Introduction

Camelot (GRAIL) is Arbitrum's native decentralized exchange (DEX). Its public sale was conducted on December 6th, and it raised over $3.8 million. The token became tradable on December 8th.

Although the public sale started slow, attention and hype quickly picked up within the Arbitrum ecosystem. The token experienced a parabolic run and increased by 10-20x within weeks. The addresses holding these tokens are likely early adopters of protocols within the Arbitrum ecosystem, signaling potential alpha. Furthermore, with the attention on the Arbitrum ecosystem due to the airdrop on March 23rd, most of the airdrop recipients will likely sell their tokens and rotate into other Arbitrum tokens. These addresses could be interesting to keep an eye on due to their likely loyalty to the ecosystem. Our team has created new labels to track Smart Money movements in emerging L1/L2s such as Arbitrum to identify new interesting tokens, protocols, or farms.

We covered an in-depth analysis of the real-yield and DEX Wars landscape on Arbitrum here.

Methodology

Early GRAIL Participants is a new label that Nansen pushed out to capitalize on the Arbitrum narrative.

Early GRAIL Participants refer to addresses that received ≥ 30 GRAIL Tokens between 8 Dec ’22 and 6 Feb ’23.

Are Early GRAIL Participants Still Holding and/or Staking?

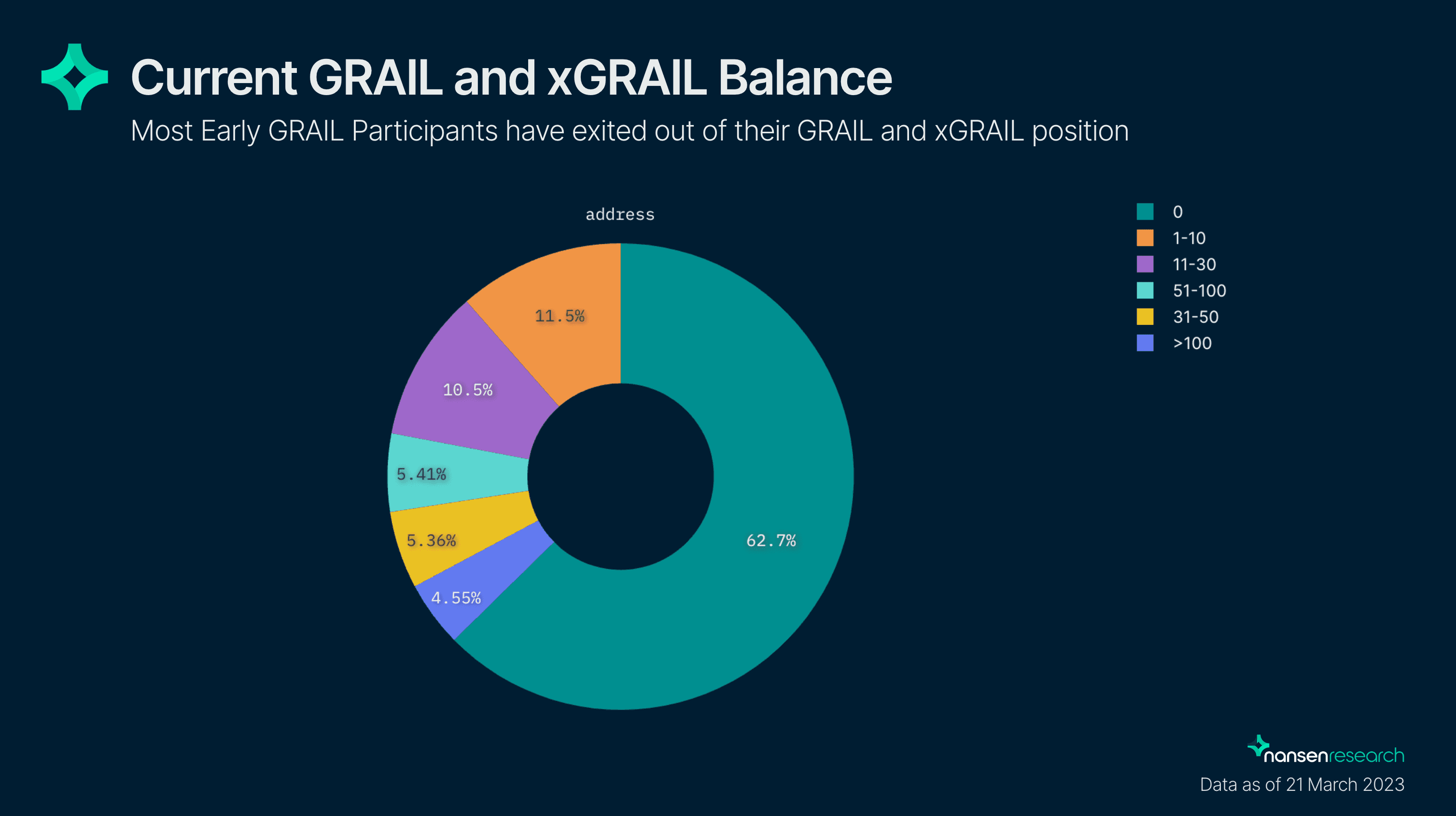

Since the label refers to addresses that received ≥ 30 GRAIL tokens, this query shows the current GRAIL balance of all addresses as of March 21, 2023. We categorized GRAIL balances as 0, 1-10, 11-30, 31-50, 51-100, and>100.

