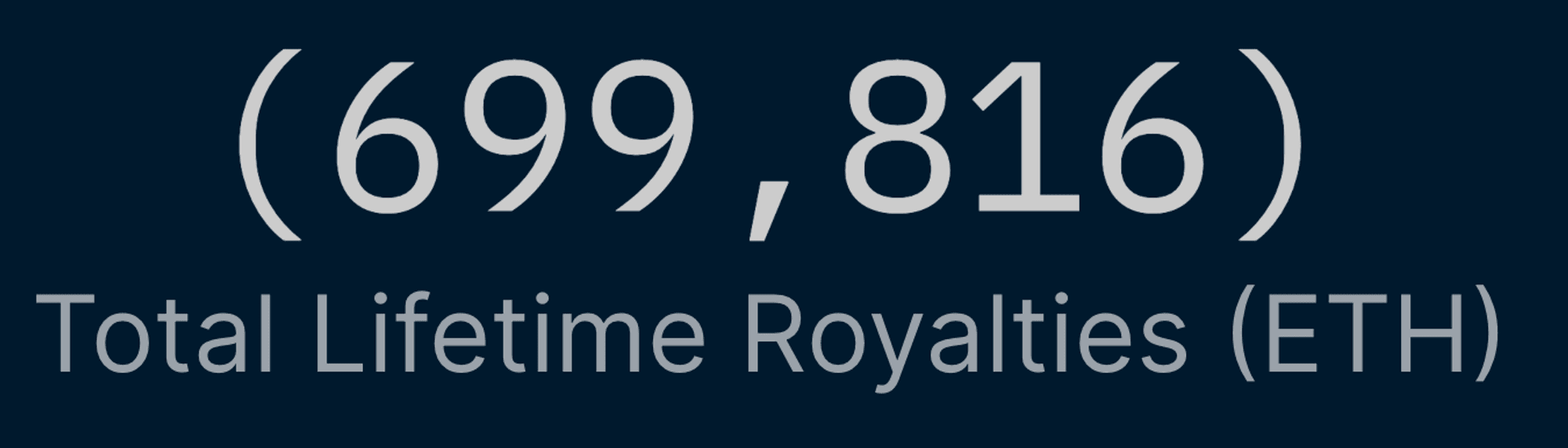

An Overview of All-Time Royalties

Figure 1: All-time Royalties Earned

