Introduction

This week we will briefly cover a high level overview of onchain metrics, sector performances and broader market thoughts.

Overall Market Performance

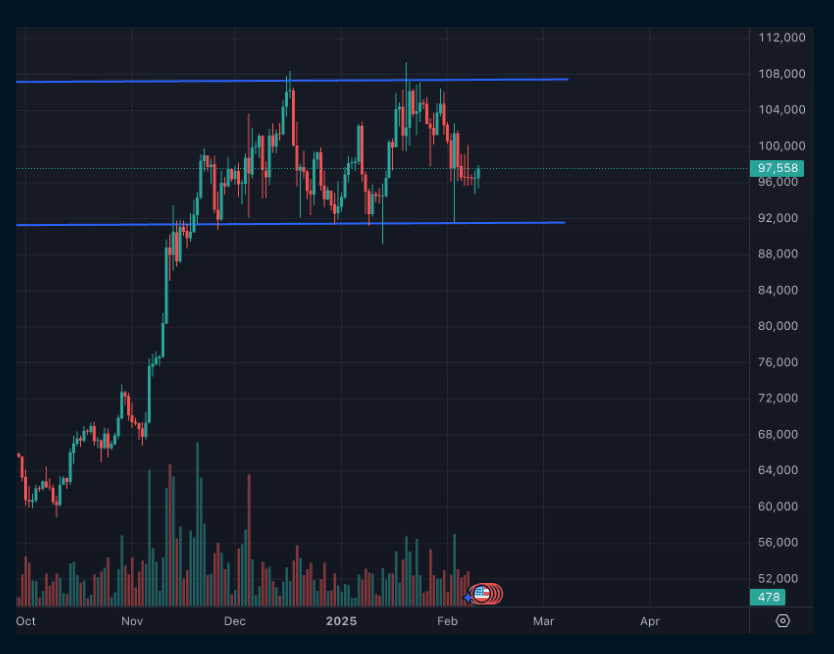

BTC Performance

Bitcoin appears to be ranging, facing strong resistance in the low $90k region, with occasional wicks down to around $89k. Volume remains low, suggesting a lack of strong momentum in either direction. For now, BTC seems stuck in this zone, with no major catalysts on the horizon.

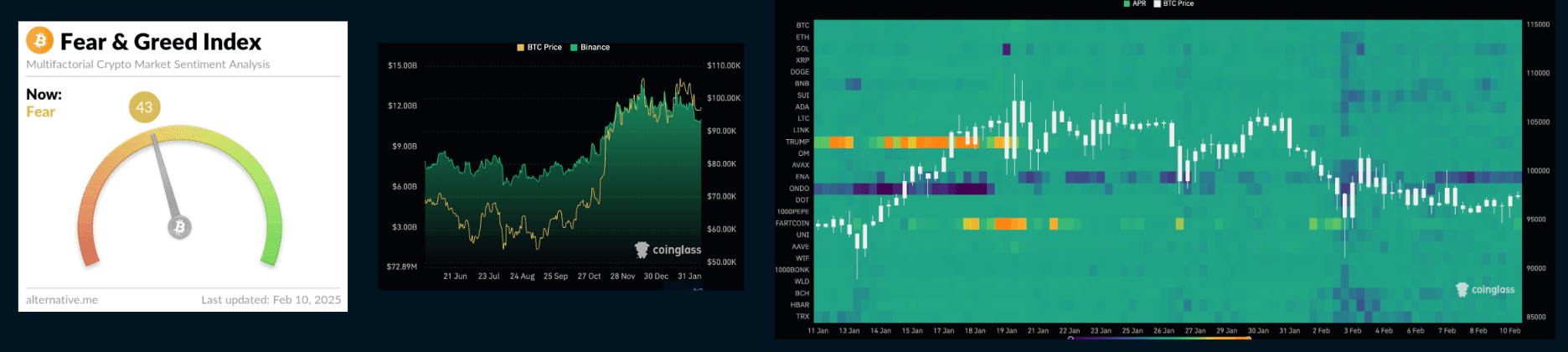

The market sentiment appears reasonable, with the Fear & Greed Index indicating fear. Funding rates for BTC remain below 10%, while many altcoins have negative rates. Open interest is declining, suggesting reduced leverage in the market. Additionally, DeFi stablecoin borrowing APYs are staying under 10%, reflecting a relatively calm environment.

Ethereum

Ethereum continues to struggle against Bitcoin, unable to gain any real momentum. With no clear catalysts on the horizon, ETH keeps bleeding against BTC, recovering less each time. The rise of new chains further complicates things, as they appear to dilute Ethereum’s value rather than strengthen its position—all of them eventually launching their own tokens.

