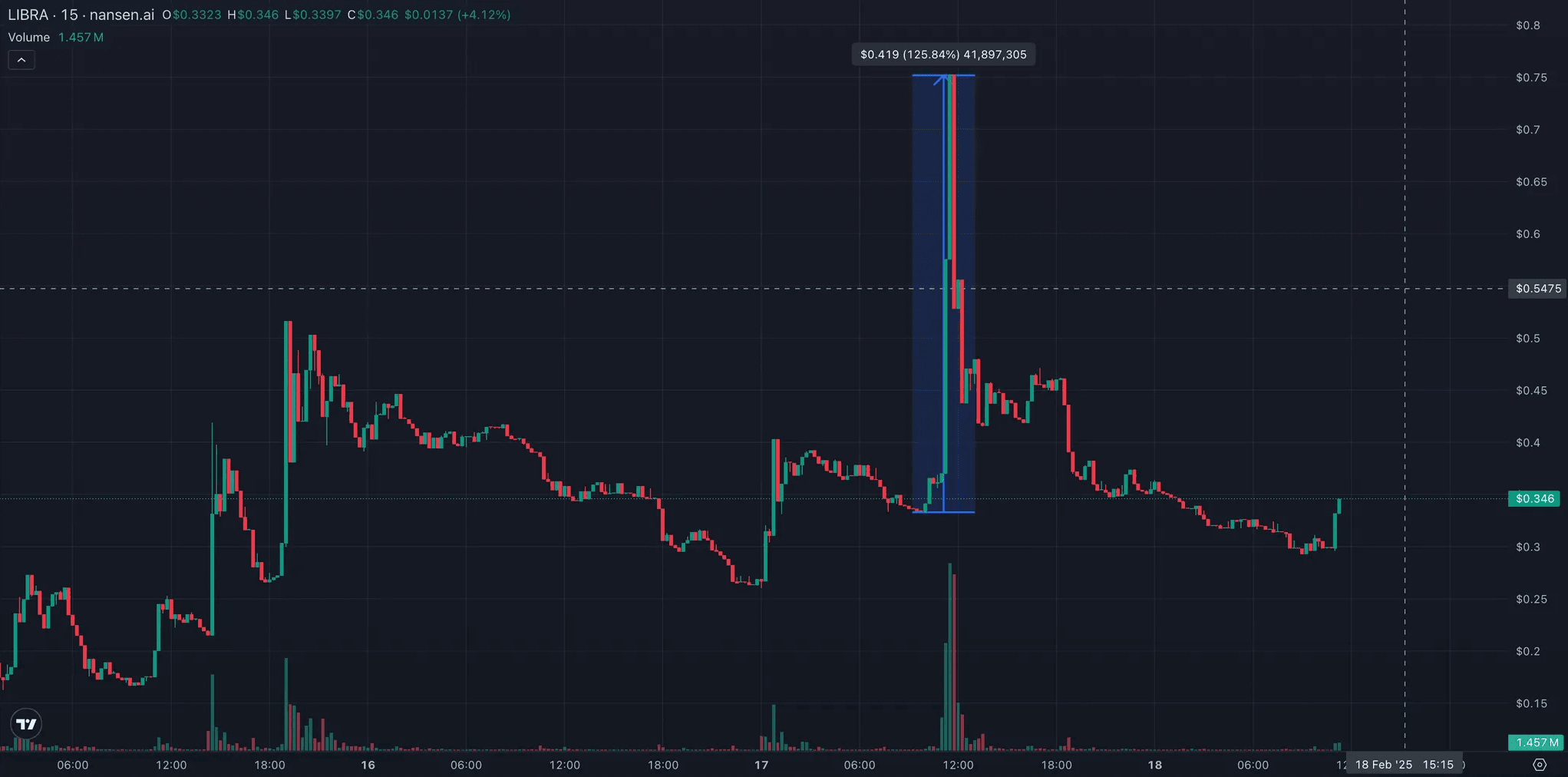

Javier Milei reposted a tweet on February 17th, mentioning how it was not easy for retail to easily buy $LIBRA, causing the price to momentarily surge (but very far from the prior high). From the lows on February 17th, LIBRA went up over 125% post-Milei’s tweet, it then fully retraced the entire move over the next 24 hours.

