1,2,3 bank failures: quick recap of what happened

Lot of good analyses have dissected what happened to the three tech and VC-friendly banks, Silvergate Bank (SI), Silicon Valley Bank (SIVB), and Signature Bank (SBNY) that were successively shut down by the banking authorities in the past seven days.

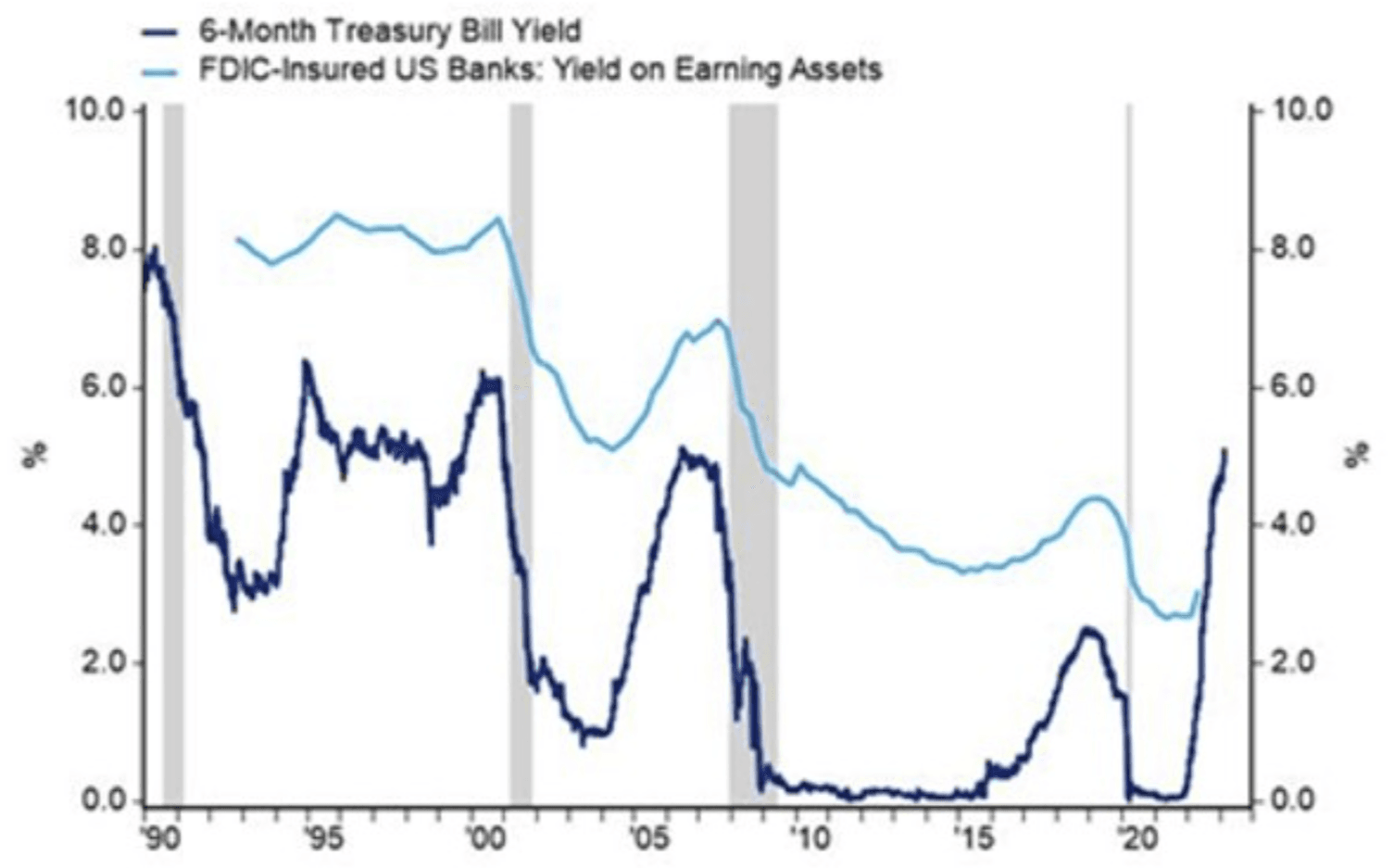

A summary would read: some of the consequences of 14 years of Fed fund rates standing below 2.5% (and during many of these years close to zero) have been poor risk management in the least-regulated areas of finance and investment, combined with unrealized asset value growing increasingly at-odds with fundamental value.

