“Enjoy the party but stay close to the door”

The market is celebrating relatively resilient growth and lower-than-expected inflation globally (India CPI 5.72% or 18bps miss, Spain CPI 5.7% YoY or 10bps miss, US 6.5% and 5.7% as expected for headline and core but MoM headline below expectations at -0.1%).

The “celebration” translated into a flatter US Treasury curve, pricing a 50bps hike in H1 2023 followed by rate cuts in the next 18 months. The market “losers” of 2022 recovered some shine last week: US Tech gained + 5%, the Korean Kospi +5%; within US Tech the crypto-correlated semi stock Nvidia was up +13%, and the stock Mercado Libre +24%. Meanwhile, the US dollar weakness persisted, with JPY up +3.2%, EUR +1.8%, and AUD + 1.4%.

And of course cryptocurrencies broke key levels to reach last November’s highs.

How long can the goldilocks narrative of lower inflation and resilient growth support crypto and risk assets?

As flagged in prior newsletters, China re-opening is propping up global growth and this tailwind should have more to run.

Turning to global disinflationary drivers, we will likely see lagging food prices and, in the US, housing-related components of the CPI drive inflation lower (OER to weaken after April this year). For ex-housing services inflation to come down, the scenario of a recession likely needs to materialize. Indeed, US wage inflation still hovers close to 4% YoY, and the average of initial jobless claims remains close to the historical lows at ~212k (4wk moving average).

