Economic pulse

The macro picture is becoming less foggy as we progress in this cycle. It is one of divergence, where manufacturing is on the verge of a recession, but where services are benefitting from households spending the remaining of the extra savings accumulated during the 2020-2021 covid fiscal bonanza.

The US Manufacturing Survey, which has a history of predicting economic cycles, is forecasting weaker growth, with the new orders sub-index down more than 3 points to 42.6 in May.

Meanwhile, the Services sector is doing ok, from EM Asia to the Americas, and is the main engine of growth and inflation, and the reason why mature market central banks are signaling high rates for longer.

Below are a few quotes from the US Fed’s beige book summarizing the growth and inflation pulse in the US.

The pockets of strength:

- “Residential real estate activity picked up”

- “Employment increased in most Districts, though at a slower pace than in previous reports”

The areas of weakness:

- “The office segment continuing to be a weak spot”

- “Contacts reported there was a freight recession”

- “Several Districts noted a rise in consumer loan delinquencies, which were returning closer to pre-pandemic levels.”

On inflation:

- “Consumer prices continued to move up due to solid demand and rising costs”

- “But many contacts said cost pressures had eased and noted price declines for some inputs, such as shipping and certain raw materials”

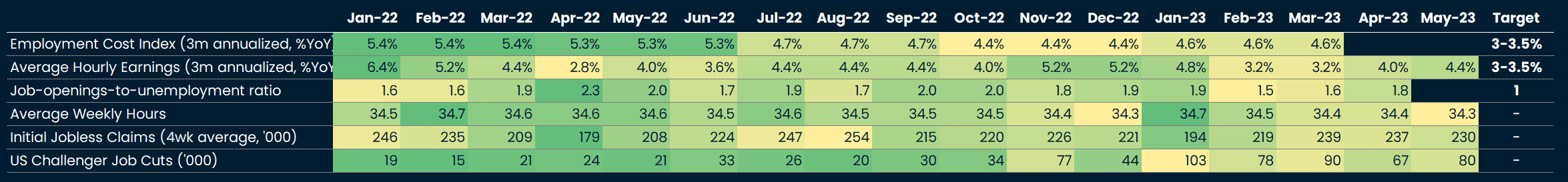

US labor market

Labor market data are usually lagging in the macro cycle, and tend to deteriorate significantly once a recession has already started (see the Kansas City Fed Labor Market Indicator chart vs recessions, below). Nevertheless, employment is one of the two main inputs in the US Fed’s policy decision process.

We summarize the state of the US labor market by a heatmap of its main indicators and by charting the Kansas City Fed Labor Market Indicator, which aggregates various employment variables, and allows to average out the potential divergences between those variables.

The overall message of both figures is one of a tight labor market, with negative momentum. We can recognize today’s pattern in past historical episodes preceding growth slow downs, in 2000 and 2007.

Central banks’ likely actions vs market pricing

So far, growth and inflation are slowing but the destination, “soft” or “hard landing”, remains uncertain. The reaction function of central banks will of course influence the next stage of the cycle, whether a “shallow” or more severe recession.

Interestingly, a Fed rate hike priced by bond futures for June has been delayed to July. We also expect the Fed to hold rates steady for now. Fed Chair Powell’s messaging has changed after March and the banking bankruptcies. Tackling inflation is still the primary objective, but Powell has pointed towards the tightening in lending standards as an additional vehicle for transmission of monetary policy, likely to weigh on growth and inflation. There is also more willingness by the FOMC voting committee to observe the “lagged effect” of monetary policy. This would change if inflation were to consistently surprise to the upside (PCE did, we will get the next CPI print released on June 13, just before the next FOMC).

Markets are now pricing one more Fed rate hike before rate cuts from December 2023 on. What could diverge from this pricing? We are not confident that a further hike will happen, but, given the current macro picture, expect rate cuts to be pushed back later into 2024.

Ex-US, it seems to us that market pricings for further rate hikes by the European Central Bank and the Reserve Bank of Australia are still too modest, given high core inflation and wage growth in both regions.

This leaves us with at least a few more months of tight monetary policy, and less generous fiscal policy. In the US, the spending caps having emerged from the debt ceiling’s deal look like they could shave ~50bps of GDP growth in 2023 - 2024, starting from August 2023 with the resumption of student loan payments.

China to the rescue of global manufacturing?

Not every policy maker is hawkish. According to Bloomberg, the Chinese authorities are considering additional fiscal support following the failed revival of manufacturing activity post-lockdown-exit (services are here again doing ok), namely the extension of electric vehicles tax breaks, potential property rule easing, and reserve requirement ratio rate cuts. The policy measures are likely to be modest. However, we note that this is the second fiscal package this year. If Beijing is worried about growth, it could announce more stimulus measures this year. This is interesting given that the Hang Seng has moved lower in the past few weeks, to arguably more attractive levels.

We are monitoring copper and aggregate commodity prices (below) for a sign of stabilization of Chinese and global manufacturing growth. The BCOM index seems to have paused at resistance levels around ~100. It will take more pain in our view before the index recovers, and before policy markers, in China and other markets, decide to implement more decisive pro-growth measures. Nevertheless, the Chinese policy easing cycle has started.

Crypto

The fundamental backdrop above argues for range-bound price action in crypto markets (although China’s ongoing shift towards growth-supportive policies will at some point be positive for the asset class).

In this range-trading phase, we rely on pure technical and positioning indicators to assess where we are in the range. The news around the SEC charges against Binance and its CEO have delivered the trigger to the net-selling that some of our tactical indicators had been flagging since a few weeks (see BTC call-put spread and momentum indicator below). Since FTX’s collapse last November (also coinciding with the peak of headline inflation in the US), crypto sell-offs have been brief and have not led BTC below the 19k level. We should expect a similar pattern for the ongoing sell-off, and we will monitor our trading indicators for the next risk-on signal to validate our assumption.

Light week this week

Wednesday 7 June Bank of Canada policy meeting (consensus on hold at 4.50%)

Saturday 10 June China lending data. More on the additional stimulus package should be communicated this week.