The jump from 0% to 4.5-4.75% in the US Federal fund rates has exposed the vulnerabilities that a decade-long low-rate environment has enabled. In the case of the three failed regional banks the specific issues were:

- A high-share (or, for SI most of the) exposure to undiversified customer deposits: concentrated in VC and fund management entities, on the liability side

- A duration mismatch between these customer deposits (redeemable at all time) and the asset side, the latter having been invested in long-duration US Treasuries, munis, and other MBS securities

- The weaknesses above get exposed when customer deposits fall (bank run) and have to be redeemed by the sale of securities at a realized loss

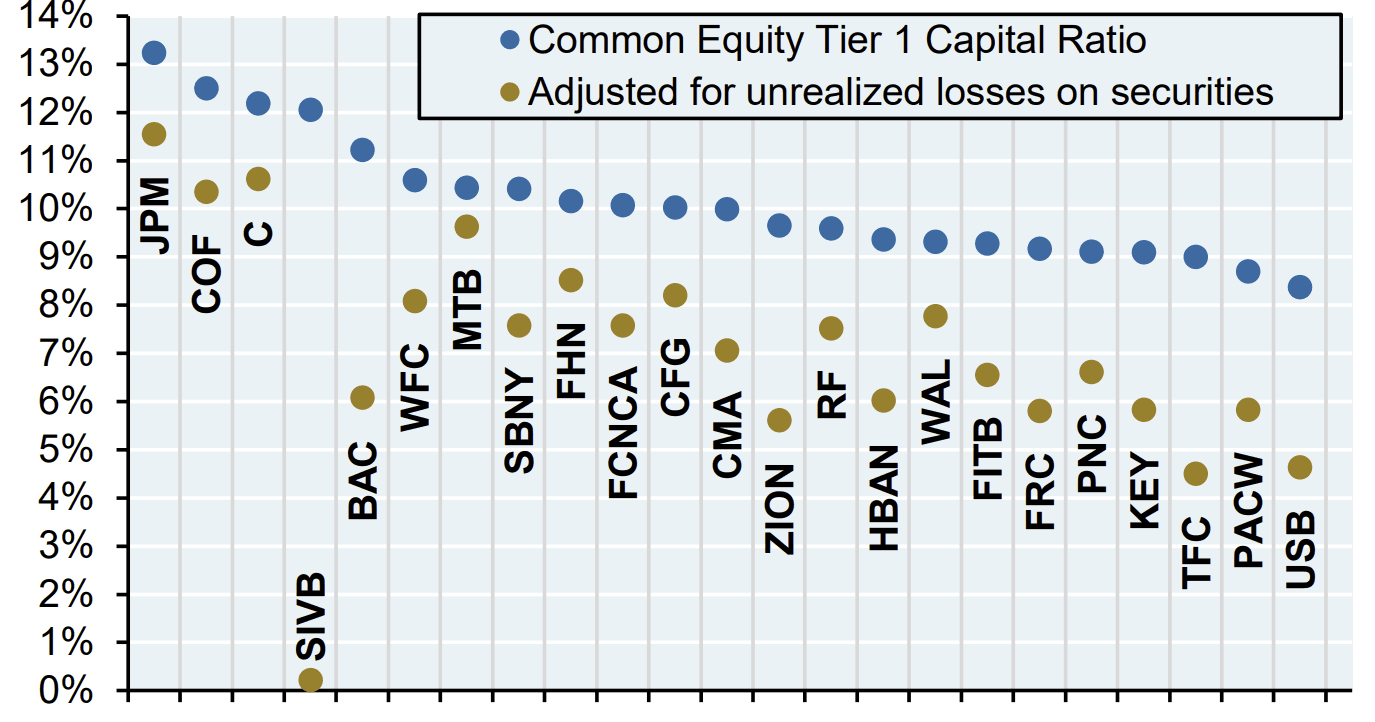

We show below the chart created by JPM strategist Michael Cembalest and recommend reading his short note on Silicon Valley Bank failure.

The chart below analyzes what happens to the Common Equity Tier 1 (the capital that is supposed to absorb any unforeseen realized loss in the balance sheet of a bank) if unrealized losses on securities held by the respective banks are deducted. Two remarks on this chart: 1) ex-post, SIVB was in a difficult position, 2) US Bancorp (USB) and Truist (TFC) would be left with very low CET1 ratios (below 5%) were losses forced to be materialized (e.g. by a bank run). Maybe the FDIC, Fed, and Treasury had this picture in mind when meeting this weekend to decide on the fate of uninsured deposits of the failed banks. More on this later.

The FDIC / Fed / Treasury rescue: the how and the why

The how

The Federal Deposit Insurance Corporation (FDIC), US Federal Reserve and the Treasury met this weekend and announced that:

- The uninsured deposits (e.g. above USD 250k) of both Silicon Valley Bank (SIVB) and Signature Bank (SBNY) would be “made whole” or available for a 100% recovery by the depositors

- The uninsured deposits of SIVB are estimated at USD ~160+bn and those of Signature Bank at USD ~79.5bn (as of 31/12/2022 89.7% of USD 88.59bn deposits were not FDIC-insured, according to the bank’s quarterly disclosures). That is a rough total estimate of USD 240bn across both banks

- The financement will come from the FDIC’s Deposit Insurance Fund, which amounted to USD 128.2bn as of end of December 2022