62.7% of Early GRAIL Participants have completely exited their GRAIL and xGRAIL positions. 11.5% are holding between 1-10 (4k -40k USD) and 10.5% are holding between 11-30 GRAIL (42k - 100k USD). Only 4.55% of the addresses are holding >100 tokens (>400k USD).

Largest Current Holdings: Top 10 Addresses

This section includes the top 10 addresses with the largest current holdings for GRAIL and xGRAIL which can be utilized to discover, track, and analyze some of the addresses that are both early to GRAIL and are still holding or staking a substantial GRAIL position.

- 0x133d93566f9699b3af46fe150daa8a67a9563ed6

- Staked $1.7m xGRAIL

- Staked $672k GMX

- Locked $200k VELO (on Optimism)

- Locked $200k PENDLE

- Staked $134k Y2K

- Link to Nansen Portfolio

- 0x75691b20d872be09243a6cc24fe815d10f089847

- Staked $848k GRAIL and holding $823k GRAIL in spot

- Holding $380k WINR

- Farming $410k JONES on JonesDAO

- Deposited $968 on RageTrade

- Link to Nansen Portfolio

- 0x93771c1622e780a48d62333374ea743fa3d644d3

- Staked $1.2m xGRAIL

- Locked VELO (on Optimism)

- Holding $121k FOLD

- Link to Nansen Portfolio

- 0x01e5d631ba707a029c8a1555bdac4805d7853e21

- Holding $429k GRAIL and staked $583k xGRAIL

- Link to Nansen Portfolio

- 0x5e29fc164189ae03f7f05ab4a6e14620df60501c

- Staked and holding $677k worth of GRAIL

- Link to Nansen Portfolio

- 0x77d2fb2fa0748eccb41d48e70001dc5aaaa7670c

- Staked and holding $680k worth of GRAIL

- Might be related to 0x5e29fc164189ae03f7f05ab4a6e14620df60501c

- Link to Nansen Portfolio

Other Notable Addresses

- These are notable addresses within the Early GRAIL Participants label that are still holding GRAIL and xGRAIL tokens with interesting on-chain footprints. Link to bundled portfolio to track their movements in the next few days.