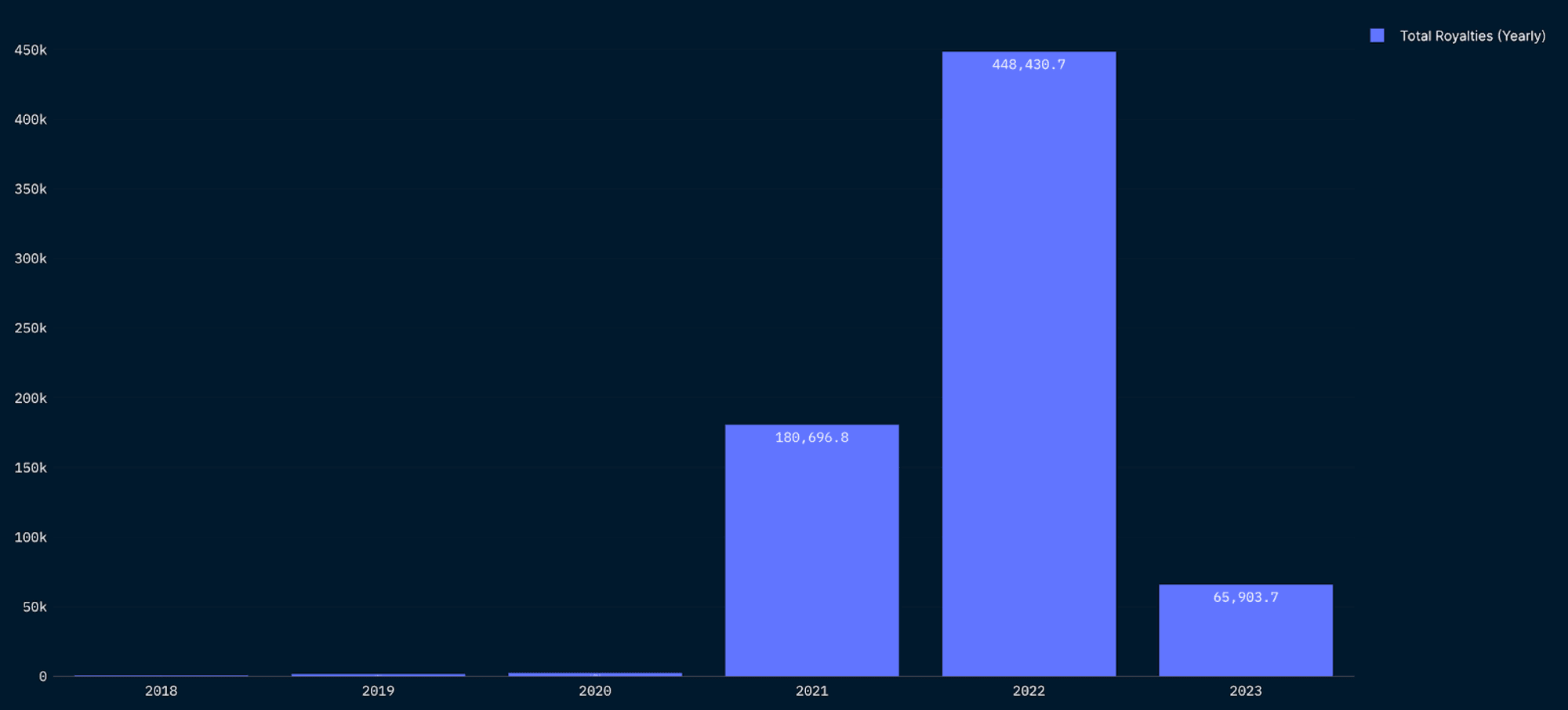

Figure 2: Royalties on a Yearly Basis

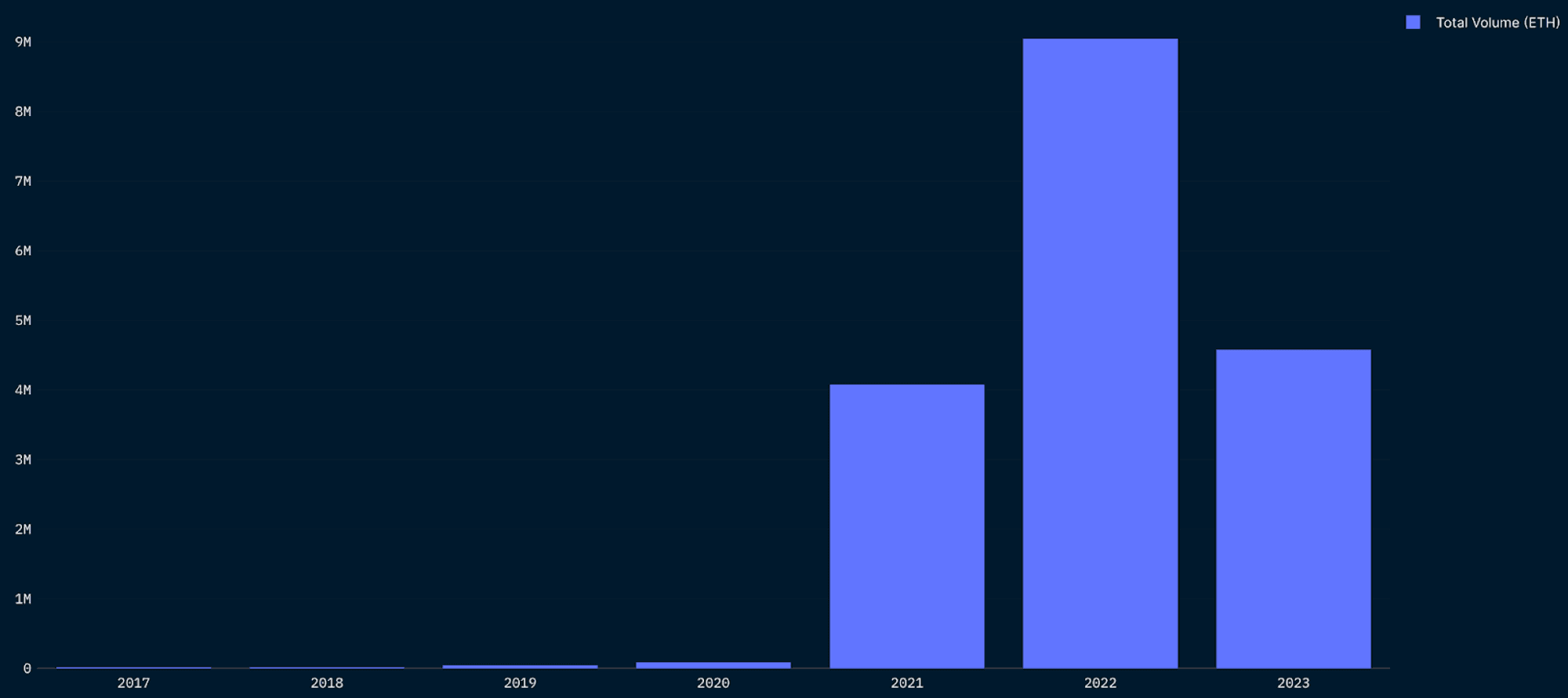

Figure 3: NFT Volume (Yearly)

