Of investors’ fear and recessionary trades

Markets have remained jittery all last week, with the main theme remaining banks’ distress, and a new epicenter emerging in the Eurozone with Deutsche Bank. First Republic Bank’s stock fell -43% and Deutsche Bank’s dropped by -8%. Oil and energy markets underperformed (implying expectations of less demand and less inflation).

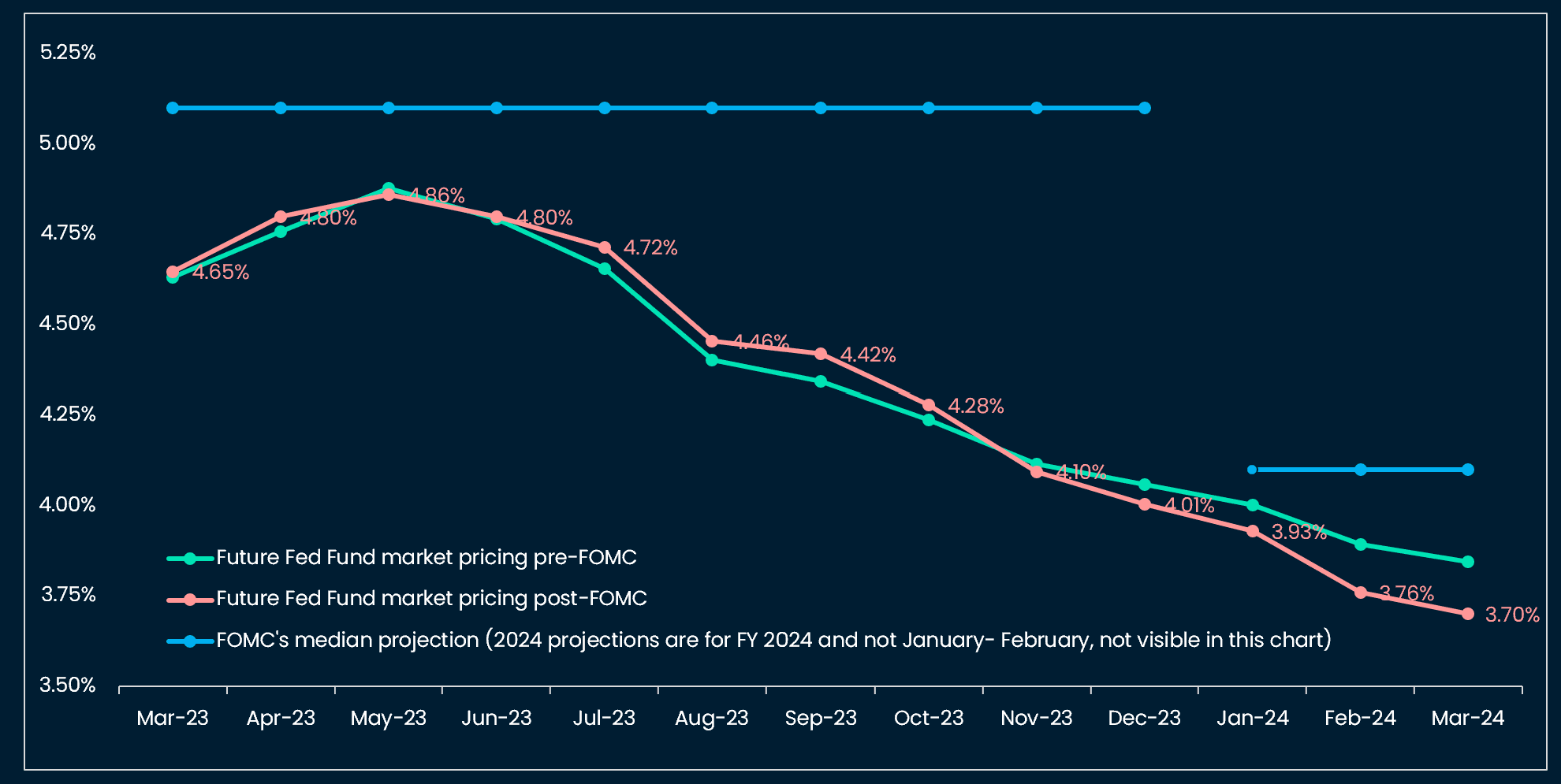

But as market participants were anticipating the disease (slower growth), they were also pricing the cure (central banks easing monetary policy): the US Treasury 1-year yield shaved -30bps, vs -10bps for the US 10-year yield, inferring further rate cuts from June 2023 on, in contradiction with the Fed’s projection at last week’s FOMC meeting. The FOMC committee expected the policy rate to remain stable around ~5.1% in 2023. As a consequence of this pricing in rate markets, BTC held its prior gains. Among equity markets; Taiwan, Chinese component stocks and the Nasdaq were the top weekly performers (Netflix and the semiconductor manufacturer Micron were up 8% each).

That investors’ fear should now coalesce around Deutsche Bank (DB) does not signify any structural commonality between the German lender and US regional banks, nor between DB and Credit Suisse (DB offered to redeem its Tier 2 bonds). The link between these entities might be summarized as investors (and depositors) panicking, and exacerbating individual liquidity issues (not the case of DB at present).

Fear being a powerful motivator, the central banks of the respective countries (US and Switzerland for now) have reacted by offering liquidity backstops, while the respective governments have played an active role in architecting takeovers by banking competitors and offering further guarantee over non-insured customer deposits. As we write, the latest government-intermediated acquisition has been announced: First Citizens Bank will purchase ~$72 billion of Silicon Valley Bank assets at a discount of $16.5 billion. Another $90bn in securities and other assets will remain “in receivership for disposition by the FDIC [Federal Deposit Insurance Corporation].” The cost of failure is for now estimated at $20bn to be covered by the FDIC’s fund (made of insured banks’ premia).

Our interpretation of the various bankruptcy and public-engineered acquisitions so far is that the reaction function of governments (of Treasury Secretary Yellen in particular) is very sensitive and has so far motivated the prevention of any idiosyncratic weakness in banks’ balance sheets or profitability from spilling over to other banks. We see central bankers as more sanguine though, and still focused primarily on their respective inflation mandates.

