Introduction

Treasure launched its native marketplace, TreasureTrove, MAGIC token, and the TreasureDAO ecosystem in October 2021 before launching its flagship metaverse Bridgeworld in January 2022, making it one of the first projects on Arbitrum. Because of their first mover advantage, Treasure has continued to dominate as one of the blue-chip protocols on the network and is responsible for over 95% of all gaming and NFT volume on Arbitrum.

Furthermore, this means that addresses that were early adopters of Treasure and investors of the MAGIC token are considered among the earliest settlers on the Aribtrum network and have profited substantially from it. Hence, this report will break down the cohort of addresses that qualify as an Early MAGIC Miner, dive into relevant data points, identify some of their current positions and recent activities, and surface high-activity wallets to track.

Breaking Down The Early MAGIC Miner Label

Firstly, an Early MAGIC Miner is defined as the top 200 addresses that mined MAGIC via the Genesis Mining contract between October 6, 2021, and January 6, 2022. The addresses are scored based on the quantity and duration of mining throughout the period.

Cohort Statistics

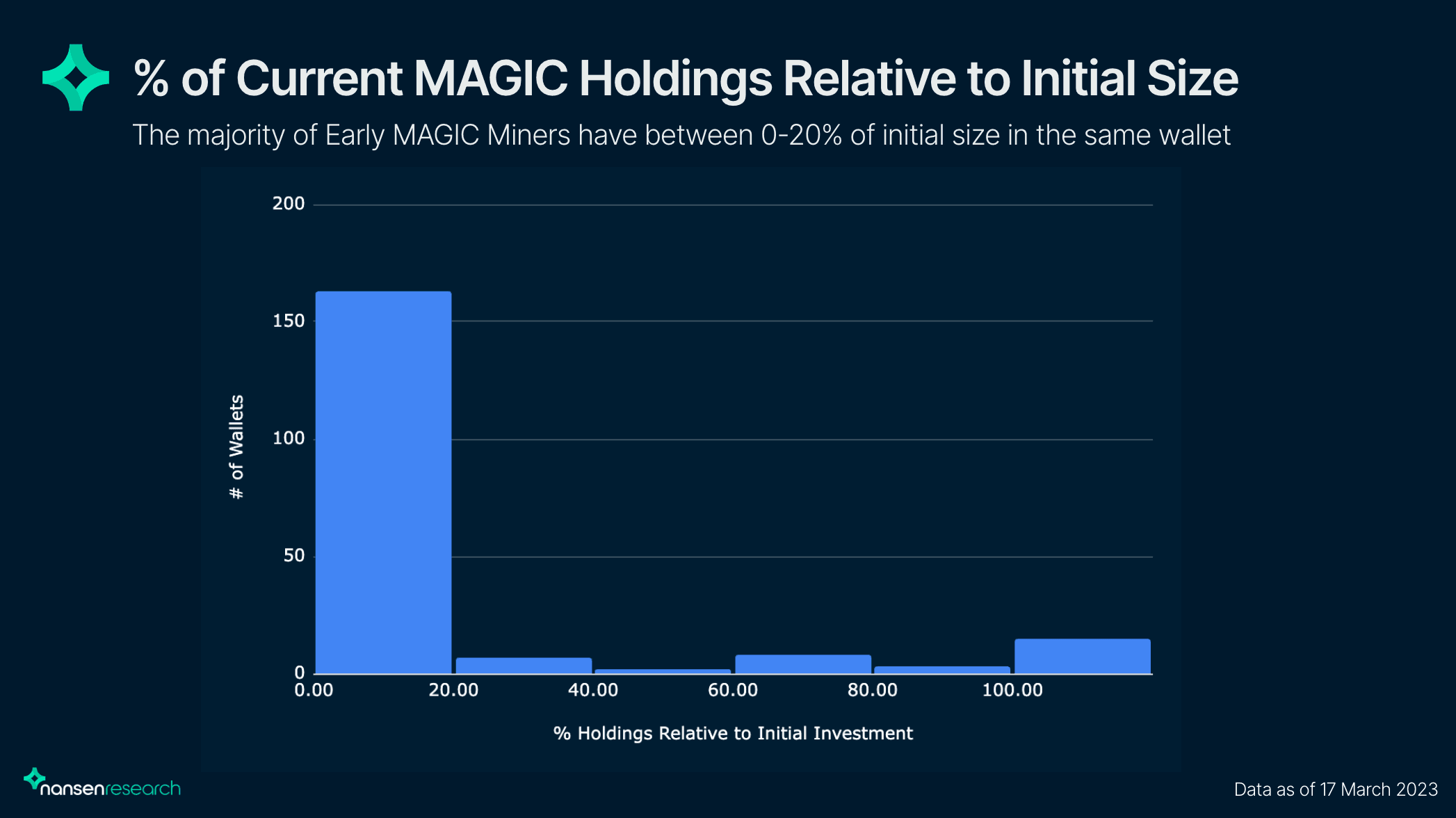