- 0x88ce30f11723e38ffafa91a22462e57222433467

- Currently staked $959k GRAIL

- Staked $929k GMX

- Staked $60k PLS

- Staked $71k GNS

- Staked $43k in Y2K + WETH pool

- Swapped $20k PLS for WBTC and farming in several pools

- Holding $122k LODE in spot

- This address is quite active in the Arbitrum ecosystem with relatively diversified holdings in a few different protocols

- Link to Nansen Portfolio

- 0xd47d1bd0aa47523f311aaa02b1782ce66dde1517

- Holding $294k GRAIL

- Holding $95k WINR

- Holding $58k VELO on Optimism

- Holding $25k ZYB

- This address seems to be betting on the DEX Wars on Arbitrum with GRAIL and ZYB as their main holdings

- Link to Nansen Portfolio

- 0x69445a240fbfcf5d63a52ddf89126f2dfd4a5ad7

- Holding $117k VELA

- Holding $113k GRAIL

- Staked $336k GRAIL

- Holding $24k DICE

- Holding $21k ROUL and $1k AGC

- This address is invested in a few GameFi tokens on Arbitrum relative to their overall portfolio size.

- Link to Nansen Portfolio

- 0x2817d13ed8ed176cd99684c8bd5bdb0145667228

- $2m portfolio size (97% assets on Arbitrum and 3% on Avalanche)

- Staked $791k in GMX

- Staked $432k in GRAIL and holding $113k spot ($555k total)

- Lending on Sentiment

- Link to Nansen Portfolio

- 0xa4a499b71ebe68562fc7a430a031729a87d74242

- Sent all GRAIL assets to another wallet 0x69ef7ad29ef0b317d54e9b992f66e95be4f69cbd (potentially related)

- Link to Nansen Portfolio

- 0xe563c2473d039c34adca7542240e68368b987b54

- Main holdings are $164k GRAIL, $100k MAGIC

- Allocated some of their holdings to lower-cap plays on Arbitrum like $28k PLS, $21k PSI, $13k RDPX

- Staked $10k in Arbi Roul (ROUL)

