Slow disinflation, hawkish Fed speakers

US core CPI is slowly decelerating, with the 3-month annualized YoY rate reaching ~5.2% in April, still way above the Fed’s 2% target. Shelter, one of the stickiest components, has posted a lower growth rate for the first time since since January 2021, at 8.1% in April 2023 vs a peak of 8.2% YoY in March 2023.

The Case-Shiller U.S. National Home Price Index leads Shelter inflation by 12-month and has correctly predicted the lower April rate, although the index tends to underestimate the level of Shelter Inflation (regression r-square of 46%). If this leading relationship holds, Shelter inflation should continue to cool into 2024, leading core inflation lower.

Outside of Shelter, Services inflation remains elevated, driven by wage growth. The recent FOMC members’ speeches delivered a consistent message of data-dependency and patience, justifying the decision to pause rate hikes. However, the bias was on the hawkish side. Governor Bowman declared: “In my view, our policy stance is now restrictive, but whether it is sufficiently restrictive to bring inflation down remains uncertain.” Putting it altogether, a slow disinflation and a determined Fed will lead to stable rates until growth cracks. This will challenge the market pricing of rate cuts from September 2023 on (one 25bps cut is priced at every FOMC meeting in September and in the few following months).

Households’ savings to cushion growth till year-end

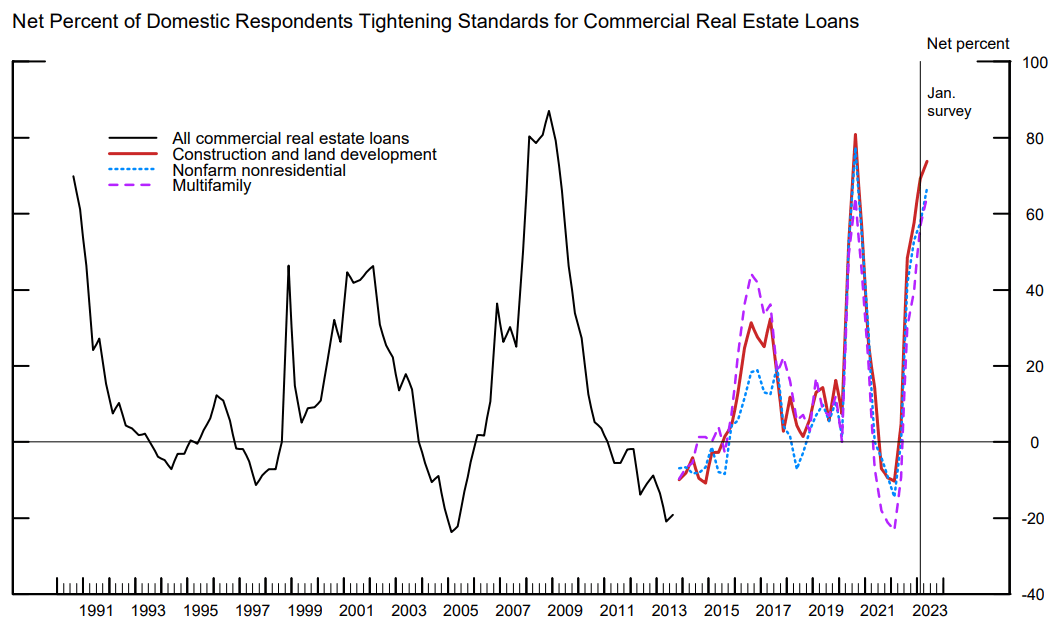

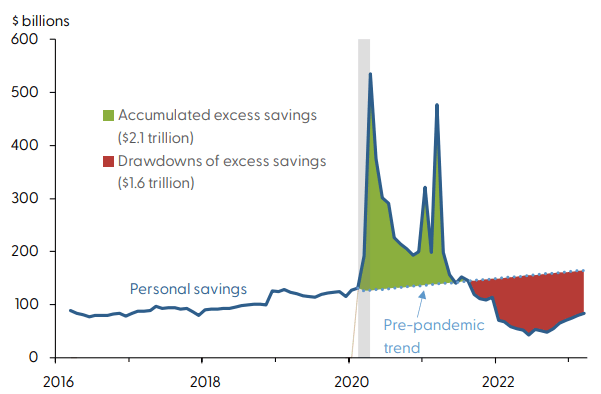

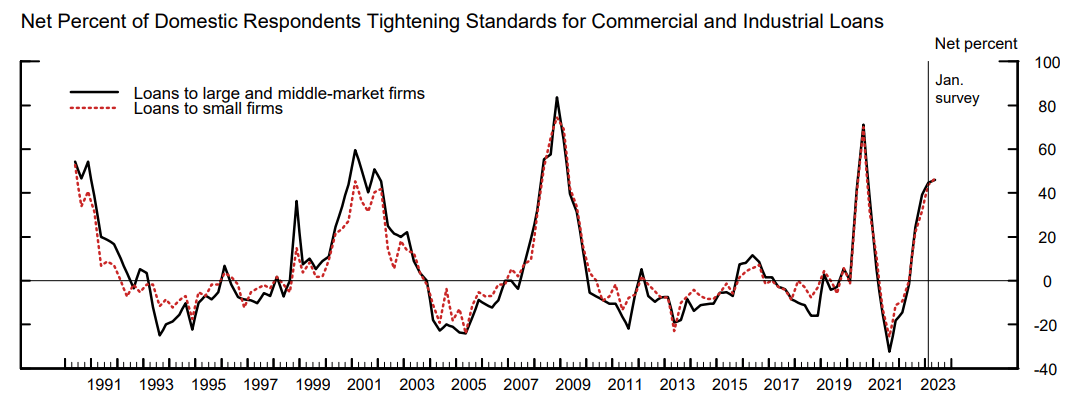

In last week’s newsletter, we pointed out that both monetary policy, via a resumption of the Fed balance sheet’s negative growth, and fiscal policy are becoming more restrictive. Lending standards, as measured by the latest US Senior Loan Officer Survey are at their tightest levels since 2020 for Commercial & Industrial Loans and for Commercial Real Estate (CRE), suggesting a very likely slowdown in overall capex and in sectoral growth in CRE. Historically, the Senior Loan Officer Survey has forecasted recessions with a lead of one-to three-months. This time, a recession has not yet materialized. We think that part of the reasons for this macro resilience is the unprecedented level of cash injected in the economy by the pandemic fiscal support programmes.

According to a recent study by the Federal Reserve of San Francisco, US households’ excess savings still amount to $1.6 trillion as of March 2023. If the recent pace of savings’ drawdowns is maintained, then excess savings should cushion growth until the end of the year. This brings the odds of a recession from 2024 higher.