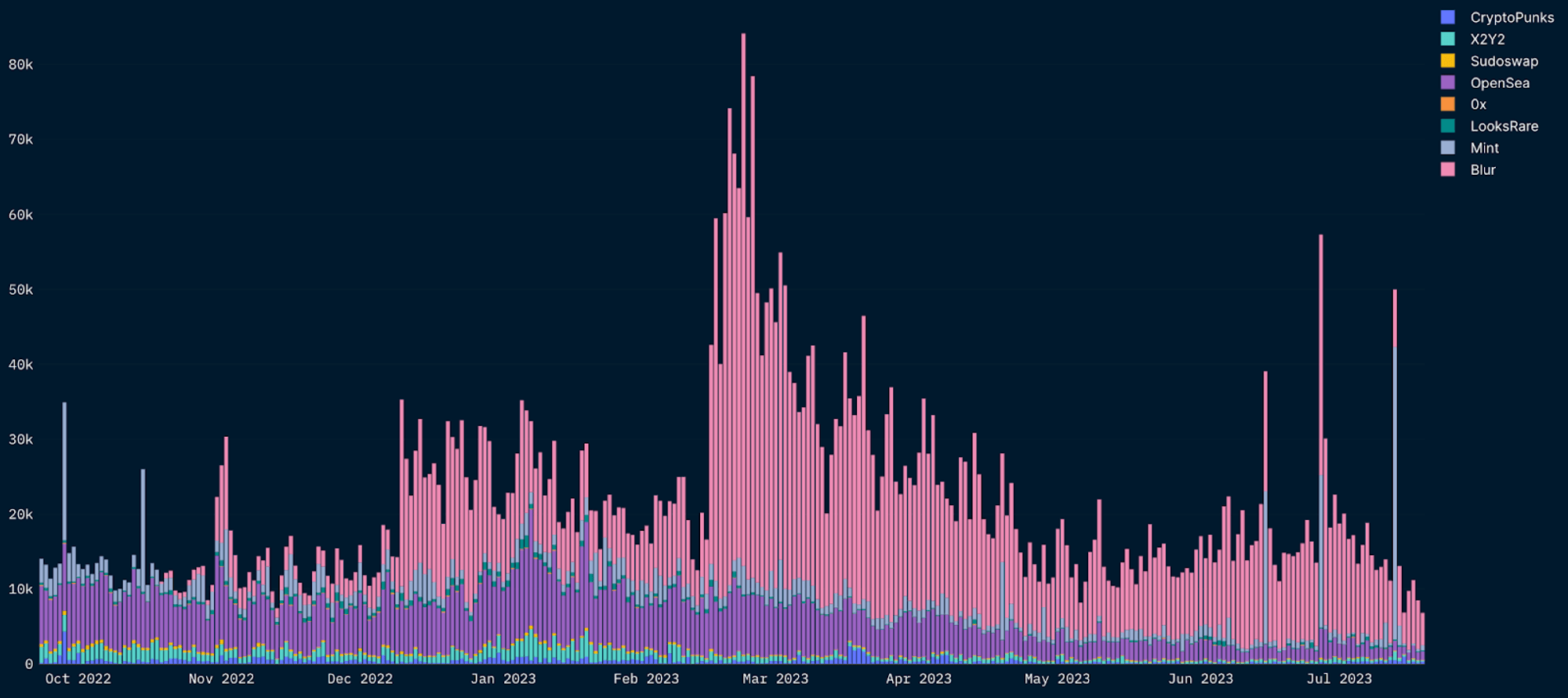

Figure 4: Daily NFT Volume by Marketplace (Past 300 Days)