- Link to Nansen Portfolio

Other Top Token Holdings

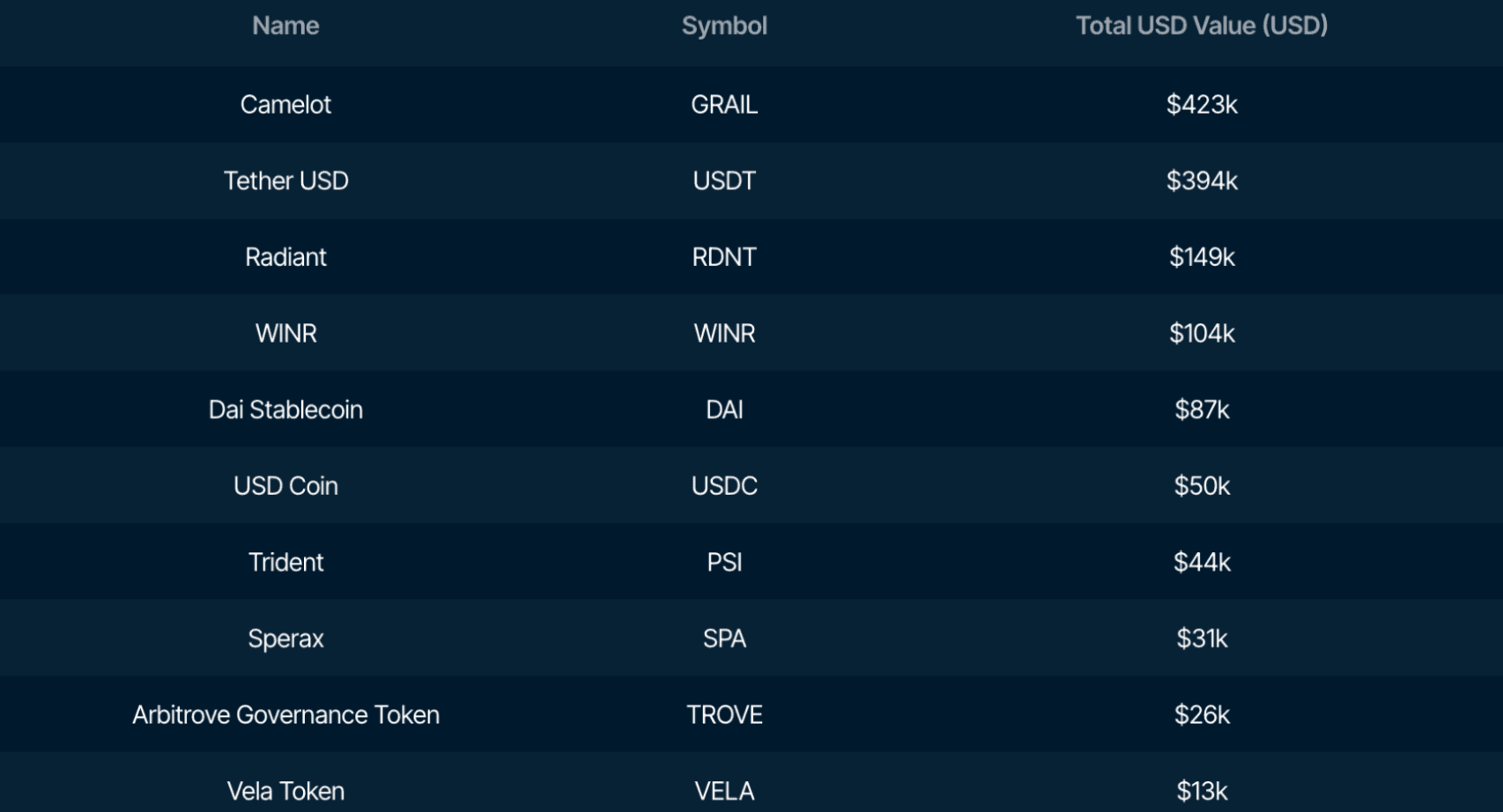

Top 10 Addresses - What are the other top tokens in their portfolio (USD Value)?

The top 10 addresses from "Early Grail Participants" hold mainly GRAIL tokens, with a total USD value of 4.2 million collectively. Apart from stablecoins, these addresses also hold a significant portion of RDNT and WINR tokens. Other holdings include mid-to-low market caps tokens such as PSI, VSTA, SPA, TROVE, VELA, and ARC, which have only recently gained traction.