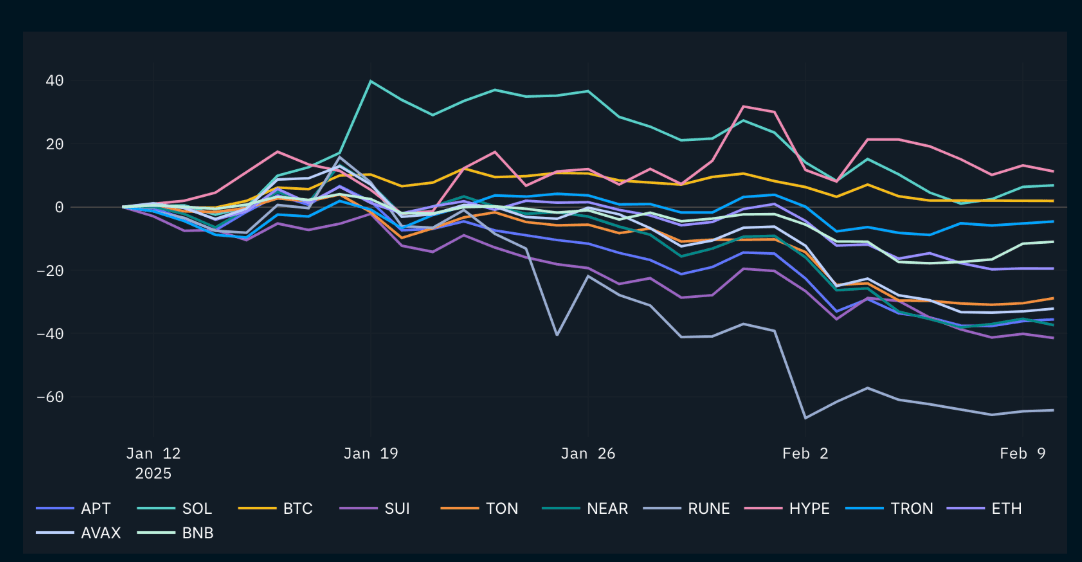

L1s and L2s

Most Layer 1 (L1) networks have struggled over the past 30 days, with only BTC, HYPE, and SOL managing to stay afloat. Other L1s have significantly underperformed, showing weakness across the sector. This suggests that capital is consolidating around a few winners while the rest of the market lags.

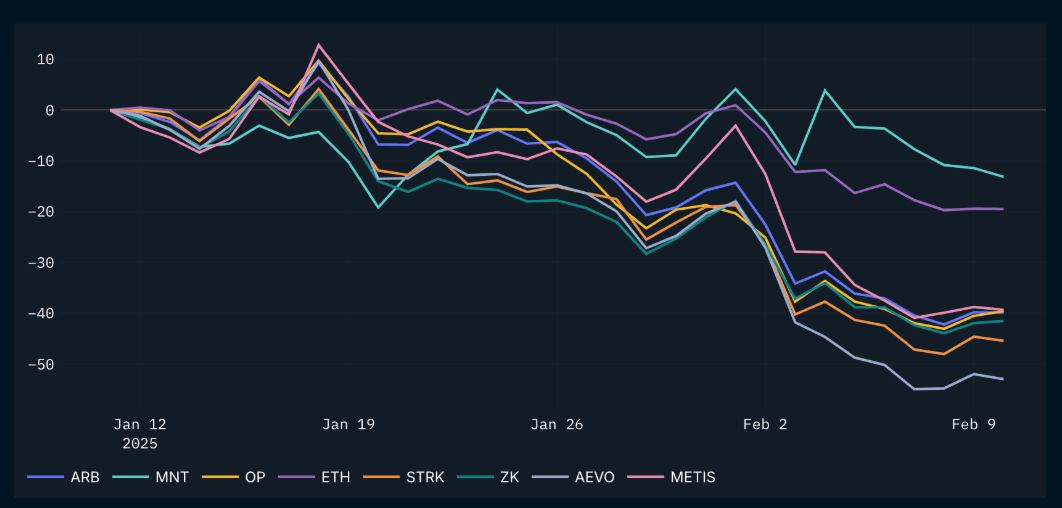

Layer 2 (L2) networks have performed even worse than Ethereum, following its downward trend but with steeper losses. Most L2s are down over 30%, struggling to maintain liquidity in an increasingly challenging market. The broader weakness in ETH and L1s has only amplified the pain for L2 ecosystems.