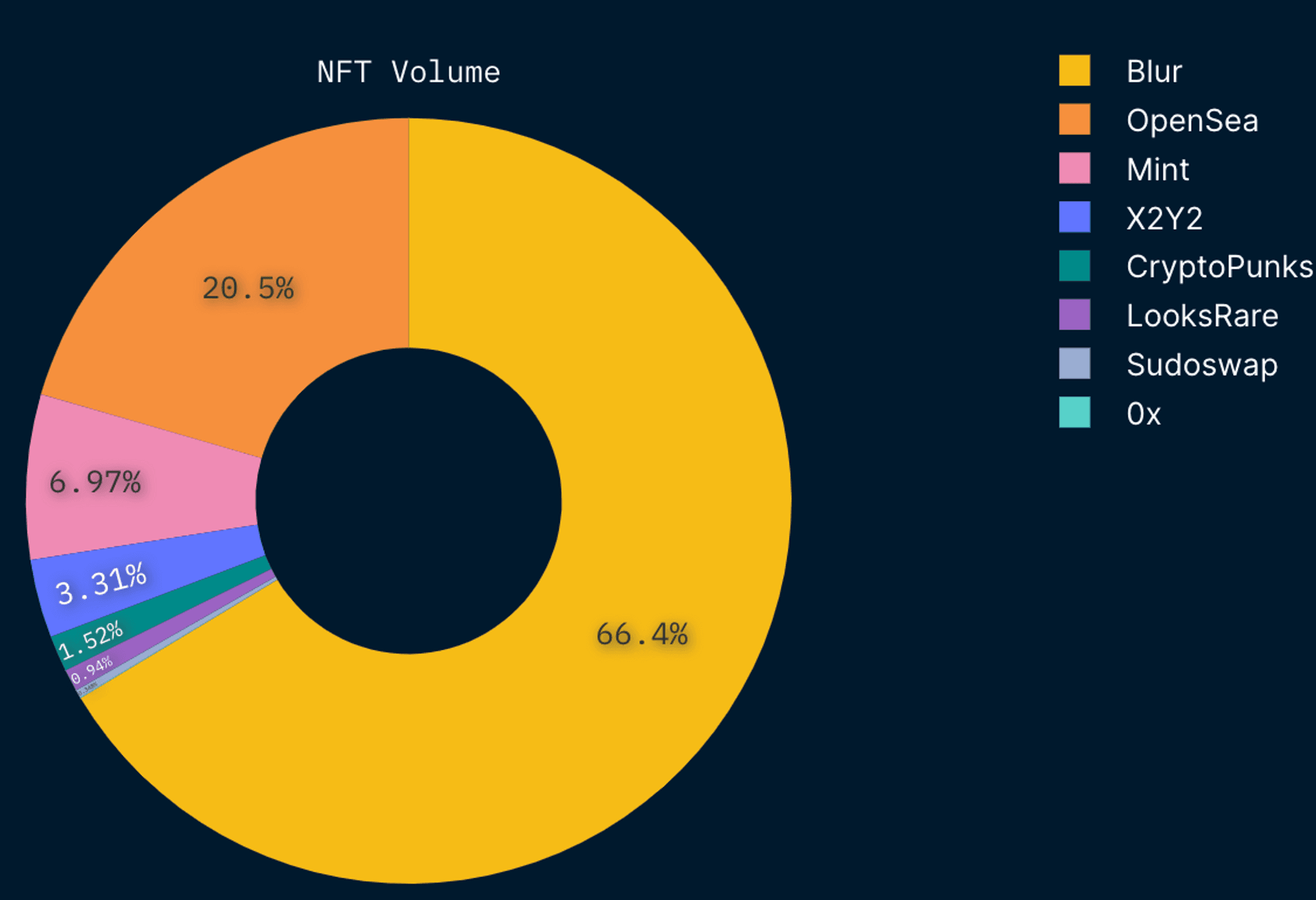

Figure 5: NFT Volume Aggregated by Marketplace and Type (YTD)

As of Jul 20, 2023, a total of 699,816 ETH has been earned by NFT projects via trading royalties. At current prices, that translates to approximately $1.3 billion USD. Note that when we price ETH at the time of NFT sale, lifetime royalties earned translate to $1.8 billion USD.

Earlier, we saw that a majority of royalties have been earned in 2022 (64.2% of all royalties earned), with collections trading in ‘23 experiencing significantly reduced revenue. It is worth noting the divergence in volume and royalties.

- YTD NFT Volume in ‘23 is 50.6% of NFT Volume in ‘22 - lining up nicely as we are in July.

- However, royalties earned in ‘23 are a much smaller fraction of 2022 (14.7%).

This is largely due to the launch of Blur in Oct 2022, with it dominating in trading volume since its launch. The reason for this is because earlier this year - Blur implemented a 0.5% minimum royalty fee for collections, which led the effective royalty fee to begin falling as OpenSea lowered their minimum royalty fee as well in a bid to maintain market share.

Blur currently accounts for 66.4% (~3 million ETH) of all NFT Sales Volume this year.