The distribution of current MAGIC holdings relative to the initial investment size indicates that the vast majority (163) of these addresses have taken significant, if not all, of the profits from their positions or transferred out of the initial wallet. It was observed that multiple wallets within this cohort have withdrawn and taken profits on the remainder of their stake in late January 2023, with many selling or transferring out of their respective addresses between January 24 and January 26.

Meanwhile, 15 of the Early MAGIC Miner addresses have increased their position size after the Genesis Mining period, as shown in the column with over a 1.0 relative holding ratio.

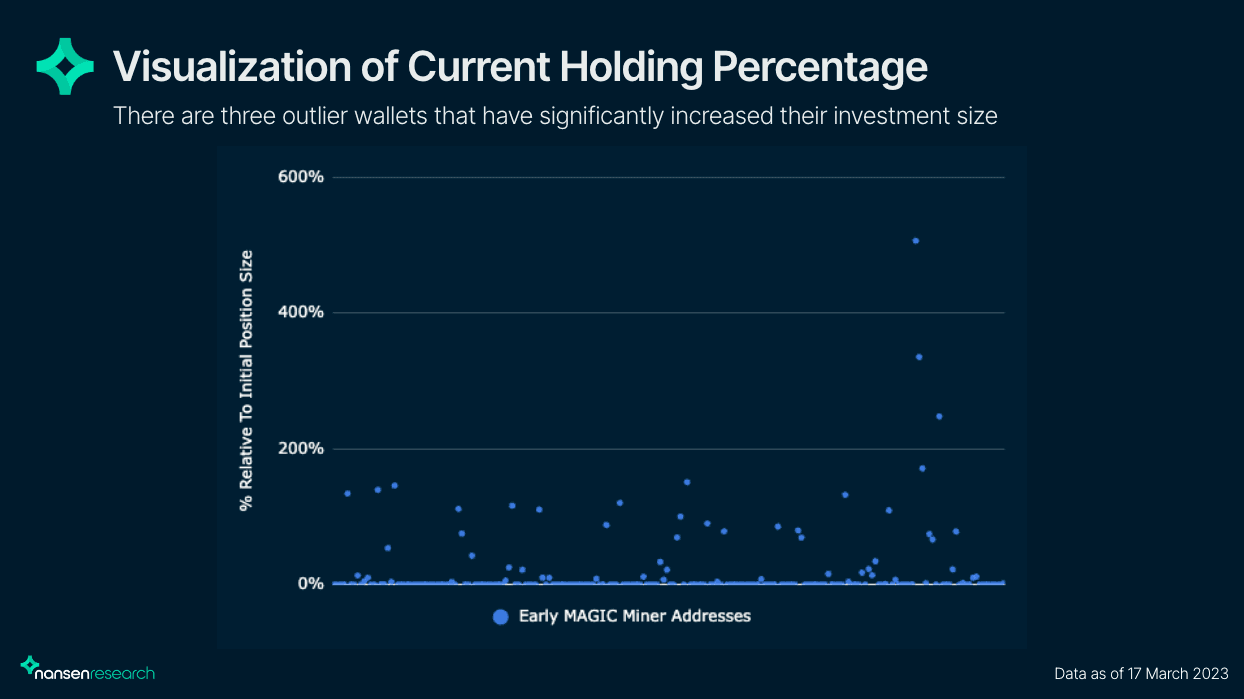

Three addresses were identified as outliers for relative position size compared to the initial investment, with one entity recording a 507% increase since January 2022. Similarly, the other two registered a 335% and 248% addition, respectively.

As of March 17, the average net position size remaining in the same wallet relative to the initial investment for all the addresses within this cohort sits at 19.75%. Although, we can also measure the level of conviction for addresses that still have skin in the game by filtering for only wallets with non-zero balances and measuring how much percentage of their investment is left. Zooming in on this subset of remaining MAGIC holders, on average, still have approximately 67% of their initial position.