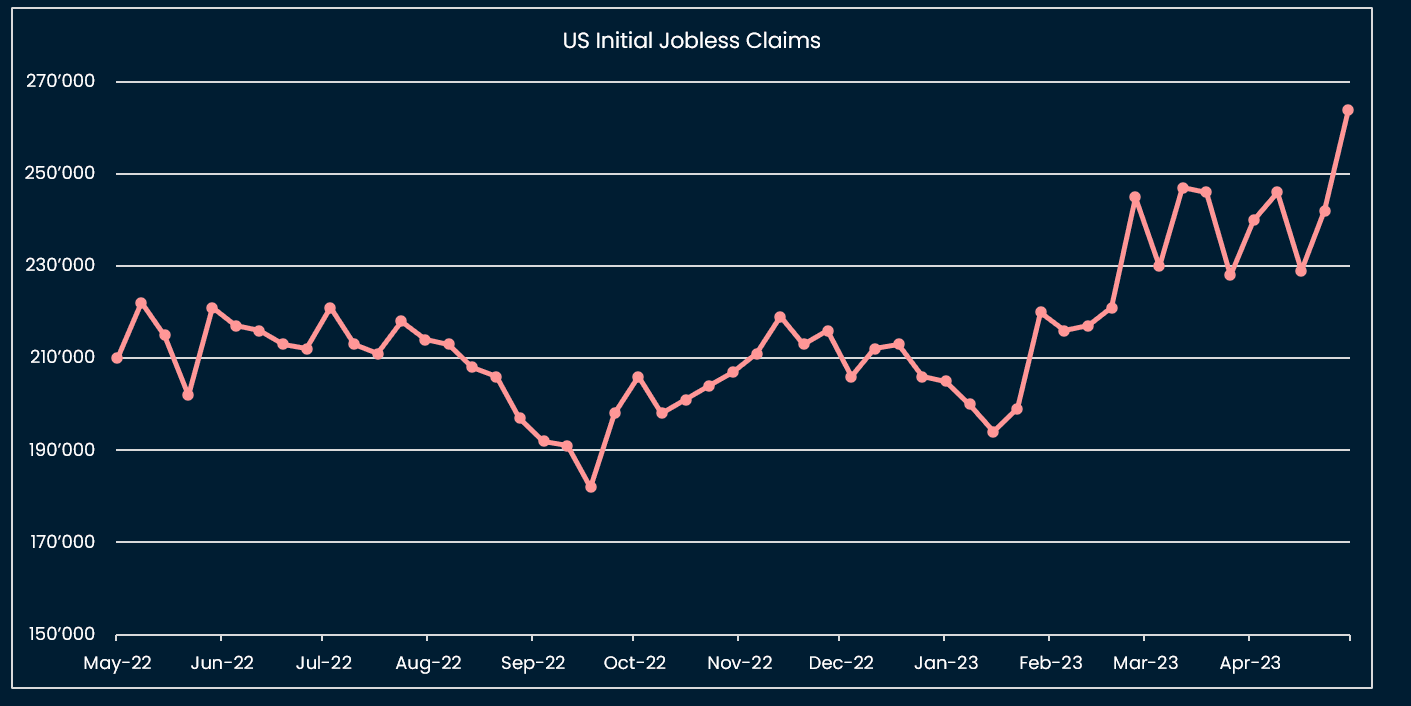

Coincidently, initial jobless claims have started to slowly edge up.

Financial markets pricing slower growth

A combination of the negative fundamental factors described above, and the risk-off May seasonality (equity markets tend to underperform in May) is currently challenging risk assets. Assets across several classes are starting to price a slowdown in growth.

Copper has started to retrace lower, after the “China reopening” boost:

