No quantitative easing has occured in the last two weeks

Not Quantitative Easing (QE) but a set of financial stability instruments to provide banks with immediate liquidity without having to “fire sell” debt securities:

The various facilities and tools that have been put forward or facilitated by the US Fed and the FDIC since March 12 and the failure of Signature Bank and Silicon Valley Bank aim at restoring confidence while the “problematic” banks get restructured / acquired by stronger competitors and while markets calm down. In the US, one main common issue between Signature, Silicon Valley Bank and now First Republic Bank was the presence of “unrealized losses” in the securities that sit on the banks’ respective asset sides. The Fed’s discount window and the new Bank Term Funding Program (BTFP) respectively allow banks to post some of these debt securities as collateral, and obtain short-term funding in return, without having to sell the securities and materialize a loss. This short-term funding will not be stimulating bank lending activity and is therefore unlikely to support the economy (unlike quantitative easing or policy rate cuts). If anything, banks will probably tighten their lending conditions: they have already started doing so, and the market volatility seen in the last two weeks will likely force banks to continue increasing rates on offered loans and hold stricter eligibility criteria for loan applicants.

The Fed’s discount window allows loans of up to 90-days. It has been used for USD 148bn new loans in the past two weeks. There is usually a stigma in using this facility, but the Fed has been encouraging banks to do so since the market volatility started (see this podcast for a deep-dive on the discount window).

The BTFP registered USD 12bn loans. Loans via this new facility have a maximum duration of one year and total loans can reach 25bn.

There were also new loans of USD 143bn to the former Silicon Valley Bank.

Although the amounts lent are large, they remain for a short period of time (most of the discount window new loans have a maturity of two weeks) which re-emphasizes their role of funding emergency sources.

From the US to Switzerland

Credit Suisse will no longer exist as it will be acquired by the Swiss banking leader UBS, in a deal brokered by the Swiss government and the banking regulator.

It is worth highlighting the distinction between the US situation described above and CS’s case. Issues in both countries have been exposed by tighter global financing conditions. The root issues of CS are not related to issues in the duration of asset / liability, but linked to a history of risk management weaknesses: see the report on Archegos investigation for more context.

A few numbers:

- The backstop from the Swiss central bank and State could amount to up to CHF 260bn (that is more than a quarter of the Swiss GDP)

- The price of the acquisition is CHF 3bn, this is CHF 0.76 per CS share

- For shareholders, this is a loss of 93% on the book value estimated at the end of 2022 (45bn)

- The holders of high-trigger and low-trigger convertible debt (“CoCos”) will not recover their ~CHF 15bn initial investment

There has been surprise expressed around the last point: we note that convertible bonds are first in line for loss-absorption in case of a fall of the capital ratio below a certain threshold or in case a bank goes out of concern: see details on how these instruments work here. CoCos are usually held by insurers and pension fund investors. A systemic contagion to similar instruments is worth monitoring but not apparent yet.

No contagion so far

“Panic” transmission to the broader financial markets has so far been contained: the equity risk premium of the S&P500, a measure of investors’ risk aversion, is up to 6.8% but still below last year’s average.