- Depending on the realized losses when unwinding the two banks’ assets - Joseph Wang and other analysts have estimated a haircut to uninsured deposits ranging from 10% to 30% - up to 60% of the Deposit Insurance Fund could be drained (assuming the same magnitude of realized loss at SBNY)

- This implies an increase on the future risk premia collected on banks by the FDIC, to finance the fund

- (Also, bondholders and equity shareholders of the two banks will suffer the losses)

- A funding facility, the Bank Term Funding Program (BTFP), would be created to offer loans of up to one year to banks unable to meet deposit redemptions

- The following assets can be pledged at par (ignoring any unrealized losses) for the banks to obtain funding: U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral

- The fund “just” amounts to USD 25bn, financed by the Exchange Stabilization Fund (US FX reserves). This fund could be topped up but with the authorization of Congress

The why

“Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system.” reads the opening statement by the Treasury, Federal Reserve, and FDIC on the depositor rescue announcement. The key word here is “confidence”. The three institutions have anticipated the worst case scenario of contagious bank runs, which would have forced some regional banks to realize losses (see the second chart of this newsletter).

Psychologically, it is worth emphasizing that one of the decision maker, Fed Chair Powell experienced a similar situation at the beginning of his career which taught him to prioritize tackling the risk of contagion over the “moral hazard” (e.g. bad press following the rescue of undeserving borrowers): see this anecdote related by the WSJ journalist Nick Timiraos.

The other decision maker was Treasury Secretary Yellen (with the consultation of President Biden): 2024 is an election year, and any contagion to the economy would be problematic.

Finally, the fear of contagion to other regional US banks is not completely irrational. True, SIVB was an outlier in terms of risk mismanagement (ratio of uninsured deposits, allocation to duration etc.), but, judging by equity market reactions, the probability of a bank run out of fear is not null for certain banks: as we write the stock of First Republic Bank is down 78% since today’s open after falling 32% the past week. We also note that Signature Bank had a significant exposure to commercial real estate via its lending activity. This exposure might have pushed the Fed notably to offer an additional funding facility.