Central banks: Rates are for inflation and macroprudential tools for financial stability

The approach of central bankers towards the ongoing banking turmoils is best exemplified by the Swiss National Bank (SNB) hiking its policy rate by 50bps last week to 1.50% (vs a consensus forecast of no hike) and maintaining the following sentence from its December statement: “It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term.” This hike and guidance occurred after allowing hundreds of billions of liquidity backstops to facilitate the takeover of Credit Suisse by UBS the weekend prior (see the interesting press conference transcript “Let me make one thing very clear: our liquidity measures are loans that are secured and subject to interest, and not gifts”).

SNB’s Jordan’s strategy was echoed by US FOMC voting member Bullard in a speech last week: “Continued appropriate macroprudential policy can contain financial stress, while appropriate monetary policy can continue to put downward pressure on inflation.” Bullard added that there was “not as much desinflation as we [the Fed voting committee] would like”.

This highlights that the Fed and other central banks will remain very much focused on taming inflation, while macroprudential tools and other liquidity backstops will be deployed to safeguard financial stability.

Last week, the Fed hiked its policy rate by 25bps to 4.75%-5.0% and said it would hold rates steady (with maybe one more rate hike before pausing) to assess the effects of credit tightening on the economy, the labor market and inflation. Credit tightening was deemed equivalent to a rate hike or more but there is high uncertainty around the severity and duration of this tightening. This signals:

- more uncertainty and concern around the future path of US growth,

- more data dependency to determine what to do next with a new emphasis on lending data.

The issue is that markets understood point 1) above and extrapolated it into ~80bps of rate cuts in H2 2023.

Letting aside central banks, we were struck by the reactivity of US Treasury Secretary Yellen in responding to increased market volatility: volatility picked up in the afternoons of the US trading sessions twice on Thursday and Friday (including for BTC and crypto assets), and subsided twice following commentaries from Secretary Yellen, who declared that “similar actions [to protect all depositors at SVB and Signature Bank] could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion”.

Uncertainty around the economy, policy actions, and market pricing leads us to some scenario analysis.