Chain Distribution

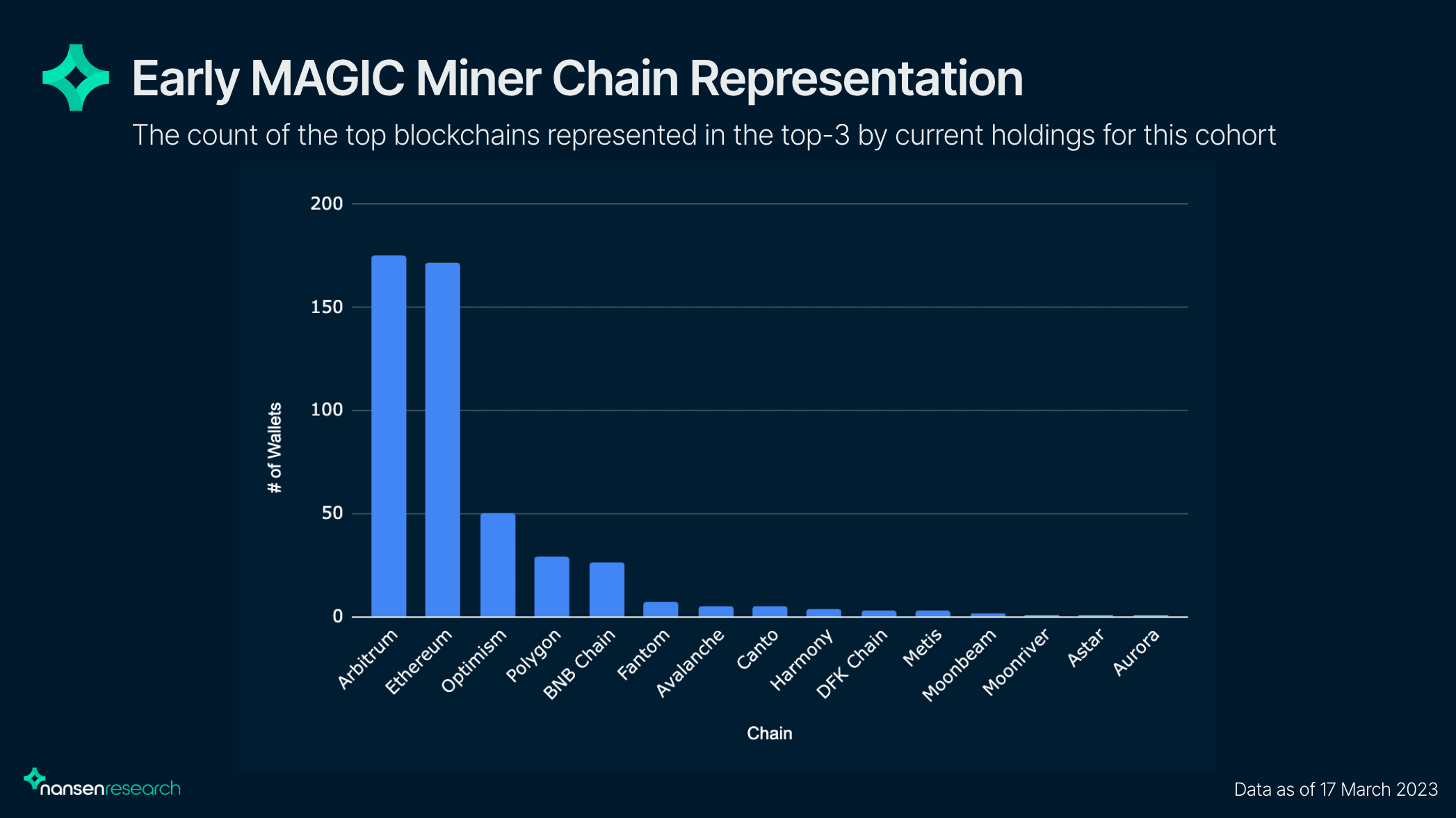

The chart above shows the top 3 chains by capital distribution percentage for each wallet, which measures the most popular chains this cohort has the most allocation towards. For example, a wallet has 50%, 20%, 15%, 10%, and 5% of their portfolio allocated to Ethereum, Arbitrum, Optimism, Avalanche, and BNB Chain, respectively. Ethereum, Arbitrum, and Optimism will be counted since this address has the most capital in these chains.

Unsurprisingly, Arbitrum and Ethereum are the most represented chains for this group, with 175 and 172 addresses presently having capital on the chains, respectively. Other popular chains in the top 3 for this cohort are Optimism, Polygon, and BNB Chain. Some of the Early MAGIC Miner addresses are used for Arbitrum specifically, while others are used for deploying capital into L2s across the board.