Regardless of the time of entry, most wallets still ended up with realized losses, with 70% of wallets losing money from February 16th to 18th (11:00 AM UTC).

| P&L Cohorts | Wallets | Total Realized (USD) |

|---|---|---|

| -1M to -100K | 11 | -2,637,510.00 |

| -100K to -10K | 167 | -4,337,750.00 |

| -10K to -1K | 1008 | -2,941,590.00 |

| 1K to 10K | 394 | 1,108,300.00 |

| 10K to 100K | 98 | 2,620,700.00 |

| 100K to 1M | 12 | 2,669,200.00 |

On the unrealized side, however, the situation differs significantly: unrealized losses exceed unrealized gains by $4.57 million, highlighting a significantly larger imbalance (and likely losses yet to be realized…).

| P&L Cohorts | Wallets | Total Unrealized (USD) |

|---|---|---|

| -1M to -100K | 9 | -2,166,710.00 |

| -100K to -10K | 62 | -1,606,640.00 |

| -10K to -1K | 298 | -856,781.00 |

| 1K to 10K | 12 | 37,392.00 |

| 10K to 100K | 2 | 27,707.00 |

Onchain Breakdown

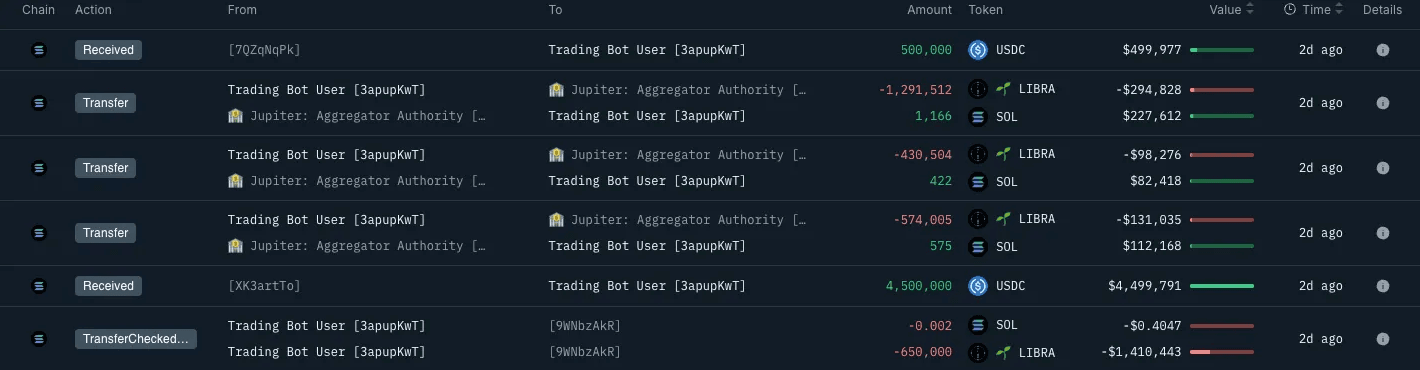

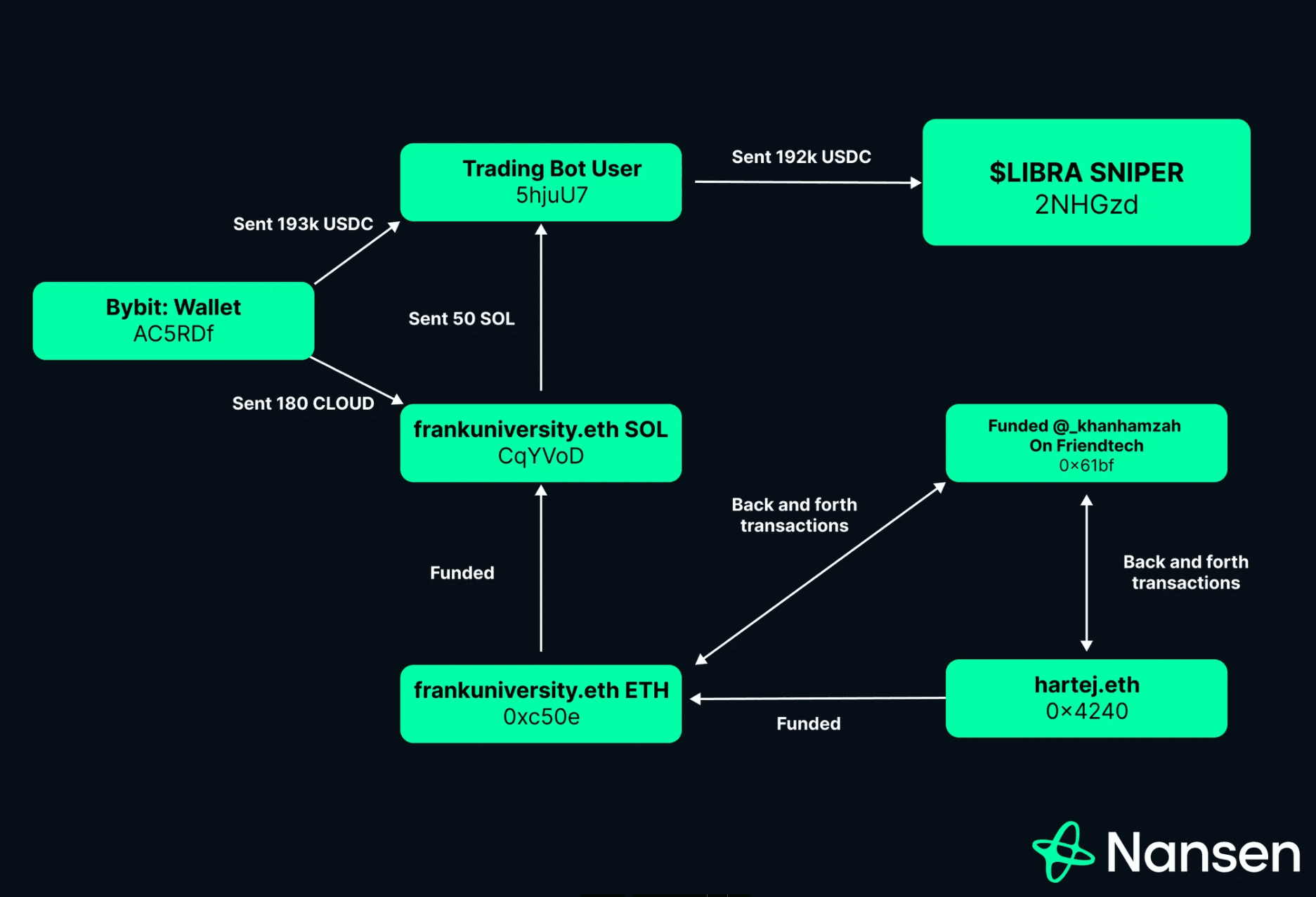

One of the most successful snipers realized a profit of $6.5 million. The wallet was funded by a Bybit wallet as well as another external wallet, which is also a trading bot user (Users that use bots from, e.g., GMGN or BULLX) with relations to named wallets such as Frankuniversity.eth, in extension hartej.eth, and a wallet which funded _khanhamzah on Friendtech.

While there aren’t enough data points to confirm they belong to the same person, the data show some level of relation with 5hjuU7 and Frankuniversity.eth both interacted with the same Bybit hot wallet just a few days apart.