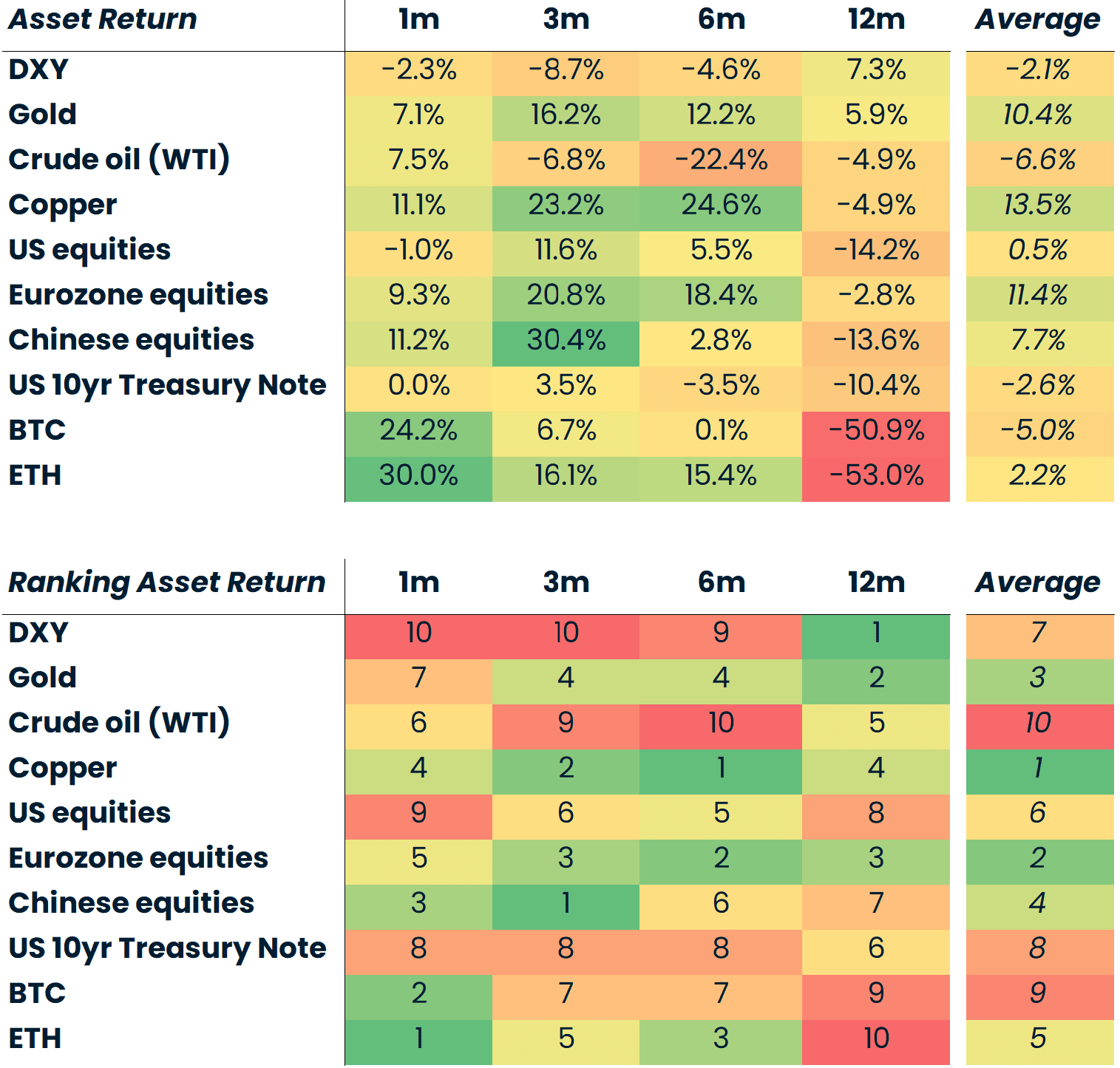

What are the implications for crypto? We can see a scenario for prices similar to 2019 (crypto up as growth slows) - 2020 (crypto sells off with other assets) where crypto assets retest the cycle lows as US growth contracts, and traditional risk assets sell off. The risk premium for equity is now below 6%, following the risk-on bout year-to-date. This is too low given the likely economic outlook of slower growth, notably in the US.