Current Holdings and Recent Activity

At the time of writing, 127 Early MAGIC Miner addresses of the 200 still hold MAGIC, with a cumulative value of $18m. But which Arbitrum ecosystem assets are they collectively invested in, and what do their recent movements look like?

Check out their activities and balance changes in real-time with Nansen dashboard here.

Holdings

In terms of most popular holdings by total USD value:

- RDNT is the second most popular token, with 6 unique addresses holding an aggregate of $1.22m.

- GRAIL is the third-largest token held, with 8 unique addresses having a sum of $1.02m in their portfolios.

After these two tokens, there is a sharp decline in total investment value, with WINR and TROVE having larger investment sizes than some of the other tokens but were only accumulated by one entity. The current value invested for these tokens is $283k and $184k, respectively.

Other notable holdings from this cohort include:

- $176k invested in Y2K from 7 different wallets

- $173k invested in JONES from 7 different wallets

- $110k invested in ARC from 6 different wallets

Following the allocations of this cohort could be worthwhile, as some of the top Arbitrum ecosystem tokens held collectively have been some of the top performers in recent weeks.

Recent Activity

In the past 30D, RDNT and GRAIL saw the largest balance increases from Early MAGIC Miners, with all of the $1.22m RDNT accumulated within the past week, and a $757k increase in GRAIL holdings. Although, there was a $393k outflow in GRAIL over the past 7D, which could indicate profit-taking from the recent surge of approximately 167% from the local lows on March 11.

Other notable pickups in the past month include $36.6k in rDPX, $28.9k in HAMI, and $26.4k in PREMIA from 3, 3, and 2 distinct wallets, respectively. Additionally, single entities have picked up WINR and TROVE, as mentioned above, as well as POISON and CAP.

On the other hand, notable balance drawdowns for Arbitrum tokens in the past 30D include:

- $4.26m in MAGIC, with a $717k decline in the past week

- $134k in ARC

- $96.6k in TND

- $77.6k in gFLY, with a $159k decline in the past week

- $64.8k in PLS, with a $21k decline in the past week

Interesting Wallets

This section of the report will surface the top-5 MAGIC whales and other Arbitrum-specific and high activity wallets that belong to the Early MAGIC Miners label.

Notable MAGIC Whales

- Smart DEX Trader

- 1m ($1.8m) spot MAGIC position, and a $1.21m MAGIC-WETH LP position on SushiSwap, totaling 1.32m ($2.4m) in MAGIC holdings.

- This address is also the single entity buyer of WINR and TROVE (highlighted in the section above) in the past 30D, while also taking profits on GRAIL and VELA.

- This wallet still holds $589k GRAIL, $475k RDNT, and $22k PSI.

- This wallet also has a $131k position in the BAYC APE staking pool from 3 different Bored Apes.

- Biggest wins on Ethereum include a $3.2m, $496k, and $37.1k realized PnL on ETH, DYDX, and BADGER, respectively.

- “islanders08” on OpenSea

- 1.42m ($2.53m) spot MAGIC position.

- This wallet is almost entirely allocated to MAGIC, apart from a $63.4k spot position in ARC.

- "FelicityFeline" on OpenSea

- 1.04m ($1.9m) spot MAGIC position, making up over 81% of their portfolio.

- Other notable spot positions include $102k in SUDO, $46.5k in SNOOP, and $38.8k in WRLD.

- $138k CVX and $16k X2Y2 staking positions.

- This wallet is also a prolific NFT trader with a proven track record, including a 109 ETH (757%) ROI on NFT Worlds, 25.4 ETH (112%) ROI on Moonbirds, 24.3 ETH (95%) ROI on Parallel, and much more.

- gen0.eth

- 841k ($1.54m) spot MAGIC position.

- This wallet is entirely allocated to MAGIC.

- This wallet has realized 21.5 ETH of profits from Treasure’s Legions NFT and is still holding 5 Smol Brains.

- Smart NFT Early Adopter

- 804k ($1.47m) spot MAGIC position.

- This wallet is also entirely allocated to MAGIC.

- This wallet has realized 18.7 ETH in gains from Arbitrum NFTs, including Legions and Smol Cars, but is still in possession of 22 Smol Brains.

Check out the MAGIC whales portfolio bundle in Nansen Portfolio here.

Other Arbitrum-specific and High-activity Wallets

- hashcred.eth

- This wallet is a prominent farmer on Arbitrum and Ethereum:

- $380k position in multiple farms on Aura.