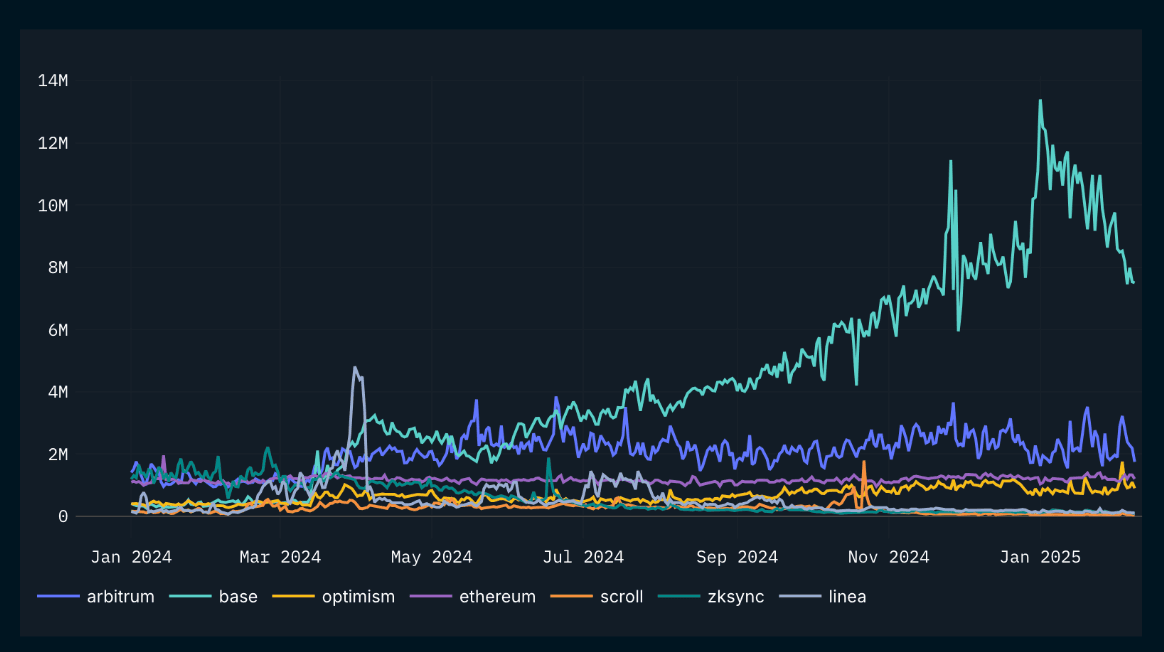

Even Base, the so-called golden boy of L2s, has seen a sharp drop in daily transactions. This is likely linked to a decline of the Memecoin craze and reduced activity of AI agents. On-chain activity is generally declining, with Ethereum mainnet gas fees hovering around 1–2 GWEI, indicating lower network demand. The slowdown in Base’s transactions further highlights the weakening momentum across the ecosystem.