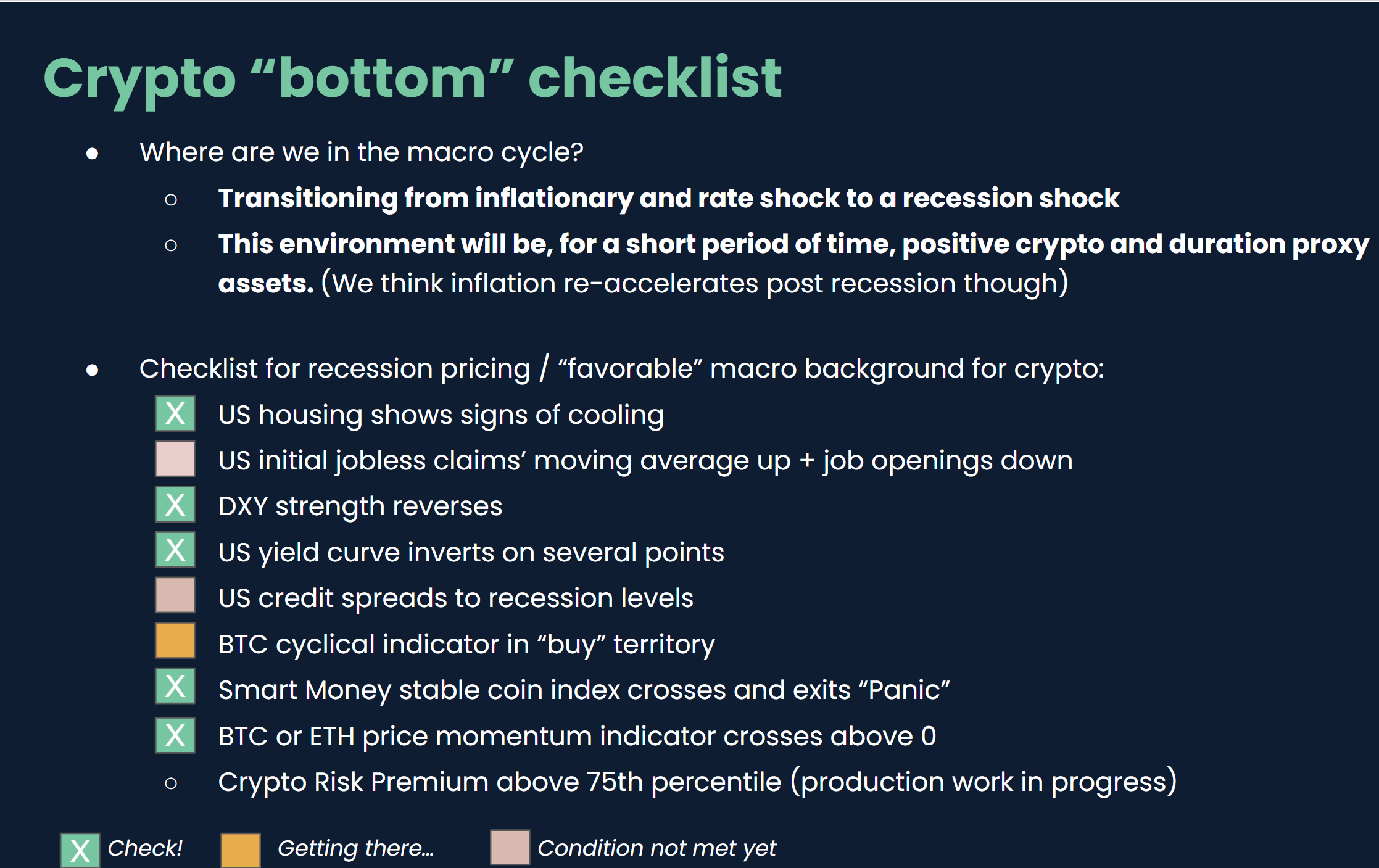

Our heat map for a crypto bottom has quite a few green lights already, but we are notably missing a capitulation in traditional risk assets:

Macro thread

Japanese inflation is catching up with the rest of the world. The Bank of Japan has continued to defend the 10yr yield with record JGB purchases but it looks like the JPY momentum is on the side of investors, who are rightly anticipating a normalization of monetary policy when Kuroda retires in a few months.

US CPI: energy has remained the negative force since a few months, used car price inflation is also negative; food is positive but the pace of inflation is coming down; higher positive contribution from shelter, and apparel. Going forward: the negative push from energy may have run its course but we expect food inflation to come down, and shelter will add to desinflation after April this year. Of note, economists have started to revise their inflation forecast down since October. Those moves are usually autocorrelated (more to come).

US wage growth looks like it is slowing down but US initial jobless claims are too low. The labor market and wage growth are the ultimate “battle” of the Fed. We are unlikely to see lower rates as long as the labor market stays tight.

What could go wrong for growth? We see a scenario of macro weakness coming from financial markets, notably from the less liquid investment vehicles becoming insolvent (see REIT funds troubles in the US), or possibly, from the consumer cutting consumption especially if the labor market becomes less tight as desired by the Fed.

JP Morgan, Bank of America, Citi, Wells Fargo reported their Q4 earnings and gave us the pulse of the US economy. A few observations: mortgage loans were the weakest segments in terms of revenues (together with investment banking). But aside from this trading and also net interest income bolstered earnings, telling us that the economy is still very strong, including loan growth ex-mortgages. However, guidance is interesting: all the banks increased their provisions for loan losses substantially, and guided net interest income down. Also interesting was the significant increase in credit card balances, indicating that consumers are relying on short-term expensive debt to finance consumption and supporting the likelihood of a slow down in consumption in 2023:

Market thread

This brings us to crypto: we are transitioning to a macro backdrop of slower growth and slower inflation, which is usually positive for crypto because of the Fed’s reaction function. However we are not quite at the point where growth is weak enough to lead the Fed to pivot. This is why we see the past move in crypto (and in US tech) as a likely bear market rally before a re-test of the lows.