Scenarios and implications for cryptos and financial assets

Scenario 1: Stable policy rate for some months then hard landing / severe recession

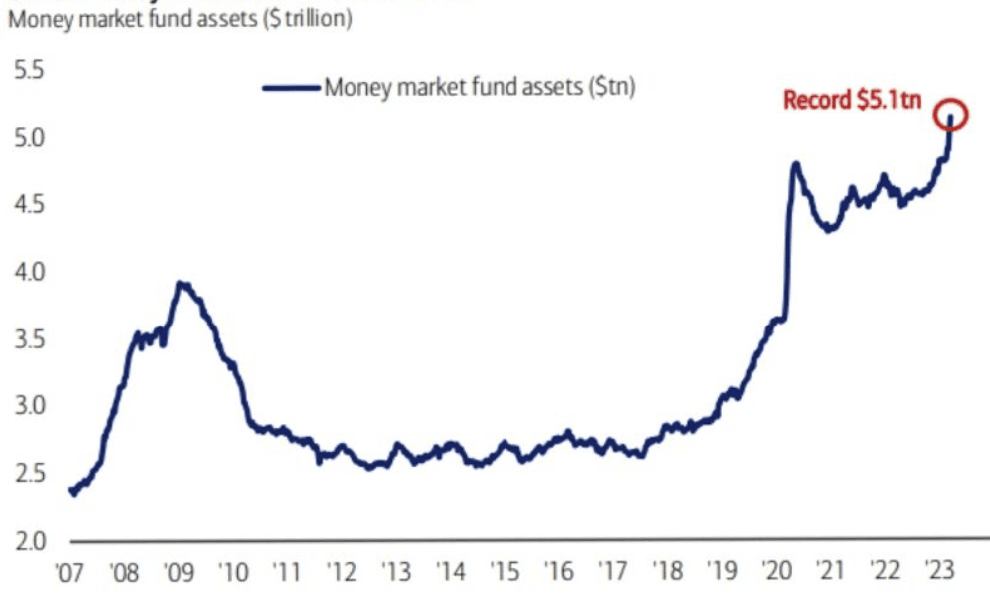

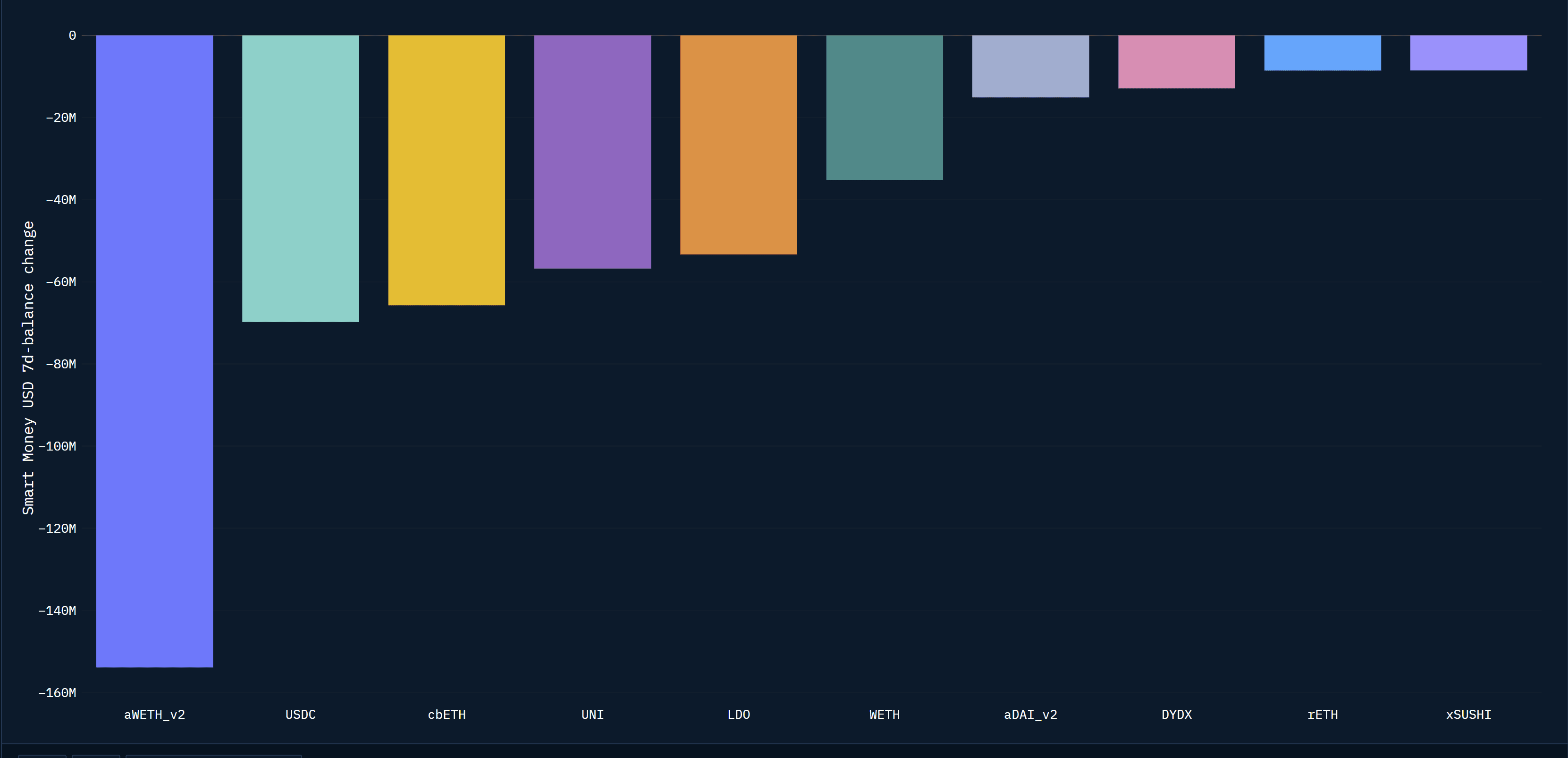

This is the most probable scenario in our view. In this configuration, the US policy rate remains stable for most of 2023, as forecasted by the Fed (above future markets’ expectations, see chart above). Banking contagion is contained by intermediated acquisitions and liquidity backstops. Inflation and growth come down while high Treasury bill rates continue to attract investment (see chart on money market flows below) leading to net outflows from other assets (except maybe from long-duration bonds). At some point, something else “breaks” as a consequence, with more severe and widespread effects than in the current episode, and with contagion to the economy. US jobless claims jump, the Fed cuts rates, pauses Quantitative Tightening, and crypto and risk assets take some time to recover (this scenario assumes a severe recession leading to a lag in the recovery of risk assets).

The two following scenarios bear lower probabilities in our view.

Scenario 2: Shallow recession and Fed eases policy

Growth does slow down as a result of tighter lending standards, and unemployment increases enough to worry the Fed, but not as much as in the case of a hard landing. If desinflation has made some progress, the Fed eases. In that case, crypto bottoms, after selling off less severely than in Scenario 1.

Scenario 3: Smooth desinflation, soft economic landing and progressive Fed rate cuts

This is the best case for crypto. Desinflation continues while growth is holding up, leading to progressive rate cuts. BTC continues its bottoming process (no sell-off).