Overall Effective Fee Rates Have Been Trending Downwards

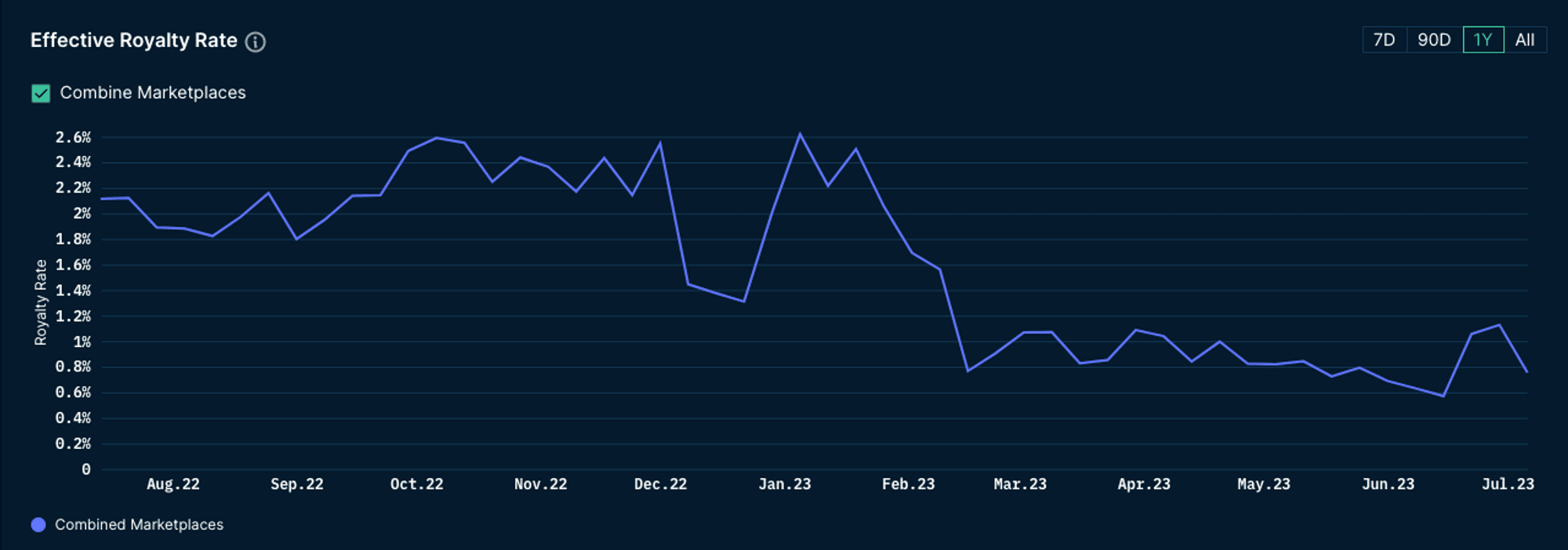

Figure 6: NFT Royalties Effective Fee Rate (Average)

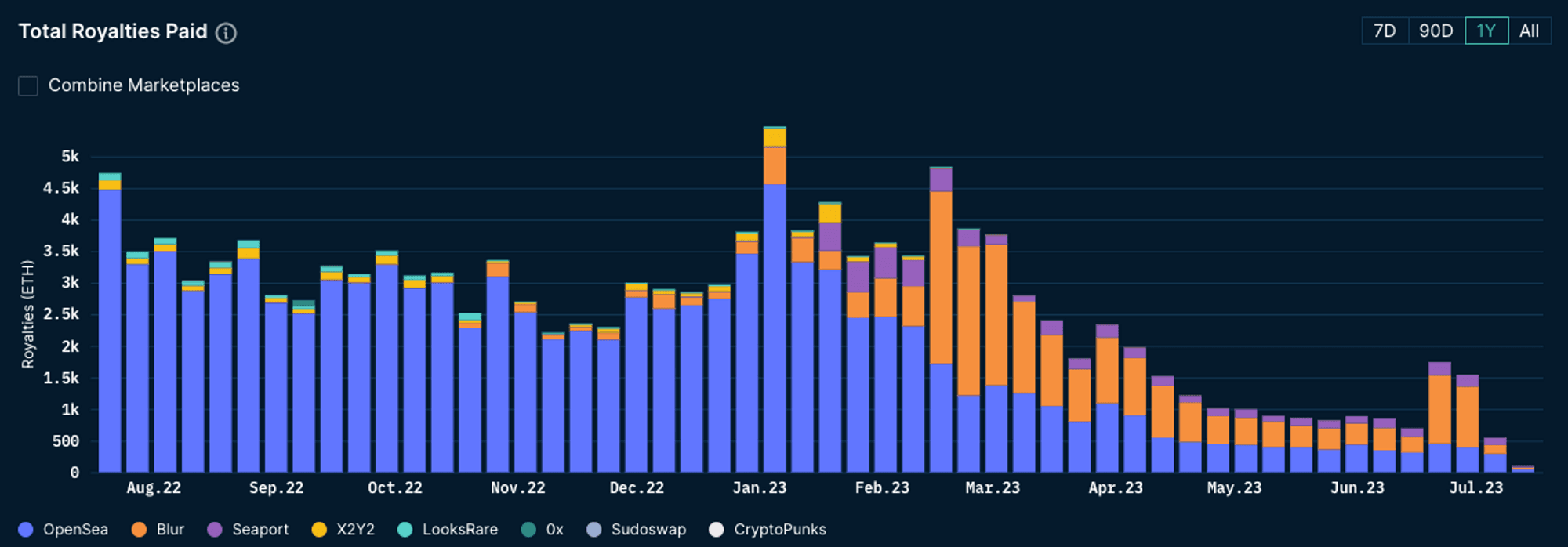

Figure 7: Total Royalties Paid by Platform

The war for traders between OpenSea and Blur has had a considerable impact on the effective royalties rate paid by traders. Before the launch of Blur, it was straightforward for OpenSea to enforce royalties (a 2.5% marketplace fee + creator fees set by the collection). With Blur, there is currently a 0% marketplace fee and a 0.5% minimum royalty. This has resulted in a dip in effective royalty fees over time. A detailed explanation of the battle between OpenSea and Blur can be found here.