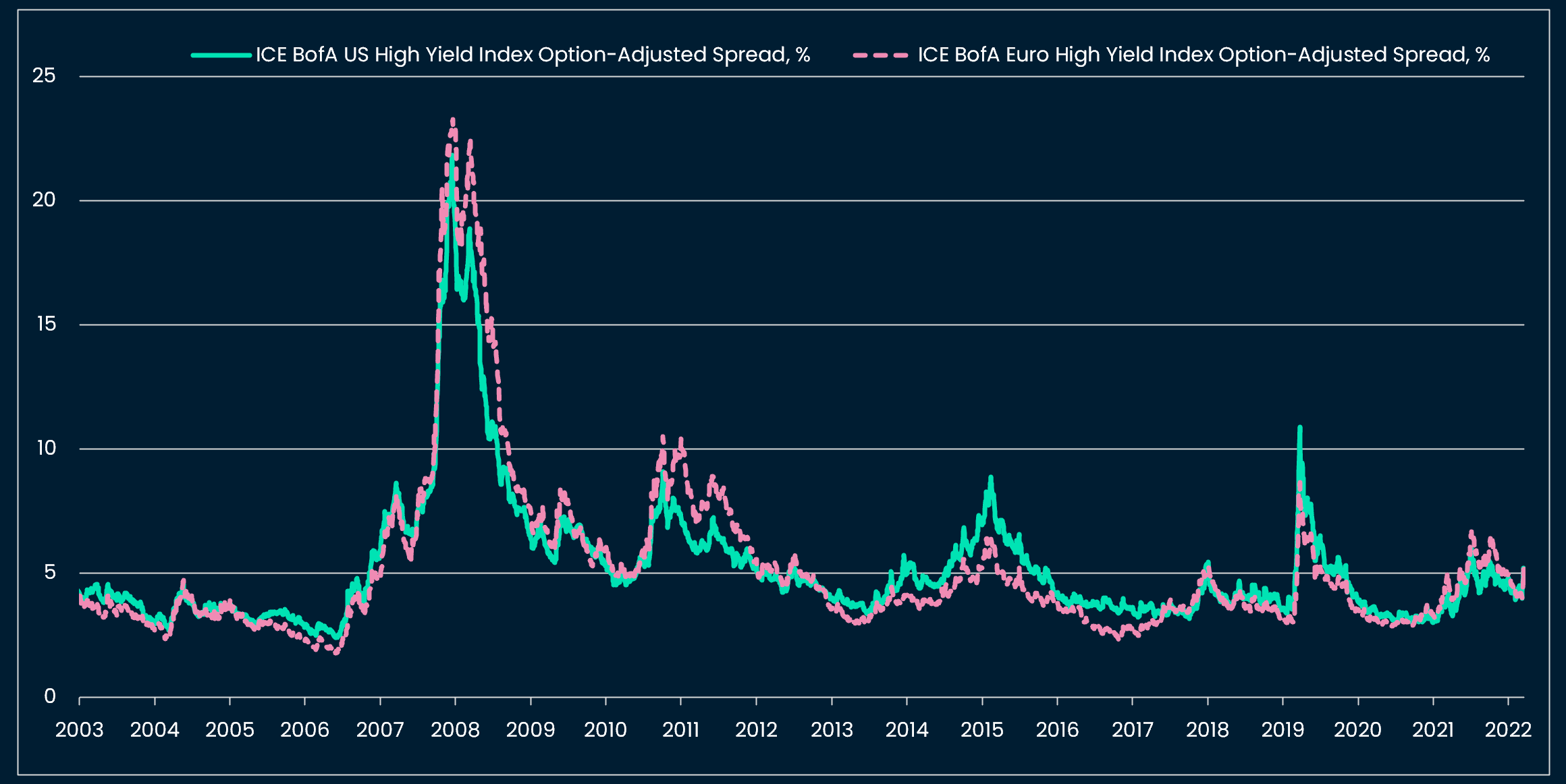

We see the absence of panic in high-yield credit spreads:

Finally, there is no sign of cross-currency funding stress so far (which emerges when other countries are lacking access to US dollar or other currencies’ funds).

Policy implications

What are the likely next steps for monetary policy?

We address this question for the US by a quick analysis, before moving to a more qualitative assessment for the ECB and the Fed, respectively.