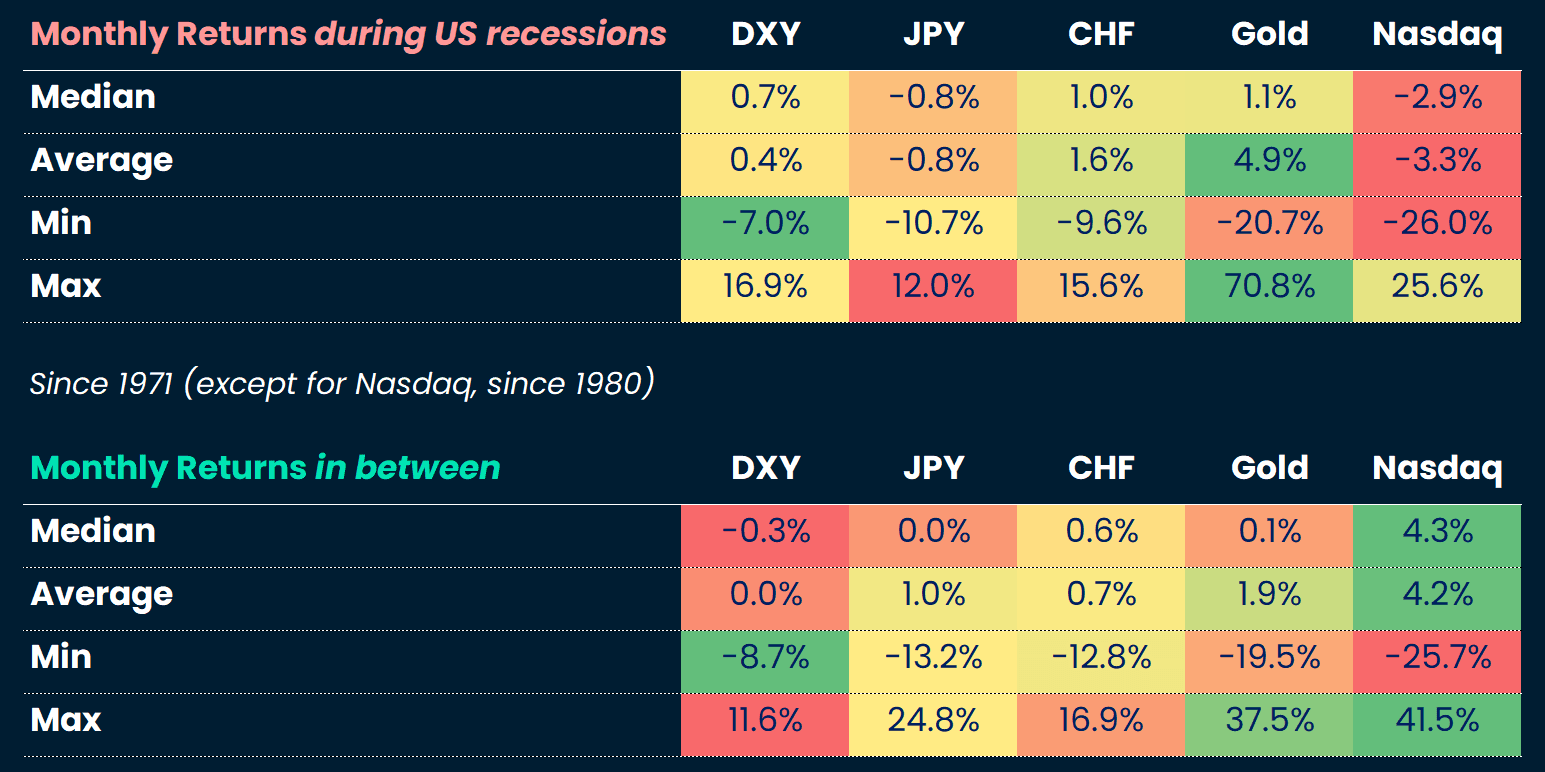

We highlight that those are all hypothetical scenarios. We attempt to inform these with some historical analysis. Given crypto’s relative young age and non-existence during the inflationary 1970s-1980s, we use the Nasdaq index as a proxy.