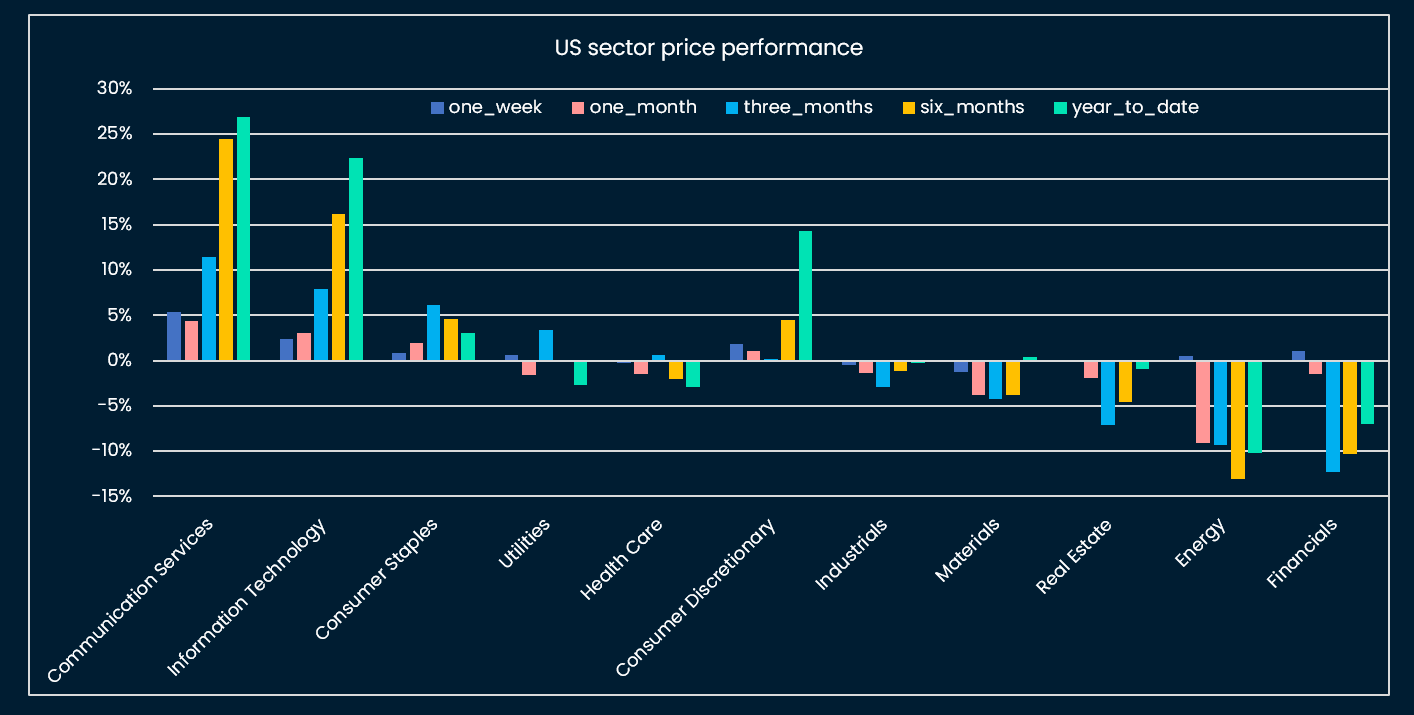

Among equities, cyclical sectors are underperforming defensive ones and we expect this to persist:

The DXY USD index is testing its resistance and could strengthen further in May before resuming its multi-month downward trend:

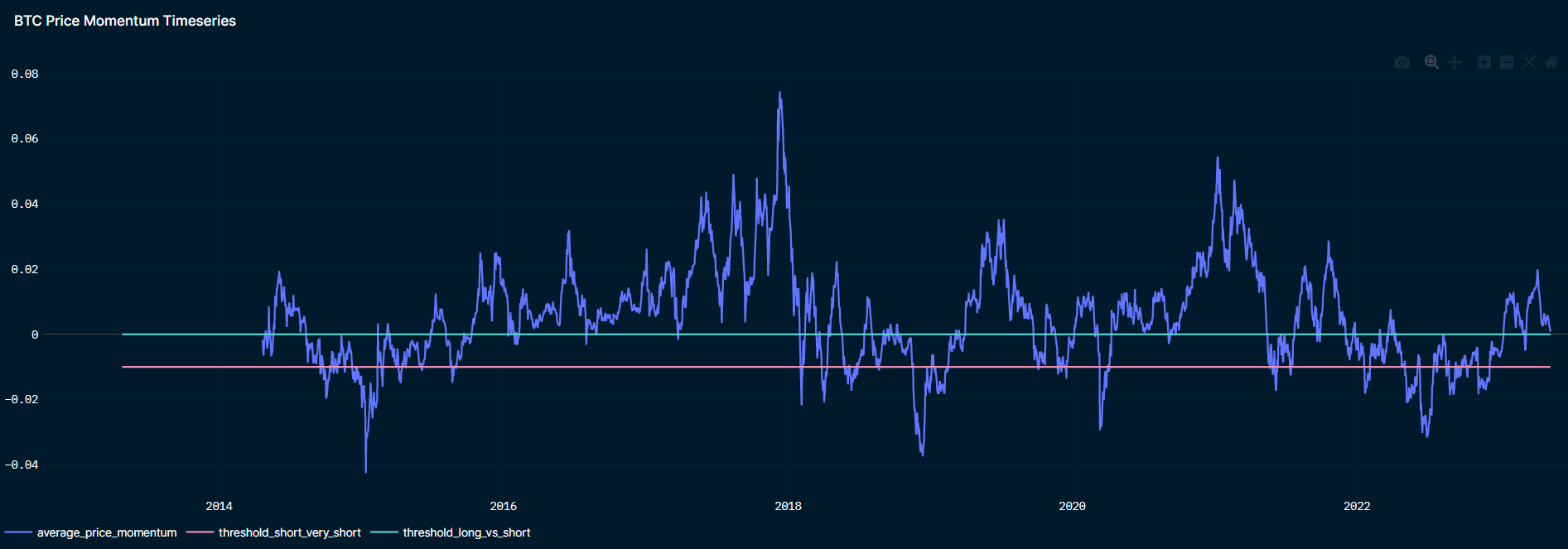

Crypto tactical indicators are becoming less bullish: the momentum indicator is hovering around zero, below zero would trigger a “short” signal in our quantitative strategy:

