Overview

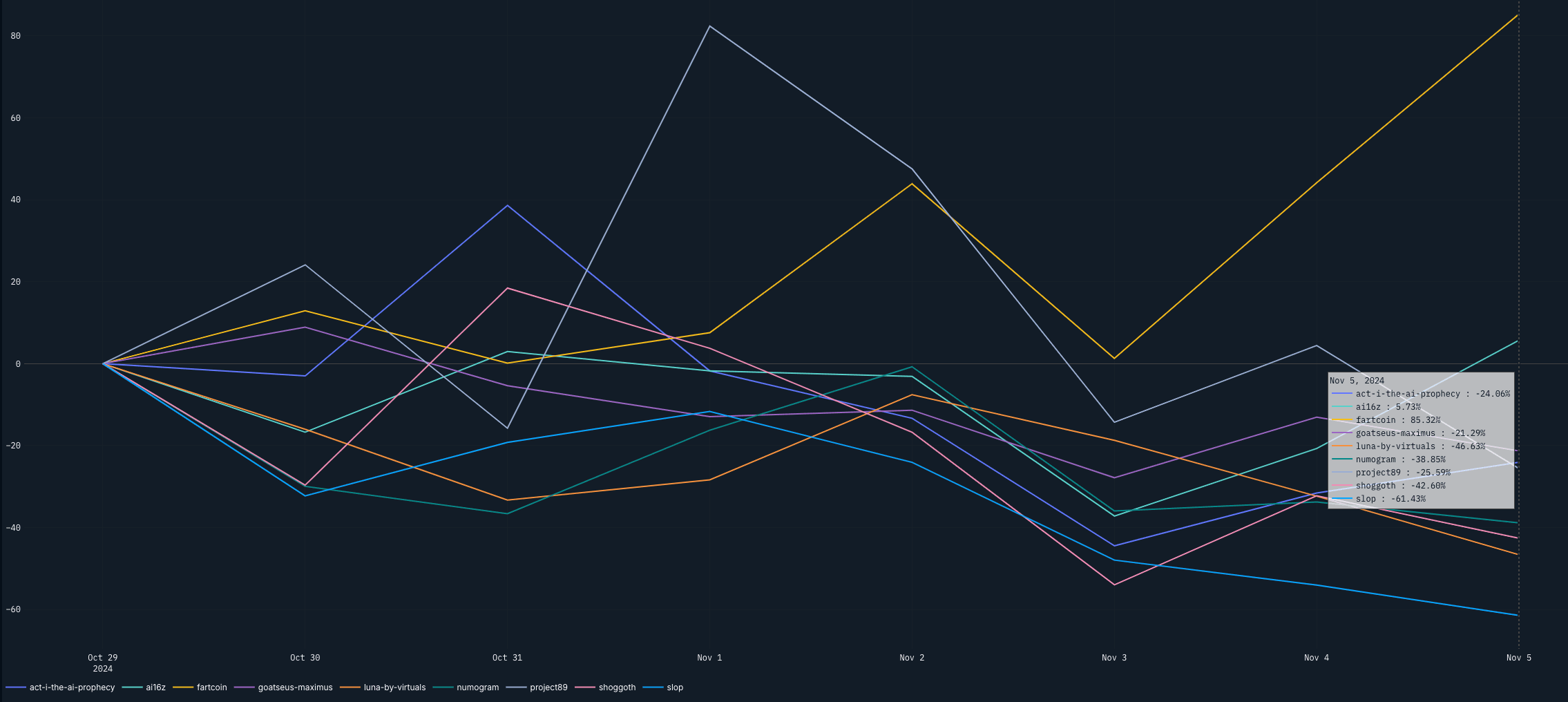

AI-driven memes and interactive agents are drawing significant attention, with some projects achieving notable early gains. While many of these tokens have since retraced, the question remains: Do they still deserve a spot on our radar? And are smart money maintaining or adjusting their positions?

In recent weeks, several AI-powered influencers and agents have launched on platforms like Virtual, gaining substantial visibility. If you’d like to dive deeper into this trend, you can read more about it in our detailed article here.

Now, let’s take a closer look at some of the tokens that have captured recent interest and see how they’re performing today. Please note that this list is not exhaustive and all tokens were selected with a minimum requirement of having at least 10 smart money holders, as well as fitting into the recent trend of sentient memes and having had social attention.

| Token | SM Holders | SM Trend |

|---|---|---|

| Goat | 83 | Holders and Balance trending down |

| Ai16z | 30 | Holders and Balance trending down |

| Fartcoin | 32 | Holders trending down. Balance stable |

| Shoggoth | 20 | Holders and Balance trending down |

| Yousim | 15 | Holders and Balance stable |

| Luna | 13 | Holders trending down. Balance stable |

| Project89 | 26 | Holders trending down. Balance in slight uptrend. |

| Memesai | 23 | Holders stable. Balance in slight uptrend |

| Gnon | 20 | Holders and Balance stable |

| Kira | 10 | Holders trending down. Balance stable |

| Slop | 17 | Holders and Balance trending down |

| Act | 19 | Holders and Balance trending down |

source: Nansen Query

As shown above, nearly all tokens that experienced significant price movement are trending downward, both in terms of holder count and balance. However, it’s important to recognize that some projects may have similar numbers of smart holders, but the actual dollar amounts held can differ greatly. For instance, SLOP has the largest smart money holder base with a balance of $2,698. In contrast, YOUSIM has two fewer smart holders but holds notably larger balances, with the top account reaching $70,297.

Given the current trends, it seems likely that only a handful of these tokens will retain a lasting community. Actual use cases may need to emerge before we see widespread adoption of AI-driven agents. That said, there are already examples of AI agents assigning bounties to humans for completing tasks, and it’s probable we’ll see more of this, alongside AI agents interacting directly with each other, in the near future.

Where is Smart Money Moving Next?

Tracking smart money holders and their transactions reveals two key trends. Many continue to invest smaller amounts in various meme coins, whether AI-driven or otherwise. However, a significant number are reallocating large portions of their gains, moving funds into other wallets or converting them to SOL or USDC. This strategy suggests they may be waiting for new opportunities or observing market developments, especially with the upcoming election in mind.

This movement also makes tracking these holders more challenging, as funds are distributed across multiple wallets rather than remaining in those traditionally associated with “smart money.”

Over the past week, we’ve seen shifts from high-performing smart money holders—those with at least an 80% win rate over the past 90 days—into specific tokens like HAT, ZEREBRO, and WORM. Notable entities, such as DevmonsGG, have also been actively dollar-cost averaging into HAT. This broader trend of smart money flowing into meme tokens and often moving in unison likely signals a focus less on deeply researched projects and more on entering early enough to secure manageable profits. Here, the strategy seems to be capturing gains, even if modest, rather than holding out for large, speculative multiples.

Conclusion

At the end of the day, AI-driven meme tokens remain largely speculative. While they’ve generated attention and some early profits, most still lack the real-world applications that could give them staying power. Smart money wallets appear to be testing the waters, selectively investing in certain tokens while also derisking as noted by their profit taking into stable assets.

The larger question is whether any of these tokens can build a lasting community and real utility or if they’ll ultimately fade as trends shift. With AI agents exploring new ways to interact and incentivize engagement, there’s potential for further developments, but for now, the strategy seems to focus on early entry, timely exits, and a watchful eye on the next move.