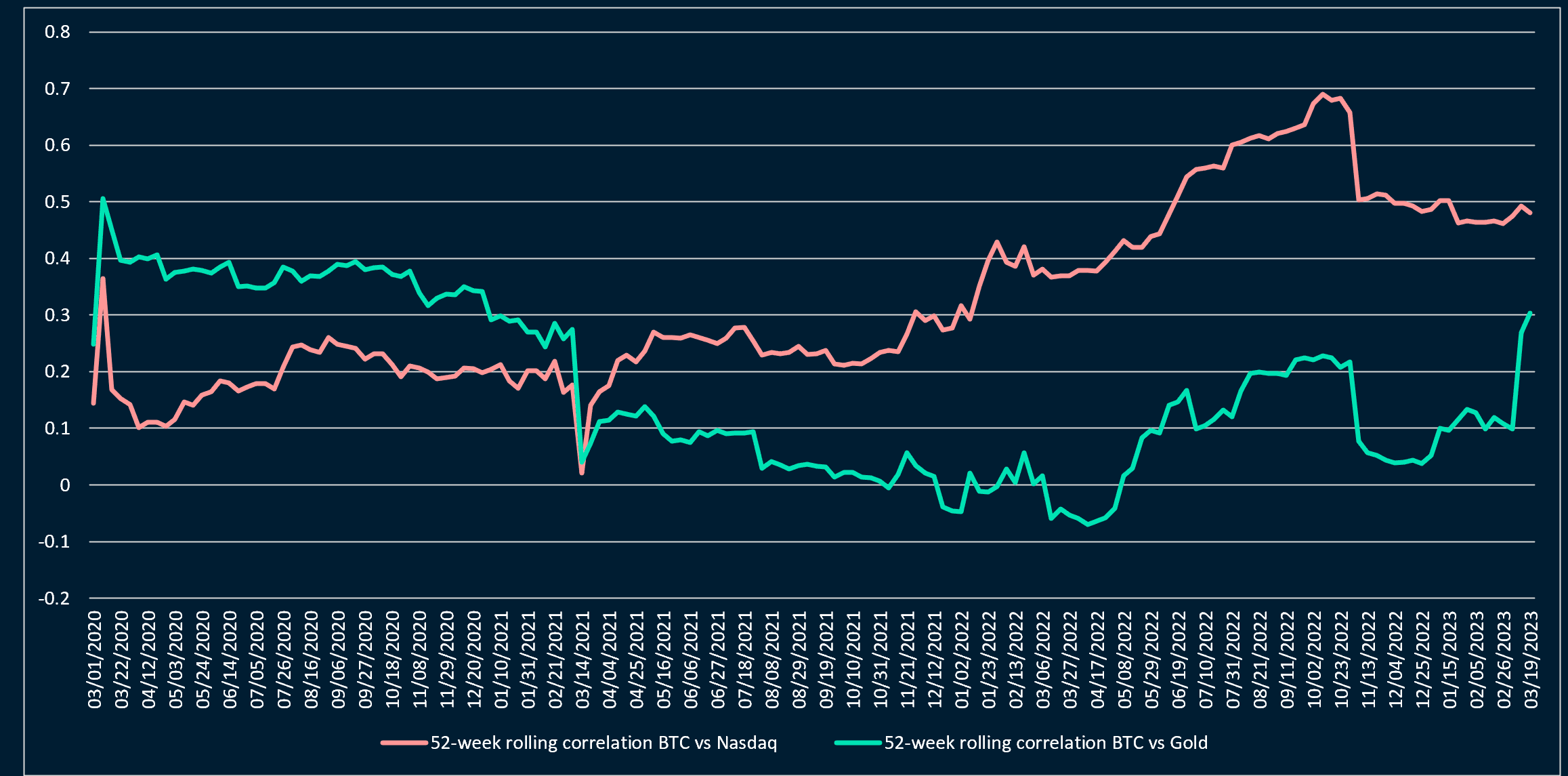

Some have argued that BTC borrows some properties from “safe haven” assets like gold as well as the Nasdaq. While all three assets are sensitive to monetary policy, we see BTC as closer to the Nasdaq (high risk premium e.g. high compensation required for investing in it). Assuming a sudden loss of faith in the US dollar system, we struggle to see BTC as a viable currency alternative, at least for now. The US Fed, among mature market central banks, was able to hike rates the most, which argues for the relative strength of the US economy vs other mature economies, at least in the near future.

Nevertheless, we acknowledge that, recently, BTC’s correlation with gold has increased and its correlation with the Nasdaq has decreased:

Looking at asset return backtests during recessions, we find that the Nasdaq tends to deliver negative returns and underperform vs gold and the DXY. We would expect BTC’s risk premium to increase (and its price to decrease) in the Scenario 1 of a hard landing.