This is especially true when considering that a majority of NFT traders are likely profit-maxis. By trading on Blur, they have the opportunity to pay less royalties and reduce their ETH expenditure. Furthermore, trading on Blur grants Blur points, increasing their $BLUR airdrop size.

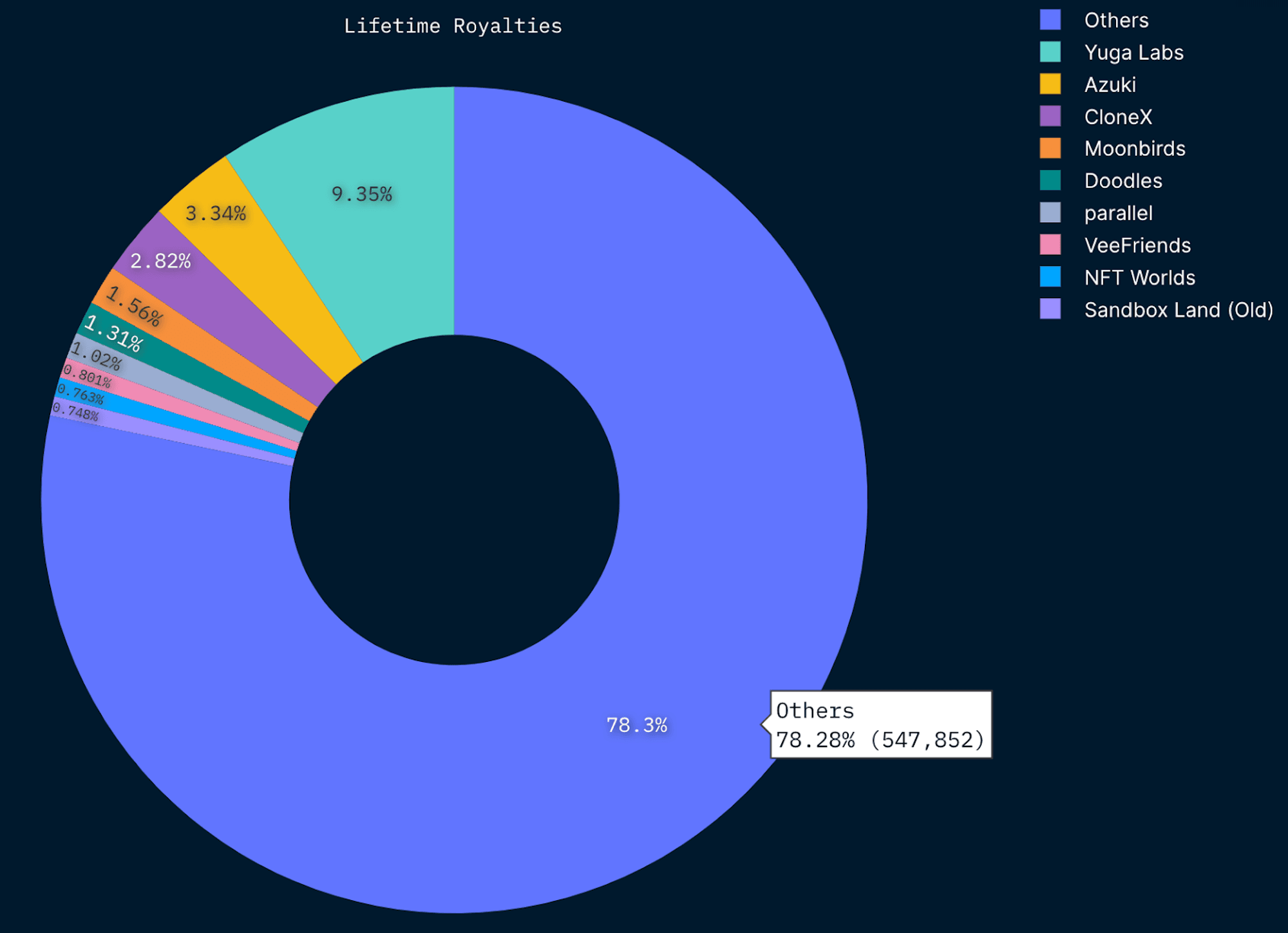

80/20 is law - Yuga Labs alone has earned ~10% of all royalties

Figure 8: NFT Royalties - comparing the top entities against all others

Just like volume, NFT royalties are also very skewed, with the top projects receiving most of the royalties. For example, Yuga Labs alone has been responsible for 9.35% of all royalties earned. For context - 10% is approximately 69.9k ETH (134 million USD at Jul 20, 2023 prices).