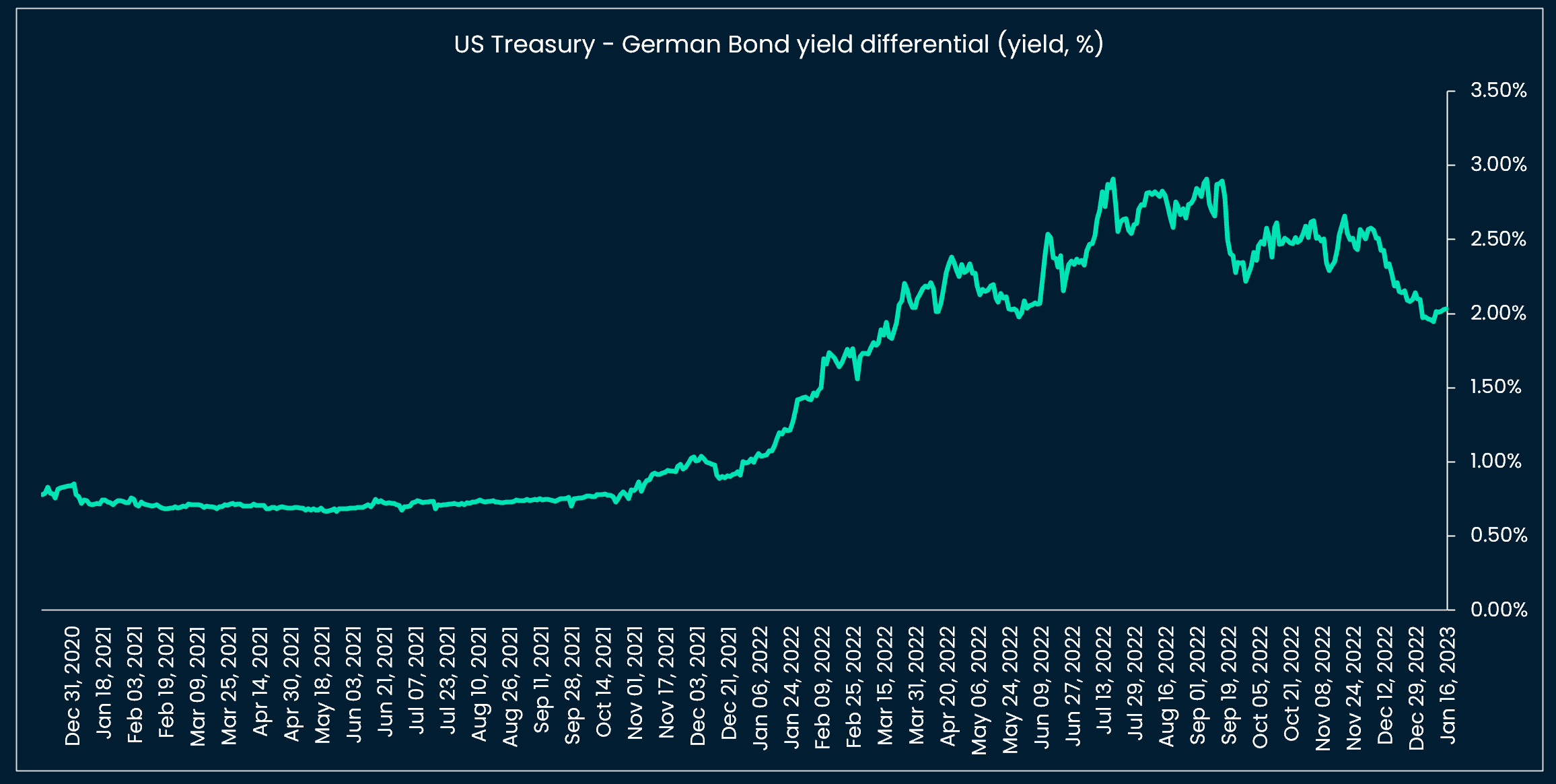

We have been wrong so far about the US dollar as its weakness has persisted. We update two types of indicators (yield differentials, and price momentum) to track US dollar moves, and both remain negative USD.