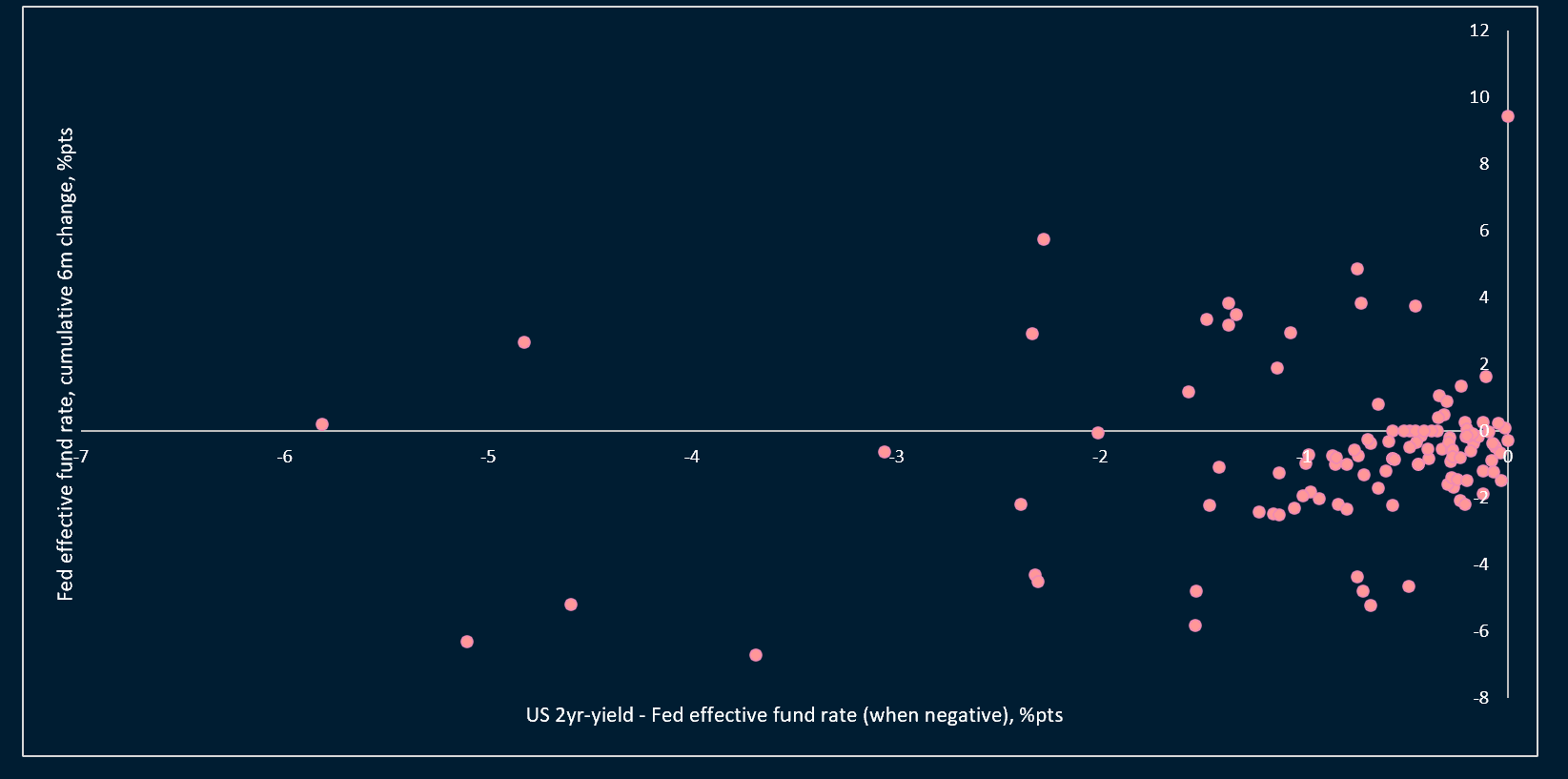

In our analysis, we find that the US 2yr rate crossing below the Fed policy rate (this happened last week) has little predictive value on whether the Fed policy rate is cut in the next six months:

During last week’s ECB press conference, there were a few messages that President Largarde highlighted:

- The ECB has “a lot of ground to cover” on inflation if baseline projections resume after the market uncertainty

- The central bank is more data-dependent than ever

- Interest rate hikes are to tackle inflation, other tools are appropriate for bank stability (separation of mandate). The ECB stands ready to use those tools but do not see the need at this stage

This translates into even more scrutiny on the inflation, growth, and lending survey data until May, with, in our view, more hikes in the pipeline. The ECB key interest rate now stands at 3.0% and estimates of underlying inflation projections are above 4% YoY for now. This implies more rate hikes to reach a positive real rate (where interest rate > inflation).

In the US, the inflation components monitored by Fed Chair Powell, the core services, ex-owner-occupied rents CPI, is tracking at 5.5% - 6%. Assuming some declines in inflation from here, this would imply at least one more 25bps rate-hike to two times more 25bps-hikes to bring the real rate closer to zero (the Fed fund rates now stand at 4.50%-4.75%).

Following the volatility in the regional banking sector, we expect the Fed to hike by “just” 25bps and indicate one to two more rate hikes in the Summary of Economic Projections this week (SEP). The divergence with the market is likely to be visible in H2 2023 since futures are pricing rate cuts while we expect a “hike and hold” signal from the SEP. Fed Chair Powell, like President Lagarde last week, will probably emphasize data dependency. The Q&A around quantitative tightening will be interesting to monitor during the press conference.

As we have written before, less availability of bank lending will probably lead to slower growth and slower inflation in the US. The speed of this transmission remains uncertain though. We note that inflation expectations in various regional surveys (see Michigan survey below) have sunk.

Implications for crypto and financial assets

Last week saw gold and lumber outperform energy asset prices, and tech stocks (and crypto) outperform banks and also cyclical stocks. Markets are starting to price a regime change where growth is of concern, not just inflation.

This pricing makes sense: tighter lending conditions mean lower growth and lower inflation at some point. But, if there is no further contagion from the three regional banks’ failing in the US (and CS in Europe), it could be that the economy weakens with a lag of time. In that period, central bankers would at least hold rates at restrictive levels and probably hike further.

It means that we are not 100% confident that the pain point where growth is a concern (over inflation), which leads to a central bank pivot, is here yet.

This would imply that what we are witnessing in crypto and tech is probably another bear market rally.

However, it makes sense to adjust for the beginning of a regime transition: we note notably the recent outperformance of JPY, usually a strong performer during global growth slowdowns.

For crypto, the lack of strong reaction to the downside (compared to 2021-2022) is again notable. We continue to see a last leg down probably during the next recession followed by a botomming when the central bank pivot actually occurs (when growth worries are more tangible).

This week: the Fed and the SNB

Wednesday 22 March

UK February CPI (consensus 9.9% MoM)

The FOMC meets. We agree with the consensus of +25bps rate hike to 5.0%. We see the median rate in the Committee’s projections at ~5.25% and stable through the rest of 2023

Thursday 23 March

The Swiss National Bank meets. The SNB Chair, T. Jordan, had flagged more rate hikes prior to the Credit Suisse’s debacle. Now consensus expects the SNB to hold at 1%, which seems reasonable. The SNB’s decision will give another indication on how central bankers address the inflation / financial stability prioritization after the last two weeks.