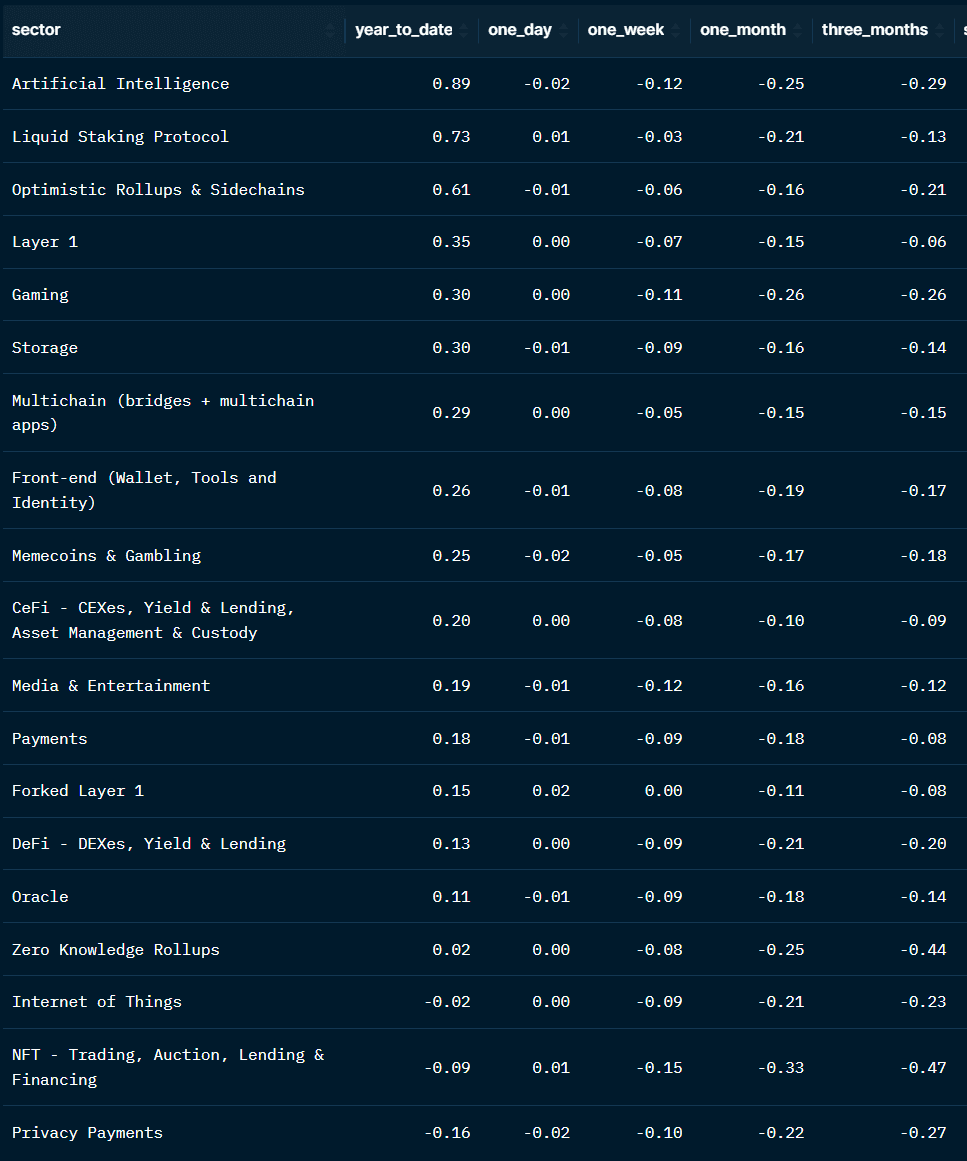

We also note that the crypto narratives that drove the year-to-date rally, such as Artificial Intelligence, are losing momentum:

This week: Fed Chair Powell speaks

Tuesday 16 May

- UK March Average Earnings (consensus 5.8% YoY)

- German May ZEW Economic Sentiment (consensus -5.3)

- US April Core Retail Sales (consensus 0.4% MoM)

Wednesday 17 May

Eurozone April CPI (consensus 7.0% YoY)

Thursday 18 May

US May Philadelphia Fed Manufacturing Index (consensus -19.8)

Friday 19 May

Fed Chair Powell speaks on a policy panel