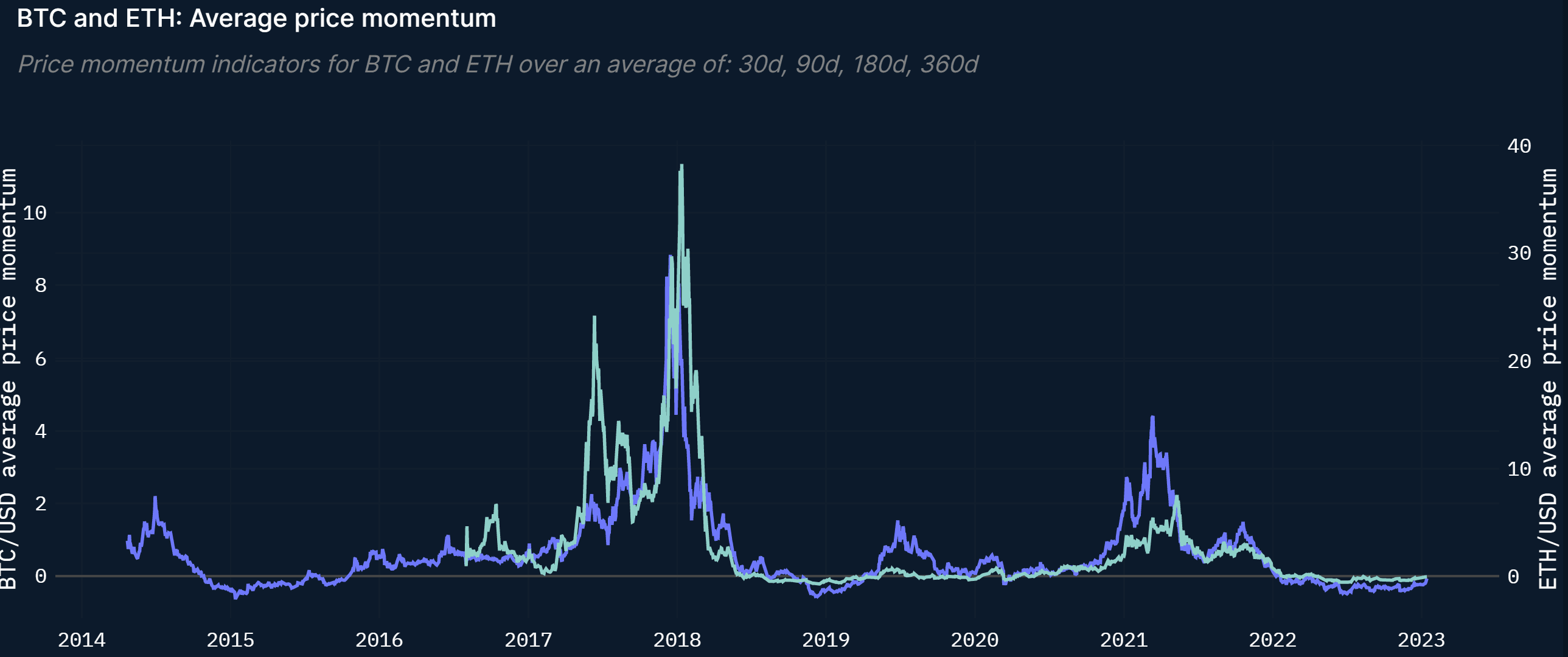

The price momentum indicator (average of price growth over several periods) has turned positive for ETH and is about to turn positive for BTC:

Nansen stable coin risk appetite indicator has been positive crypto since May 2022:

Nansen long term BTC indicator not positive yet: went very close to MVRV threshold though.

Optimism leads transactions higher still.

Equity risk premium: Equity investor’s pessimism melts in 2023 YTD, reaches the 75th long-term percentile at 5.8%.

What matters this week

Tuesday 17 January

- The Bank of Japan meets. We expect the central bank to hold the short-term rate at -0.1%, this is consistent with consensus so any hawkish surprise (even rhetoric) would push the JPY higher.

Wednesday 18 January

- Eurozone December CPI, expected at 9.2% YoY

- US December core retail sales (consensus -0.4% MoM)

- US December PPI (consensus -0.1% MoM)

Thursday 19 January

- US December building permits (consensus 1.370m)

- US initial jobless claims (consensus 212k)

- US January Philadelphia Fed Manufacturing Index (consensus -11)

Friday 20 January

- US December existing home sales (consensus 3.95m)