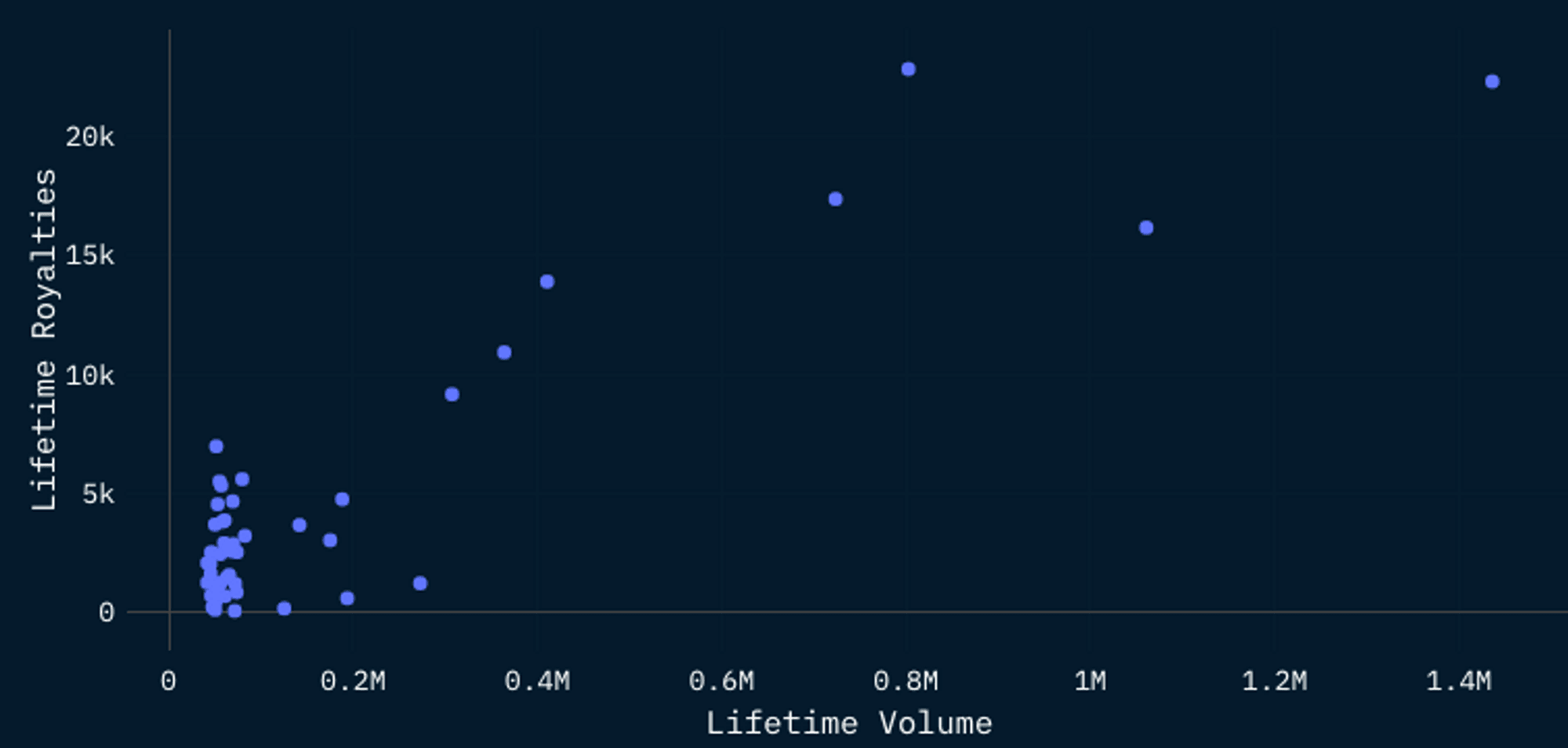

However, an interesting phenomenon is the strength of the correlation between volume and royalties earned. In the following section, we will explore how projects can have significantly different royalties despite having similar volume.

Does High-Volume Mean High-Earnings?

Figure 9: A Scatterplot of Volume Against Royalties (Top 50 projects by lifetime volume)

In theory, there should be a strong correlation between the volume of an NFT and its royalties earned. However, there are multiple variables that affect this.

- What is the royalty amount set by the project?

- What type of traders are trading the NFT? Are they likely to be more sophisticated?

- For example, a trader of GaryVee VeeFriends might be considered to be in the less sophisticated category. (Gary Vee is an internet personality who is extremely popular on various social media platforms).

- Are there incentives for royalty-enforced trades?

- The date the NFT project was launched - was it when royalties were strictly enforced?