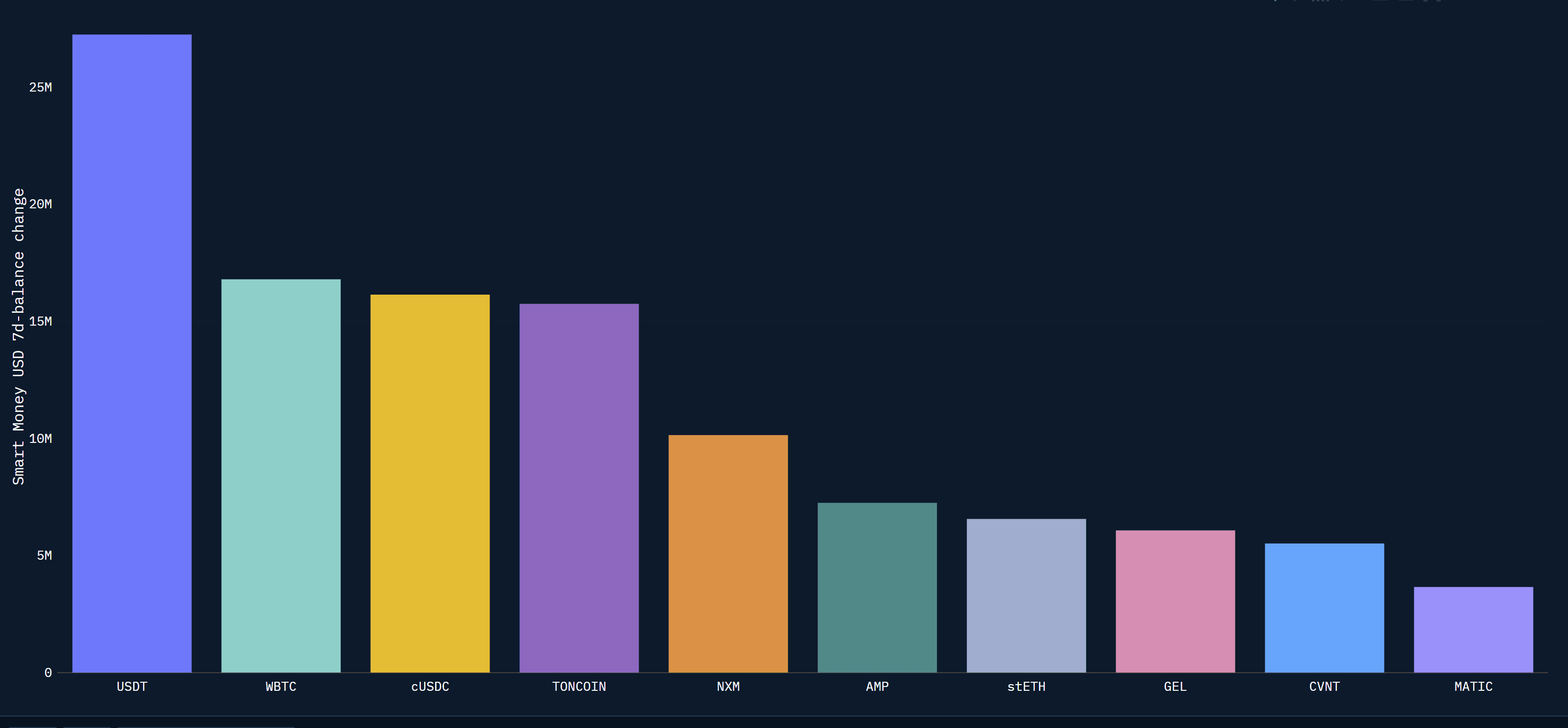

Looking at on-chain data, and more specifically at stable coins we note that 1) USDT has continued to gain market share over USDC (this started in November 2022 and accelerated recently), 2) The aggregate market cap of stablecoins has fallen further (it peaked in May 2022), suggesting some migration to fiat.

This week: Markets more important than macro

Notable macroeconomic data will include the March German CPI (consensus 7.3% YoY, reported on Thursday), and the US February core PCE (consensus 4.7% YoY, disclosed on Friday).

Markets are providing timelier and more relevant information than macro data at the moment. We will watch whether bank equity and credit markets are recovering following SVB’s partial asset acquisition by Citizen Bank and Secretary Yellen’s reassuring comments on deposit guarantee. We will also scrutinize any additional borrowing via the discount window (flat last week) and the Bank Term Funding Program (+34.6bn last week).