Other Alts

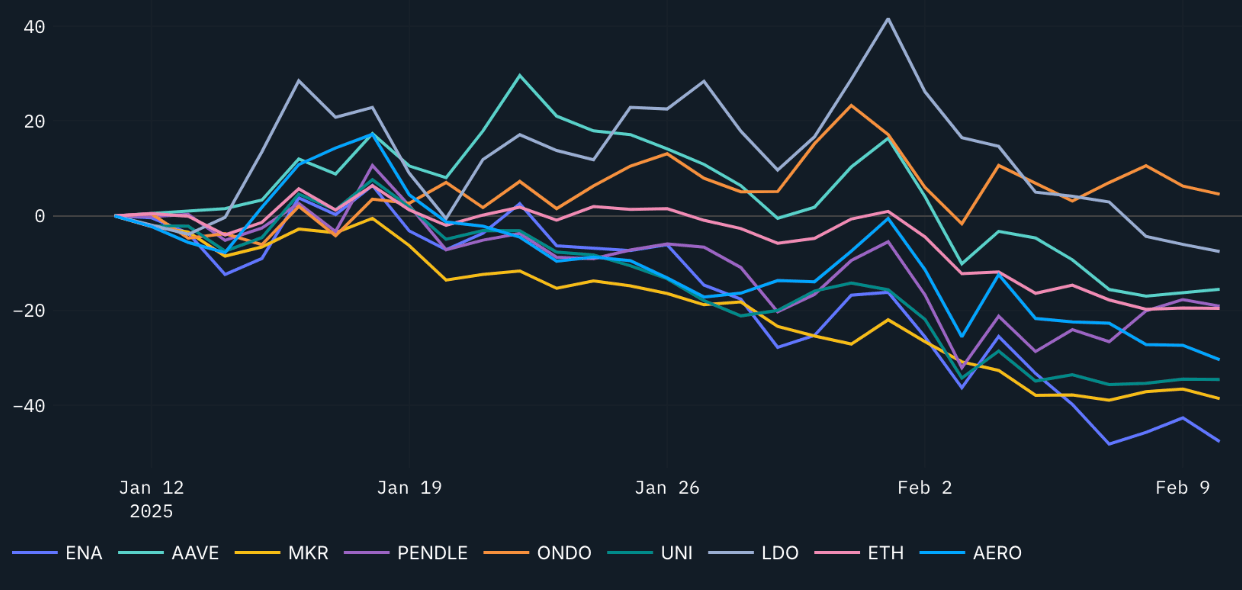

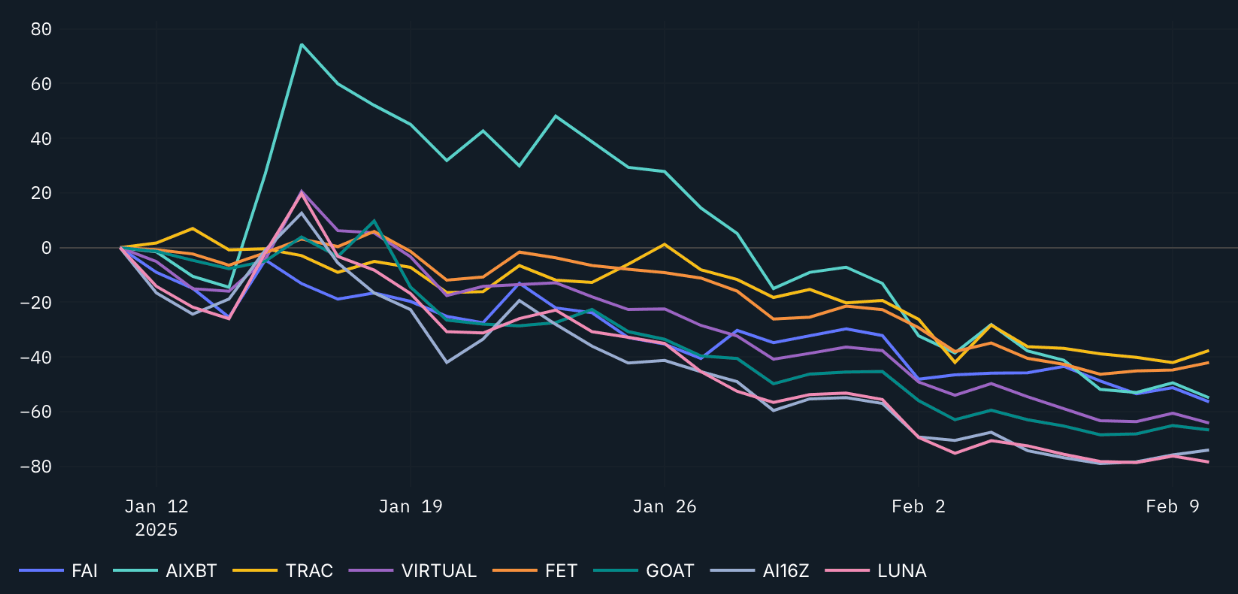

DeFi tokens are struggling, but AI-related tokens are suffering even more. Liquidity remains tight, and most projects are facing significant declines. However, one notable exception is ONDO, which has managed to hold up better than the rest. The AI sector, which once showed promise, has been hit particularly hard, underperforming even the broader DeFi market.