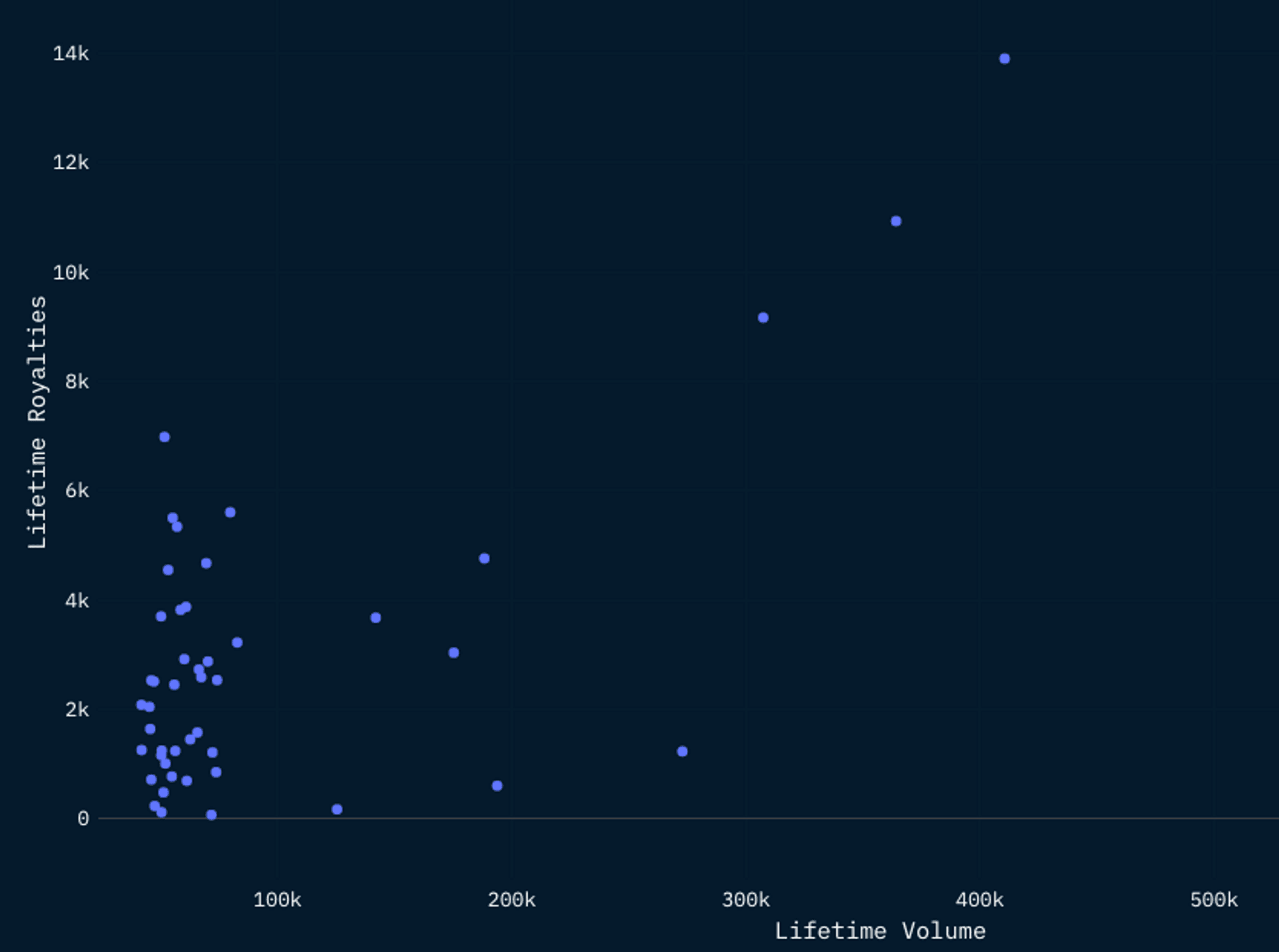

Figure 10: NFT Royalties - Drilling into the Bottom-left Quadrant

Drilling down deeper into the scatterplot of Fig 5, we see that there is a very weak relationship between lifetime volume and royalties. This is due to a number of reasons:

Creator-set royalties

- For example, DeGods has received 112 ETH in royalties over a lifetime volume of 50k. This is due to the creator royalties being set at 0% for a period of time.

Launch Date

- Parallel has one of the highest effective royalty rates, at 8.96%. A majority of their lifetime volume was conducted between July ‘21 - Jan ‘22. This was when royalty fees were enforced, resulting in them having a very high royalty:volume ratio.

This is especially interesting if we consider NFT projects to be similar to businesses, meaning that they need royalties to grow their treasury and extend their runway - lesser royalties likely mean a shorter roadmap.

The launch of Blur has significantly impacted the royalties received by NFTs, potentially impacting the survivability of NFT projects as well as their ability to build out their roadmap. If we were to adopt the mental model that NFT Collections acts as businesses sustained by royalties - then it has now become much harder for collections to sustain their runway.

It is imperative that NFT Collections explore alternatives to the current royalty model. Potential examples include selling soft toys such as what Pudgy Penguins have done to fundraising from venture funds such as Doodles, Bored Apes and DigiDagaku. Of course, launching a secondary mint to raise more funds is always an option, assuming the mint is successfully executed (Azuki).

Furthermore, there is a possibility that a large part of current NFT trading volume (both wash and non-wash trades) is propped up by Blur points farming. This means that once Blur airdrops stop, we might see a significant fall in NFT Volume, further reducing the rate at which collections earn royalties.