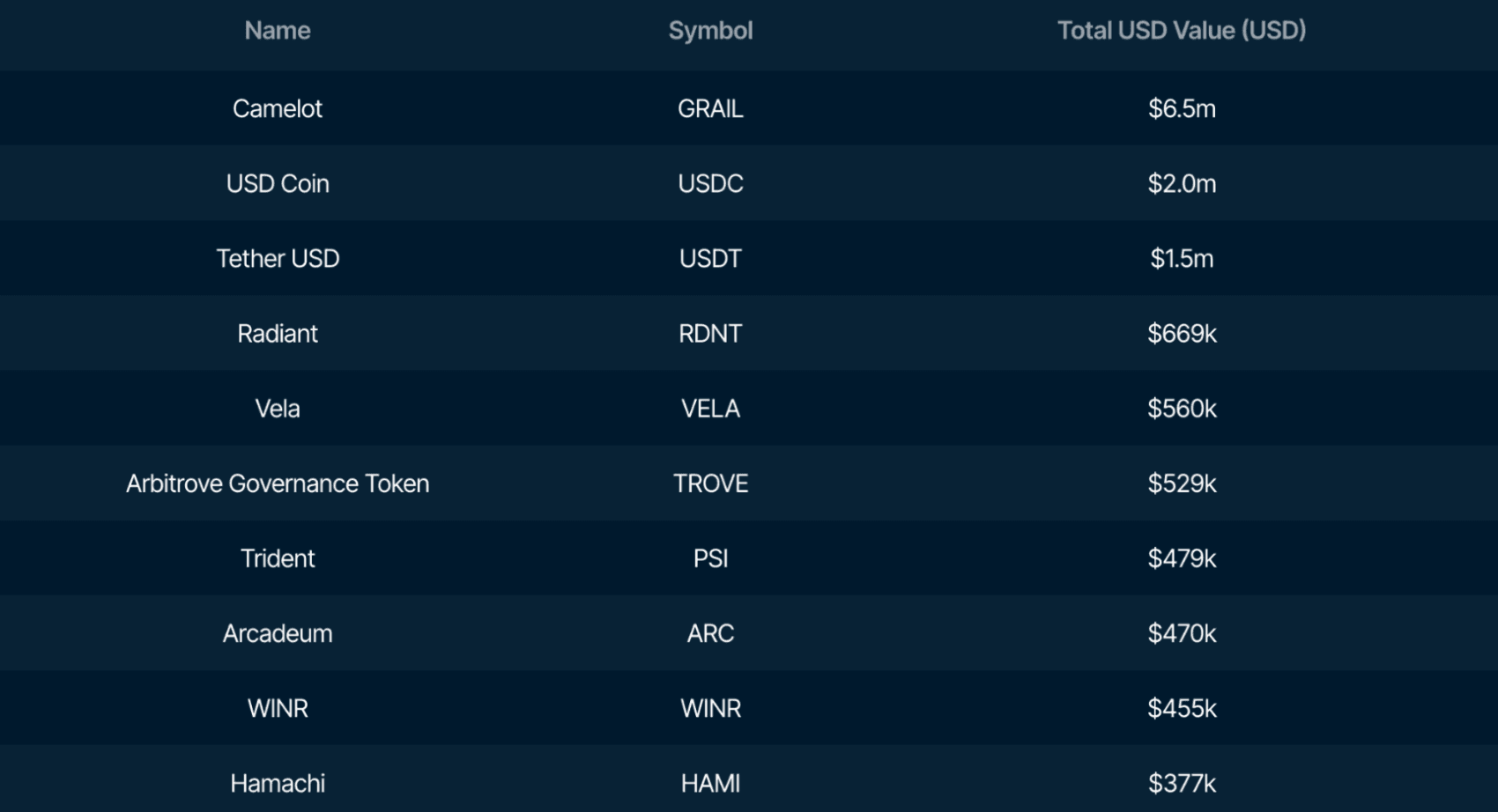

All Addresses - What are the other top tokens in their portfolio (USD Value)?

The main token holding from all the addresses from “Early Grail Participants” is GRAIL with 6.5m in total USD value collectively. Other than stables, the addresses are also holding a significant portion of RDNT, VELA, TROVE, PSI, ARC, WINR, and HAMI.