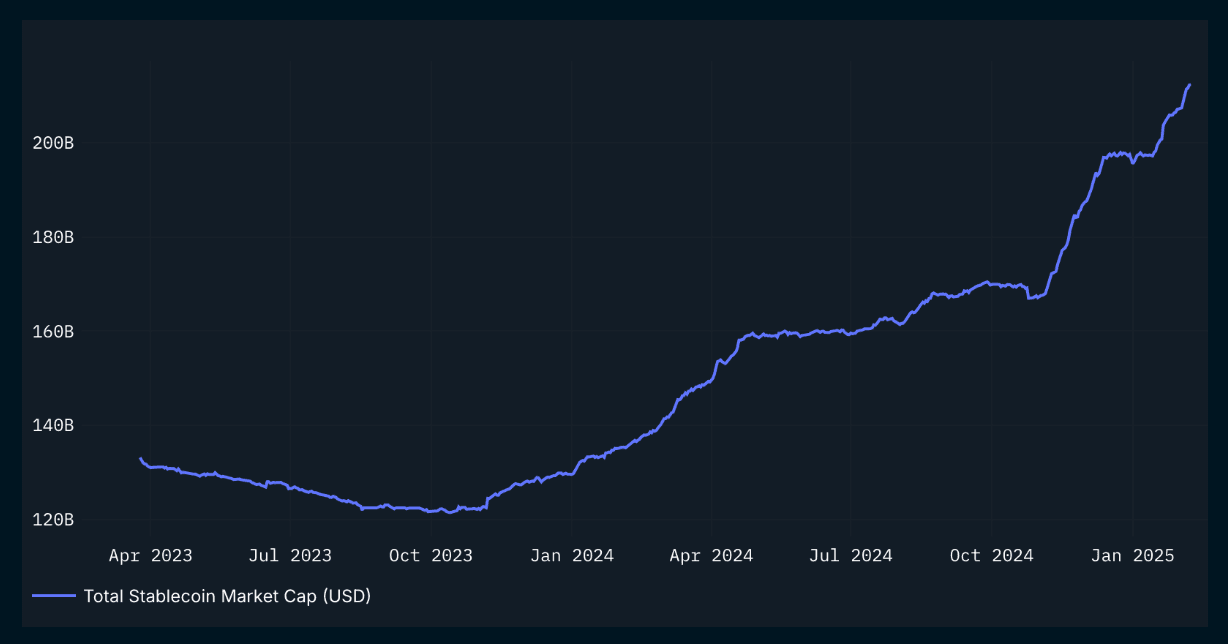

Stables

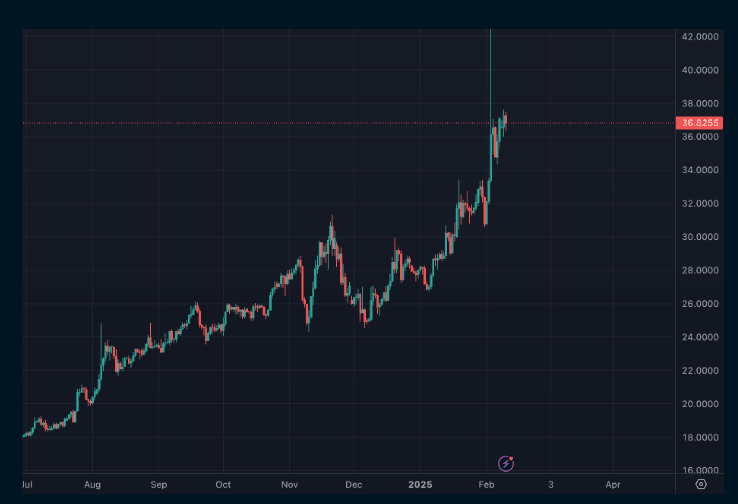

Despite broader market struggles, the stablecoin market cap continues to rise, largely driven by USDC. This trend could be influenced by the EU's recent ban on USDT, forcing exchanges to transition to alternative stablecoins (with USDC being one of the more obvious choices). Additionally, many new stablecoins are backed by existing stablecoins rather than direct fiat, leading to some degree of double counting. However, this does not fully explain the growth—most of the increase is still likely coming from fresh fiat inflows.

Market Positioning and Thoughts

The market remains in a sideways phase, which could spell further bleeding for altcoins. While Bitcoin continues to range, the rising stablecoin market cap suggests ongoing institutional interest—primarily in BTC. Meanwhile, altcoins face increasing dilution as crypto tooling and AI advancements make it easier than ever to launch new tokens, fragmenting liquidity across the ecosystem.

Given this environment, I’m mostly risk-off—stacking stables and farming yields while waiting for better re-entry points. I have some stink bids set for BTC, HYPE, and SOL to catch potential dips. I’ve also taken profits from USDE Pendle farms, rotating into some non-trauma token-farms like AO, Resolv, and BERA, hoping they eventually get their moment. Note, that I am farming these tokens and not taking directional risk.

Looking ahead, I’m planning to buy more into SOL around March post-unlock. I’m also trying to lock in yields on Pendle where they haven’t been hit too hard—like USR on Base. Additionally, I’m considering selling my USR YT on Base in the next 1–2 weeks before points decrease. For now, I’m avoiding most alts and meme coins due to a poor risk-reward tradeoff, but if I do make a move, it will be in something new where I can take advantage of market inefficiencies—similar to how BERA was mispriced at launch while most airdrops took a while to be claimed.