- $196k position in multiple farms on Camelot.

- $144k SYN-WETH farming position on Synapse.

- Other farming and staking positions totaling $465k on Uniswap V3, Convex, Yearn, Plutus, Stargate, Zyberswap, Maple Finance, SolidLizard, Radiant, CAP, StakeWise, and more.

- This wallet still holds 13 Smol Brains and has also realized 46 ETH, 14.4 ETH, and 4.38 in profits from Legions, The Beacon - Founding Characters, and Legions Genesis, respectively.

- This wallet is a prominent farmer on Arbitrum and Ethereum:

- Smart NFT Trader

- Notable spot positions include $313k RDNT, $89.7k Y2K, $35.2k LINK, and $11k NFTB.

- This wallet has multiple farming and staking allocations across various chains:

- Farming across various pools in Convex, totaling $1.18m.

- $522k GMX and GLP staking positions on Arbitrum.

- $50k GMX and GLP staking positions on Avalanche.

- This wallet has also realized 152 ETH in PnL from Legacy Legions Genesis and Seed of Life NFTs on Arbitrum.

- Smart NFT Trader

- Spot positions include $64.2k in UMAMI, $58.9k in ETH, and $7k in MAGIC.

- Similarly, this wallet is also active on Arbitrum and Optimism, suggesting that it may be an L2-specific portfolio.

- Arbitrum activities:

- $137k GMX and GLP staking.

- $51.9k WSTETH-STETH farming position on Camelot and $2.2k worth of GRAIL staked.

- $31.9k vault position in the WSTETHCRV pool on Beefy Finance.

- $16.9k JONES staked.

- Optimism activities:

- Multiple vault positions in Beefy Finance, totaling $120k.

- Supplied $65.5k SNX for $12.1k SUSD, with a collateral ratio of 536.2%.

- $10.6k of KWENTA staked.

- $1.9k VELO locked in Velodrome until June 2026.

- This entity is also highly profitable on Arbitrum NFTs, with 115 ETH in total profits from Legacy Legion Genesis, Seed of Life, Treasures, Smol Brains, and more. The wallet still owns 17 Smol Brains.

- Smart NFT Hodler

- Multiple big spot positions on Arbitrum tokens, including $474k MAGIC, $397k GRAIL, $119k JONES, $75.2k PLS, $60.5k VSTA, and much more. The total portfolio value is $1.8m.

- More notable spot positions in various on Ethereum.

- Arbitrum activities:

- CAP-WETH and MGN-USDC farming positions on Uniswap V3.

- $9.2k UMAMI staked.

- This wallet is also staking $30k MAIA on Metis.

- "xxxxxxxxxmrider" on OpenSea

- This wallet is also active on multiple chains, including a $159k GLP staking position on Avalanche and a $61.4k USDT farming position on Stargate on BNB Chain.

- Arbitrum-specific activities include a $108k MAGIC-WETH LP position on SushiSwap, a $71.6k MAGIC and WETH borrowing and lending on Impermax, and an $18.9k JONES staking position.

- Notable spot positions include $16.8k ZYB, $15.9k VELA, and $15.3k GRAIL.

Other high-balance wallets to track:

- wbl.eth

- Multi-millionaire whale with a $3.85m portfolio, $2.03m of which is currently allocated to USDT, and $646k is allocated to various Arbitrum tokens.

- Many notable profitable trades on Ethereum. Some of the highest realized PnLs includes $1.27m, $337k, and $309k on ETH, K3PR, and DERC, respectively.

- zepump.eth

- Big spot positions in many tokens totaling $1.1m, $855k of which is allocated to Arbitrum ecosystem tokens.

- $17.3k GMX staking position.

- Early MAGIC Miner

- $1.6m GMX and GLP staking position, which makes up the entirety of the portfolio.

Check out these high-activity addresses in Nansen Portfolio here.

Conclusion

It is reasonable to expect that the majority of these first movers will have realized most, if not all, of the profits and rotated capital towards other investments. Although, the number of Early MAGIC Miner addresses with non-zero balances is surprisingly high, and some even increased their position sizes relative to the initial investment.

The recent announcement of an Arbitrum token airdrop has seen some profit-taking reactions from this cohort. However, their conviction in Arbitrum tokens and the ecosystem remains firm, with sizable allocations to Arbitrum ecosystem tokens both in the past week and month. An investigation into the top MAGIC whales and some of the high-activity wallets in this cohort supports this claim. Monitoring these wallets by setting up smart alerts will be beneficial in tracking their movements and sentiment over time.