One of the unsuccessful snipers, XRfKhaCA, lost $407k, buying for $6.5 million but selling for $6.1 million. However, XRfKhaCA is connected to and funded by another wallet with the domain dysphoria.sol, who gained around $341K on LIBRA and coincidentally earned $11.6 million on $TRUMP and $655K on $MELANIA, which could indicate "insider knowledge" or a close relationship to an “insider”. Dysphoria.sol has also received funds from blader.eth on Ethereum back on January 4th, supposedly as part of a reimbursement plan for wallets that lost money on $ZERO.

dysphoria.sol also traded $GREED on February 18, one of Dave Portnoy’s new tokens, though the profits were relatively modest around $7K as the token price promptly dropped more than 90%.

The largest single wallet winner comes in at about $25 million in profit, but what really happened, and did they really earn $25 million? 8bZsrR swapped $1.7 million USDC for 12.3 million $LIBRA on February 14, 2025, 22:01:00 +UTC, and afterward sent $LIBRA to seven other wallets. Our model calculates token transfers out of the wallet as selling points that contribute to the $25 million figure, but this is not the full picture - we need to look at the subsequent trading behaviors once the tokens were moved around to these seven other wallets. These wallets then offloaded their holdings at different intervals, with some appearing to sell at a loss based on the token’s price when they received it versus when they fully exited.

The “worst” 15 addresses’ losses totaled $33.7 million, with one wallet still holding 57% of their initial balance. The steepest realized loss came from Dave Portnoy’s wallet at $6.3 million.

As has come to light in the interview from Coffeezilla on his alternate channel Voidzilla, some key people in the project seemingly knew about $LIBRA, but can this be verified onchain?

To take the example of the worst "insider"'s loss, Dave Portnoy, who publicly admitted to knowing about the token pre-launch, had decided not to act immediately and invested just 10 minutes after TGE, only to lose millions. However, he was later refunded $5 million as seen in the below USDC inflows. This was confirmed offchain by both Hayden Davis and Dave Portnoy himself, adding another twist to the controversy.

David Hayes and Kelsier (the company) have also openly admitted to sniping tokens they've helped launch, which included $LIBRA as well as the $MELANIA token, putting additional weight on the accusations that "insiders" were also able to buy the $TRUMP token early, with knowledge supposedly being shared at the crypto party in Washington, D.C. This is unconfirmed and mere speculation as David Hayes mentions hearing it from someone else with no clear evidence. Nonetheless, as highlighted by BubbleMaps, insiders were likely active across several other tokens, showcasing connected addresses.

Reputational Harm

Companies face instant reputational harm when scandals arise, as seen with Meteora. Ben Chow’s resignation sparked widespread scrutiny, with social media amplifying concerns.

At the same time, SOL began declining on February 14th, when the $LIBRA situation unfolded and has been down about 16% since then. Despite Solana being the underlying infrastructure rather than a direct participant, it has faced repercussions, with liquidity outflows dropping from $12.1B to $8.29B (DefiLlama), with investors likely speculating on the future issuance and trading of memecoins.

Conclusion

What started with a presidential endorsement and a $4.5B valuation quickly unraveled as "insiders" took profits, retail got burned, and key backers distanced themselves.

Onchain data make it clear that a handful of wallets walked away with millions, while most traders were left with deep losses. The mechanics are nothing new: early access, sniping, and exit liquidity provided by latecomers. The real damage? Trust erosion and broader fatigue from yet another viral token blowing up before most people even had a chance to process what was happening.

Even Solana saw liquidity outflows spike, showing how these events can ripple beyond just one token. At this point, the crypto market may just be getting tired of the same cycle of big promises, quick pumps, and even quicker exits.

Time will tell whether the Libra episode just triggered a needed cooldown for an overheated market, a "healthy" correction, or something with broader implications especially when it comes to the narrative of U.S. crypto adoption, through the channels of the recent memecoins launched by the US president and his First Lady.