Implications for US policy, the economy and crypto markets

Monetary policy

If three bank failures had not happened, and considering just the macro data, we would maintain that the Fed is likely to hike by 50bps at its next meeting and announce a higher terminal rate (5.50%-5.75%):

- Job openings, at 10.824m, are slowly decreasing but surprised to the upside for January, were revised up for December and remain close to all-time highs

- Other data point to a cooling of the US labor market, albeit a very gradual one: the average working week ticked down to 34.5 hours from 34.6 hours, non-farm payrolls slowed to 311k from 504k and were revised down last month. The disparity in sectors is now evident: in February, the information industry lost 25,000 jobs, while, at the opposite end, leisure and hospitality added 105,000 jobs. If we project the current pace of job gains for leisure, in four months (June report), the leisure sector will have come back to its pre-2020 staffing level. Coincidentally, from May-June on, we should also see the shelter component of the CPI cool (lags from new rents)

- CPI: All things equal, considering gasoline price developments in March, the headline CPI would come in at 5.7% YoY. The consensus is now at 6.0% YoY but could change before tomorrow’s release

We now see a higher bar for a 50bps rate hike, given the developments in financial markets, post-rescue-measure announcements. A +25bps hike at the Fed March meeting now seems more probable, unless the February CPI released tomorrow surprises significantly to the upside.

The economy

We expect changes in banks’ behaviors, namely, an amplification of the following measures, which started in Q4 2022:

- Tightening of lending standards (the Fed Senior Loan Officer Survey already showed that lending standards for commercial loans were as tight as during the last recession, see our past commentaries)

- Increase in the remuneration of deposits, especially at regional banks, to incentivize stickiness

- Increase in provisions for credit losses (already started in Q4 2022, but mainly for credit card loans by the big US banks)

- The measures above should lead to a stronger transmission of monetary tightening to the economy (e.g. more headwinds for the US economy). This should in time weigh on inflation, likely with a lag though (watch shelter CPI in May)

Financial Markets

- Following last week’s testimony of Fed Chair Powell, who signaled a likely higher level of terminal rate, recessionary trades made a come back: US duration was bought, the USD strengthened and so did the CHF and the JPY

- The most resilient assets in recessionary times have been the safe haven cash: namely USD, CHF and JPY

- Will duration rally further? It would make sense to put some probability of this occurring (a small one, given the high uncertainty surrounding the inflation developments and the still very tight labor market)

- We would also expect more risk aversion from equity investors: the risk premium had fallen significantly YTD but then jumped 1%pt from February to 6.1% last Friday

For crypto, we would expect to see the following:

- More diversification among stablecoins outside of USDC (see the price developments of LQTY) at least until we get more regulatory clarity on stablecoins vs CBDC

- More risk aversion translating into exits from crypto to T-bills, notably from crypto protocols’ treasuries

- We note that our cyclical indicators have not yet turned bullish crypto: the Crypto Risk Premia for BTC and ETH are risk-off since January and October 2022 respectively

This week: US CPI, ECB, and bank stock developments

Tuesday 14 March

- US Feb. headline CPI (consensus has 6.0% YoY, it would be closer to 5.7% considering gasoline price developments, all things equal)

Wednesday 15 March

- US Feb. PPI (consensus 0.3% MoM)

- US Feb. retail sales (consensus -0.3% MoM)

Thursday 16 March

- ECB meeting: a 50bps hike of the policy rate to 3.50% is priced in. We expect guidance to point towards “data dependency” for the May meeting. We will scrutinize the press conference for any signs of lesser hawkishness (Is President Lagarde extrapolating the US situation? There are differences between the US and EZ banking systems, so the parallels should be limited, but the Eurozone has other issues in the shape of sovereign debt. Lending standards are also tightening following the step back from TLTROs)