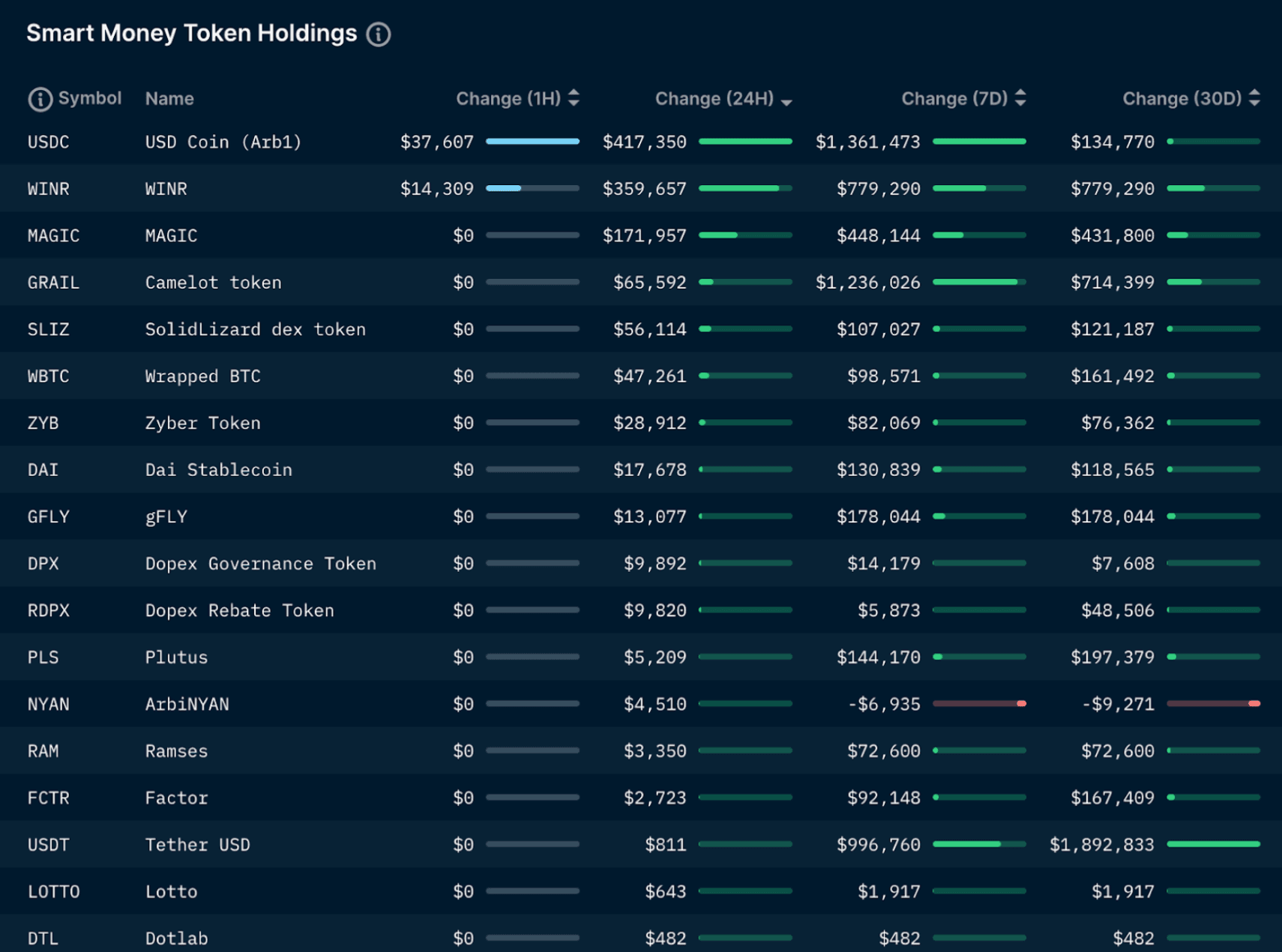

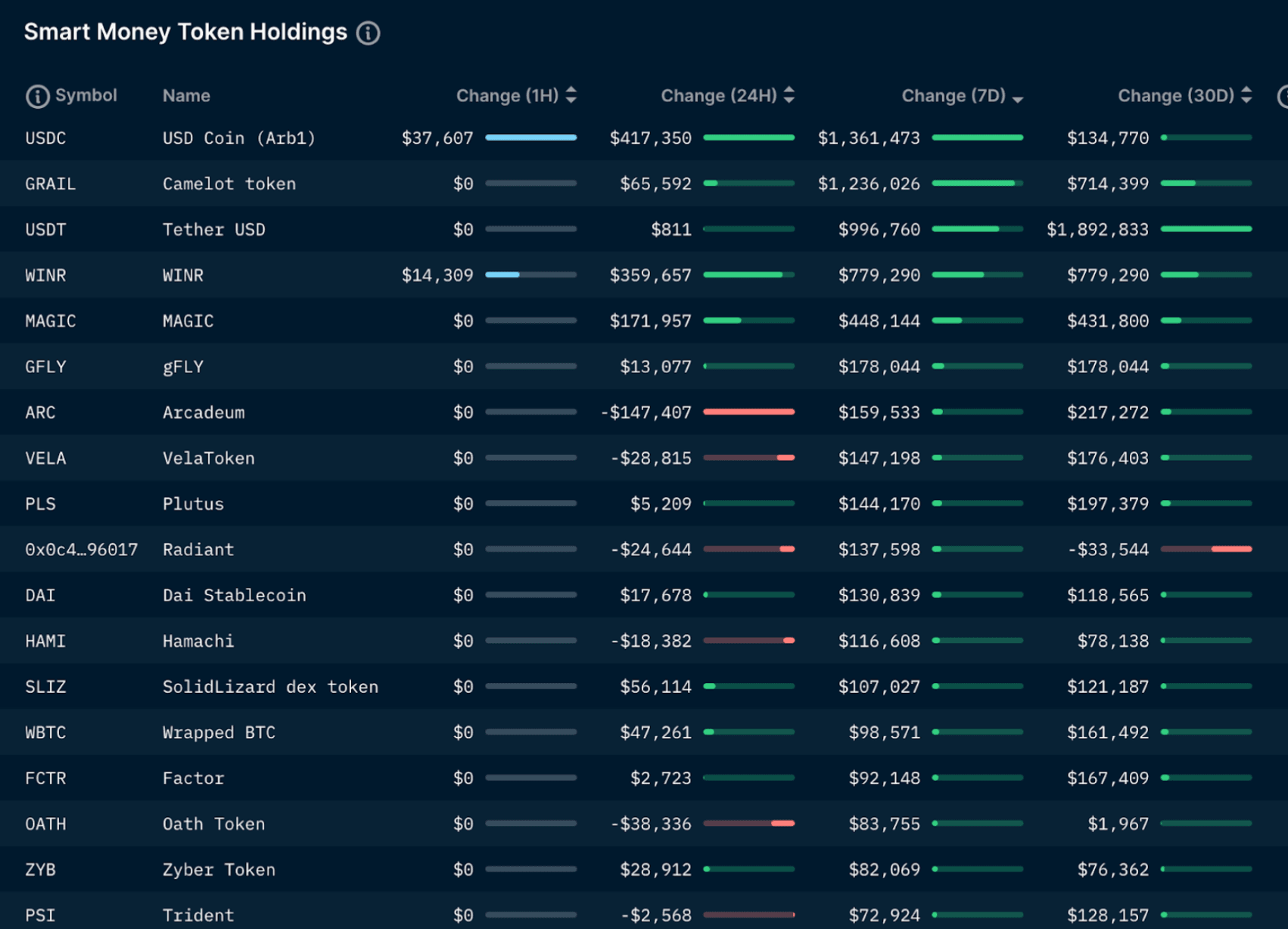

All Addresses - What are the tokens with the largest change in USD Value over the last 24 hours?

In the past day, there was a $417k change in USDC inflow into addresses in Early GRAIL Participants. WINR and MAGIC had the largest inflow of $359k and $171k. WINR Protocol is a new GameFi protocol on Arbitrum and has been gaining momentum in recent days. MAGIC just announced their BTC/ MAGIC listing on Upbit, a leading exchange in South Korea. Other notable tokens include GRAIL, SLIZ, WBTC, and ZYB.

All Addresses - What are the tokens with the largest change in USD Value over the last 7 days?

In the past 7 days, there was a $1.3m inflow of USDC into addresses in the Early GRAIL Participant label, followed by GRAIL and USDT. Other tokens that were not included in the above are ARC, VELA, PLS, RDNT, HAMI, and more. These tokens are ranging between established blue-chip projects on Arbitrum as well as lower caps.

The Early GRAIL Participant label was built to capitalize on the Arbitrum narrative given the newfound interest in the ecosystem, leading up to the airdrop distribution this week. These addresses entered GRAIL before the hyperbolic run-up of 10-20x for its token and are therefore considered early adopters of newer protocols on Arbitrum. Therefore, these wallets could be worth following for anyone interested and participating in the Arbitrum ecosystem.